SUI (SUI)

SUI (SUI)

$0.9720 -1.10% 24H

- 57Indice de Sentiment Social (SSI)-12.62% (24h)

- #100Classement du Pouls du Marché (MPR)+8

- 19Mention sur les réseaux sociaux sur 24 h-32.14% (24h)

- 69%Ratio haussier KOL 24h12 KOL actif

- Résumé

- Signaux haussiers

- Signaux baissiers

Indice de Sentiment Social (SSI)

- Données globales57SSI

- Tendance SSI (7 JOURS)Prix (sur sept jours)Répartition des sentimentsExtrêmement haussier (37%)Haussier (32%)Neutre (26%)Extrêmement baissier (5%)Analyses SSI

Classement du Pouls du Marché (MPR)

- Informations sur les alertes

Publications X

- Tendance de SUI après le lancementBaissier

Ema26❤️ OnChain_Analyst DeFi_Expert B1.68K @jack33336666

Ema26❤️ OnChain_Analyst DeFi_Expert B1.68K @jack33336666

Ema26❤️ OnChain_Analyst DeFi_Expert B1.68K @jack333366664 1 23 Original >Tendance de SUI après le lancementExtrêmement haussier

Ema26❤️ OnChain_Analyst DeFi_Expert B1.68K @jack333366664 1 23 Original >Tendance de SUI après le lancementExtrêmement haussier Angelo.sui Community_Lead Influencer B18.83K @angelodotsui

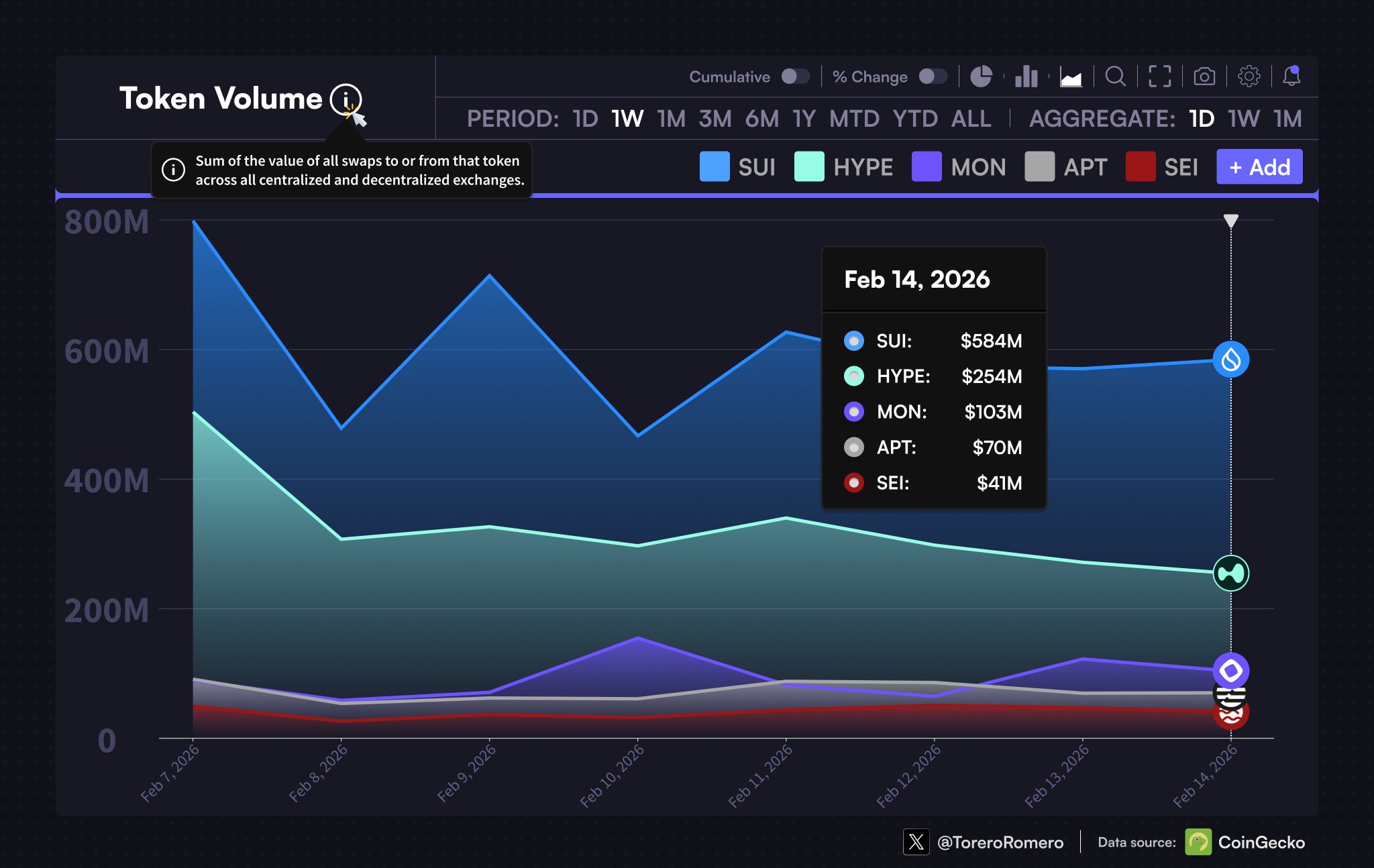

Angelo.sui Community_Lead Influencer B18.83K @angelodotsui ToreroRomero D8.86K @ToreroRomero

ToreroRomero D8.86K @ToreroRomero 14 0 611 Original >Tendance de SUI après le lancementHaussier

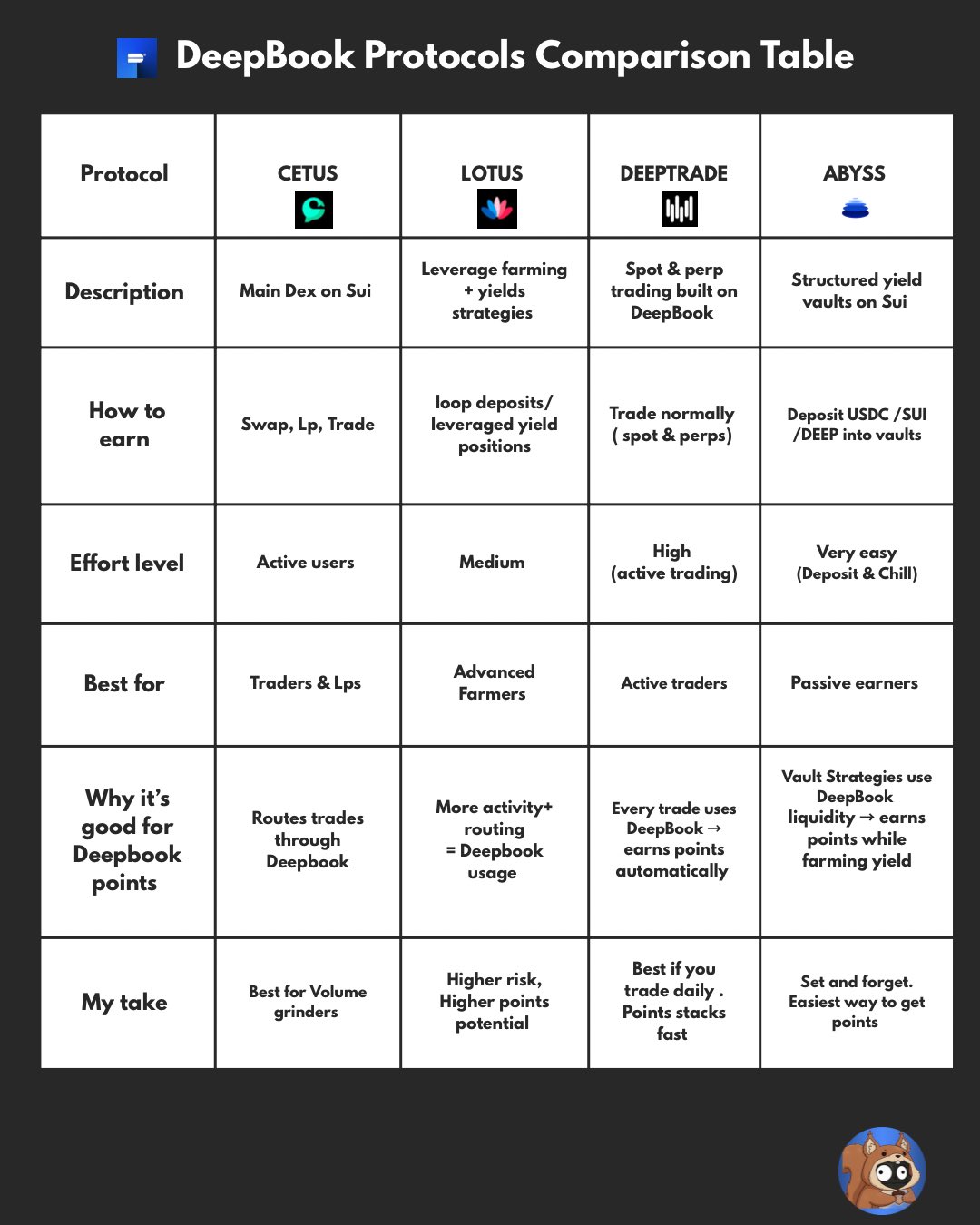

14 0 611 Original >Tendance de SUI après le lancementHaussier Raccoon Chan 小浣熊 Influencer Community_Lead B38.50K @RaccoonHKG

Raccoon Chan 小浣熊 Influencer Community_Lead B38.50K @RaccoonHKG

Raccoon Chan 小浣熊 Influencer Community_Lead B38.50K @RaccoonHKG10 1 2.90K Original >Tendance de SUI après le lancementExtrêmement baissier

Raccoon Chan 小浣熊 Influencer Community_Lead B38.50K @RaccoonHKG10 1 2.90K Original >Tendance de SUI après le lancementExtrêmement baissier Philose (delulu arc) Community_Lead Influencer B5.88K @Philose

Philose (delulu arc) Community_Lead Influencer B5.88K @Philose MrBreadSmith D16.61K @MrBreadSmith

MrBreadSmith D16.61K @MrBreadSmith 89 10 3.14K Original >Tendance de SUI après le lancementHaussier

89 10 3.14K Original >Tendance de SUI après le lancementHaussier tehMoonwalkeR FA_Analyst Influencer C133.91K @tehMoonwalkeR

tehMoonwalkeR FA_Analyst Influencer C133.91K @tehMoonwalkeR Kostas Kryptos Dev Researcher S27.07K @kostascrypto4 3 756 Original >Tendance de SUI après le lancementHaussier

Kostas Kryptos Dev Researcher S27.07K @kostascrypto4 3 756 Original >Tendance de SUI après le lancementHaussier Philose (delulu arc) Community_Lead Influencer B5.88K @Philose

Philose (delulu arc) Community_Lead Influencer B5.88K @Philose Tommy ✦ D2.18K @Tommy__one

Tommy ✦ D2.18K @Tommy__one 31 16 787 Original >Tendance de SUI après le lancementHaussier

31 16 787 Original >Tendance de SUI après le lancementHaussier Philose (delulu arc) Community_Lead Influencer B5.88K @Philose

Philose (delulu arc) Community_Lead Influencer B5.88K @Philose Philose (delulu arc) Community_Lead Influencer B5.88K @Philose

Philose (delulu arc) Community_Lead Influencer B5.88K @Philose 22 4 435 Original >Tendance de SUI après le lancementNeutre

22 4 435 Original >Tendance de SUI après le lancementNeutre K A L E O Trader NFT_Expert C729.95K @CryptoKaleo

K A L E O Trader NFT_Expert C729.95K @CryptoKaleo K A L E O Trader NFT_Expert C729.95K @CryptoKaleo

K A L E O Trader NFT_Expert C729.95K @CryptoKaleo 158 37 19.65K Original >Tendance de SUI après le lancementExtrêmement haussier

158 37 19.65K Original >Tendance de SUI après le lancementExtrêmement haussier Somi Sa ✨ OnChain_Analyst Tokenomics_Expert B6.14K @somaye_sarani

Somi Sa ✨ OnChain_Analyst Tokenomics_Expert B6.14K @somaye_sarani Click D4.15K @Cllickk

Click D4.15K @Cllickk

38 36 261 Original >Tendance de SUI après le lancementHaussier

38 36 261 Original >Tendance de SUI après le lancementHaussier