MemeCore (M)

MemeCore (M)

- 24社交熱度指數(SSI)-62.71% (24h)

- #166市場預警排名(MPR)-124

- 124小時社交提及量-88.89% (24h)

- 0%24小時KOL看好比例1位活躍KOL

- 概要M is set to launch Phase1 airdrop tomorrow, price up 2.8% modestly, while social hype plummets.

- 看漲訊號

- Airdrop starts tomorrow

- Low-friction distribution mechanism

- Fees generate buying pressure

- Rewards guide liquidity

- Price up 2.8%

- 看跌訊號

- Social hype drops 62%

- Possibly short-term speculation

- High-leverage perpetual risk

- Mechanism lacks proven sustainability

- Token protection implied

社交熱度指數(SSI)

- 總體資料24SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈中性 (100%)社交熱度洞察M's social hype is extremely low (24.41/100, -63%), mainly due to activity dropping 88% and KOL attention decreasing 92%; although there is a 2.8% rise, sentiment only slightly declines.

市場預警排名(MPR)

- 預警解讀M's warning rank fell to #166 (down 124), with social anomalies, sentiment polarization, and KOL attention all at 0, indicating all abnormal signals have disappeared, and the airdrop expectation did not trigger any anomalies.

相關推文

yueya.eth Founder Researcher A38.55K @yueya_eth

yueya.eth Founder Researcher A38.55K @yueya_ethWhen Meme Needs Its Own Wall Street: Why I'm Bullish on the Rebuilding of Meme Trading Logic? I recently reread the K1 Research report on @MemeCore_M and @MemeMax_Fi, and found it very inspiring. We are experiencing a highly fragmented market: Meme has grown into an independent asset class worth $80 billion, yet the way we trade it is no different from how we traded corn and oil decades ago. We treat each asset made up of “Pepe the frog” and “Shiba Inu” with serious candlestick charts, MACD analysis, and resistance levels. Essentially, this is a structural mismatch—we are trying to measure emotional explosiveness with the same rulers used for industrial commodities. The price formula for Meme has never been “fundamentals + cash flow”; instead: Price = Sentiment Intensity × Propagation Speed × Narrative Cycle. This is precisely the pain point MemeMax aims to solve, and what I consider the sexiest entry point for the MemeCore ecosystem: it wants to become the Nasdaq of the meme world. 1. From “betting on size” to “trading sentiment”. Existing DEXes can only speculate on price via spot trading. But Meme’s lifecycle is non‑linear: emergence → FOMO → crash → zombie phase → revival. Spot can only capture the first half of the upside, whereas MemeMax’s perpetual contracts and sentiment‑pricing model make “shorting narrative decline” and “lying in wait for dead‑coin revival” tradable strategies. This transforms Meme from a simple PVP casino into a financial market where opinions can be structured. 2. The ecosystem’s closed‑loop, low‑dimensional strike that MemeCore delivers is a combination punch: MemeX (issuance) creates the asset source, PixelSwap (spot) handles liquidity, and MemeMax (derivatives) amplifies value. This vertical integration from issuance to trading builds far more barriers than a simple token‑issuance platform. 3. Only when the tide recedes do we see who’s swimming naked. Many are watching $M’s recent price pullback and shorting it, but I focus on the “honesty” of on‑chain data. The report shows an interesting metric: during the late‑November market crash that halved $M’s price, the number of MemeCore token‑holding addresses stayed steady at about 6.2k, and daily active wallets remained at 2‑3k. What does this mean? It means the early speculative bubble was cleaned out, leaving only genuine core users waiting for the product launch. Price reflects sentiment volatility; retention is the ironclad evidence of execution. Conclusion: Although the pre‑launch window has passed (deadline 12/4), it actually provides a better observation point. The Meme market doesn’t lack a thousandth copycat (https://t.co/3v48mKEtYf); what it lacks is genuine financial infrastructure capable of supporting tens of billions of sentiment assets. If MemeMax can successfully implement a pricing mechanism based on volume and propagation, it will be not just MemeCore’s Alpha, but the entire Meme track’s Beta. When Meme gets its own Wall Street, the real carnival is only just beginning. #MemeCore #MemeMax

K1 Research D2.29K @K1_Research

K1 Research D2.29K @K1_ResearchWhen Memes Need Their Own Wall Street: How MemeMax Is Rebuilding the Trading Logic of Sentiment Assets

18 11 962 閱讀原文 >釋出後M走勢極度看漲The author is bullish on MemeCore and MemeMax’s reconstruction of Meme trading logic, believing that after $M’s pullback the data is positive and the potential is huge.

18 11 962 閱讀原文 >釋出後M走勢極度看漲The author is bullish on MemeCore and MemeMax’s reconstruction of Meme trading logic, believing that after $M’s pullback the data is positive and the potential is huge. Jerry Researcher Tokenomics_Expert B5.18K @Jerry_HCcapital

Jerry Researcher Tokenomics_Expert B5.18K @Jerry_HCcapitalI woke up to @MemeMax_Fi confirming the Phase 1 airdrop claim goes live TOMORROW on @KaitoAI and spent the morning poking the claim flow and reward mechanics. Kaito’s smart-wallet delivery (think Beldex-style direct drops and that 50k USDC creator reward model) makes distribution feel low-friction. MemeMax moving Szn1 from $M to USDT while keeping Szn2 in $M looks like a token-protection play, especially alongside that chance-based reward engine (rumored top-end prizes and a Jan perp launch with intense leverage) This is a neat product-design loop: fees → buy pressure → rewards, with Kaito handling social distribution and claims. My question is simple can this loop turn casual claim hunters into sustained creators and liquidity contributors, or will it mostly turbocharge short-term engagement farming?

11 10 109 閱讀原文 >釋出後M走勢中性MemeMax airdrop and token economics analysis, the author questions its long-term user retention capability.

11 10 109 閱讀原文 >釋出後M走勢中性MemeMax airdrop and token economics analysis, the author questions its long-term user retention capability. belk.btc 🟧 FA_Analyst OnChain_Analyst B1.85K @belk3_95

belk.btc 🟧 FA_Analyst OnChain_Analyst B1.85K @belk3_95 Power.Ranger (Ø,G)🔥 D1.02K @mooon_1123

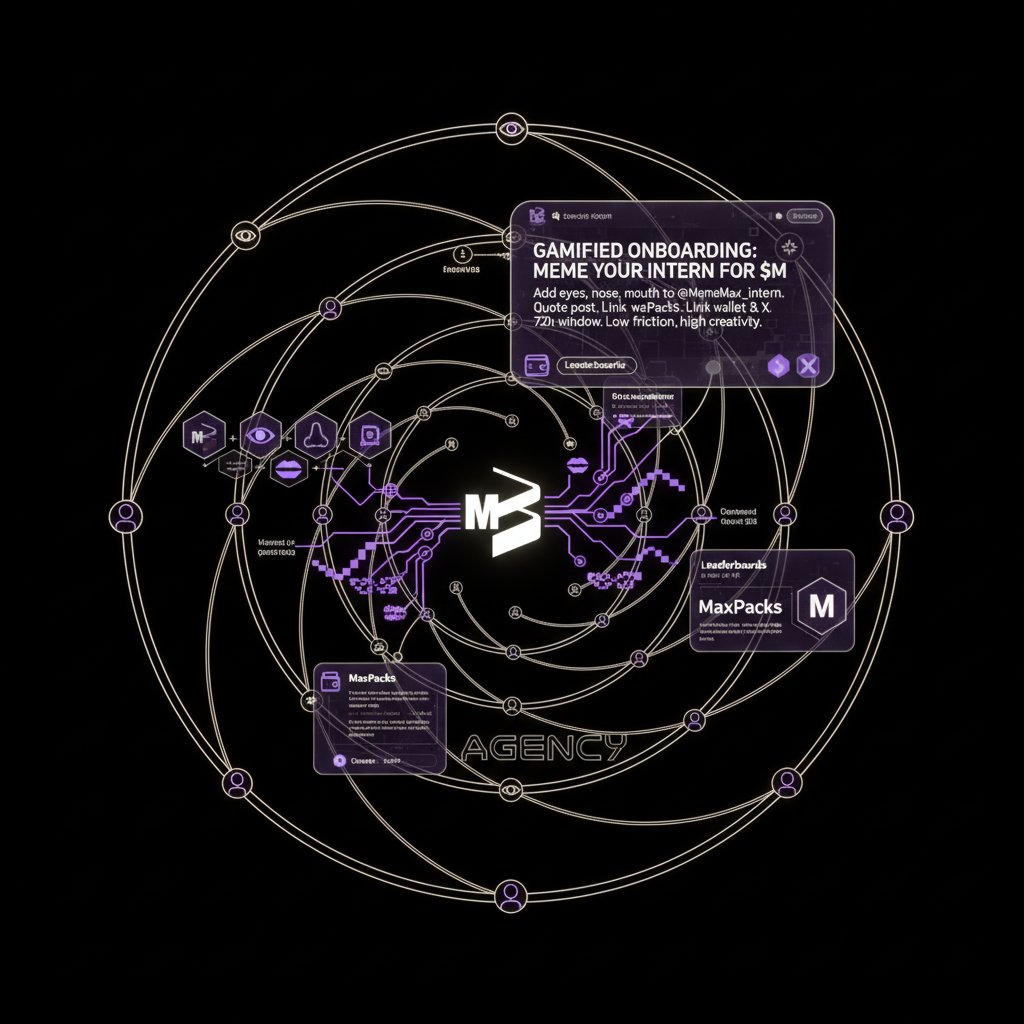

Power.Ranger (Ø,G)🔥 D1.02K @mooon_1123Tried the "Meme Your Own Intern" drop this morning. Simple constraint: add eyes, a nose and a mouth to @MemeMax_intern, quote their post, and make sure your wallet and X are linked on the dapp. If the intern replies you land 5 MaxPacks that convert to $M at launch. 72h window. Low friction, high creativity This is a clean product move. Gamified onboarding (MaxPacks, leaderboards, quests) converts social creativity into tradable optionality and real on‑chain signals. They've already run top 200 $200k rewards and hinted at a Season 2 ~800k pool, and the playbook explains the 400% activity spikes people cite. If you want optional asymmetric upside for minimal effort, join and link anyone else sketching chaotic interns right now?

131 64 652 閱讀原文 >釋出後M走勢極度看漲MemeMax promotes token M through a gamified onboarding activity, offering low‑threshold, high‑return participation opportunities.

131 64 652 閱讀原文 >釋出後M走勢極度看漲MemeMax promotes token M through a gamified onboarding activity, offering low‑threshold, high‑return participation opportunities. Sjuul | AltCryptoGems TA_Analyst Media C477.61K @AltCryptoGems

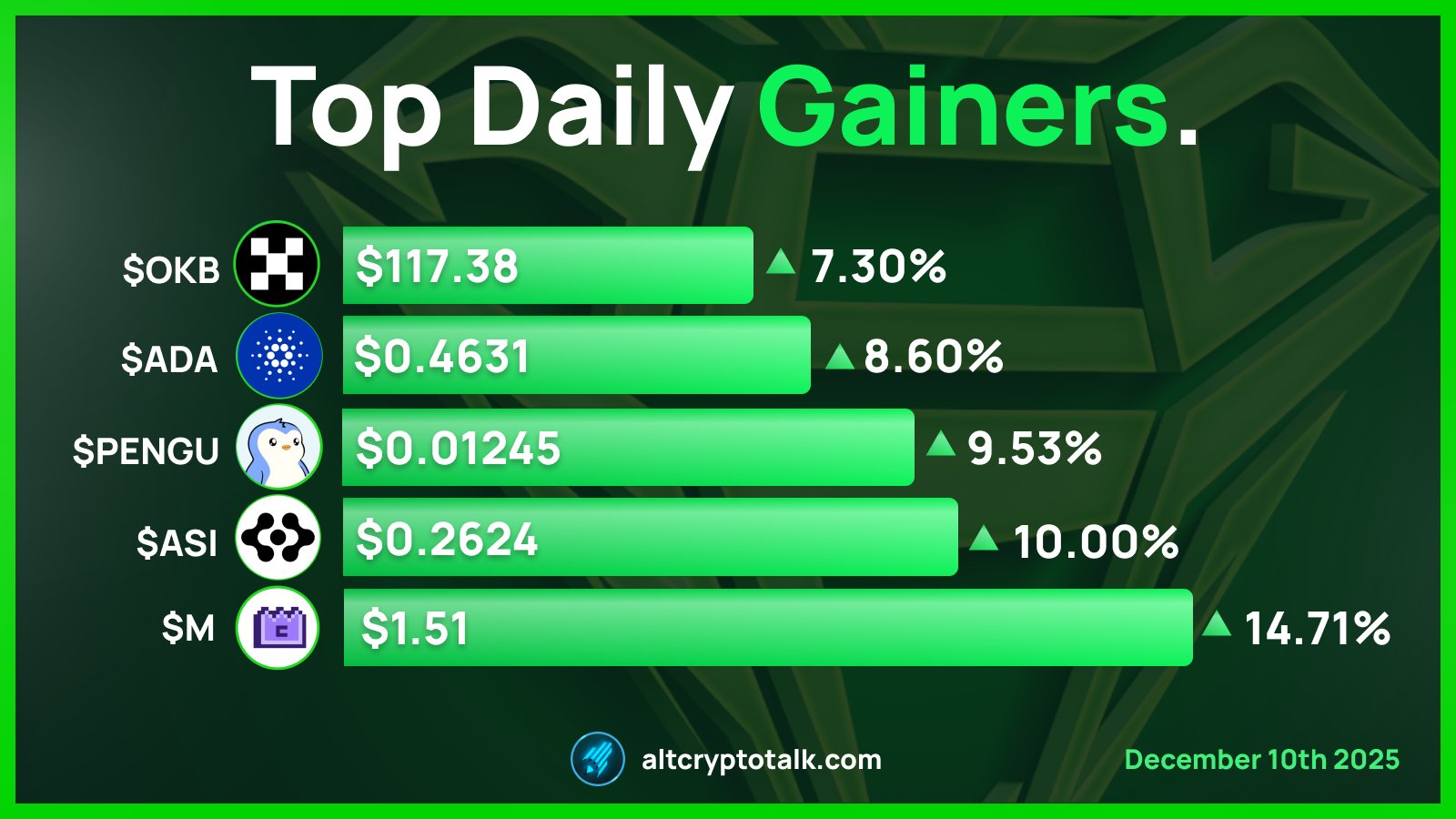

Sjuul | AltCryptoGems TA_Analyst Media C477.61K @AltCryptoGemsTop Daily Crypto Gainers | 10/12/25 1- @MemeCore_ORG $M 2- @ASI_Alliance $ASI 3- @PudgyPenguins $PENGU 4- @Cardano $ADA 5- @OKX $OKB Source: @CoinMarketCap https://t.co/0fv9kLZCkZ

502 15 27.96K 閱讀原文 >釋出後M走勢看漲Several cryptocurrencies performed strongly on the day, with gains ranging from 7.30% to 14.71%.

502 15 27.96K 閱讀原文 >釋出後M走勢看漲Several cryptocurrencies performed strongly on the day, with gains ranging from 7.30% to 14.71%. Athena Researcher OnChain_Analyst B2.95K @athena_yapper

Athena Researcher OnChain_Analyst B2.95K @athena_yapperMemeMax [M] MaxPack early POV Opened Pre-TGE packs, played. Top 200 scoop from $200k rewards, MaxPoints on every action Why it matters: MemeCore L1 (EVM), stable block space & congestion avoidance predictable execution in chaos; $M backing (~$300M) anchors liquidity Perp DEX for memes: shorts, leverage, price discovery Stacking MaxPacks or watching? @MemeMax_Fi $M #meme #DeFi

0xMumble D382 @2012Assael

0xMumble D382 @2012AssaelFound @MemeMax_Fi during a Pre-TGE MaxPack drop and actually opened packs instead of scrolling past. DM'd mates. Saw the top 200 scoop pieces from a $200k rewards pool. MaxPoints stacked with every action. It felt like a game that pays you to play, not a pump that leaves you holding noise What stuck with me is the architecture: MemeCore L1, EVM-compatible, stable block space and congestion avoidance baked in. That’s why $M backing (~$300M cited in community threads) matters execution stays predictable when chaos hits. A perp DEX built for memes gives shorting, leverage, and continuous price discovery instead of hope-driven spot volatility This isn’t flash. It’s structure. MaxPack → MP → compounding participation. If sentiment becomes tradable the same way fundamentals are, behavior changes from one-off bets to identity-bound accumulation Are you stacking MaxPacks or watching from the sidelines #meme #DeFi $M

0 0 25 閱讀原文 >釋出後M走勢看漲MemeMax provides a stable Meme coin trading platform, backed by $300M, encouraging participation in its MaxPack mechanism.

0 0 25 閱讀原文 >釋出後M走勢看漲MemeMax provides a stable Meme coin trading platform, backed by $300M, encouraging participation in its MaxPack mechanism. Jerry Researcher Tokenomics_Expert B5.18K @Jerry_HCcapital

Jerry Researcher Tokenomics_Expert B5.18K @Jerry_HCcapitalGM RHYTHM TESTING: My two-day experiment connecting @KaitoAI yaps → on-chain actions → live trades on @MemeMax_Fi turned into a neat loop of signal → reward I qualified through Kaito Earn Phase 1 snapshots (Top200 shoutout), then made small, frequent trades to chase MaxPacks and hold overnight to accumulate MP. Brevis personalized fees + ZK-verified distributions actually showed up in my account, and the time-weighted MP math felt meaningful, not just marketing Steps I used: connect wallet, trigger Kaito yaps for activity credit, execute 10+ chain ops to boost MaxPack odds, trade cadence for MaxPacks or HODL for MP, claim rewards when eligible This combo turned social energy into on-chain leverage $M upside aside, MP as a pre-TGE ownership score changes how I think about staying in a project long-term Who else is pairing Kaito yapping with MemeMax trading and what patterns are you seeing, pros or cons?

16 12 105 閱讀原文 >釋出後M走勢看漲Experiments show that the M token can earn rewards via Kaito and MemeMax, outlook is positive nbaluong 🟨 Influencer Community_Lead A7.77K @luong4101992

nbaluong 🟨 Influencer Community_Lead A7.77K @luong4101992 nbaluong 🟨 Influencer Community_Lead A7.77K @luong4101992

nbaluong 🟨 Influencer Community_Lead A7.77K @luong4101992GUIDE: How I pushed my way into the Top 500 on @MemeMax_Fi Season 2 If you’re aiming to climb the leaderboard, here’s exactly what worked for me: 1) Connect your X + wallet This is non-negotiable. You need both linked to qualify for contests, earn MaxPacks, and make sure every action is counted on-chain. No connection = no progress. 2) Join the Intern Challenge Watch for the official intern post → quote it → upload your own humanized intern meme within 72 hours. This is one of the easiest ways to secure up to 5 MaxPacks and boost your visibility early in the phase. 3) Maintain a steady on-chain rhythm Don’t go all-in at once spread out small swaps, use MemeCore boosts, and keep a consistent activity pattern. MemeMax rewards presence, not random spikes. If you show up, stay active, and keep your creativity flowing, climbing the ranks becomes a lot more achievable. #MemeMax $M @MemeMax_Fi @KaitoAI

85 102 540 閱讀原文 >釋出後M走勢看漲Providing a guide for climbing the leaderboard in MemeMax_Fi Season 2, recommending connecting your wallet, joining challenges, and staying active on-chain.

85 102 540 閱讀原文 >釋出後M走勢看漲Providing a guide for climbing the leaderboard in MemeMax_Fi Season 2, recommending connecting your wallet, joining challenges, and staying active on-chain. nbaluong 🟨 Influencer Community_Lead A7.77K @luong4101992

nbaluong 🟨 Influencer Community_Lead A7.77K @luong4101992GUIDE: How I pushed my way into the Top 500 on @MemeMax_Fi Season 2 If you’re aiming to climb the leaderboard, here’s exactly what worked for me: 1) Connect your X + wallet This is non-negotiable. You need both linked to qualify for contests, earn MaxPacks, and make sure every action is counted on-chain. No connection = no progress. 2) Join the Intern Challenge Watch for the official intern post → quote it → upload your own humanized intern meme within 72 hours. This is one of the easiest ways to secure up to 5 MaxPacks and boost your visibility early in the phase. 3) Maintain a steady on-chain rhythm Don’t go all-in at once spread out small swaps, use MemeCore boosts, and keep a consistent activity pattern. MemeMax rewards presence, not random spikes. If you show up, stay active, and keep your creativity flowing, climbing the ranks becomes a lot more achievable. #MemeMax $M @MemeMax_Fi @KaitoAI

85 102 540 閱讀原文 >釋出後M走勢極度看漲Providing a guide for climbing the leaderboard in MemeMax_Fi Season 2, recommending connecting your wallet, joining challenges, and staying active on-chain.

85 102 540 閱讀原文 >釋出後M走勢極度看漲Providing a guide for climbing the leaderboard in MemeMax_Fi Season 2, recommending connecting your wallet, joining challenges, and staying active on-chain. | The Heroman Influencer Trader B14.45K @heroman0x

| The Heroman Influencer Trader B14.45K @heroman0x | The Heroman Influencer Trader B14.45K @heroman0x

| The Heroman Influencer Trader B14.45K @heroman0xI’m not great at price predictions, but I was hoping $M would pump harder. With how the market looks right now, I expected it to follow the small waves of green we’ve been seeing. I wanted to see it push toward $1.5, but instead it dipped a bit. Still, the fact that the token has held strong through the rough market over the last few weeks shows that @MemeMax_Fi and the entire MemeCore ecosystem are clearly doing something right. It looks like a solid moment for people to pay attention, but always DYOR and make decisions responsibly.

73 68 293 閱讀原文 >釋出後M走勢看漲MemeCore ($M) fell short of short‑term expectations, but its market resilience is strong; the author believes it is worth paying attention to.

73 68 293 閱讀原文 >釋出後M走勢看漲MemeCore ($M) fell short of short‑term expectations, but its market resilience is strong; the author believes it is worth paying attention to. Jerry Researcher Tokenomics_Expert B5.18K @Jerry_HCcapital

Jerry Researcher Tokenomics_Expert B5.18K @Jerry_HCcapitalDid a little experiment this week and leaned into @MemeMax_Fi Boost Up, opening MaxPacks heavily. Watching the probability prompts jump on screen was wild: the more I opened, the higher my $M odds trended. Daily quests never stopped; the pre‑launch extended toward the Perp DEX, feeling less like a wrap‑up and more like a sustained stress‑test. Season 2 truly feels like the metagame is changing. Then I paired that grind with a twin on @KaitoAI to manage timing and execution. A simple checklist saved me: set claim alerts for 30/60 minutes, mock‑simulate a small sell to cover fees, move bulk to self‑custody (Tria), and let the twin monitor leaderboard drift and listing price. Outcome: fewer panic sells, cleaner on‑chain operations, and airdrop gains that actually stick—not just reflex farming. If you're grinding MaxPacks, who's your AI co‑pilot? #PerpDEX #airdrop #DeFi

12 9 115 閱讀原文 >釋出後M走勢看漲M coin MaxPacks paired with AI, airdrop earnings substantially boosted