Uniswap (UNI)

Uniswap (UNI)

$3.627 +4.55% 24H

- 82社交熱度指數(SSI)-12.47% (24h)

- #76市場預警排名(MPR)-75

- 5524小時社交提及量-62.07% (24h)

- 58%24小時KOL看好比例43位活躍KOL

- 概要

- 看漲訊號

- 看跌訊號

社交熱度指數(SSI)

- 總體資料82SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈極度看漲 (16%)看漲 (42%)中性 (15%)看跌 (16%)極度看跌 (11%)社交熱度洞察

市場預警排名(MPR)

- 預警解讀

相關推文

- 釋出後UNI走勢看漲

- 釋出後UNI走勢看漲

- 釋出後UNI走勢看漲

Subjective Views Influencer FA_Analyst A21.22K @subjectiveviews

Subjective Views Influencer FA_Analyst A21.22K @subjectiveviews Subjective Views Influencer FA_Analyst A21.22K @subjectiveviews

Subjective Views Influencer FA_Analyst A21.22K @subjectiveviews

33 0 2.60K 閱讀原文 >釋出後UNI走勢看漲

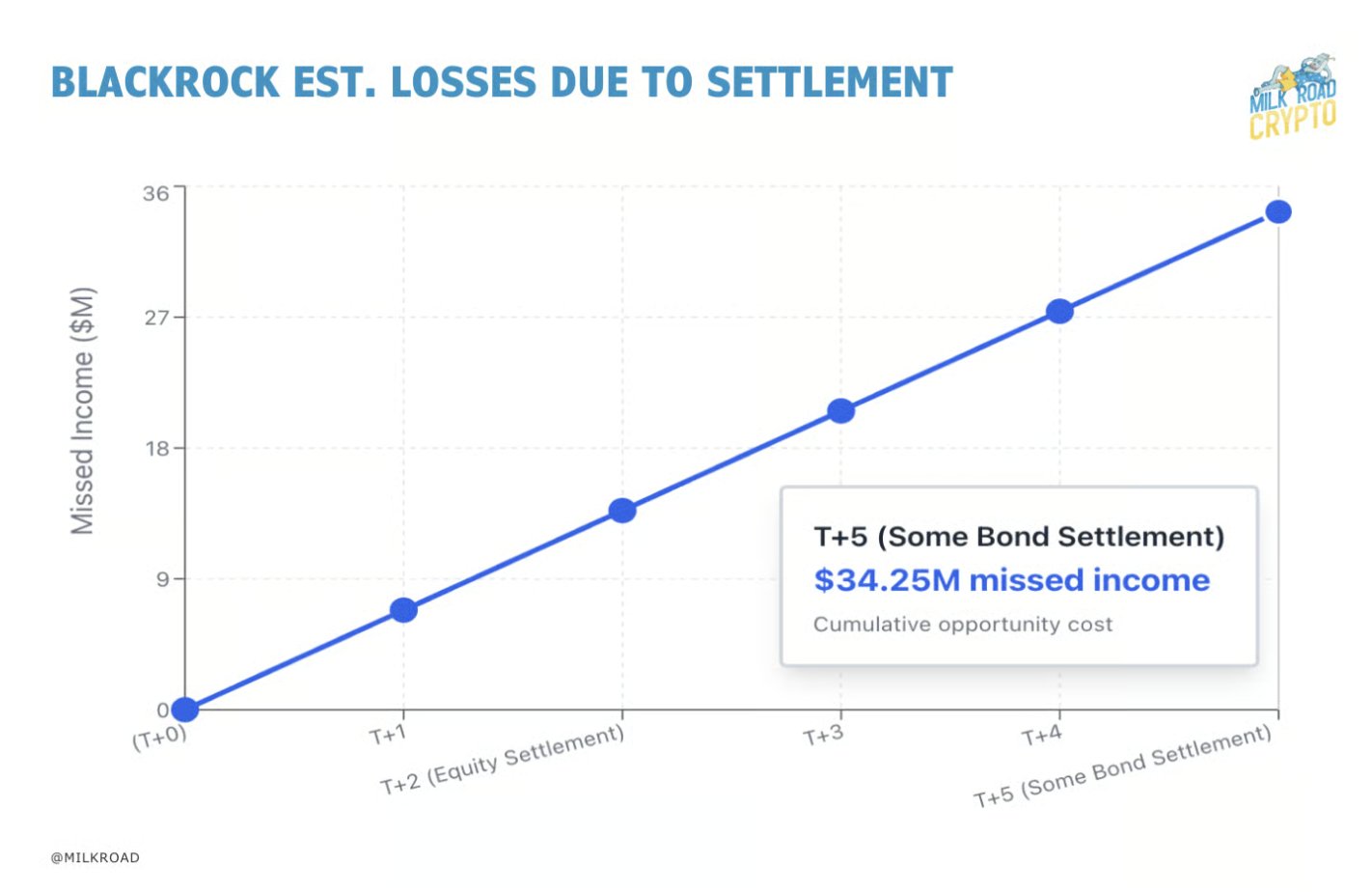

33 0 2.60K 閱讀原文 >釋出後UNI走勢看漲 Milk Road Educator Influencer D94.09K @MilkRoad

Milk Road Educator Influencer D94.09K @MilkRoad Milk Road Educator Influencer D94.09K @MilkRoad

Milk Road Educator Influencer D94.09K @MilkRoad 25 4 4.31K 閱讀原文 >釋出後UNI走勢極度看漲

25 4 4.31K 閱讀原文 >釋出後UNI走勢極度看漲- 釋出後UNI走勢中性

chainyoda FA_Analyst DeFi_Expert B43.16K @chainyoda

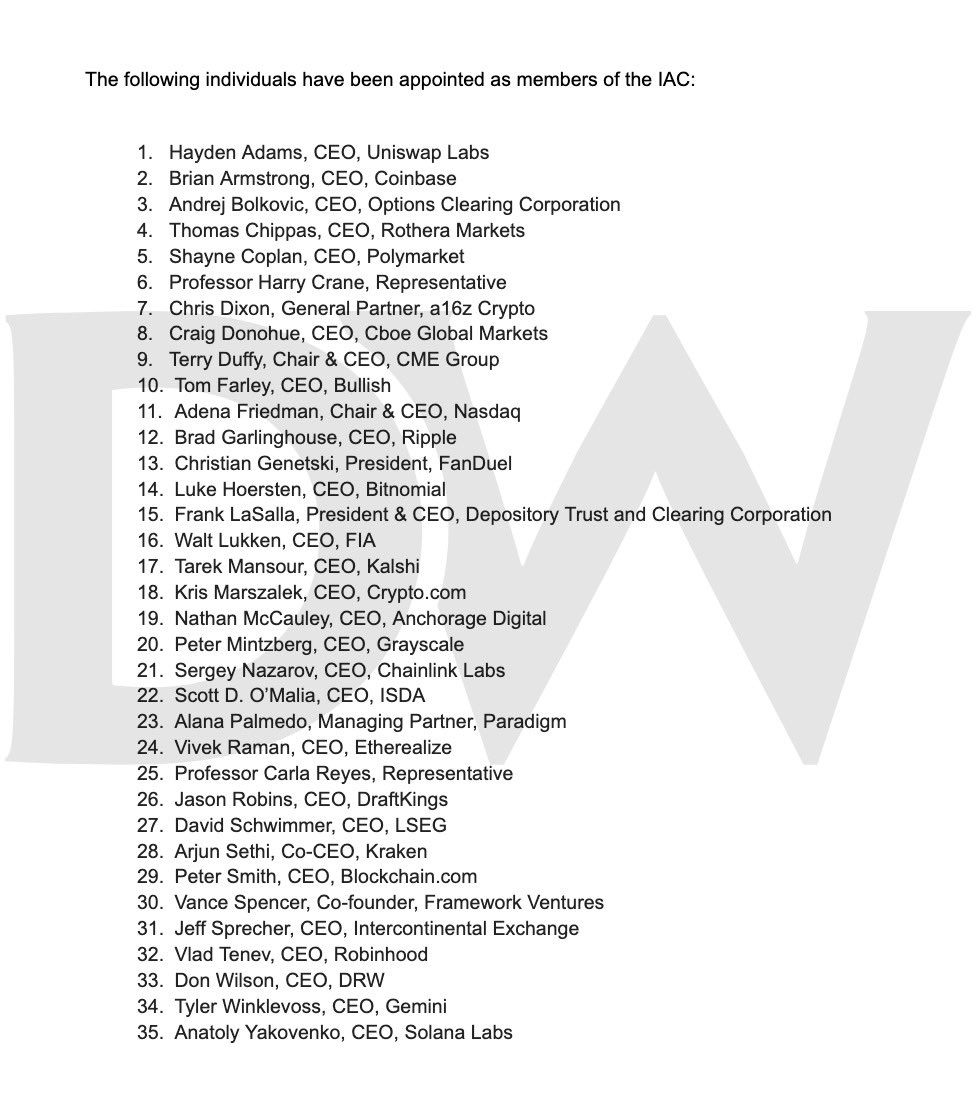

chainyoda FA_Analyst DeFi_Expert B43.16K @chainyoda Mike Selig D852 @ChairmanSelig

Mike Selig D852 @ChairmanSelig 1.54K 191 407.74K 閱讀原文 >釋出後UNI走勢看漲

1.54K 191 407.74K 閱讀原文 >釋出後UNI走勢看漲 CJ Bennett TA_Analyst Educator A3.54K @the_real_CJ

CJ Bennett TA_Analyst Educator A3.54K @the_real_CJ Brecca Stoll D18.01K @breccastoll

Brecca Stoll D18.01K @breccastoll 1.05K 116 292.62K 閱讀原文 >釋出後UNI走勢看漲

1.05K 116 292.62K 閱讀原文 >釋出後UNI走勢看漲- 釋出後UNI走勢看漲

Anthony Scaramucci Founder Influencer C1.08M @Scaramucci

Anthony Scaramucci Founder Influencer C1.08M @Scaramucci Mike Selig D852 @ChairmanSelig

Mike Selig D852 @ChairmanSelig 1.54K 191 407.74K 閱讀原文 >釋出後UNI走勢中性

1.54K 191 407.74K 閱讀原文 >釋出後UNI走勢中性