OPEN (OPEN)

OPEN (OPEN)

- 47社交熱度指數(SSI)-17.46% (24h)

- #116市場預警排名(MPR)-73

- 224小時社交提及量-50.00% (24h)

- 100%24小時KOL看好比例2位活躍KOL

- 概要Community data generates revenue, multiple projects launched, $OPEN price fell 2.7%, social heat declined.

- 看漲訊號

- Pay-per-use

- 250k $OPEN task

- EigenDA fast low fee

- Buyback profit distribution

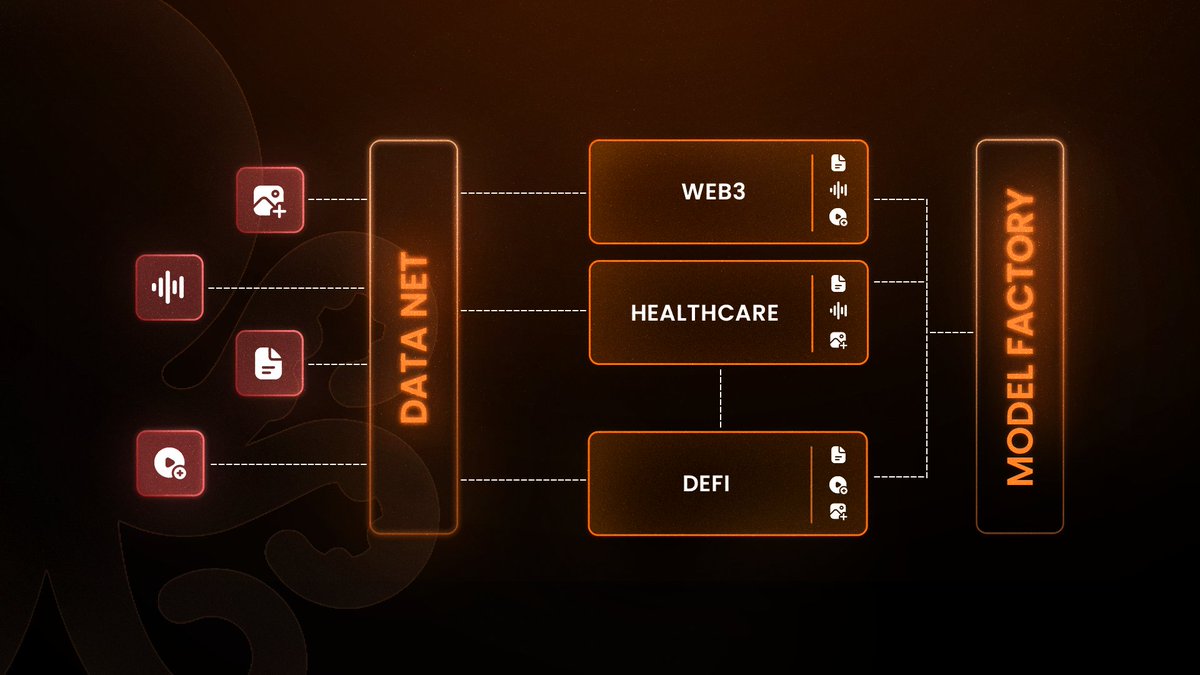

- Multi-project datanet

- 看跌訊號

- Price fell 2.67%

- Social heat dropped 17.46%

- Low interaction (<10)

- Short-term selling pressure appears

- Sentiment weakening

社交熱度指數(SSI)

- 總體資料47SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈極度看漲 (100%)社交熱度洞察OPEN social heat is moderately low (47/100, -17%), with social activity sharply dropping 54.8% as the main cause; although positive sentiment rose +23% and KOL attention increased +14%, multiple project launches and price decline weakened it.

市場預警排名(MPR)

- 預警解讀OPEN warning rank fell to #116 (↓73), sentiment polarity rose to 100/100 (+104%) significantly, other social anomalies and KOL shifts are zero, mainly reflecting price drop and low social activity.

相關推文

Tradinator Trader TA_Analyst B36.09K @Tradinator33

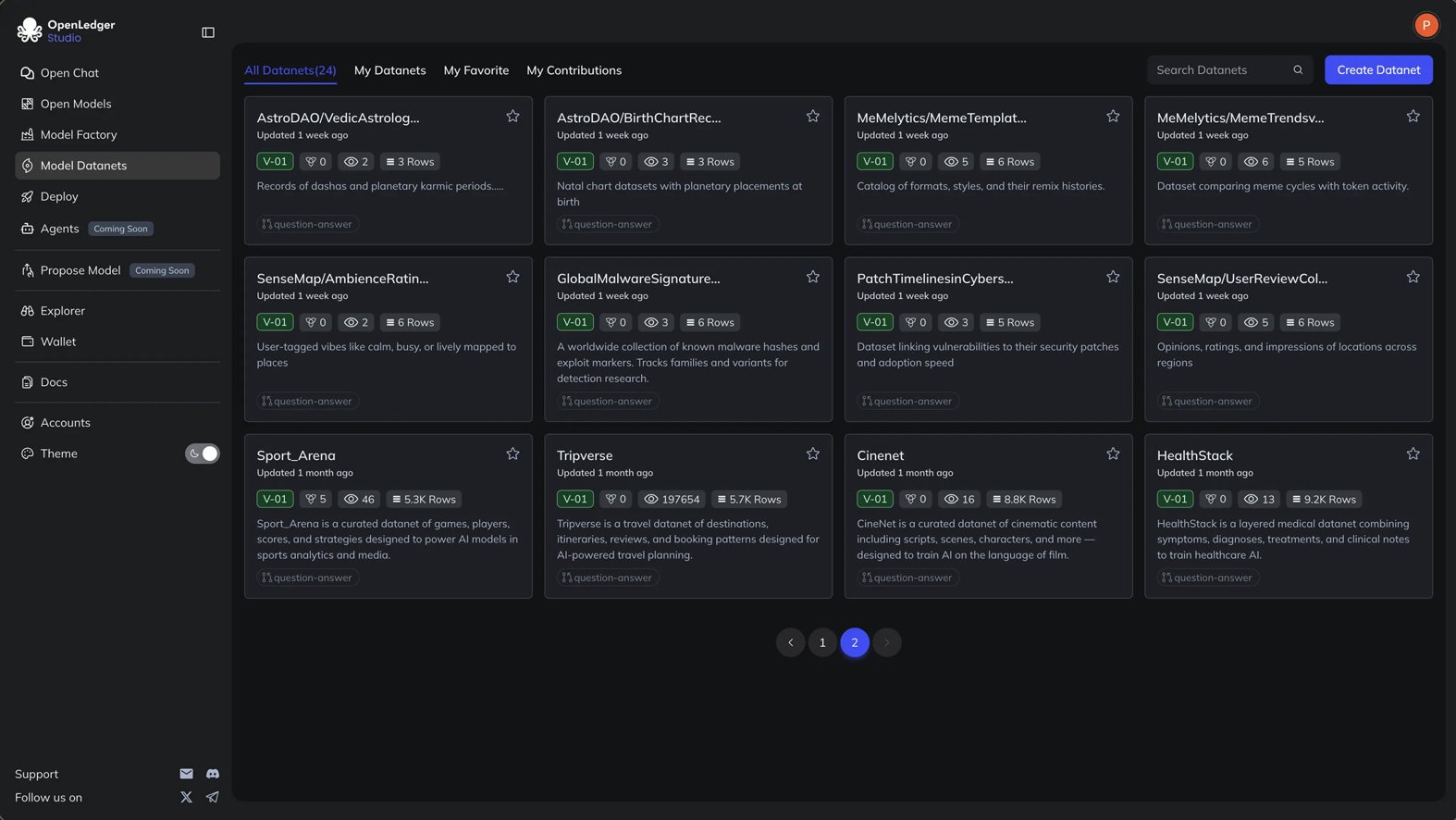

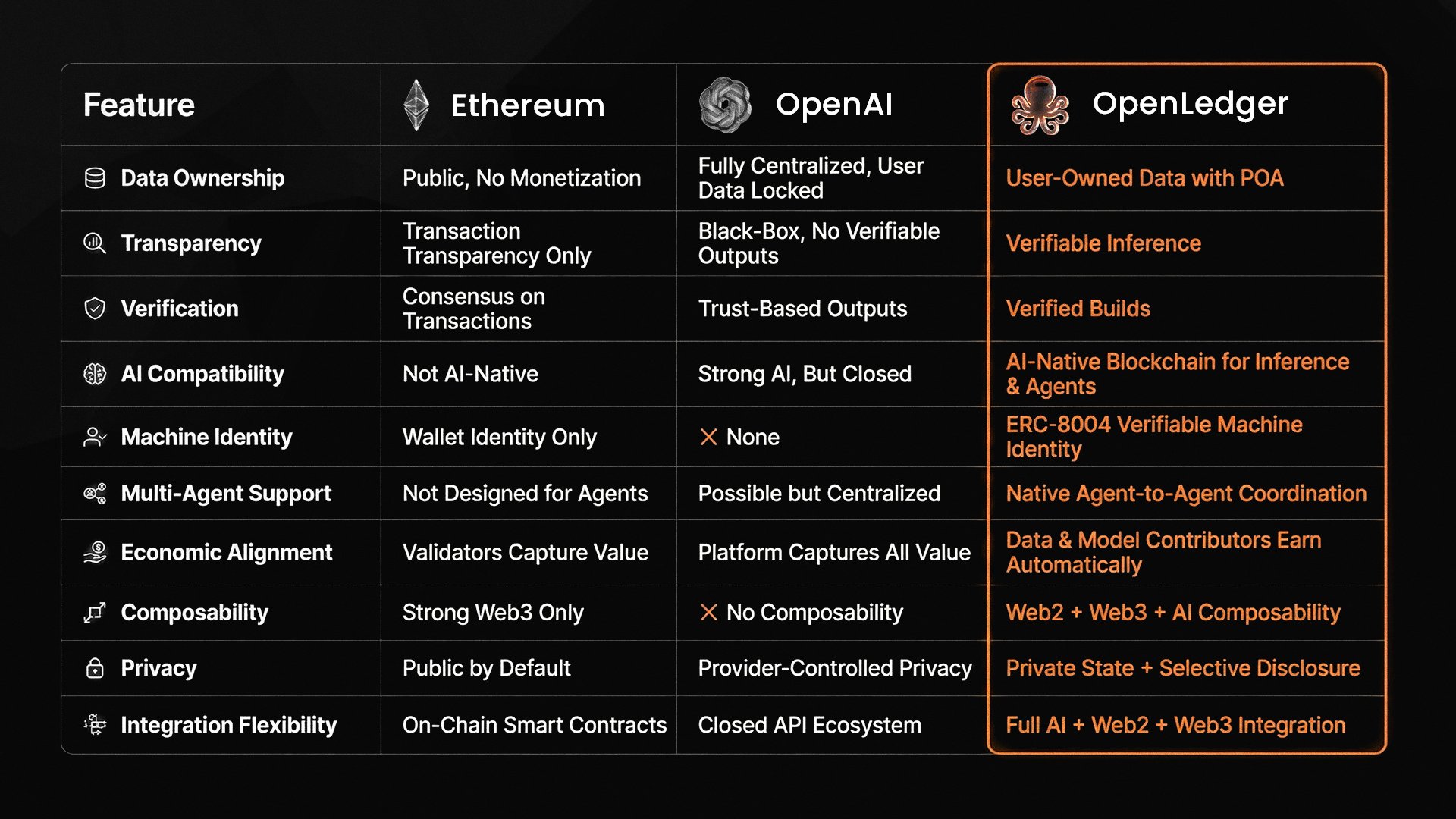

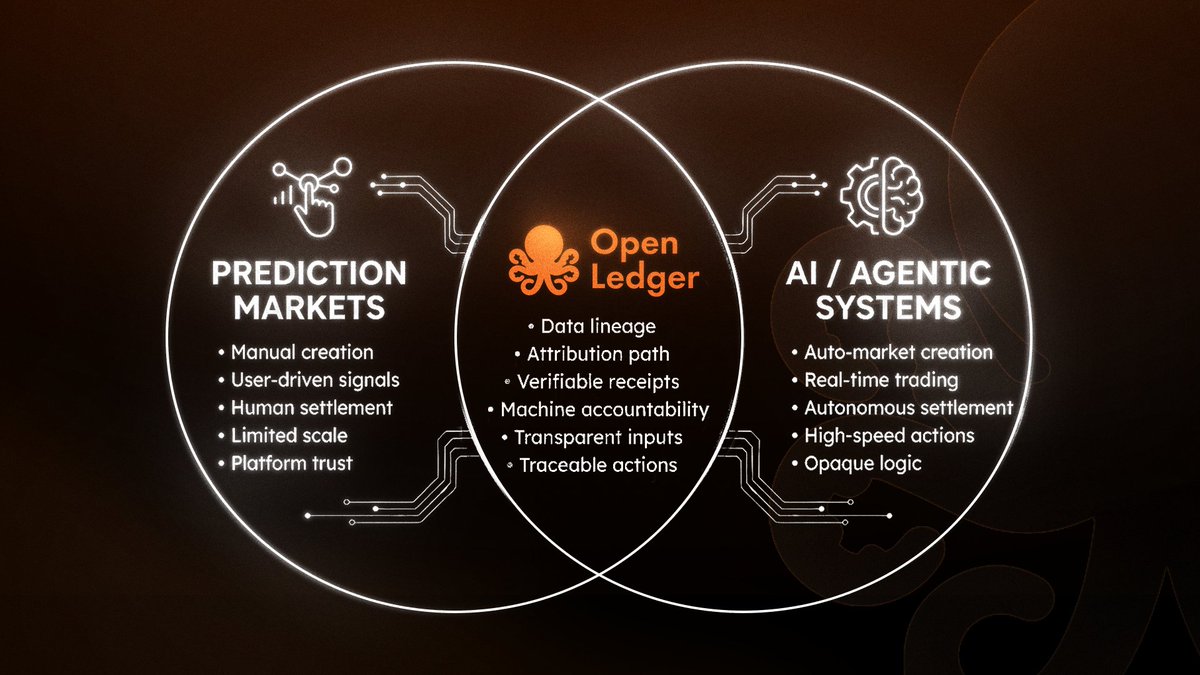

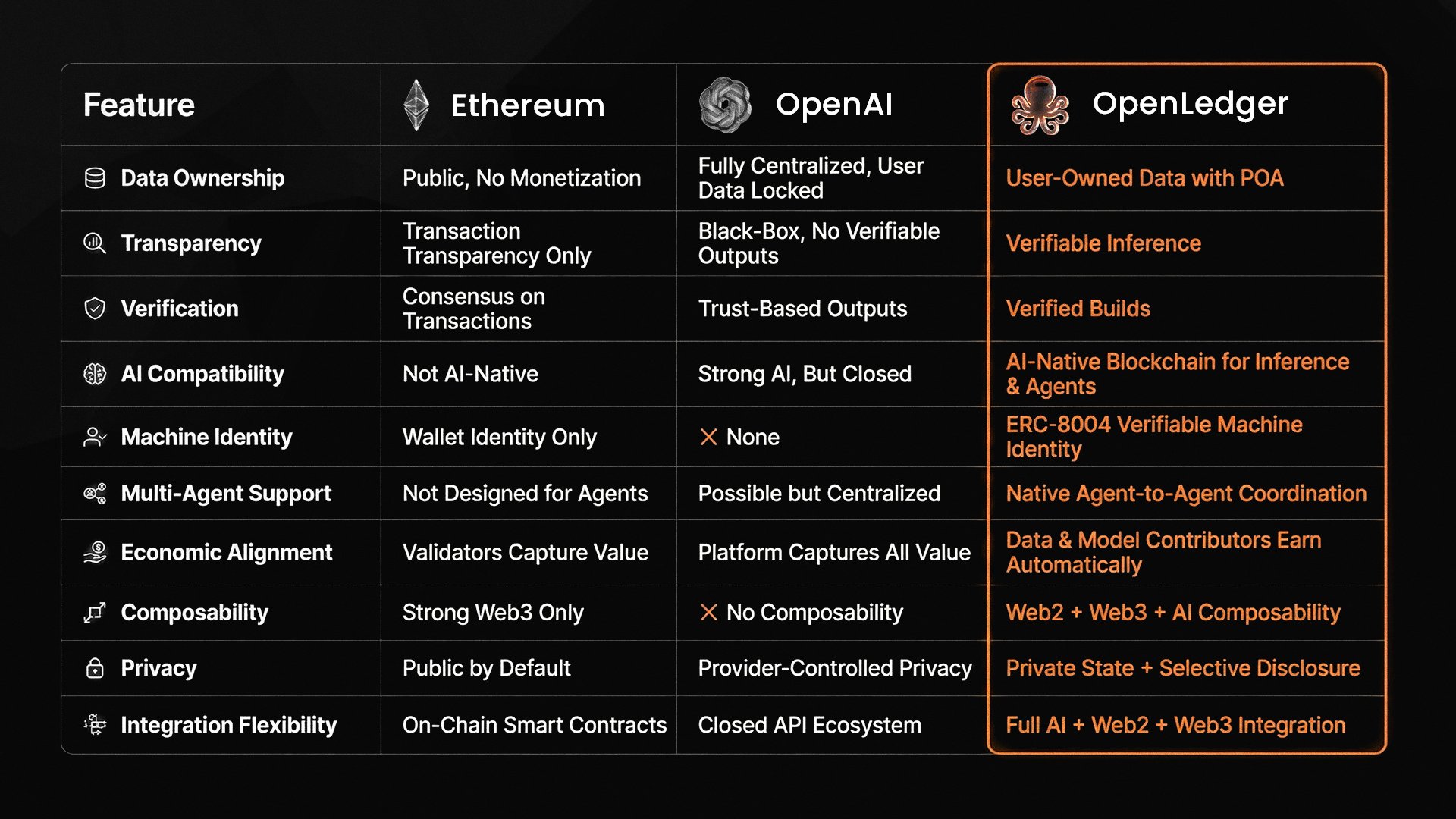

Tradinator Trader TA_Analyst B36.09K @Tradinator33Been digging deeper into $OPEN datanets lately. And I finally get why people keep calling them “community-owned datasets.” It’s not just storage, the data actually earns when it gets used. Anyone can upload, and the system automatically threads it into models with clean attribution. Feels like the opposite of how big AI companies treat data (hoard everything, reveal nothing). Instead on @OpenledgerHQ it’s: Open pools → permissionless access → contributors actually get paid. Pair that with EigenDA for cheap + fast data availability, and we get scalable AI infra without some massive corporation as the gatekeeper. Ngl it feels more and more like they’re building the data economy part of AI the right way.

Tradinator Trader TA_Analyst B36.09K @Tradinator33

Tradinator Trader TA_Analyst B36.09K @Tradinator33Most people still look at $OPEN like it’s “another AI chain,” but their model is way deeper. 1. This thing is built around actual value flow: Data, models, agents, they actually earn when they’re used. Actual real-life payouts hitting wallets. On-chain receipts and everything. 2. PoA is a HUGE unlock, and @OpenledgerHQ already built the infra for it. Once attribution is programmable, the AI economy will become much more transparent. 3. IAOs might also end up being their sleeper narrative. Funding models publicly and permissionlessly > waiting for VCs to quietly pick winners. Add OP Stack + EigenDA throughput + legit activity on mainnet, and we've got a chain where AI value actually settles instead of just being marketed. I know it's still early, but they're very obviously onto something.

72 33 7.01K 閱讀原文 >釋出後OPEN走勢極度看漲The author is extremely bullish on OPEN, believing its community-owned, data-profit AI data economy model outperforms traditional ones and holds huge potential.

72 33 7.01K 閱讀原文 >釋出後OPEN走勢極度看漲The author is extremely bullish on OPEN, believing its community-owned, data-profit AI data economy model outperforms traditional ones and holds huge potential. P|.edge🦭 Researcher DeFi_Expert B2.21K @eth2828

P|.edge🦭 Researcher DeFi_Expert B2.21K @eth2828gm uploaded a tiny datanet (15 min) into @OpenledgerHQ AI Studio, PoA stamped it, someone ran inference, $OPEN hit my wallet in seconds on‑chain receipts for every run, buyback routing rev back to contributors, OpenLoRA keeping provenance clean feels like farming signal not vanity 20+ datanets, 250k $OPEN campaigns moving boards who else stacking tiny wins this week #DeAI

CandyMan.eth 🍭⛓️ D1.18K @alw4lnany

CandyMan.eth 🍭⛓️ D1.18K @alw4lnanygm tried the AI Studio on @OpenledgerHQ this morning. uploaded a tiny Datanet (15 mins), PoA stamped my contribution, someone ran an inference and $OPEN landed in my wallet instantly. every inference wrote an on‑chain receipt, buyback flows showed revenue routing back to contributors, and OpenLoRA versioning kept provenance clean. felt like farming real value, not chasing vanity metrics they’ve got 20+ Datanets live, 11k+ wallets, 100k+ daily tx, a $5M buyback and active 250k $OPEN campaigns actually moving leaderboards. start niche, iterate metadata, rinse and repeat. who else is stacking tiny wins on @OpenledgerHQ this week? #AI #DeAI #ProofOfAttribution $OPEN

4 2 45 閱讀原文 >釋出後OPEN走勢極度看漲OpenledgerHQ AI Studio enables contributors to instantly earn $OPEN rewards, showcasing real value creation, with strong ecosystem growth and a $5M buyback.

4 2 45 閱讀原文 >釋出後OPEN走勢極度看漲OpenledgerHQ AI Studio enables contributors to instantly earn $OPEN rewards, showcasing real value creation, with strong ecosystem growth and a $5M buyback. alliseeisW TA_Analyst Trader A6.25K @alliseeis_W

alliseeisW TA_Analyst Trader A6.25K @alliseeis_W Its me again D200 @ohhhey69

Its me again D200 @ohhhey69Added another 5000 shares between 6.78-6.90 this morning of $OPEN. One of these days there will be a NUKE and this thing will laugh at sub double digits. Could be tomorrow 📈📈🔥 @alliseeis_W @amitisinvesting @fahdananta @wiseapeman @ottersarecute15 @APompliano @ohhhey69 @AldrinGiler @8bitsteveo @longcomfybear @BlueDot_Techs @insanelybull @BradTranMD @misterdoboy @Mr_Derivatives @don475820938689 @Dehix_Trades @ericjackson @founderwithadhd @Opendoor_God @GMN_watch @ChuckGarza7 @howard9829 @YaronBuilds @Han_Akamatsu @bborock2 @investingluc @jeffye888 @jasonlewris @jchoieth @JoePlatform @jaredkushner @rabois @KrypticMization @TigerLineTrades @SeanL1M @maelan_sdmr @Nugget_Trades @OpendoorNews @Openroar

8 1 429 閱讀原文 >釋出後OPEN走勢看漲OPEN will break double digits, short-term bullish Cestrian Capital Research, Inc TA_Analyst FA_Analyst B8.07K @CestrianInc

Cestrian Capital Research, Inc TA_Analyst FA_Analyst B8.07K @CestrianInc Cestrian Capital Research, Inc TA_Analyst FA_Analyst B8.07K @CestrianInc

Cestrian Capital Research, Inc TA_Analyst FA_Analyst B8.07K @CestrianInca lot of people are having a good laugh at $OPEN but save for capital liquidity there is no reason that real estate works any differently to other markets, as @CanadaKaz says look for Opendoor to start to build a giant line of credit akin to an auto leasing business I’m long

7 1 2.12K 閱讀原文 >釋出後OPEN走勢看漲Bullish on OPEN, expecting its credit business to increase value Cestrian Capital Research, Inc TA_Analyst FA_Analyst B8.07K @CestrianInc

Cestrian Capital Research, Inc TA_Analyst FA_Analyst B8.07K @CestrianInca lot of people are having a good laugh at $OPEN but save for capital liquidity there is no reason that real estate works any differently to other markets, as @CanadaKaz says look for Opendoor to start to build a giant line of credit akin to an auto leasing business I’m long

7 1 2.12K 閱讀原文 >釋出後OPEN走勢看漲Bullish on OPEN, expecting its credit business to increase value Ema26❤️ OnChain_Analyst Researcher B1.49K @jack33336666

Ema26❤️ OnChain_Analyst Researcher B1.49K @jack33336666I got tired of guessing who gets credit in AI, so I opened OpenLedger Studio and built a tiny niche Datanet. Cleaned labels, tightened metadata, ran provenance with OpenLoRA, published. A few hours later the call receipts showed someone used it and $OPEN streamed in with an onchain trace I could actually read. Work → usage → instant settlement, no chasing payouts That’s the difference with @OpenledgerHQ: Proof of Attribution baked in. Every sample has lineage, every inference has a reward path, and buyback flows route usage back to contributors. This isn’t just vibes either 20+ Datanet live, 11k+ wallets, ~100k tx/24h on mainnet, a prior $5M buyback executed, plus a 250k $OPEN campaign fueling real contributions. They also became the first Gold tier Data Community on Theo Network feeding into Proof of Attention Quick loop to try → upload a small domain set → fix labels + metadata, re-run provenance → watch calls, receipts, and $OPEN accrue Who’s shipping a fresh Datanet this week with receipts you can verify #AI #DeAI #ProofOfAttribution $OPEN?

8 5 432 閱讀原文 >釋出後OPEN走勢極度看漲OpenLedger Studio provides AI data attribution and instant settlement, showcasing $OPEN's strong utility and growth.

8 5 432 閱讀原文 >釋出後OPEN走勢極度看漲OpenLedger Studio provides AI data attribution and instant settlement, showcasing $OPEN's strong utility and growth. Tradinator Trader TA_Analyst B36.09K @Tradinator33

Tradinator Trader TA_Analyst B36.09K @Tradinator33Most people still look at $OPEN like it’s “another AI chain,” but their model is way deeper. 1. This thing is built around actual value flow: Data, models, agents, they actually earn when they’re used. Actual real-life payouts hitting wallets. On-chain receipts and everything. 2. PoA is a HUGE unlock, and @OpenledgerHQ already built the infra for it. Once attribution is programmable, the AI economy will become much more transparent. 3. IAOs might also end up being their sleeper narrative. Funding models publicly and permissionlessly > waiting for VCs to quietly pick winners. Add OP Stack + EigenDA throughput + legit activity on mainnet, and we've got a chain where AI value actually settles instead of just being marketed. I know it's still early, but they're very obviously onto something.

30 41 9.23K 閱讀原文 >釋出後OPEN走勢極度看漲The author is extremely bullish on OPEN, believing its community-owned, data-profit AI data economy model outperforms traditional ones and holds huge potential.

30 41 9.23K 閱讀原文 >釋出後OPEN走勢極度看漲The author is extremely bullish on OPEN, believing its community-owned, data-profit AI data economy model outperforms traditional ones and holds huge potential. Ema26❤️ OnChain_Analyst Researcher B1.49K @jack33336666

Ema26❤️ OnChain_Analyst Researcher B1.49K @jack33336666Spent my morning inside OpenLedger Studio and it finally clicked why @OpenledgerHQ matters I submitted a niche dataset, passed validation, and watched Proof of Attribution stitch a clear trail from my data to model to agent output seeing the reward path light up in $OPEN felt like the opposite of the black box we’re used to Quick guide if you want in: → Log into Studio and pick a Datanet that fits your domain → Submit data and pass validation for provenance → Track your attribution and receipts on every update → Join the Openledger x Theo topics and start Yapping → Gold-tier on @Theo_Network means 3 5× attention weight and direct $THEO yield It’s speed with receipts and autonomy with verification verifiable lineage for signals, traceable attribution for trades, auditable settlement when agents act this is how #InfoFi gets real Who else shipped a Datanet this week and saw their Yaps jump on the leaderboard #TheoNetwork #AIAgent #Yaps $OPEN $THEO

8 5 88 閱讀原文 >釋出後OPEN走勢極度看漲OpenLedger Studio数据归属透明,推动InfoFi创新,涉及OPEN和THEO。

8 5 88 閱讀原文 >釋出後OPEN走勢極度看漲OpenLedger Studio数据归属透明,推动InfoFi创新,涉及OPEN和THEO。 alliseeisW TA_Analyst Trader A6.25K @alliseeis_W

alliseeisW TA_Analyst Trader A6.25K @alliseeis_W$OPEN breakout out of the bull flag is inevitable. https://t.co/vTn32ThMtu

1 0 303 閱讀原文 >釋出後OPEN走勢極度看漲OPEN forms a bull flag pattern, indicating an inevitable upward breakout.

1 0 303 閱讀原文 >釋出後OPEN走勢極度看漲OPEN forms a bull flag pattern, indicating an inevitable upward breakout. Ace of Trades TA_Analyst Trader A11.95K @acethebullly

Ace of Trades TA_Analyst Trader A11.95K @acethebullly$OPEN on the daily timeframe is consolidating, holding above the key volume-weighted demand zone between $6.50–$7.00, where the volume profile shows a major node of interest. Price is sitting near the mid-range while riding inside a tightening Bollinger Band structure, signaling volatility compression. The Hilbert Transform slope looks flattened, reflecting a loss of trend momentum and a transition into a neutral phase. Upside resistance sits around $8.00–$8.50, where heavy volume and past rejections cluster, while support remains firm at $6.40–$6.60. Overall, price is in a cooling consolidation, awaiting either a volatility expansion or a breakdown from this high-volume balance zone.

9 5 1.05K 閱讀原文 >釋出後OPEN走勢中性OPEN is consolidating above the $6.50-$7.00 key demand zone, awaiting volatility expansion or breakout.

9 5 1.05K 閱讀原文 >釋出後OPEN走勢中性OPEN is consolidating above the $6.50-$7.00 key demand zone, awaiting volatility expansion or breakout.