ZETA (ZETA)

ZETA (ZETA)

$0.05529 -2.85% 24H

- 31Индекс социальных настроений (SSI)-12.96% (24h)

- #9Рейтинг пульса рынка (MPR)+3

- 1Упоминание в социальных сетях за 24 часа0% (24h)

- 0%24-часовой бычий коэффициент лидеров мнений1 активный лидер мнений

- Краткое содержание

- Бычьи сигналы

- Медвежьи сигналы

Индекс социальных настроений (SSI)

- Общие данные31SSI

- Тренд SSI (7 дн.)Цена (7 дн.)Распределение настроенийЧрезвычайно медвежий (100%)Инсайты по SSI

Рейтинг пульса рынка (MPR)

- Инсайт Оповещение

Посты из X

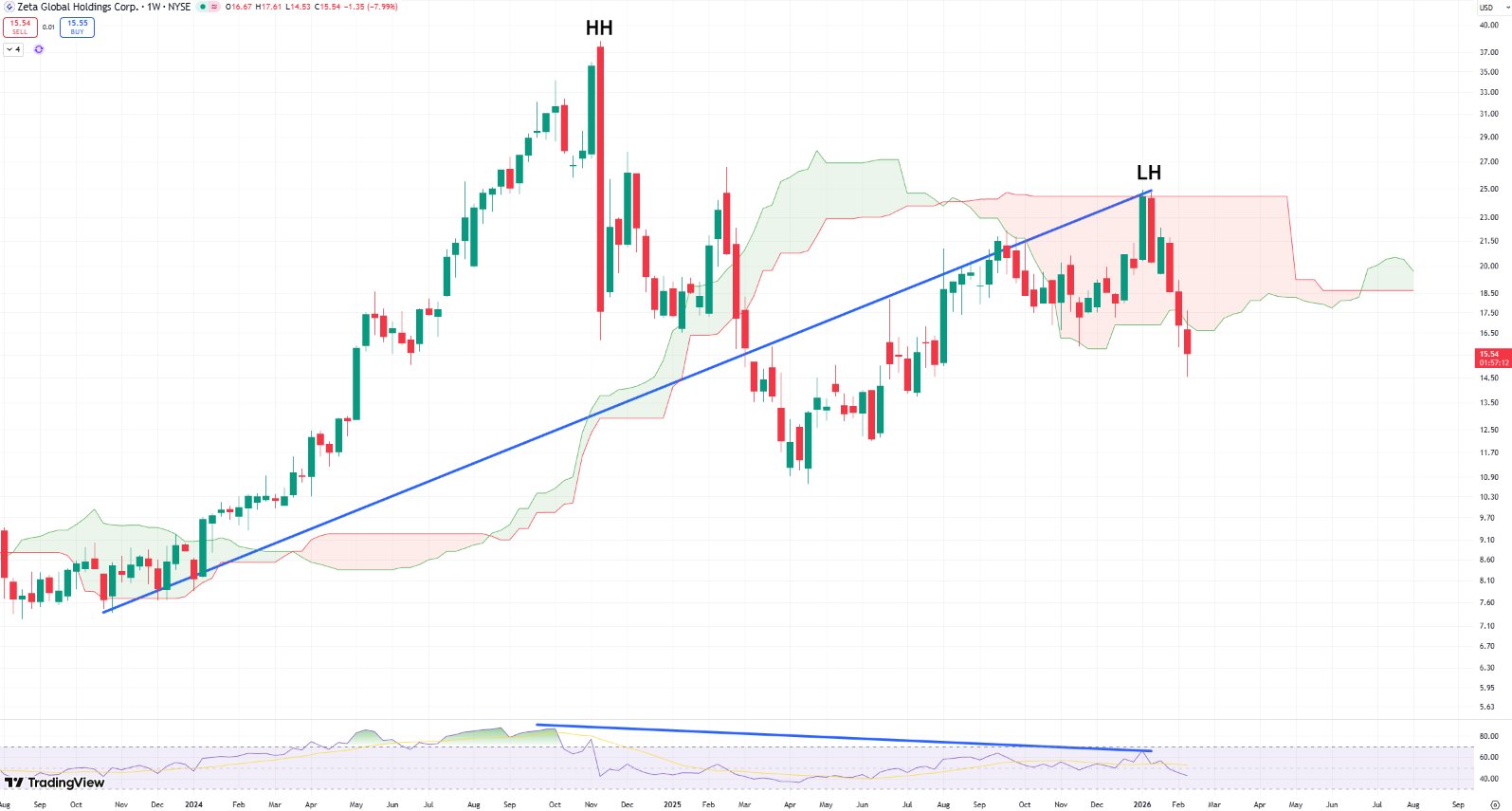

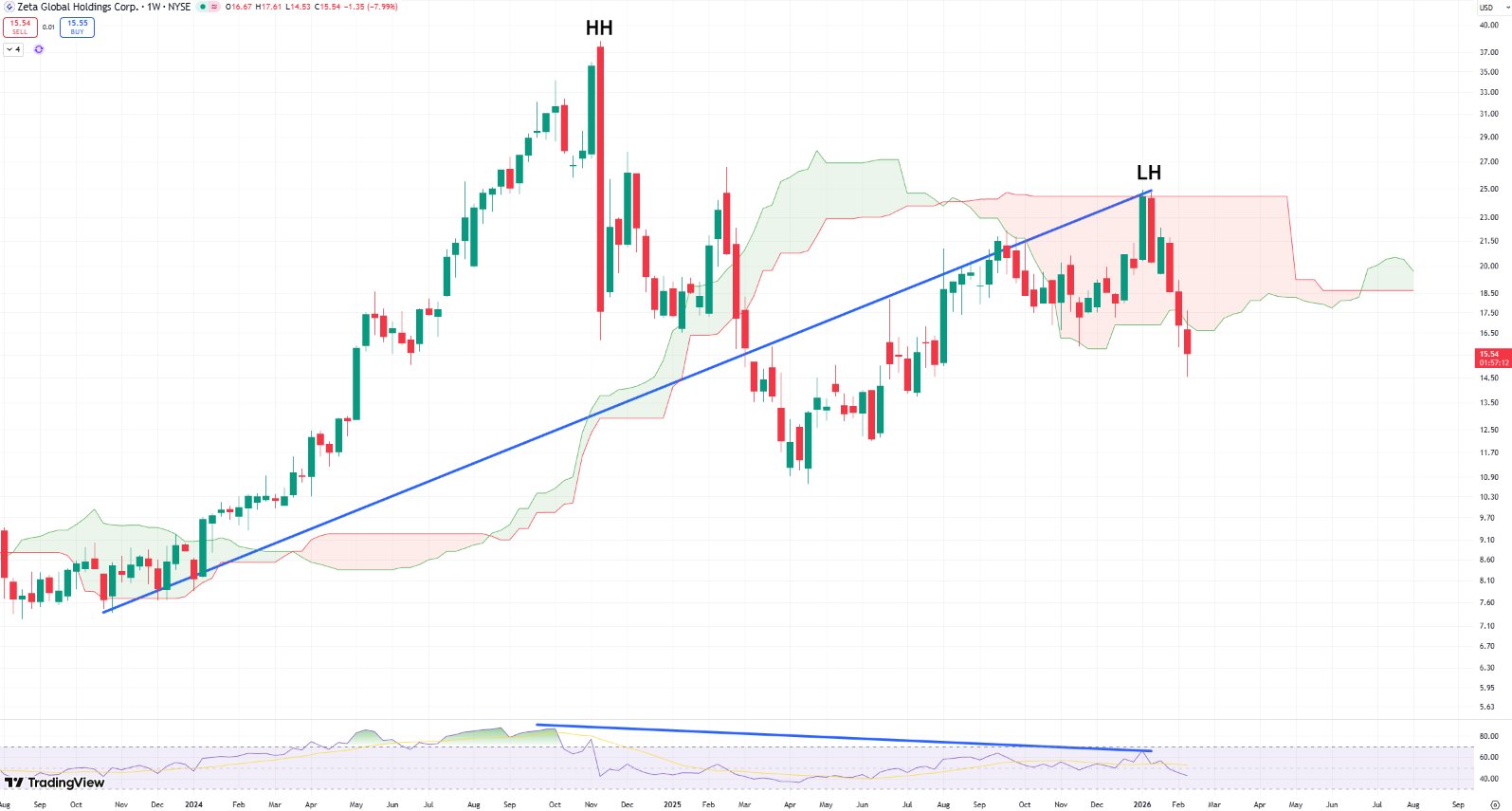

Chris The KOL states in their bio that they have over 10 years of equity and crypto swing trading experience. Their tweets frequently publish detailed technical chart analyses (such as candlestick patterns, Ichimoku, RSI, support and resistance, etc.) along with clear price targets and entry/exit points, making them a typical technical analysis and trading strategy sharer; the extensive buy/short signals and take-profit/stop-loss settings reflect the characteristics of a Trader. Valid A27.68K @StonkChris

Chris The KOL states in their bio that they have over 10 years of equity and crypto swing trading experience. Their tweets frequently publish detailed technical chart analyses (such as candlestick patterns, Ichimoku, RSI, support and resistance, etc.) along with clear price targets and entry/exit points, making them a typical technical analysis and trading strategy sharer; the extensive buy/short signals and take-profit/stop-loss settings reflect the characteristics of a Trader. Valid A27.68K @StonkChris Chris The KOL states in their bio that they have over 10 years of equity and crypto swing trading experience. Their tweets frequently publish detailed technical chart analyses (such as candlestick patterns, Ichimoku, RSI, support and resistance, etc.) along with clear price targets and entry/exit points, making them a typical technical analysis and trading strategy sharer; the extensive buy/short signals and take-profit/stop-loss settings reflect the characteristics of a Trader. Valid A27.68K @StonkChris

Chris The KOL states in their bio that they have over 10 years of equity and crypto swing trading experience. Their tweets frequently publish detailed technical chart analyses (such as candlestick patterns, Ichimoku, RSI, support and resistance, etc.) along with clear price targets and entry/exit points, making them a typical technical analysis and trading strategy sharer; the extensive buy/short signals and take-profit/stop-loss settings reflect the characteristics of a Trader. Valid A27.68K @StonkChris

128 35 19.93K Оригинал >Тренд ZETA после выпускаЧрезвычайно медвежий

128 35 19.93K Оригинал >Тренд ZETA после выпускаЧрезвычайно медвежий Chris The KOL states in their bio that they have over 10 years of equity and crypto swing trading experience. Their tweets frequently publish detailed technical chart analyses (such as candlestick patterns, Ichimoku, RSI, support and resistance, etc.) along with clear price targets and entry/exit points, making them a typical technical analysis and trading strategy sharer; the extensive buy/short signals and take-profit/stop-loss settings reflect the characteristics of a Trader. Valid A27.68K @StonkChris

Chris The KOL states in their bio that they have over 10 years of equity and crypto swing trading experience. Their tweets frequently publish detailed technical chart analyses (such as candlestick patterns, Ichimoku, RSI, support and resistance, etc.) along with clear price targets and entry/exit points, making them a typical technical analysis and trading strategy sharer; the extensive buy/short signals and take-profit/stop-loss settings reflect the characteristics of a Trader. Valid A27.68K @StonkChris

128 35 19.93K Оригинал >Тренд ZETA после выпускаЧрезвычайно медвежий

128 35 19.93K Оригинал >Тренд ZETA после выпускаЧрезвычайно медвежий Trader Jim TA_Analyst Trader C3.91K @Trades_with_Jim

Trader Jim TA_Analyst Trader C3.91K @Trades_with_Jim

Trader Jim TA_Analyst Trader C3.91K @Trades_with_Jim

Trader Jim TA_Analyst Trader C3.91K @Trades_with_Jim 1 0 403 Оригинал >Тренд ZETA после выпускаЧрезвычайно медвежий

1 0 403 Оригинал >Тренд ZETA после выпускаЧрезвычайно медвежий- Тренд ZETA после выпускаЧрезвычайно бычий

- Тренд ZETA после выпускаБычий

- Тренд ZETA после выпускаЧрезвычайно бычий

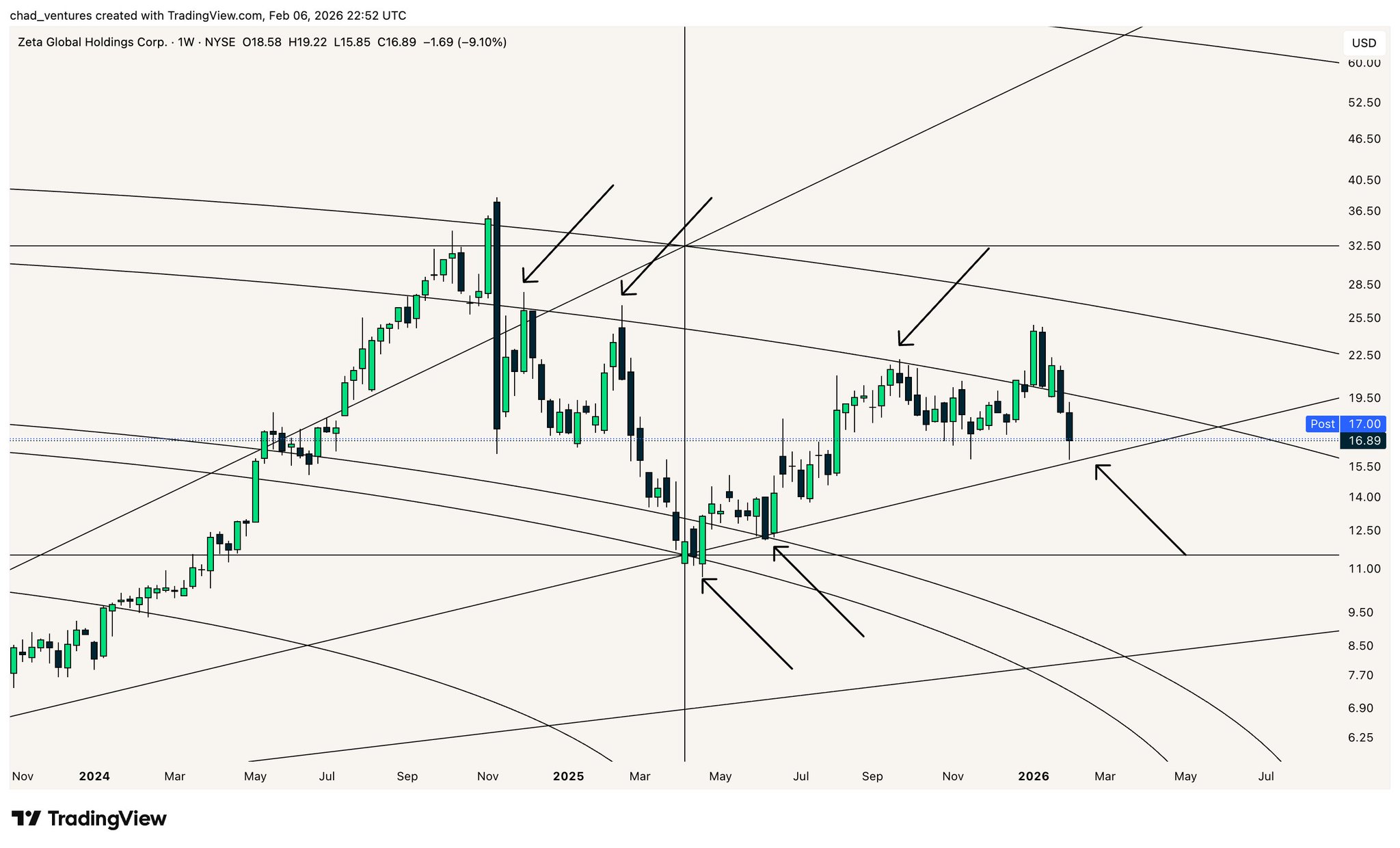

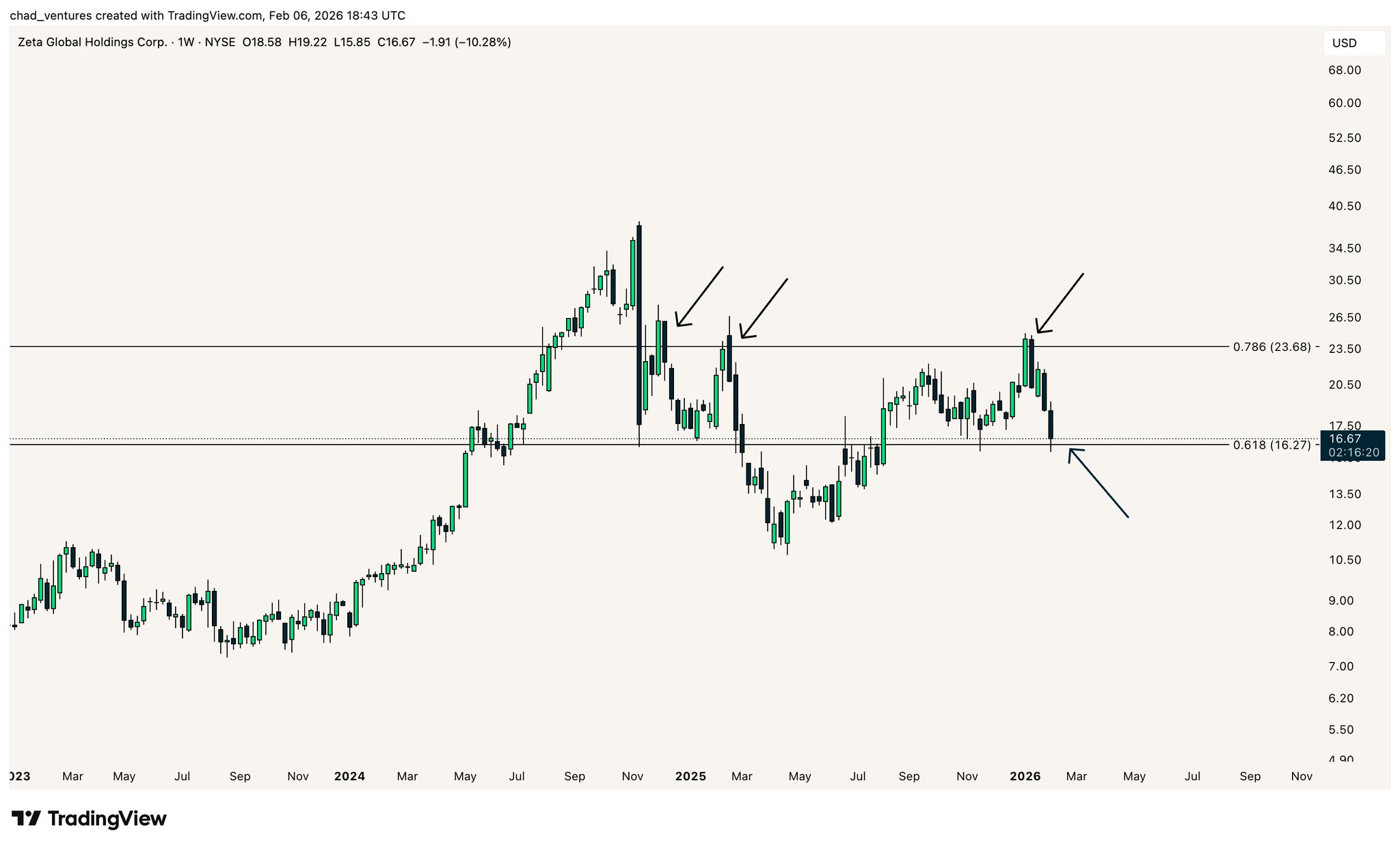

chad. TA_Analyst Trader B13.31K @chad_ventures

chad. TA_Analyst Trader B13.31K @chad_ventures

chad. TA_Analyst Trader B13.31K @chad_ventures

chad. TA_Analyst Trader B13.31K @chad_ventures 14 0 1.93K Оригинал >Тренд ZETA после выпускаНейтрально

14 0 1.93K Оригинал >Тренд ZETA после выпускаНейтрально- Тренд ZETA после выпускаБычий

Abnormal AI FA_Analyst OnChain_Analyst B1.29K @AbnormalAIX

Abnormal AI FA_Analyst OnChain_Analyst B1.29K @AbnormalAIX ZetaChain 🟩 D1.02M @ZetaChain

ZetaChain 🟩 D1.02M @ZetaChain 4 0 809 Оригинал >Тренд ZETA после выпускаЧрезвычайно бычий

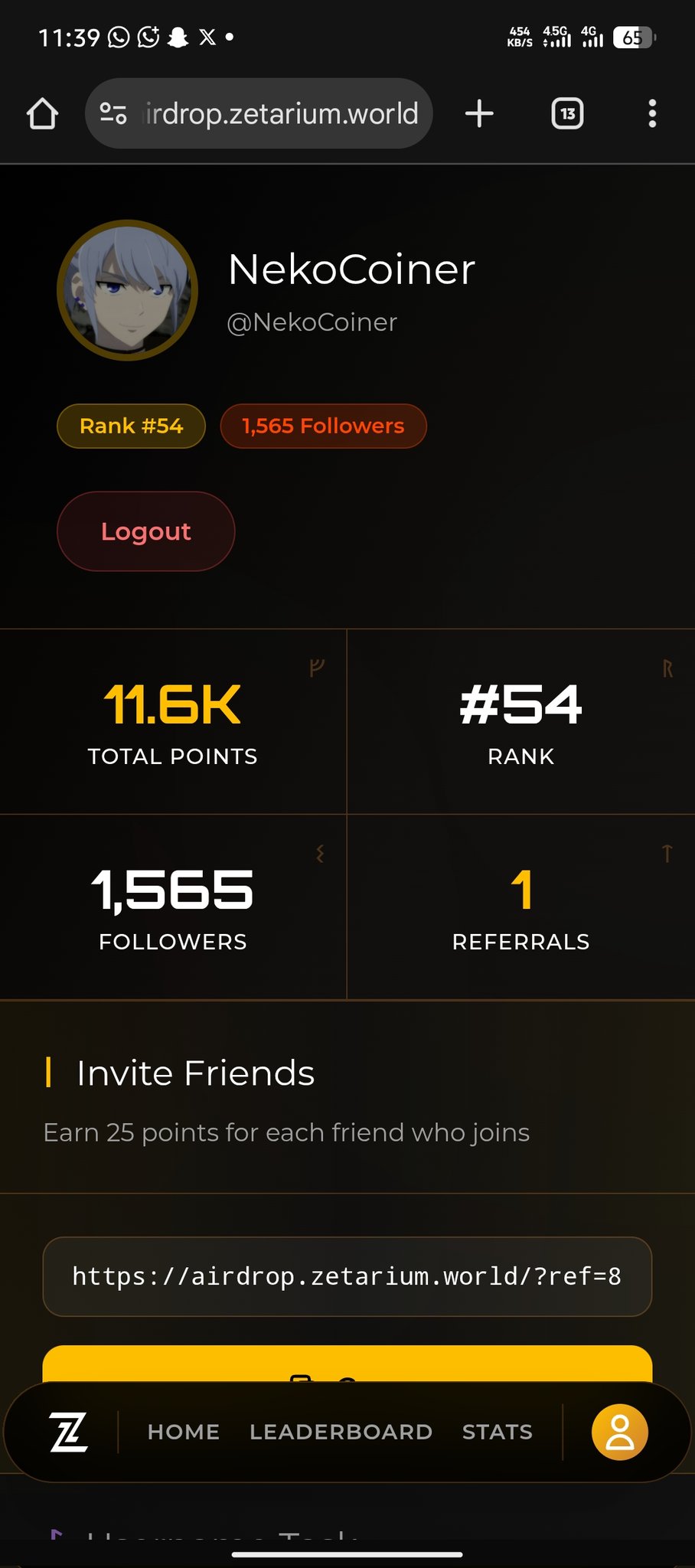

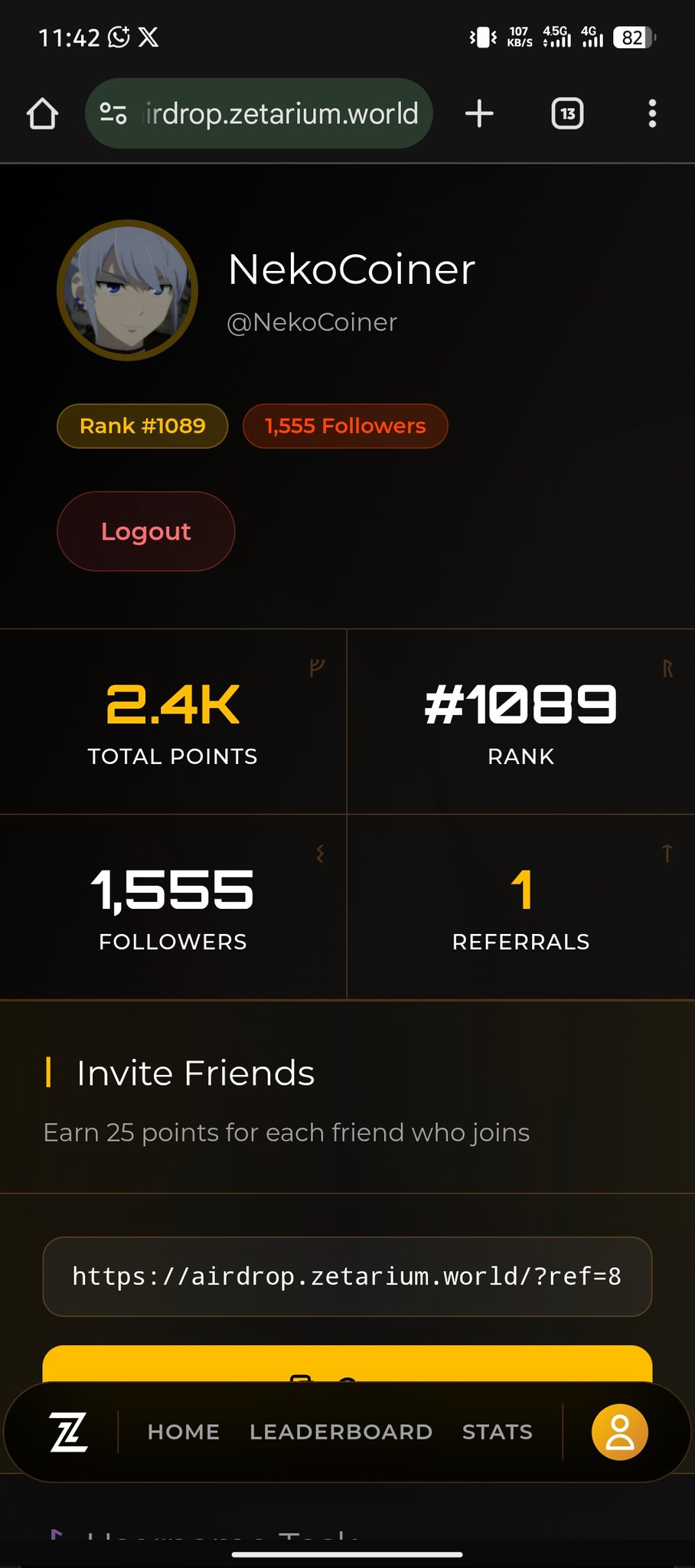

4 0 809 Оригинал >Тренд ZETA после выпускаЧрезвычайно бычий NekoCoiner ( Growth Arc ) OnChain_Analyst Trader B1.56K @NekoCoiner

NekoCoiner ( Growth Arc ) OnChain_Analyst Trader B1.56K @NekoCoiner

NekoCoiner ( Growth Arc ) OnChain_Analyst Trader B1.56K @NekoCoiner

NekoCoiner ( Growth Arc ) OnChain_Analyst Trader B1.56K @NekoCoiner 2 2 607 Оригинал >Тренд ZETA после выпускаБычий

2 2 607 Оригинал >Тренд ZETA после выпускаБычий