Ethereum (ETH)

Ethereum (ETH)

$2,062.51 -0.56% 24H

- 63Індекс соціальних настроїв (SSI)-3.60% (24h)

- #86Рейтинг пульсу ринку (MPR)+22

- 20524-годинні згадки в соціальних мережах-24.82% (24h)

- 66%24-годинний коефіцієнт бичачого настрою KOL135 Активних KOL

- Підсумок

- Бичачі сигнали

- Ведмежі сигнали

Індекс соціальних настроїв (SSI)

- Загальні дані63SSI

- Тенденція SSI (7 днів)Ціна (7 днів)Розподіл настроївНадзвичайно бичачий (26%)Бичачий (40%)Нейтральні (14%)Ведмежий (16%)Надзвичайно ведмежий (4%)Аналітика SSI

Рейтинг пульсу ринку (MPR)

- Аналітика сповіщень

Дописи з платформи X

- Тенденція ETH після випускуНадзвичайно бичачий

- Тенденція ETH після випускуНейтральні

- Тенденція ETH після випускуБичачий

- Тенденція ETH після випускуНейтральні

- Тенденція ETH після випускуБичачий

- Тенденція ETH після випускуНадзвичайно бичачий

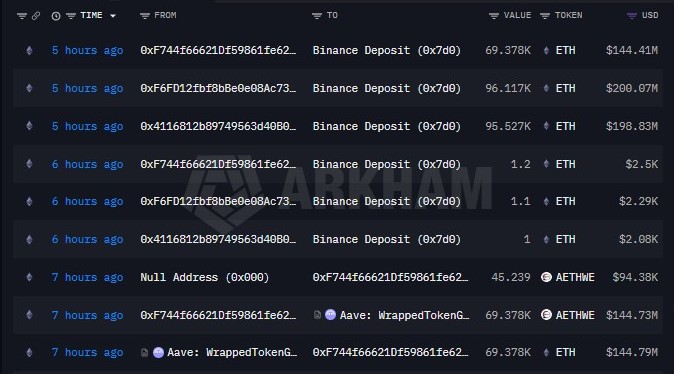

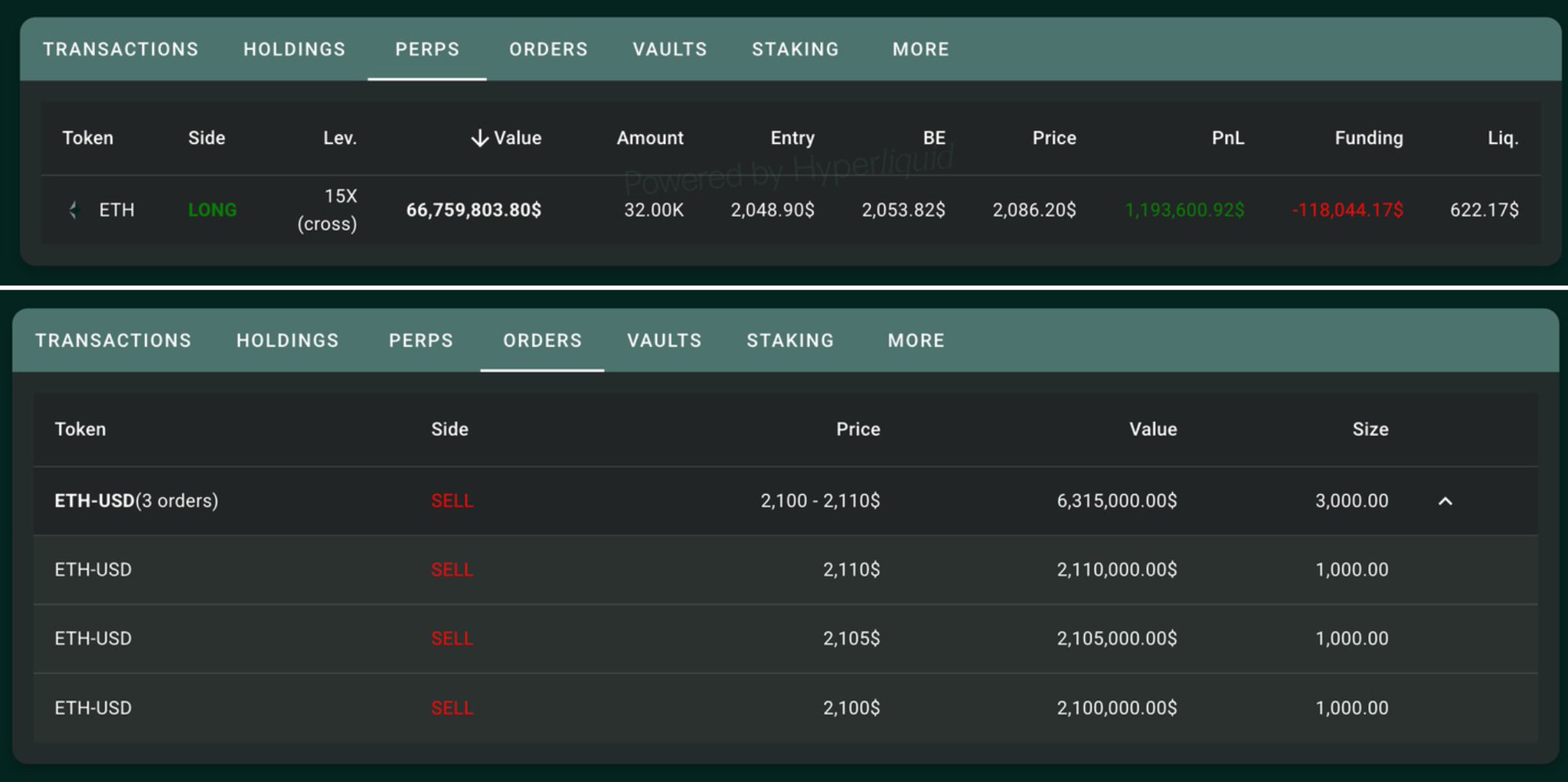

icefrog.◎ 🇻🇳 | 🎒 OnChain_Analyst Tokenomics_Expert B6.80K @icefrog_sol

icefrog.◎ 🇻🇳 | 🎒 OnChain_Analyst Tokenomics_Expert B6.80K @icefrog_sol 0xCenk.ETH D557 @Cenk_SsS6 4 39 Оригінал >Тенденція ETH після випускуВедмежий

0xCenk.ETH D557 @Cenk_SsS6 4 39 Оригінал >Тенденція ETH після випускуВедмежий EyeOnChain OnChain_Analyst Trader C5.51K @EyeOnChain

EyeOnChain OnChain_Analyst Trader C5.51K @EyeOnChain

EyeOnChain OnChain_Analyst Trader C5.51K @EyeOnChain

EyeOnChain OnChain_Analyst Trader C5.51K @EyeOnChain 1 1 81 Оригінал >Тенденція ETH після випускуВедмежий

1 1 81 Оригінал >Тенденція ETH після випускуВедмежий- Тенденція ETH після випускуНейтральні

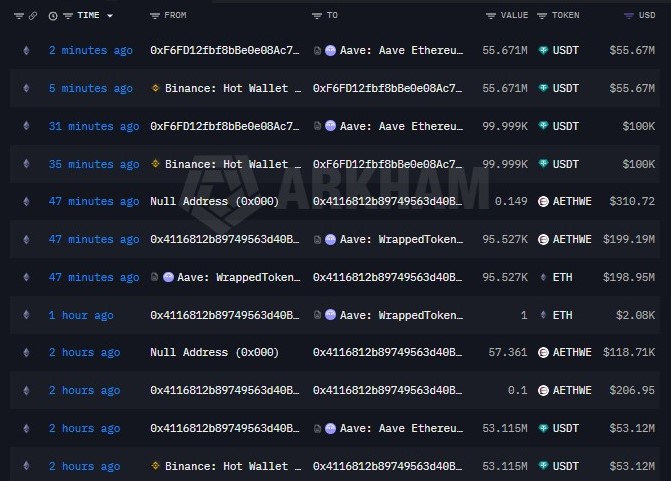

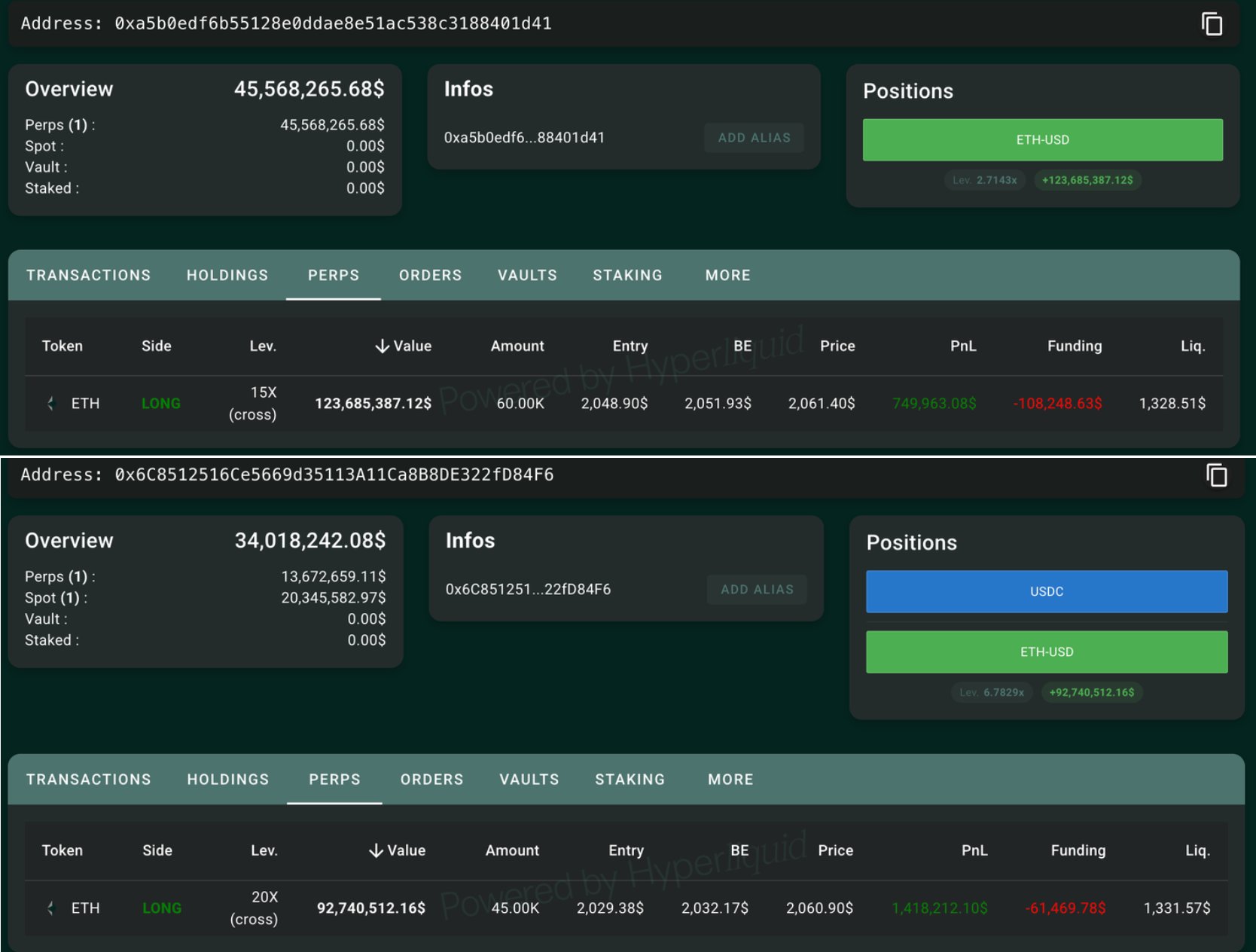

Ai 姨 OnChain_Analyst Media B127.40K @ai_9684xtpa

Ai 姨 OnChain_Analyst Media B127.40K @ai_9684xtpa

Ai 姨 OnChain_Analyst Media B127.40K @ai_9684xtpa

Ai 姨 OnChain_Analyst Media B127.40K @ai_9684xtpa 13 1 4.05K Оригінал >Тенденція ETH після випускуНадзвичайно бичачий

13 1 4.05K Оригінал >Тенденція ETH після випускуНадзвичайно бичачий