Haftungsausschluss:

Daten von X (Twitter), Eigentum der ursprünglichen Ersteller. Nur zur Orientierung, keine Anlageberatung.

X Beiträge

- Bullisch

- Trend von SOL nach VeröffentlichungNeutral

- Trend von BTC nach VeröffentlichungNeutral

- Extrem bullisch

- Bullisch

Suji Yan 💜🔥🎭 Founder Influencer B34.14K @suji_yan

Suji Yan 💜🔥🎭 Founder Influencer B34.14K @suji_yan vitalik.eth Founder Researcher C5.88M @VitalikButerin1 0 75 Original >Trend von ETH nach VeröffentlichungBärisch

vitalik.eth Founder Researcher C5.88M @VitalikButerin1 0 75 Original >Trend von ETH nach VeröffentlichungBärisch Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.00K @hongngo38104169

Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.00K @hongngo38104169 Kripton D2.99K @kripton_la0 0 5 Original >Bullisch

Kripton D2.99K @kripton_la0 0 5 Original >Bullisch Mayne TA_Analyst Trader C558.26K @Tradermayne

Mayne TA_Analyst Trader C558.26K @Tradermayne The Haven D47.14K @TheHavenCrypto33 0 5.66K Original >Neutral

The Haven D47.14K @TheHavenCrypto33 0 5.66K Original >Neutral sassal.eth/acc 🦇🔊 Educator Media B296.15K @sassal0x

sassal.eth/acc 🦇🔊 Educator Media B296.15K @sassal0x Devansh Mehta D7.55K @devanshmehta

Devansh Mehta D7.55K @devanshmehta

70 7 5.00K Original >Trend von ETH nach VeröffentlichungExtrem bullisch

70 7 5.00K Original >Trend von ETH nach VeröffentlichungExtrem bullisch Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.00K @hongngo38104169

Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.00K @hongngo38104169

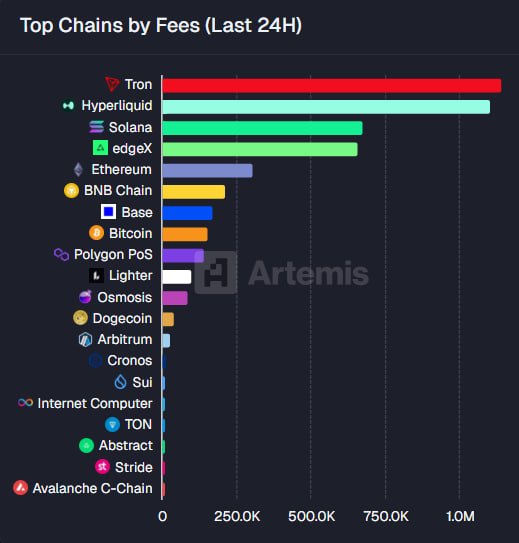

TRON DAO D1.76M @trondao0 0 8 Original >Trend von TRX nach VeröffentlichungExtrem bullisch

TRON DAO D1.76M @trondao0 0 8 Original >Trend von TRX nach VeröffentlichungExtrem bullisch

24 Stunden Social Media-Stimmung von X

5,170Analysierte Beiträge-34.11%2,468Befragte KOLs0%Die Marktstimmung geht in Richtung Bullisch- CoinsSSIÄndernSSI Insights

- CoinsMPRÄndern

SPACE#1 KOL attention surge+75

SPACE#1 KOL attention surge+75 ON#2 Social mentions surged-

ON#2 Social mentions surged- MANA#3 Social mentions surged-

MANA#3 Social mentions surged- MEME#4 Social mentions surge-

MEME#4 Social mentions surge- SOMI#5 Extremely polarized sentiment-

SOMI#5 Extremely polarized sentiment-

Zusammenfassung der Warnung