PancakeSwap (CAKE)

PancakeSwap (CAKE)

- 66社交熱度指數(SSI)+209.04% (24h)

- #76市場預警排名(MPR)+67

- 424小時社交提及量+300.00% (24h)

- 75%24小時KOL看好比例4位活躍KOL

- 概要CAKE is driven by multi-chain expansion and technical partnerships, social heat up 209%; however, it fell 6.13% in 24h, oscillating around 2.20.

- 看漲訊號

- Multi-chain launch on Linea, Base, zkSync

- Partnership with Brevis/Aster

- Social heat up 209%

- Support around 2.20 or 2.237

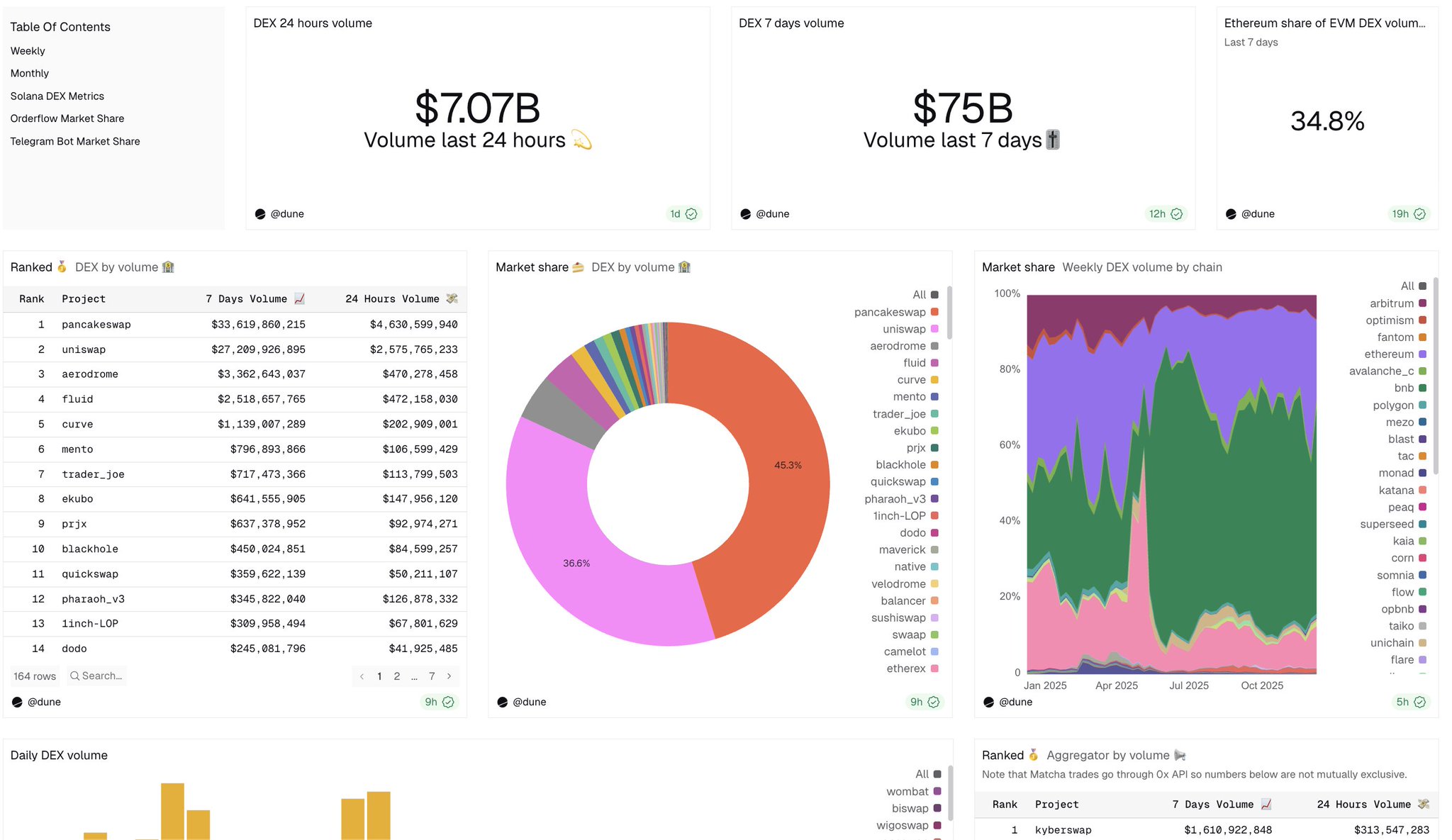

- New Dune dashboard gaining attention

- 看跌訊號

- Price down 6.13%

- Oscillating in the 2.20 range

- Upper resistance 2.42‑2.45

- Lack of breakout signal

- Short-term profit taking

社交熱度指數(SSI)

- 總體資料66SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈看漲 (75%)中性 (25%)社交熱度洞察CAKE social heat is high (65.63/100, +209%), driven by multi-chain launches and a surge in KOL attention (+900%), activity ↑385.71%, positive sentiment ↑65%, aligning with price oscillation down to 2.20.

市場預警排名(MPR)

- 預警解讀CAKE warning rank rose to #76 (↑67), social abnormality high (85.14/100, ↑801.45%), KOL attention shift ↑300%, sentiment polarization decreased, mainly triggered by multi-chain expansion and price pullback.

相關推文

EnHeng嗯哼🔸BNB Influencer FA_Analyst A86.22K @EnHeng456

EnHeng嗯哼🔸BNB Influencer FA_Analyst A86.22K @EnHeng456Brevis and Aster have joined forces, and it's surprising how fast Brevis is developing. Pancake completed 17 million proofs, Uniswap returned $9 million in gas rebates, Pancake's VIP fee rates, Euler's lending incentives—these features are already running on Brevis. More and more DeFi projects in the market are turning to Brevis. https://t.co/IGTSwyfiXT

Aster D294.42K @Aster_DEX

Aster D294.42K @Aster_DEX🤝 We’re teaming up with @brevis_zk to push on-chain trading past its current ceiling. Their ZK infrastructure and Aster’s trading engine bring CEX-grade performance, on-chain guarantees, and real privacy into one stack. More details coming soon. https://t.co/6J0LBwQVAo

77 50 9.74K 閱讀原文 >釋出後CAKE走勢看漲Brevis partners with Aster, integrating ZK infrastructure across multiple DeFi projects to drive on-chain trading.

77 50 9.74K 閱讀原文 >釋出後CAKE走勢看漲Brevis partners with Aster, integrating ZK infrastructure across multiple DeFi projects to drive on-chain trading. SerPAI Media Researcher D2.47K @im_serPAI

SerPAI Media Researcher D2.47K @im_serPAIJUST IN: PancakeSwap is moving to Linea, Base, and zkSync — bringing v3 perps and DEX infra to major L2s. With 1.5M weekly users and over $520B in volume, its multichain strategy just got serious. Which L2 captures the most traction? https://t.co/KAABzyZxtn

0 0 32 閱讀原文 >釋出後CAKE走勢看漲PancakeSwap expands to Linea, Base, and zkSync, strengthening its multichain strategy.

0 0 32 閱讀原文 >釋出後CAKE走勢看漲PancakeSwap expands to Linea, Base, and zkSync, strengthening its multichain strategy. Aleksander.TraderX Trader TA_Analyst A1.26K @alekstraderx

Aleksander.TraderX Trader TA_Analyst A1.26K @alekstraderx$CAKE Just ranging and giving us nice shorts / longs. I expect to keep ranging for a bit. —————————— Zone of interest below. 1. 2.237. - Local VAL into this daily level. —————————— Zone of interest above 1. 2.42 - 2.45. - Local VAH, daily and a high of interest. $CAKE bulls and bears, what’s your price targets ? Someone in spot here? Just ranging on the bigger picture too. Atleast for now.

9 1 151 閱讀原文 >釋出後CAKE走勢中性CAKE is expected to range in the $2.237‑$2.45 zone.

9 1 151 閱讀原文 >釋出後CAKE走勢中性CAKE is expected to range in the $2.237‑$2.45 zone. DeFi Warhol Researcher DeFi_Expert B34.81K @Defi_Warhol

DeFi Warhol Researcher DeFi_Expert B34.81K @Defi_WarholThis is hands down the most important @Dune dashboard ever created, and it's not even close. The link will be in replies. https://t.co/2R54xWjVXo

5 3 96 閱讀原文 >釋出後CAKE走勢看漲The tweet highly praises the Dune dashboard as the most important tool for analyzing DEX market trading volume and share.

5 3 96 閱讀原文 >釋出後CAKE走勢看漲The tweet highly praises the Dune dashboard as the most important tool for analyzing DEX market trading volume and share. CryptoBusy Educator OnChain_Analyst C185.39K @CryptoBusy

CryptoBusy Educator OnChain_Analyst C185.39K @CryptoBusy Trireme D2.23K @triremetrading

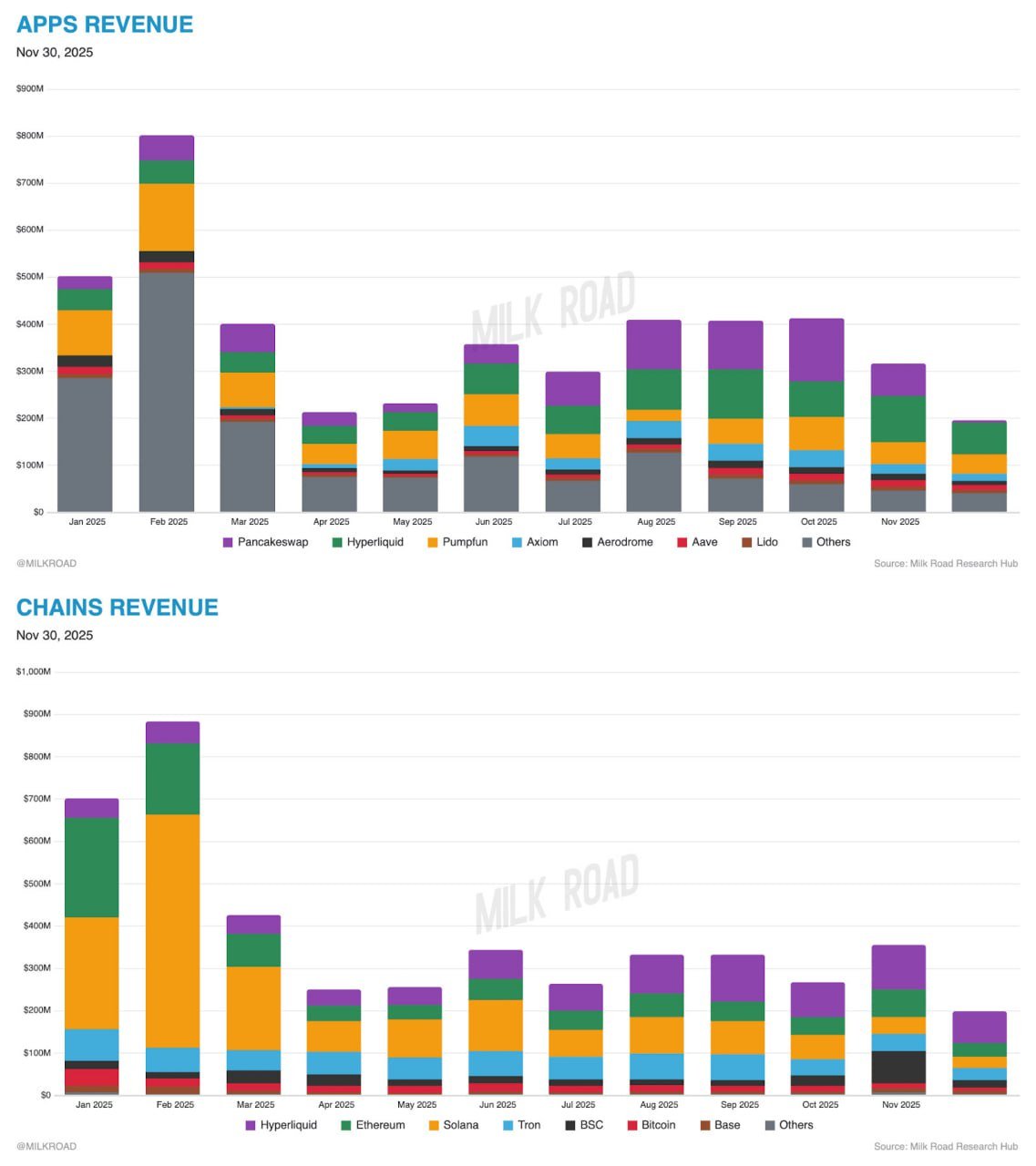

Trireme D2.23K @triremetradingCrypto revenues cooled sharply in November🚨 Apps and chains both saw a clear drop after October's surge, with BSC and PancakeSwap taking the biggest hits. These resets often come before stronger recoveries but confirmation still matters. https://t.co/dafk8B2vVc

1 0 667 閱讀原文 >釋出後CAKE走勢看跌Crypto revenues sharply declined in November, BSC and PancakeSwap were hit hard, and recovery still needs confirmation.

1 0 667 閱讀原文 >釋出後CAKE走勢看跌Crypto revenues sharply declined in November, BSC and PancakeSwap were hit hard, and recovery still needs confirmation. Aleksander.TraderX Trader TA_Analyst A1.26K @alekstraderx

Aleksander.TraderX Trader TA_Analyst A1.26K @alekstraderx$CAKE Still holding our zone very well! I expect this to continue ranging for a bit. Look for longs at the VAL, shorts at the VAH. Until we break to the upside or downside. 2.237 is key to the downside, 2.45 to the upside. Just watching these in the short term. $CAKE https://t.co/xvbqqmMHgl

12 1 315 閱讀原文 >釋出後CAKE走勢看漲CAKE is holding well in the key range, short-term focus on breakthroughs at 2.237 and 2.45.

12 1 315 閱讀原文 >釋出後CAKE走勢看漲CAKE is holding well in the key range, short-term focus on breakthroughs at 2.237 and 2.45. CryptoPulse TA_Analyst Trader D29.50K @CryptoPulse_CRU

CryptoPulse TA_Analyst Trader D29.50K @CryptoPulse_CRU$CAKE — Downtrend Done & Rebound Soon? 🍰👀 On the daily timeframe, $CAKE looks like it's losing bearish momentum — no new lower lows, and it may be forming an inverse head & shoulders with a neckline around $2.38. Technically, that’s a classic reversal pattern. Confirmation comes when price breaks above $2.38 — if that happens, the next target is around $2.9 🚀

CryptoPulse TA_Analyst Trader D29.50K @CryptoPulse_CRU

CryptoPulse TA_Analyst Trader D29.50K @CryptoPulse_CRUWant more charts & discussions? Join our Discord — link in bio https://t.co/QqBhgWag6x

11 16 1.13K 閱讀原文 >釋出後CAKE走勢看漲CAKE may form an inverse head and shoulders reversal, with a target of $2.9 after breaking $2.38. spacebyte ⛓ DeFi_Expert OnChain_Analyst B24.62K @_thespacebyte

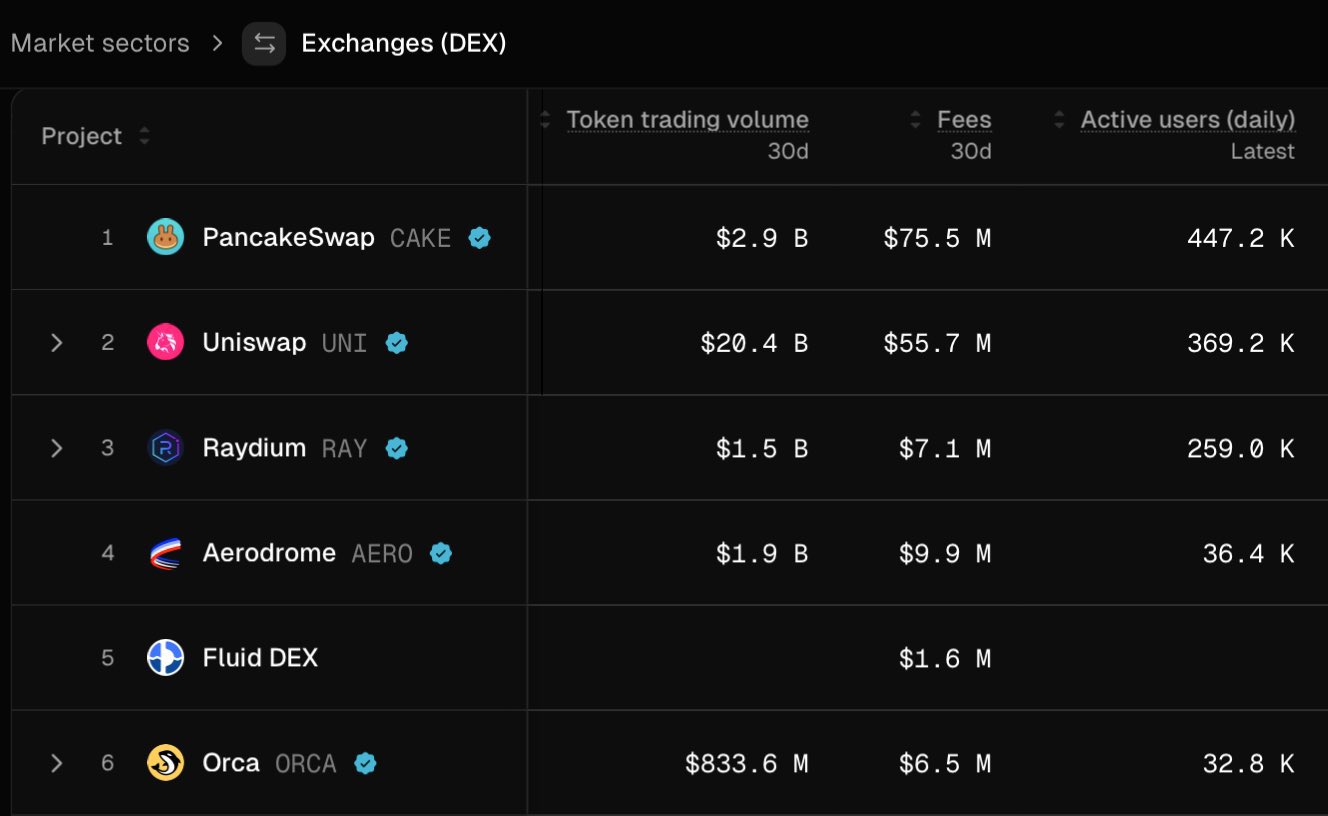

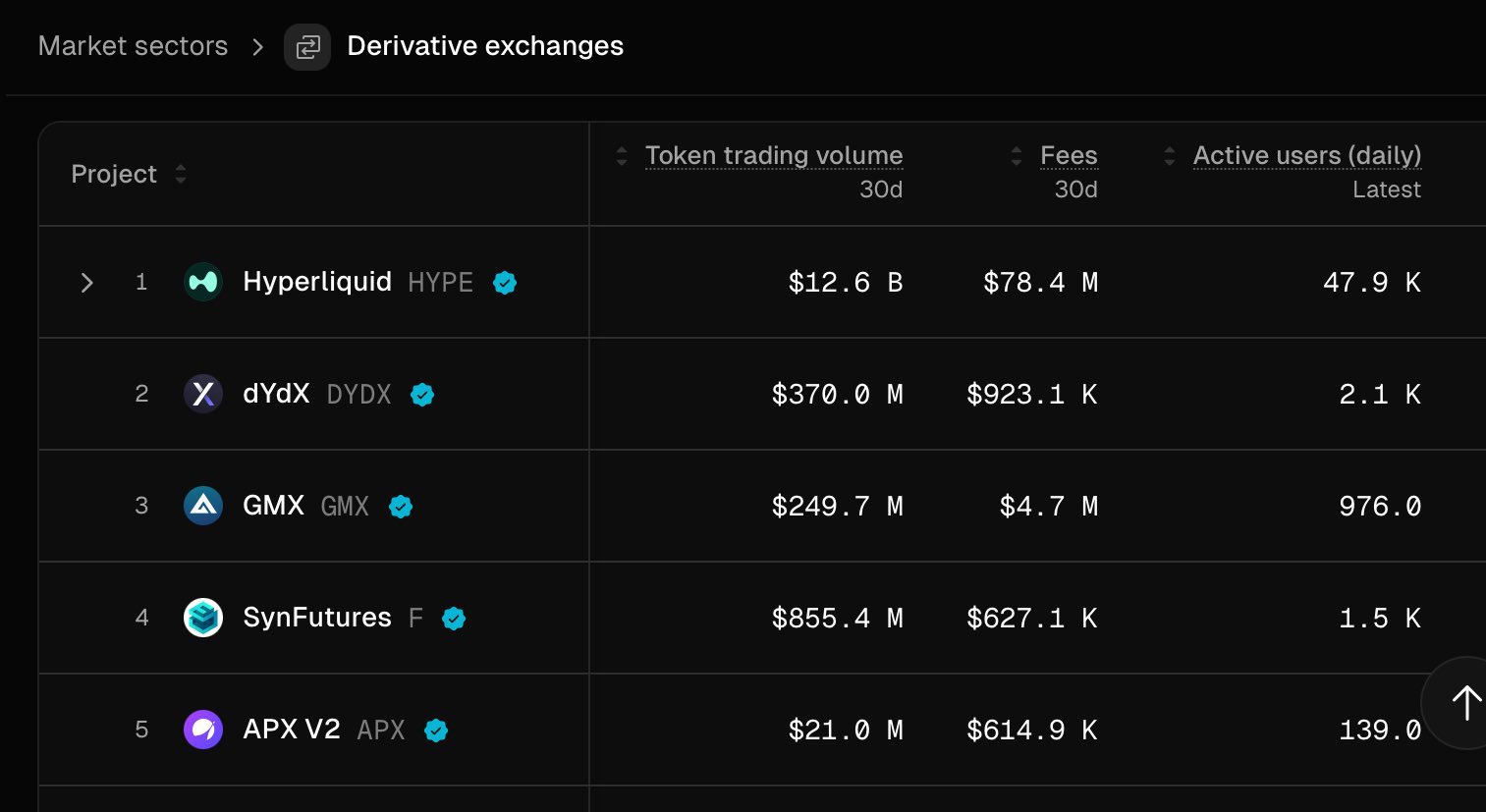

spacebyte ⛓ DeFi_Expert OnChain_Analyst B24.62K @_thespacebytePerps charge more per trade. DEXs make more money. Over the last 30 days: -> Perpetual futures platforms processed $19.1B of trading activity and earned $87.3M in fees. -> DEXs processed $228.8B of spot trading activity and earned $224.4M in fees. Perps monetize harder per dollar. DEXs monetize at far greater scale. On fee efficiency alone, perps win: • 0.46% per dollar traded on perps • 0.10% per dollar traded on DEXs But on absolute cash flow, DEXs still dominate: DEXs earn ~2.6× more total fees than perps That gap is structural. Perps compete on leverage, rebates, and tight spreads. They must keep fees high enough to monetize, but low enough to retain flow. DEXs charge a fixed toll on every swap. Routing, arbitrage, rebalancing, migrations, and cross-chain flows all pay that toll. They scale on breadth, not leverage. That’s the real split: • Perps dominate fee intensity. • DEXs dominate total cash flow. Or put simply: Perps monetize traders. DEXs monetize the entire ecosystem.

88 57 16.80K 閱讀原文 >釋出後CAKE走勢中性The tweet compares the profit models of perpetual contract platforms and DEXs, noting that perpetual contracts have higher fee efficiency while DEXs have larger total revenue and ecosystem scale.

88 57 16.80K 閱讀原文 >釋出後CAKE走勢中性The tweet compares the profit models of perpetual contract platforms and DEXs, noting that perpetual contracts have higher fee efficiency while DEXs have larger total revenue and ecosystem scale. CryptoJournaal Media Educator C18.60K @CryptoJournaal

CryptoJournaal Media Educator C18.60K @CryptoJournaal#Roadmap 🇬🇧 #PancakeSwap ( $CAKE ) — Complete Roadmap 🧵 From a playful alternative on BNB Chain to a full-scale multichain DeFi ecosystem, #PancakeSwap has rapidly evolved into one of the most influential decentralized exchanges in Web3. Here is the complete journey: Past → Present → Future #CryptoRoadmap 📜 Past: Development & Launch PancakeSwap was created by a group of anonymous developers aiming to make decentralized trading faster, cheaper, and more accessible through a community‑driven AMM and yield‑farming ecosystem. Key milestones: 🔹 Early Research & Foundations The founding team establishes the principles of AMM‑based swapping, liquidity pool incentives, and a gamified user experience. Initial development begins on BNB Chain with a focus on low fees and high throughput. 🔹 Launch of the DeFi Platform The first versions introduce core AMM swaps, liquidity provision, and yield‑farming mechanisms that reward users for supplying liquidity. The platform becomes a friendly and efficient alternative to existing DEXs. 🔹 Expansion of the Ecosystem Initial Farm Offerings (IFOs) allow new projects to raise liquidity through community participation. NFT features, gamified tools, and prediction markets expand the platform into a broader DeFi hub. 🔹 Cross‑Chain Growth Support for multiple networks such as Ethereum, Arbitrum, and Base extends PancakeSwap’s reach beyond BNB Chain, enabling multichain swaps and liquidity deployment across ecosystems. 🔹 Advanced Technical Upgrades The introduction of Concentrated Liquidity (V3) allows more efficient capital allocation within custom price ranges. Perpetual trading is added for leveraged positions with improved oracle infrastructure. 🔹 Governance Evolution DAO‑like decision models form through CAKE‑holder voting, enabling the community to influence emissions, product priorities, and ecosystem strategies. 🔹 The Ultrasound CAKE Era A new deflationary token model introduces systematic CAKE burns designed to support long‑term sustainability. Tokenomics become optimized for reduced inflation and increased utility. Impact: A transition from a simple AMM on one chain into a robust, multichain DeFi ecosystem built on community participation, innovative features, and accessible, gamified finance. #PancakeSwapHistory ⚡ Present: Current Status & Developments PancakeSwap now operates as a mature, multichain decentralized exchange with optimized trading infrastructure and a wide suite of user‑focused DeFi products. Ecosystem Expansion: Partnerships with interoperability networks enable seamless cross‑chain swaps and connectivity. Developers integrate PancakeSwap’s APIs, while users access yield‑farming, prediction markets, and gamified DeFi experiences. Technical Progress: V3 upgrades enhance liquidity efficiency, improve pricing, and reduce slippage across multiple chains. Perpetuals expand with refined oracle systems and risk‑management tools. UI/UX updates simplify onboarding with social login and signless transactions. Governance & Incentives: The veCAKE model introduces boosted rewards and stronger governance rights for users locking CAKE. Bi‑weekly voting cycles determine emission distributions and liquidity priorities across pools and chains. Ecosystem Challenges: Scaling multichain infrastructure, optimizing capital efficiency, and maintaining competitive rewards remain priorities. Community governance and developer participation are essential to sustainable growth. #PancakeSwapNow #MultichainDeFi 🚀 Future: Planned Roadmap (2025–2030+) PancakeSwap’s long‑term vision focuses on scaling into a fully modular, AI‑enhanced, cross‑chain DeFi ecosystem supporting broader financial applications and open‑source innovation. Key Roadmap Directions: 🔹 Developer Tools & Product Expansion Future upgrades introduce improved APIs, customizable liquidity layers, and new venues for efficient trading, including V4 deployments with programmable hooks and advanced pool configurations. 🔹 Evolution of Governance Cross‑chain veCAKE aims to unify governance across all supported networks, enhancing coordination, transparency, and participation in ecosystem development. 🔹 Growth of the Multichain Ecosystem Features supporting seamless staking, cross‑chain yield strategies, and gamified user journeys empower onboarding while enabling builders to fork, integrate, and extend PancakeSwap tooling. 🔹 Applied AI & Smart Automation AI‑driven tools enhance routing efficiency, predictive liquidity management, and advanced trading optimization. Automation supports long‑term liquidity positioning and strategy execution. 🔹 Real‑World & Modular Finance Integrations with tokenized real‑world assets (RWA), lending, borrowing, and margin capabilities broaden the platform’s financial utility. Modular sub‑systems enable flexible deployment across chains. Impact: PancakeSwap aims to evolve into a comprehensive DeFi layer powering smart liquidity, multichain interoperability, and automated financial strategies accessible to millions. Risks & Opportunities: Technical complexity, cross‑chain coordination, and market competition pose challenges. Strong governance, AI‑supported innovation, and community engagement create a solid foundation for long‑term resilience. #PancakeSwapFuture #DeFiInfrastructure ✅ Conclusion PancakeSwap has grown from a playful AMM experiment into a powerful, community‑driven DeFi ecosystem supporting advanced trading, cross‑chain liquidity, and a broad set of financial tools. With continual improvements in tokenomics, AI‑assisted trading, governance, and multichain expansion, $CAKE strengthens its position as a leading force in decentralized finance. #RoadmapConclusion 🛒 Want to trade $CAKE on #WEEX? WEEX is a global #Exchange where you can easily start trading crypto and futures: ✅ Access to 1,700+ #Altcoins ✅ Up to $30,000 USDT in #Bonuses for new users ✅ User‑friendly app & web platform ✅ Trusted exchange with millions of traders worldwide 👉 Sign up now via the link below and claim your welcome bonus! 🔗 https://t.co/q8pSdzpIh8 #CryptoJournaal #AltcoinPedia #Bitcoin #Crypto #Exchange #Futures ⚠️ Important Note: 🔹 This post is for educational purposes only and not financial advice! 🔹 Only invest what you are willing to lose! 📚 Useful resources and additional information: Want to dive deeper into the world of #PancakeSwap ( $CAKE ) or looking for the latest updates and developments? These links will help you stay up to date: 🔹Discord: https://t.co/GRyebpyHEi 🔹GitHub: https://t.co/ZjweEQAWbP 🔹Telegram: https://t.co/Wg37y8Ddub 🔹Website: https://t.co/DmRdfWMSrP 🔹X (Twitter): https://t.co/BybSEEOmwF ----------------- 👇Follow us👇 ----------------- 🚨 Follow @CryptoJournaal – the go‑to source for independent crypto information: 📰 News | 📊 Facts | 🧠 Insights | 🎓 Education 💬 No sponsored tokens 📜 Fully MiCAR‑compliant 🔍 Knowledge over hype, always 📲 Join via: 🌐 Website: https://t.co/i0eHsaqt3O 📘 Facebook: https://t.co/he5bTXLFXR 💬 Telegram: https://t.co/i976fBvtv0 👥 CryptoJournaal‑AltcoinPedia Community: https://t.co/3yFdzLLS2O 🐦 X‑profile: https://t.co/fd2bI2MInh #Altcoins #Bitcoin #CryptoNews #CryptoEducation #CryptoPrices

2 0 135 閱讀原文 >釋出後CAKE走勢極度看漲PancakeSwap outlines in detail its comprehensive development roadmap from AMM to a multi‑chain AI‑enhanced DeFi ecosystem, with a positive outlook.

2 0 135 閱讀原文 >釋出後CAKE走勢極度看漲PancakeSwap outlines in detail its comprehensive development roadmap from AMM to a multi‑chain AI‑enhanced DeFi ecosystem, with a positive outlook. Aleksander.TraderX Trader TA_Analyst A1.26K @alekstraderx

Aleksander.TraderX Trader TA_Analyst A1.26K @alekstraderx$CAKE short term update! The 2.42 zone is KEY to get past or reject to the downside. Pushing and pushing! - If we get acceptance above 2.42$, the target can be 2.6$ with time. RIGHT HERE, trying to hold 2.23 trying to hold as support. https://t.co/DIOYmTjHqc

15 1 459 閱讀原文 >釋出後CAKE走勢看漲CAKE is trying to hold the $2.23 support; if it breaks the $2.42 resistance, the target could be $2.6.

15 1 459 閱讀原文 >釋出後CAKE走勢看漲CAKE is trying to hold the $2.23 support; if it breaks the $2.42 resistance, the target could be $2.6.