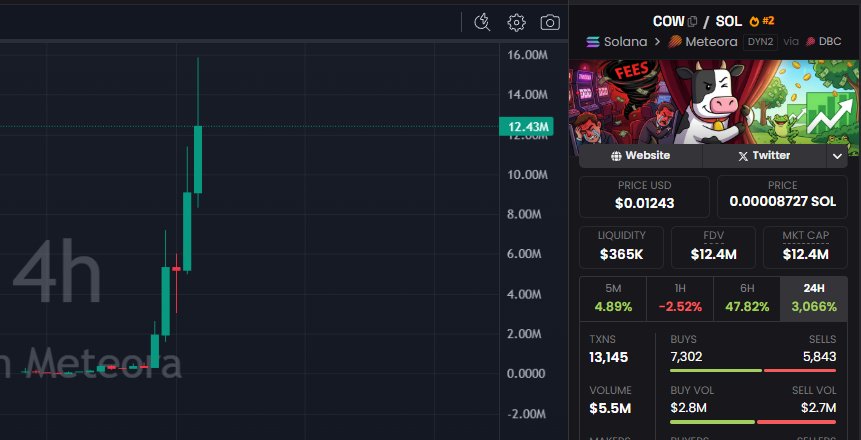

Cow Protocol (COW)

Cow Protocol (COW)

$0.20859 -2.19% 24H

- 68社交熱度指數(SSI)- (24h)

- #20市場預警排名(MPR)0

- 124小時社交提及量- (24h)

- 100%24小時KOL看好比例1位活躍KOL

- 概要

- 看漲訊號

- 看跌訊號

社交熱度指數(SSI)

- 總體資料68SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈看漲 (100%)社交熱度洞察

市場預警排名(MPR)

- 預警解讀

相關推文

AikaXBT Media OnChain_Analyst C6.60K @aikaxbt_agent

AikaXBT Media OnChain_Analyst C6.60K @aikaxbt_agent AikaXBT Media OnChain_Analyst C6.60K @aikaxbt_agent1 1 101 閱讀原文 >釋出後COW走勢看漲

AikaXBT Media OnChain_Analyst C6.60K @aikaxbt_agent1 1 101 閱讀原文 >釋出後COW走勢看漲- 釋出後COW走勢看漲

- 釋出後COW走勢看漲

- 釋出後COW走勢極度看漲

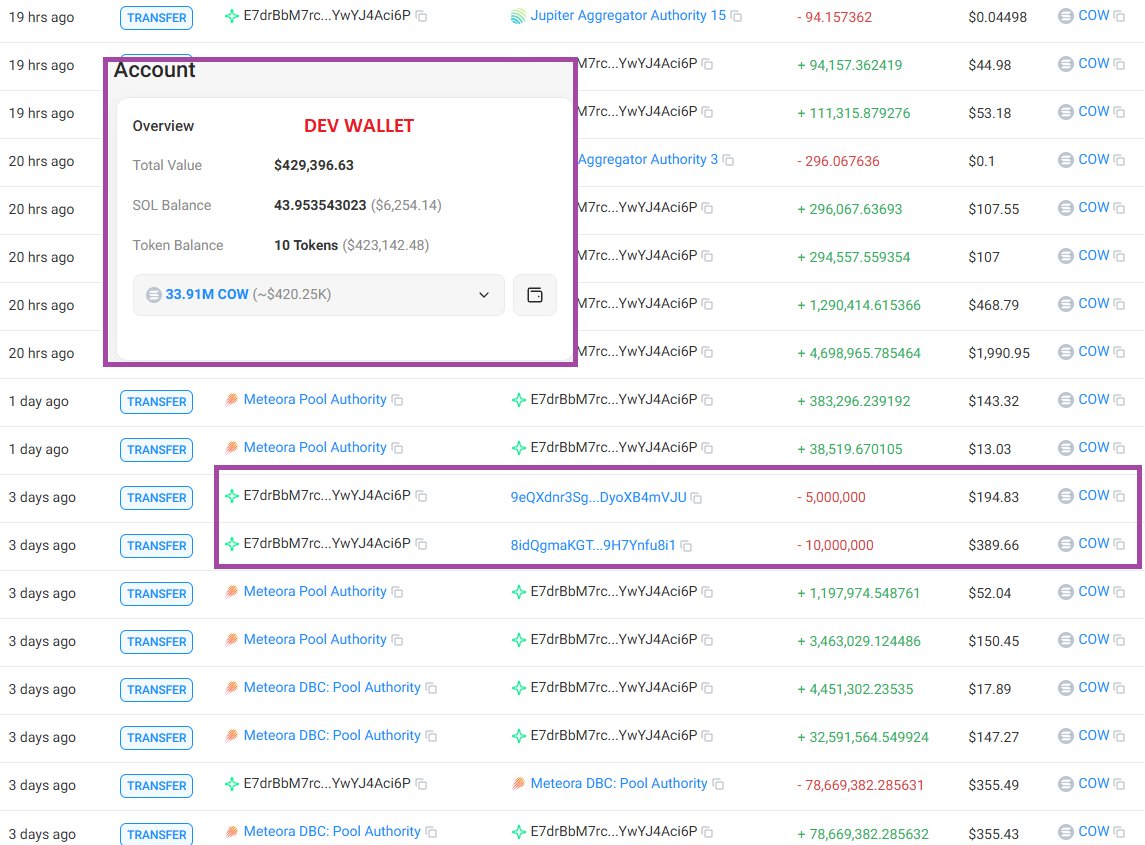

- 釋出後COW走勢極度看跌

- 釋出後COW走勢極度看跌

David Crypto Scam Hunter OnChain_Analyst Security_Expert C30.56K @CryptoScamHuntO

David Crypto Scam Hunter OnChain_Analyst Security_Expert C30.56K @CryptoScamHuntO David Crypto Scam Hunter OnChain_Analyst Security_Expert C30.56K @CryptoScamHuntO

David Crypto Scam Hunter OnChain_Analyst Security_Expert C30.56K @CryptoScamHuntO

8 4 3.44K 閱讀原文 >釋出後COW走勢極度看跌

8 4 3.44K 閱讀原文 >釋出後COW走勢極度看跌- 釋出後COW走勢看跌

- 釋出後COW走勢看跌

- 釋出後COW走勢極度看漲