Disclaimer:

Data from X (Twitter), Property of original creators. For reference only, not investment advice.

X Posts

Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo38104169

Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo38104169

TRON DAO D1.76M @trondao

TRON DAO D1.76M @trondao 0 0 1 Original >Trend of BTC after releaseExtremely Bullish

0 0 1 Original >Trend of BTC after releaseExtremely Bullish peterpriew 🔴✨🥷 OnChain_Analyst Educator S10.62K @PriewPeter

peterpriew 🔴✨🥷 OnChain_Analyst Educator S10.62K @PriewPeter peterpriew 🔴✨🥷 OnChain_Analyst Educator S10.62K @PriewPeter

peterpriew 🔴✨🥷 OnChain_Analyst Educator S10.62K @PriewPeter 5 1 418 Original >Trend of BTC after releaseExtremely Bullish

5 1 418 Original >Trend of BTC after releaseExtremely Bullish Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo38104169

Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo38104169

Tron Inc. D2.43K @TRON_INC0 0 6 Original >Trend of TRX after releaseExtremely Bullish

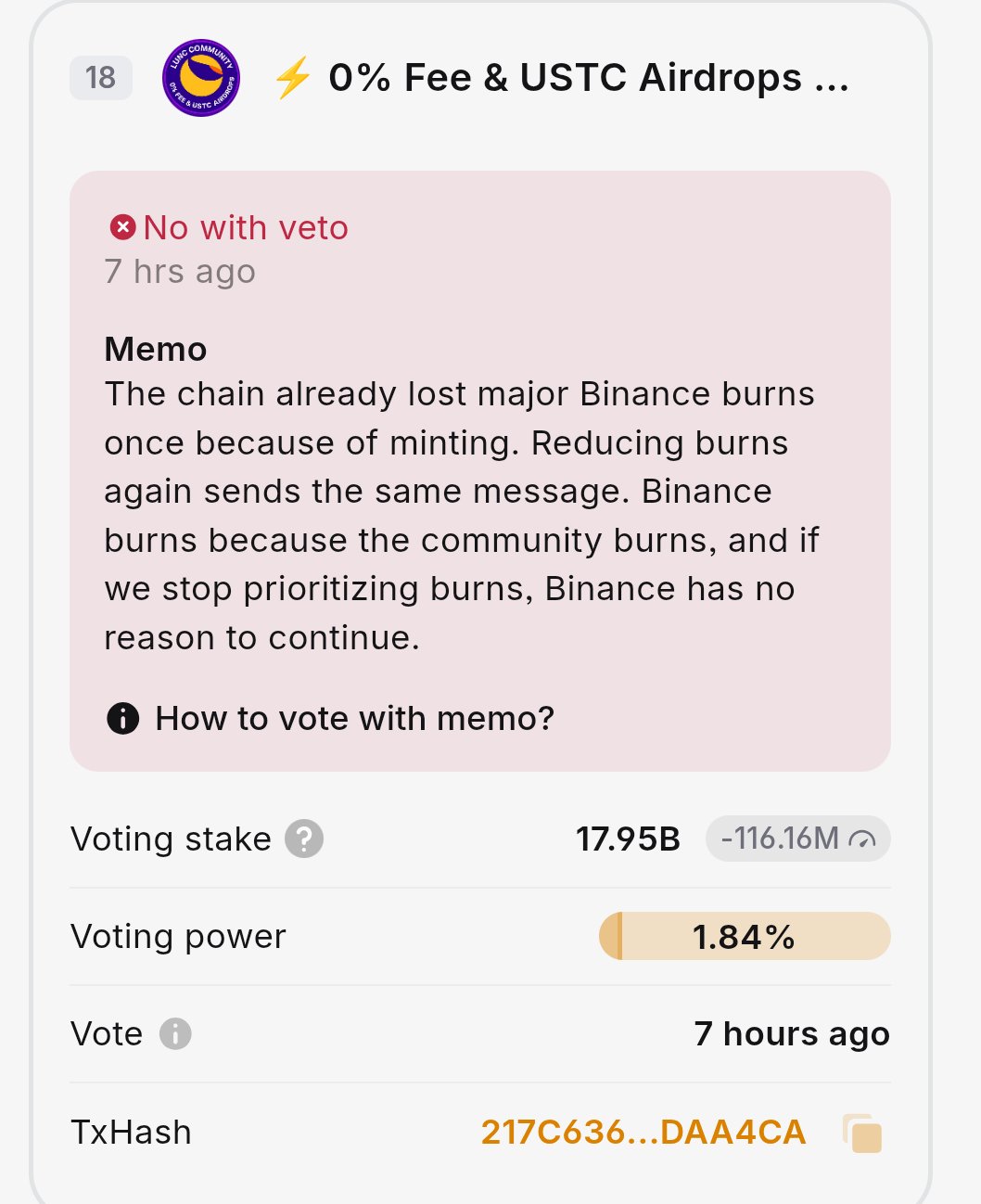

Tron Inc. D2.43K @TRON_INC0 0 6 Original >Trend of TRX after releaseExtremely Bullish Greenpeace.BNB.probablynothing.LUNC OnChain_Analyst Community_Lead S6.20K @Greenpeace06_09

Greenpeace.BNB.probablynothing.LUNC OnChain_Analyst Community_Lead S6.20K @Greenpeace06_09

1 0 15 Original >Extremely Bearish

1 0 15 Original >Extremely Bearish Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo38104169

Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo38104169 Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo381041694 5 24 Original >Trend of TRX after releaseBullish

Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo381041694 5 24 Original >Trend of TRX after releaseBullish- Trend of BTC after releaseNeutral

CryptoHotep.eth 🛡️ TA_Analyst Educator C7.10K @CryptoHotep

CryptoHotep.eth 🛡️ TA_Analyst Educator C7.10K @CryptoHotep

CryptoHotep.eth 🛡️ TA_Analyst Educator C7.10K @CryptoHotep

CryptoHotep.eth 🛡️ TA_Analyst Educator C7.10K @CryptoHotep 0 0 12 Original >Trend of ADA after releaseBullish

0 0 12 Original >Trend of ADA after releaseBullish- Bullish

- Trend of BTC after releaseNeutral

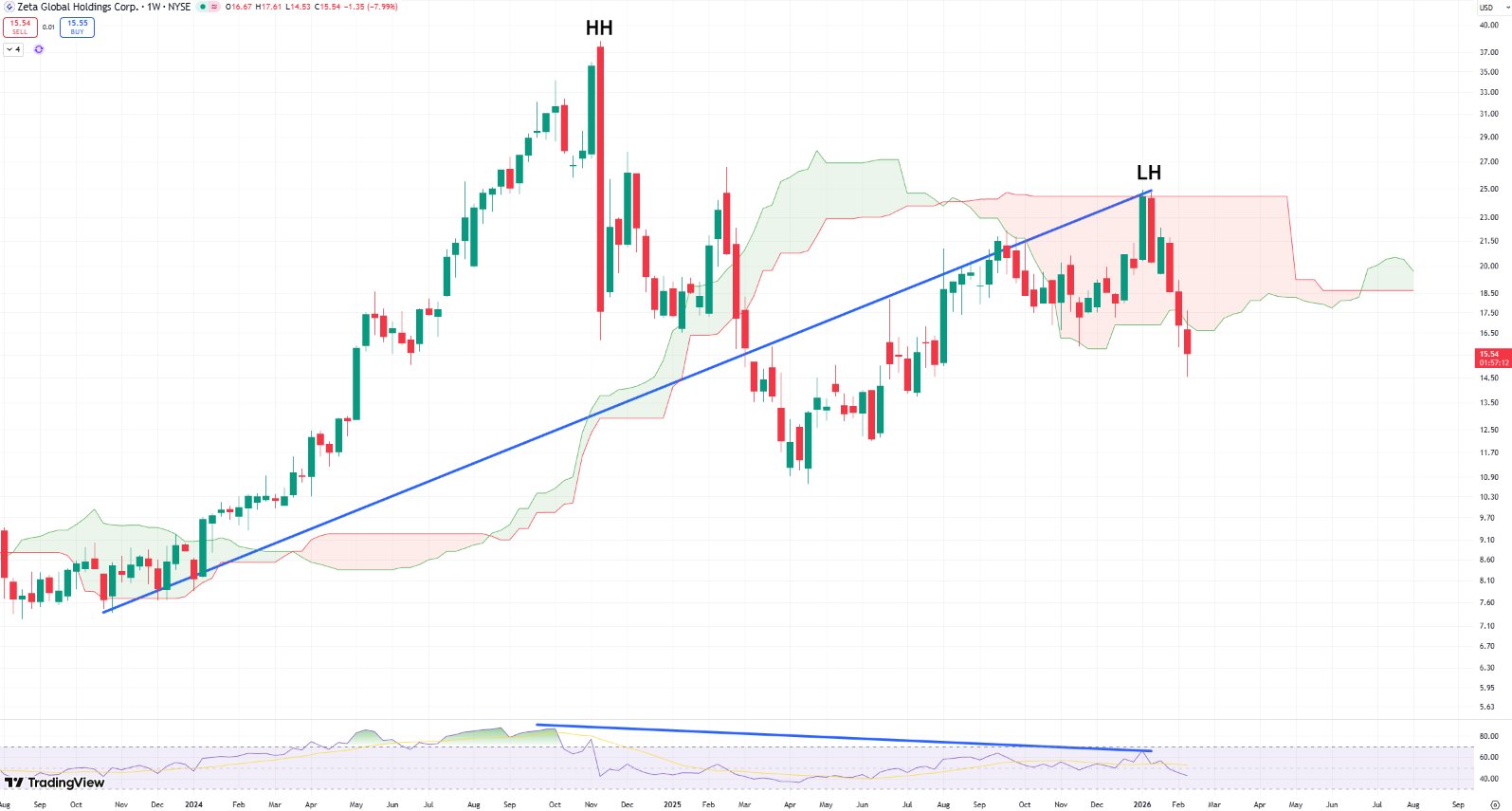

Chris The KOL states in their bio that they have over 10 years of equity and crypto swing trading experience. Their tweets frequently publish detailed technical chart analyses (such as candlestick patterns, Ichimoku, RSI, support and resistance, etc.) along with clear price targets and entry/exit points, making them a typical technical analysis and trading strategy sharer; the extensive buy/short signals and take-profit/stop-loss settings reflect the characteristics of a Trader. Valid A27.68K @StonkChris

Chris The KOL states in their bio that they have over 10 years of equity and crypto swing trading experience. Their tweets frequently publish detailed technical chart analyses (such as candlestick patterns, Ichimoku, RSI, support and resistance, etc.) along with clear price targets and entry/exit points, making them a typical technical analysis and trading strategy sharer; the extensive buy/short signals and take-profit/stop-loss settings reflect the characteristics of a Trader. Valid A27.68K @StonkChris Chris The KOL states in their bio that they have over 10 years of equity and crypto swing trading experience. Their tweets frequently publish detailed technical chart analyses (such as candlestick patterns, Ichimoku, RSI, support and resistance, etc.) along with clear price targets and entry/exit points, making them a typical technical analysis and trading strategy sharer; the extensive buy/short signals and take-profit/stop-loss settings reflect the characteristics of a Trader. Valid A27.68K @StonkChris

Chris The KOL states in their bio that they have over 10 years of equity and crypto swing trading experience. Their tweets frequently publish detailed technical chart analyses (such as candlestick patterns, Ichimoku, RSI, support and resistance, etc.) along with clear price targets and entry/exit points, making them a typical technical analysis and trading strategy sharer; the extensive buy/short signals and take-profit/stop-loss settings reflect the characteristics of a Trader. Valid A27.68K @StonkChris

115 34 17.51K Original >Trend of ZETA after releaseExtremely Bearish

115 34 17.51K Original >Trend of ZETA after releaseExtremely Bearish

24h Social Sentiment from X

5,185Analyzed Posts-34.59%2,468Surveyed KOLs+0.04%Market sentiment leans Bullish- CoinsSSIChangeSSI Insights

- CoinsMPRChange

SPACE#1 KOL attention surges+79

SPACE#1 KOL attention surges+79 ON#2 Social mentions surged-

ON#2 Social mentions surged- MANA#3 Social mentions surged-

MANA#3 Social mentions surged- MEME#4 Social mentions skyrocketed-

MEME#4 Social mentions skyrocketed- MINA#5 Sentiment polarization sharply increased+64

MINA#5 Sentiment polarization sharply increased+64

Alert Summary