Avertissement:

Données de X (Twitter), propriété des créateurs originaux. À titre indicatif uniquement, ce n'est pas un conseil en investissement.

Publications X

Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo38104169

Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo38104169

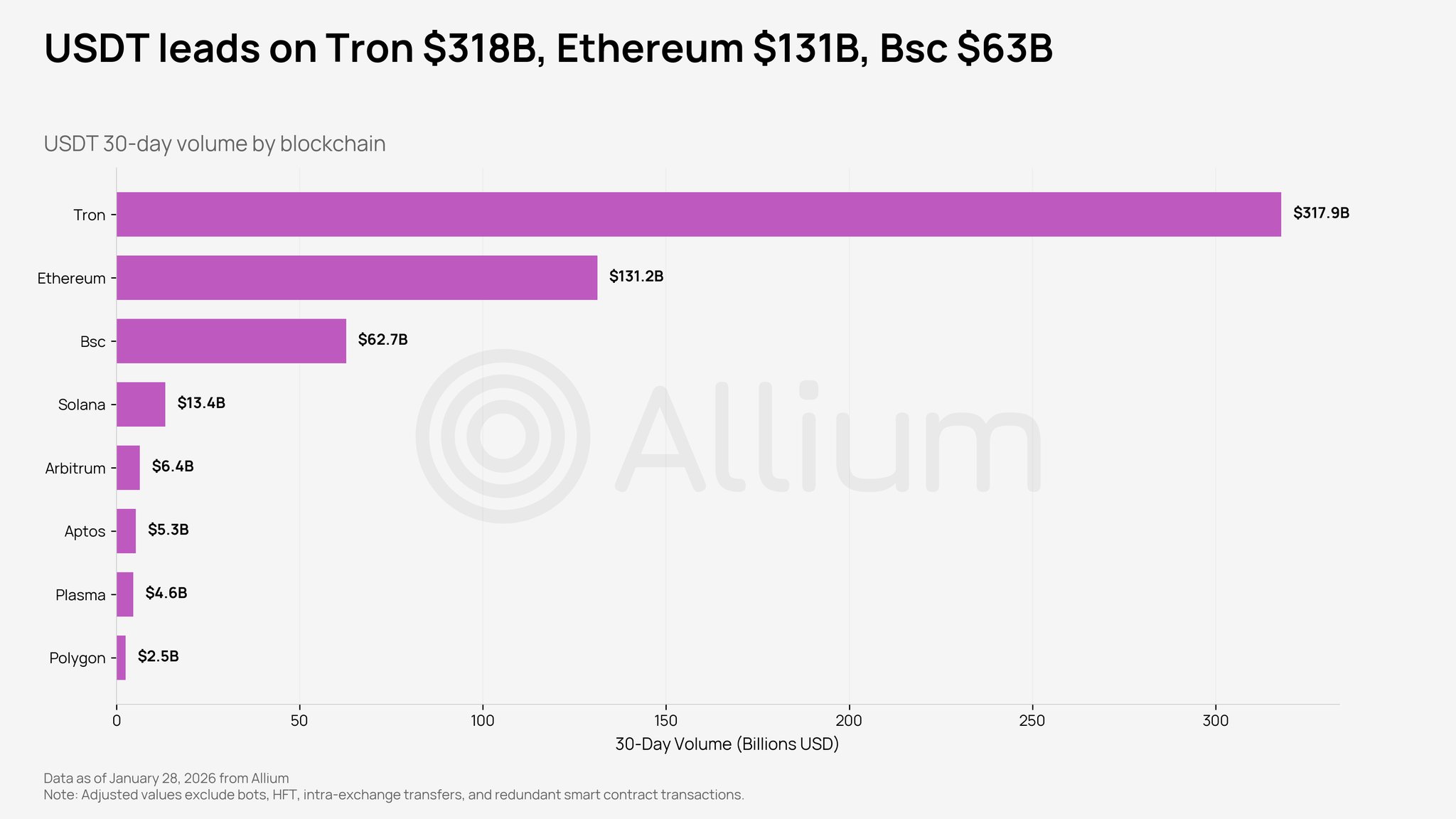

Allium D8.98K @AlliumLabs

Allium D8.98K @AlliumLabs 0 0 5 Original >Haussier

0 0 5 Original >Haussier Digital Perspectives Influencer Community_Lead B205.57K @DigPerspectives

Digital Perspectives Influencer Community_Lead B205.57K @DigPerspectives COACHTY Media Regulatory_Expert S27.36K @TheRealTRTalks28 2 2.11K Original >Haussier

COACHTY Media Regulatory_Expert S27.36K @TheRealTRTalks28 2 2.11K Original >Haussier Digital Perspectives Influencer Community_Lead B205.57K @DigPerspectives

Digital Perspectives Influencer Community_Lead B205.57K @DigPerspectives Vet Dev Community_Lead S46.67K @Vet_X0874 26 18.50K Original >Tendance de XRP après le lancementHaussier

Vet Dev Community_Lead S46.67K @Vet_X0874 26 18.50K Original >Tendance de XRP après le lancementHaussier CBduck 🛡️ Influencer Media B14.66K @CoinbaseDuck

CBduck 🛡️ Influencer Media B14.66K @CoinbaseDuck paulgrewal.eth Regulatory_Expert Influencer S100.48K @iampaulgrewal13 2 880 Original >Baissier

paulgrewal.eth Regulatory_Expert Influencer S100.48K @iampaulgrewal13 2 880 Original >Baissier Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo38104169

Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo38104169

Digital Sovereignty Alliance (DSA) D1.20K @DSAForg

Digital Sovereignty Alliance (DSA) D1.20K @DSAForg 0 0 6 Original >Tendance de TRX après le lancementHaussier

0 0 6 Original >Tendance de TRX après le lancementHaussier Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo38104169

Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo38104169 TRON DAO D1.76M @trondao0 0 7 Original >Tendance de TRX après le lancementHaussier

TRON DAO D1.76M @trondao0 0 7 Original >Tendance de TRX après le lancementHaussier Ansem Trader Influencer C787.11K @blknoiz06

Ansem Trader Influencer C787.11K @blknoiz06 doug funnie Trader Influencer A24.97K @cryptoklotz33 6 2.03K Original >Baissier

doug funnie Trader Influencer A24.97K @cryptoklotz33 6 2.03K Original >Baissier- Tendance de SOL après le lancementHaussier

Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo38104169

Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo38104169

TRON DAO D1.76M @trondao

TRON DAO D1.76M @trondao 0 0 1 Original >Tendance de BTC après le lancementExtrêmement haussier

0 0 1 Original >Tendance de BTC après le lancementExtrêmement haussier peterpriew 🔴✨🥷 OnChain_Analyst Educator S10.62K @PriewPeter

peterpriew 🔴✨🥷 OnChain_Analyst Educator S10.62K @PriewPeter peterpriew 🔴✨🥷 OnChain_Analyst Educator S10.62K @PriewPeter

peterpriew 🔴✨🥷 OnChain_Analyst Educator S10.62K @PriewPeter 5 1 418 Original >Tendance de BTC après le lancementExtrêmement haussier

5 1 418 Original >Tendance de BTC après le lancementExtrêmement haussier

Sentiment social de X sur 24 h

5,094Publications analysées-34.06%2,470KOLs interrogés+0.04%Le sentiment du marché penche vers Haussier- CryptomonnaiesSSIModifierAnalyses SSI

- CryptomonnaiesMPRModifier

SPACE#1 KOL attention surges+79

SPACE#1 KOL attention surges+79 ON#2 Social mentions surged-

ON#2 Social mentions surged- MANA#3 Social mentions surged-

MANA#3 Social mentions surged- MEME#4 Social mentions skyrocketed-

MEME#4 Social mentions skyrocketed- MINA#5 Sentiment polarization sharply increased+64

MINA#5 Sentiment polarization sharply increased+64

Résumé des alertes