Compound (COMP)

Compound (COMP)

$21.9051 +10.35% 24H

- 46Índice de Sentimento Social (SSI)- (24h)

- #4Classificação do Pulso de Mercado (MPR)0

- 1Menção Social 24H- (24h)

- 0%Índice Bullish dos KOLs (24h)1 KOLs Ativos

- Resumo

- Sinais Bullish

- Sinais Bearish

Índice de Sentimento Social (SSI)

- Dados Gerais46SSI

- Tendência SSI (7D)Preço (7D)Distribuição de SentimentosExtremamente Bearish (100%)Insights de SSI

Classificação do Pulso de Mercado (MPR)

- Insight dos Alertas

Posts no X

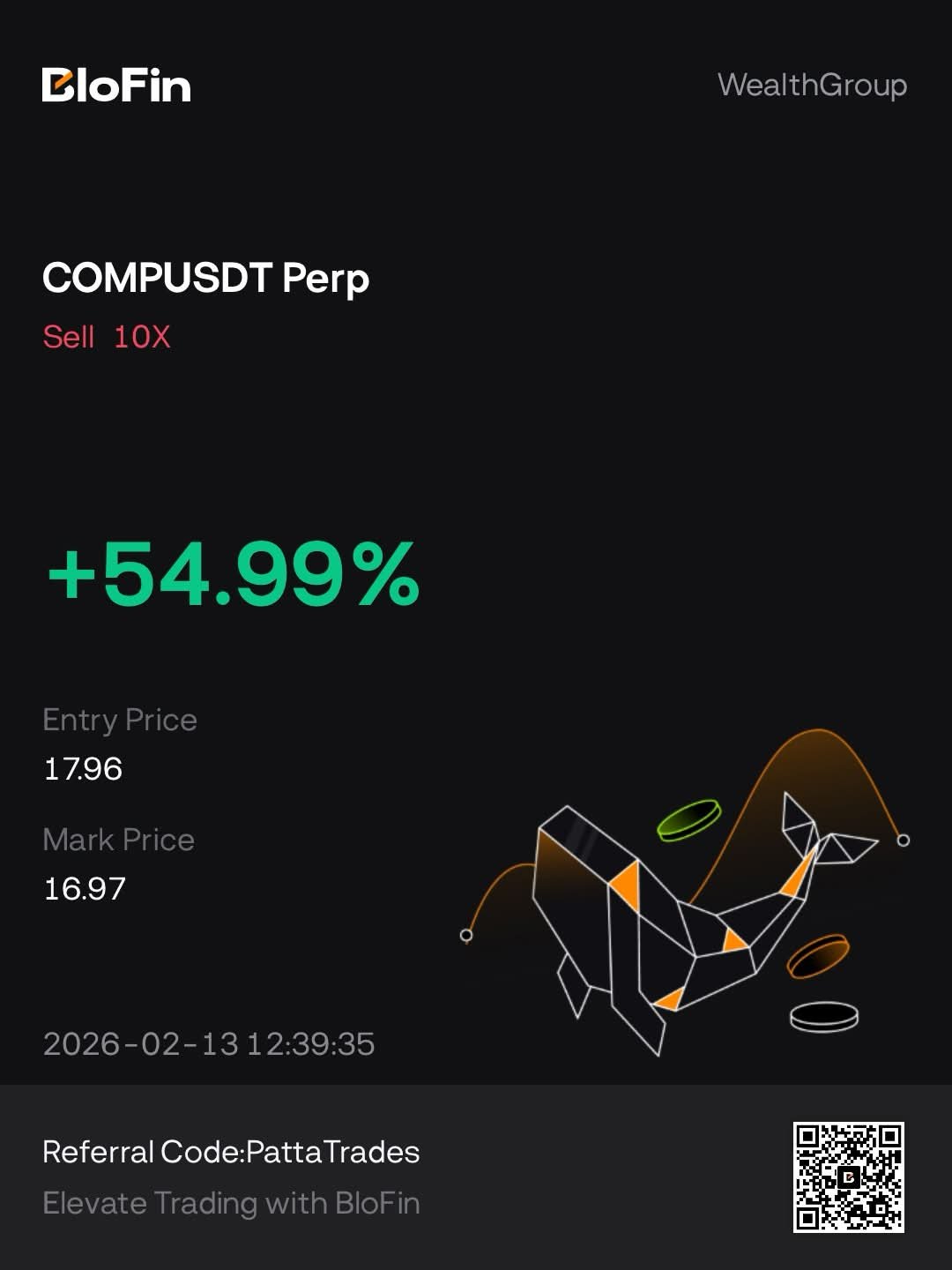

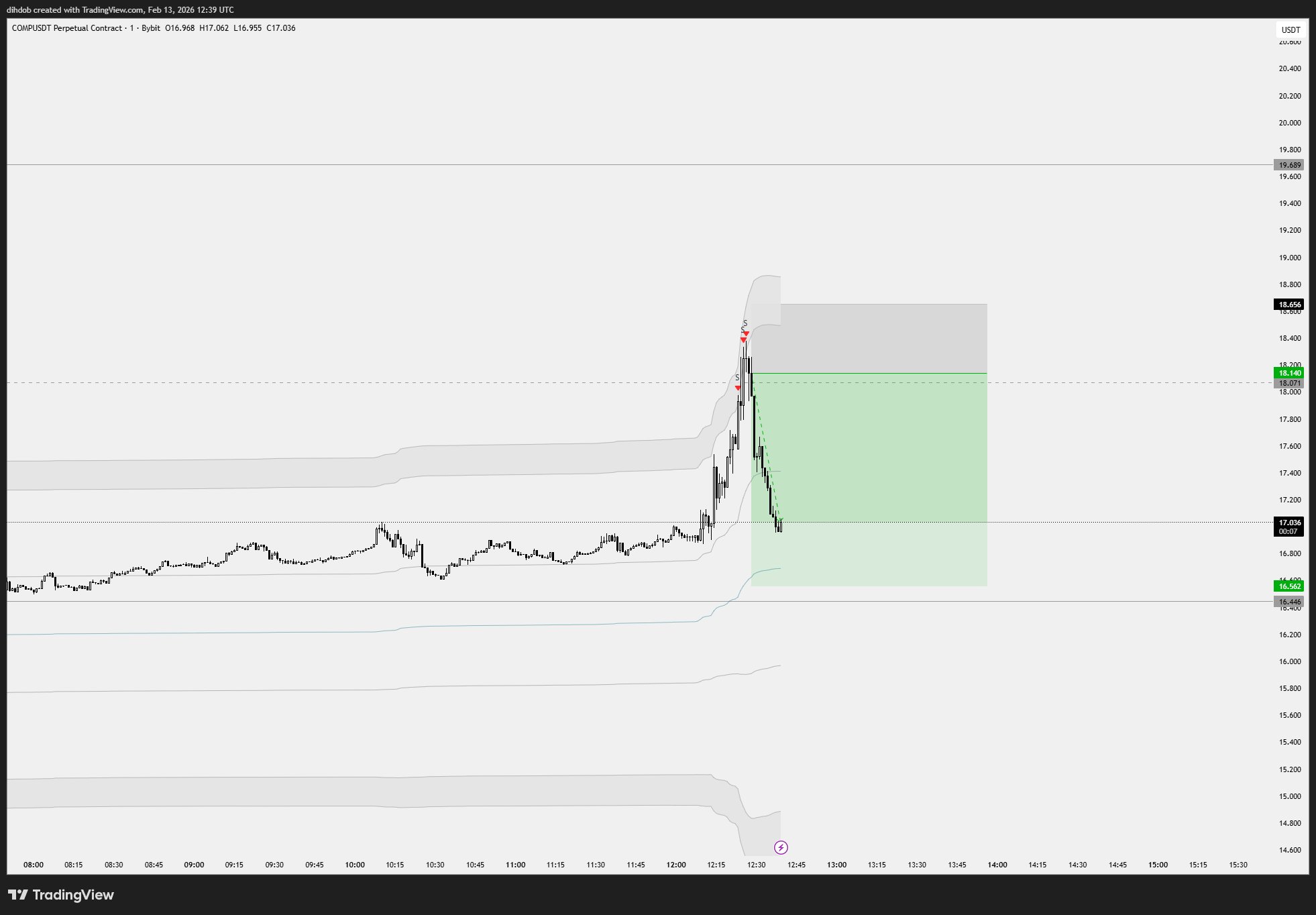

Pat TA_Analyst Trader C21.76K @PattaTrades

Pat TA_Analyst Trader C21.76K @PattaTrades

Pat TA_Analyst Trader C21.76K @PattaTrades8 2 2.18K Original >Tendência de COMP após o lançamentoExtremamente Bearish

Pat TA_Analyst Trader C21.76K @PattaTrades8 2 2.18K Original >Tendência de COMP após o lançamentoExtremamente Bearish Eldar FA_Analyst DeFi_Expert A2.03K @eldarcap

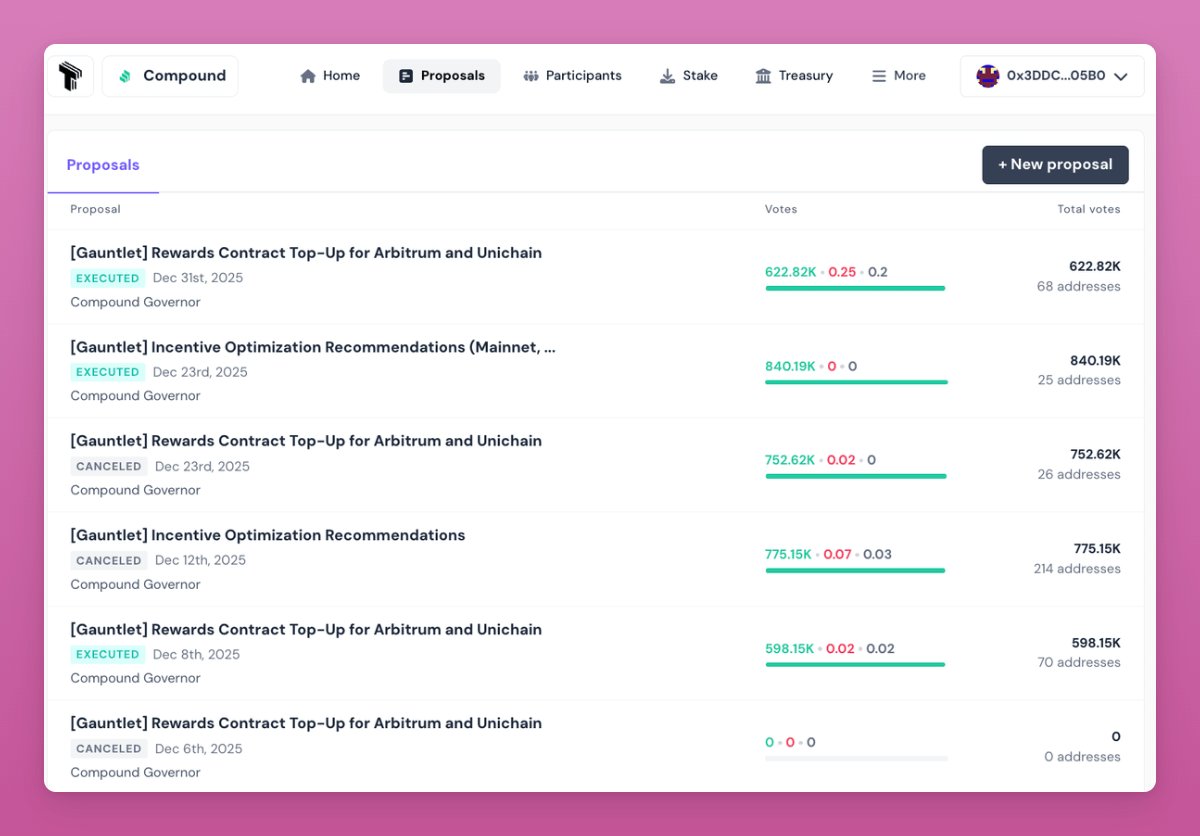

Eldar FA_Analyst DeFi_Expert A2.03K @eldarcap Compound Foundation D126 @Compound_xyz

Compound Foundation D126 @Compound_xyz 2 0 393 Original >Tendência de COMP após o lançamentoExtremamente Bullish

2 0 393 Original >Tendência de COMP após o lançamentoExtremamente Bullish chainyoda FA_Analyst DeFi_Expert B43.16K @chainyoda

chainyoda FA_Analyst DeFi_Expert B43.16K @chainyoda chainyoda FA_Analyst DeFi_Expert B43.16K @chainyoda132 25 7.17K Original >Tendência de COMP após o lançamentoBullish

chainyoda FA_Analyst DeFi_Expert B43.16K @chainyoda132 25 7.17K Original >Tendência de COMP após o lançamentoBullish- Tendência de COMP após o lançamentoBullish

- Tendência de COMP após o lançamentoBullish

- Tendência de COMP após o lançamentoBullish

- Tendência de COMP após o lançamentoExtremamente Bullish

- Tendência de COMP após o lançamentoBearish

- Tendência de COMP após o lançamentoNeutro

Ignas | DeFi DeFi_Expert Tokenomics_Expert B158.50K @DefiIgnas

Ignas | DeFi DeFi_Expert Tokenomics_Expert B158.50K @DefiIgnas

vitalik.eth Founder Researcher C5.88M @VitalikButerin100 28 12.07K Original >Tendência de COMP após o lançamentoBearish

vitalik.eth Founder Researcher C5.88M @VitalikButerin100 28 12.07K Original >Tendência de COMP após o lançamentoBearish