Hyperliquid (HYPE)

Hyperliquid (HYPE)

$30.657 -1.70% 24H

- 68Indice de Sentiment Social (SSI)-0.96% (24h)

- #134Classement du Pouls du Marché (MPR)-23

- 54Mention sur les réseaux sociaux sur 24 h-24.66% (24h)

- 78%Ratio haussier KOL 24h44 KOL actif

- Résumé

- Signaux haussiers

- Signaux baissiers

Indice de Sentiment Social (SSI)

- Données globales68SSI

- Tendance SSI (7 JOURS)Prix (sur sept jours)Répartition des sentimentsExtrêmement haussier (24%)Haussier (54%)Neutre (11%)Baissier (7%)Extrêmement baissier (4%)Analyses SSI

Classement du Pouls du Marché (MPR)

- Informations sur les alertes

Publications X

- Tendance de HYPE après le lancementExtrêmement haussier

- Tendance de HYPE après le lancementExtrêmement haussier

PJ Trader Quant S10.96K @Prithvir12

PJ Trader Quant S10.96K @Prithvir12 nairolf Tokenomics_Expert Influencer A38.11K @0xNairolf175 38 21.00K Original >Tendance de HYPE après le lancementNeutre

nairolf Tokenomics_Expert Influencer A38.11K @0xNairolf175 38 21.00K Original >Tendance de HYPE après le lancementNeutre CryptoPulse TA_Analyst Trader D29.72K @CryptoPulse_CRU

CryptoPulse TA_Analyst Trader D29.72K @CryptoPulse_CRU

CryptoPulse TA_Analyst Trader D29.72K @CryptoPulse_CRU

CryptoPulse TA_Analyst Trader D29.72K @CryptoPulse_CRU 1 1 253 Original >Tendance de HYPE après le lancementHaussier

1 1 253 Original >Tendance de HYPE après le lancementHaussier- Tendance de HYPE après le lancementExtrêmement haussier

CЯ TA_Analyst Trader C2.48K @crjr_0

CЯ TA_Analyst Trader C2.48K @crjr_0 Tobias Reisner FA_Analyst Influencer B16.53K @reisnertobias

Tobias Reisner FA_Analyst Influencer B16.53K @reisnertobias 0 0 18 Original >Tendance de HYPE après le lancementExtrêmement haussier

0 0 18 Original >Tendance de HYPE après le lancementExtrêmement haussier- Tendance de HYPE après le lancementExtrêmement haussier

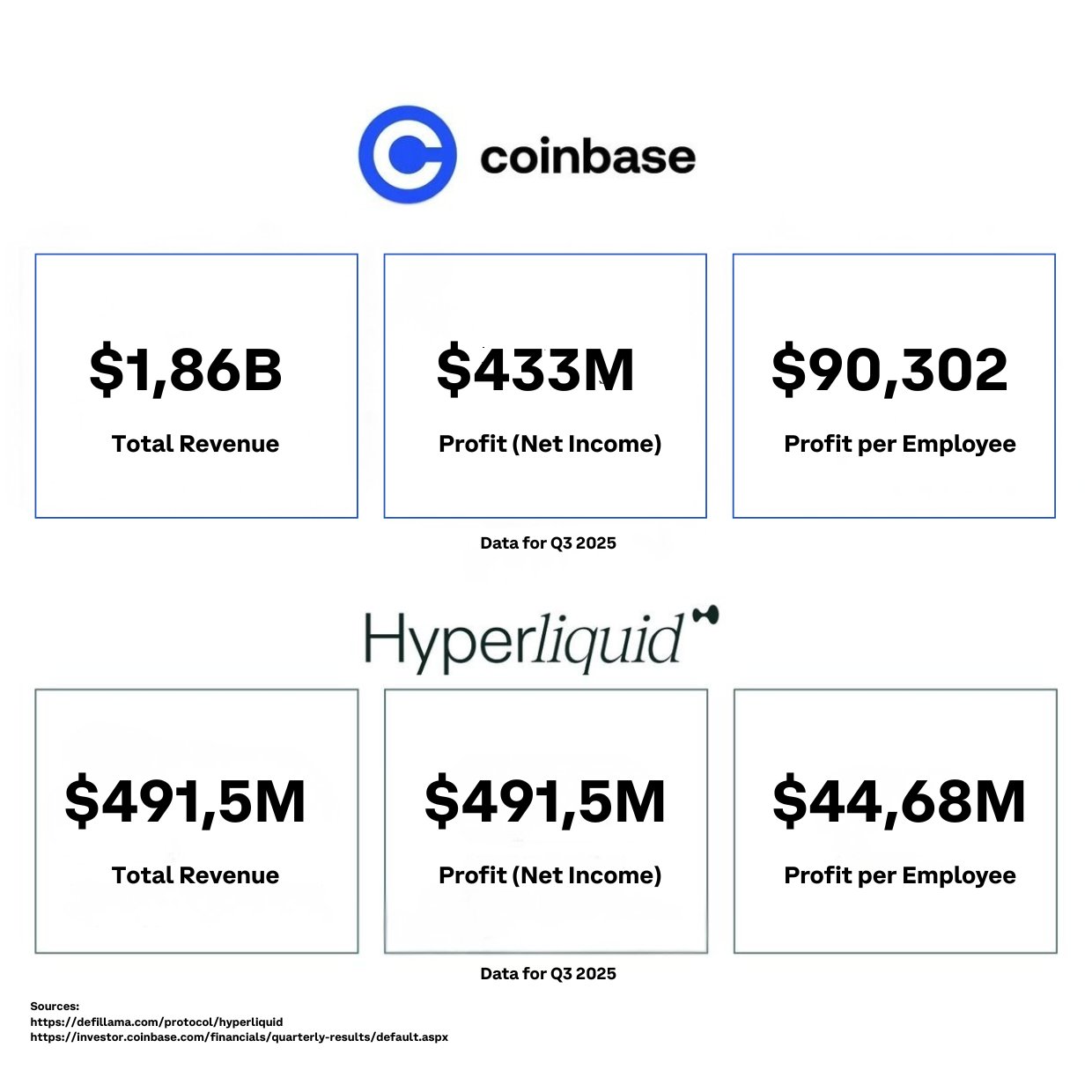

𝕋𝕖𝕞𝕞𝕪🦇🔊 DeFi_Expert Educator C41.53K @Only1temmy

𝕋𝕖𝕞𝕞𝕪🦇🔊 DeFi_Expert Educator C41.53K @Only1temmy 𝕋𝕖𝕞𝕞𝕪🦇🔊 DeFi_Expert Educator C41.53K @Only1temmy

𝕋𝕖𝕞𝕞𝕪🦇🔊 DeFi_Expert Educator C41.53K @Only1temmy 37 11 2.68K Original >Tendance de HYPE après le lancementHaussier

37 11 2.68K Original >Tendance de HYPE après le lancementHaussier 𝕋𝕖𝕞𝕞𝕪🦇🔊 DeFi_Expert Educator C41.53K @Only1temmy

𝕋𝕖𝕞𝕞𝕪🦇🔊 DeFi_Expert Educator C41.53K @Only1temmy 𝕋𝕖𝕞𝕞𝕪🦇🔊 DeFi_Expert Educator C41.53K @Only1temmy

𝕋𝕖𝕞𝕞𝕪🦇🔊 DeFi_Expert Educator C41.53K @Only1temmy 37 11 2.68K Original >Tendance de HYPE après le lancementHaussier

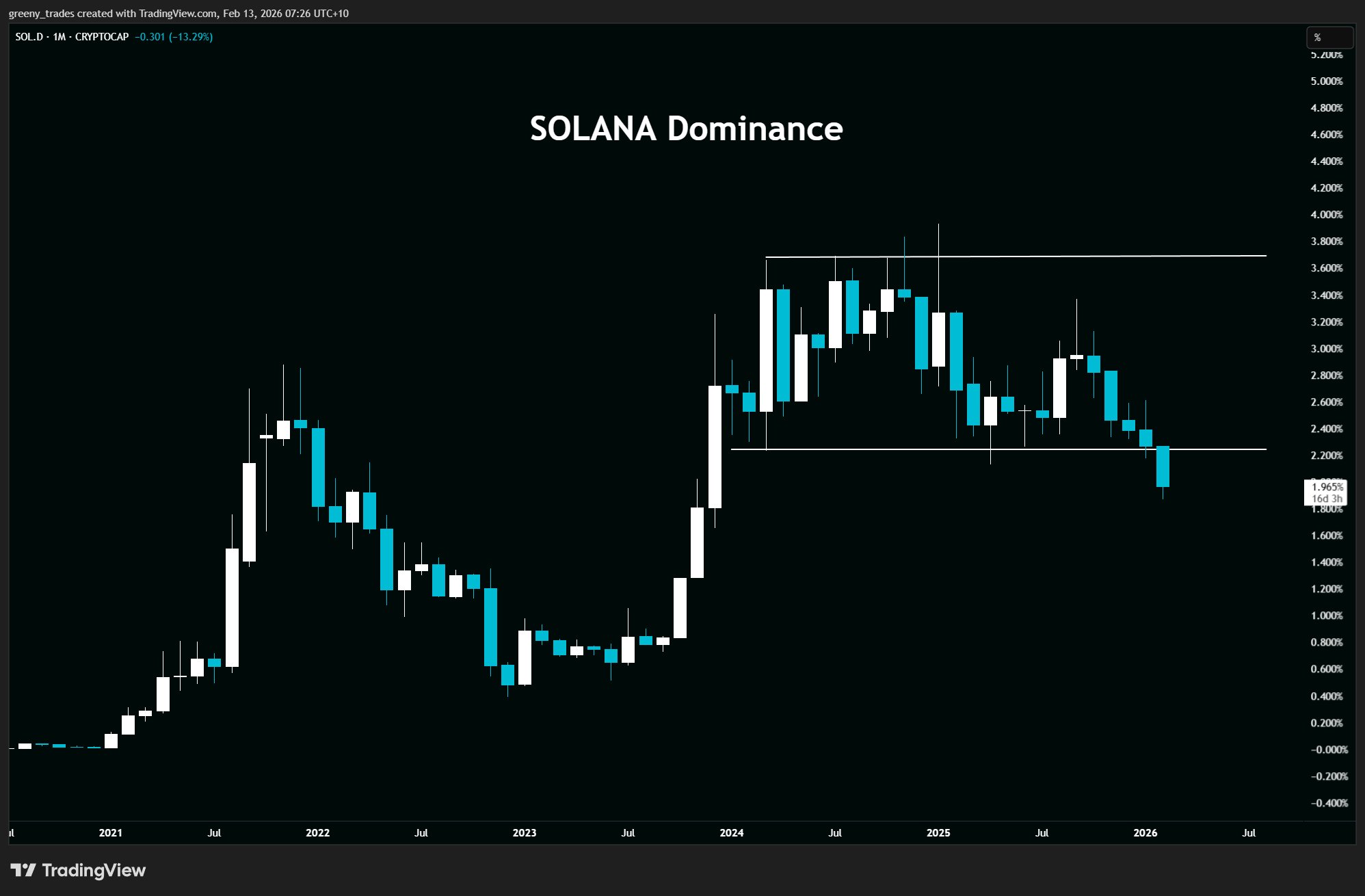

37 11 2.68K Original >Tendance de HYPE après le lancementHaussier Greeny TA_Analyst Trader B42.32K @greenytrades

Greeny TA_Analyst Trader B42.32K @greenytrades

Greeny TA_Analyst Trader B42.32K @greenytrades

Greeny TA_Analyst Trader B42.32K @greenytrades 23 3 1.97K Original >Tendance de HYPE après le lancementHaussier

23 3 1.97K Original >Tendance de HYPE après le lancementHaussier