Euler (EUL)

Euler (EUL)

$1.423 +43.02% 24H

- 71Индекс социальных настроений (SSI)0% (24h)

- #5Рейтинг пульса рынка (MPR)+23

- 1Упоминание в социальных сетях за 24 часа0% (24h)

- 100%24-часовой бычий коэффициент лидеров мнений1 активный лидер мнений

- Краткое содержание

- Бычьи сигналы

- Медвежьи сигналы

Индекс социальных настроений (SSI)

- Общие данные71SSI

- Тренд SSI (7 дн.)Цена (7 дн.)Распределение настроенийЧрезвычайно бычий (100%)Инсайты по SSI

Рейтинг пульса рынка (MPR)

- Инсайт Оповещение

Посты из X

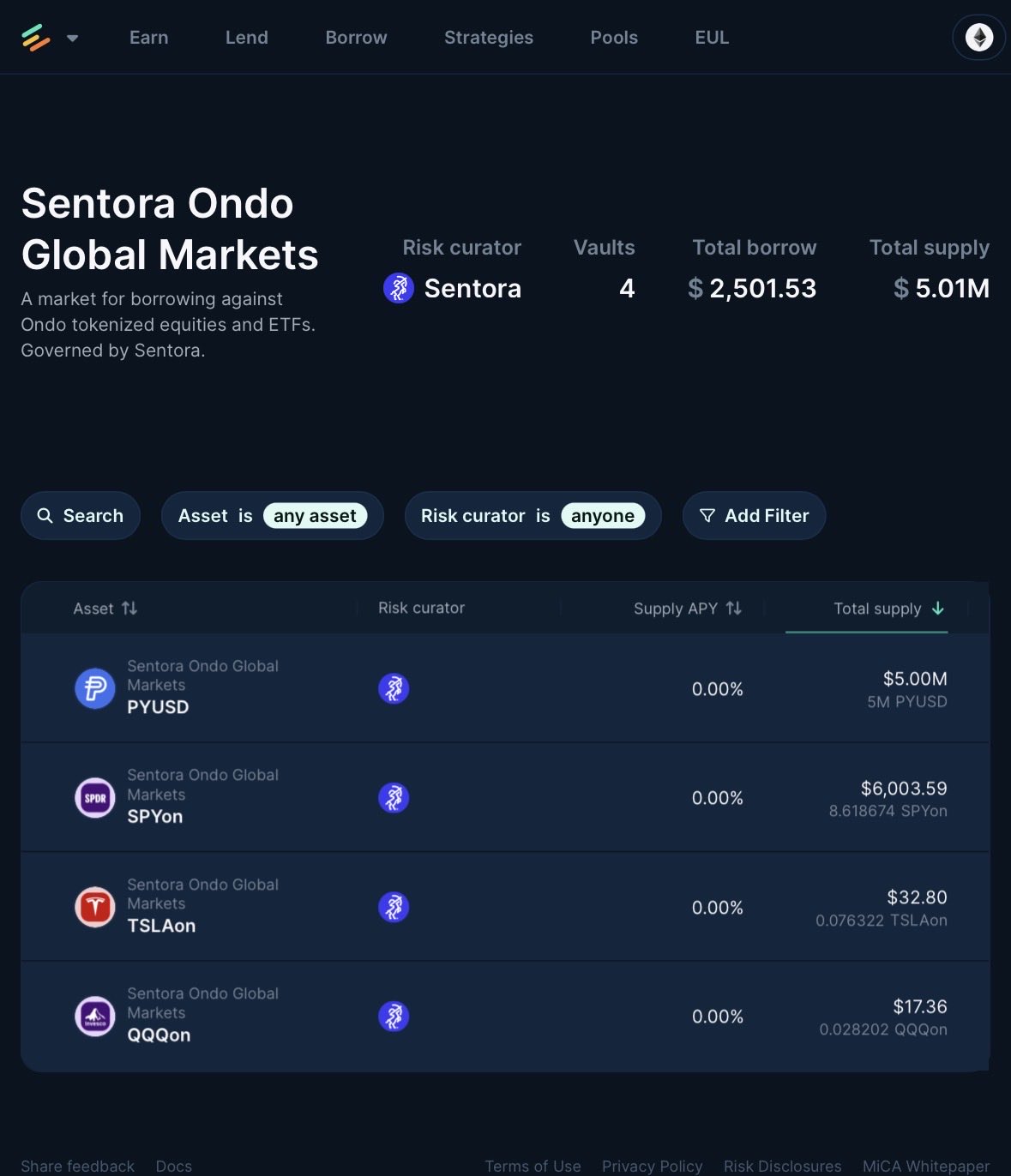

DeFi Dad ⟠ defidad.eth Educator DeFi_Expert C177.11K @DeFi_Dad

DeFi Dad ⟠ defidad.eth Educator DeFi_Expert C177.11K @DeFi_Dad

Euler Labs D72.10K @eulerfinance101 12 10.53K Оригинал >Тренд EUL после выпускаЧрезвычайно бычий

Euler Labs D72.10K @eulerfinance101 12 10.53K Оригинал >Тренд EUL после выпускаЧрезвычайно бычий- Тренд EUL после выпускаБычий

- Тренд EUL после выпускаБычий

Crypto Picsou TA_Analyst Trader C182.50K @CryptoPicsouHypurrFi D15.09K @HypurrFi

Crypto Picsou TA_Analyst Trader C182.50K @CryptoPicsouHypurrFi D15.09K @HypurrFi 497 82 73.27K Оригинал >Тренд EUL после выпускаБычий

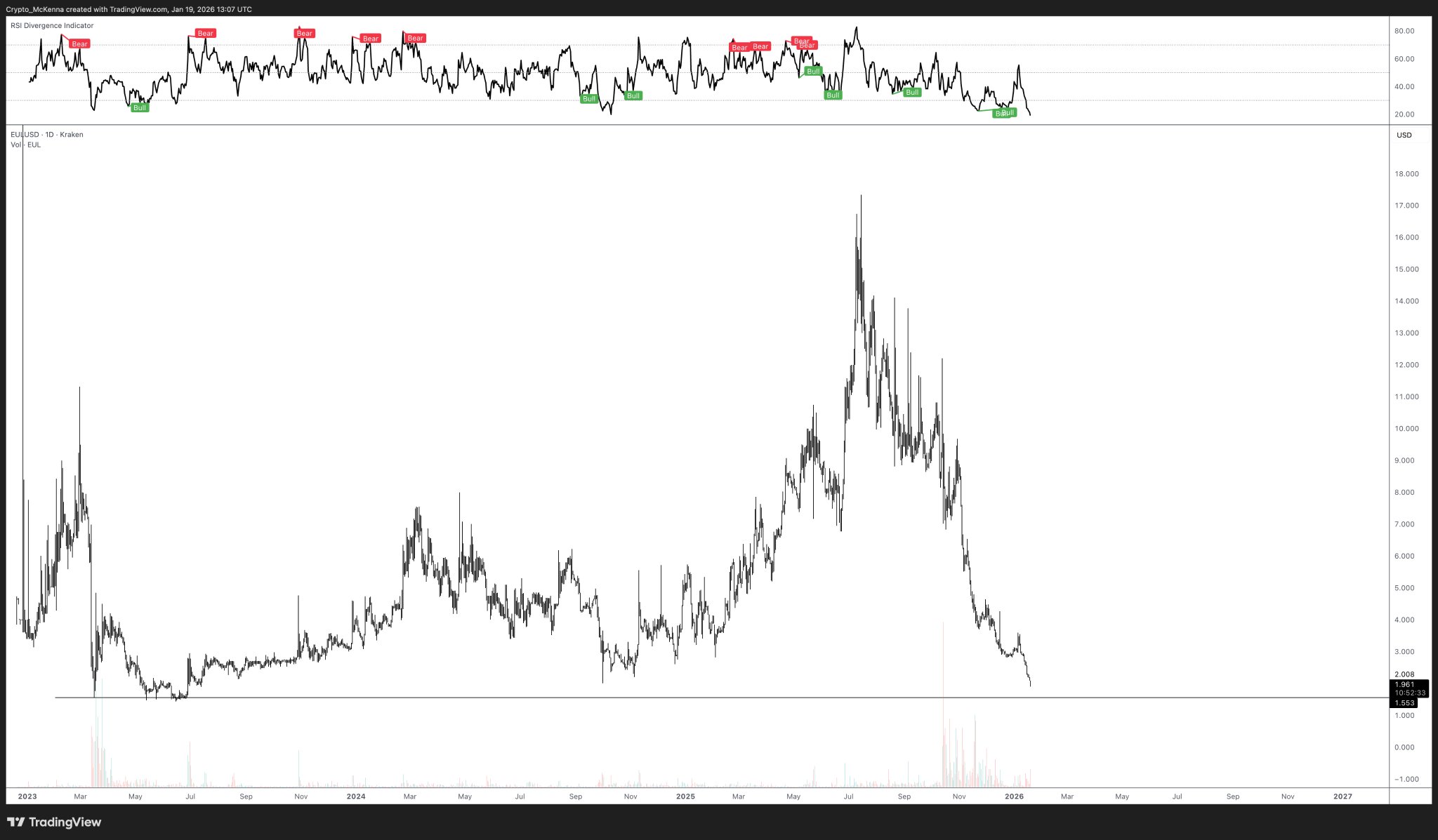

497 82 73.27K Оригинал >Тренд EUL после выпускаБычий McKenna VC Tokenomics_Expert B104.03K @Crypto_McKenna

McKenna VC Tokenomics_Expert B104.03K @Crypto_McKenna

McKenna VC Tokenomics_Expert B104.03K @Crypto_McKenna

McKenna VC Tokenomics_Expert B104.03K @Crypto_McKenna 77 26 17.84K Оригинал >Тренд EUL после выпускаЧрезвычайно медвежий

77 26 17.84K Оригинал >Тренд EUL после выпускаЧрезвычайно медвежий- Тренд EUL после выпускаБычий

𝕯𝖆𝖓𝖌𝖊𝖗 Trader OnChain_Analyst C51.68K @safetyth1rd

𝕯𝖆𝖓𝖌𝖊𝖗 Trader OnChain_Analyst C51.68K @safetyth1rd Michael Bentley D16.00K @euler_mab11 0 1.33K Оригинал >Тренд EUL после выпускаБычий

Michael Bentley D16.00K @euler_mab11 0 1.33K Оригинал >Тренд EUL после выпускаБычий Vogue Merry DeFi_Expert Educator B2.29K @MerryGaming

Vogue Merry DeFi_Expert Educator B2.29K @MerryGaming Michael Bentley D16.00K @euler_mab4 1 40 Оригинал >Тренд EUL после выпускаБычий

Michael Bentley D16.00K @euler_mab4 1 40 Оригинал >Тренд EUL после выпускаБычий Eldar FA_Analyst DeFi_Expert A2.03K @eldarcap

Eldar FA_Analyst DeFi_Expert A2.03K @eldarcap Euler Labs D72.10K @eulerfinance14 0 2.44K Оригинал >Тренд EUL после выпускаБычий

Euler Labs D72.10K @eulerfinance14 0 2.44K Оригинал >Тренд EUL после выпускаБычий- Тренд EUL после выпускаНейтрально