Jupiter (JUP)

Jupiter (JUP)

- 80社交熱度指數(SSI)-12.10% (24h)

- #38市場預警排名(MPR)+7

- 1724小時社交提及量-29.17% (24h)

- 59%24小時KOL看好比例13位活躍KOL

- 概要JUP community vote decides whether to pause team issuance and postpone the Jupuary airdrop, aiming for net-zero supply, with short-term price up 8%.

- 看漲訊號

- Net-zero supply proposal

- Halt team issuance

- Continue ASR rewards

- Price up 8.33% in 24h

- High community participation in voting

- 看跌訊號

- Airdrop delay uncertain

- Weak market sentiment

- Social hype down 12%

- Historical unlock price compression

- Voting result unknown

社交熱度指數(SSI)

- 總體資料80SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈極度看漲 (18%)看漲 (41%)中性 (41%)社交熱度洞察JUP social hype 80.49 (-12.1%) down, activity 29.75 ↓25.63%, sentiment 20.74 ↓3.84%, KOL score remains at full 30, affected by community vote to pause issuance and airdrop delay.

市場預警排名(MPR)

- 預警解讀JUP warning rank rose to #38 (+7), social anomaly score 90.11 ↓9.89, sentiment polarization 24.28 ↓20.75, but KOL attention shifted ↑325% to 17, linked to the pause issuance vote.

相關推文

Kantian FA_Analyst OnChain_Analyst A5.06K @kantianum

Kantian FA_Analyst OnChain_Analyst A5.06K @kantianumBrutal reality check for Jupiter. Once one of the strongest tokens in the market, $JUP started spiraling into death the moment the first team unlock hit. Some are upset about Jupuary potentially being suspended under the “Net Zero Emissions” proposal, as many built expectations around the annual airdrop. But if you look at the current unlock schedule and broader market conditions, no rational buyer wants to step in front of continuous unlocks. If this new proposal passes, it would fix one of the biggest sources of FUD, imo. It won’t solve everything. Execution, growth, and product expansion still matter. But structurally fixing the supply side creates breathing room for JUP. The market has changed a lot over the past few years. You can’t get away with predatory tokenomics anymore, and it’s quite refreshing to see the Jupiter team pushing a proposal that really deals with the matter. (Even if they fucked up by going with tokenomics V1 in the first place.)

Jupiter DeFi_Expert Media C610.10K @JupiterExchange

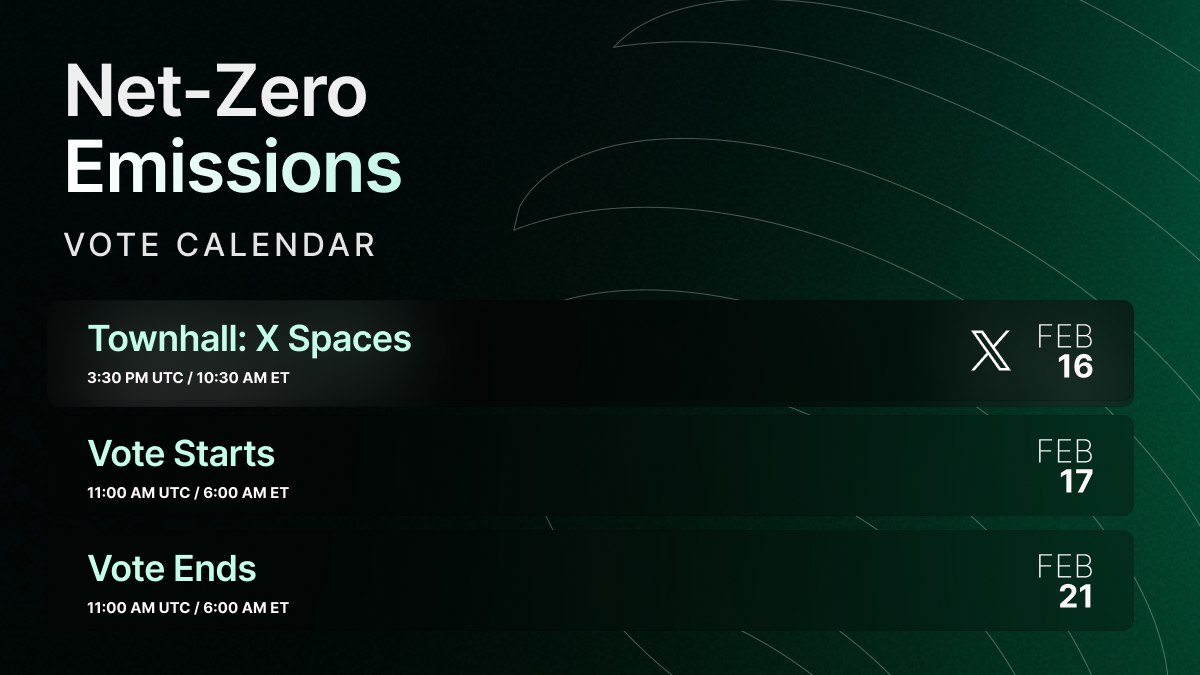

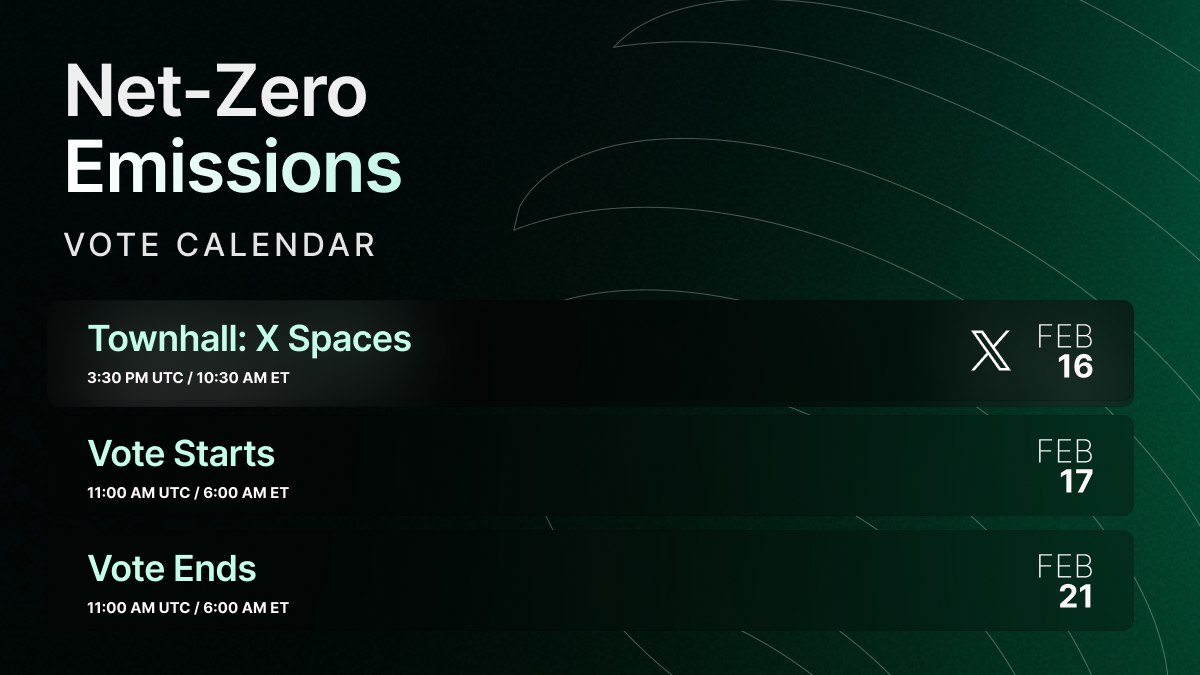

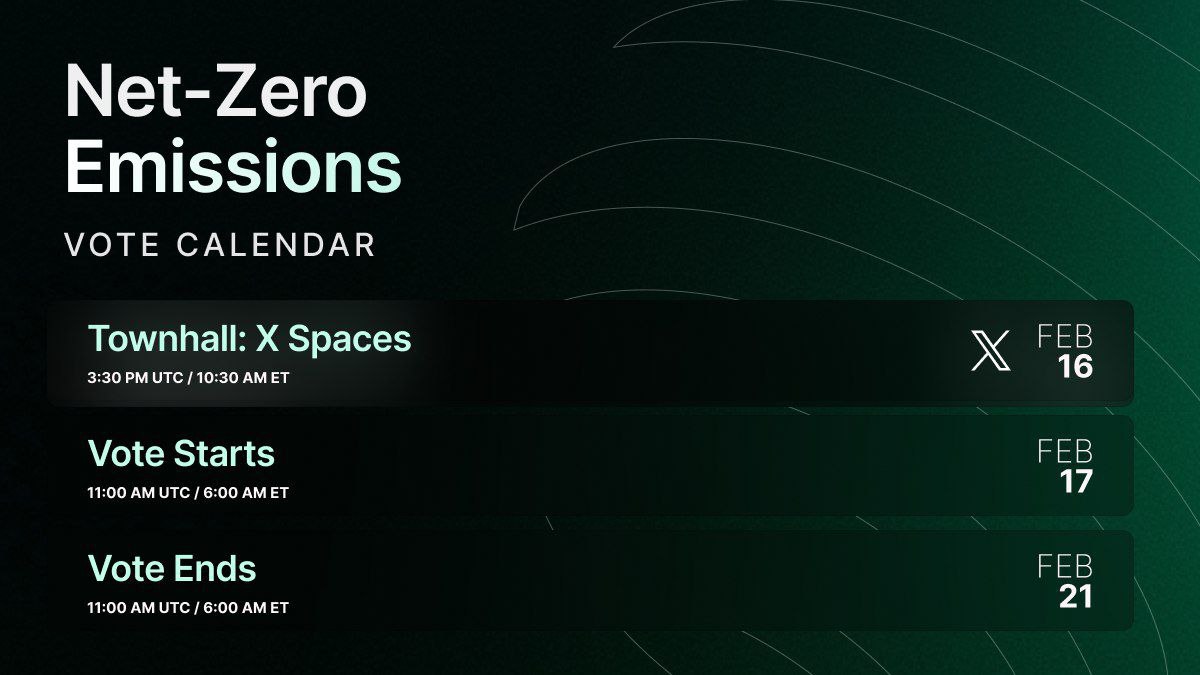

Jupiter DeFi_Expert Media C610.10K @JupiterExchangeToday we’re bringing forward an important proposal to effectively bring net emissions to zero for the foreseeable future. This involves: 1. Pausing emissions from the Team Reserve indefinitely 2. Absorbing any team sales of vesting tokens in the Jupiter treasury 3. Postponing Jupuary indefinitely 4. Accelerating and offsetting Mercurial vesting The decision lies with the DAO. Full calendar of events below

5 2 383 閱讀原文 >釋出後JUP走勢看漲The JUP team has proposed a “Net Zero Emissions” plan to address oversupply, and the DAO will vote on it.

5 2 383 閱讀原文 >釋出後JUP走勢看漲The JUP team has proposed a “Net Zero Emissions” plan to address oversupply, and the DAO will vote on it. Coin Bureau Educator Media C1.08M @coinbureau

Coin Bureau Educator Media C1.08M @coinbureau🌱 JUPITER PLANS TO “GO GREEN” Jupiter’s proposal aims to achieve plan zero net JUP emissions by eliminating net new $JUP token releases for a while and delaying the Jupuary airdrop. The DAO would offset any sales with open-market buybacks to neutralize supply impact.

130 32 11.10K 閱讀原文 >釋出後JUP走勢看漲Jupiter proposes to reduce JUP supply by halting new token issuance and conducting market buybacks.

130 32 11.10K 閱讀原文 >釋出後JUP走勢看漲Jupiter proposes to reduce JUP supply by halting new token issuance and conducting market buybacks. Marino FA_Analyst DeFi_Expert A20.13K @marinonchain

Marino FA_Analyst DeFi_Expert A20.13K @marinonchainThis isn’t just “another vote” - it’s potentially a full reset of $JUP’s structure. Balancing product development & token health is way harder than most people think. If this proposal passes, it simplifies emissions, improves transparency & strengthens long-term alignment. https://t.co/KoIUpoZFPQ

⚔️ SIONG Community_Lead Tokenomics_Expert S23.99K @sssionggg

⚔️ SIONG Community_Lead Tokenomics_Expert S23.99K @sssiongggearly this year, i posted a question on whether we should continue the buyback and early this week i posted an update on how the Jupuary timeline would look like. both tweets got a lot of attention. reading the comments and feedback from users has been eye-opening. now, for this proposal and option 2 (if it passes), here’s what it addresses in my mind: first, team emissions. there’s been a persistent narrative about team selling. with this vote, there’s a real path to stopping all team on-chain emissions entirely. if there is any selling, it comes from the treasury fully visible, fully on-chain. transparency over speculation. second, Mercurial stakeholder vesting. the buyout structure is designed to create a counter buy pressure against any selling, ideally creating a net neutral effect on JUP. it’s a clean solution to a structural issue. third, ASR will continue to reward stakers for staking. this will be something that will reward long-term stakers. also, with January letterbox buyback standing at almost 28m JUP (annualised 336m JUP), the buyback maybe more than the emitting staking reward, obviously, price may fluctuate and market will move. fourth, JUP token utility within products. there are things already happening across our products and there are plans to push more forward. i don’t want to guarantee a timeline but it’s actively being worked on. lastly, something personal. running a public protocol with a token creates real pressure to balance product building with token health. building great products is necessary but not sufficient, the token itself needs to be managed thoughtfully. this proposal is about resetting the fundamentals: products that users love and token economics that are clean and simple. anyway good thing about this proposal is it really resets the energy. for me, that means great products and a token structure that’s easy for anyone to understand and believe in.

52 14 3.61K 閱讀原文 >釋出後JUP走勢看漲If the JUP proposal passes, it will stop team token issuance, improve transparency, and strengthen long‑term holding incentives. ⚔️ SIONG Community_Lead Tokenomics_Expert S23.99K @sssionggg

⚔️ SIONG Community_Lead Tokenomics_Expert S23.99K @sssiongggearly this year, i posted a question on whether we should continue the buyback and early this week i posted an update on how the Jupuary timeline would look like. both tweets got a lot of attention. reading the comments and feedback from users has been eye-opening. now, for this proposal and option 2 (if it passes), here’s what it addresses in my mind: first, team emissions. there’s been a persistent narrative about team selling. with this vote, there’s a real path to stopping all team on-chain emissions entirely. if there is any selling, it comes from the treasury fully visible, fully on-chain. transparency over speculation. second, Mercurial stakeholder vesting. the buyout structure is designed to create a counter buy pressure against any selling, ideally creating a net neutral effect on JUP. it’s a clean solution to a structural issue. third, ASR will continue to reward stakers for staking. this will be something that will reward long-term stakers. also, with January letterbox buyback standing at almost 28m JUP (annualised 336m JUP), the buyback maybe more than the emitting staking reward, obviously, price may fluctuate and market will move. fourth, JUP token utility within products. there are things already happening across our products and there are plans to push more forward. i don’t want to guarantee a timeline but it’s actively being worked on. lastly, something personal. running a public protocol with a token creates real pressure to balance product building with token health. building great products is necessary but not sufficient, the token itself needs to be managed thoughtfully. this proposal is about resetting the fundamentals: products that users love and token economics that are clean and simple. anyway good thing about this proposal is it really resets the energy. for me, that means great products and a token structure that’s easy for anyone to understand and believe in.

Jupiter DeFi_Expert Media C610.10K @JupiterExchange

Jupiter DeFi_Expert Media C610.10K @JupiterExchangeToday we’re bringing forward an important proposal to effectively bring net emissions to zero for the foreseeable future. This involves: 1. Pausing emissions from the Team Reserve indefinitely 2. Absorbing any team sales of vesting tokens in the Jupiter treasury 3. Postponing Jupuary indefinitely 4. Accelerating and offsetting Mercurial vesting The decision lies with the DAO. Full calendar of events below

188 105 23.43K 閱讀原文 >釋出後JUP走勢極度看漲The Jupiter proposal achieves net-zero emissions for JUP, pauses team releases and enhances buybacks, optimizing token economics.

188 105 23.43K 閱讀原文 >釋出後JUP走勢極度看漲The Jupiter proposal achieves net-zero emissions for JUP, pauses team releases and enhances buybacks, optimizing token economics. Cloudz Influencer Media B46.18K @cloudz

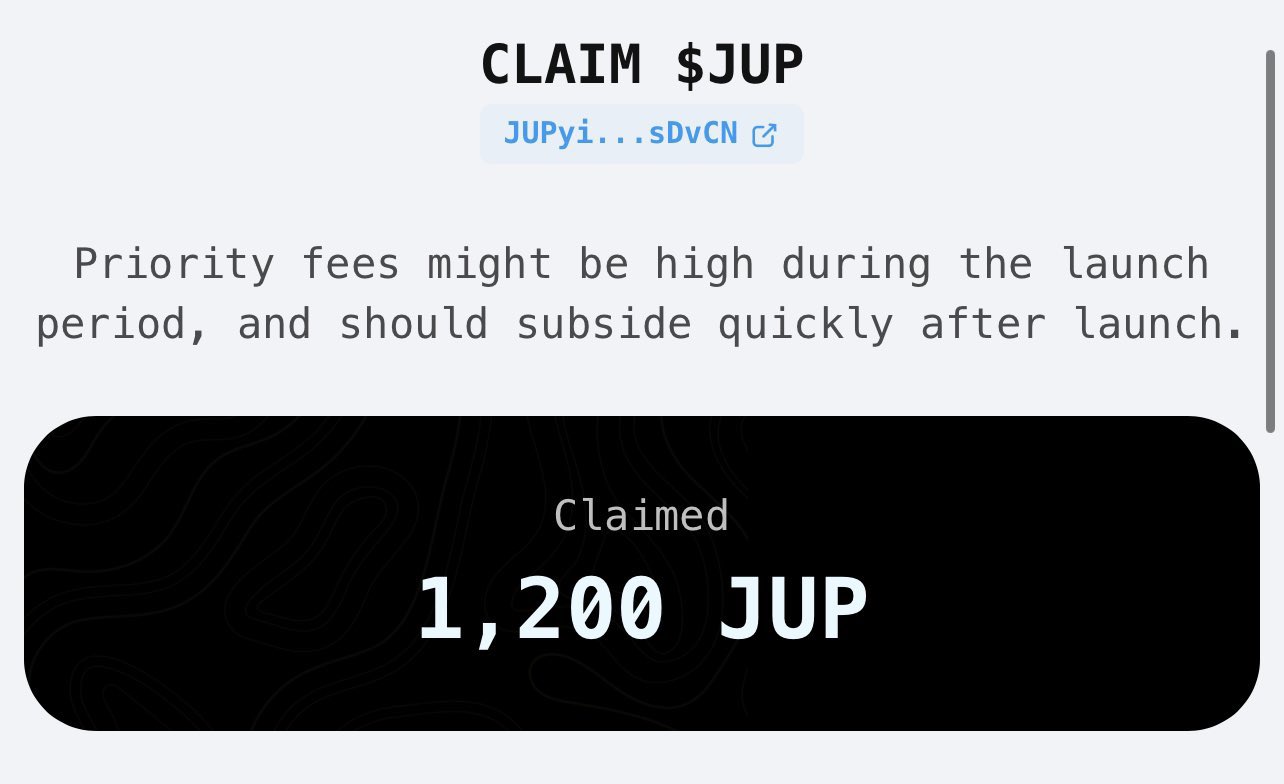

Cloudz Influencer Media B46.18K @cloudzWho’s still holding their first ever $JUP airdrop? https://t.co/haTGICg93L

133 48 6.13K 閱讀原文 >釋出後JUP走勢中性The tweet asks about JUP airdrop holdings, the image shows 1200 JUP claimed and warns of high fees.

133 48 6.13K 閱讀原文 >釋出後JUP走勢中性The tweet asks about JUP airdrop holdings, the image shows 1200 JUP claimed and warns of high fees. Kyledoops TA_Analyst Derivatives_Expert C129.38K @kyledoops

Kyledoops TA_Analyst Derivatives_Expert C129.38K @kyledoopsSupply shock incoming for $JUP? Jupiter COO Kash has proposed cutting net $JUP emissions to zero. • 700M Jupuary airdrop postponed • Team unlocks suspended • Balance sheet potentially used to absorb sell pressure • Vote starts Feb 17 $JUP is still down 92%+ from its ATH. If supply tightens from here, does that change the trajectory… or is the damage already done?

43 14 3.55K 閱讀原文 >釋出後JUP走勢看漲Jupiter COO proposes to achieve net zero JUP emissions by delaying airdrops, suspending unlocks, etc., aiming to tighten supply.

43 14 3.55K 閱讀原文 >釋出後JUP走勢看漲Jupiter COO proposes to achieve net zero JUP emissions by delaying airdrops, suspending unlocks, etc., aiming to tighten supply. spacebyte ⛓ OnChain_Analyst DeFi_Expert A24.40K @_thespacebyte

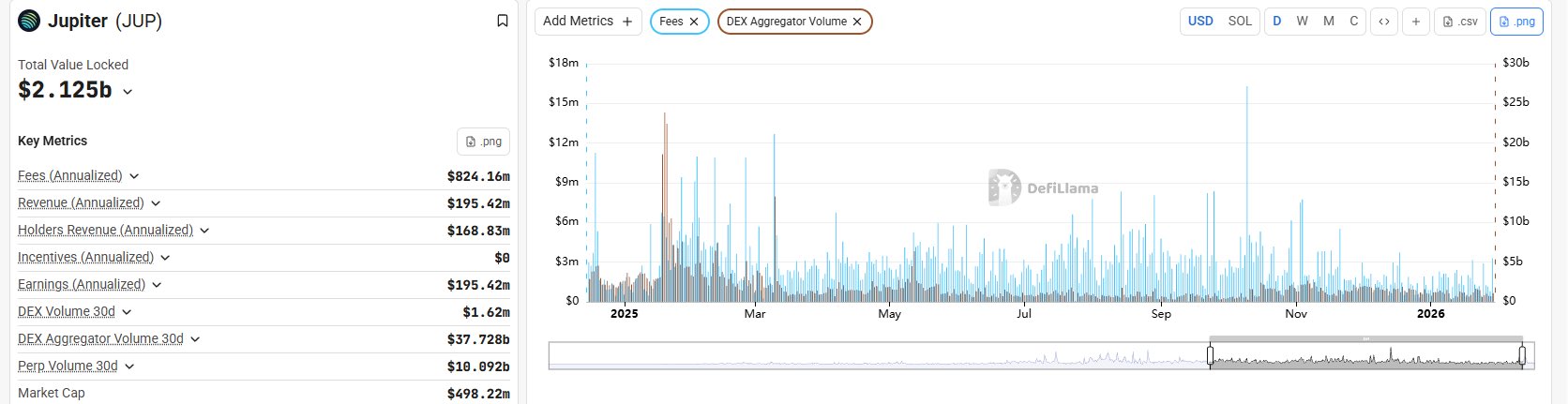

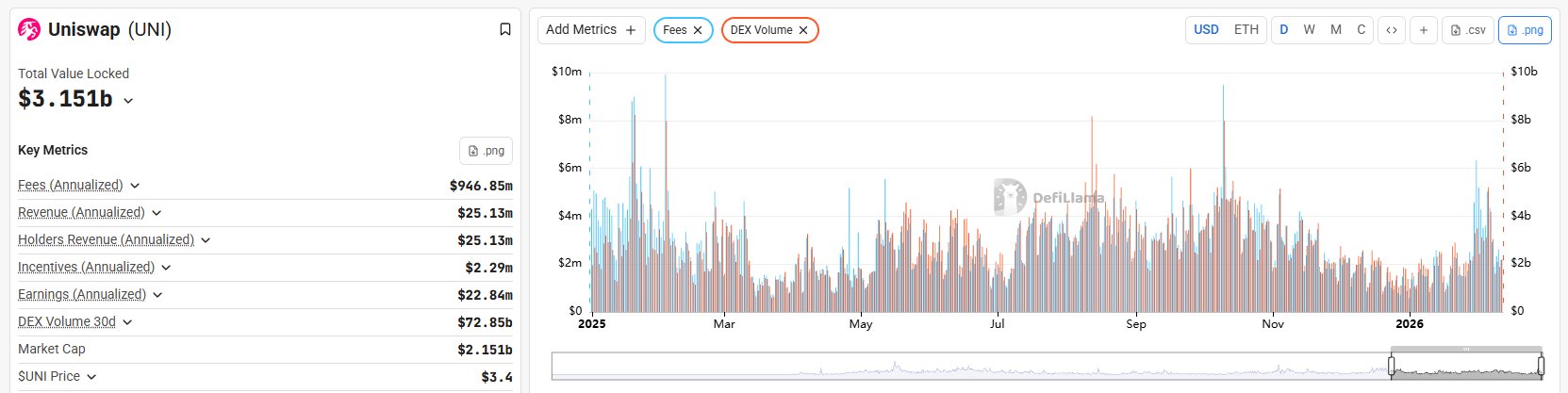

spacebyte ⛓ OnChain_Analyst DeFi_Expert A24.40K @_thespacebyteThe DEX vs Aggregator argument is fading. The real shift is pool ownership → order-flow ownership. - @JupiterExchange is routing ~$37B/month in volume. - @Uniswap earnings are exploding. Different positions in the stack. Same conclusion: Control the flow, capture the value. Liquidity is becoming a commodity. Distribution and routing are becoming the moat.

72 46 4.81K 閱讀原文 >釋出後JUP走勢極度看漲Jupiter and Uniswap excel in order‑flow control, with strong growth in both volume and revenue.

72 46 4.81K 閱讀原文 >釋出後JUP走勢極度看漲Jupiter and Uniswap excel in order‑flow control, with strong growth in both volume and revenue. Kash (🐱, 🐐) DeFi_Expert Community_Lead A48.81K @kashdhanda

Kash (🐱, 🐐) DeFi_Expert Community_Lead A48.81K @kashdhanda wassieloyer D43.14K @wassielawyer

wassieloyer D43.14K @wassielawyerSome thoughts on the latest Jupiter proposal, Jupiter's tokenomics and emissions in general. Starting in reverse order, let's break down as a matter of first principles what emissions are. I think of emissions as a tax on the existing tokenholder base via inflation. When a token is emitted to a user as rewards, a project is essentially asking all existing tokenholders to subsidize the reward to the user. Similarly, when a token is emitted to a team member or an investor, you are socializing the cost of that team member or investor on the general tokenholder base. Now it is not always unreasonable for tokenholders to bear these inflationary costs. Tokenholders economic interests are served when the demand for the token outstrips the supply and there are scenarios where introducing more tokens into the market via inflation may create net demand (e.g. team is building a better product, more people use the product, more people want the token etc). The question is who should have the right to decide whether

95 49 12.10K 閱讀原文 >釋出後JUP走勢中性JUP's inflationary issuance is seen as a cost to holders and requires careful governance. Jupiter DeFi_Expert Media C610.10K @JupiterExchange

Jupiter DeFi_Expert Media C610.10K @JupiterExchange JupiterDAO D70.74K @jup_dao

JupiterDAO D70.74K @jup_daoA new DAO proposal is now LIVE! This is a crucial vote that impacts all token holders. High leverage decisions about $JUP are exactly what the DAO is built for, and so this must be decided collectively. The vote comes down to 2 options regarding the emissions schedule for 2026: Option 1: Proceed with Jupuary Jupuary will continue as planned, with the airdrop checker released ~1 week after the conclusion of the vote. In the event that option 1 passes, Jupuary emissions, Team emissions, and Mercurial emissions will proceed as per their regular vesting schedules. Option 2: Pause Emissions - Jupuary will be postponed, with tokens returned to the Community Cold Multisig - Tokens will not be emitted from the team reserve for the foreseeable future, and Jupiter will absorb any team token sales - Mercurial stakeholders will be airdropped their remaining tokens and an equivalent number will be purchased by Jupiter The vote begins on Tuesday the 17th @ 11am UTC and will run to Saturday to give people enough t

396 110 41.29K 閱讀原文 >釋出後JUP走勢中性JUP DAO vote will decide the direction of the 2026 emission schedule. Crypto Warehouse Media Educator S5.60K @GibCryptoNews

Crypto Warehouse Media Educator S5.60K @GibCryptoNews🟢 Voting is Important Get involved in the vote on @jup_dao, this starts next Tuesday. Stop emissions Continue emissions You vote, you decide, links below. @JupiterExchange

JupiterDAO D70.74K @jup_dao

JupiterDAO D70.74K @jup_daoA new DAO proposal is now LIVE! This is a crucial vote that impacts all token holders. High leverage decisions about $JUP are exactly what the DAO is built for, and so this must be decided collectively. The vote comes down to 2 options regarding the emissions schedule for 2026: Option 1: Proceed with Jupuary Jupuary will continue as planned, with the airdrop checker released ~1 week after the conclusion of the vote. In the event that option 1 passes, Jupuary emissions, Team emissions, and Mercurial emissions will proceed as per their regular vesting schedules. Option 2: Pause Emissions - Jupuary will be postponed, with tokens returned to the Community Cold Multisig - Tokens will not be emitted from the team reserve for the foreseeable future, and Jupiter will absorb any team token sales - Mercurial stakeholders will be airdropped their remaining tokens and an equivalent number will be purchased by Jupiter The vote begins on Tuesday the 17th @ 11am UTC and will run to Saturday to give people enough t

16 0 3.68K 閱讀原文 >釋出後JUP走勢中性JUP 2026 emission plan voting opened, deciding whether to pause or continue the airdrop