X Posts

Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo38104169

Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo38104169New coverage from The Banker highlights the evolving path toward stablecoin legislation in the United States — a development that could significantly shape the future of digital finance. Regulatory clarity remains one of the most important factors for unlocking institutional participation and enabling stablecoins to scale responsibly within the global financial system. Policy expert Adrian Wall emphasized that meaningful legislative progress will require bipartisan cooperation and good-faith negotiation. Establishing a framework that balances innovation, consumer protection, and financial stability is essential to providing legal certainty for issuers and fostering long-term industry growth. 1️⃣ Why bipartisan cooperation matters ➜ Prevents regulatory fragmentation and policy reversals ➜ Builds long-term confidence for institutions and issuers ➜ Encourages responsible innovation within clear boundaries ➜ Supports financial stability while enabling growth 2️⃣ Legal clarity: the missing foundation ➜ Clear rules reduce compliance uncertainty ➜ Enables banks and fintech firms to participate safely ➜ Protects consumers and strengthens trust ➜ Creates a predictable environment for innovation Constructive compromise, as highlighted in the report by Gabriel Whitwam, is critical to building durable and workable policy. Rather than restrictive measures, balanced regulation can help stablecoins function as trusted financial infrastructure supporting payments, settlements, and digital commerce. 3️⃣ Global implications for stablecoin adoption ➜ U.S. policy often sets the tone for global regulation ➜ Clear frameworks accelerate institutional adoption worldwide ➜ Encourages cross-border interoperability standards ➜ Strengthens legitimacy of digital dollar ecosystems 4️⃣ The role of the TRON network in stablecoin growth ➜ One of the leading settlement layers for stablecoin transfers ➜ Enables fast, low-cost global transactions ➜ Supports remittances, payments, and DeFi liquidity ➜ Powers real-world usage across emerging markets As policymakers move toward clearer rules, networks that already support high-volume stablecoin activity stand to benefit from increased institutional confidence and regulatory legitimacy. TRON’s infrastructure, optimized for speed and efficiency, positions it as a critical bridge between traditional finance and decentralized payment systems. The direction of U.S. stablecoin policy will influence global adoption trends, and constructive regulatory progress could accelerate the integration of blockchain networks into mainstream financial infrastructure. A balanced framework, built on cooperation and clarity, may ultimately define the next era of digital payments — one where stablecoins and blockchain networks operate as trusted components of the global economy. @trondao @justinsuntron #TRONEcoStar

Digital Sovereignty Alliance (DSA) D1.20K @DSAForg

Digital Sovereignty Alliance (DSA) D1.20K @DSAForgNew coverage in @TheBanker on the path forward for U.S. stablecoin legislation. @AdrianWall8395 noted that meaningful progress will depend on a good faith effort to keep the framework bipartisan and provide greater legal certainty for issuers. Constructive compromise is essential to achieving durable, workable stablecoin policy. Thank you @GabrielWhitwam for the thoughtful coverage. Read more below 👇 https://t.co/mytX3ILShF

0 0 6 Original >Trend of TRX after releaseBullishProgress in US stablecoin legislation will boost market development, benefiting TRON.

0 0 6 Original >Trend of TRX after releaseBullishProgress in US stablecoin legislation will boost market development, benefiting TRON. Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo38104169

Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo38104169The TRON ecosystem has released its Q4 2025 Quarterly Report, highlighting another period of strong network performance and accelerating real-world adoption. The data confirms TRON’s growing role as a foundational infrastructure layer for global digital payments and stablecoin settlement. During Q4, the network recorded over 20 million daily active addresses, reflecting sustained user engagement across DeFi, payments, gaming, and on-chain applications. At the same time, total quarterly transactions reached 994 million, marking a 16% increase compared to Q3 — a clear signal of expanding usage and network throughput. Key performance highlights ➜ Over 20M daily active addresses demonstrating consistent network participation ➜ 994M transactions processed in Q4 alone ➜ 16% quarter-over-quarter transaction growth ➜ Continued dominance in stablecoin transfer activity Stablecoins powering real-world adoption Stablecoin activity remained a central driver of TRON’s growth. The network continues to serve as a preferred settlement layer thanks to its speed, low fees, and scalability — making it ideal for cross-border transfers, remittances, and everyday financial transactions. 🚀 Expanding ecosystem utility Beyond payments, TRON’s infrastructure supports a rapidly evolving ecosystem: ➜ DeFi platforms enabling lending, liquidity, and yield opportunities ➜ Web3 applications and gaming ecosystems ➜ Cross-chain integrations improving liquidity flow ➜ Developer tools supporting next-generation dApps Industry analyst Sam Elfarra provides additional insights into the quarter’s performance, breaking down the metrics and their implications for TRON’s future growth trajectory. The Q4 report reinforces a clear narrative: TRON is not only growing in size, but deepening in utility. As stablecoin usage expands and global demand for efficient blockchain settlement increases, TRON continues strengthening its position as one of the most actively used networks in the digital asset economy. With strong momentum entering 2026, the ecosystem appears poised for further adoption, innovation, and infrastructure expansion worldwide. @trondao @justinsuntron #TRONEcoStar

TRON DAO D1.76M @trondao

TRON DAO D1.76M @trondaoTRON has released its first Q4 2025 Quarterly Report. Q4 reflected continued strength in stablecoin activity, with over 20M daily active addresses and 994M total transactions during the quarter — a 16% increase from Q3. Hear @SamElfa0 break down the key highlights below. Read the full report 👇 https://t.co/F3blBF1DFA

0 0 7 Original >Trend of TRX after releaseBullishTRX季度交易量增16%,活跃地址超2000万,前景看好 Ansem Trader Influencer C787.11K @blknoiz06

Ansem Trader Influencer C787.11K @blknoiz06 doug funnie Trader Influencer A24.97K @cryptoklotz

doug funnie Trader Influencer A24.97K @cryptoklotzKinda sad/funny, after eons on ct Seeing the 2020-2021 crypto VC crowd have tantrums on the tl lately I get it - my performance thus far hasn’t been what I thought it’d be. Things have been challenging. But holy hell man, seeing some accounts that I initially considered “thought leader” intelligentsia luminary types (some with 100k+ followers) devolve into routinely sounding like petulant children (in an almost boomer-like way) is wild It’s only the VC types with this tone too - plenty of Chungus-size traders have gotten smoked.. and though they moan and blow off steam, their complaints aren’t just absolutely dripping with entitlement Really makes you wonder how factory-lubricated the retail rape machine was last time around tbh

33 6 2.03K Original >BearishThe author satirizes recent crypto VC complaints, revealing a privileged mindset toly 🇺🇸 Founder Dev D677.85K @toly

toly 🇺🇸 Founder Dev D677.85K @tolyWoot woot! The age of unverified code is over https://t.co/VMyeZ8beaS

Torch Market D133 @torch_market

Torch Market D133 @torch_marketwe ran kani model checking (https://t.co/6fWsijZ6OC) against the https://t.co/7ibDD9qBif protocol. there are 20 proof harnesses testing all inputs on program v3.2.0, all passing, proving none can violate the invariants defined @solana @toly 🤌🔥 https://t.co/pM6tJhFXTP

9 0 656 Original >Trend of SOL after releaseBullishAll SOL code has been verified, security is enhanced, and it’s worth being bullish. Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo38104169

Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo38104169Recent coverage from CoinDesk highlights a major strategic move by Justin Sun, who plans to add between $50 million and $100 million worth of Bitcoin to the blockchain ecosystem’s holdings. The report underscores a growing trend: leading blockchain networks are diversifying reserves with BTC as a long-term strategic asset. This initiative reflects a broader vision of strengthening financial resilience while aligning with the evolving role of Bitcoin as a global reserve asset within digital economies. 1️⃣ Strengthening reserve strategy ➜ Adding BTC enhances treasury diversification ➜ Provides a hedge against market volatility ➜ Reinforces long-term financial stability 2️⃣ Why Bitcoin remains strategic ➜ Recognized globally as the most secure blockchain network ➜ Increasing institutional adoption and reserve use ➜ Store-of-value characteristics similar to digital gold 3️⃣ Impact on the TRON ecosystem ➜ Strengthens confidence among institutions and partners ➜ Supports cross-ecosystem liquidity and interoperability ➜ Signals maturity in treasury and risk management practices 4️⃣ A growing institutional trend ➜ More blockchain organizations are integrating BTC into reserves ➜ Reflects convergence between traditional finance and Web3 ➜ Demonstrates long-term commitment to sustainable growth By incorporating Bitcoin into strategic holdings, Justin Sun continues positioning TRON within the broader digital asset economy — one where interoperability, financial resilience, and global trust play central roles. As highlighted in the article, this move signals not just asset accumulation, but a forward-looking approach to building a stronger and more adaptable blockchain ecosystem for the future. @justinsuntron #TRONEcoStar

TRON DAO D1.76M @trondao

TRON DAO D1.76M @trondao“@justinsuntron plans to add between $50 million and $100 million worth of bitcoin (BTC) to the blockchain’s holdings.” Thank you @CoinDesk and @OKnightCrypto for the coverage. Read the full article below. 👇 https://t.co/BOYIyQEek9 https://t.co/79VlaGQ4r5

0 0 1 Original >Trend of BTC after releaseExtremely BullishJustin Sun plans to increase his BTC holdings by $50 million to $100 million, strengthening the strategic reserves of the TRON ecosystem.

0 0 1 Original >Trend of BTC after releaseExtremely BullishJustin Sun plans to increase his BTC holdings by $50 million to $100 million, strengthening the strategic reserves of the TRON ecosystem. peterpriew 🔴✨🥷 OnChain_Analyst Educator S10.62K @PriewPeter

peterpriew 🔴✨🥷 OnChain_Analyst Educator S10.62K @PriewPeter peterpriew 🔴✨🥷 OnChain_Analyst Educator S10.62K @PriewPeter

peterpriew 🔴✨🥷 OnChain_Analyst Educator S10.62K @PriewPeter🔐 Attacking Bitcoin 51% is almost impossible when the initial cheating cost is 45 million baht per hour 🔥 . Based on data from the PoW 51% Attack Cost website (link in the comments), as of February 4, 2026, it states clearly that…… . 🔒 Bitcoin has the highest hash rate in the world . 💰 To carry out a 51% attack, it would cost nearly $1.47 million per hour . 💱 Calculated at an exchange rate of 31.6 baht/USD . 👉 Approximately 45.7 million baht per hour 😱 . 1⃣ What is a 51% Attack (explained in simple terms) . ⛓️ The system trusts the “chain with the most mining power” . 👿 If someone controls more than 50% of the mining power . 🔄 They can reverse transactions and double‑spend . ❗ But for Bitcoin, you must defeat the mining power of the entire world . 2⃣ Even just the cost of renting mining power is huge . 💰 Attack cost = $1.47 million per hour . 🇹🇭 ≈ 45.7 million baht per hour . ⏱️ If the attack lasts 24 hours . 👉 Approximately 1,097 million baht (≈ 1.1 billion baht) . ⚠️ Must pay per hour, not a one‑time payment . 🚫 Importantly, Bitcoin cannot rent hash power from NiceHash (0%) → Even with money, there is no mining power to rent . 3⃣ That's not enough… you also need real “mining rigs” 🛠️ . ⚙️ Suppose using Antminer S21 (~200 TH/s per unit) . 🔋 Mining power needed...

5 1 418 Original >Trend of BTC after releaseExtremely BullishA Bitcoin 51% attack is almost impossible due to its extremely high cost and hash power.

5 1 418 Original >Trend of BTC after releaseExtremely BullishA Bitcoin 51% attack is almost impossible due to its extremely high cost and hash power. Crypto Aman Influencer Media C88.89K @cryptoamanclub

Crypto Aman Influencer Media C88.89K @cryptoamanclubWill crypto finish banks in the next 10 years?

1 1 25 Original >NeutralWhether cryptocurrency can replace banks in the next ten years remains to be seen. Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo38104169

Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo38104169Tron Inc. has expanded its digital asset treasury with the acquisition of 179,058 TRX at an average price of $0.28, bringing its total holdings to over 681.6 million TRX. This latest purchase reinforces the company’s long-term commitment to the TRON ecosystem and signals continued confidence in the network’s growth trajectory. By steadily increasing its TRX reserves, Tron Inc. is strengthening its Tron Digital Asset Treasury (DAT) strategy — a move designed to enhance long-term shareholder value while aligning the company’s balance sheet with the expansion of blockchain-based financial infrastructure. 📊 Strategic significance of the acquisition ➜ Strengthens treasury exposure to a high-utility blockchain asset ➜ Demonstrates institutional confidence in TRON’s long-term adoption ➜ Aligns corporate treasury strategy with Web3 infrastructure growth ➜ Supports balance sheet diversification through digital assets The accumulation strategy reflects a broader trend of publicly listed firms integrating blockchain assets into corporate treasury management. As blockchain adoption accelerates globally, holding utility-driven digital assets like TRX provides strategic exposure to decentralized finance, cross-border settlement, and on-chain economic activity. 🌐 Why TRON remains a strategic asset The TRON network continues to rank among the most active blockchain ecosystems, supporting high transaction throughput, stablecoin settlement dominance, and a rapidly expanding DeFi landscape. These fundamentals position TRX as a utility asset powering real‑world financial applications rather than purely speculative demand. Tron Inc.’s growing treasury reflects confidence not only in token value potential, but also in the infrastructure layer TRON provides for global digital payments and decentralized applications. For real‑time transparency, the company provides public visibility into its designated on‑chain treasury wallet via TRONSCAN, allowing stakeholders to monitor holdings and transactions directly on‑chain. As institutional participation deepens and blockchain infrastructure continues to mature, Tron Inc.’s accumulation strategy highlights the evolving relationship between public companies and decentralized financial ecosystems — a signal that the integration of traditional finance and Web3 is accelerating. @trondao @justinsuntron #TRONEcoStar

Tron Inc. D2.43K @TRON_INC

Tron Inc. D2.43K @TRON_INCTron Inc. (NASDAQ: TRON) acquired 179,058 TRX tokens today at an average price of $0.28, further increasing its TRX treasury holdings to more than 681.6 million TRX in total. The company aims to further grow its Tron DAT holdings to enhance long term shareholder value. For live update on the designated on-chain TRX treasury wallet for Tron Inc, please refer to: https://t.co/UYZgaRvn97.

0 0 6 Original >Trend of TRX after releaseExtremely BullishTron Inc. increased its holdings by 179,000 TRX to 681.6 million, demonstrating long‑term confidence in the TRON ecosystem. Documenting Saylor Media Influencer B75.26K @saylordocs

Documenting Saylor Media Influencer B75.26K @saylordocs0.1 BTC is a lot of Bitcoin 0.3 BTC is a lot of Bitcoin 0.5 BTC is a lot of Bitcoin 0.7 BTC is a lot of Bitcoin 0.9 BTC is a lot of Bitcoin 1 BTC is a lot of Bitcoin 1.5 BTC is a lot of Bitcoin Don't let the fiat-brained convince you otherwise.

4 2 129 Original >Trend of BTC after releaseBullishEven a small amount of BTC is hugely valuable, encouraging holding Greenpeace.BNB.probablynothing.LUNC OnChain_Analyst Community_Lead S6.20K @Greenpeace06_09

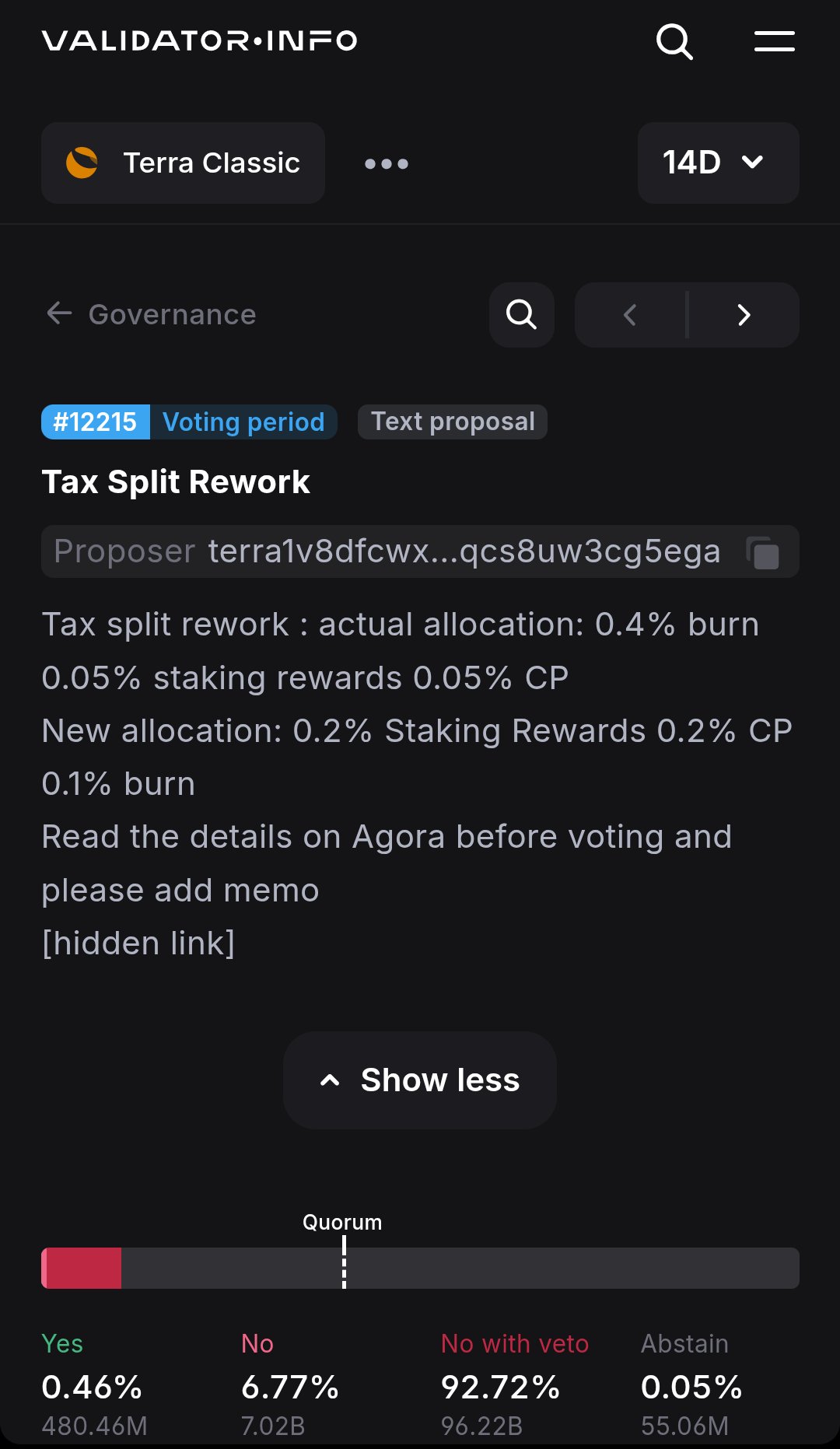

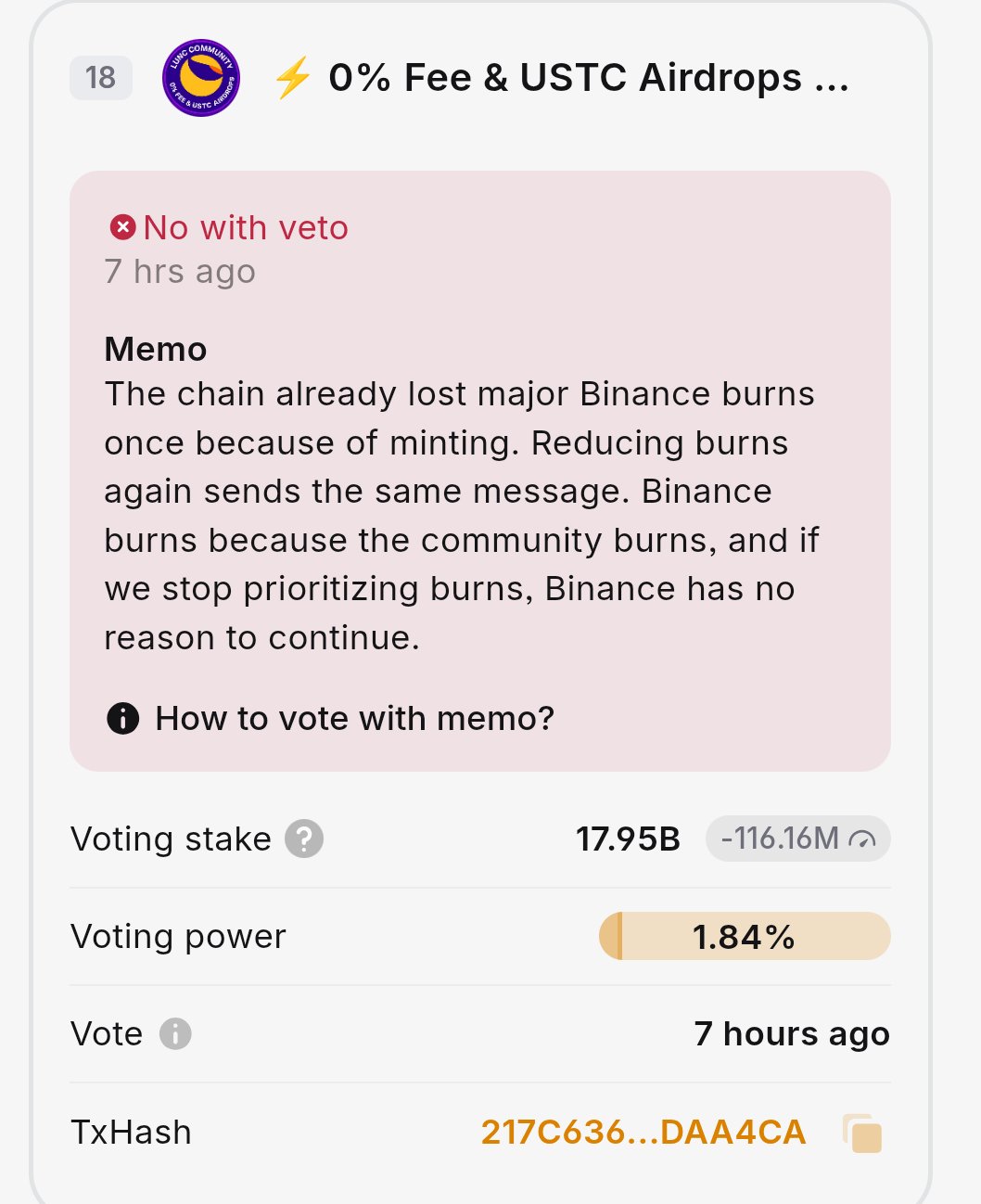

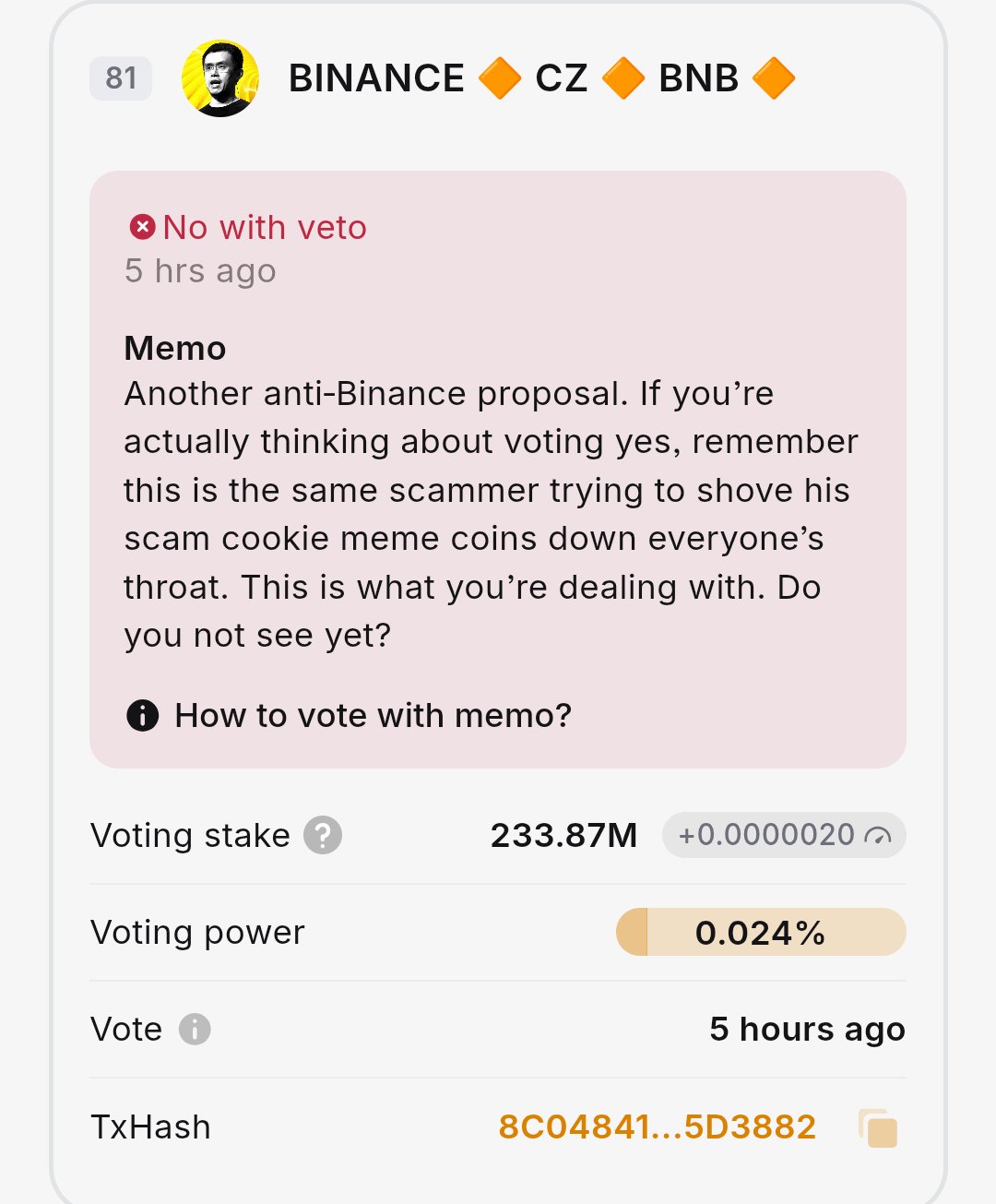

Greenpeace.BNB.probablynothing.LUNC OnChain_Analyst Community_Lead S6.20K @Greenpeace06_09NEW PROPOSAL...... Another Nicolas Boulay ignorant prop. There were so many NO votes with messages that I picked a few that I agree with. I'm a NWV for two reasons: (1) Nicolas Boulay, Cookie sh$t coin, Do, and Artemis which he is part of are all scams. His last prop still being voted on is a scam. (2) This reminds me of the December 2022 prop created by Juris founder who wanted to mint binance burn coins which we are still being punished for today. We have lost over $12,000,000 worth of LUNC burns because of that prop (burns reduced by 50%). I warned this community back then and they didn't listen. It's time to listen. Any anti Binance proposals are NWV for me. As always, I vote how many delegators choose REGARDLESS of my personal opinion. So let me know your thoughts. #lunc #GreenpeaceUNITED

1 0 15 Original >Extremely BearishThe LUNC community strongly opposed and rejected a proposal deemed fraudulent and harmful to the LUNC burn mechanism.

1 0 15 Original >Extremely BearishThe LUNC community strongly opposed and rejected a proposal deemed fraudulent and harmful to the LUNC burn mechanism.

24h Social Sentiment from X

5,185Analyzed Posts-34.59%2,468Surveyed KOLs+0.04%Market sentiment leans BullishSentiment index +63, boosted by X platform's upcoming timeline trading and Bitcoin rallying to $70k, GMT and other coins drawing attention, tax authority concerns are mild.- CoinsSSIChangeSSI InsightsMarket social sentiment overall rises, with average SSI ≈ 71.6 (+≈20%), QNT (78.8, +35%) and SPACE (76, +36%) leading the gains, driven by technological breakthroughs and institutional partnerships.

- CoinsMPRChange

SPACE#1 KOL attention surges+79

SPACE#1 KOL attention surges+79 ON#2 Social mentions surged-

ON#2 Social mentions surged- MANA#3 Social mentions surged-

MANA#3 Social mentions surged- MEME#4 Social mentions skyrocketed-

MEME#4 Social mentions skyrocketed- MINA#5 Sentiment polarization sharply increased+64

MINA#5 Sentiment polarization sharply increased+64

Alert SummaryWarning intensity is extremely high (anomaly ≈100, ↑15%); SPACE(#1, ↑79) leads the rally, MINA(#5, ↑64) and QNT(#7, ↑63) are also notable, driven by surging social buzz and institutional partnerships.