Arbitrum (ARB)

Arbitrum (ARB)

$0.1156 -2.69% 24H

- 52Social Sentiment Index (SSI)+92.37% (24h)

- #75Marktimpuls-Ranking (MPR)+44

- 1124-St. in Social Media+83.33% (24h)

- 91%24 Std-Bullisch-Verhältnis7 aktive Meinungsbildner

- Zusammenfassung

- Bullische Signale

- Bärische Signale

Social Sentiment Index (SSI)

- Daten insgesamt52SSI

- SSI-Trend (7-Tage)Preis (7 Tage)StimmungsverteilungExtrem bullisch (36%)Bullisch (55%)Bärisch (9%)SSI Einblicke

Marktimpuls-Ranking (MPR)

- Warnungseinblick

Beiträge auf X

Pinnacle Crypt 💎🥷🦾 Influencer Community_Lead B11.23K @PinnacleCrypt

Pinnacle Crypt 💎🥷🦾 Influencer Community_Lead B11.23K @PinnacleCrypt Veee D3.88K @vikktorrrre

Veee D3.88K @vikktorrrre 1 1 80 Original >Trend von ARB nach VeröffentlichungExtrem bullisch

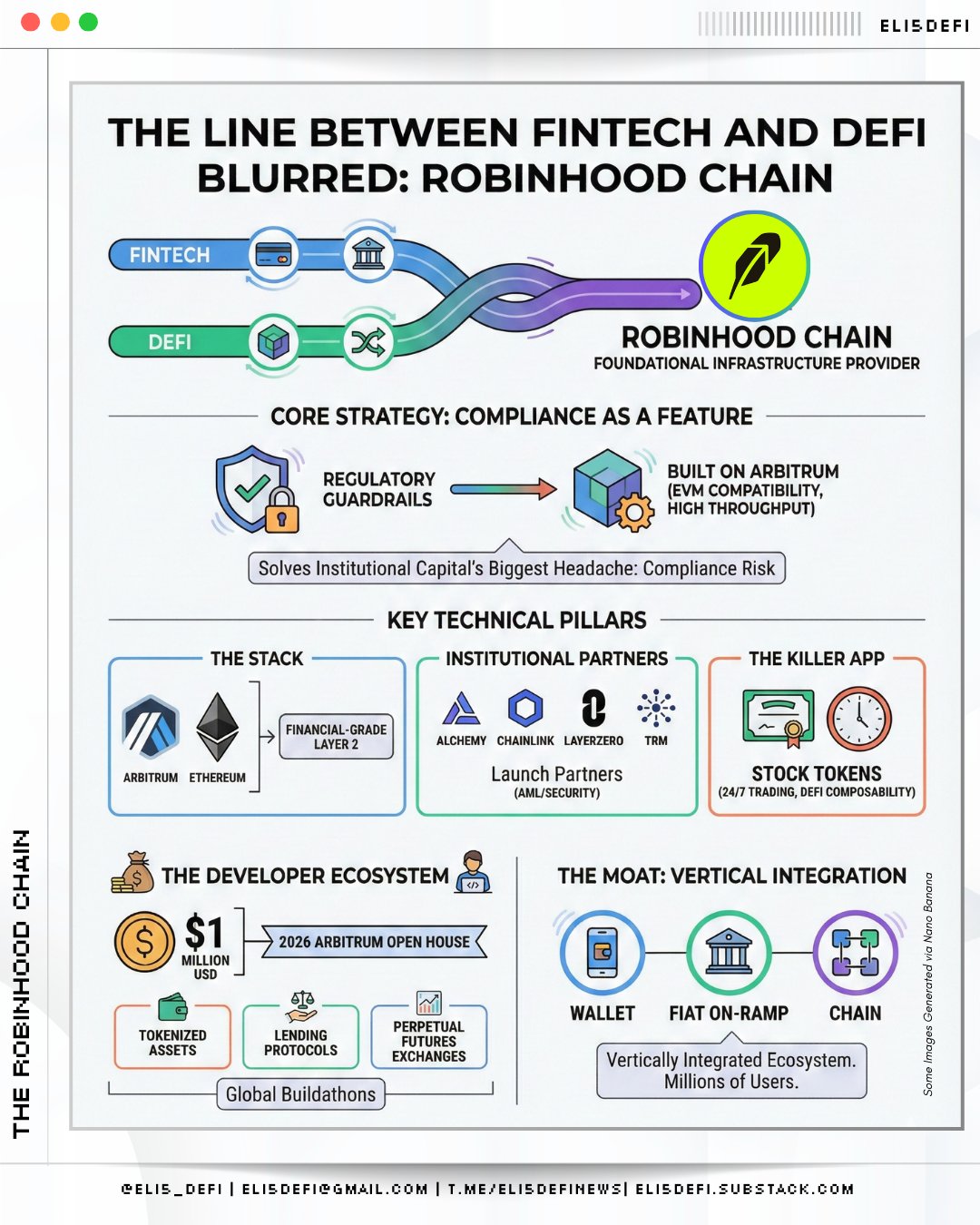

1 1 80 Original >Trend von ARB nach VeröffentlichungExtrem bullisch Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi 38 21 1.27K Original >Trend von ARB nach VeröffentlichungBullisch

38 21 1.27K Original >Trend von ARB nach VeröffentlichungBullisch Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi 38 21 1.27K Original >Trend von ARB nach VeröffentlichungExtrem bullisch

38 21 1.27K Original >Trend von ARB nach VeröffentlichungExtrem bullisch- Trend von ARB nach VeröffentlichungExtrem bullisch

- Trend von ARB nach VeröffentlichungBärisch

- Trend von ARB nach VeröffentlichungBullisch

MobΞth Researcher Tokenomics_Expert B3.60K @MobWeth

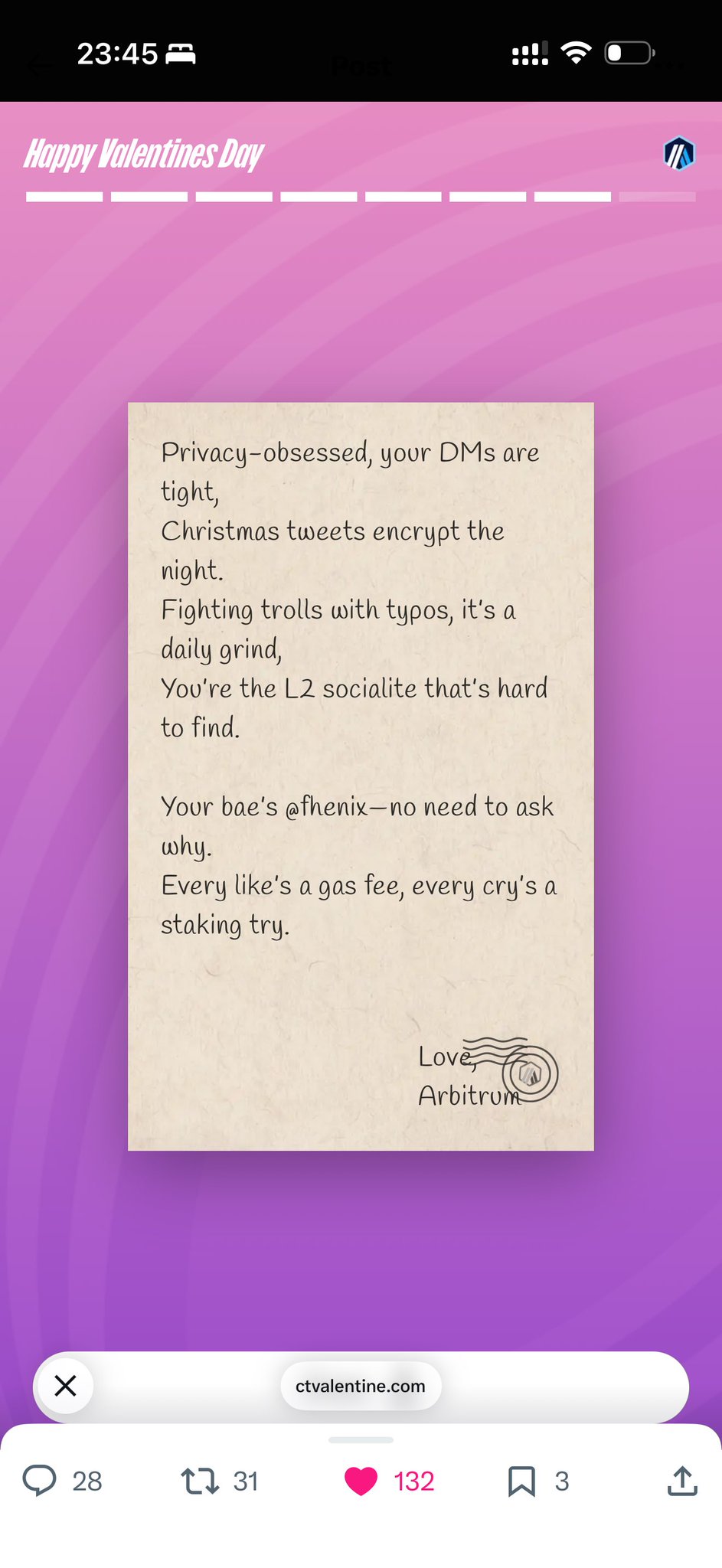

MobΞth Researcher Tokenomics_Expert B3.60K @MobWeth Arbitrum D1.16M @arbitrum340 58 49.75K Original >Trend von ARB nach VeröffentlichungBullisch

Arbitrum D1.16M @arbitrum340 58 49.75K Original >Trend von ARB nach VeröffentlichungBullisch 𝗵𝘂𝗻𝘁𝗲𝗿 Media Community_Lead A15.75K @BFreshHB

𝗵𝘂𝗻𝘁𝗲𝗿 Media Community_Lead A15.75K @BFreshHB (Angie*) ❤️🔥 D2.03K @AngieMKTmom

(Angie*) ❤️🔥 D2.03K @AngieMKTmom

42 12 4.95K Original >Trend von ARB nach VeröffentlichungExtrem bullisch

42 12 4.95K Original >Trend von ARB nach VeröffentlichungExtrem bullisch- Trend von ARB nach VeröffentlichungBullisch

- Trend von ARB nach VeröffentlichungBullisch