Aave (AAVE)

Aave (AAVE)

$127.07 +5.84% 24H

- 94Индекс социальных настроений (SSI)+21.66% (24h)

- #15Рейтинг пульса рынка (MPR)+33

- 38Упоминание в социальных сетях за 24 часа+111.11% (24h)

- 87%24-часовой бычий коэффициент лидеров мнений29 активный лидер мнений

- Краткое содержание

- Бычьи сигналы

- Медвежьи сигналы

Индекс социальных настроений (SSI)

- Общие данные94SSI

- Тренд SSI (7 дн.)Цена (7 дн.)Распределение настроенийЧрезвычайно бычий (37%)Бычий (50%)Нейтрально (8%)Медвежий (5%)Инсайты по SSI

Рейтинг пульса рынка (MPR)

- Инсайт Оповещение

Посты из X

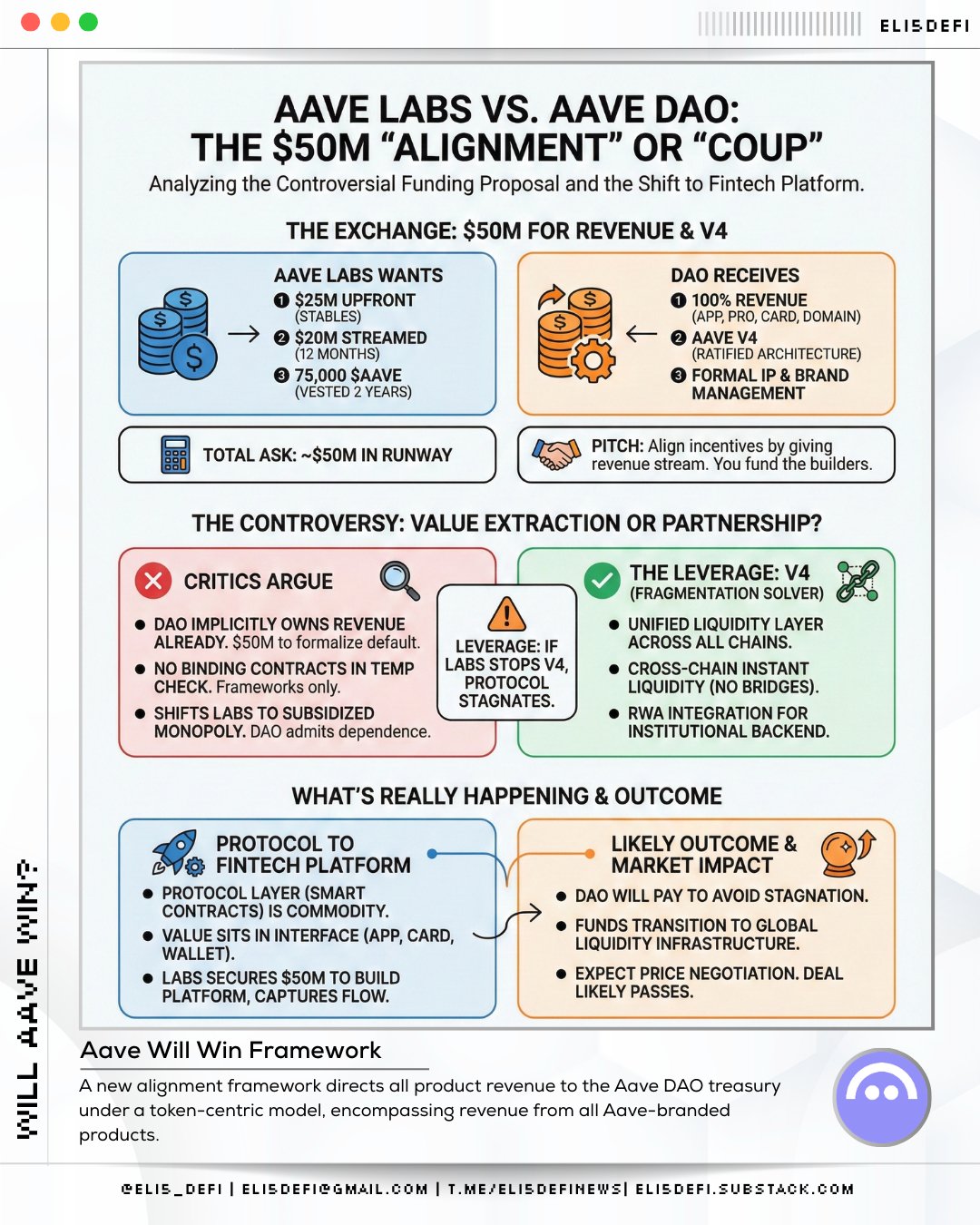

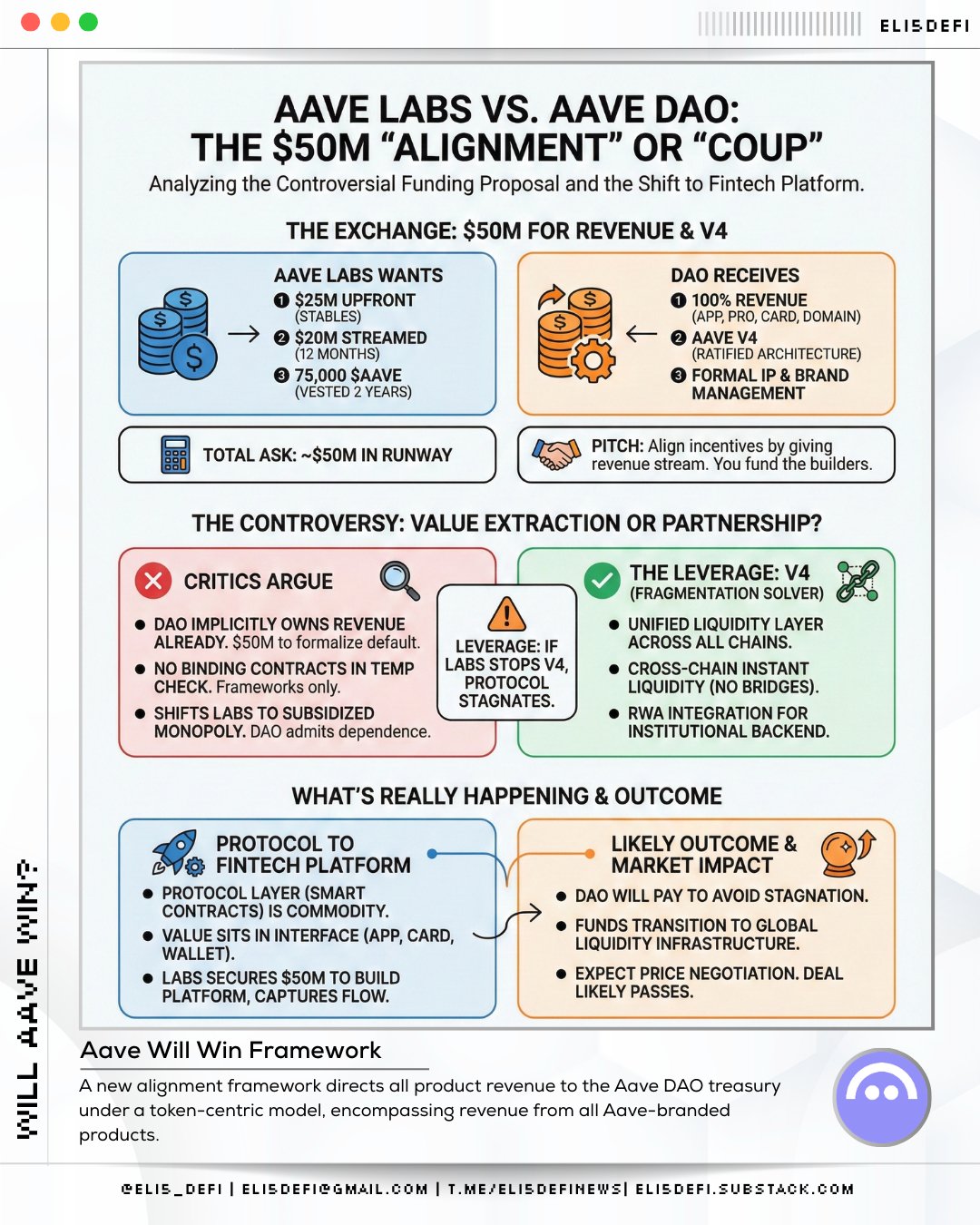

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi 65 15 4.55K Оригинал >Тренд AAVE после выпускаБычий

65 15 4.55K Оригинал >Тренд AAVE после выпускаБычий chainyoda FA_Analyst DeFi_Expert B43.16K @chainyoda

chainyoda FA_Analyst DeFi_Expert B43.16K @chainyoda Stani.eth Founder DeFi_Expert C282.51K @StaniKulechov509 49 90.36K Оригинал >Тренд AAVE после выпускаБычий

Stani.eth Founder DeFi_Expert C282.51K @StaniKulechov509 49 90.36K Оригинал >Тренд AAVE после выпускаБычий Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi 65 15 4.55K Оригинал >Тренд AAVE после выпускаБычий

65 15 4.55K Оригинал >Тренд AAVE после выпускаБычий- Тренд AAVE после выпускаБычий

- Тренд AAVE после выпускаБычий

- Тренд AAVE после выпускаЧрезвычайно бычий

- Тренд AAVE после выпускаЧрезвычайно бычий

𝕯𝖆𝖓𝖌𝖊𝖗 Trader OnChain_Analyst C51.68K @safetyth1rd

𝕯𝖆𝖓𝖌𝖊𝖗 Trader OnChain_Analyst C51.68K @safetyth1rd zoomer D82.28K @zoomerfied27 5 5.45K Оригинал >Тренд AAVE после выпускаМедвежий

zoomer D82.28K @zoomerfied27 5 5.45K Оригинал >Тренд AAVE после выпускаМедвежий crypto.news Media Influencer D111.77K @cryptodotnews

crypto.news Media Influencer D111.77K @cryptodotnews crypto.news Media Influencer D111.77K @cryptodotnews1 1 273 Оригинал >Тренд AAVE после выпускаБычий

crypto.news Media Influencer D111.77K @cryptodotnews1 1 273 Оригинал >Тренд AAVE после выпускаБычий- Тренд AAVE после выпускаБычий