IN (IN)

IN (IN)

$0.06581 -3.66% 24H

- 69Índice de Sentimento Social (SSI)- (24h)

- #17Classificação do Pulso de Mercado (MPR)0

- 1Menção Social 24H- (24h)

- 100%Índice Bullish dos KOLs (24h)1 KOLs Ativos

- Resumo

- Sinais Bullish

- Sinais Bearish

Índice de Sentimento Social (SSI)

- Dados Gerais69SSI

- Tendência SSI (7D)Preço (7D)Distribuição de SentimentosBullish (100%)Insights de SSI

Classificação do Pulso de Mercado (MPR)

- Insight dos Alertas

Posts no X

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav10 4 277 Original >Tendência de IN após o lançamentoBullish

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav10 4 277 Original >Tendência de IN após o lançamentoBullish OCT News Media Influencer C1.87K @news_oct

OCT News Media Influencer C1.87K @news_oct OCT News Media Influencer C1.87K @news_oct

OCT News Media Influencer C1.87K @news_oct 1 1 83 Original >Tendência de IN após o lançamentoExtremamente Bullish

1 1 83 Original >Tendência de IN após o lançamentoExtremamente Bullish- Tendência de IN após o lançamentoNeutro

- Tendência de IN após o lançamentoBullish

YashasEdu Educator Tokenomics_Expert B8.93K @YashasEdu

YashasEdu Educator Tokenomics_Expert B8.93K @YashasEdu Cryptor ⚡️ D10.12K @cryptorinweb341 20 2.28K Original >Tendência de IN após o lançamentoBullish

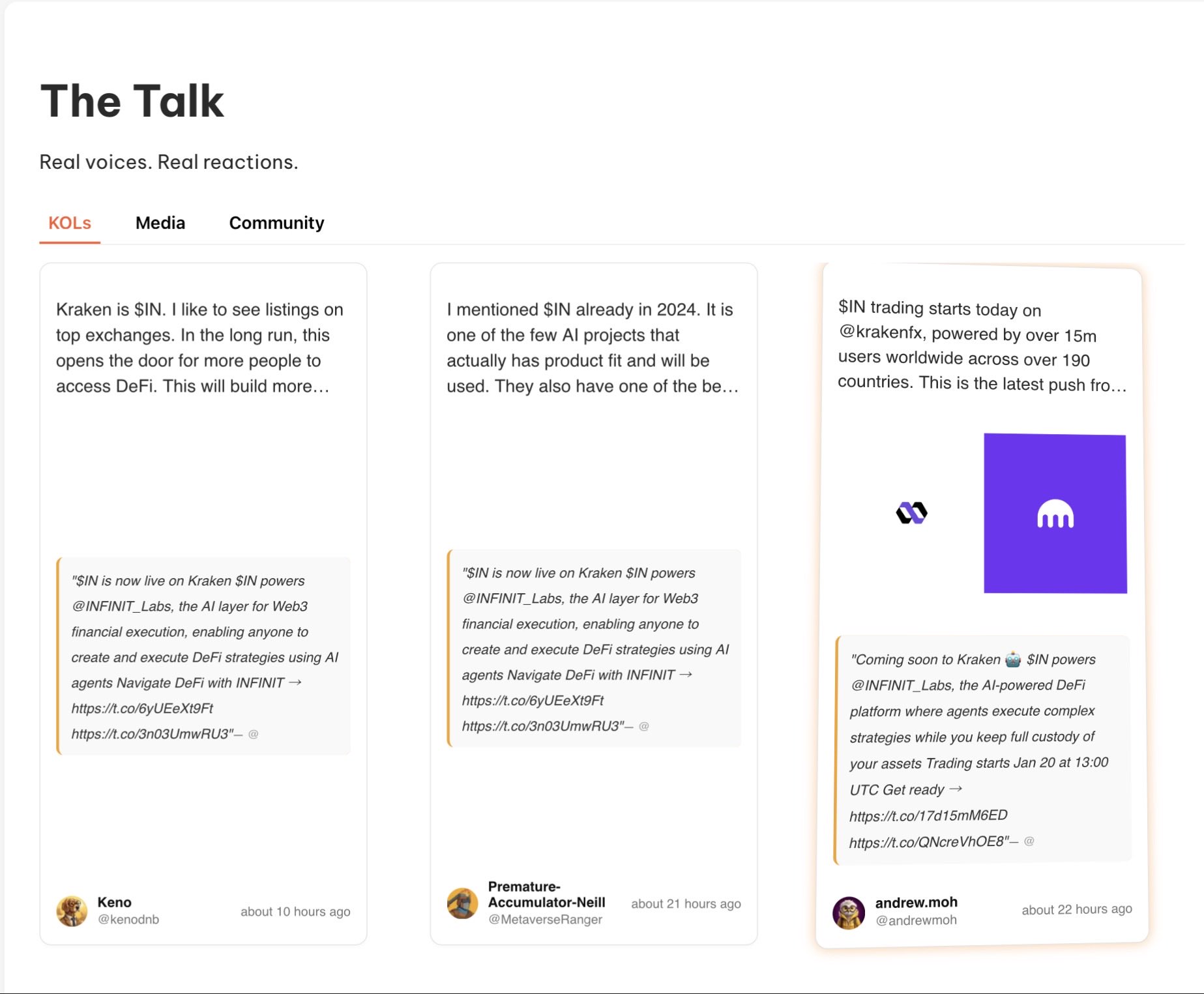

Cryptor ⚡️ D10.12K @cryptorinweb341 20 2.28K Original >Tendência de IN após o lançamentoBullish andrew.moh OnChain_Analyst Educator A53.40K @andrewmoh

andrew.moh OnChain_Analyst Educator A53.40K @andrewmoh

Kraken D1.73M @krakenfx

Kraken D1.73M @krakenfx 74 51 7.91K Original >Tendência de IN após o lançamentoExtremamente Bullish

74 51 7.91K Original >Tendência de IN após o lançamentoExtremamente Bullish- Tendência de IN após o lançamentoExtremamente Bullish

- Tendência de IN após o lançamentoBullish

Tbros6868| MemeMax⚡️ Educator DeFi_Expert S5.41K @tbros6868

Tbros6868| MemeMax⚡️ Educator DeFi_Expert S5.41K @tbros6868 Tbros6868| MemeMax⚡️ Educator DeFi_Expert S5.41K @tbros686815 16 597 Original >Tendência de IN após o lançamentoBullish

Tbros6868| MemeMax⚡️ Educator DeFi_Expert S5.41K @tbros686815 16 597 Original >Tendência de IN após o lançamentoBullish- Tendência de IN após o lançamentoBullish