Injective Protocol (INJ)

Injective Protocol (INJ)

- 44Social Sentiment Index (SSI)+32.59% (24h)

- #111Marktimpuls-Ranking (MPR)+5

- 624-St. in Social Media0% (24h)

- 50%24 Std-Bullisch-Verhältnis4 aktive Meinungsbildner

- ZusammenfassungINJ up over 13% this week despite a 3.5% daily drop, social hype up 32%, network active, staking yields 8%+, resistance suppressed.

- Bullische Signale

- Weekly rise 13%

- Social hype ↑32%

- Staking APR 8%+

- Volume 1.41M

- EVM upgrade proposal

- Bärische Signale

- 24h down 3.47%

- Active addresses only 9.7k

- Resistance not broken

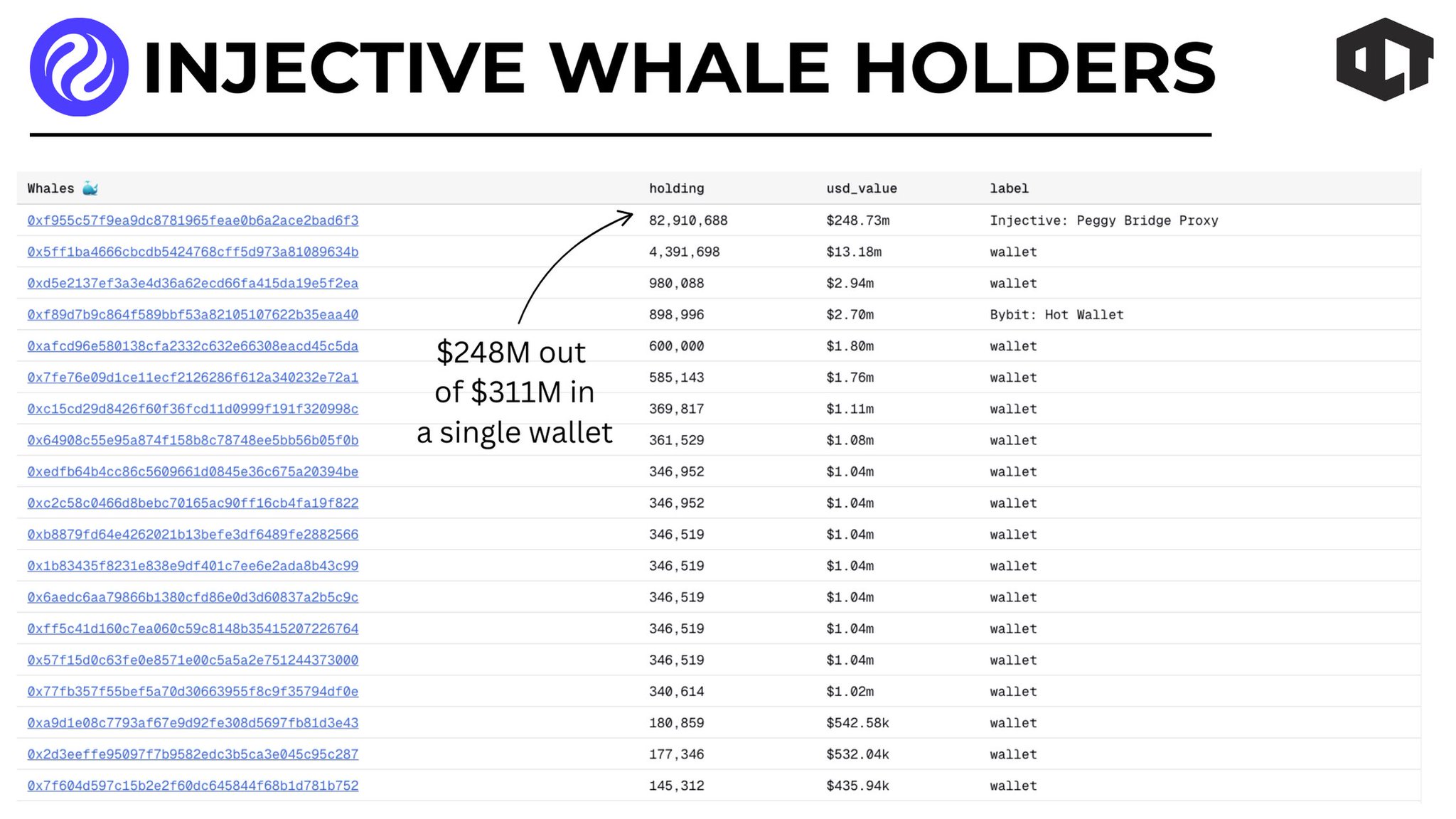

- Some whales taking profit

- Unique addresses decreasing

Social Sentiment Index (SSI)

- Daten insgesamt44SSI

- SSI-Trend (7-Tage)Preis (7 Tage)StimmungsverteilungExtrem bullisch (17%)Bullisch (33%)Neutral (33%)Extrem bärisch (17%)SSI EinblickeINJ social hot index moderate (43.74/100, +32.59%), KOL attention surged 166% leading the rise, sentiment positive +27%, activity slightly down -3%, corresponding to weekly rise 13% and daily drop 3.5%.

Marktimpuls-Ranking (MPR)

- WarnungseinblickINJ warning rank rose to #111 (↑5), social anomaly dropped to 10.37 (-42.65%), sentiment polarization +252% synchronized with KOL attention +140%, indicating recent volatility risk.

Beiträge auf X

CryptoBullet TA_Analyst Trader A174.86K @CryptoBullet1

CryptoBullet TA_Analyst Trader A174.86K @CryptoBullet1$INJ 1W update My $3 target reached ✅ https://t.co/OBq95OGLIE

CryptoBullet TA_Analyst Trader A174.86K @CryptoBullet1

CryptoBullet TA_Analyst Trader A174.86K @CryptoBullet1$INJ 1W chart #Injective is also cooked. Imo this is the most likely scenario. March 2024 was the Cycle Top. By the end of 2025 we should have a nice Bounce (X) (Dead Cat Bounce) to $25 and then another painful ABC down to $3-4 📉 https://t.co/FKbLdyzvWX

75 24 9.34K Original >Trend von INJ nach VeröffentlichungExtrem bärischINJ已达作者3美元目标,预计经历死猫反弹至25美元后,将再次跌回3-4美元。

75 24 9.34K Original >Trend von INJ nach VeröffentlichungExtrem bärischINJ已达作者3美元目标,预计经历死猫反弹至25美元后,将再次跌回3-4美元。 CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.93K @IvanM10529875

CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.93K @IvanM10529875Injective (INJ) vs. Osmosis (OSMO) 📊🔍 Good day, esteemed audience! Today, I am pleased to present a formal comparative analysis of two prominent networks within the Cosmos ecosystem: @injective ( $INJ ) and @osmosis ( $OSMO ).Our focus will encompass key metrics, including market indicators, network activity, staking, validators, and beyond. Each section features a concise table for swift comparison, followed by an insightful commentary. The objective is to illuminate the strengths and potential challenges of each network, thereby facilitating informed decisions in investments or development initiatives. Let us proceed! 🚀 1. Market Metrics 💼📈 These indicators reflect the overall valuation and liquidity of the tokens. Metric Injective Osmosis |----------------------|-----------------|----------------| ! Market Cap (USD) $322M $86M | FDV Market Cap $322M $386M | Total Supply 100M 762.8M | Circulating Supply 100M 762.8M | Price (USD) $3.20 $0.04 | Max Supply - 1.0B | BTC Price 0.0000462 0.0000054 | Market Cap Rank 133 664 Injective demonstrates greater stability through its elevated market capitalization and token price, positioning it as a more mature asset. Conversely, Osmosis exhibits substantial fully diluted valuation (FDV) potential, attributable to its expansive maximum supply. Notably, INJ's superior ranking in leading indices underscores enhanced market visibility. 📊💰 2. Network Activity ⚡👥 Emphasizing user engagement and transaction volumes as proxies for real-world utility. | Metric Injective Osmosis |--------------------------|-----------------|------------ | Addresses (>0 balance) 62,844 105,803 | 24h Active Addresses 9,994 3,262 | Change in Holders (1d) -27 -31 | Emptied Wallets (1d) 176 386 | 24h Transactions 1,446,102 53,547 | 7d Transactions 1,139,306 378,159 | 30d Transactions 5,381,182 2,113,371 | Net New Address (1d) -27 -31 | Net New Address (7d) +58 +23 | Net New Address (30d) -595 -14 Osmosis boasts a broader cohort of active addresses, indicative of a more distributed user base. However, Injective unequivocally leads in transactional throughput, surpassing 1.4 million daily transactions—a testament to its velocity and scale. Both networks exhibit marginal attrition in new addresses over the 30-day horizon, warranting strategic user acquisition efforts. 🔄📱 3. Address Statistics 📍🔢 Delving into portfolio dynamics and transactional evolution. | Metric Injective Osmosis |--------------------------|-----------------|------------- | Emptied Wallets (1d) 176 386 | 24h Transactions 1,446,102 53,547 | 7d Transactions 1,139,306 378,159 | 30d Transactions 5,381,182 2,113,371 | Net New Address (1d) -27 -31 | Net New Address (7d) +58 +23 | Net New Address (30d) -595 -14 | Address % Change (1d) 0% 0% | Address % Change (7d) +0.01% 0% | | Address % Change (30d) -0.09% 0% Injective's commanding transactional volume underscores its dynamism within the ecosystem. While Osmosis experiences higher daily wallet attrition, its comparatively subdued net address decline over 30 days signals underlying resilience. These patterns highlight opportunities for retention-focused innovations. 🛡️📈 4. Staking Metrics 🔒💎 Assessing locked token volumes and yield attractiveness. | Metric Injective Osmosis |--------------------------|-----------------|------------- | Total Stake (USD) $179.4M $10M | Percent Staked 56.10% 34% | Staking APR 8.13% 4.19% | Average APR (30d) 8.5% 4.94% | Stake % Change (1d) +0% +0.03% | Stake % Change (7d) +0.2% +0.26% | Stake % Change (30d) -3.94% -1.66% | Unbonded Stake (USD) $2M Sourse: @SmartStake

2 0 74 Original >Trend von INJ nach VeröffentlichungNeutralINJ market cap and trading volume lead OSMO, bullish on INJ CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.93K @IvanM10529875

CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.93K @IvanM10529875Injective ($INJ) Network Snapshot – February 15, 2026 ⚛️🚀 Fresh on-chain update for @injective – the high-speed #Cosmos L1 for DeFi & trading. Price stable ~$3.20, staking at 56% with 8%+ APR, and EVM upgrade proposal live. Time for a deep dive! 📊🔥 1. Core Network & Market Stats - Total Supply: 100M $INJ (fixed) - Circulating Supply: 100M $INJ - Current Price: $3.20 - Market Cap / FDV: $322M - Block Time: 0.63 seconds (blazing fast!) - 24h Transactions: 1.41M successful (7,456 failed) - Staking APR / APY: 8.11% / 8.3% (30-day avg ~8.51%) - Percent Staked: 56.10% - Total Staked: 56.07M $INJ (~$179M) 2. Growth & Activity Metrics - Unique Addresses: 626,584 (↓27 in 24h | +58 in 7d) - Unique Delegators: 231,299 (↓2 in 24h) - 24h Active Addresses: 9,695 - 30-day Rolling Active Addresses: 1,268,591 - Transactions (24h): 1.41M - Total Stake Change: +0.001% (24h) | +0.19% (7d) | +3.39% (30d) 3. Staking & Decentralization - Gini Coefficient: 0.248 (fairly distributed) - Nakamoto Coefficient: 6 (solid for 50 validators) - Top 100 Delegators’ Stake Share: 87.4% (some concentration) - Active Validators: 50 - Validators Below Avg Voting Power: 35 - Last Active Validator Stake: 9,748 $INJ (~$31K) 4. Undelegation Stats - Unbonding Period: 21 days - Pending Undelegations: ~28.1K (1d) | ~3.7M (7d) | ~4.2M $INJ (all) - Pending Count: 1,891 - As % of Total Supply: 4.21% - As % of Not Staked Supply: 9.59% 5. Liquid Staking (Last 24 Hours) - Total Liquid Staked: ~3.18M $INJ (+26K net) - TruFin: ~1.58M $INJ (leader, +282) - Hydro Protocol: ~1.55M $INJ (↓2.2K) - Stride: ~22.3K $INJ (↑0.9K) - DojoSwap: ~13.4K $INJ (↑0.96K) - Black Panther: ~11.5K $INJ (↑6.8K) → Healthy inflows, TruFin/Hydro dominate ~97% of LST. 6. Token Burn Activity - Total Burned to Date: 6.91M $INJ (~$30.4M at current price) - Last 30 Days: 431K $INJ - Last 7 Days: 43K $INJ - Today: Minimal (0 recent burns shown) - Largest Single-Day Burn: 43K $INJ (Jan 21, 2026) → Deflationary mechanism active, but low fees limit pace. 7. Top Validators by Voting Power 1. Zilliqa – 8.85% (~4.9M $INJ) | 5–20% commission 2. Informal Systems – 6.68% (~3.6M) | 5–42% 3. Binance Staking – 5.44% (~3.0M) | 7–100% 4. Kraken – 5.09% (~2.8M) | 10% 5. SCV-Security Staking Rebate – 4.89% (~2.7M) | 5–20% 6. Everstake – 4.76% (~2.6M) | 10% 7. Figment – 3.88% (~2.2M) | 5–25% 8. Cointelegraph Decentralized – 3.61% (~2.0M) | 10% 9. Core ONE – 3.53% (~2.0M) | 5–20% 10. Chorus One – 2.65% (~1.5M) | 7.5–100% ... Injective Foundation at 2.65% (100% comm). 8. Governance Proposals - #619: Real-Time EVM Mainnet Upgrade – In Voting| 170 votes | 7 validators | 23.46% Yes | 3d 6h left 🌐Link: https://t.co/01GHLv9PRz - #618: OLP Reward Disbursement – Epoch 54 – Passed (40.86% Yes) - #617: INJ Supply Squeeze – Passed - #616: dApps LTV Update on Injective Exchange – Passed 9. Foundation Delegation Program - Assessment Window #13 (Jan-Feb 2026): Active - Start: 01/01/2026 | End: 02/28/2026 - Validators Meeting Requirements: 10 - Not Meeting: 15 → Ongoing incentives for validator performance. 10. Recent Large Transactions (>10K $INJ) - Mix of undelegates (e.g., 20K to Trust Nodes), sends (11K–24K between wallets). - Notable: 24K send, multiple 14K–21K transfers, delegations to Allnodes/Coinbase01. 11. Weekly Recap (Feb 8–14) - Price: $3.29 (↓0.3%) - Active Addresses: 644,536 - Transactions: 13.06M - Burned: 0 $INJ - Stake: 56M (+0.2%) - Undelegatione: 1,899 (110K $INJ) - Gini / Nakamoto: 0.425 / 6 → Staking growth resilient amid stable markets. Summary Injective thriving with 56% staked, 8%+ APR, and 1.4M daily tx on 0.63s blocks. EVM upgrade could unlock more DeFi magic. MC $322M, burn at 6.9M total. Decentralization strong (Nakamoto 6), but watch validator jails. Sourse: @SmartStake Bullish on $INJ's speed & EVM future? 🚀💬 #Injective #INJ #CosmosEcosystem #DeFi #EVM #CryptoStaking #Blockchain #LiquidStaking #Web3 #OnChain

9 1 147 Original >Trend von INJ nach VeröffentlichungBullischINJ holds high positions, APR 8%+, EVM upgrade will speed up, expected to keep rising Aleksander.TraderX TA_Analyst Trader A1.33K @alekstraderx

Aleksander.TraderX TA_Analyst Trader A1.33K @alekstraderx$INJ Rejected our key resistance zone✅ - Not really chasing anything new here just yet! Will keep updating this every day next week! Remember, the secret to stay alive in trading is good risk management! https://t.co/qjdP4wb4uO

5 0 52 Original >Trend von INJ nach VeröffentlichungNeutralINJ failed to break through the key resistance level, the author emphasizes risk management and recommends a wait-and-see approach.

5 0 52 Original >Trend von INJ nach VeröffentlichungNeutralINJ failed to break through the key resistance level, the author emphasizes risk management and recommends a wait-and-see approach. Aleksander.TraderX TA_Analyst Trader A1.33K @alekstraderx

Aleksander.TraderX TA_Analyst Trader A1.33K @alekstraderx$INJ Up over 13% from our poi this week! That’s fantastic!!! Would for sure book some profits here:) https://t.co/UPWX0l6qvL

Aleksander.TraderX TA_Analyst Trader A1.33K @alekstraderx

Aleksander.TraderX TA_Analyst Trader A1.33K @alekstraderx$INJ Bounce or die from this golden pocket a little lower! - 2.9$ - Golden pocket This zone is key for $INJ to stay above! If not, we will most likely bleed all the way down to previous week low. https://t.co/6JmmNhGD9L

9 0 317 Original >Trend von INJ nach VeröffentlichungBullischINJ rebounds from a key support level, up 13%; the author suggests taking profits and watching the $2.9 support.

9 0 317 Original >Trend von INJ nach VeröffentlichungBullischINJ rebounds from a key support level, up 13%; the author suggests taking profits and watching the $2.9 support. IKAY 🥷👷♂️🔥 Media Community_Lead B2.90K @Great_Ikay

IKAY 🥷👷♂️🔥 Media Community_Lead B2.90K @Great_Ikay $INJ Memecoins D1.01K @memes_on_inj

$INJ Memecoins D1.01K @memes_on_injForget roses, buy memes Happy Valentine’s Day, Injective memecoin believers Valentine’s Day is temporary, Injective memes are forever. $INJ | @injective https://t.co/4gOp7lOYyu

11 2 244 Original >Trend von INJ nach VeröffentlichungExtrem bullischThe tweet encourages investors to buy the Injective memecoin on Valentine's Day, stating its value lasts longer than traditional gifts.

11 2 244 Original >Trend von INJ nach VeröffentlichungExtrem bullischThe tweet encourages investors to buy the Injective memecoin on Valentine's Day, stating its value lasts longer than traditional gifts. Anarcho Economy TA_Analyst Trader B4.14K @Anarchoeconomy

Anarcho Economy TA_Analyst Trader B4.14K @Anarchoeconomy Our Crypto Talk Media Influencer C76.65K @ourcryptotalk

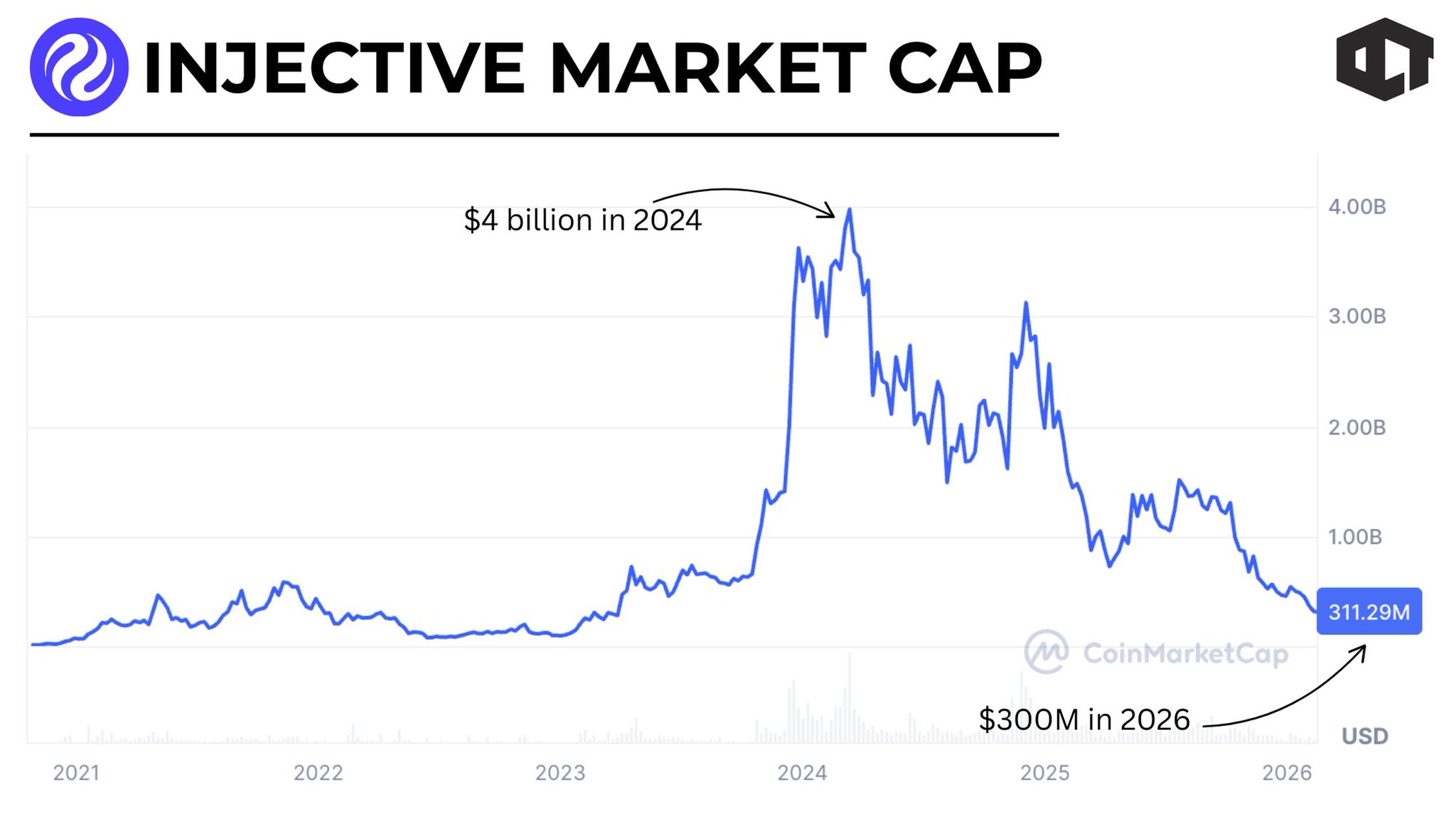

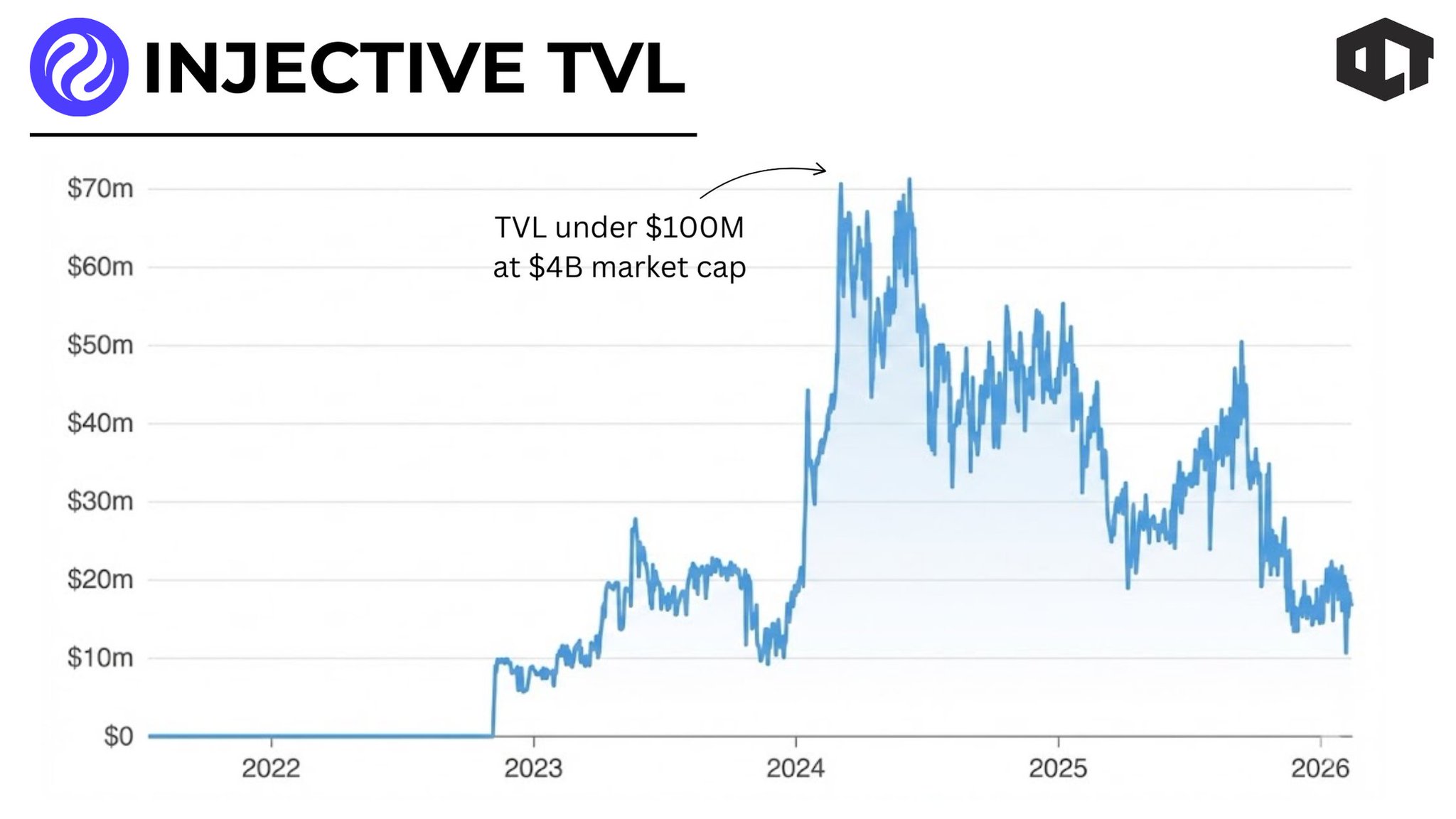

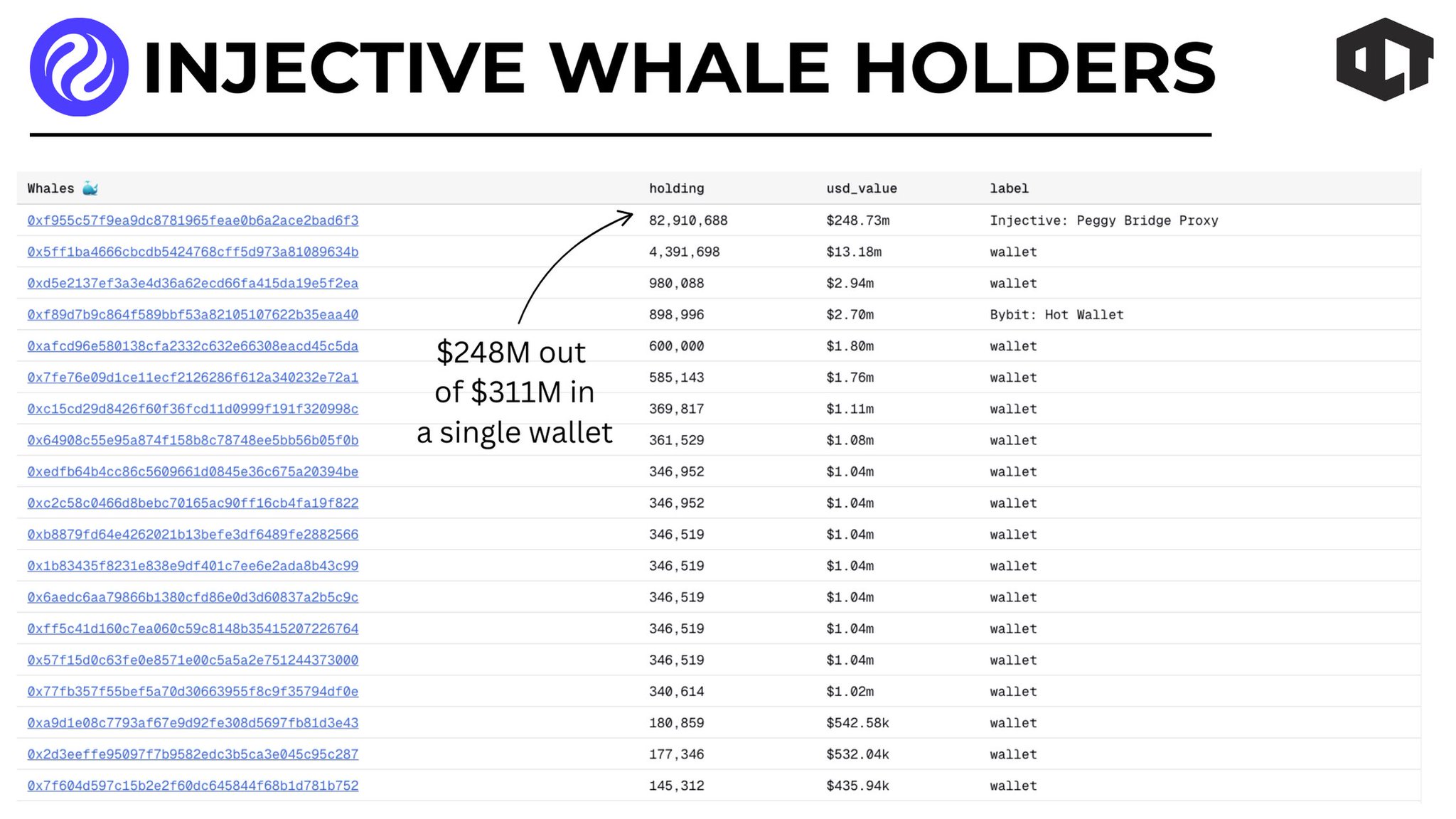

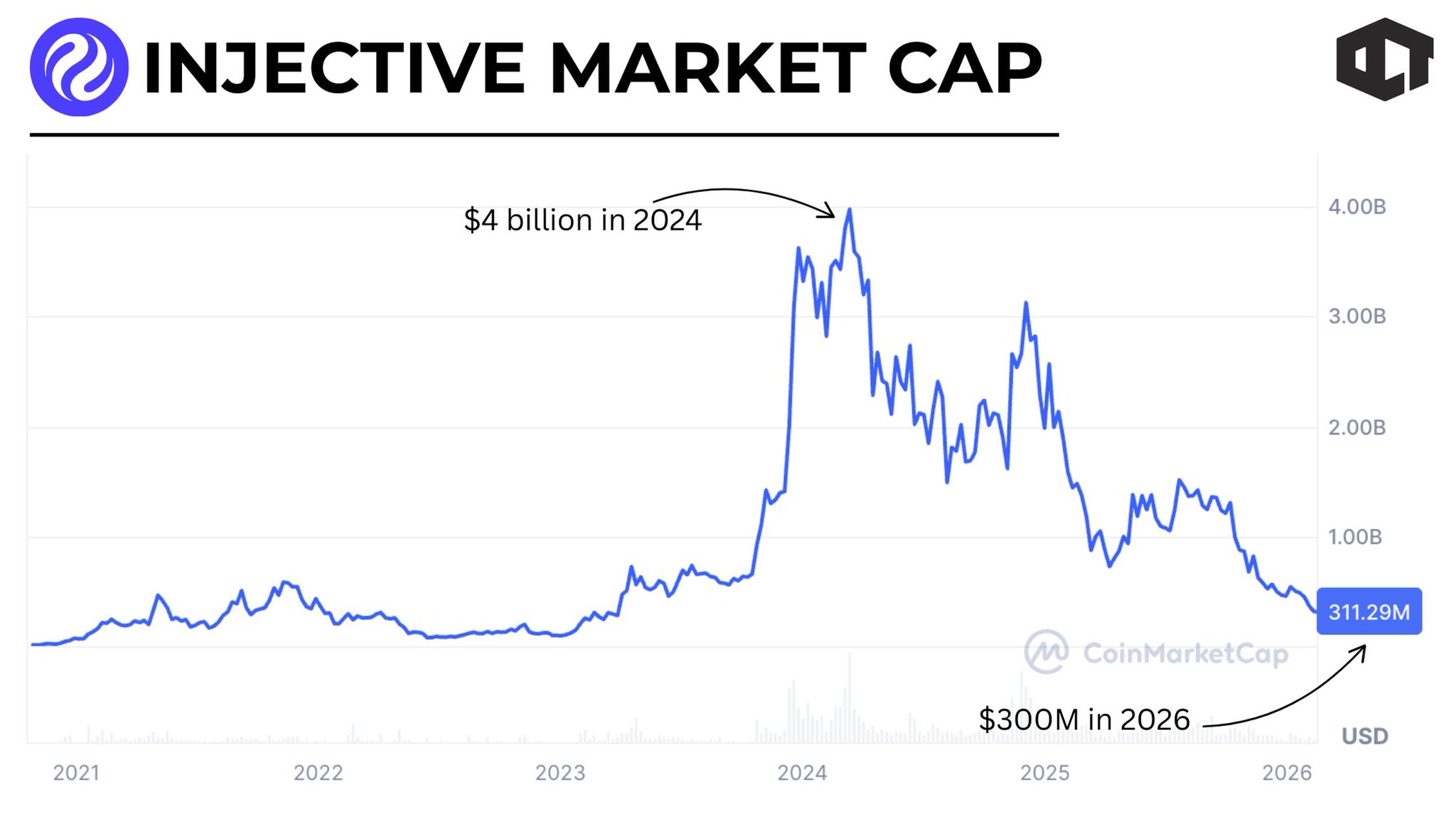

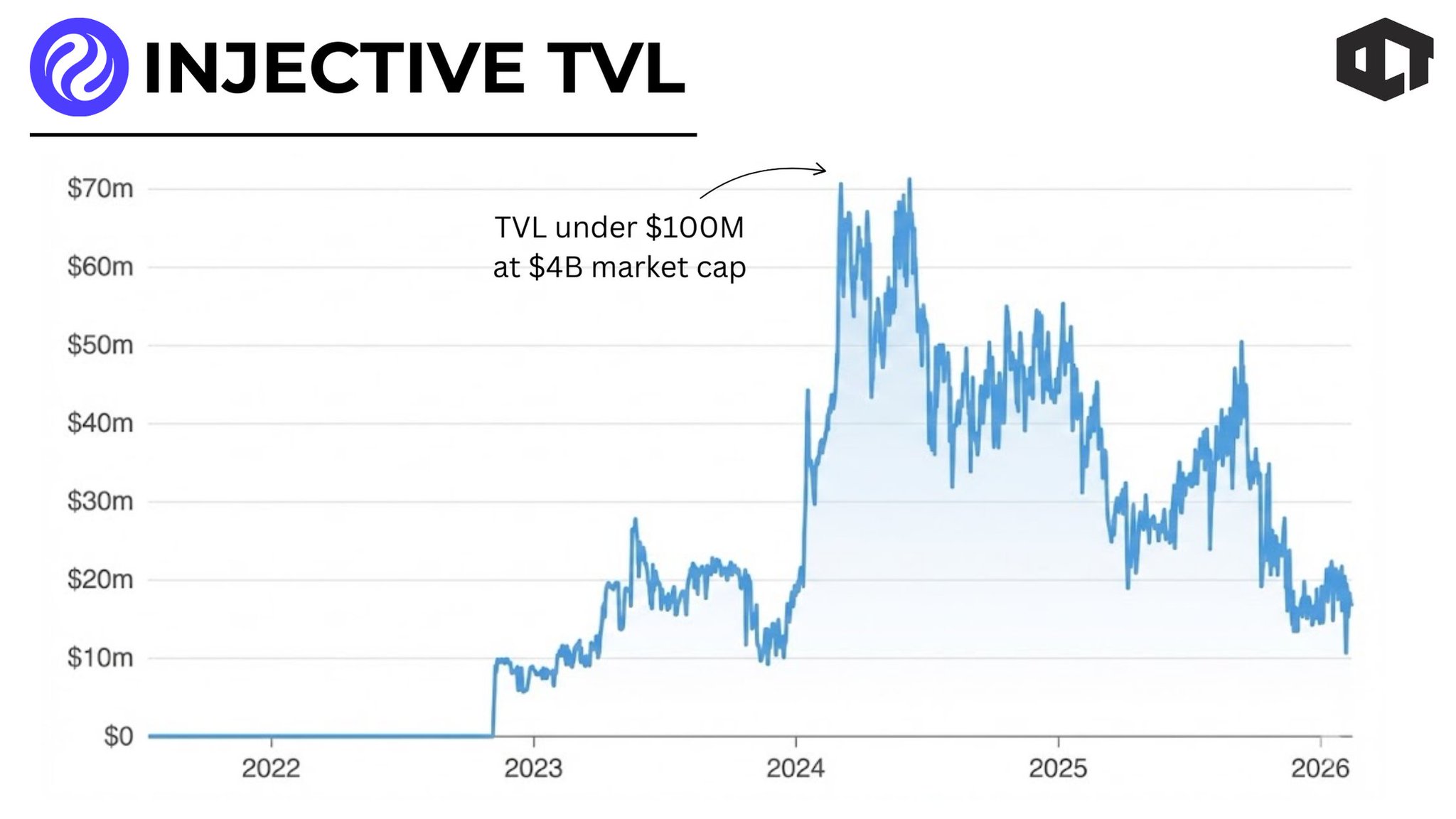

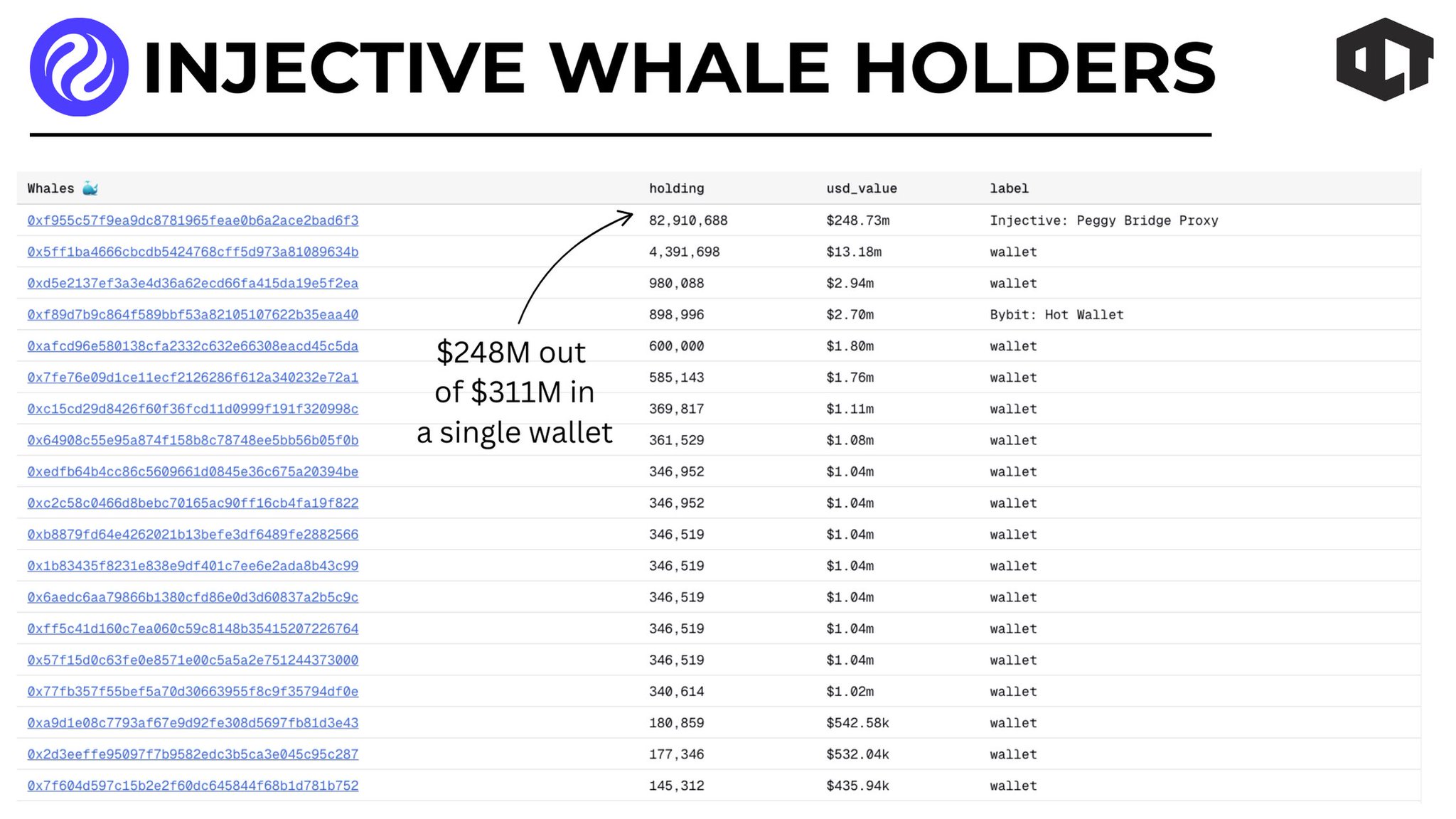

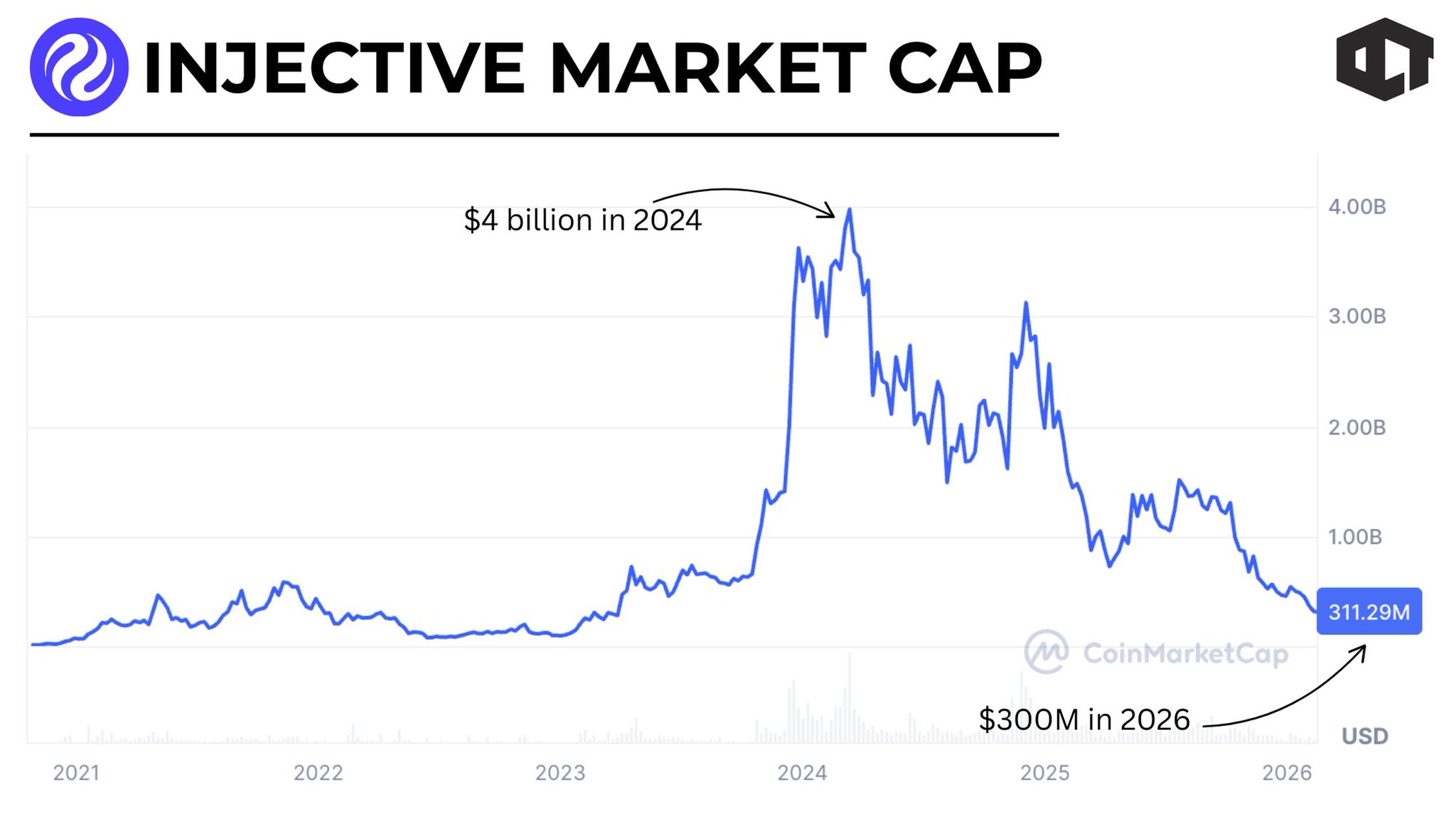

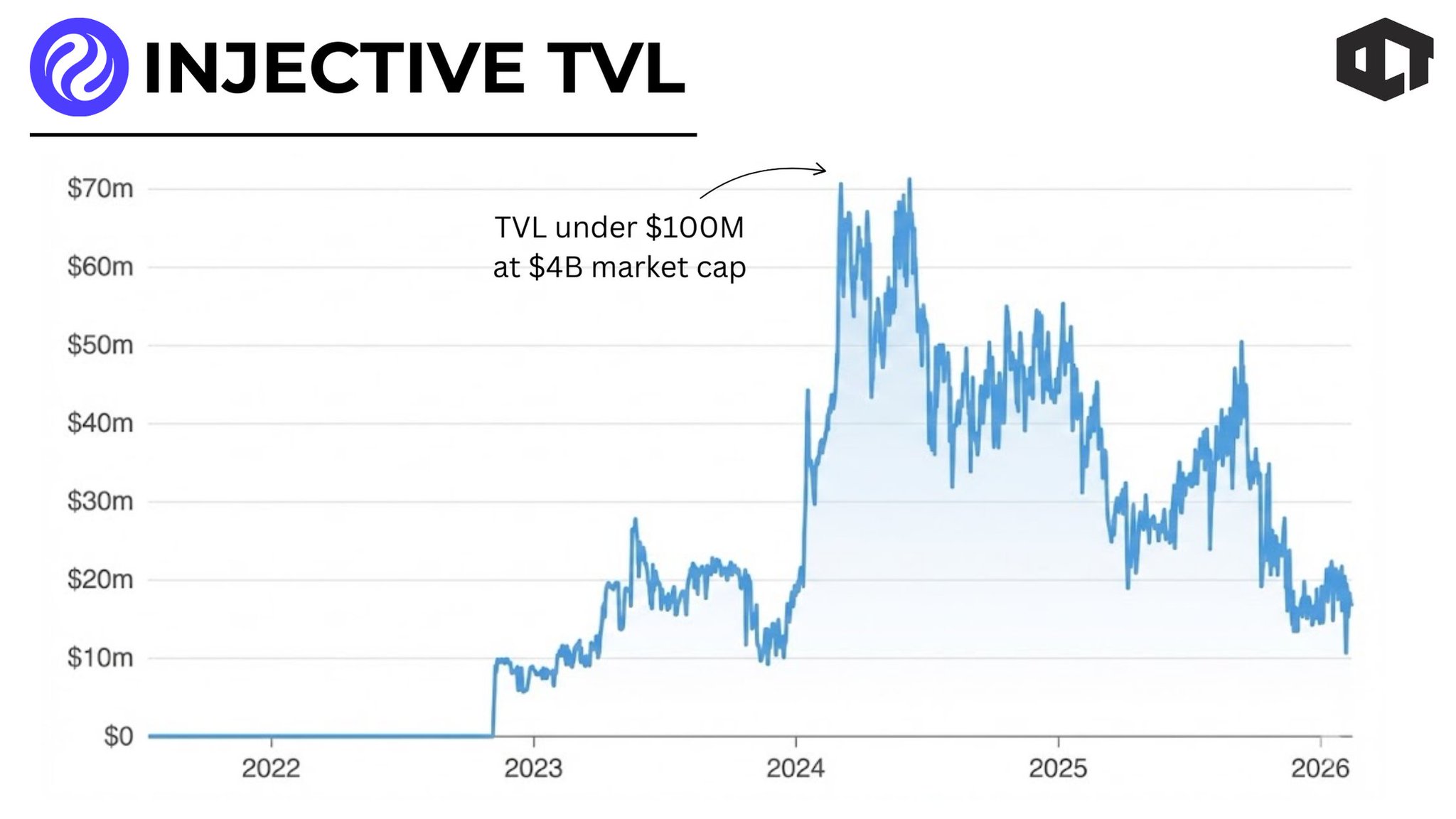

Our Crypto Talk Media Influencer C76.65K @ourcryptotalk$INJ lost 90% of its value > A $4B market cap. > Under $100M in TVL. > Now sitting near $300M. The warning signs were always there. Let's break them down 👇 1️⃣ THE VALUATION RAN TOO FAST In 2024, Injective’s market cap pushed close to $4 billion. The narrative was strong. On-chain derivatives. Fast execution. New integrations. It felt like the “next big thing” in DeFi. But when you zoom out, the move was vertical. And vertical moves usually need strong fundamentals underneath them. When liquidity dried up and risk appetite cooled off, the market started asking harder questions. Was usage deep enough? Was capital sticky enough? At $300M now, it’s clear the earlier valuation was pricing in a lot of future growth that simply didn’t show up fast enough. 2️⃣ PRICE STRUCTURE BROKE Look at the 2023 breakout zone on the price chart. That area acted as a base before the big rally. In late 2025, price tried to reclaim the $10 level and failed. That rejection mattered. When a token cannot hold or reclai

142 44 14.31K Original >Trend von INJ nach VeröffentlichungExtrem bärischINJ’s market cap fell from $4 billion to $300 million, a 90% drop, with clear warning signals and a broken price structure.

142 44 14.31K Original >Trend von INJ nach VeröffentlichungExtrem bärischINJ’s market cap fell from $4 billion to $300 million, a 90% drop, with clear warning signals and a broken price structure. OCT Trades TA_Analyst Trader B5.16K @oct_trades

OCT Trades TA_Analyst Trader B5.16K @oct_trades Our Crypto Talk Media Influencer C76.65K @ourcryptotalk

Our Crypto Talk Media Influencer C76.65K @ourcryptotalk$INJ lost 90% of its value > A $4B market cap. > Under $100M in TVL. > Now sitting near $300M. The warning signs were always there. Let's break them down 👇 1️⃣ THE VALUATION RAN TOO FAST In 2024, Injective’s market cap pushed close to $4 billion. The narrative was strong. On-chain derivatives. Fast execution. New integrations. It felt like the “next big thing” in DeFi. But when you zoom out, the move was vertical. And vertical moves usually need strong fundamentals underneath them. When liquidity dried up and risk appetite cooled off, the market started asking harder questions. Was usage deep enough? Was capital sticky enough? At $300M now, it’s clear the earlier valuation was pricing in a lot of future growth that simply didn’t show up fast enough. 2️⃣ PRICE STRUCTURE BROKE Look at the 2023 breakout zone on the price chart. That area acted as a base before the big rally. In late 2025, price tried to reclaim the $10 level and failed. That rejection mattered. When a token cannot hold or reclai

142 44 14.31K Original >Trend von INJ nach VeröffentlichungExtrem bärischINJ market cap plummeted 90%, early overvaluation, price structure broken and TVL stagnant, warning risk.

142 44 14.31K Original >Trend von INJ nach VeröffentlichungExtrem bärischINJ market cap plummeted 90%, early overvaluation, price structure broken and TVL stagnant, warning risk. Our Crypto Talk Media Influencer C76.65K @ourcryptotalk

Our Crypto Talk Media Influencer C76.65K @ourcryptotalk$INJ lost 90% of its value > A $4B market cap. > Under $100M in TVL. > Now sitting near $300M. The warning signs were always there. Let's break them down 👇 1️⃣ THE VALUATION RAN TOO FAST In 2024, Injective’s market cap pushed close to $4 billion. The narrative was strong. On-chain derivatives. Fast execution. New integrations. It felt like the “next big thing” in DeFi. But when you zoom out, the move was vertical. And vertical moves usually need strong fundamentals underneath them. When liquidity dried up and risk appetite cooled off, the market started asking harder questions. Was usage deep enough? Was capital sticky enough? At $300M now, it’s clear the earlier valuation was pricing in a lot of future growth that simply didn’t show up fast enough. 2️⃣ PRICE STRUCTURE BROKE Look at the 2023 breakout zone on the price chart. That area acted as a base before the big rally. In late 2025, price tried to reclaim the $10 level and failed. That rejection mattered. When a token cannot hold or reclai

142 44 14.31K Original >Trend von INJ nach VeröffentlichungBärischINJ’s market cap fell from $4 billion to $300 million, a 90% drop, with clear warning signals and a broken price structure.

142 44 14.31K Original >Trend von INJ nach VeröffentlichungBärischINJ’s market cap fell from $4 billion to $300 million, a 90% drop, with clear warning signals and a broken price structure. PRYNXX 🥷💚 Influencer OnChain_Analyst B8.42K @OguzieWisdom

PRYNXX 🥷💚 Influencer OnChain_Analyst B8.42K @OguzieWisdom. @injective just processed over 10M transactions in the last 24 hours and over 70M in the past 7 days, ranking it among the top 3 chains by transaction volume. This shows real users actively building, trading, and deploying on-chain. More usage means higher fees, stronger network economics, and greater potential for community buybacks over time. $INJ

38 2 282 Original >Trend von INJ nach VeröffentlichungExtrem bullischInjective's transaction volume is soaring, exceeding 10M in 24 hours and over 70M in 7 days, indicating a positive network economy.

38 2 282 Original >Trend von INJ nach VeröffentlichungExtrem bullischInjective's transaction volume is soaring, exceeding 10M in 24 hours and over 70M in 7 days, indicating a positive network economy.