STBL (STBL)

STBL (STBL)

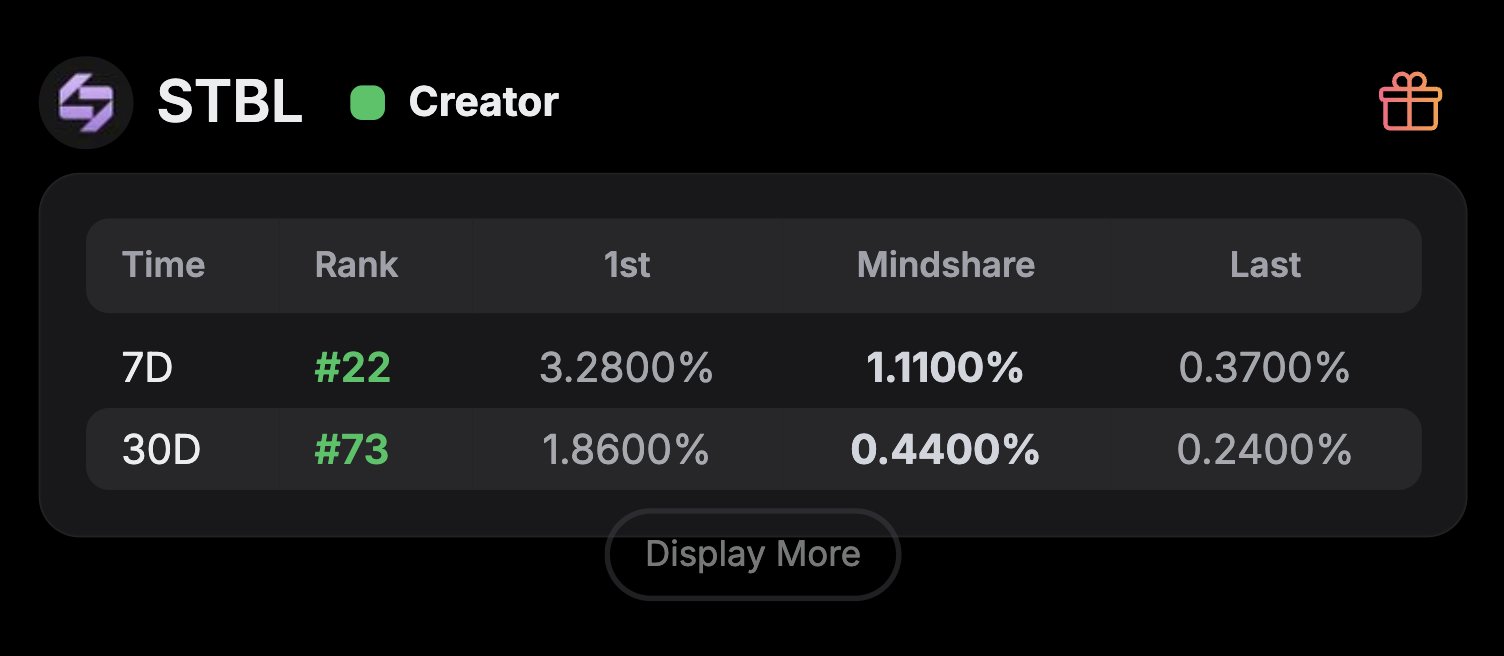

- 41社交熱度指數(SSI)-22.45% (24h)

- #141市場預警排名(MPR)-23

- 424小時社交提及量-60.00% (24h)

- 100%24小時KOL看好比例3位活躍KOL

- 概要STBL technical side stopped falling, supply locked, founder background strong, yield cycle started, short-term price still falling.

- 看漲訊號

- Downtrend halted

- Only 14% supply unlocked

- Founder previously co-built Tether

- Staking yield cycle launched

- Institutional buyback plan in place

- 看跌訊號

- Price down 5.95%

- Social buzz down 22%

- 1h chart still weak

- Supply locked, liquidity tight

- Low interaction volume shows insufficient interest

社交熱度指數(SSI)

- 總體資料41SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈極度看漲 (75%)看漲 (25%)社交熱度洞察STBL social hot index low (41.46/100, -22.45%), activity down 56% and KOL attention down 55% are the main reasons; although sentiment is positive ↑21%, it is still insufficient to boost.

市場預警排名(MPR)

- 預警解讀STBL warning rank fell to #141 (↓23), social anomalies at 0, sentiment polarization rose to 68.6/100 (+188%), which is the main anomaly signal, linked to the continued price decline.

相關推文

deathmage.x .edge🦭 DeFi_Expert Researcher B2.27K @phanthanguss

deathmage.x .edge🦭 DeFi_Expert Researcher B2.27K @phanthanguss$STBL mint-stake loop: testing the Q4 boosts on @stbl_official today (ETA-2hrs) Staker rewards live since Nov 29, yield sharing kicking in with DeFi integrations. Caps steady at ecosystem issuance, no rush but solid for scaling. I'll run a USST mint → STBL stake → YLD claim cycle, watching the auto-peg and liquidity push. • Mint USST via dashboard: over-collateralize with RWAs, get 1:1 stable with built-in yield anchor. Principal stays locked, yield accrues to ecosystem (no leaks). • Stake STBL: partial redemptions enabled, Tri-Factor peg holds it calm (settle-band logic waits for consistency, no spike drags). Boosts scale with stake size daily pool ~115k STBL, whispered $1M/mo buyback looping in. • Claim YLD: split principal/yield, redeem partial without full unwind. Tokenomics split 45/17/20/15/3 keeps supply tight (only 14% unlocked). Net: borrow-free yield capture, turning stability into revenue. NAV holds flat while ecosystem compounds your "bet" is lower RWA volatility vs. long-term monetary sovereignty. If you're holding naked USST, bridge to a DeFi partner for extra sharing (reg flex + tokenization trend). IMO, this flips stablecoin utility into actual infra power. My entry link if you want to join the loop: [https://t.co/DUeZ9XFAcA] Note: mint splits to principal + yield ticket, redeem anytime 1:1. Minimizes exposure, maximizes ecosystem stickiness. Working a points model for stakers team code if you're in: stblboost23. Any better redemption plays or vault tweaks? GL on the quiet build

1 1 73 閱讀原文 >釋出後STBL走勢極度看漲STBL upgrades multi-factor staking, offering high yields and a stable mechanism.

1 1 73 閱讀原文 >釋出後STBL走勢極度看漲STBL upgrades multi-factor staking, offering high yields and a stable mechanism. Ni Researcher DeFi_Expert B40.64K @ni_celeb

Ni Researcher DeFi_Expert B40.64K @ni_celebwild how people love chasing random degen plays but somehow miss the founders with actual track records of building trillion-dollar infrastructure @stbl_official when someone who helped shape stablecoins from day one spins up a new project… that’s not noise, that’s signal. did you know that @stbl_official co-founder @Reeve_Collins is also the co-founder of @Tether_to ? yeah the same tether that became the biggest stablecoin onchain with $180b+ market cap, the backbone of global crypto liquidity. and you’re still sleeping on his newest project? reeve already proved he knows how to scale a stablecoin from zero to system-critical infrastructure. stbl is clearly his next iteration cleaner design, stronger architecture, and built for where stablecoins are heading, not where they came from. feels like one of those “the writing is on the wall but people will only see it later” plays. sometimes the most obvious moves are the ones everyone overthinks.

12 7 167 閱讀原文 >釋出後STBL走勢極度看漲STBL, launched by a co‑founder of Tether, is seen as the next iteration of stablecoins with huge potential.

12 7 167 閱讀原文 >釋出後STBL走勢極度看漲STBL, launched by a co‑founder of Tether, is seen as the next iteration of stablecoins with huge potential. Ni Researcher DeFi_Expert B40.64K @ni_celeb

Ni Researcher DeFi_Expert B40.64K @ni_celebcrazy part about stablecoin narratives right now is everyone keeps chasing loud headlines, @stbl_official but the real power plays are the ones building quiet, controlled foundations. $stbl is one of those plays the kind that looks “slow” until it suddenly isn’t. people still underestimate how early $STBL really is. only 14% of the @stbl_official supply is unlocked the remaining majority is locked tight and structured for long-term stability, not short-term hype. that’s exactly the kind of supply curve you want when a project is aiming to rebuild stablecoin infrastructure from the ground up. a stablecoin ecosystem is only as strong as its base. and stbl’s base? durability. predictability. institutional alignment. it’s engineered for the players who actually need reliability, not just volatility farming. when you look at stablecoin 2.0, you can tell which projects are designing for the next cycle instead of the next tweet. stbl is clearly in that first category. and if you’re truly paying attention to where stablecoins are heading this chart already tells the whole story.

Ni Researcher DeFi_Expert B40.64K @ni_celeb

Ni Researcher DeFi_Expert B40.64K @ni_celebdig into stablecoin 2.0, the more it becomes obvious: stbl isn’t just tweaking the system @stbl_official it’s flipping the entire monetary architecture on its head. ecosystems won’t just use money anymore. they’ll design it. here’s the cleaner, deeper breakdown of what @stbl_official is actually unleashing with Money as a Service (MaaS) $STBL and why it hits way harder than people think: 1️⃣ monetary sovereignty becomes a feature, not a privilege with ecosystem-specific stablecoins (ESS), platforms finally stop renting financial infrastructure from banks or third-party issuers. they control: • issuance • incentives • supply dynamics • internal monetary policy basically, every ecosystem gets its own mini-central bank but built for speed, transparency, and programmability. that’s not “a nice extra.” that’s structural power. 2️⃣ yield stops leaking out it stays inside the ecosystem right now, billions in corporate deposits generate yield… for someone else. banks take it. stablecoin issuers take it.

25 17 774 閱讀原文 >釋出後STBL走勢極度看漲STBL is hailed as a disruptive stablecoin project with long-term value and an innovative MaaS model.

25 17 774 閱讀原文 >釋出後STBL走勢極度看漲STBL is hailed as a disruptive stablecoin project with long-term value and an innovative MaaS model. Leo.Master.edge🦭. MemeMax ⚡️ Influencer DeFi_Expert C11.46K @ezeroho8245

Leo.Master.edge🦭. MemeMax ⚡️ Influencer DeFi_Expert C11.46K @ezeroho8245. @stbl_official $STBL MEXC exchange 1-hour chart. As the market revives, the STBL downtrend also seems to have paused to some extent. Gradually preparing for a rebound. https://t.co/pdqChDGGBd

19 17 572 閱讀原文 >釋出後STBL走勢看漲STBL downtrend has stopped, market warming up and preparing for a rebound.

19 17 572 閱讀原文 >釋出後STBL走勢看漲STBL downtrend has stopped, market warming up and preparing for a rebound. Searchfi/MemeMax⚡️ Community_Lead Influencer C169.23K @searchfi_eth

Searchfi/MemeMax⚡️ Community_Lead Influencer C169.23K @searchfi_eth< Among introverts, who do you think is the mountain champion? > Suddenly, what's this about? You say you're not curious about this at all? Me too. I am most curious about who will be the RWA stable champion. I hope it becomes @stbl_official! STBL's Stablecoin 2.0 provides returns through YLD NFT (4.8% annual), MFS staking (up to 90% APY), and protocol buybacks. Especially, it is a structure that can earn RWA revenue while maintaining stablecoin liquidity. With this, can't STBL become the RWA champion?

MOODOO.edge🦭 MemeMax⚡️ Influencer Educator B12.98K @MOODOO_Diary

MOODOO.edge🦭 MemeMax⚡️ Influencer Educator B12.98K @MOODOO_DiaryFeel the RWA emergence era approaching more and more. Personally, I expect RWA to become one of the best use cases in Web3! Beyond the old STOs that only talked about "dreams", RWA is now seeing actual collaboration cases emerging! (It seems the trend changed after BlackRock started building BUIDL?) There are many RWA news at Abu Dhabi Finance Week! Anyway, let’s all ride the surge of the three RWA giants!! 🚀 @Theo_Network @KAIO_xyz @stbl_official

76 63 1.52K 閱讀原文 >釋出後STBL走勢極度看漲The author is extremely bullish on the RWA track and projects such as STBL, THEO, and KAIO. Shuarix™ Researcher Influencer B41.95K @Shuarix

Shuarix™ Researcher Influencer B41.95K @ShuarixLast night's green made me to bullish $STBL shows a tight consolidation zone over the past 24 hours, w/ candles clustering in a narrow range and volatility staying low Momentum is flat Suggesting neither bulls nor bears hold control, and volume remains moderate without any breakout signals Market structure still leans neutral, with short-term traders waiting for a catalyst to define direction If liquidity begins to expand, the next move will likely come quickly, compression like this rarely lasts long Waiting for more bullish news from @stbl_official team👀

91 86 4.87K 閱讀原文 >釋出後STBL走勢看漲STBL is in a tight consolidation, the author is waiting for bullish news to determine direction.

91 86 4.87K 閱讀原文 >釋出後STBL走勢看漲STBL is in a tight consolidation, the author is waiting for bullish news to determine direction. Ni Researcher DeFi_Expert B40.64K @ni_celeb

Ni Researcher DeFi_Expert B40.64K @ni_celebdig into stablecoin 2.0, the more it becomes obvious: stbl isn’t just tweaking the system @stbl_official it’s flipping the entire monetary architecture on its head. ecosystems won’t just use money anymore. they’ll design it. here’s the cleaner, deeper breakdown of what @stbl_official is actually unleashing with Money as a Service (MaaS) $STBL and why it hits way harder than people think: 1️⃣ monetary sovereignty becomes a feature, not a privilege with ecosystem-specific stablecoins (ESS), platforms finally stop renting financial infrastructure from banks or third-party issuers. they control: • issuance • incentives • supply dynamics • internal monetary policy basically, every ecosystem gets its own mini-central bank but built for speed, transparency, and programmability. that’s not “a nice extra.” that’s structural power. 2️⃣ yield stops leaking out it stays inside the ecosystem right now, billions in corporate deposits generate yield… for someone else. banks take it. stablecoin issuers take it.

18 11 1.02K 閱讀原文 >釋出後STBL走勢極度看漲STBL is hailed as a disruptive stablecoin project with long-term value and an innovative MaaS model.

18 11 1.02K 閱讀原文 >釋出後STBL走勢極度看漲STBL is hailed as a disruptive stablecoin project with long-term value and an innovative MaaS model. Henri/MemeMax⚡️ Trader TA_Analyst B6.88K @HenriLee92

Henri/MemeMax⚡️ Trader TA_Analyst B6.88K @HenriLee92Is Stablecoin 2.0 a digital gold standard? The limits of collateral‑based currency and the challenges to overcome. Recently I introduced the vision of STBL @stbl_official's currency, using the term "scary story". Today I will try to explain my thoughts on this as simply as possible. Stablecoin 2.0's core is collateral‑based trust. The structure that deposits tokenized sovereign bonds, money market funds and other RWA 100% on‑chain, and issues USST and YLD based on that collateral, evokes the old gold standard. The gold standard was also the most intuitive and powerful trust model of "currency = real‑asset collateral". However, the gold standard was abolished and replaced by a fiat‑money system for reasons. (There are many interesting stories like the Nixon shock, but I will limit to generic discussion.) 1. Limitation of economic growth speed When the supply speed of gold cannot keep up with economic growth, states cannot provide liquidity. 2. Lack of flexibility in national policy In emergencies such as war, financial crises, bank collapses, governments needed to issue more currency to supply needed funds, which was impossible under the gold standard. 3. Inability to resolve global trade imbalances The gold standard effectively blocked liquidity adjustments, exposing the international trade system to sustained pressure. Then, might Stablecoin 2.0 face the same problems? The USST·YLD structure we have studied so far can only be issued to the extent that collateral exists. So does this system also have limits on liquidity supply like the gold standard? Is there insufficient policy flexibility? Does it inhibit the expansion and reproduction of the economic system? These are reasonable questions. So how will Stablecoin 2.0 address the limitations that the gold standard could not overcome? (Recall what we have studied so far) 1. Solving liquidity limits with unlimited digital collateral supply The problem of the gold standard was that gold supply was limited. But what is the collateral of Stablecoin 2.0? Sovereign bonds Money market funds Tokenized bonds Tokenized funds Private credit (RWA) Commercial assets, etc. The entirety of real assets in the global financial market can become potential collateral. In other words, collateral supply is effectively infinite. This can greatly mitigate the gold‑standard's growth slowdown problem. 2. Securing policy flexibility / programmable money While the gold standard's policy adjustments were tied to physical constraints, Stablecoin 2.0 gains flexibility by using smart contracts to adjust collateral ratios, issuance volume, and liquidity supply in real time. 3. Global asymmetry auto‑balanced by USST USST becomes not a single ecosystem but the settlement layer for all ESS (ecosystem stablecoins). Thus, global flows are automatically settled. The asymmetric structure of past international finance is alleviated by protocol‑level settlement mechanisms. 4. Distributing issuance profit from concentration to community Both the gold standard and fiat money had issuance profits monopolized by the state or central institutions. Stablecoin 2.0 attributes the issuer's profit to enterprises/ecosystem/users as YLD to the community, and redistributes issuance revenue from the central authority to participants. This can be seen as a reallocation of economic power. Nevertheless, Stablecoin 2.0 still faces realistic challenges that must be overcome. Even if collateral is transparent on‑chain, the collateral‑based monetary system contains the following risks. 1. Risks inherent to RWA (a concept not present in the gold standard) Issuer default Reliability of tokenisation infrastructure Regulatory clashes Risks across multiple chains 2. Weakening of monetary policy due to excessive private currency The advantage of fiat money is that governments can adjust money supply during crises. Because Stablecoin 2.0 transfers this authority to the private ecosystem, it can clash with the stability of national monetary policy. 3. Emergence of new forms of global system risk Although collateral‑based, the collateral is a financial asset, thus subject to market volatility. This is a different type of risk from the gold standard. Conclusion Stablecoin 2.0 is not a revival of the gold standard, but a new monetary system based on digital collateral and programmable policy, which is a rational perspective. In simple terms, it is an attempt to simultaneously capture the trust of the gold standard and the flexibility of fiat money. However, there are clearly problems that need to be solved RWA credibility Regulatory clashes Weakening of state authority due to expansion of private currency Systemic risk of digital financial infrastructure Stablecoin 2.0 is indeed a new attempt and reform of money, but to ensure its stability and social acceptance, these complex risks must be managed in balance.

Henri/MemeMax⚡️ Trader TA_Analyst B6.88K @HenriLee92

Henri/MemeMax⚡️ Trader TA_Analyst B6.88K @HenriLee92STBL @stbl's interview with Leeve Collins / Stablecoin 2.0 / The moment money becomes code (interview subtitles video attached) This is a repetitive explanation of the STBL official blog content delivered in the previous post. STBL continues to repeat and expose important content! In this interview, Leeve Collins also emphasizes that stablecoins have entered a stage of redesigning the fundamental structure of the digital economy beyond a payment method. He defines this as Stablecoin 2.0 and explains the differences from existing stablecoins in the interview! 1. Evolution of collateral: from invisible collateral to 24/7 on‑chain verification The early stablecoin model innovatively improved global fund flows, but because collateral existed off‑chain, it carried structural constraints in transparency, verifiability, and reliability. However, as RWA officially moves on‑chain, the situation has completely changed. US Treasury bonds, money market funds and other high‑quality assets are being transformed into blockchain‑based token forms, opening an era where anyone can view collateral status in real time. This shifts the previous paradigm that stablecoins must be trusted to a new standard where anyone can directly verify. 2. Transition of revenue structure / from centralized issuer → community Collins most emphasizes the innovation of the revenue structure. In the past, a few institutions that issued stablecoins took all the profits generated from the collateral assets. Users provided liquidity on the scale of hundreds of billions of dollars but received no economic compensation. STBL's Stablecoin 2.0 aims to change this structure. Collateral is separated into USST (principal‑based stablecoin) Revenue is separated into YLD (tokenized interest revenue) Anyone who deposits collateral and issues USST will hold the corresponding revenue (YLD). This structure satisfies regulatory compliance (especially the US GENIUS Act) and is among the first models that technically achieve a user‑centric revenue structure in Web3. 3.

55 48 1.52K 閱讀原文 >釋出後STBL走勢看漲Stablecoin 2.0 aims to combine the trust of the gold standard with the flexibility of fiat currency; the STBL model addresses its challenges through digital collateral and programmable policies. gt🔮🌊 Influencer Media B3.15K @gtofweb3

gt🔮🌊 Influencer Media B3.15K @gtofweb3you are doing so well on the stbl leaderboard. keep it up as for me am locked in on @Infinit_Labs infinit labs is making defi seamless and simple with their one click agentic defi

따따 DDADDA | MemeMax⚡️ D4.46K @crypto_ddadda[ @stbl_official web 3.0 era new currency 💵 ] STBL is also climbing hard! The goal is to get inside the top 50🏔️ When you set overly ambitious goals while “yaping”, you get exhausted easily ㅠ.ㅠ Select projects and numbers that can enter the leaderboard according to each one's account size, YAPs, and engagement, It's better to set achievable goals. Actually I was a bit greedy too... hehe The STBL protocol is also setting goals these days and continuing active development! After securing $5 million in pre-seed funding in December 2024, we are proceeding with USST issuance, liquidity provision, and DeFi integration in Q4 2025. They said $STBL would be bought back... but I heard it's not happening much? lol Please do the buyback~~ The journey of money that started with barter is now meeting web 3.0 and entering a completely new stage. From shells, gold and silver, paper money, credit cards, to Bitcoin, we have now entered the era of programmable, customizable Stable 2.0 coins! In the future, won’t more companies run their own central banks? Controlling their own monetary policy, directly capturing revenue from funds, and raising growth capital through transparent, programmable money. New currency can function as a strategic asset, an engine of ecosystem growth, and a mechanism for value distribution. The transparent and interoperable infrastructure provided by STBL makes this future possible. ESS is pegged to USST, a high-quality RWA-collateralized stable coin, securing stability and global liquidity. Institutions will own the entire monetary system that underpins economic activity. Money that has evolved over thousands of years is now meeting Stable Coin 2.0 and entering a new phase. A world where every ecosystem has its own monetary sovereignty, controls value, and thrives within a transparent, programmable system. That is exactly what we

1 0 40 閱讀原文 >釋出後STBL走勢看漲The STBL project is progressing positively, securing $5 million in funding, and performing well on the leaderboard.

1 0 40 閱讀原文 >釋出後STBL走勢看漲The STBL project is progressing positively, securing $5 million in funding, and performing well on the leaderboard. Javi🥥.eth Community_Lead Influencer B62.03K @jgonzalezferrer

Javi🥥.eth Community_Lead Influencer B62.03K @jgonzalezferrer.@Reeve_Collins is definitely one of the best founders out here, he’s everywhere 😍 Another event at LONGITUDE Abu Dhabi with @cointelegraph Get ready to hear about the future of @stbl_official, RWAs, and many more! 👇

Javi🥥.eth Community_Lead Influencer B62.03K @jgonzalezferrer

Javi🥥.eth Community_Lead Influencer B62.03K @jgonzalezferrer@Reeve_Collins @Cointelegraph @stbl_official you can join the convo here: https://t.co/EaWwF4btrD

71 33 956 閱讀原文 >釋出後STBL走勢看漲STBL will be driven by its founder, and its outlook is anticipated.