World Liberty Financial (WLFI)

World Liberty Financial (WLFI)

- 43ソーシャル・センチメント・インデックス(SSI)+6.82% (24h)

- #71マーケット・パルス・ランキング(MPR)+36

- 724時間ソーシャルメンション+40.00% (24h)

- 71%24時間のKOL強気比率6人のアクティブなKOL

- 概要WLFI experienced large vault transfers to the project team, fell to key support, social heat rose, institutional interest increased but faces regulatory review.

- 強気のシグナル

- Vault transfer shows activity

- Touches key support level

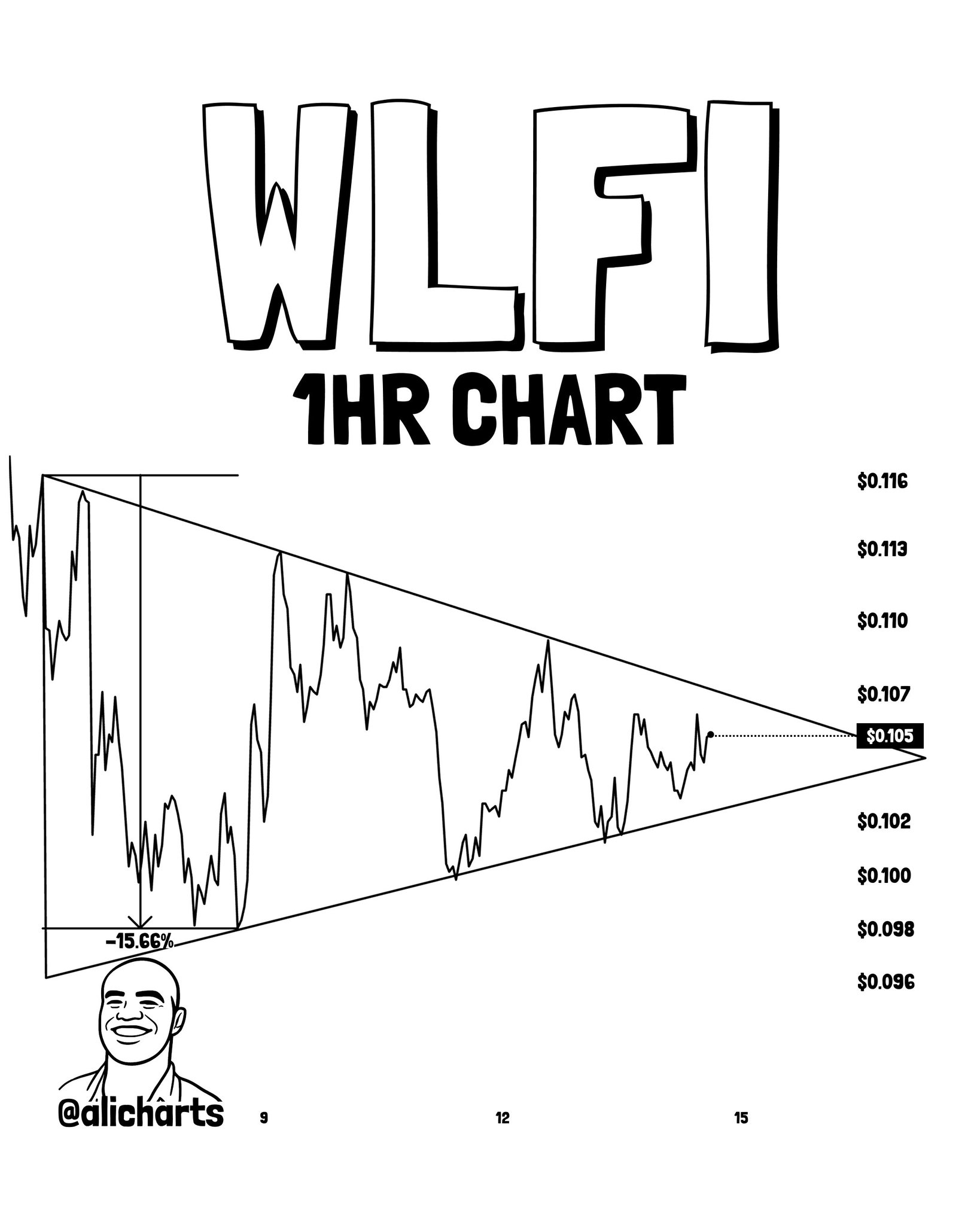

- alicharts predicts +15% rise

- Binance launches USD1 wealth management

- Coinbase CEO will attend the event

- 弱気のシグナル

- Price down 1.91% in 24h

- CFIUS investigation regulatory risk

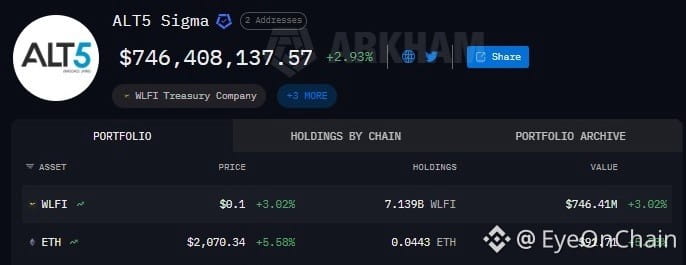

- Whale holding 7.1B suppresses circulation

- If support breaks, may continue to fall

- Social heat rises but lacks substantive positive news

ソーシャル・センチメント・インデックス(SSI)

- データ全体43SSI

- SSIトレンド(7日間)価格(7日間)センチメントの分布強気 (71%)中立 (14%)弱気 (15%)SSIインサイトWLFI social heat is medium (42.79/100, +6.82%) driven by KOL attention up 40% and positive sentiment up 60.71%, related to large vault transfers to the project team and falling to key support, activity down -21.74%.

マーケット・パルス・ランキング(MPR)

- アラートインサイトWLFI warning rank rose to #71 (+36), social anomaly (50/100, +68.99%) and sentiment polarization (18.17/100, +51.38%) are significant, KOL attention shift up 150%, linked to CFIUS regulatory review and large vault transfers.

Xへの投稿

BitalkNews Media Educator C28.51K @0xBitalk

BitalkNews Media Educator C28.51K @0xBitalk🔶 U.S. bipartisan lawmakers urge CFIUS to investigate WLFI U.S. Senators Elizabeth Warren and Andy Kim are requesting the Treasury to probe the Emirati investment in WLFI involving a $50 million stake. The deal is linked to the Trump family, raising concerns about national security and foreign influence. (cointelegraph) https://t.co/0ClZ8yIicU

0 0 225 オリジナル >リリース後のWLFIのトレンド弱気U.S. lawmakers urge investigation of WLFI's Emirati investment due to national security concerns and the Trump family.

0 0 225 オリジナル >リリース後のWLFIのトレンド弱気U.S. lawmakers urge investigation of WLFI's Emirati investment due to national security concerns and the Trump family. The Boss TA_Analyst Trader B99.49K @Crypto_TheBoss

The Boss TA_Analyst Trader B99.49K @Crypto_TheBoss🔷️ Coinbase CEO Brian Armstrong is set to attend #WLF2026 ( @worldlibertyfi ) $WLFI ✅️ As one of the leading figures in the crypto industry, Brian Armstrong’s participation highlights the continued integration of financial innovation with blockchain infrastructure. ✅️ $Coinbase is also one of the largest cryptocurrency exchanges in the world, holding a significant position within the sector. Therefore, CEO-level participation is considered a notable and valuable development for the event. ⚠️ This is not investment advice. #WLF2026 #Coinbase #Crypto #Blockchain #Finance

WLFI D775.96K @worldlibertyfi

WLFI D775.96K @worldlibertyfiWe’re excited to welcome Brian Armstrong (CEO, Coinbase) to #WLF2026. A champion for crypto and a key platform for World Liberty, Coinbase has been instrumental in bringing the future of finance on-chain. @brian_armstrong https://t.co/JtE1KEVMOS

36 8 6.32K オリジナル >リリース後のWLFIのトレンド強気Coinbase CEO will attend WLF2026, highlighting the integration of financial innovation with blockchain.

36 8 6.32K オリジナル >リリース後のWLFIのトレンド強気Coinbase CEO will attend WLF2026, highlighting the integration of financial innovation with blockchain. BITWU.ETH 🔆 FA_Analyst OnChain_Analyst C358.52K @Bitwux

BITWU.ETH 🔆 FA_Analyst OnChain_Analyst C358.52K @BitwuxStablecoin competition has never been about who is more stable, but about who can control “where the money comes from and where it goes”. What Lao Pang said makes sense: the path of WLFI @worldlibertyfi is becoming clearer: fundamentally it is not about creating a stablecoin, but about battling for the “distribution rights of USD liquidity”. In the stablecoin arena, many competitors vie, and technology is no longer a barrier; the real hurdles are only three things: 1️⃣ Entry point (exchanges / channels) 2️⃣ Habit (why users choose you over USDT / USDC) 3️⃣ Yield structure (can you offer more attractive capital efficiency) WLFI has recently continued its financial product on Binance, with a clear intent. From this perspective, WLFI’s path is very clear: Use USD1 as a liquidity entry point, cultivate usage habits through yields and channels, and finally bring out the “equity layer” of WLFI. Therefore, WLFI’s valuation is not based on technology nor narrative, but on a very practical matter: whether USD1 can achieve real scale and settlement in several key channels. If it can, it will naturally become a “dividend certificate” tied to stablecoin cash flow. This is why Binance’s offering of financial products for USD1 is so critical: It is not a perk, but a way to create a usage pathway. The final sentence summarizes this logic: The ultimate outcome of stablecoins is not about who is more stable, but who can control “where the money comes from and where it goes”.

庞教主.edge🦭 D77.79K @kiki520_eth

庞教主.edge🦭 D77.79K @kiki520_ethRecently at my hometown, I unintentionally chatted with a few older cousins about the crypto world. They are pure outsiders, only knowing Sun Cut, Trump Coin, and Trump's stablecoin, which is WLFI's USD1 – a very representative outsider perspective. Also, last time a on-chain whale bought WLFI; looking at recent on-chain data, that whale bought only WLFI, with a position of about $9 million. So I think it’s necessary to talk about WLFI and USD1. You can understand WLFI as: A group of people who best understand “how to monetize attention”, coming to build a compliance-wrapped, more TradFi-like stablecoin/financial distributor. What’s most valuable isn’t the technology but the entry point – who can, in the shortest time, turn the hidden demand for dollars, exchange channels, yield products, and narrative hype into a closed loop. WLFI’s approach is also straightforward: First push USD1 to become a “usable stablecoin”, then use USD1 to feed the ecosystem, liquidity, and growth, and finally bring the “equity/token” of WLFI to the forefront. What’s the relationship between WLFI and USD1? In plain words: WLFI is the power layer (governance + ecosystem) USD1 is the blood layer (stablecoin + liquidity) The official structure confirms this: WLFI is the native token of World Liberty Financial USD1 is the stablecoin they issue In other words, WLFI decides the direction, USD1 decides where the money flows. This structure is similar to early pairs such as: BNB + BUSD MKR + DAI CRV + crvUSD WLFI is more like the “equity layer” built around this pipeline. Its early fundraising/sales and community structure were disclosed in the media, belonging to “issue the token first, then fulfill the narrative with the product”. The deep significance of Binance’s financial product activity for USD1 / WLFI: What you see as “USD1 doing financial products on Binance with high yields” is on the surface a perk, but at its core a strategy. This is hugely important for USD1: the hardest part of a stablecoin is not “issuance”, it’s “habit formation”. Why do people use USDT/USDC? Not because they love the logo, but because they’re usable everywhere, instantly redeemable, pools are deep, and you don’t have to think. If USD1 truly achieves scale within Binance’s ecosystem, WLFI will no longer be “empty storytelling”, but has the chance to become an “equity token that grows with the stablecoin”, turning the narrative from a PPT to a cash flow statement. Where is WLFI’s investment value? The core point is that WLFI’s value heavily depends on the scaling progress of USD1. If you ask me the probability of USD1 challenging USDT/USDC, I would say: it doesn’t need to directly defeat USDT/USDC. It just needs to become the default option in certain channels with “better yields + smoother path”, then gradually chip away from the edges. And WLFI’s investment logic essentially bets on one thing: US

17 15 6.86K オリジナル >リリース後のWLFIのトレンド強気WLFI seeks the distribution rights of USD liquidity through USD1 on Binance and other channels, showing investment potential.

17 15 6.86K オリジナル >リリース後のWLFIのトレンド強気WLFI seeks the distribution rights of USD liquidity through USD1 on Binance and other channels, showing investment potential. عمر كريبتو - Omar Crypto TA_Analyst Trader C82.25K @MrOmarCrypto

عمر كريبتو - Omar Crypto TA_Analyst Trader C82.25K @MrOmarCrypto♨️ Did you invest in it or not? ♨️ Could the Trump’s Children Fund token $WLFI hit new highs in the upcoming period? And could the Trump token $TRUMP become a meme phenomenon? https://t.co/P8Qvw0kns5

36 10 6.19K オリジナル >リリース後のWLFIのトレンド強気The tweet discusses the potential of WLFI and TRUMP tokens reaching new highs in a bull market or becoming popular meme coins.

36 10 6.19K オリジナル >リリース後のWLFIのトレンド強気The tweet discusses the potential of WLFI and TRUMP tokens reaching new highs in a bull market or becoming popular meme coins. Ali Charts TA_Analyst OnChain_Analyst C164.43K @alicharts

Ali Charts TA_Analyst OnChain_Analyst C164.43K @alichartsWorld Liberty Financial $WLFI looks set up for a 15% price move. https://t.co/d9A0mPjGtj

57 18 6.83K オリジナル >リリース後のWLFIのトレンド強気The WLFI token is expected to see a 15% price increase, and the chart shows a consolidation breakout pattern.

57 18 6.83K オリジナル >リリース後のWLFIのトレンド強気The WLFI token is expected to see a 15% price increase, and the chart shows a consolidation breakout pattern. The Boss TA_Analyst Trader B99.49K @Crypto_TheBoss

The Boss TA_Analyst Trader B99.49K @Crypto_TheBoss🔷️ $WLFI ( @worldlibertyfi ) has reached a key support zone, an area where buying interest has previously been concentrated. If price manages to hold at this level, it may attempt to retest the Fibonacci-based resistance levels, marked by the yellow lines on the chart. ⚠️ This is not investment advice. #WLFI #Crypto #Altcoin #TechnicalAnalysis

183 18 31.92K オリジナル >リリース後のWLFIのトレンド強気WLFI has reached a key support level; if it holds, a rebound to test resistance is possible.

183 18 31.92K オリジナル >リリース後のWLFIのトレンド強気WLFI has reached a key support level; if it holds, a rebound to test resistance is possible. EyeOnChain OnChain_Analyst Trader C5.51K @EyeOnChain

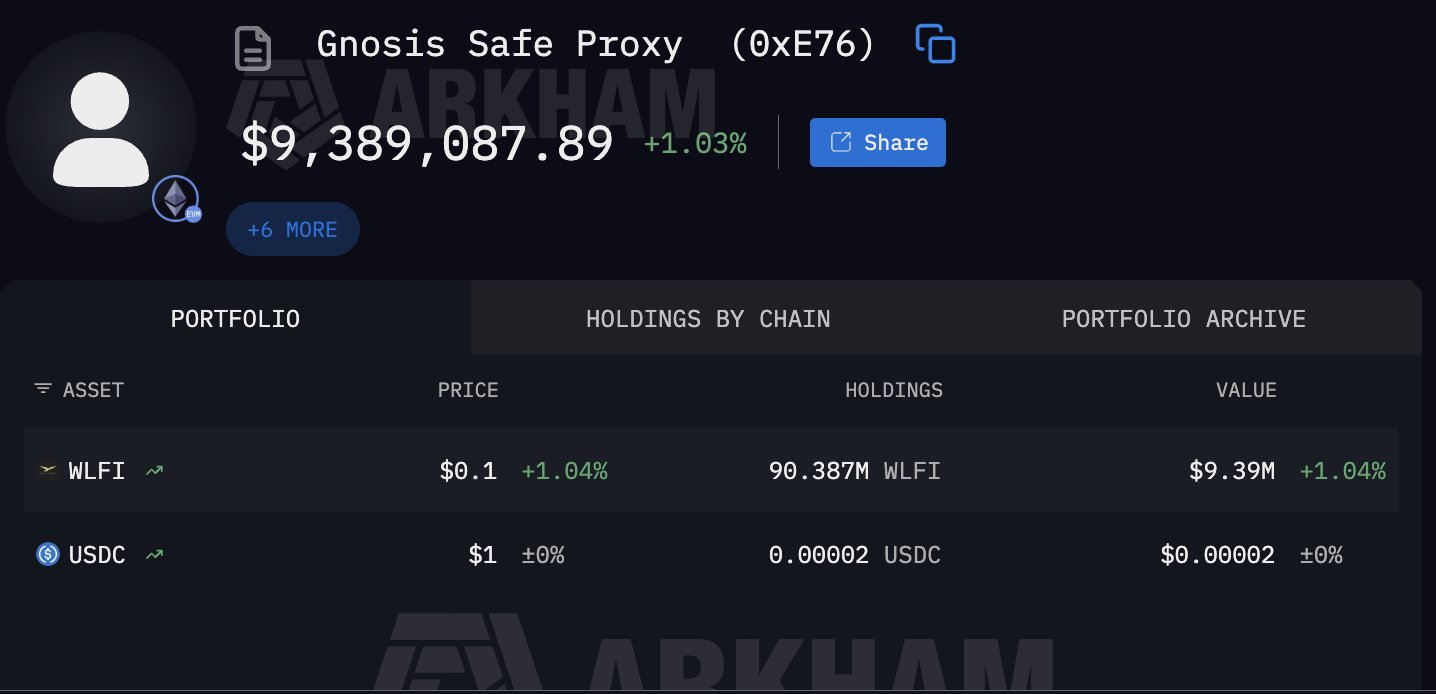

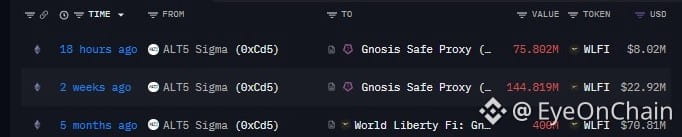

EyeOnChain OnChain_Analyst Trader C5.51K @EyeOnChainThe WLFI treasury is moving pieces again… 75.8M $WLFI SENT🥶. 18 hours ago, Alt5 Sigma sent another 75.8M WLFI, roughly $8.02M, over to World Liberty Fi. Same direction as before. Almost routine at this point. What really stands out though is what didn’t move. Even after the transfer, Alt5 Sigma is still sitting on a massive holding -- around 7.139B #WLFI , valued near $746.4M. Just a reminder that the biggest wallets don’t need to hurry -- they already have time on their side.

2 1 482 オリジナル >リリース後のWLFIのトレンド中立The WLFI whale Alt5 Sigma continues to transfer but still holds a massive amount of tokens, indicating a long‑term strategy.

2 1 482 オリジナル >リリース後のWLFIのトレンド中立The WLFI whale Alt5 Sigma continues to transfer but still holds a massive amount of tokens, indicating a long‑term strategy. BlockchainBaller TA_Analyst OnChain_Analyst B30.75K @bl_ockchain

BlockchainBaller TA_Analyst OnChain_Analyst B30.75K @bl_ockchain🚨 JUST IN 🚨 WLFI treasury firm ALT5 Sigma has sent 75.8M $WLFI (worth $8.02M) back to World Liberty FI Big on-chain transfer 75.8M tokens $8M+ in value $WLFI moving again https://t.co/ngLxyDbjcF

2 0 136 オリジナル >リリース後のWLFIのトレンド中立WLFI treasury transferred back 75.8M WLFI to World Liberty FI, valued at over $8 million.

2 0 136 オリジナル >リリース後のWLFIのトレンド中立WLFI treasury transferred back 75.8M WLFI to World Liberty FI, valued at over $8 million. TingHu♪ Educator Trader C136.96K @TingHu888

TingHu♪ Educator Trader C136.96K @TingHu888Sometimes I really don't know what to say. When Binance launched this event, my first reaction was that $WLFI would definitely drop, because many participants would sell once they receive it; that's the direction. But then I wondered, could there be a short squeeze in the middle? Could those who anticipated the drop and shorted or hedged be forced to cover before it falls further? In the end, it just fell straight down… https://t.co/LNYhxQ5Xu7

69 12 30.33K オリジナル >リリース後のWLFIのトレンド非常に弱気WLFI fell sharply due to airdrop expectations, with the price dropping directly and not rebounding.

69 12 30.33K オリジナル >リリース後のWLFIのトレンド非常に弱気WLFI fell sharply due to airdrop expectations, with the price dropping directly and not rebounding. 吴说区块链 Media Researcher D171.57K @wublockchain12

吴说区块链 Media Researcher D171.57K @wublockchain12Wu said he learned that, according to Lookonchain monitoring, the company Alt5 Sigma (ALT5), suspected to be related to the WLFI Treasury, transferred again 75.8 million WLFI to World Liberty Fi about 11 hours ago, valued at approximately $8.02 million. https://t.c…/93zq8su95n

1 1 2.78K オリジナル >リリース後のWLFIのトレンド中立WLFI transferred again 75.8 million tokens, valued at approximately $8.02 million