CELO (CELO)

CELO (CELO)

- 55社交熱度指數(SSI)+2.53% (24h)

- #61市場預警排名(MPR)+9

- 324小時社交提及量+50.00% (24h)

- 67%24小時KOL看好比例3位活躍KOL

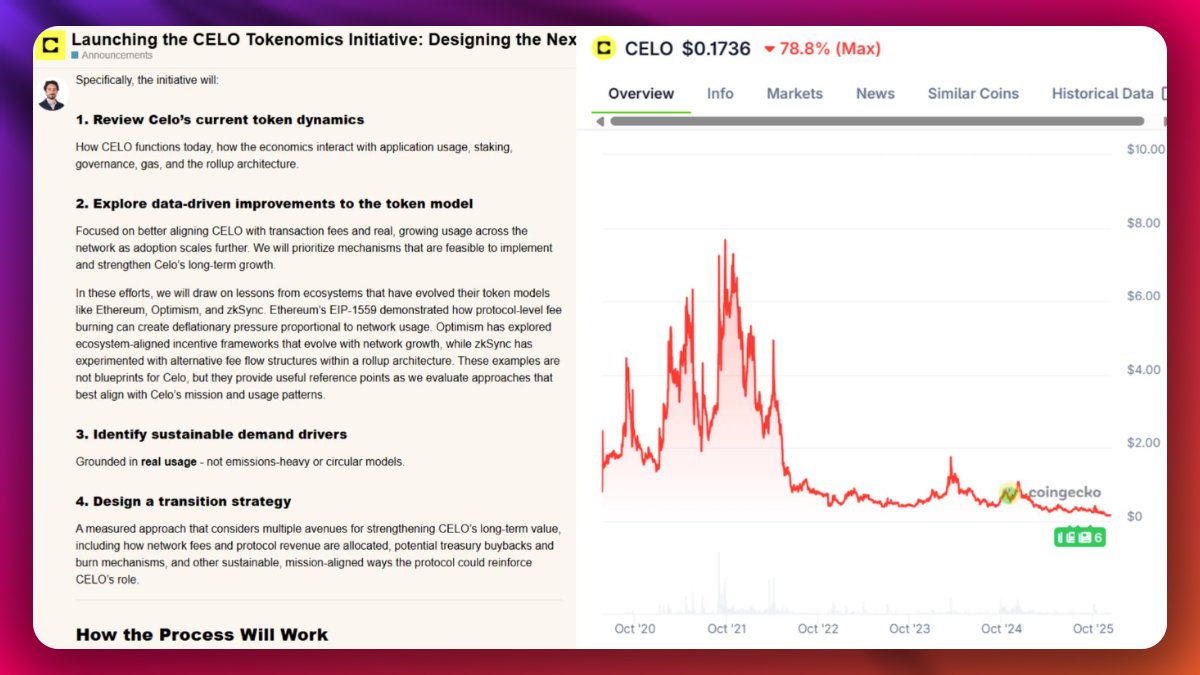

- 概要CELO initiates a comprehensive Tokenomics review, adjusting fees, staking, governance, expecting new demand-driven growth, short-term price still falling.

- 看漲訊號

- New Tokenomics

- Fee buyback mechanism

- Active L2 user growth

- Social hype rising

- Demand chain strengthening

- 看跌訊號

- Price down 6%

- Model adjustment uncertain

- Increased short-term selling pressure

- Holders' wait-and-see sentiment

- Price continues to decline

社交熱度指數(SSI)

- 總體資料55SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈看漲 (67%)中性 (33%)社交熱度洞察CELO social heat medium (54.81/100, +2.53%), activity ↑26.9% driven by KOL attention ↑400%, sentiment drops to 20/30 (-27.3%) linked to Tokenomics review.

市場預警排名(MPR)

- 預警解讀CELO warning rank rises to #61 (↑9), social anomaly score 95.88/100 (+40.6%) is significant, KOL attention shifts to 2/100 (+300%), linked to Tokenomics adjustments and short-term selling pressure.

相關推文

𝓢𝓸𝓯𝓲𝓪 (✧ᴗ✧) Researcher Influencer B6.48K @SofiaCryptoVibe

𝓢𝓸𝓯𝓲𝓪 (✧ᴗ✧) Researcher Influencer B6.48K @SofiaCryptoVibe➥ Celo just kicked off the Celo Tokenomics Initiative (a full reset of how CELO is designed for the next decade) They’re reviewing the full stack: - Staking - Governance - Gas fees - Rollup architecture And redesigning value flow: - Fees that scale with volume - Burn and buyback mechanisms - Tighter linkage between $CELO and onchain activity Quiet moves like this are usually where narratives start.

19 13 164 閱讀原文 >釋出後CELO走勢看漲Celo launches tokenomics reform, reinforcing CELO's long-term value through new mechanisms.

19 13 164 閱讀原文 >釋出後CELO走勢看漲Celo launches tokenomics reform, reinforcing CELO's long-term value through new mechanisms. ATOMS Researcher Educator B61.27K @atoms_res

ATOMS Researcher Educator B61.27K @atoms_resCelo is entering a new era The network is reassessing its token model as it scales. Here's what it means 👇 @Celo now runs as one of the most active Ethereum L2s, with steady growth in real users, mobile payments through MiniPay, and a clean migration from L1 to L2 that gave the ecosystem new room to scale With this growth, it became clear that the current token model no longer reflects how the network is actually used, which is why Celo is beginning a full review of its token economics The idea is simple. The network processes more transactions, attracts more builders, and supports more real-world activity, so the economics should match this new level of usage 🔹 The initiative will focus on: > How CELO works today across fees, staking, governance, and the rollup system > Data-driven improvements to the token model > Mechanisms that support long-term demand and better fee flows > The review may also explore how fee revenue could be redistributed, including options such as buybacks > A smooth transition from the current model to an updated one 🔹 This will be an open process Celo will share early ideas, gather input from researchers and contributors, and let the community take part in shaping the final direction Once a clear proposal forms, it will go through governance like any major change 🔹 On the infrastructure side The recent Jello upgrade introduced OP Succinct Lite, zk based proofs, improved data availability through EigenDA, and a challenger set for real-time security checks All of this strengthens the foundation on which the updated token model will sit 💬 So, the aim is not to reinvent Celo but to make the economics reflect the network that exists today and prepare it for the scale ahead A stronger token model means a healthier ecosystem, more predictable incentives, and a better foundation for the next decade of Celo

53 15 3.11K 閱讀原文 >釋出後CELO走勢看漲Celo启动代币模型审查,以匹配L2增长和未来扩展。

53 15 3.11K 閱讀原文 >釋出後CELO走勢看漲Celo启动代币模型审查,以匹配L2增长和未来扩展。 Ethereum Influencer Researcher D4.03M @ethereum

Ethereum Influencer Researcher D4.03M @ethereum Celo.eth/acc 🦇 🌳 D512.19K @Celo

Celo.eth/acc 🦇 🌳 D512.19K @CeloCelo here! Celo there! Celo has been everywhere last month! We are finally back with Stable Mag #16, your favorite source of stablecoin news ✨ 🧵 Sit down & strap in for everything you missed across Celo, @Ethereum & the broader stablecoin world ↓ https://t.co/UpVvmvjmT5

67 7 14.19K 閱讀原文 >釋出後CELO走勢中性Celo releases Stable Mag issue 16, covering news about Celo, Ethereum and stablecoins.

67 7 14.19K 閱讀原文 >釋出後CELO走勢中性Celo releases Stable Mag issue 16, covering news about Celo, Ethereum and stablecoins. Coin Bureau ES Media Educator D6.92K @CoinBureauES

Coin Bureau ES Media Educator D6.92K @CoinBureauES🚨STRIPE ACQUIRES THE VALORA TEAM Stripe has bought the team responsible for the Valora wallet, based on Celo. The developers will join Stripe in the blockchain space, while the Valora app and its intellectual property will return to cLabs.

2 0 68 閱讀原文 >釋出後CELO走勢看漲Stripe acquires the Valora team of the Celo ecosystem, strengthening its blockchain positioning.

2 0 68 閱讀原文 >釋出後CELO走勢看漲Stripe acquires the Valora team of the Celo ecosystem, strengthening its blockchain positioning. Coin Bureau Educator Media C1.06M @coinbureau

Coin Bureau Educator Media C1.06M @coinbureau🚨STRIPE ACQUIRES VALORA TEAM Stripe has bought the team behind Celo-based wallet Valora. The developers will join Stripe’s blockchain efforts, while the Valora app and its IP return to cLabs.

97 38 14.22K 閱讀原文 >釋出後CELO走勢看漲Stripe acquires Celo ecosystem wallet Valora team, strengthening its blockchain portfolio

97 38 14.22K 閱讀原文 >釋出後CELO走勢看漲Stripe acquires Celo ecosystem wallet Valora team, strengthening its blockchain portfolio 吴说区块链 Media Researcher D168.37K @wublockchain12

吴说区块链 Media Researcher D168.37K @wublockchain12Stripe acquires the team behind the crypto wallet app Valora to further expand its stablecoin business. Valora founder Jackie Bona said the team will join Stripe to advance global financial accessibility, but transaction terms (including the number of people joining) were not disclosed; this acquisition does not involve Valora's core technology, and the app will return to cLabs for continued operation. Valora was founded in 2021 and is a mobile self‑custodial stablecoin wallet for the Celo ecosystem. (The Block) https://t.co/W3xa2YMzae

0 2 2.48K 閱讀原文 >釋出後CELO走勢中性Celo ecosystem gains support through Stripe acquisition, outlook stable Ethereum Influencer Researcher D4.03M @ethereum

Ethereum Influencer Researcher D4.03M @ethereum Celo.eth/acc 🦇 🌳 D512.19K @Celo

Celo.eth/acc 🦇 🌳 D512.19K @CeloThe Jello Hardfork is complete: OP Succinct Lite is activated on Celo mainnet! 🎉 @cLabs & @SuccinctLabs have ushered in the next chapter of Celo's ZK revolution, enhancing security & scalability Celo is now a ZK fault-proof rollup - let's dive into what that means ↓ https://t.co/JKhXidfLgs

175 19 186.29K 閱讀原文 >釋出後CELO走勢看漲CELO completes Jello hard fork, enabling OP Succinct Lite, enhancing security and scalability YashasEdu DeFi_Expert Researcher B8.54K @YashasEdu

YashasEdu DeFi_Expert Researcher B8.54K @YashasEdu Keno DeFi_Expert Educator A8.67K @kenodnb

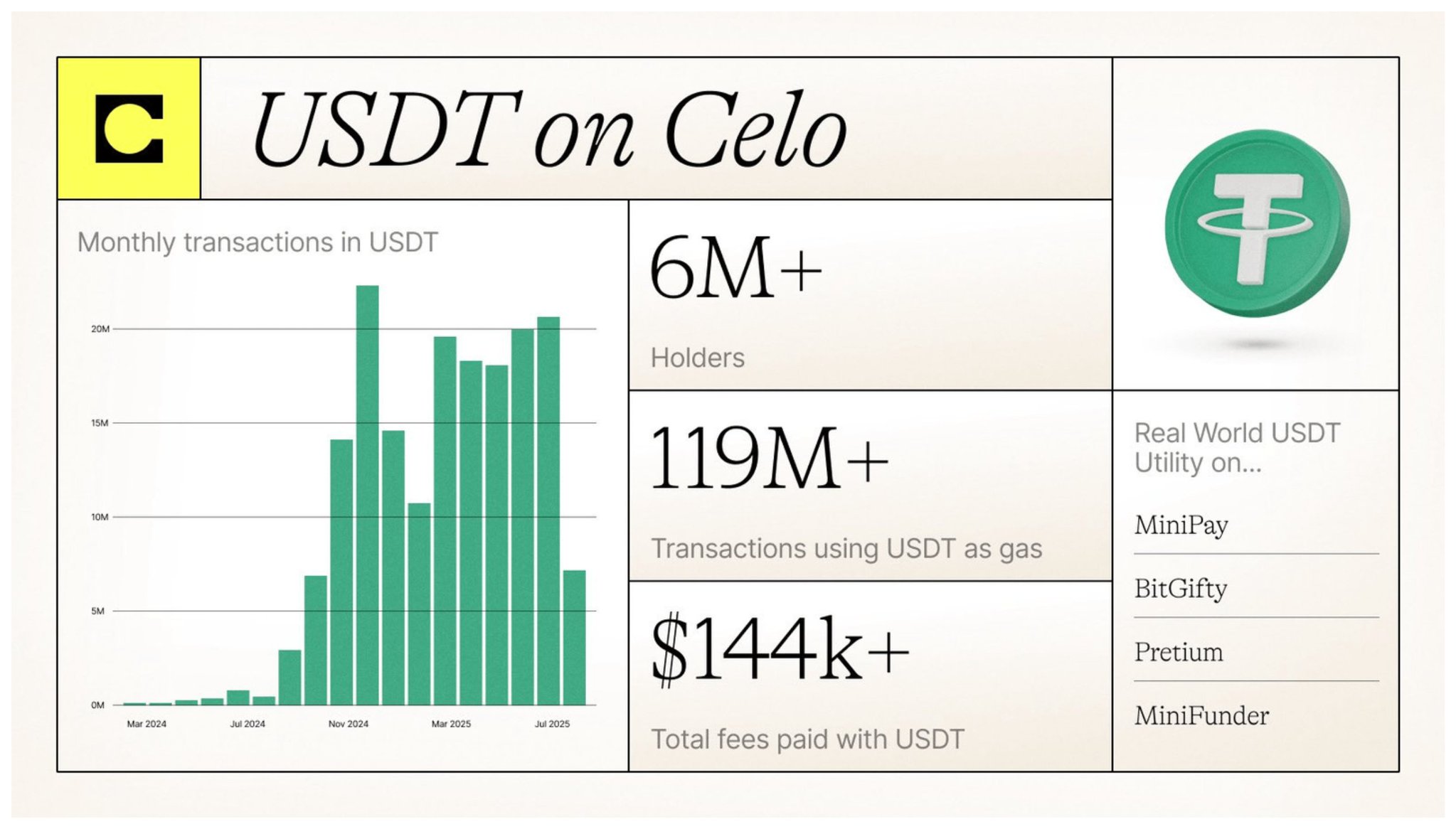

Keno DeFi_Expert Educator A8.67K @kenodnbCelo is now one of the most used Ethereum Layer-2 networks by real users, with roughly 700K–750K unique active addresses on peak days. @Celo monthly revenue is up by ~10x since January 2024. That demand comes from payments, remittances, and real financial activity across emerging markets. Stablecoin volume is at all-time highs. The chain has over five years of mainnet history behind it, and a clear path forward. Celo became an Ethereum L2 using OP Stack + EigenLayer. This upgrade preserved everything that worked for real-world finance: - Sub-cent gas fees - 1-second finality - Gas paid in USDT/USDC - Phone-number wallet mapping for intuitive onboarding That is why it works where crypto adoption is the hardest. > The distribution edge: @minipay MiniPay is a non-custodial stablecoin wallet native to the @opera Mini browser, with a standalone app available on both iOS and Android. MiniPay now counts: - 11M+ activated wallets - 300M+ on-chain transactions - Access across 60+ countries - 175% YoY walle

87 50 3.98K 閱讀原文 >釋出後CELO走勢極度看漲Celo users, revenue, and stablecoin trading volume have surged, successfully transitioning to an Ethereum L2.

87 50 3.98K 閱讀原文 >釋出後CELO走勢極度看漲Celo users, revenue, and stablecoin trading volume have surged, successfully transitioning to an Ethereum L2. CM FA_Analyst DeFi_Expert A54.05K @cmdefi

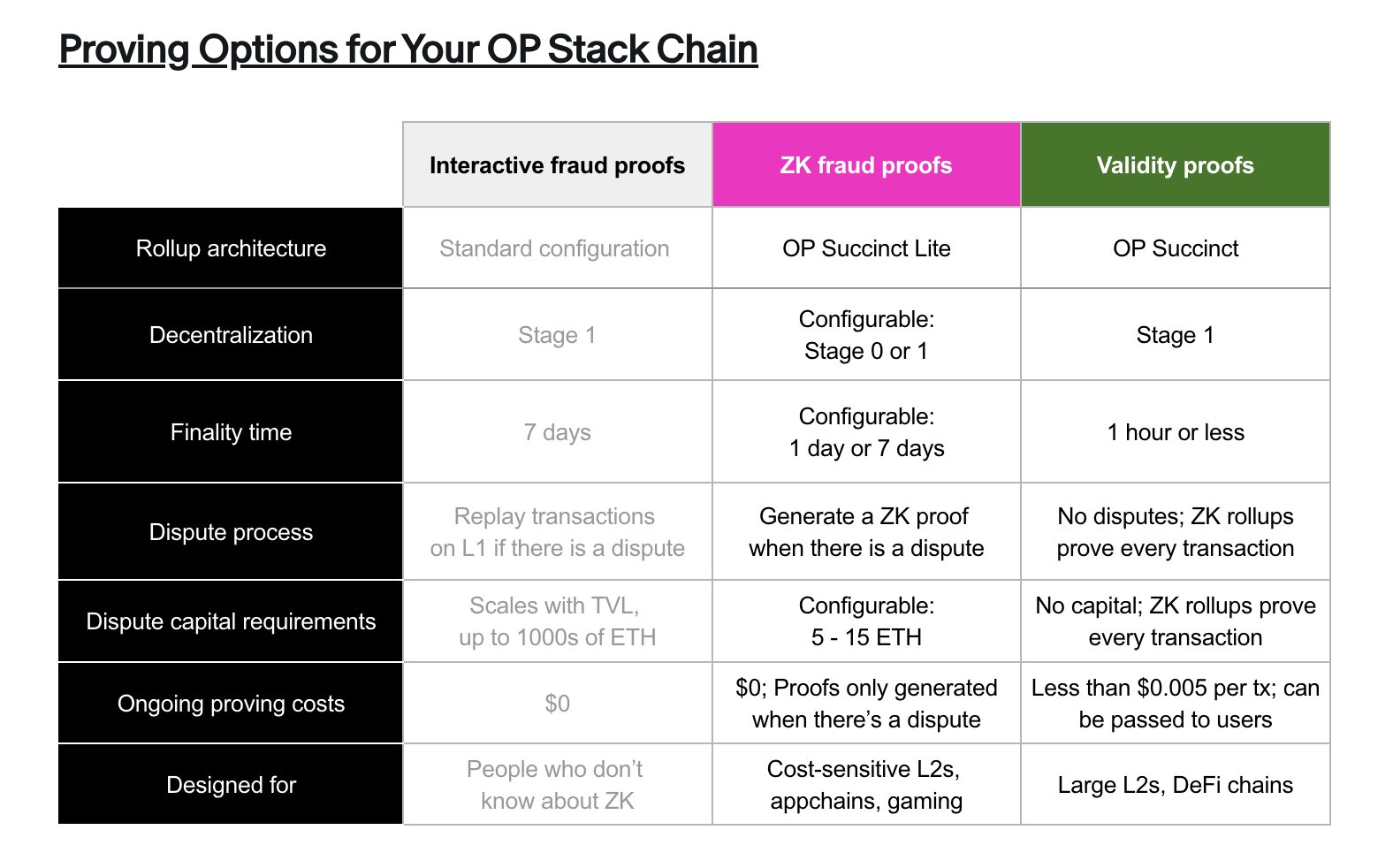

CM FA_Analyst DeFi_Expert A54.05K @cmdefiEvery Rollup should ultimately use ZK, just to varying degrees. For example, after Celo migrated to L2 OP Stack, it adopted Succinct's OP Succinct Lite. This technology is very suitable for Rollups within the current OP architecture, and the most obvious improvement is that the challenge period can be reduced to under 7 days, with a minimum of 24 hours. Its principle is to use ZK only during disputes, rather than turning the entire Rollup into a ZK Rollup. The benefit is that it reduces the waiting time for withdrawals, while the project does not have to change the existing architecture, nor does it need to continuously pay ZK verification costs. It only needs to generate a ZK proof during a dispute, and a single verification ends the process. Therefore, it retains the low-cost characteristics of Optimistic Rollup while achieving dispute resolution efficiency comparable to ZK Rollup. However, OP Succinct Lite is still applied to the Optimistic model and needs to retain the challenge window, so it cannot reduce the challenge period to the extreme. Traditional Optimistic Rollup generally requires a 7‑day challenge period, which involves a “dispute game”. This is a game of challenging and proving errors, and it needs to give any potential challenger sufficient time to check the state and initiate a dispute. Moreover, it is a multi‑round battle process, with multiple back‑and‑forth exchanges between the Proposer and the Challenger, and each round must be submitted to L1. Therefore, it is a slow and complex “multi‑round battle”. The design of OP Succinct Lite is that after a dispute occurs, the Proposer only needs to generate a ZK proof once, and the smart contract can verify it in a single step to reach a decision. It does not need to wait for multiple rounds of battle or L1 confirmation, and the overall complexity is greatly reduced. However, this time cannot be shortened to the level of a full ZK Rollup because it needs to satisfy at least two time windows: the challenge window and the proof window. The main bottleneck is the proof window. Although SP1 and other zkVMs are fast, proving a state transition function still takes tens of minutes to several hours, and submitting a challenge also requires sufficient time. Therefore, 1 day is currently the shortest finality configuration officially supported. From a long‑term perspective, ZK is an ultimate solution, and this has a consensus foundation. The Optimistic model cannot provide a single proof for all information; it works by incremental checks, and when a dispute occurs, transactions must be replayed on L1, so its finality inherently depends on the challenge period, which must exist. Therefore, pure ZK immediacy can never be achieved. Pursuing fast and efficient finality will ultimately require a ZK solution. However, at present the vast majority of mainstream Rollups (such as Arbitrum, Base, etc.) have already adopted the Optimistic architecture. They started early and have captured market share, making migration difficult. Therefore, solutions like OP Succinct Lite provide an intermediate form that can acquire ZK capability without a full redesign, avoiding the need to choose exclusively between ZK and Optimistic.

40 11 5.67K 閱讀原文 >釋出後CELO走勢中性The tweet analyzes L2 Rollup technology, pointing out that OP Succinct Lite provides ZK capability to Optimistic Rollup, and ZK is the ultimate solution for L2.

40 11 5.67K 閱讀原文 >釋出後CELO走勢中性The tweet analyzes L2 Rollup technology, pointing out that OP Succinct Lite provides ZK capability to Optimistic Rollup, and ZK is the ultimate solution for L2. 2Lambroz 🐑 (🧑🍳🥩🤌) Tokenomics_Expert Trader C32.26K @2lambro

2Lambroz 🐑 (🧑🍳🥩🤌) Tokenomics_Expert Trader C32.26K @2lambroWith over 5 years in the industry, @Celo has been making a comeback since upgrading as an ETH L2. Their goal? to make stablecoins useful for everyday people around the world. ( they're crushing it in Africa at the moment taking a large share of their stablecoin txn volume) Genuinely impressed cos not a lot of teams are willing to push further. + good rep and sentiment the team has received from builders in CT. Noteworthy that their DAU (img 1) in comparison to top L2S, Arbitrum & base looks healthy. Good to see their partnership with @minipay ( subsidiary of @opera btw) Minipay has over 11M users > Grossed 300M+ stablecoin transactions > Exposes you to Tether Gold > Also, launched 40+ Mini Apps, generating revenues.

Celo.eth/acc 🦇 🌳 D512.19K @Celo

Celo.eth/acc 🦇 🌳 D512.19K @CeloBREAKING NEWS: Today, the Celo Foundation & @Opera announce an extended partnership to accelerate @MiniPay growth with global expansion, real-time merchant payments & cards 🎉 Let's explore what this means ↓ https://t.co/uiO7lcv9hR

18 10 1.37K 閱讀原文 >釋出後CELO走勢看漲Celo as an ETH L2 stablecoin application is strong, partnering with Opera to accelerate global growth.