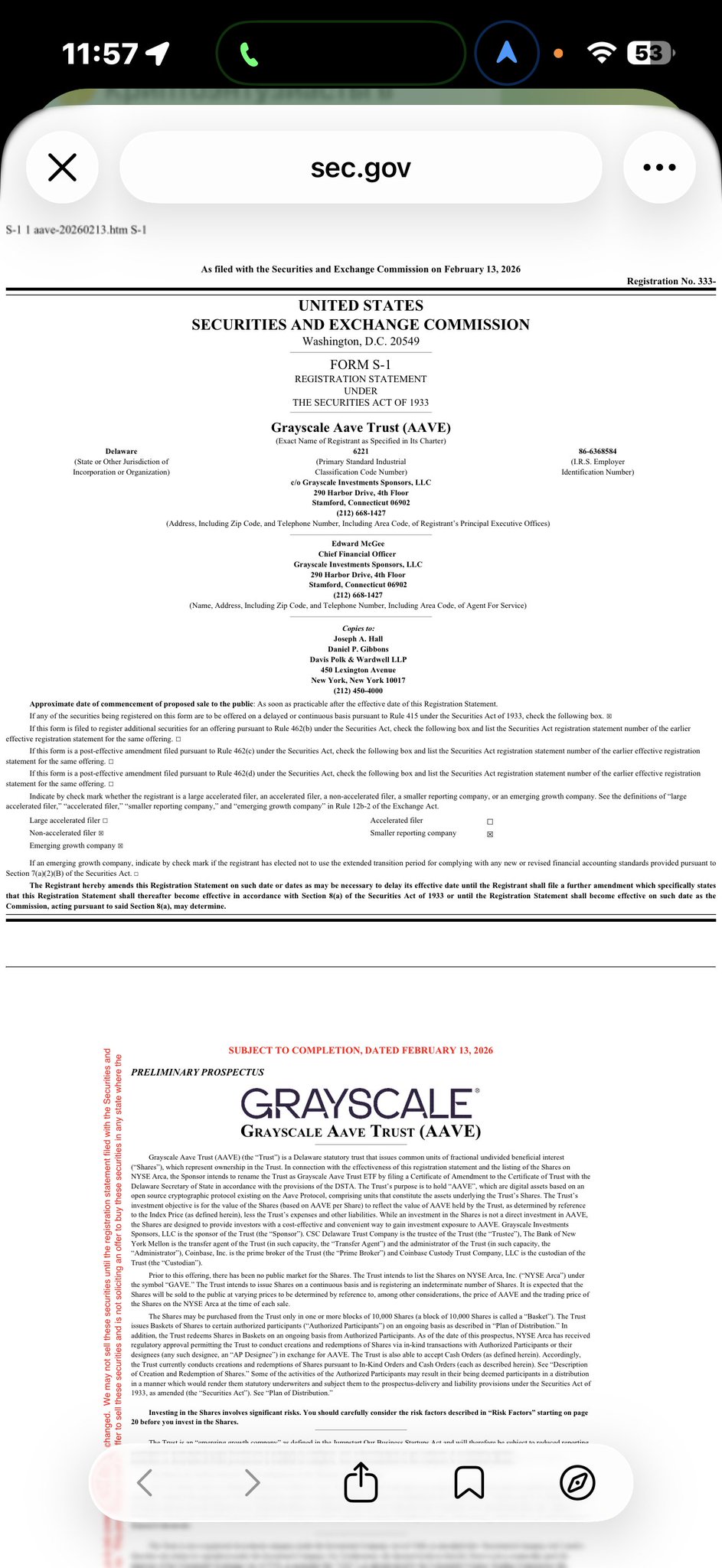

Aave (AAVE)

Aave (AAVE)

$129.11 +1.41% 24H

- 78Індекс соціальних настроїв (SSI)-6.10% (24h)

- #35Рейтинг пульсу ринку (MPR)+10

- 2724-годинні згадки в соціальних мережах-37.21% (24h)

- 93%24-годинний коефіцієнт бичачого настрою KOL21 Активних KOL

- Підсумок

- Бичачі сигнали

- Ведмежі сигнали

Індекс соціальних настроїв (SSI)

- Загальні дані78SSI

- Тенденція SSI (7 днів)Ціна (7 днів)Розподіл настроївНадзвичайно бичачий (41%)Бичачий (52%)Нейтральні (7%)Аналітика SSI

Рейтинг пульсу ринку (MPR)

- Аналітика сповіщень

Дописи з платформи X

- Тенденція AAVE після випускуНадзвичайно бичачий

- Тенденція AAVE після випускуБичачий

- Тенденція AAVE після випускуБичачий

CM FA_Analyst DeFi_Expert A54.63K @cmdefi

CM FA_Analyst DeFi_Expert A54.63K @cmdefi Cointelegraph Media Influencer C2.90M @Cointelegraph

Cointelegraph Media Influencer C2.90M @Cointelegraph

43 15 13.92K Оригінал >Тенденція AAVE після випускуНадзвичайно бичачий

43 15 13.92K Оригінал >Тенденція AAVE після випускуНадзвичайно бичачий robbie Media Influencer B4.51K @robbie_rollup

robbie Media Influencer B4.51K @robbie_rollup Stani.eth Founder DeFi_Expert C282.51K @StaniKulechov149 21 9.59K Оригінал >Тенденція AAVE після випускуБичачий

Stani.eth Founder DeFi_Expert C282.51K @StaniKulechov149 21 9.59K Оригінал >Тенденція AAVE після випускуБичачий Ansem Trader Influencer C787.14K @blknoiz06

Ansem Trader Influencer C787.14K @blknoiz06 insomniac D10.49K @insomniacxbt

insomniac D10.49K @insomniacxbt

148 10 45.87K Оригінал >Тенденція AAVE після випускуНадзвичайно бичачий

148 10 45.87K Оригінал >Тенденція AAVE після випускуНадзвичайно бичачий Stani.eth Founder DeFi_Expert C282.51K @StaniKulechov

Stani.eth Founder DeFi_Expert C282.51K @StaniKulechov Yannis D3.47K @yannisDeFi

Yannis D3.47K @yannisDeFi 79 8 4.99K Оригінал >Тенденція AAVE після випускуНадзвичайно бичачий

79 8 4.99K Оригінал >Тенденція AAVE після випускуНадзвичайно бичачий Stani.eth Founder DeFi_Expert C282.51K @StaniKulechov

Stani.eth Founder DeFi_Expert C282.51K @StaniKulechov Coin Bureau Educator Media C1.08M @coinbureau

Coin Bureau Educator Media C1.08M @coinbureau

277 42 17.11K Оригінал >Тенденція AAVE після випускуБичачий

277 42 17.11K Оригінал >Тенденція AAVE після випускуБичачий- Тенденція AAVE після випускуНадзвичайно бичачий

- Тенденція AAVE після випускуНадзвичайно бичачий