Cosmos (ATOM)

Cosmos (ATOM)

- 39社交热度指数(SSI)+97.44% (24h)

- #122市场预警排名(MPR)+17

- 124小时社交提及量0% (24h)

- 100%24小时KOL看好比例1位活跃KOL

- 概要ATOM在24h涨8.64%,社热↑97%,推文称持有可获跨链奖励,提升持币动机

- 看涨信号

- 价格上涨8.64%

- 社交热度涨97%

- 持有可获跨链奖励

- 链上激励提升需求

- KOL提及奖励机制

- 看跌信号

- 价值若早卖下降

- 奖励计划不确定

- 依赖跨链项目

- 短期获利压力

社交热度指数(SSI)

- 总体数据39SSI

- 社交热度趋势(7D)价格(7D)情绪分布看涨 (100%)社交热度洞察ATOM社交热度中等(38.5/100,+97%),活跃度↑42.86%情绪正面↑120%驱动,关联8.64%涨幅及跨链奖励宣传。

市场预警排名(MPR)

- 预警解读ATOM预警排名升至#122(↑17),社交异常0/100低、情绪极化50/100持平,关联激励宣传未触发异常。

相关推文

Tanned.edge🦭 🧬⚛️🦣🦥⛽️🏕️🧪(Ø,G)🥷 DeFi专家 意见领袖 B2.00K @crabetan

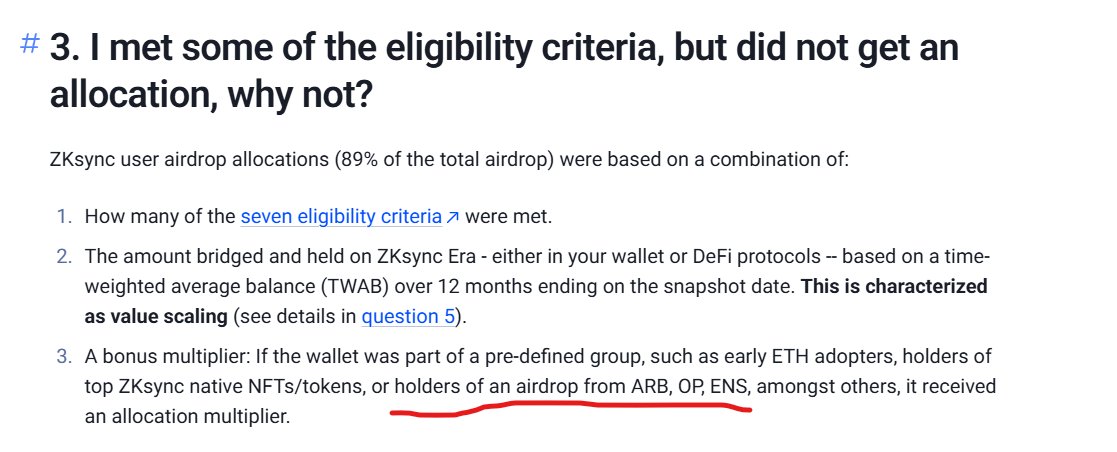

Tanned.edge🦭 🧬⚛️🦣🦥⛽️🏕️🧪(Ø,G)🥷 DeFi专家 意见领袖 B2.00K @crabetanHodl & get rewarded $Atom gave Tia, Dym & Saga (Stake in 2022) $Tia -> Dym & Saga (2023年质押) $Zk get rewarded by holding $arb or $OP (2024) $ESP did the same for Layer zero, Hyperlane, eigen, etc... Of course, $ value is lower if sold early but ON CHAIN matter 明白吗? https://t.co/KFyG3lkxU6

6 0 429 阅读原文 >发布后ATOM走势看涨推文鼓励长期持有ATOM、TIA、ZK等币种以获取空投奖励,并强调链上资产的重要性。

6 0 429 阅读原文 >发布后ATOM走势看涨推文鼓励长期持有ATOM、TIA、ZK等币种以获取空投奖励,并强调链上资产的重要性。 Airdrops 教育者 基本面分析师 D146.13K @Airdrops_one

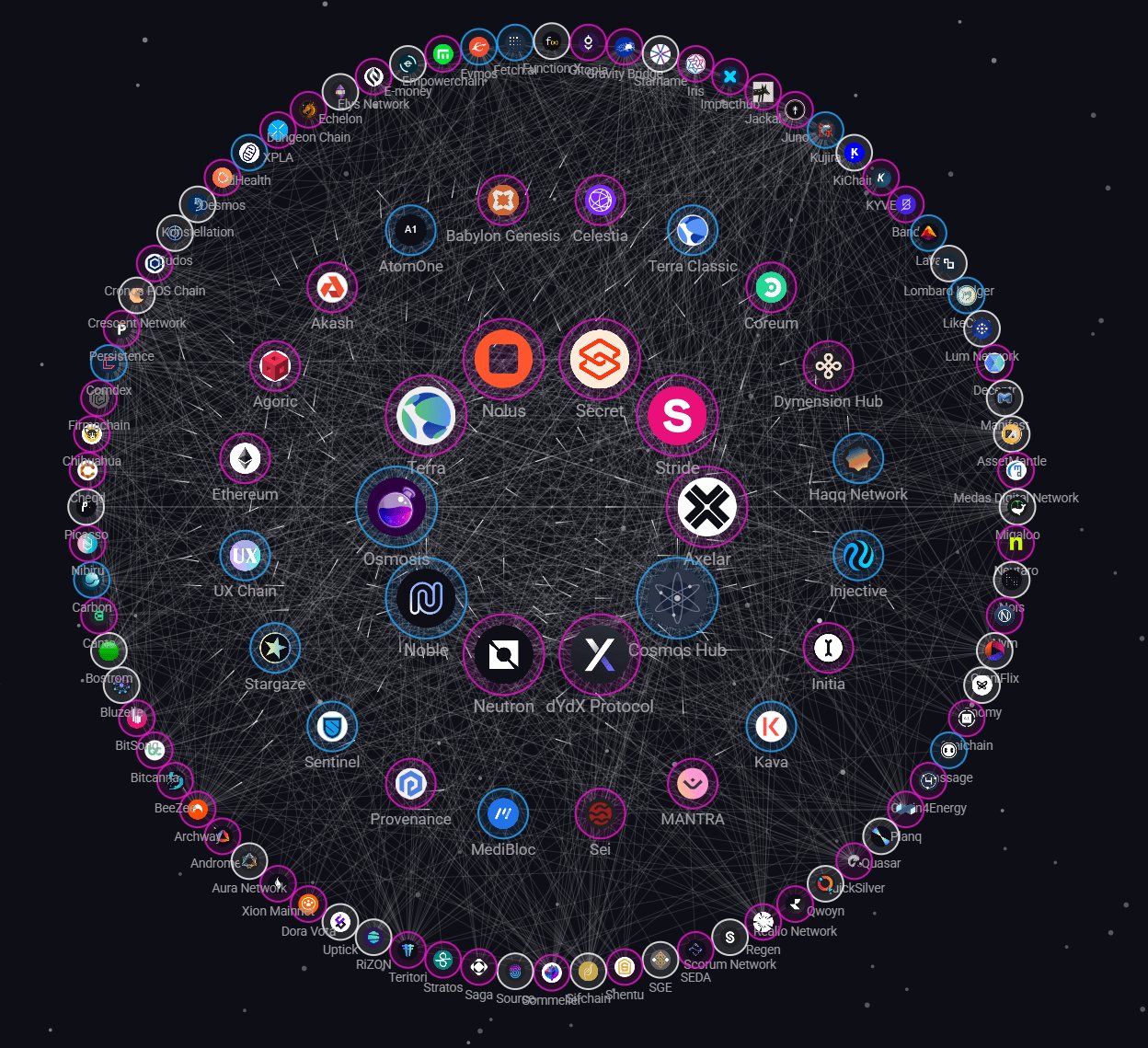

Airdrops 教育者 基本面分析师 D146.13K @Airdrops_oneWhen $ATOM Gets Paid (Part3): Router > Religion Forget "ecosystem token." Forget " $ATOM is the ETH of Cosmos." * @Ripple 在 Cosmos 堆栈上发布了一个 EVM 侧链。未触及 $ATOM。 * @OndoFinance 正在 Cosmos 上构建代币化市场轨道。未触及 $ATOM。 * Telegram/TAC、@mantra_chain、@Lombard_Finance、@Figure —— 全部在该堆栈中。均未通过 Hub 路由。 The stack is winning. The token? Not so much. More chains means more potential Hub traffic - but potential isn't revenue. You can't tax an SDK. You can toll a route. -- What "router" actually means The only way $ATOM captures value is if the Cosmos Hub becomes a router - infrastructure that sits in the middle of real cross-chain flows and charges for the service. Not a landlord. Not a brand. Not a mascot. A router. The question isn't "does Cosmos win?" It's: does the Hub handle traffic someone will pay for? Everything below is graded against that standard. -- Fee surfaces - graded honestly -- 1. IBC Eureka routing fees Eureka brought Ethereum onto IBC in April 2025. Solana, Base, and Arbitrum are on the 2026 roadmap. First time there's real cross-ecosystem volume to route. If the Hub becomes the preferred crossing - fast batching, reliable settlement, lower cost - it can toll that traffic. Catch: Eureka enables direct chain-to-chain links. You can route around the Hub. Verdict: Plausible - but the Hub has to earn its position through speed and cost, not assume it. If chains bypass it, this surface is zero. -- 2. Neutral settlement + compliance middleware Stablecoin/FX primitives, RWA settlement, compliance toolkits that enterprises plug into because the Hub is neutral - no competing commercial product on the other side. Most defensible fee surface. Enterprises pay for interop, compliance, and reliability as a service. The Hub has no competing commercial interest - that's its edge. Reality check: none of this is live yet. Primitives need to ship. Toolkits need to be production‑grade. Verdict: Best long‑run surface - but it's a build, not a brand. Earliest realistic: late 2026. Enterprise timelines are slow, mired in legal and compliance. This isn't agile development. -- 3. Cosmos-as-Red‑Hat (off‑chain revenue) SLAs, audits, LTS branches, managed upgrades. @cosmoslabs_io is reportedly closing enterprise deals. Most immediately real revenue stream in the ecosystem right now. The paradox: revenue goes to @cosmoslabs_io the company, not $ATOM the token. Red Hat made billions. Linux kernel contributors didn't. Unless there's explicit on‑chain routing - fee‑share, buybacks, staker rewards - this is a Cosmos Labs equity story. Verdict: Stack‑bullish. Token‑neutral until the wiring exists. -- 4. Interchain Security (ICS) Was designed to be the " $ATOM gets paid" mechanism: Hub validators secure external chains, earn a cut of fees. In practice, the highest‑profile chains self‑validated, consumer chains left or shut down, and the 2026 stack roadmap doesn't mention ICS at all. Development is in maintenance mode. Hub operations teams are scoping deprecation work. Verdict: Dead end. The market tested "shared security as a product" and said no. Reinforces why the router model - charge for routing, not for security - is the path forward. -- 5. PoA enterprise chains + Hub interop Native PoA lets banks and fintechs run permissioned chains without a staking token. These chains still need to connect outward - the Hub could be that gateway. Fastest‑growing use case. Slowest BD cycle. 6‑18 months per deal. No CT signal. Verdict: High‑fit, but 2027+ timeline. Don't expect hype. -- RWA is the near‑term toll road If any fee surface generates revenue first, it's probably here. Tokenized US Treasuries crossed ~$10B AUM - up from ~$5‑6B mid‑2025. Stablecoins at ~$250B. Citi estimates tokenized assets could reach $4‑5T by 2030. Institutions are already building on the Cosmos stack: ▫️ @OndoFinance - Ondo GM on Cosmos Stack. Bridges tokenized assets to public‑market liquidity. Moved ~$95M into BlackRock's BUIDL fund. ▫️ @Lombard_Finance - BTC as institutional collateral. Cosmos‑based Lombard Ledger. $1B TVL in first 3 months. ▫️ @Injective - digital‑securities infrastructure for institutional issuance and trading. ▫️ @ZIGChain - brokerage rails + blockchain settlement, partnered with Apex Group ($3.4T fund admin). ▫️ @provenancefdn / @Figure - leading non‑bank HELOC lender in the US, on Cosmos. ▫️ @progmat_en - Japan's largest regulated tokenization platform. Joint venture of MUFG, Mizuho, SMB. The pipeline is real. The revenue path to $ATOM is not - yet. If the Hub becomes the default router and settlement layer for this traffic, there's an obvious, chargeable service. If it doesn't, these remain proof that the stack wins while the token watches. -- What's wishful thinking ▫️ "SDK adoption tax." The SDK is permissive by design. You can't add rent to open source after the fact. ▫️ "Just add EVM." EVM compatibility is table stakes. @LayerZero_Labs just launched its own L1 with Citadel, DTCC, and ICE behind it. The moat is flows, not another VM. ▫️ "Narrative routing." If value‑routing to $ATOM depends on governance politics, nobody trusts it. It has to be automatic, measurable, auditable - or it's just vibes. -- The tokenomics RFP - the silence is the signal The tokenomics‑research RFP was the process meant to answer "how does $ATOM capture any of this?" Proposals were due in January 2026. As of mid‑February - little public update. Fair: good modeling takes time. Doing it right matters more than doing it fast. Also fair: the stack team ships at pace - v25.3.0 went live in January, Cosmos EVM is being adopted by Ripple and Telegram, IBC Eureka is connecting ecosystems. The one process meant to solve token value capture is quiet while everything around it accelerates. Every month that gap stays open, the market prices $ATOM accordingly. What a credible outcome looks like: ▫️ Fee mechanisms tied to shipped Hub services - not hypothetical ones ▫️ Explicit revenue routing with numbers: fees -> stakers, buybacks, or burns ▫️ Inflation that actually drops (target: low single‑digits, down from 7‑20%) ▫️ A vote and implementation timeline What governance theater looks like: ▫️ PDFs and "further research" -- What has to be true by end of 2026 ▫️ At least one Hub fee surface live with measurable revenue ▫️ Tokenomics redesign shipped on‑chain - not as a paper ▫️ Inflation below 5% ▫️ IBC Eureka beyond Ethereum - Solana, Base, or Arbitrum, at least one live ▫️ A named enterprise paying for Hub services with a visible route to $ATOM All five -> oh man! $ATOM starts looking like infrastructure equity with a token attached. Router > Religion becomes real. Three or more -> the router starts feeling real. Attainable, but a lot of work. Zero or one -> the stack keeps winning, $ATOM stays a spectator, and the bear case from Part 2 becomes the permanent state. That's the honest trade. ⚛️ Part 1: Cosmos Is Running the Linux Playbook. $ATOM Is the Open Question. https://t.co/PdTnkjxMQX Part 2: If Cosmos is “Linux,” where does $ATOM get paid? https://t.co/6BJixcVszk -- NFA. DYOR. Not a paid post. Sources: ▫️ Cosmos Stack 2026 Roadmap: https://t.co/8AokCfWqJ6 ▫️ ATOM Tokenomics RFP: https://t.co/RYUP3obipT ▫️ IBC Eureka walkthrough: https://t.co/ACVMrcOjZE ▫️ Real‑World Assets on Cosmos: https://t.co/aic3NiyjKV ▫️ LayerZero announces Zero L1: https://t.co/vEiWqQYm4o ▫️ Cosmos EVM: https://t.co/UZwxhccRYn

110 12 9.06K 阅读原文 >发布后ATOM走势看跌Cosmos生态成功,但ATOM代币价值捕获路径仍不明确且面临挑战。

110 12 9.06K 阅读原文 >发布后ATOM走势看跌Cosmos生态成功,但ATOM代币价值捕获路径仍不明确且面临挑战。 f1go.eth 基本面分析师 代币经济学专家 B6.73K @FigoETH

f1go.eth 基本面分析师 代币经济学专家 B6.73K @FigoETHCosmos缺少什么,以及区块链技术的独特卖点是什么。 国家级安全。 只有ETH。

barry D5.51K @BPIV400

barry D5.51K @BPIV400Cosmos对曾考虑或构建L2的企业来说,比以往任何时候都更准备就绪: - 自2025年6月以来实现了10倍吞吐量和稳定性提升 - EVM兼容性 - 对以太坊及其L2的信任最小化连接

36 6 1.21K 阅读原文 >发布后ATOM走势看涨Cosmos(ATOM)准备就绪,具备10倍吞吐和EVM兼容,前景看好 CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 技术分析师 DeFi专家 B1.93K @IvanM10529875

CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 技术分析师 DeFi专家 B1.93K @IvanM10529875. @grok 这会如何影响 $Atom Cosmos 价格 https://t.co/76pDoMs6oW

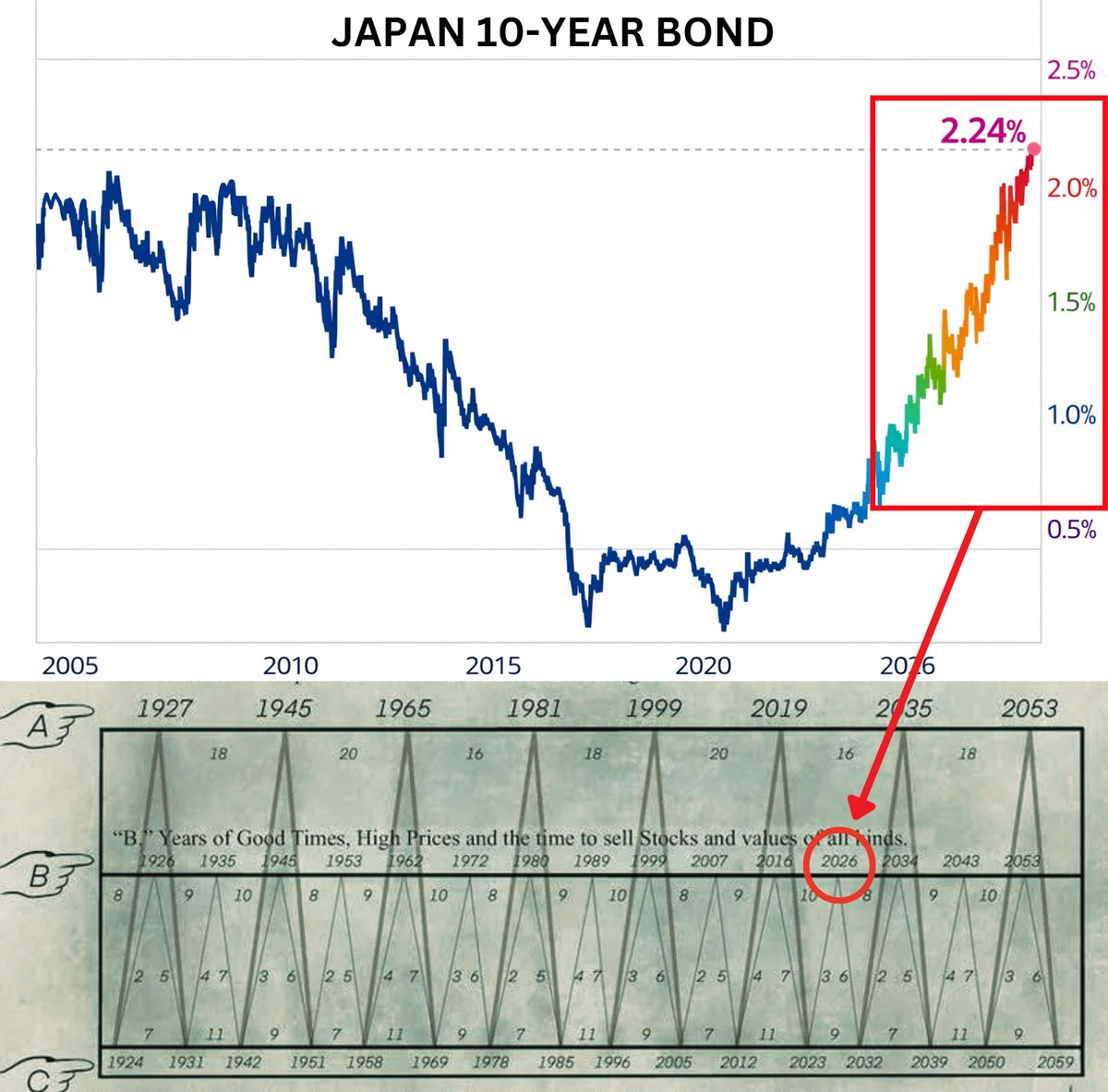

Wimar.X D251.46K @DefiWimar🚨 市场正在发出警报!! 看看日本政府债券目前的情况。 10年期: 2.24% 20年期: 3.10% 30年期: 3.51% 40年期: 3.73% 这些数字完全不正常。 日本是全球最大的债权国,净外汇资产约为 $3.7 万亿美元。 现在加入下一部分。 掉期市场给出约 80% 的概率,预计日本在四月将利率上调至 1.00%。 再次阅读。 日本利率到 1.00% 标志着廉价资金中心的终结。 这一事实解释了很多。 因为数十年来,日本是资金引擎。人们借入廉价日元并将资金投入美国股票、美国信贷、美国科技和加密货币。 当日本利率上调,那个引擎开始破裂。 而且日本并不小。 所以如果日本将 $3.7 万亿美元中的哪怕一小部分转回国内,就会在其他地方强迫抛售。 现在把这些点连接起来。 中国已经在从美国国债中撤出。 如果日本也开始以相同方式行动,即使缓慢,也会形成真正的去美元化流动,而不仅是标题。 而当最大的

9 1 1.23K 阅读原文 >发布后ATOM走势极度看跌日本加息预警全球廉价资金终结,或引发加密市场抛售潮。

9 1 1.23K 阅读原文 >发布后ATOM走势极度看跌日本加息预警全球廉价资金终结,或引发加密市场抛售潮。 O.N.Y.E.M.A🕵🏽♂️ 社区领袖 DeFi专家 B5.41K @ioDeFi

O.N.Y.E.M.A🕵🏽♂️ 社区领袖 DeFi专家 B5.41K @ioDeFi Prof K of MANTRA (🕉️,🏠) D6.80K @Profoneur

Prof K of MANTRA (🕉️,🏠) D6.80K @ProfoneurLe @Cryptocito 在香港的首次活动中主持。 🇭🇰 #ConsensusHK2026 https://t.co/cerMA3veK1

77 20 4.27K 阅读原文 >发布后ATOM走势看涨Cryptocito在香港ConsensusHK2026活动上主持Cosmos Connect活动。

77 20 4.27K 阅读原文 >发布后ATOM走势看涨Cryptocito在香港ConsensusHK2026活动上主持Cosmos Connect活动。 CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 技术分析师 DeFi专家 B1.93K @IvanM10529875

CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 技术分析师 DeFi专家 B1.93K @IvanM10529875$Atom,15m TF,现货市场 在价格上方有一些限价订单,分别在 Binance 和 Coinbase 上。 $2.05~2.1~2.14 🧐 https://t.co/zhKhElTdgF

24 0 941 阅读原文 >发布后ATOM走势中性ATOM在$2.05、$2.1、$2.14存在上方限价订单,需关注这些阻力位。

24 0 941 阅读原文 >发布后ATOM走势中性ATOM在$2.05、$2.1、$2.14存在上方限价订单,需关注这些阻力位。 Airdrops 教育者 基本面分析师 D146.13K @Airdrops_one

Airdrops 教育者 基本面分析师 D146.13K @Airdrops_oneCosmos是对的。 多年来,Cosmos的宣传基本是:为什么租用而不是拥有?运行自己的链,掌控自己的规则和成本,同时仍然通过 IBC 连接所有人。 大多数加密社区耸肩——因为只要以太坊 L2 看起来是默认路径,主权就等同于意识形态。 那么 @VitalikButerin 的帖子指出:L2 去中心化和互操作性进展比预期慢,@ethereum 的 L1 本身在扩容,通用的 “更便宜的以太坊” L2 需要新的存在理由…… 这一转变正是 Cosmos 所在的位置。(这里的 “Cosmos” 我主要指 Cosmos Labs 以及推动该技术栈的团队。) -- 在 Vitalik 的帖子之后,你无法忽视这样一个事实:成为以太坊 L2 意味着在别人的平台上作为租户构建业务——当房东在底层开设竞争店铺时,这种风险就变得真实。 Cosmos 的整体论点正好与租户相反:拥有链,拥有规则,向外连接。当市场开始以 “平台风险” 的角度思考时,这种宣传不再是意识形态,而更像是风险管理。 于是团队快速行动。发布博客;@0xMagmar 发布了一份 “看起来像 trolling 但不是” 的迁移清单:在几天而非几个月内将以太坊 L2 移动到主权的 EVM L1。用户几乎感觉不到变化。 “私信我,我们帮你完成。” 对每个开始质疑自身布局的 L2 团队发出明确且开放的邀请。 -- 为了让这个宣传变得真实,Cosmos 正在交付过去的 “但是……” 列表: ▫️ Cosmos EVM - 保持 Solidity 与熟悉的工具链。你的合约直接迁移。开发者无需学习新东西。 ▫️ PoA 模式 - 如果你不想在第一天就启动完整的验证者经济,可以先使用规模更小的授权验证者集合。后期如有需要再演进。 ▫️ IBC 升级 - 承诺是 “主权但已连接”,超越仅仅 Cosmos 链的互联正成为一等目标。 结果:两年前的每一个 “但 Cosmos 做不到……” 正在被划掉。 -- 我已经发布了一段时间——出现了更广泛的模式:更多大玩家想要自己的轨道而不是做租户。 该 “走向主权” 方向的案例: ▫️ @circle 宣布其自有 L1(“Arc”),专为稳定币金融构建。 ▫️ @HyperliquidX 构建了自己的链。 ▫️ @OndoFinance 与 @Figure 正在倾向 Cosmos 风格的主权布局。 ▫️ @tempo - 由 @stripe 与 @paradigm 孵化 - 正在构建一个专注支付的 L1。 细节各有不同,且还有很多我们尚未了解的团队和名字,但方向一致:主权再次流行。 -- ELI5: Ethereum 的旧计划基本是 “L2 就像以太坊的特许经营店——同品牌、同信任,只是更快更便宜”。 Vitalik 说这种框架已经不适用了: 1. L2 的去中心化 + 互操作性进展比预期慢 2. 以太坊 L1 正在扩容,2026 年可能获得显著更高容量 他告诉 L2 必须找到除 “我们在扩容以太坊” 之外的价值主张。 这不是 “L2 亡”。而是 “通用 L2 不能永远依赖扩容叙事”。 这两者差距很大——如果你唯一的卖点是 “更便宜的以太坊”,你应该感到不安。 -- 用户并不在乎 “L1 vs L2” 的标签。他们在乎的是速度、费用、连接性,以及如果基础平台改变立场是否会被割韭菜。 这场争论的关键就在于最后一点。 L2 借用以太坊的安全(很好),但你仍是租户——受制于房东的规则、费用或竞争。 主权链拥有整套堆栈并可插入其他链。 风险不同,收益也不同。 -- Cosmos “此时赢” 并不等同于 $ATOM 持有者赢。 如果论点是 “由 $ATOM 部分或全部资助的开发应使 $ATOM 受益”,那么价值捕获路径不能仅凭情感。它必须明确:费用、服务、回购、收入分成,或任何最终机制。 主权链和 @cosmoslabs_io 可以为整个堆栈带来收益——但 $ATOM 必须有清晰的合约来说明它如何从该堆栈中捕获价值。 -- Cosmos 只有在生产环境满足两件事时才能在此时获胜: 1. “主权但已连接” 必须显得平淡可靠。 2. 迁移必须在生产环境中顺滑如黄油。 如果他们执行到位,这可能带来真实的成交量(并可能最终通过 Hub 服务/费用带来 $ATOM 需求)。 🫡 Sources: https://t.co/WXY0bgaiOi https://t.co/T0nOjcjPfX https://t.co/UZwxhccRYn https://t.co/QIfhnA6r7k

126 16 8.12K 阅读原文 >发布后ATOM走势极度看涨Cosmos主权链模式获胜,ATOM需明确价值捕获。

126 16 8.12K 阅读原文 >发布后ATOM走势极度看涨Cosmos主权链模式获胜,ATOM需明确价值捕获。 chainyoda 基本面分析师 DeFi专家 B43.16K @chainyoda

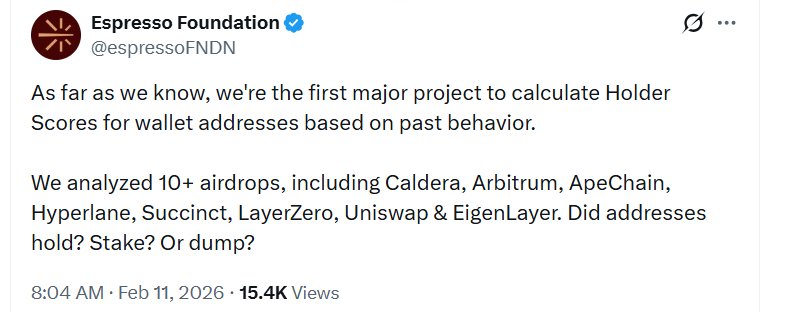

chainyoda 基本面分析师 DeFi专家 B43.16K @chainyoda因为 Cosmos 通胀率高于实体经济通胀率,在高利率环境下,你无法阻止 Cosmos 逐渐逼近 0,但当零利率政策(ZIRP)像 2021 年那样回归时,每个 Cosmosian 都会变得异常富裕 https://t.co/ynr22dPkSI

24 11 938 阅读原文 >发布后ATOM走势看跌推文警示Cosmos代币在高利率下或趋零,但预期零利率政策回归后将暴涨。

24 11 938 阅读原文 >发布后ATOM走势看跌推文警示Cosmos代币在高利率下或趋零,但预期零利率政策回归后将暴涨。 Alex Crypto 研究员 意见领袖 C6.69K @alex_crypto98

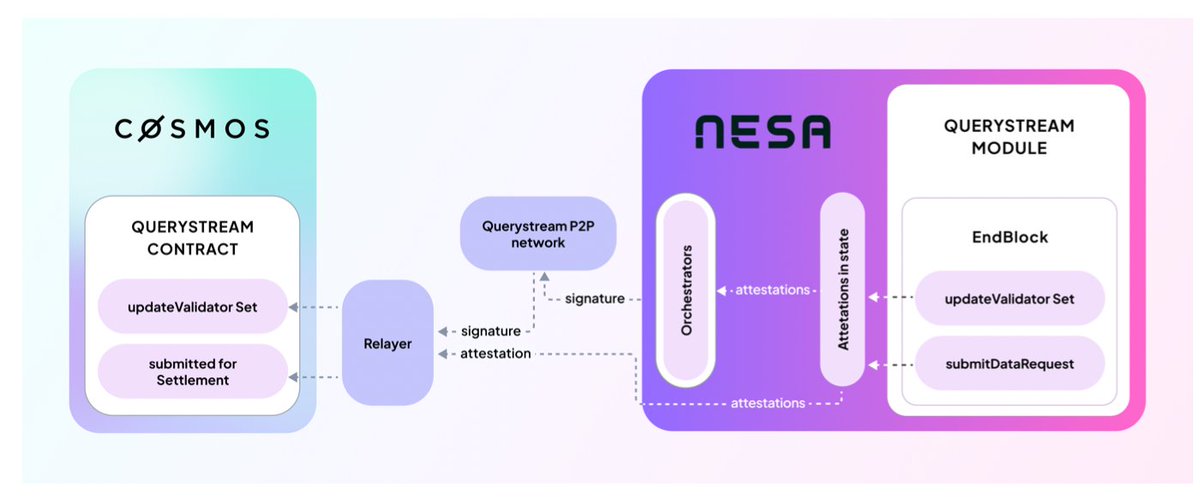

Alex Crypto 研究员 意见领袖 C6.69K @alex_crypto98作为构建者,问题从不是“它有没有代币”,而是“它能可靠地让我做什么” 在 Nesa 上,PayForQuery 将 AI 执行转变为具有明确费用语义的一等事务 您根据优先级和负载大小付费,因此成本随实际消耗而伸缩 queryStream 为您提供了一条将已验证查询输出移入结算环境而无需信任单一服务器的路径 安全预算是明确的:投入更多即可获得更多矿工和更广的证明覆盖 这使得定价和风险可以思考而不是猜测 gNesa

10 7 101 阅读原文 >发布后ATOM走势看涨Nesa在Cosmos上提供可靠的AI执行和安全数据流,费用透明可控。

10 7 101 阅读原文 >发布后ATOM走势看涨Nesa在Cosmos上提供可靠的AI执行和安全数据流,费用透明可控。 Cito Zone 链上数据分析师 衍生品专家 B8.54K @Cito_Zone

Cito Zone 链上数据分析师 衍生品专家 B8.54K @Cito_Zone🌌 IBC 交易量正在加速 🌌 🔸 IBC 交易总额: $146.6M (+58.5% 环比) 🔸 IBC 总转账次数: 188K (+19.7%) 🔸 交易量最大对: Noble - dYdX ($33.2M) 🔸 最活跃对: Hub - Osmosis (15.8K) 🔸 跨链周活跃用户: 67.7K (-11%) 🔸 Cosmos 链市值: $18.6B https://t.co/FzpLIxkSt7

40 2 1.52K 阅读原文 >发布后ATOM走势看涨Cosmos IBC交易量周环比增长58.5%,总转账量增长19.7%,生态活跃。

40 2 1.52K 阅读原文 >发布后ATOM走势看涨Cosmos IBC交易量周环比增长58.5%,总转账量增长19.7%,生态活跃。