Hyperliquid (HYPE)

Hyperliquid (HYPE)

$31.426 -1.25% 24H

- 64Chỉ số cảm xúc xã hội (SSI)-4.31% (24h)

- #100Xếp hạng nhịp đập thị trường (MPR)+17

- 38Đề cập trên mạng xã hội 24h-18.75% (24h)

- 68%Tỷ lệ tăng KOL 24h25 KOL đang hoạt động

- Tóm tắt

- Tín hiệu tăng giá

- Tín hiệu giảm giá

Chỉ số cảm xúc xã hội (SSI)

- Tổng quan dữ liệu64SSI

- Xu hướng SSI (7 ngày)Giá (7 ngày)Phân bổ cảm xúcCực kỳ lạc quan (29%)Tăng giá (39%)Trung tính (16%)Giảm giá (16%)Thông tin chuyên sâu SSI

Xếp hạng nhịp đập thị trường (MPR)

- Thông tin chuyên sâu về cảnh báo

Bài đăng trên X

Sovereign Trader DeFi_Expert A3.80K @Sovereign_Web3

Sovereign Trader DeFi_Expert A3.80K @Sovereign_Web3

Sovereign Trader DeFi_Expert A3.80K @Sovereign_Web3

Sovereign Trader DeFi_Expert A3.80K @Sovereign_Web3 3 0 158 Gốc >Xu hướng của HYPE sau khi phát hànhTăng giá

3 0 158 Gốc >Xu hướng của HYPE sau khi phát hànhTăng giá- Xu hướng của HYPE sau khi phát hànhGiảm giá

- Xu hướng của HYPE sau khi phát hànhTrung tính

𝕋𝕖𝕞𝕞𝕪🦇🔊 DeFi_Expert Educator C41.53K @Only1temmy

𝕋𝕖𝕞𝕞𝕪🦇🔊 DeFi_Expert Educator C41.53K @Only1temmy 𝕋𝕖𝕞𝕞𝕪🦇🔊 DeFi_Expert Educator C41.53K @Only1temmy

𝕋𝕖𝕞𝕞𝕪🦇🔊 DeFi_Expert Educator C41.53K @Only1temmy 51 14 4.72K Gốc >Xu hướng của HYPE sau khi phát hànhTăng giá

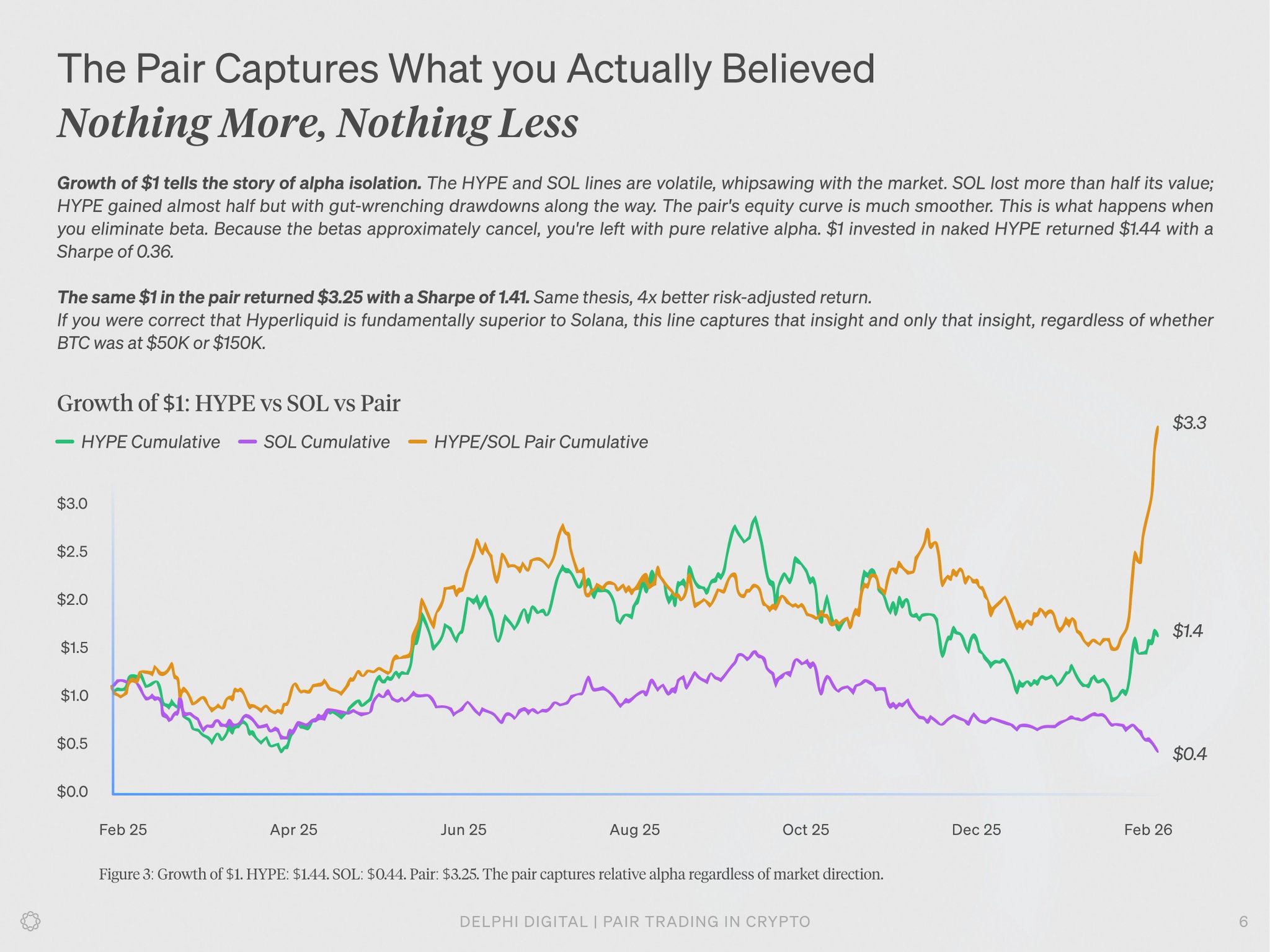

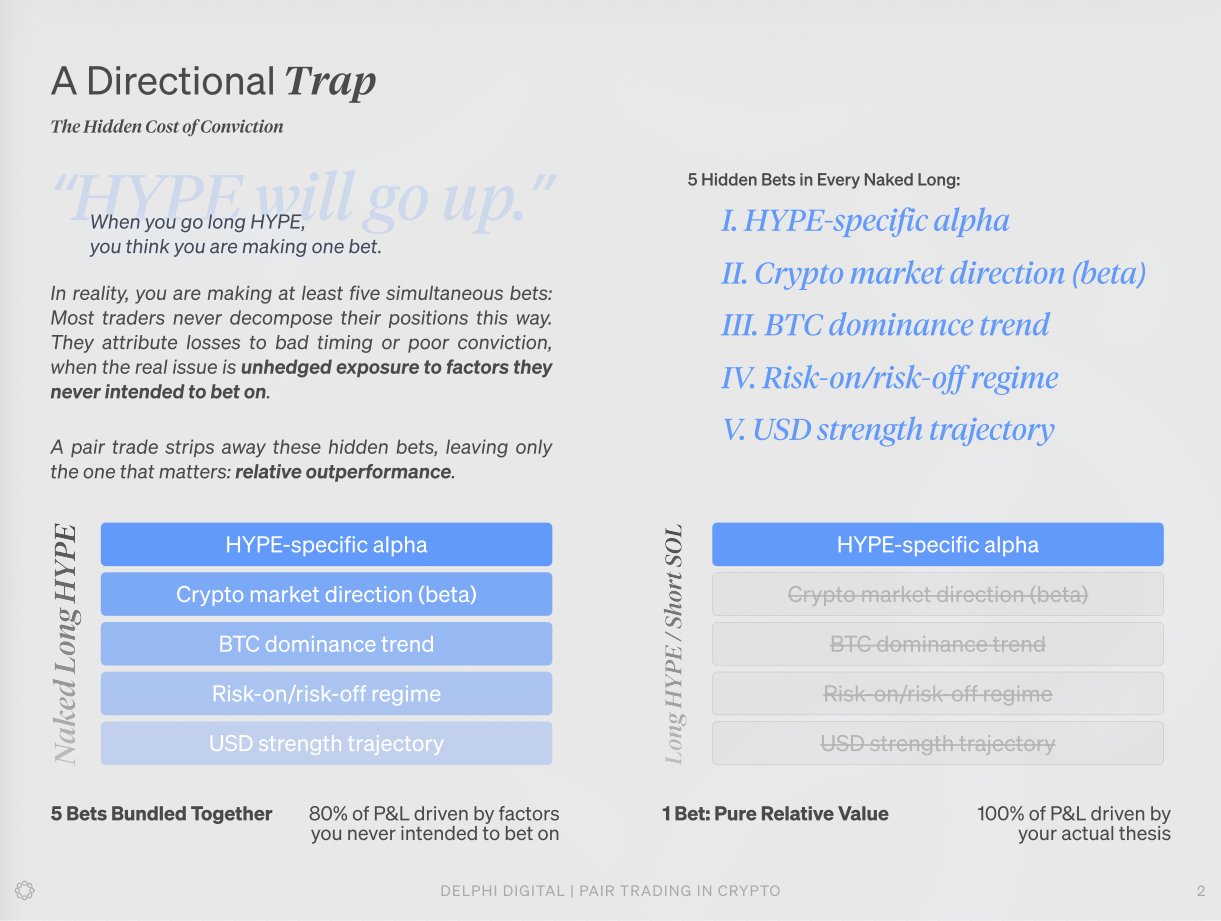

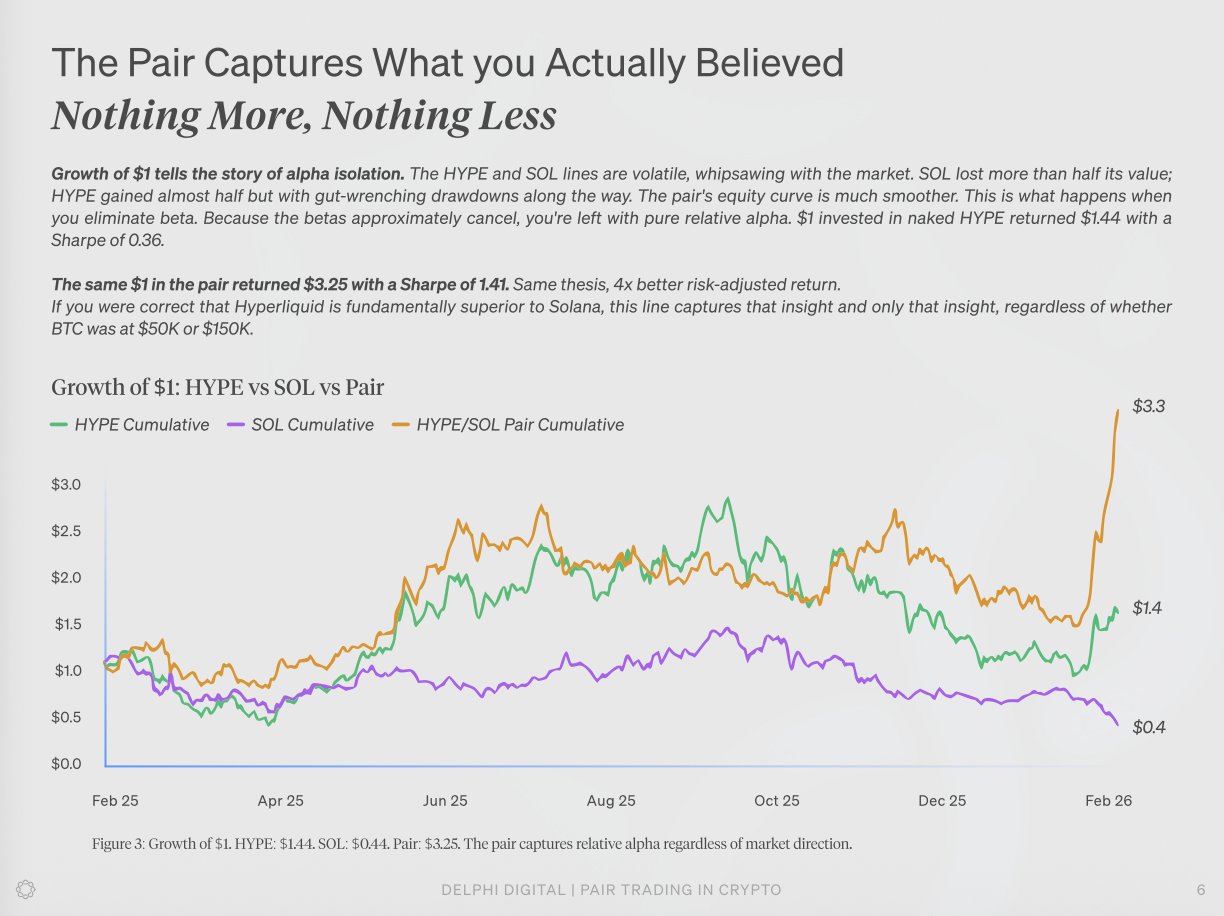

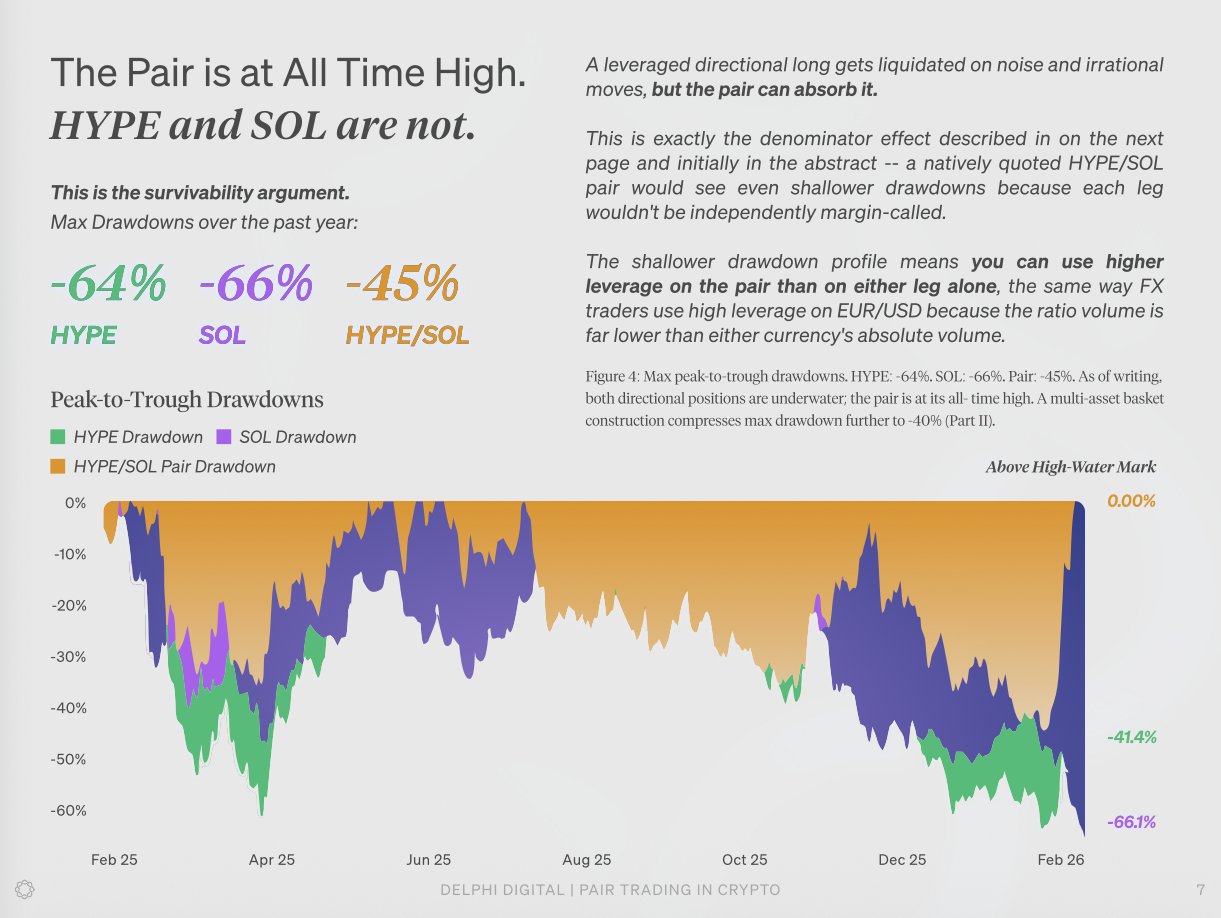

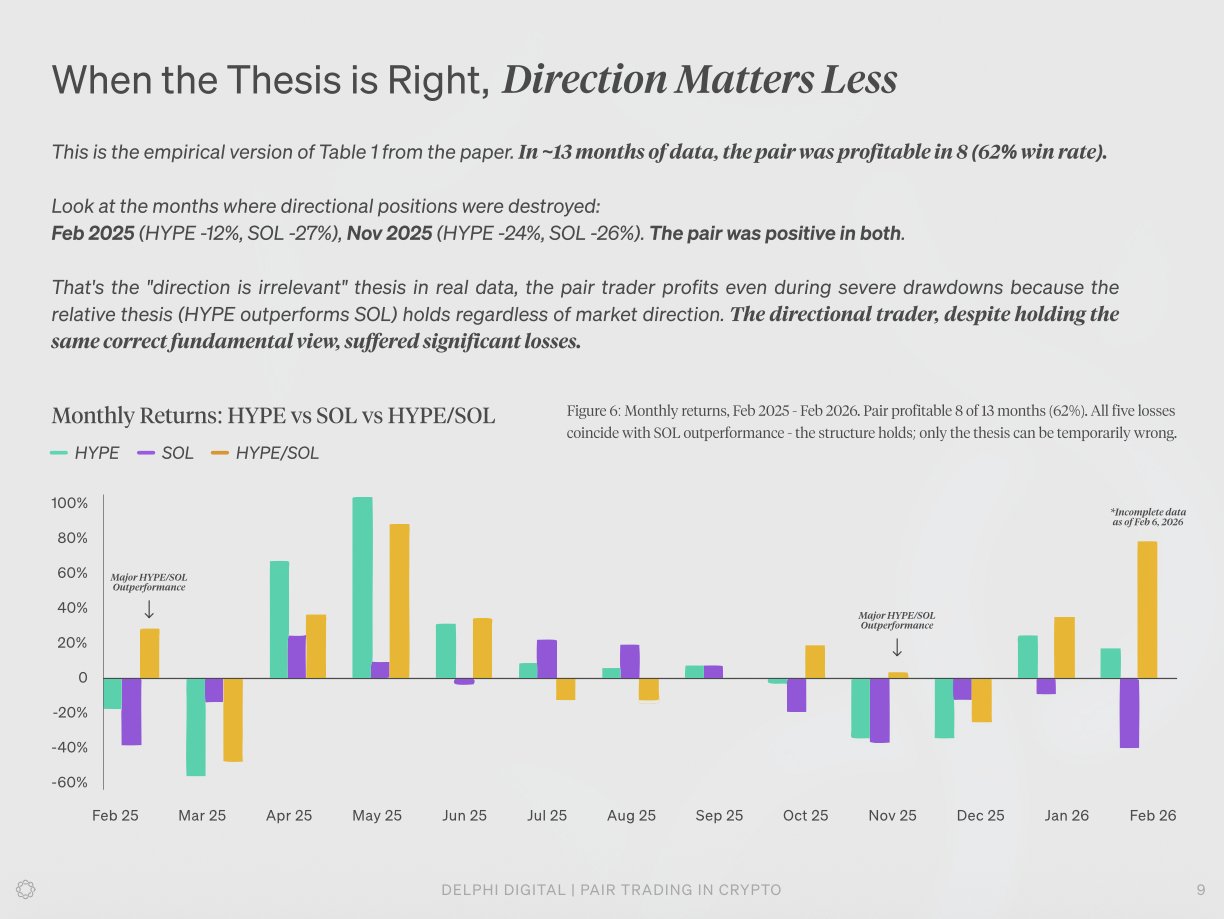

51 14 4.72K Gốc >Xu hướng của HYPE sau khi phát hànhTăng giá Delphi Digital FA_Analyst Researcher D217.76K @Delphi_Digital

Delphi Digital FA_Analyst Researcher D217.76K @Delphi_Digital

Delphi Digital FA_Analyst Researcher D217.76K @Delphi_Digital11 4 1.55K Gốc >Xu hướng của HYPE sau khi phát hànhTăng giá

Delphi Digital FA_Analyst Researcher D217.76K @Delphi_Digital11 4 1.55K Gốc >Xu hướng của HYPE sau khi phát hànhTăng giá Greeny TA_Analyst Trader B42.32K @greenytrades

Greeny TA_Analyst Trader B42.32K @greenytrades Greeny TA_Analyst Trader B42.32K @greenytrades

Greeny TA_Analyst Trader B42.32K @greenytrades 31 4 3.71K Gốc >Xu hướng của HYPE sau khi phát hànhTăng giá

31 4 3.71K Gốc >Xu hướng của HYPE sau khi phát hànhTăng giá DracoVelli OnChain_Analyst Media B5.71K @Draco__88

DracoVelli OnChain_Analyst Media B5.71K @Draco__88 flip FA_Analyst DeFi_Expert S4.17K @trevor_flipper

flip FA_Analyst DeFi_Expert S4.17K @trevor_flipper

441 50 77.87K Gốc >Xu hướng của HYPE sau khi phát hànhCực kỳ lạc quan

441 50 77.87K Gốc >Xu hướng của HYPE sau khi phát hànhCực kỳ lạc quan Smart Drop Farmer DeFi_Expert OnChain_Analyst A2.74K @SmartDropFarmer

Smart Drop Farmer DeFi_Expert OnChain_Analyst A2.74K @SmartDropFarmer Smart Drop Farmer DeFi_Expert OnChain_Analyst A2.74K @SmartDropFarmer

Smart Drop Farmer DeFi_Expert OnChain_Analyst A2.74K @SmartDropFarmer 16 1 742 Gốc >Xu hướng của HYPE sau khi phát hànhCực kỳ lạc quan

16 1 742 Gốc >Xu hướng của HYPE sau khi phát hànhCực kỳ lạc quan Tobias Reisner FA_Analyst Influencer B16.52K @reisnertobias

Tobias Reisner FA_Analyst Influencer B16.52K @reisnertobias 800.HL D9.67K @degennQuant34 8 1.85K Gốc >Xu hướng của HYPE sau khi phát hànhTăng giá

800.HL D9.67K @degennQuant34 8 1.85K Gốc >Xu hướng của HYPE sau khi phát hànhTăng giá Tobias Reisner FA_Analyst Influencer B16.52K @reisnertobias

Tobias Reisner FA_Analyst Influencer B16.52K @reisnertobias

Tobias Reisner FA_Analyst Influencer B16.52K @reisnertobias

Tobias Reisner FA_Analyst Influencer B16.52K @reisnertobias 63 5 3.40K Gốc >Xu hướng của HYPE sau khi phát hànhCực kỳ lạc quan

63 5 3.40K Gốc >Xu hướng của HYPE sau khi phát hànhCực kỳ lạc quan