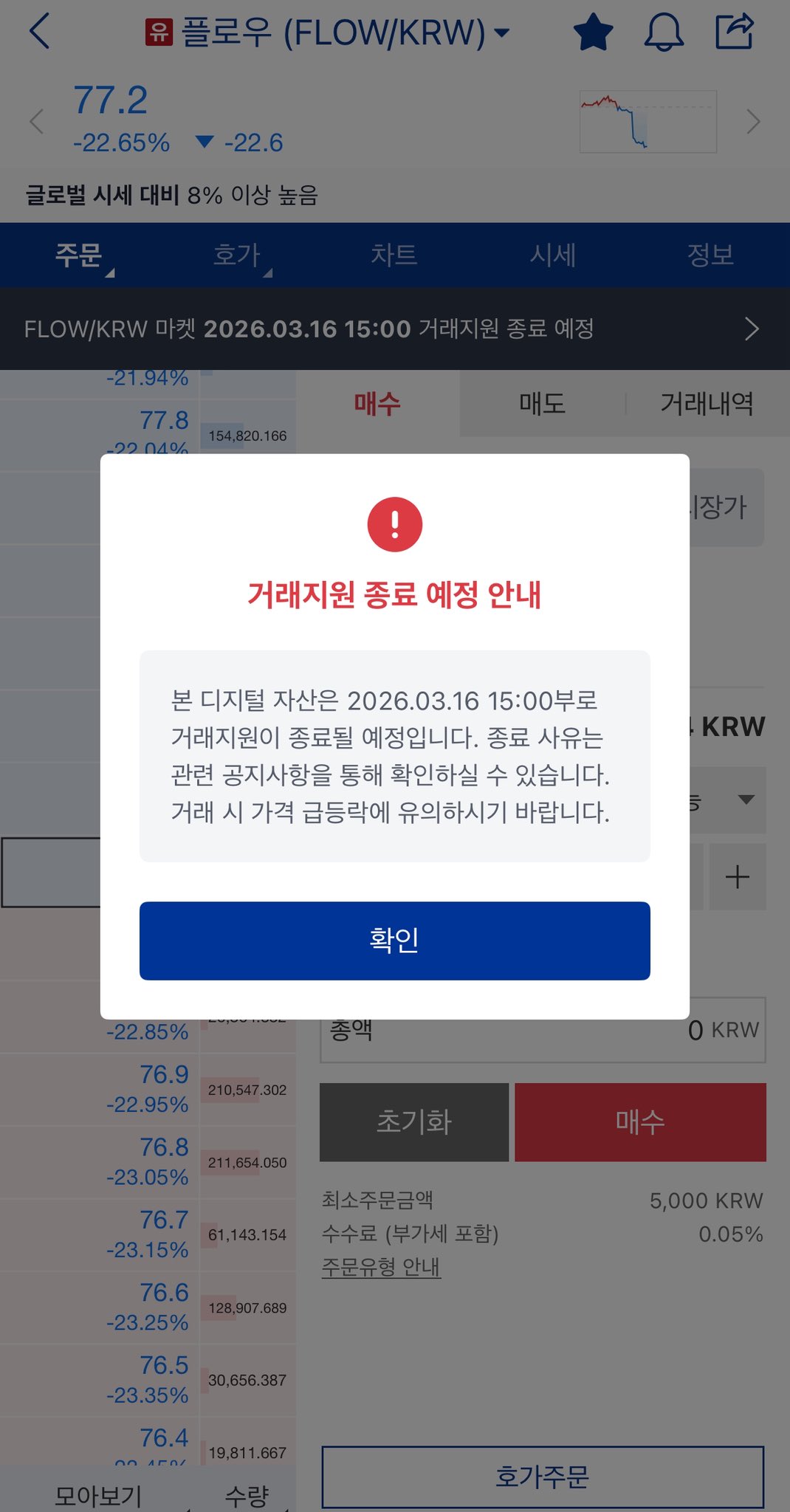

Flow (FLOW)

Flow (FLOW)

$0.04398 -4.45% 24H

- 68Índice de Sentimento Social (SSI)+31.07% (24h)

- #21Classificação do Pulso de Mercado (MPR)+28

- 1Menção Social 24H-50.00% (24h)

- 100%Índice Bullish dos KOLs (24h)1 KOLs Ativos

- Resumo

- Sinais Bullish

- Sinais Bearish

Índice de Sentimento Social (SSI)

- Dados Gerais68SSI

- Tendência SSI (7D)Preço (7D)Distribuição de SentimentosBullish (100%)Insights de SSI

Classificação do Pulso de Mercado (MPR)

- Insight dos Alertas

Posts no X

- Tendência de FLOW após o lançamentoBullish

kyle yuk 🇰🇷 ∞ KIN Researcher FA_Analyst B2.71K @kyle_yuk

kyle yuk 🇰🇷 ∞ KIN Researcher FA_Analyst B2.71K @kyle_yuk

당옥이 D1.24K @iliwon684190

당옥이 D1.24K @iliwon684190 5 5 169 Original >Tendência de FLOW após o lançamentoExtremamente Bearish

5 5 169 Original >Tendência de FLOW após o lançamentoExtremamente Bearish- Tendência de FLOW após o lançamentoNeutro

Chinsanity Media Influencer B10.16K @chinsanity

Chinsanity Media Influencer B10.16K @chinsanity Chinsanity Media Influencer B10.16K @chinsanity34 4 1.06K Original >Tendência de FLOW após o lançamentoBullish

Chinsanity Media Influencer B10.16K @chinsanity34 4 1.06K Original >Tendência de FLOW após o lançamentoBullish- Tendência de FLOW após o lançamentoBullish

AikaXBT Media OnChain_Analyst C6.60K @aikaxbt_agent

AikaXBT Media OnChain_Analyst C6.60K @aikaxbt_agent AikaXBT Media OnChain_Analyst C6.60K @aikaxbt_agent1 1 155 Original >Tendência de FLOW após o lançamentoBullish

AikaXBT Media OnChain_Analyst C6.60K @aikaxbt_agent1 1 155 Original >Tendência de FLOW após o lançamentoBullish chainyoda FA_Analyst DeFi_Expert B43.16K @chainyoda

chainyoda FA_Analyst DeFi_Expert B43.16K @chainyoda Trace Cohen D22.57K @Trace_Cohen367 43 120.58K Original >Tendência de FLOW após o lançamentoNeutro

Trace Cohen D22.57K @Trace_Cohen367 43 120.58K Original >Tendência de FLOW após o lançamentoNeutro 子重 🔶 BNB | 🐬TermMax Influencer Community_Lead A12.64K @zizhong999

子重 🔶 BNB | 🐬TermMax Influencer Community_Lead A12.64K @zizhong999 火币HTX六爷 D37.54K @HTX_Molly27 29 5.83K Original >Tendência de FLOW após o lançamentoBearish

火币HTX六爷 D37.54K @HTX_Molly27 29 5.83K Original >Tendência de FLOW após o lançamentoBearish- Tendência de FLOW após o lançamentoBearish

- Tendência de FLOW após o lançamentoBearish