Pendle (PENDLE)

Pendle (PENDLE)

$1.2912 +1.22% 24H

- 14Индекс социальных настроений (SSI)-63.62% (24h)

- #106Рейтинг пульса рынка (MPR)+22

- 1Упоминание в социальных сетях за 24 часа-50.00% (24h)

- 0%24-часовой бычий коэффициент лидеров мнений1 активный лидер мнений

- Краткое содержание

- Бычьи сигналы

- Медвежьи сигналы

Индекс социальных настроений (SSI)

- Общие данные14SSI

- Тренд SSI (7 дн.)Цена (7 дн.)Распределение настроенийЧрезвычайно медвежий (100%)Инсайты по SSI

Рейтинг пульса рынка (MPR)

- Инсайт Оповещение

Посты из X

- Тренд PENDLE после выпускаЧрезвычайно медвежий

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav Pendle D160.07K @pendle_fi

Pendle D160.07K @pendle_fi 93 13 5.76K Оригинал >Тренд PENDLE после выпускаБычий

93 13 5.76K Оригинал >Тренд PENDLE после выпускаБычий 𝕯𝖆𝖓𝖌𝖊𝖗 Trader OnChain_Analyst C51.68K @safetyth1rd

𝕯𝖆𝖓𝖌𝖊𝖗 Trader OnChain_Analyst C51.68K @safetyth1rd Today in DeFi D17.22K @todayindefi

Today in DeFi D17.22K @todayindefi 4 0 597 Оригинал >Тренд PENDLE после выпускаНейтрально

4 0 597 Оригинал >Тренд PENDLE после выпускаНейтрально Conny FA_Analyst OnChain_Analyst B10.97K @ConnyConny253

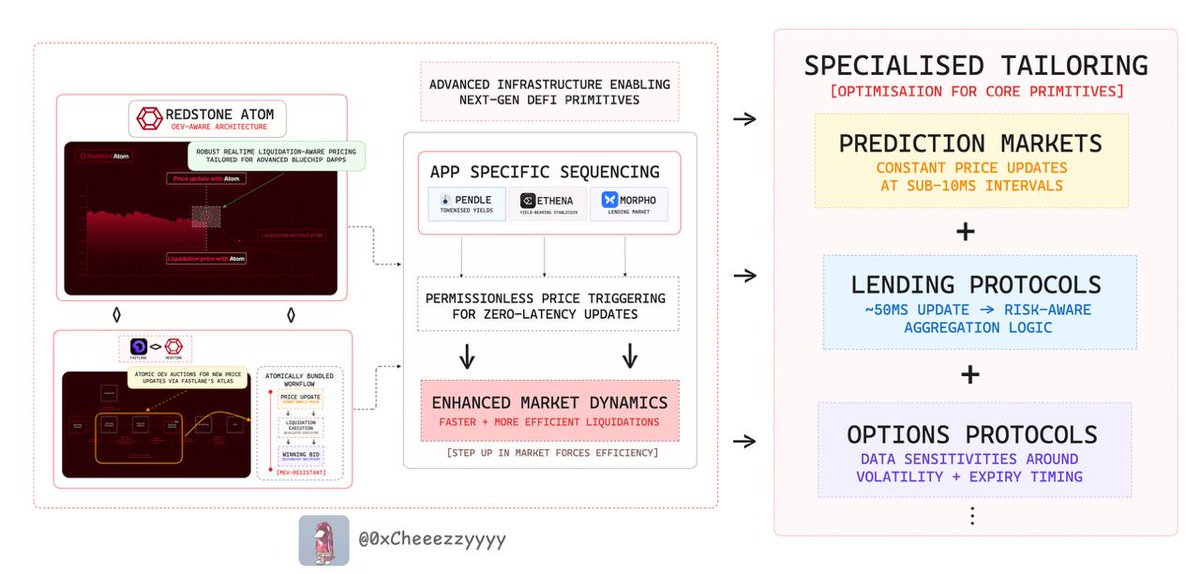

Conny FA_Analyst OnChain_Analyst B10.97K @ConnyConny253 Cheeezzyyyy D9.34K @0xCheeezzyyyy

Cheeezzyyyy D9.34K @0xCheeezzyyyy

90 54 3.42K Оригинал >Тренд PENDLE после выпускаЧрезвычайно бычий

90 54 3.42K Оригинал >Тренд PENDLE после выпускаЧрезвычайно бычий Dami-Defi TA_Analyst Trader B91.39K @DamiDefi

Dami-Defi TA_Analyst Trader B91.39K @DamiDefi Dami-Defi TA_Analyst Trader B91.39K @DamiDefi224 44 24.16K Оригинал >Тренд PENDLE после выпускаНейтрально

Dami-Defi TA_Analyst Trader B91.39K @DamiDefi224 44 24.16K Оригинал >Тренд PENDLE после выпускаНейтрально Data Wolf 🐺 OnChain_Analyst DeFi_Expert C2.52K @0xDataWolf

Data Wolf 🐺 OnChain_Analyst DeFi_Expert C2.52K @0xDataWolf

RightSide D6.96K @Rightsideonly1 0 99 Оригинал >Тренд PENDLE после выпускаЧрезвычайно медвежий

RightSide D6.96K @Rightsideonly1 0 99 Оригинал >Тренд PENDLE после выпускаЧрезвычайно медвежий- Тренд PENDLE после выпускаНейтрально

- Тренд PENDLE после выпускаЧрезвычайно бычий

- Тренд PENDLE после выпускаМедвежий

Paguinfo DeFi_Expert Tokenomics_Expert B3.20K @NewPaguinfo

Paguinfo DeFi_Expert Tokenomics_Expert B3.20K @NewPaguinfo Pendle D160.07K @pendle_fi

Pendle D160.07K @pendle_fi 5 1 377 Оригинал >Тренд PENDLE после выпускаЧрезвычайно бычий

5 1 377 Оригинал >Тренд PENDLE после выпускаЧрезвычайно бычий