Syrup (SYRUP)

Syrup (SYRUP)

- 54Індекс соціальних настроїв (SSI)-0.91% (24h)

- #42Рейтинг пульсу ринку (MPR)+39

- 224-годинні згадки в соціальних мережах0% (24h)

- 100%24-годинний коефіцієнт бичачого настрою KOL2 Активних KOL

- ПідсумокMaple used 25% Nov revenue for SYRUP buybacks, spurring 16% price jump; token up 5.3% despite modest dip in social heat.

- Бичачі сигнали

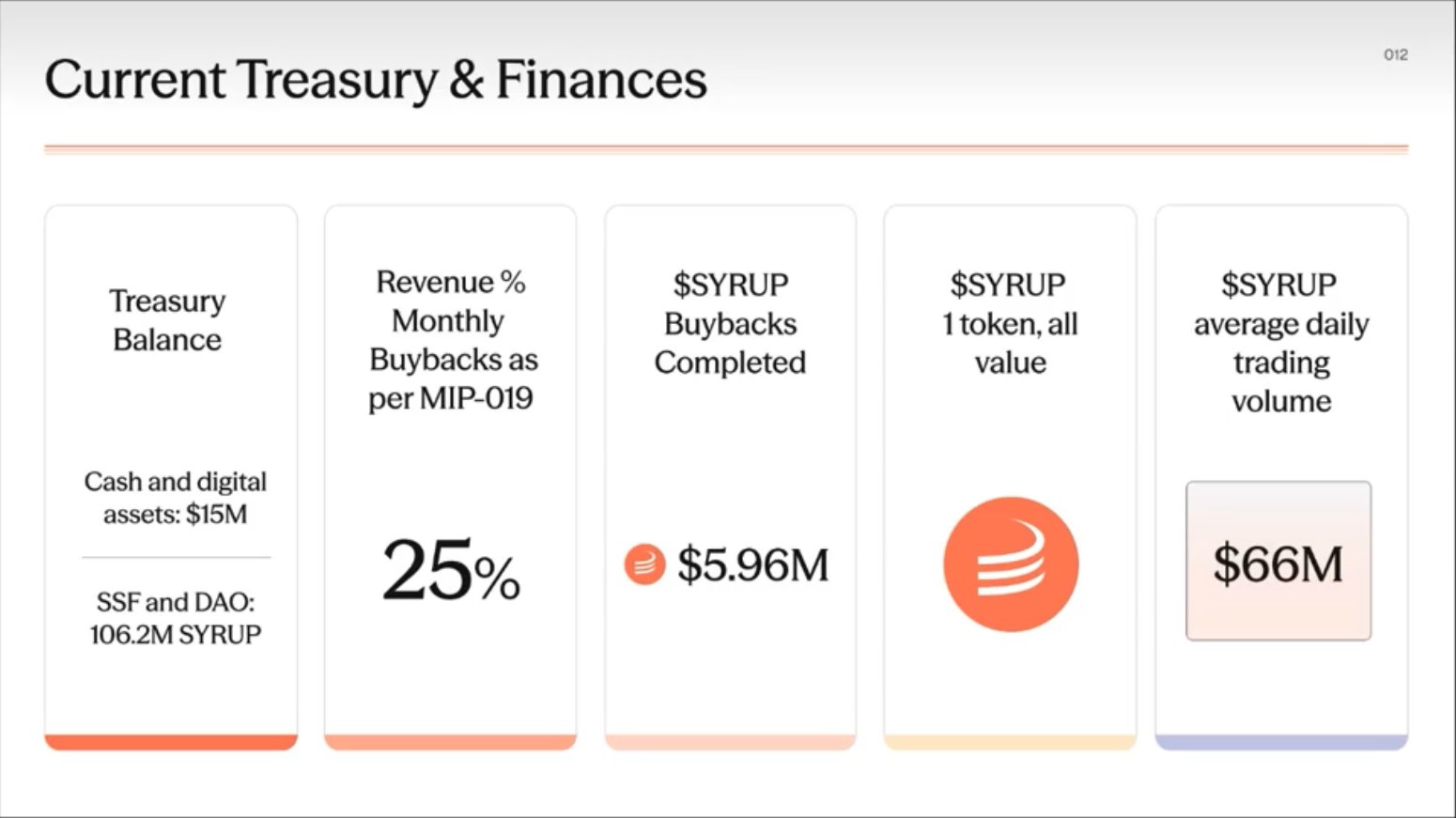

- 25% rev to buybacks

- 16% price jump

- 5.3% price rise

- Maple rev $2.11M

- Buybacks proven effective

- Ведмежі сигнали

- Social heat down 0.9%

- Buyback reliance on Maple

- Unclear protocol adoption

- One‑off revenue boost

- Limited tweet engagement

Індекс соціальних настроїв (SSI)

- Загальні дані54SSI

- Тенденція SSI (7 днів)Ціна (7 днів)Розподіл настроївНадзвичайно бичачий (50%)Бичачий (50%)Аналітика SSISYRUP social heat slightly down to 54.5/100 (-0.91%), sentiment positive +25% increase, but KOL attention fell 78.57% to 1.5/30, mainly because Maple buybacks triggered price rise but discussion heat did not keep up.

Рейтинг пульсу ринку (MPR)

- Аналітика сповіщеньWarning rank rose to #42 (+39), social abnormality stable at 84.41/100, sentiment polarization surged 306% to 50.95/100, KOL attention shift down 70%, reflecting that buyback news triggered sentiment polarization.

Дописи з платформи X

The Defiant Media DeFi_Expert D117.58K @DefiantNews

The Defiant Media DeFi_Expert D117.58K @DefiantNewsSYRUP jumped 16% on the day after @maplefinance announced it had used 25% of its November revenue to buy back its native token. @Jonajeth reports: https://t.co/v6J9pwpjlu

3 1 1.00K Оригінал >Тенденція SYRUP після випускуБичачийSYRUP up 16% on buyback news, bullish short term DeFi Dad ⟠ defidad.eth DeFi_Expert Educator C176.51K @DeFi_Dad

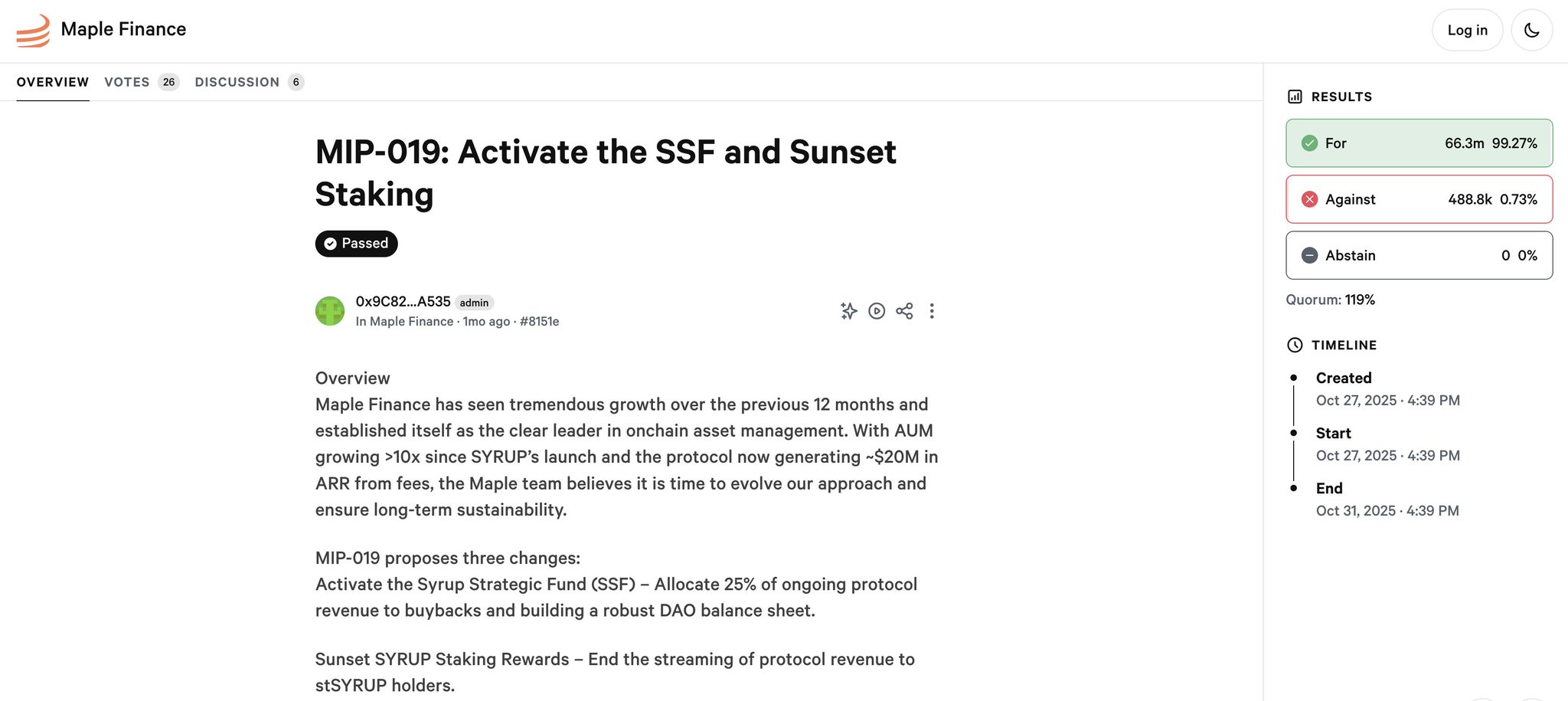

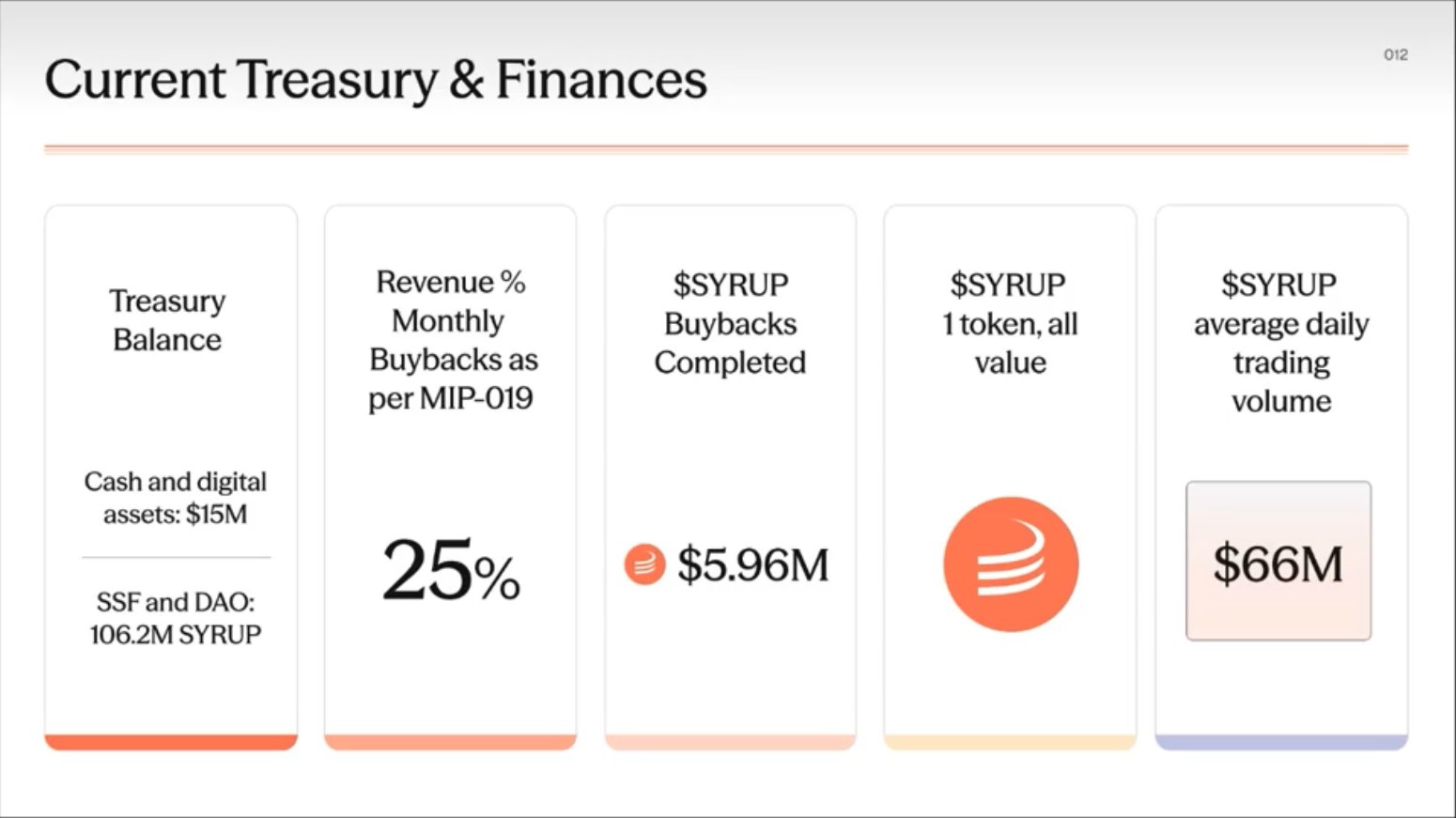

DeFi Dad ⟠ defidad.eth DeFi_Expert Educator C176.51K @DeFi_DadICYMI in October, this proposal passed in a @maplefinance governance to end streaming protocol revenue in the form of SYRUP to stSYRUP holders. Instead, 25% of ongoing protocol revenue will be allocated to the Syrup Strategic Fund (SSF) for SYRUP buybacks. Do we expect more DeFi protocols to focus on buybacks like this vs streaming token rewards, or is this unique to a high-growth, profitable protocol like Maple? Btws, Maple hit $2.11M monthly protocol rev in November, it's second highest of the year after October. That's $25M ARR if they can sustain it.

28 12 2.42K Оригінал >Тенденція SYRUP після випускуНадзвичайно бичачийMaple Finance通过SYRUP回购提案,协议收入强劲,利好SYRUP。

28 12 2.42K Оригінал >Тенденція SYRUP після випускуНадзвичайно бичачийMaple Finance通过SYRUP回购提案,协议收入强劲,利好SYRUP。 𝐌𝐮𝐛𝐢 𝐂𝐫𝐲𝐩𝐭🦺🧡 DeFi_Expert Influencer B2.22K @Mubi_crypt

𝐌𝐮𝐛𝐢 𝐂𝐫𝐲𝐩𝐭🦺🧡 DeFi_Expert Influencer B2.22K @Mubi_cryptSpotify Wrap or DeFi Wrap Here’s my 2025 DeFi Wrap. Thank you, @maplefinance Let’s do more 2026🥞. Quote with your 2025 DeFi/Crypto Wrap https://t.co/3j7y9pRJUZ

17 9 384 Оригінал >Тенденція SYRUP після випускуБичачийThe author posted a DeFi year-end summary, thanking Maple Finance and looking forward to the future.

17 9 384 Оригінал >Тенденція SYRUP після випускуБичачийThe author posted a DeFi year-end summary, thanking Maple Finance and looking forward to the future. 𝐌𝐮𝐛𝐢 𝐂𝐫𝐲𝐩𝐭🦺🧡 DeFi_Expert Influencer B2.22K @Mubi_crypt

𝐌𝐮𝐛𝐢 𝐂𝐫𝐲𝐩𝐭🦺🧡 DeFi_Expert Influencer B2.22K @Mubi_crypt 𝐌𝐮𝐛𝐢 𝐂𝐫𝐲𝐩𝐭🦺🧡 DeFi_Expert Influencer B2.22K @Mubi_crypt

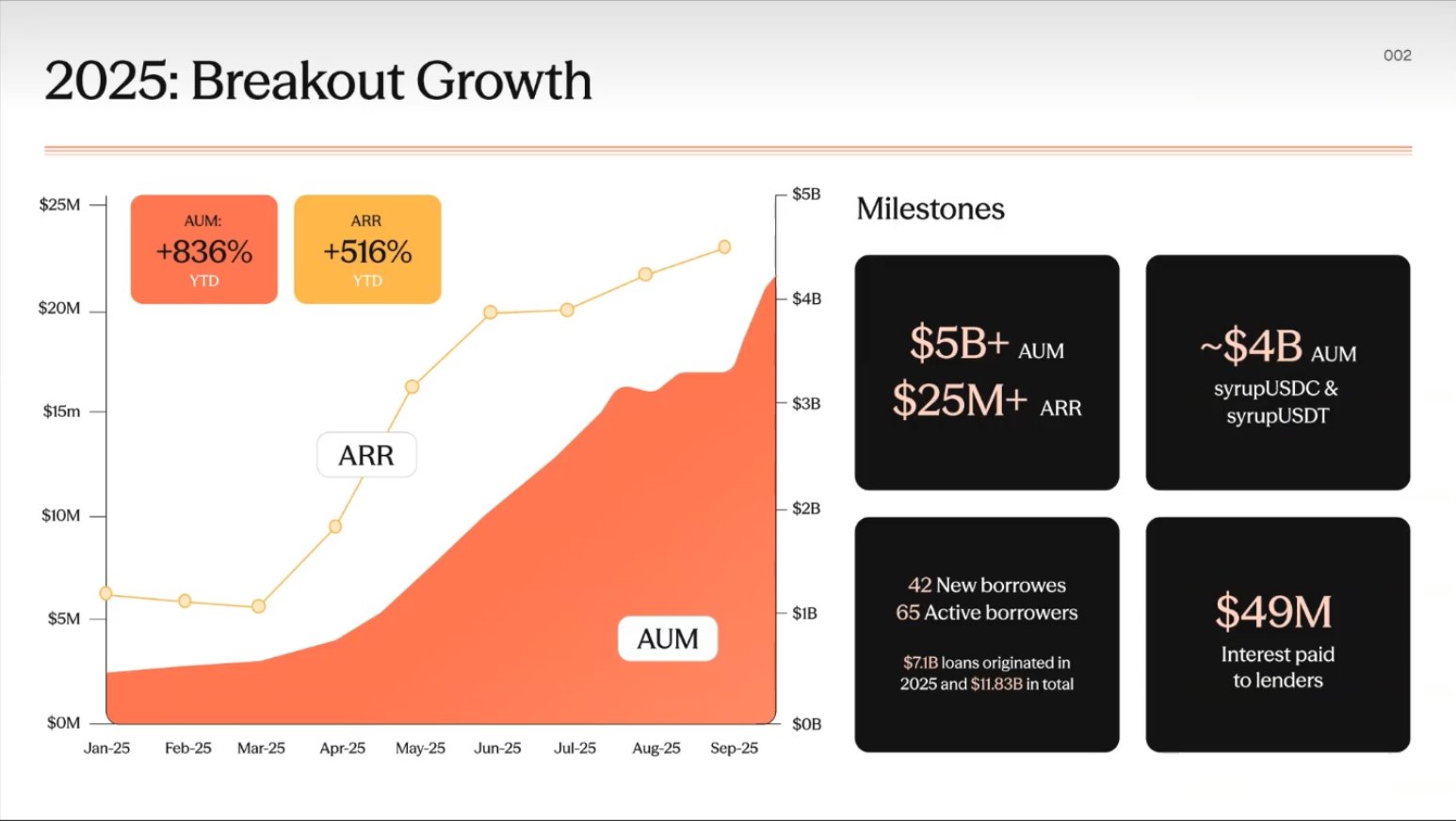

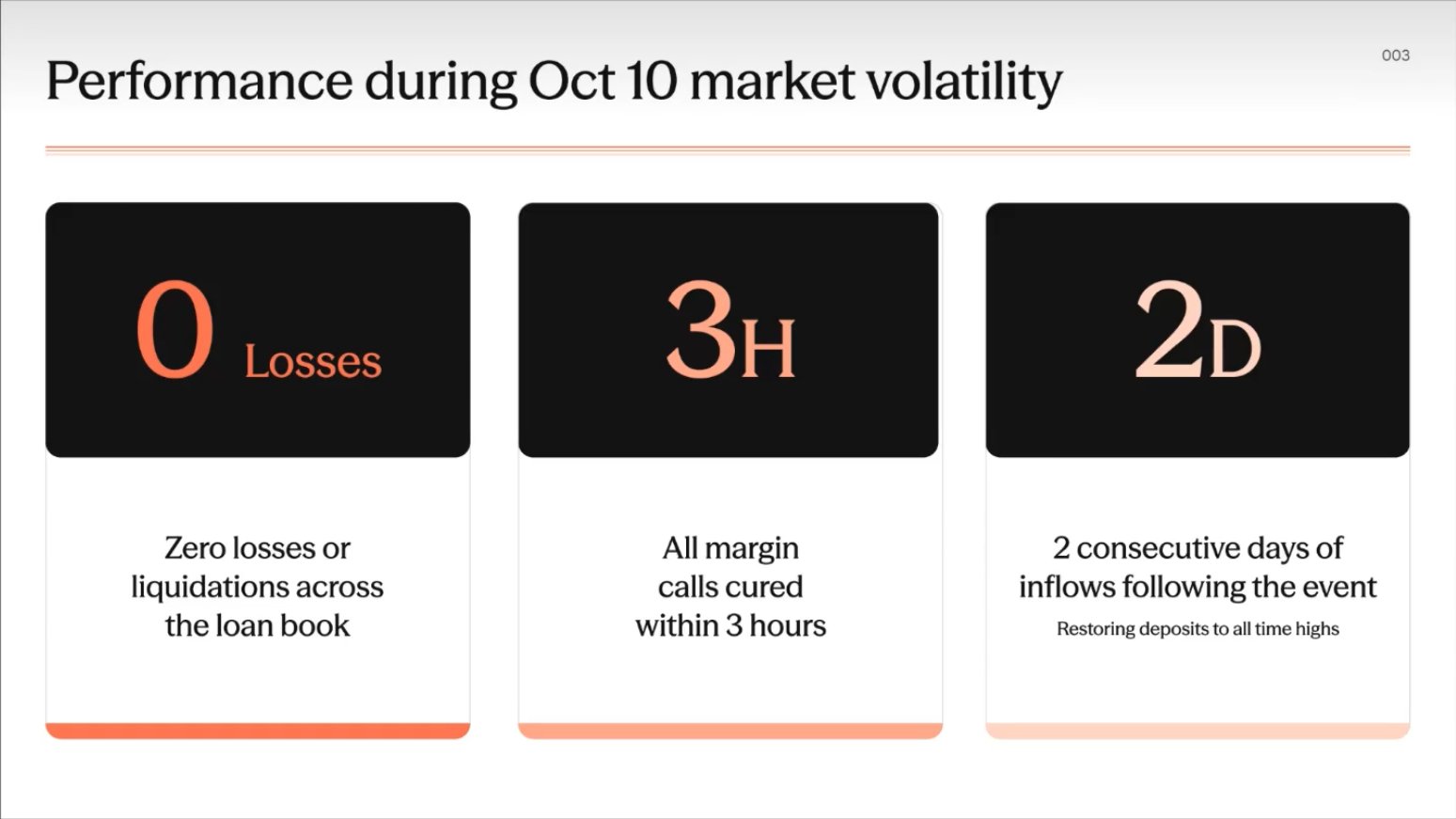

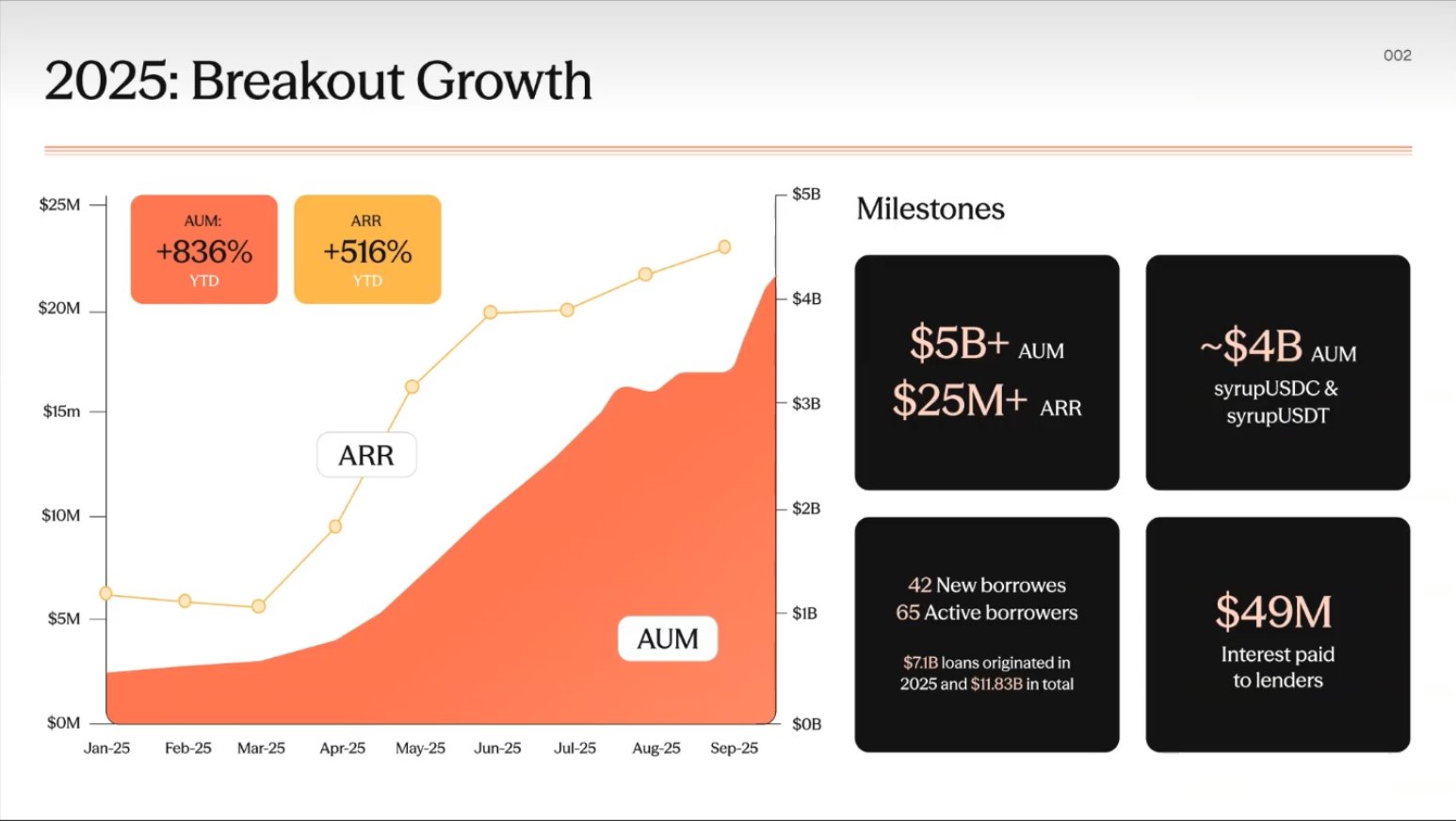

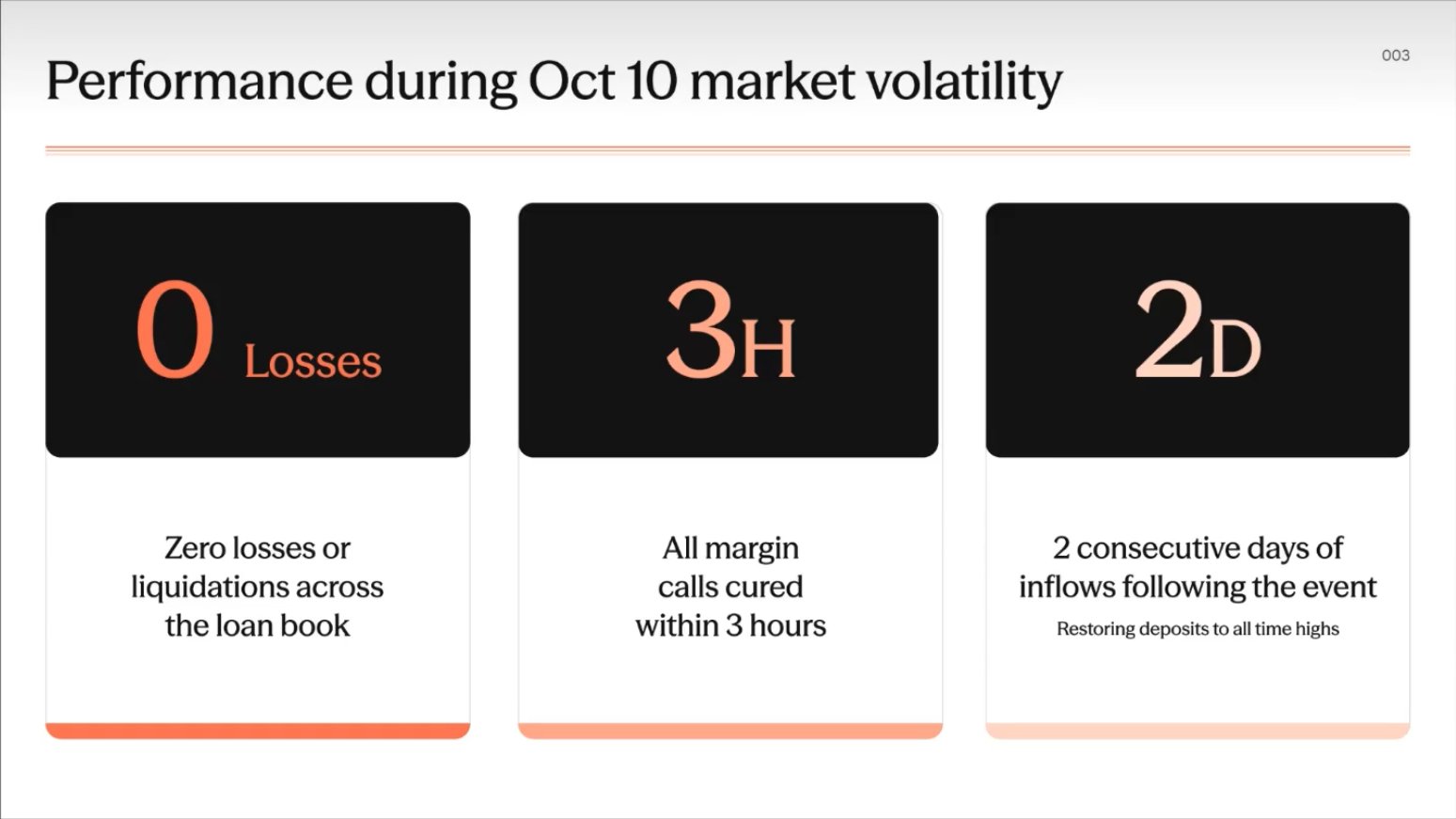

𝐌𝐮𝐛𝐢 𝐂𝐫𝐲𝐩𝐭🦺🧡 DeFi_Expert Influencer B2.22K @Mubi_cryptMaple Finance Q4 Ecosystem Updates (TL;DW) Last week, @maplefinance held its Q4 ecosystem update call. Maple has been scaling rapidly since the beginning of the year, making it the perfect time to hear directly from the team. @syrupsid and @joe_defi discussed about Maple’s 2025 and 2026 strategy during the livestream. 𝗠𝗮𝗽𝗹𝗲’𝘀 2025 𝗠𝗶𝗹𝗲𝘀𝘁𝗼𝗻𝗲𝘀 2025 was a defining year for Maple, marked by significant growth across all core metrics🔻. - Maple’s AUM grew x10 from $500 to $5B - ARR increased by x5 from $5M to $25M - $7B in originated loans in 2025, total loan originated $11B+ - 65 active borrowers & 42 new borrowers As the market faced one of the largest crypto crashes, Maple’s resilience and risk framework proved its strength. 𝗗𝘂𝗿𝗶𝗻𝗴 𝘁𝗵𝗲 𝗹𝗮𝗿𝗴𝗲𝘀𝘁 𝗰𝗿𝘆𝗽𝘁𝗼 𝗰𝗿𝗮𝘀𝗵, @maplefinance 𝗿𝗲𝗰𝗼𝗿𝗱𝗲𝗱 🔻 - Zero liquidation across all loan book. - All margin called cured within 3 hours. - Assets inflow after the liquidation event. This resilience reinforces Maple’s role in shaping the next era of Onchain asset managemen

17 7 461 Оригінал >Тенденція SYRUP після випускуНадзвичайно бичачийMaple Finance Q4 report shows strong growth and resilience.

17 7 461 Оригінал >Тенденція SYRUP після випускуНадзвичайно бичачийMaple Finance Q4 report shows strong growth and resilience. onchainschool.pro OnChain_Analyst Educator S4.46K @how2onchain

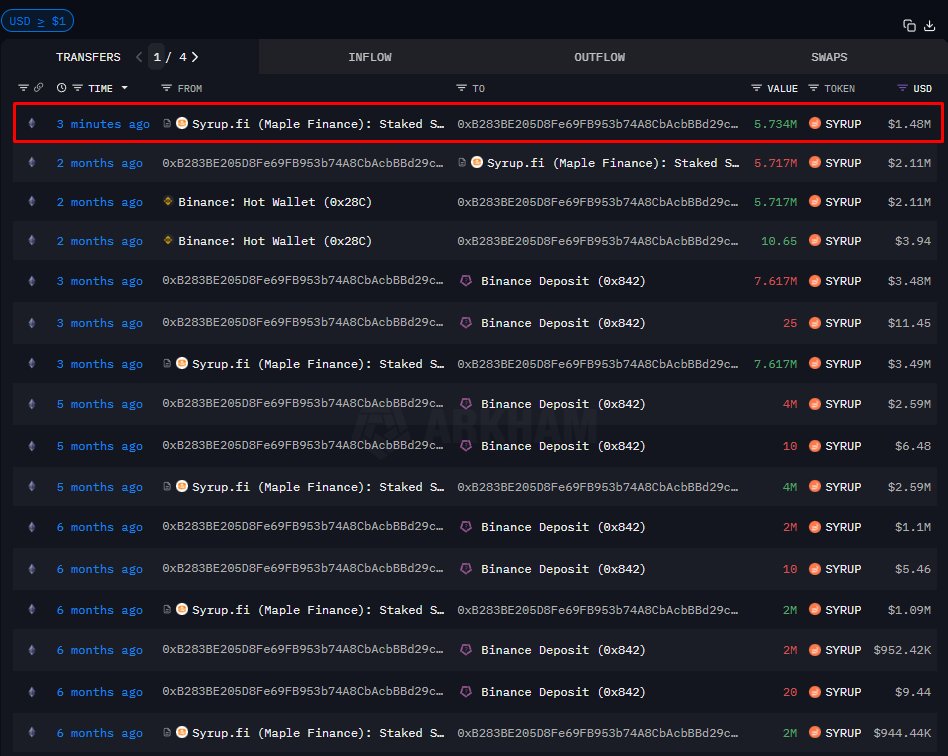

onchainschool.pro OnChain_Analyst Educator S4.46K @how2onchainPOTENTIAL $SYRUP EXCHANGE OUTFLOW AHEAD A wallet has recently unstaked $1.5M worth of $SYRUP Historically, after unstaking, this wallet sends tokens to exchanges, which is often followed by a price reaction These actions tend to occur once per quarter Wallet: 0xB283BE205D8Fe69FB953b74A8CbAcbBBd29c12ae

8 0 1.49K Оригінал >Тенденція SYRUP після випускуВедмежийLarge SYRUP token unstaking could lead to exchange sell pressure and price decline risk

8 0 1.49K Оригінал >Тенденція SYRUP після випускуВедмежийLarge SYRUP token unstaking could lead to exchange sell pressure and price decline risk Crypto Warehouse Influencer Media S5.52K @GibCryptoNews

Crypto Warehouse Influencer Media S5.52K @GibCryptoNewsMaple's supply is surging, probably nothing... @maplefinance // $SYRUP

stablewatch D8.00K @stablewatchHQ

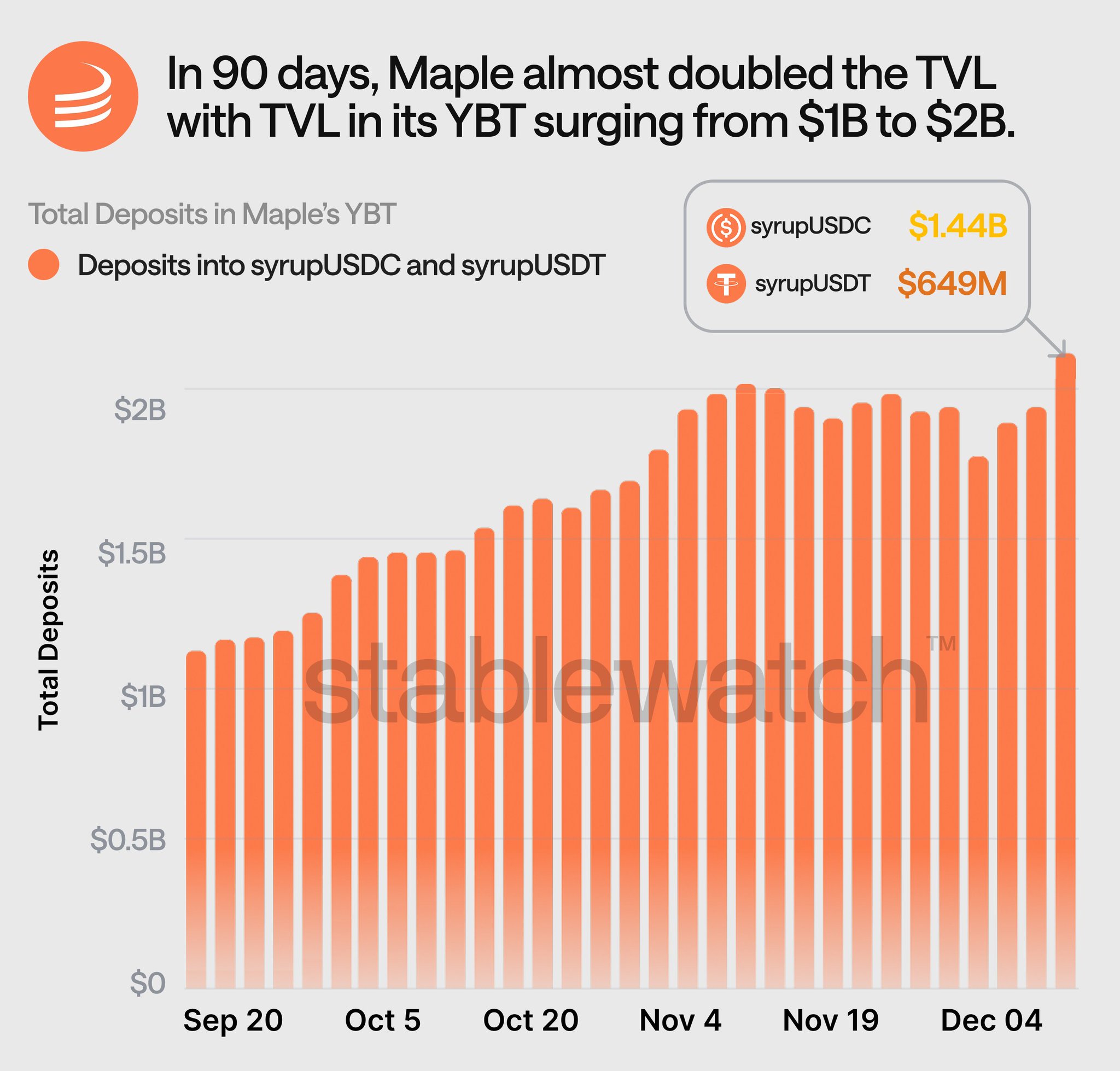

stablewatch D8.00K @stablewatchHQ.@maplefinance’s syrupUSDC and syrupUSDT together just crossed $2B in total supply. That’s nearly a doubling in just 90 days! https://t.co/PCASu7gwaU

34 3 4.54K Оригінал >Тенденція SYRUP після випускуБичачийMaple Finance total supply doubled within 90 days to over $2B.

34 3 4.54K Оригінал >Тенденція SYRUP після випускуБичачийMaple Finance total supply doubled within 90 days to over $2B. YashasEdu DeFi_Expert Researcher B8.54K @YashasEdu

YashasEdu DeFi_Expert Researcher B8.54K @YashasEdu Keno DeFi_Expert Educator A8.67K @kenodnb

Keno DeFi_Expert Educator A8.67K @kenodnb2025 was a breakout year for @maplefinance, with AUM surging from $500M to over $4B, reaching a peak close to $5B. The biggest source of that growth? - syrupUSDC - syrupUSDT If you followed my updates throughout the year, you had plenty of chances to get early exposure to the sweetest yields. We supported Maple through participation, and Maple supported our wallets with some of the highest yields available. Key stats: - $4B+ AUM (from $500M in January) - 65 active borrowers, 42 of them new in 2025 - $7.1B in loans originated this year - $11.83B cumulative since inception - $49M paid in interest to lenders The biggest stress test in crypto history: On October 10, crypto markets experienced the largest liquidation cascade ever recorded. How did Maple perform? - Zero losses or liquidations across the entire loan book - All margin calls cured within 3 hours - Two consecutive days of net inflows during peak market fear - AUM restored to all-time highs within days This was the result of institutional-gra

127 65 4.73K Оригінал >Тенденція SYRUP після випускуНадзвичайно бичачийMaple Finance’s AUM surpassed $4 billion in 2025, and it posted zero losses amid severe market volatility, showing extremely strong performance.

127 65 4.73K Оригінал >Тенденція SYRUP після випускуНадзвичайно бичачийMaple Finance’s AUM surpassed $4 billion in 2025, and it posted zero losses amid severe market volatility, showing extremely strong performance. CryptoJournaal Media Educator C18.60K @CryptoJournaal

CryptoJournaal Media Educator C18.60K @CryptoJournaal#Roadmap 🇳🇱 #MapleFinance ( $SYRUP ) — Complete Roadmap 🧵 From a mission to modernize capital markets to a fully on-chain ecosystem for institutional lending, #MapleFinance has rapidly grown into a cornerstone within decentralized credit markets. Here is the complete journey: Past → Present → Future #CryptoRoadmap 📜 Past: Development & Launch Maple Finance was founded to address inefficiencies in traditional capital markets by combining institutional lending with transparent, verifiable smart contract infrastructure. Key milestones: 🔹 Early Research Phase & Foundations The founding team develops the core principles of permissioned credit pools, undercollateralized loans, and on-chain credit rails with robust risk management. Mechanisms for pool delegates and institutional borrowers are established. 🔹 Launch of On-chain Lending Infrastructure The initial protocol version introduces smart contract-based credit markets, allowing institutional borrowers to access capital through carefully managed lending pools supervised by specialized delegates who perform strict due diligence. 🔹 Growth Phase of Institutional Pools The platform expands with leading credit pools managed by professional credit delegates, including governance mechanisms, advanced reporting tools, and programmable compliance to institutional standards. 🔹 Expansion of the Product Suite New products such as cash management pools, treasury solutions, and improved collateral models support DAOs, businesses, and Web3 treasuries seeking stable, transparent yield. 🔹 Technical Upgrades & Risk Management The protocol integrates active collateral management, borrower verification systems, compliance modules, and multi-signature security features, strengthening Maple's institutional-grade architecture. 🔹 Token Evolution & Governance Formation The ecosystem evolves with the migration to the SYRUP token, harmonizing governance, fee distribution, and community incentives into a single model that encourages long-term participation. 🔹 Ecosystem Expansion Partnerships with protocols, expansions to multiple chains, and integrations with restaking and collateral networks extend Maple's reach as a modular foundation for on-chain institutional lending. Impact: A transformation from a traditional credit concept to a decentralized, risk-managed lending ecosystem that connects institutional finance with DeFi accessibility. #MapleFinanceHistory ⚡ Present: Current Status & Developments Maple now operates as a leading on-chain asset manager combining institutional credit processes with permissionless access to yield within a single integrated ecosystem. Ecosystem Expansion: Partnerships within DeFi and institutional networks enable uniform credit workflows. Developers and institutions use Maple's infrastructure for capital-efficient loans, risk-weighted pools, and compliant access. Technical Progress: Upgrades improve withdrawal flexibility, collateral diversity, restaking integrations, and dynamic risk management. New collateral types and composable credit products increase capital efficiency and usability throughout the ecosystem. Governance & Incentives: SYRUP-based governance drives protocol developments, treasury management, pool approvals, and incentive structures. Reward tiers, staking, and buyback mechanisms strengthen community alignment and sustainable growth. Ecosystem Challenges: Scaling on-chain credit, maintaining transparent risk management, and integrating diverse collateral types remain crucial priorities. Community engagement and robust governance are essential for resilience. #MapleFinanceNow #OnchainCredit 🚀 Future: Planned Roadmap (2025–2030+) Maple's long-term vision focuses on becoming the global leader in tokenized credit markets, with institutional-grade lending across chains and asset types. Key Roadmap Directions: 🔹 Product Expansion & Growth of Institutional Credit A broader suite of lending products, restaking integrations, and varied collateral types increase capital efficiency, with a single unified product stack for both institutions and DeFi users. 🔹 Evolution of Governance Streamlined upgrade processes, contributor accountability systems, and strategic community initiatives strengthen the protocol's decentralized leadership model. 🔹 Ecosystem Growth Deeper integrations with DeFi platforms, liquidity partners, and traditional credit parties reinforce Maple's role within global financial markets. 🔹 AI-Driven Credit Models & New RWA Verticals AI-driven credit scoring, multi-chain lending, and tokenization of assets such as real estate, commodities, and trade finance open new avenues for institutional credit. 🔹 Global Tokenized Credit Layer The long-term vision includes a fully modular, globally adoptive on-chain credit infrastructure that is interoperable between institutions, chains, and asset classes. Impact: Increased global credit access, institutional participation, and the evolution of a scalable, transparent, and community-aligned financial ecosystem. Risks & Opportunities: Multi-chain complexity, credit risk, and institutional integration pose challenges. Strong governance, ecosystem engagement, and continuous technical innovation form the basis for sustainable success. #MapleFinanceFuture #OnchainInstitutionalLending ✅ Conclusion Maple Finance has evolved from an institutional credit concept into a robust, community-aligned on-chain credit ecosystem that enables scalable and transparent financial products for borrowers and lenders worldwide. With innovations in credit infrastructure, collateral management, governance, and ecosystem integration, $SYRUP strengthens the next generation of decentralized institutional finance. #RoadmapConclusion 🛒 Want to buy $SYRUP yourself? $SYRUP is easy to buy on #Bitvavo: ✅ More than 400 #Altcoins available ✅ Up to €100,000 #Accountguarantee ✅ Registered with De Nederlandsche Bank (#DNB) ✅ Sign up via the link below and trade up to €10,000 completely #Free! 🔗 https://t.co/DThEHyXfzf #CryptoJournaal #AltcoinPedia #Bitcoin #Crypto #Exchange 📚 Useful resources and additional information Want to know more about #MapleFinance ( $SYRUP )? Check out the official channels and documentation below: 🔹GitHub: https://t.co/CXitHg5Bsn 🔹Telegram: https://t.co/o4CgWTxyX1 🔹Website: https://t.co/LYlceluPcB 🔹X (Twitter): https://t.co/QO1vqfFkBY ⚠️ Important note: 🔹 This post is purely for educational purposes and not financial advice! 🔹 Only invest what you are willing to lose! ----------------- 👇Follow us👇 ----------------- 🚨 Follow @CryptoJournaal – the place for independent crypto information: 📰 News | 📊 Facts | 🧠 Backgrounds | 🎓 Education 💬 No sponsored tokens 📜 Fully MiCAR-compliant 🔍 Always knowledge over hype 📲 Join us via: 🌐 Website: https://t.co/i0eHsaqt3O 📘 Facebook: https://t.co/he5bTXLFXR 💬 Telegram: https://t.co/i976fBvtv0 👥 CryptoJournaal-AltcoinPedia Community: https://t.co/3yFdzLLS2O 🐦 X-profile: https://t.co/fd2bI2MInh #Altcoins #Bitcoin #CryptoNews #CryptoEducation #CryptoCourses

4 0 99 Оригінал >Тенденція SYRUP після випускуНадзвичайно бичачийMaple Finance (SYRUP) details its roadmap, aiming to become the global leader in tokenized credit markets.

4 0 99 Оригінал >Тенденція SYRUP після випускуНадзвичайно бичачийMaple Finance (SYRUP) details its roadmap, aiming to become the global leader in tokenized credit markets. CryptoJournaal Media Educator C18.60K @CryptoJournaal

CryptoJournaal Media Educator C18.60K @CryptoJournaal#Roadmap 🇬🇧 #MapleFinance ( $SYRUP ) — Complete Roadmap 🧵 From a mission to modernize capital markets to a fully onchain institutional lending ecosystem, #MapleFinance has rapidly evolved into a foundational force in decentralized credit. Here is the complete journey: Past → Present → Future #CryptoRoadmap 📜 Past: Development & Launch Maple Finance was founded to address inefficiencies in traditional capital markets by combining institutional-grade lending with transparent, verifiable smart contract infrastructure. Key milestones: 🔹 Early Research & Foundations The founding team establishes the principles of permissioned credit pools, undercollateralized lending, and risk-managed onchain credit rails. Core mechanisms for pool delegates and institutional borrowers are developed. 🔹 Launch of Onchain Lending Infrastructure The initial protocol introduces smart contract–based credit markets, enabling institutional borrowers to access capital through curated lending pools overseen by specialized delegates performing rigorous due diligence. 🔹 Growth of Institutional Pools The platform expands with flagship lending pools managed by professional credit delegates, integrating governance mechanisms, enhanced reporting tools, and programmable compliance to match institutional standards. 🔹 Expansion of Product Suite New offerings such as cash management pools, treasury products, and enhanced collateral frameworks are introduced to support DAOs, corporates, and Web3 treasuries seeking stable, transparent yield. 🔹 Technical Upgrades & Risk Management The protocol integrates active collateral management, borrower verification systems, programmable compliance modules, and multi-signature security enhancements, strengthening Maple’s institutional-grade architecture. 🔹 Token Evolution & Governance Formation The ecosystem evolves with a migration to the SYRUP token, aligning governance, fee distribution, and community incentives around a unified model that reinforces long-term ecosystem participation. 🔹 Ecosystem Expansion Partnerships with major protocols, expansions across chains, and integrations with restaking and collateral networks broaden Maple’s reach as a modular foundation for onchain institutional credit. Impact: A transformation from a traditional credit concept into a decentralized, risk-managed lending ecosystem bridging institutional finance with DeFi accessibility. #MapleFinanceHistory ⚡ Present: Current Status & Developments Maple now operates as a leading onchain asset manager, combining institutional lending workflows with permissionless access to yield through its integrated ecosystem. Ecosystem Expansion: Partnerships across DeFi and institutional platforms enable unified credit workflows. Developers and institutions leverage Maple’s infrastructure for capital-efficient borrowing, risk-managed pools, and compliant access portals. Technical Advancements: Upgrades enhance withdrawal flexibility, collateral diversification, restaking integrations, and dynamic risk management. New collateral types and composable credit products expand capital efficiency and usability across the ecosystem. Governance & Incentives: SYRUP-governed mechanisms guide protocol upgrades, treasury deployment, pool approvals, and incentive design. Reward tiers, staking, and buyback flows align the community with the protocol’s long-term growth trajectory. Ecosystem Challenges: Scaling onchain credit, sustaining transparent risk management, and integrating diverse collateral types remain core focus areas. Community participation and robust governance are essential to ecosystem resilience. #MapleFinanceNow #OnchainCredit 🚀 Future: Planned Roadmap (2025–2030+) Maple’s long-term vision centers on becoming the global leader in tokenized credit, powering institutional‑grade lending across chains and assets. Key Roadmap Directions: 🔹 Product Expansion & Institutional Credit Growth Broader lending products, restaking integrations, and diversified collateral types enhance capital efficiency, enabling a unified suite for institutions and DeFi participants alike. 🔹 Advancement of Governance Streamlined upgrade processes, contributor accountability systems, and strategic community‑led initiatives strengthen decentralized leadership and ensure protocol continuity. 🔹 Ecosystem Growth Deeper integrations with DeFi platforms, liquidity partners, and real‑world credit participants expand Maple’s presence across global financial markets. 🔹 AI‑Powered Credit & New RWA Verticals AI‑driven credit scoring, multi‑chain lending frameworks, and tokenization of assets such as real estate, commodities, and trade finance unlock new institutional credit pathways. 🔹 Global Tokenized Credit Layer The long‑term vision includes a fully modular, globally adopted onchain credit network interoperable across institutions, chains, and asset classes. Impact: Expansion of global credit accessibility, institutional participation, and the evolution of a highly scalable, transparent, and community‑aligned financial infrastructure. Risks & Opportunities: Complex multi‑chain scaling, credit risk, and institutional integrations pose challenges. Strong governance, ecosystem participation, and continuous technical innovation form the foundation for sustainable long‑term growth. #MapleFinanceFuture #OnchainInstitutionalLending ✅ Conclusion Maple Finance has grown from an institutional lending concept into a robust, community‑aligned onchain credit ecosystem enabling scalable, transparent financial products for borrowers and lenders worldwide. With innovations in credit infrastructure, collateral management, governance, and ecosystem integrations, $SYRUP strengthens the next generation of decentralized institutional finance. #RoadmapConclusion 🛒 Want to trade $SYRUP on #WEEX? WEEX is a global #Exchange where you can easily start trading crypto and futures: ✅ Access to 1,700+ #Altcoins ✅ Up to $30,000 USDT in #Bonuses for new users ✅ User‑friendly app & web platform ✅ Trusted exchange with millions of traders worldwide 👉 Sign up now via the link below and claim your welcome bonus! 🔗 https://t.co/q8pSdzpIh8 #CryptoJournaal #AltcoinPedia #Bitcoin #Crypto #Exchange #Futures ⚠️ Important Note: 🔹 This post is for educational purposes only and not financial advice! 🔹 Only invest what you are willing to loss! 📚 Useful resources and additional information: Want to dive deeper into the world of #MapleFinance ( $SYRUP ) or looking for the latest updates and developments? These links will help you stay up to date: 🔹GitHub: https://t.co/CXitHg5Bsn 🔹Telegram: https://t.co/o4CgWTxyX1 🔹Website: https://t.co/LYlceluPcB 🔹X (Twitter): https://t.co/QO1vqfFkBY ----------------- 👇Follow us👇 ----------------- 🚨 Follow @CryptoJournaal – the go‑to source for independent crypto information: 📰 News | 📊 Facts | 🧠 Insights | 🎓 Education 💬 No sponsored tokens 📜 Fully MiCAR‑compliant 🔍 Knowledge over hype, always 📲 Join via: 🌐 Website: https://t.co/i0eHsaqt3O 📘 Facebook: https://t.co/he5bTXLFXR 💬 Telegram: https://t.co/i976fBvtv0 👥 CryptoJournaal‑AltcoinPedia Community: https://t.co/3yFdzLLS2O 🐦 X‑profiel: https://t.co/fd2bI2MInh #Altcoins #Bitcoin #CryptoNews #CryptoEducation #CryptoPrices

3 1 260 Оригінал >Тенденція SYRUP після випускуНадзвичайно бичачийMaple Finance releases an ambitious roadmap, aiming to become the global leader in tokenized credit through SYRUP, driving institutional DeFi development.

3 1 260 Оригінал >Тенденція SYRUP після випускуНадзвичайно бичачийMaple Finance releases an ambitious roadmap, aiming to become the global leader in tokenized credit through SYRUP, driving institutional DeFi development. 𝐌𝐮𝐛𝐢 𝐂𝐫𝐲𝐩𝐭🦺🧡 DeFi_Expert Influencer B2.22K @Mubi_crypt

𝐌𝐮𝐛𝐢 𝐂𝐫𝐲𝐩𝐭🦺🧡 DeFi_Expert Influencer B2.22K @Mubi_crypt Keno DeFi_Expert Educator A8.67K @kenodnb

Keno DeFi_Expert Educator A8.67K @kenodnb2025 was a breakout year for @maplefinance, with AUM surging from $500M to over $4B, reaching a peak close to $5B. The biggest source of that growth? - syrupUSDC - syrupUSDT If you followed my updates throughout the year, you had plenty of chances to get early exposure to the sweetest yields. We supported Maple through participation, and Maple supported our wallets with some of the highest yields available. Key stats: - $4B+ AUM (from $500M in January) - 65 active borrowers, 42 of them new in 2025 - $7.1B in loans originated this year - $11.83B cumulative since inception - $49M paid in interest to lenders The biggest stress test in crypto history: On October 10, crypto markets experienced the largest liquidation cascade ever recorded. How did Maple perform? - Zero losses or liquidations across the entire loan book - All margin calls cured within 3 hours - Two consecutive days of net inflows during peak market fear - AUM restored to all-time highs within days This was the result of institutional-gra

127 65 4.73K Оригінал >Тенденція SYRUP після випускуНадзвичайно бичачийMaple Finance AUM exceeds $5 billion, with zero losses amid market volatility.

127 65 4.73K Оригінал >Тенденція SYRUP після випускуНадзвичайно бичачийMaple Finance AUM exceeds $5 billion, with zero losses amid market volatility.

- Немає даних