COAI, AIA, MYX, and RIVER are four hundred‑fold coins in the secondary market that are quite 'evil' (speculative); they may not align with most people's value‑investment criteria, but there are few truly worth‑investing coins in the crypto space anyway. Here are some thoughts 👇

1. Highly concentrated holdings = Dominant control by the major player (market maker)

Do you think concentrated holdings are a bad thing? That's the perspective of those looking to hold long‑term for value investing.

But for speculators, concentrated holdings are a huge advantage!

For a coin with dispersed holdings, if you move the price 10%, there are thousands of retail investors ready to dump. For a coin with concentrated holdings, the major player can move it at will—whether they want a "guiding sage" or a "Super Mario" scenario, they can even send it "to the moon" at any moment.

When the major player wants to pump, do they need to worry about retail investors dumping? No. Their only concern is other huge whales. For such new tokens, they are typically tightly bound to the market maker and the exchange, with few free holdings out there.

In this case, the market maker is the sole short side. As long as they don't sell, the token can fly to the moon. Our bet is whether the market maker wants us to profit.

2. No or minimal airdrops = No free‑rider dumping

Not issuing an airdrop means everyone holding the token has paid for it. This equalizes holding costs (except for the market maker themselves), eliminating zero‑cost sell pressure, so all dynamics are within predictable bounds.

Without an airdrop, every seller on the market is either cutting losses or taking profits. This makes the price chart (K‑line) very authentic, making it easier for the market maker to gauge retail sentiment; a light market translates to an easy pump.

3. List only on Binance Alpha/futures to accumulate opposing liquidity

This is the essence of the essence!

Do you think listing only futures is a bad thing? NO! Consider that this is a strategic move: futures markets focus on capital rather than token distribution. The market maker controls about 90% of the spot supply, and the futures contracts act as a double hedge, keeping the token price firmly in their hands.

Using high leverage in futures to find opposing liquidity yields classic opponent profiles:

- Retail traders, thinking the price has risen enough and should now fall

- Hedgers, who cannot sell locked positions, so they short to lock in profit first

- Value analysts, who believe the fundamentals don't justify the current price

Once you’re caught in the trap, you just wait to get beaten.

4. Rapid pumping = The ultimate goal of speculators

Why are we in the crypto space? To do charity? To build Web3?

No, we’re here to make money!

If you buy BTC and it doubles in a year, you’re grateful. If you buy a pump coin and it triples in three days—wow, that’s the adrenaline rush.

What’s the consensus in crypto? That prices go up. As long as a coin is rising, its fundamentals are seen as strong, its technology as top‑notch, its team as the savior of Web3. A fast pump is the quickest way to cement that consensus, and there will always be followers.

Speed is everything. In martial arts, only speed cannot be broken.

If you’re a value investor aiming for 100× over 10 years, look at BTC or ETH. Stay away from these speculative coins; they’re poison.

If you’re a speculator looking for 3× in three days, these coins are tailor‑made VIP gamble tickets for you.

These tokens are financial oddities created from day one for secondary‑market speculation. Their fundamentals are often not terrible, just opaque. They don’t need real‑world use cases; market control, no sell pressure, and strong expectations form a perfect closed loop designed for violent pumps.

All their speculative traits—market control, lack of sell pressure, strong expectations—are perfectly engineered to serve the final violent pump.

Investing in these coins is mostly a game with the market maker. The bet is to ride the rocket before the market maker dumps, and parachute out before it explodes.

It may be shady, but it’s the crypto world.

To find these coins and play against the market maker, I strongly recommend studying the “Smart Money” feature in Binance futures, which can help you spot opportunities early and improve your odds.

(Risk warning: This is a high‑risk gamble, a one‑in‑nine chance of survival. Don’t get addicted, don’t go all‑in, do your own research. If you profit, call me brother; if you lose, call me a dog.)

ChainOpera AI (COAI)

ChainOpera AI (COAI) ERROR TA_Analyst Educator A8.47K @ER404i

ERROR TA_Analyst Educator A8.47K @ER404i

ERROR TA_Analyst Educator A8.47K @ER404i

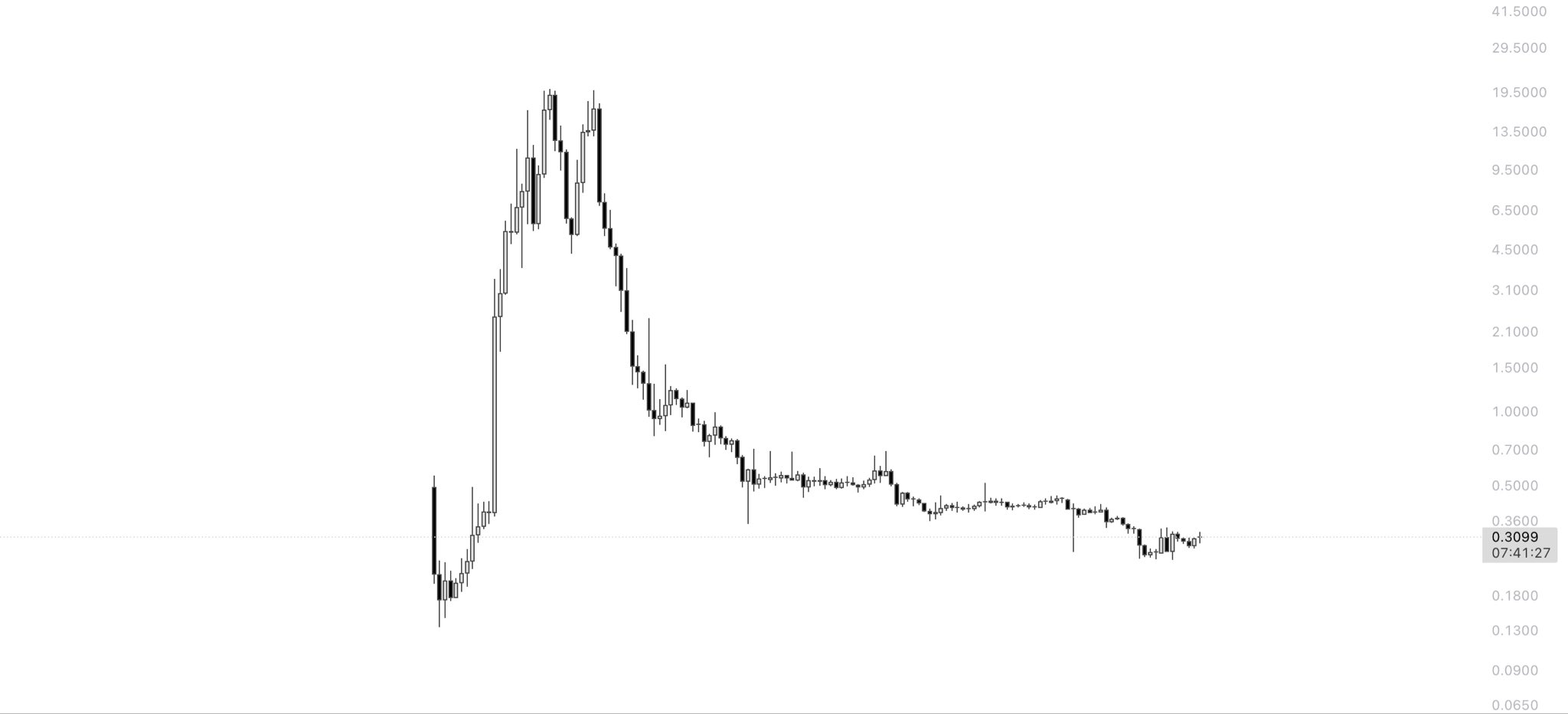

ERROR TA_Analyst Educator A8.47K @ER404i 25 2 3.99K Original >Tendência de COAI após o lançamentoExtremamente Bearish

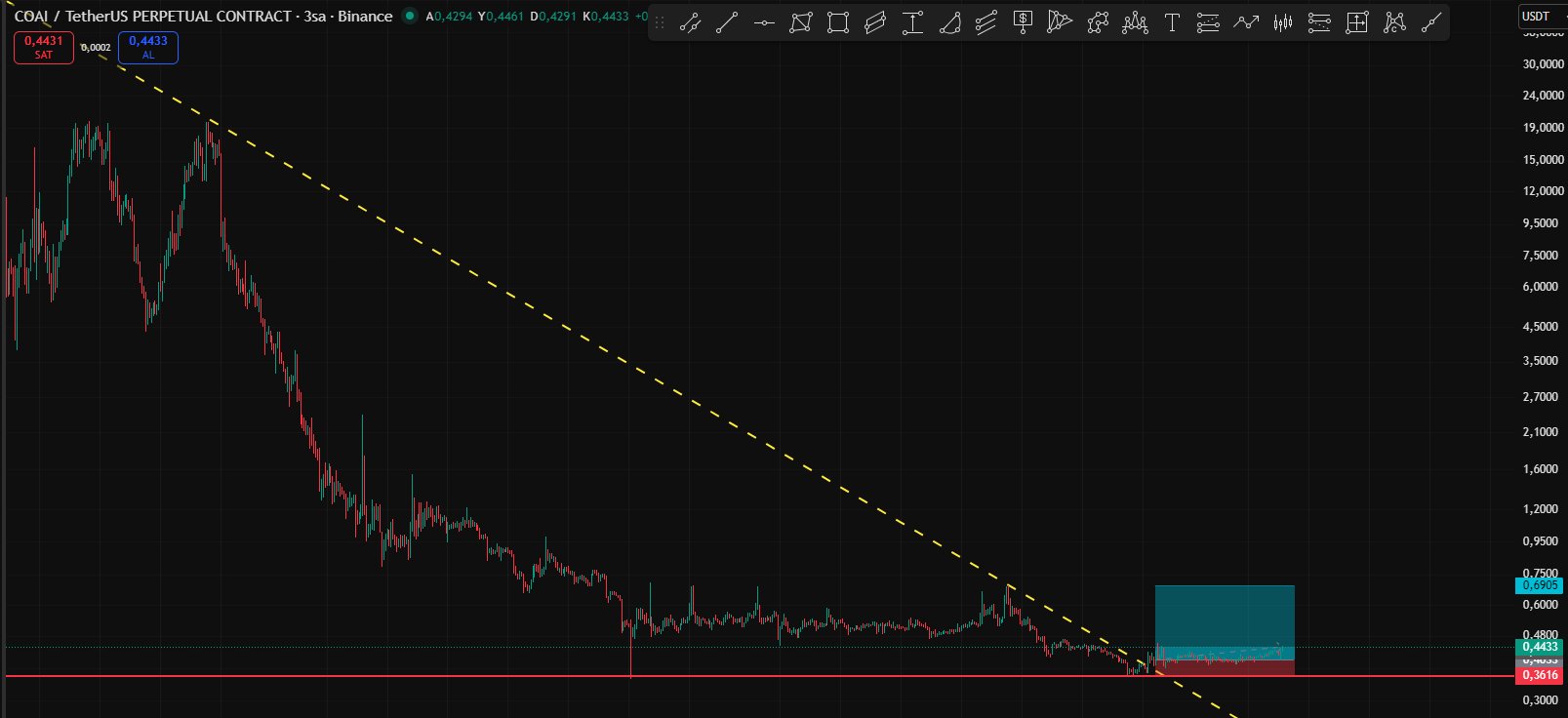

25 2 3.99K Original >Tendência de COAI após o lançamentoExtremamente Bearish CryptoTrader Trader TA_Analyst B27.42K @TraderEthem

CryptoTrader Trader TA_Analyst B27.42K @TraderEthem

CryptoTrader Trader TA_Analyst B27.42K @TraderEthem

CryptoTrader Trader TA_Analyst B27.42K @TraderEthem 83 5 3.96K Original >Tendência de COAI após o lançamentoBullish

83 5 3.96K Original >Tendência de COAI após o lançamentoBullish