Ethereum (ETH)

Ethereum (ETH)

$1,997.12 -3.65% 24H

- 67Social Sentiment Index (SSI)-2.64% (24h)

- #116Marktimpuls-Ranking (MPR)-52

- 31724-St. in Social Media-20.84% (24h)

- 63%24 Std-Bullisch-Verhältnis199 aktive Meinungsbildner

- Zusammenfassung

- Bullische Signale

- Bärische Signale

Social Sentiment Index (SSI)

- Daten insgesamt67SSI

- SSI-Trend (7-Tage)Preis (7 Tage)StimmungsverteilungExtrem bullisch (19%)Bullisch (44%)Neutral (14%)Bärisch (21%)Extrem bärisch (2%)SSI Einblicke

Marktimpuls-Ranking (MPR)

- Warnungseinblick

Beiträge auf X

- Trend von ETH nach VeröffentlichungNeutral

- Trend von ETH nach VeröffentlichungBullisch

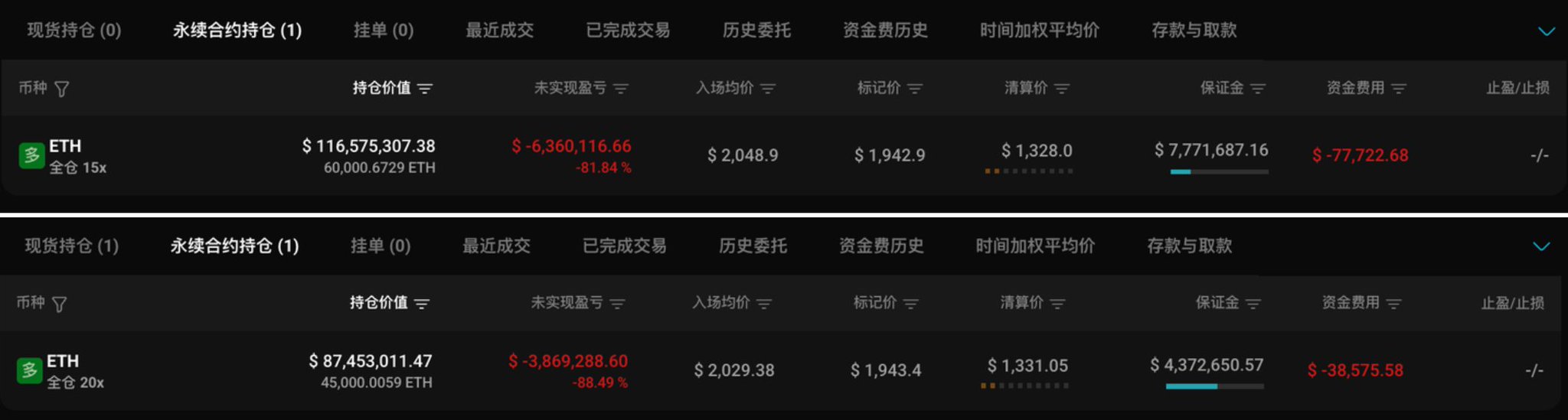

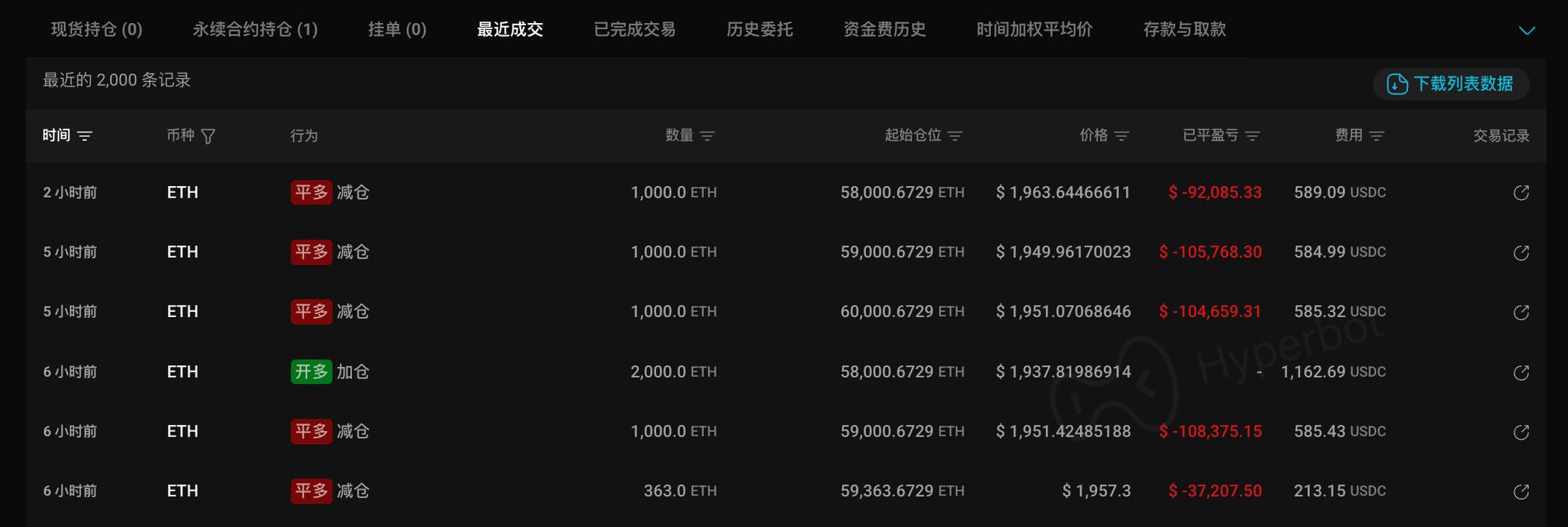

Ai 姨 OnChain_Analyst Media B127.41K @ai_9684xtpa

Ai 姨 OnChain_Analyst Media B127.41K @ai_9684xtpa

Ai 姨 OnChain_Analyst Media B127.41K @ai_9684xtpa

Ai 姨 OnChain_Analyst Media B127.41K @ai_9684xtpa 4 0 634 Original >Trend von ETH nach VeröffentlichungBärisch

4 0 634 Original >Trend von ETH nach VeröffentlichungBärisch EtherWorld Media Regulatory_Expert B1.68K @ether_world

EtherWorld Media Regulatory_Expert B1.68K @ether_world

EtherWorld Media Regulatory_Expert B1.68K @ether_world0 1 1 Original >Trend von ETH nach VeröffentlichungBullisch

EtherWorld Media Regulatory_Expert B1.68K @ether_world0 1 1 Original >Trend von ETH nach VeröffentlichungBullisch SolarEtherPunk🏄 Dev OnChain_Analyst B2.63K @SolarEtherPunk

SolarEtherPunk🏄 Dev OnChain_Analyst B2.63K @SolarEtherPunk Joseph Chalom D15.29K @joechalom592 65 50.64K Original >Trend von ETH nach VeröffentlichungBullisch

Joseph Chalom D15.29K @joechalom592 65 50.64K Original >Trend von ETH nach VeröffentlichungBullisch Digital Perspectives Influencer Community_Lead B205.57K @DigPerspectives

Digital Perspectives Influencer Community_Lead B205.57K @DigPerspectives National Cryptocurrency Association D31.64K @NatCryptoAssoc71 6 3.21K Original >Trend von ETH nach VeröffentlichungNeutral

National Cryptocurrency Association D31.64K @NatCryptoAssoc71 6 3.21K Original >Trend von ETH nach VeröffentlichungNeutral TheCoinZone.com Media Educator B4.17K @thecoinzonecom

TheCoinZone.com Media Educator B4.17K @thecoinzonecom TheCoinZone.com Media Educator B4.17K @thecoinzonecom8 1 164 Original >Trend von ETH nach VeröffentlichungBullisch

TheCoinZone.com Media Educator B4.17K @thecoinzonecom8 1 164 Original >Trend von ETH nach VeröffentlichungBullisch 大宇 FA_Analyst Tokenomics_Expert C291.18K @BTCdayu

大宇 FA_Analyst Tokenomics_Expert C291.18K @BTCdayu 大宇 FA_Analyst Tokenomics_Expert C291.18K @BTCdayu22 14 6.46K Original >Trend von ETH nach VeröffentlichungBärisch

大宇 FA_Analyst Tokenomics_Expert C291.18K @BTCdayu22 14 6.46K Original >Trend von ETH nach VeröffentlichungBärisch- Trend von ETH nach VeröffentlichungBullisch

- Trend von ETH nach VeröffentlichungBullisch