Virtual Protocol (VIRTUAL)

Virtual Protocol (VIRTUAL)

- 51ソーシャル・センチメント・インデックス(SSI)-22.22% (24h)

- #68マーケット・パルス・ランキング(MPR)-15

- 324時間ソーシャルメンション-50.00% (24h)

- 67%24時間のKOL強気比率3人のアクティブなKOL

- 概要VIRTUAL core wallet self‑purchase supply, despite a 4.5% price drop and 22% decline in social heat, leads the FUD risk, with rising attention indicating buying pressure.

- 強気のシグナル

- Core wallet buying

- Self‑purchase supply

- Leading fight against FUD

- Attention rebounding

- Funds reconverging

- 弱気のシグナル

- 24h down 4.5%

- Social heat down 22%

- Profit taking

- Low sentiment

- Price breaks support

ソーシャル・センチメント・インデックス(SSI)

- データ全体51SSI

- SSIトレンド(7日間)価格(7日間)センチメントの分布非常に強気 (67%)弱気 (33%)SSIインサイトVIRTUAL social heat is moderate (50.75/100, -22.22%), activity drops 34.38% to 26.25/40, positive sentiment rises 20% to 22.5/30, KOL attention falls 69.23% to 2/30, associated with core wallet self‑purchase supply and a 4.5% price decline.

マーケット・パルス・ランキング(MPR)

- アラートインサイトVIRTUAL warning rank fell to #68 (down 15), social anomaly score dropped to 68.04/100 (-31.96%), sentiment polarization rose 90.33% to 14.64/100, KOL attention shifted to 0.5/100 (-90.91%), reflecting an anomalous signal of FUD hedging and increased buying pressure.

Xへの投稿

Crypto Katze Influencer Educator B2.59K @CryptoKatze

Crypto Katze Influencer Educator B2.59K @CryptoKatze 「 𝕲𝖔𝖔𝖓」 OnChain_Analyst Researcher A8.01K @goon_crypto

「 𝕲𝖔𝖔𝖓」 OnChain_Analyst Researcher A8.01K @goon_cryptoThe @virtuals_io trenches are heating up again. And $VIRTUAL is doing what it always does when attention comes back.... Out performing the market ➜ Up ~50% from the flash crash 9 days ago ➜ Pushing into the prior supply zone ➜ Pressing the downtrend line again Why this matters: ➜ The 60-day launchpad is delivering. New agents are launching with actual utility instead of pure speculation. People are paying attention. ➜ The aGDP leaderboard creates a new game. Top agents compete for revenue. Holders can track performance in real time. This drives engagement and attracts capital. ➜Robotics hasn't even started yet. The team is building infrastructure while everyone else chases narrative plays. When physical AI agents hit the market, $VIRTUAL will be positioned as the base layer. Three levels i'm watching: ➜ $0.72 - immediate resistance ➜ $0.88 - mid-range resistance ➜ $1.05 - reclaim the previous resistance The trend is your friend until it bends. This chart shows accumulation turning into momentum. Have

31 7 1.43K オリジナル >リリース後のVIRTUALのトレンド非常に強気VIRTUAL token, under dual fundamental and technical tailwinds, has rebounded 50% from the flash crash and is breaking through a key resistance level.

31 7 1.43K オリジナル >リリース後のVIRTUALのトレンド非常に強気VIRTUAL token, under dual fundamental and technical tailwinds, has rebounded 50% from the flash crash and is breaking through a key resistance level. Chyan | chyan.base.eth OnChain_Analyst Influencer C12.24K @Chyan

Chyan | chyan.base.eth OnChain_Analyst Influencer C12.24K @Chyan Chyan | chyan.base.eth OnChain_Analyst Influencer C12.24K @Chyan

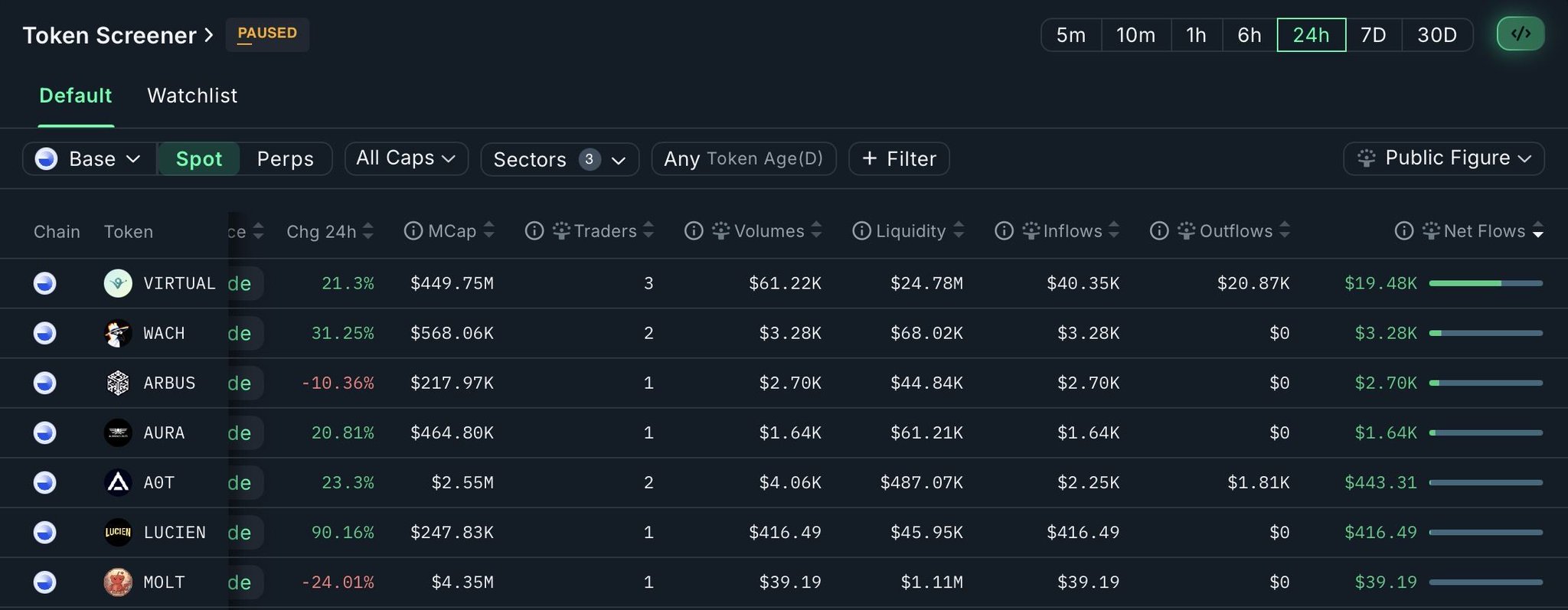

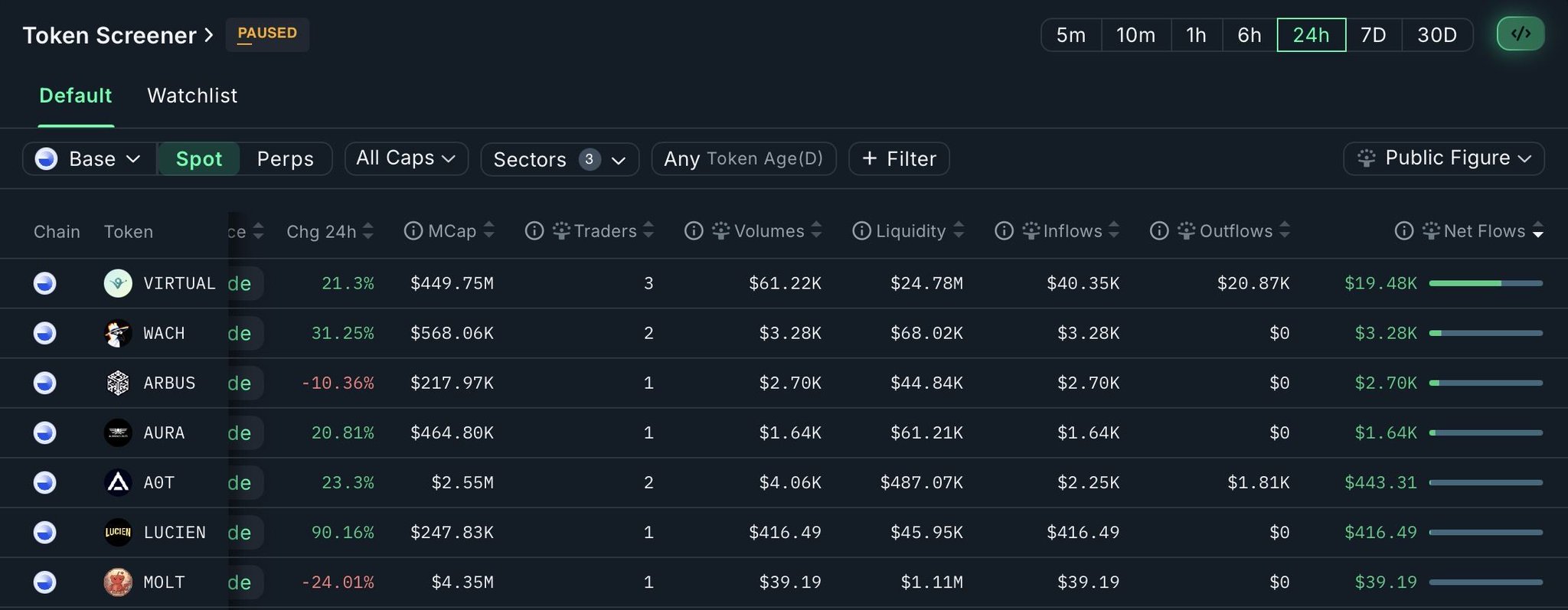

Chyan | chyan.base.eth OnChain_Analyst Influencer C12.24K @Chyan🚨 @base AI & AI Agents 24H KOL Check — $VIRTUAL leads as FUD smacks lobster coins Thin tape = attention is alpha. In compressed conditions, KOL flows punch above their weight. 🏆 Top Net Inflows (24H) via @nansen_ai (Public Figures) 🥇 $VIRTUAL (+21.3%) — +$19.48K 🥈 $WACH (+31.25%) — +$3.28K 🥉 $ARBUS (-10.36%) — +$2.70K ⬇️ Rest of the Board 4️⃣ $AURA (+20.81%) — +$1.64K 5️⃣ $AOT (+23.3%) — +$443 6️⃣ $LUCIEN (+90.16%) — +$416 7️⃣ $MOLT (-24.01%) — +$39 While lobster coins fall back amid the Nikita FUD cycle, KOL capital is rotating toward the @virtuals_io eco. $VIRTUAL reclaiming the top KOL inflow spot alongside +21% price strength is meaningful — flagship attention tends to precede broader narrative momentum. Notably, Virtuals-aligned names dominate the board: $WACH @Wach_AI, $ARBUS @arbusai, $AURA @AurraCloud — small sizing for sure, but coordinated attention. In thin liquidity, this is how rotations begin: exploratory bids → mindshare concentration → reflexivity. Watch where they size up next. Follo

30 4 2.56K オリジナル >リリース後のVIRTUALのトレンド非常に強気KOL funds are flowing into AI/Virtuals ecosystem tokens, with VIRTUAL leading, indicating market rotation.

30 4 2.56K オリジナル >リリース後のVIRTUALのトレンド非常に強気KOL funds are flowing into AI/Virtuals ecosystem tokens, with VIRTUAL leading, indicating market rotation. 𝔊𝔥𝔬𝔰𝔱 Trader Educator B43.62K @ghost93_x

𝔊𝔥𝔬𝔰𝔱 Trader Educator B43.62K @ghost93_xDD reveals top two wallets are Virtuals wallets. They have been buying up their own supply on open market. And many of you mfers are jeeting for small profits or losses. Do your own research and stop copy trading others, you’ll never get rich that way imho. https://t.co/GsFfBlUZUz

66 11 8.12K オリジナル >リリース後のVIRTUALのトレンド弱気VIRTUAL price fell 23.84%, the top two wallets appear to be self‑purchases by the project team, beware of manipulation risk.

66 11 8.12K オリジナル >リリース後のVIRTUALのトレンド弱気VIRTUAL price fell 23.84%, the top two wallets appear to be self‑purchases by the project team, beware of manipulation risk. Chyan | chyan.base.eth OnChain_Analyst Influencer C12.24K @Chyan

Chyan | chyan.base.eth OnChain_Analyst Influencer C12.24K @Chyan🚨 @base AI & AI Agents 24H KOL Check — $VIRTUAL leads as FUD smacks lobster coins Thin tape = attention is alpha. In compressed conditions, KOL flows punch above their weight. 🏆 Top Net Inflows (24H) via @nansen_ai (Public Figures) 🥇 $VIRTUAL (+21.3%) — +$19.48K 🥈 $WACH (+31.25%) — +$3.28K 🥉 $ARBUS (-10.36%) — +$2.70K ⬇️ Rest of the Board 4️⃣ $AURA (+20.81%) — +$1.64K 5️⃣ $AOT (+23.3%) — +$443 6️⃣ $LUCIEN (+90.16%) — +$416 7️⃣ $MOLT (-24.01%) — +$39 While lobster coins fall back amid the Nikita FUD cycle, KOL capital is rotating toward the @virtuals_io eco. $VIRTUAL reclaiming the top KOL inflow spot alongside +21% price strength is meaningful — flagship attention tends to precede broader narrative momentum. Notably, Virtuals-aligned names dominate the board: $WACH @Wach_AI, $ARBUS @arbusai, $AURA @AurraCloud — small sizing for sure, but coordinated attention. In thin liquidity, this is how rotations begin: exploratory bids → mindshare concentration → reflexivity. Watch where they size up next. Follo

30 4 2.56K オリジナル >リリース後のVIRTUALのトレンド非常に強気KOL funds are flowing into AI/Virtuals ecosystem tokens, with VIRTUAL leading, indicating market rotation.

30 4 2.56K オリジナル >リリース後のVIRTUALのトレンド非常に強気KOL funds are flowing into AI/Virtuals ecosystem tokens, with VIRTUAL leading, indicating market rotation. Sovereign Trader DeFi_Expert A3.80K @Sovereign_Web3

Sovereign Trader DeFi_Expert A3.80K @Sovereign_Web3Market is shouting at you that AI coins will lead the way on a bounce or return of the bull market. $virtual $tibbir $vvv $tao outperformance is glaring and I'll be adjusting my spot accumulation and trading to favor these coins.

15 2 926 オリジナル >リリース後のVIRTUALのトレンド強気AI coins are leading the bull market, recommend adding positions in VIRTUAL, etc. RaArΞs ⚓️ DeFi_Expert Educator A45.21K @RaAres

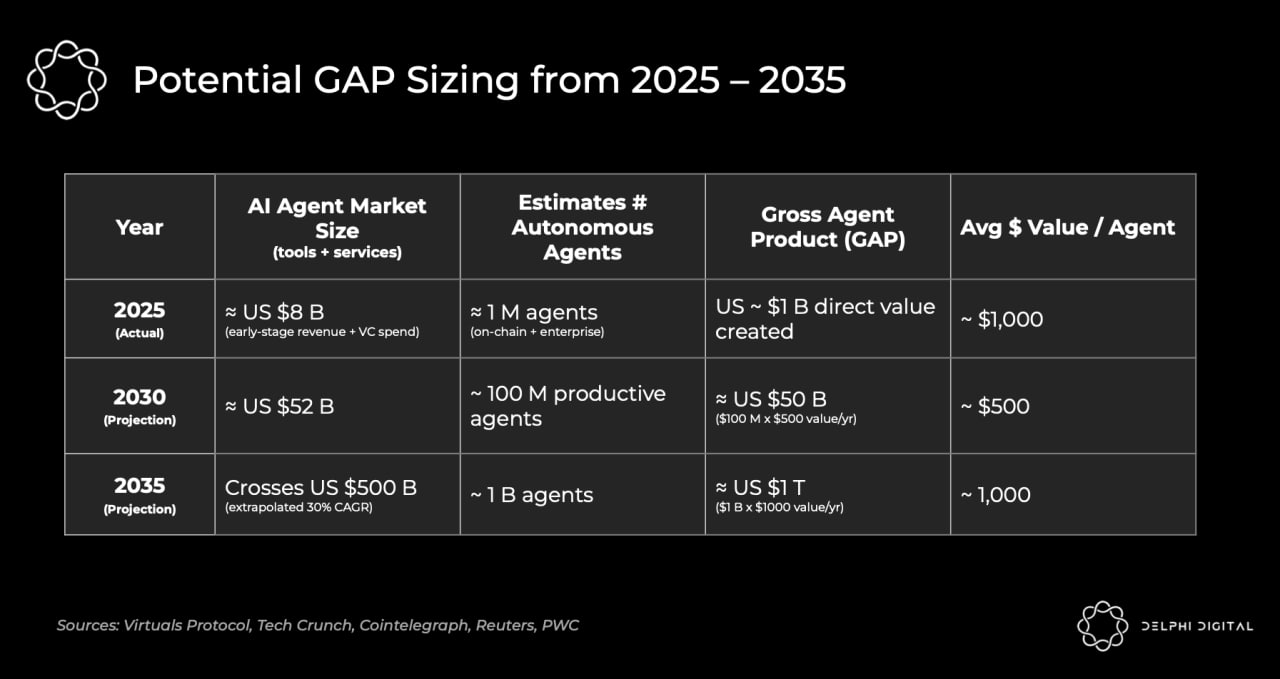

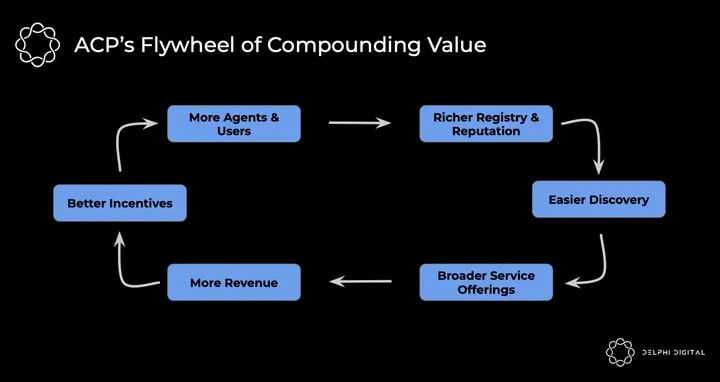

RaArΞs ⚓️ DeFi_Expert Educator A45.21K @RaAres$VIRTUAL @virtuals_io just dropped something that feels like a turning point for ai agents instead of talking about launches, tools or hype, they're focusing on who actually earns when agents do real work that changes the entire conversation here's what i understood from their recent post about monetization x AI you'll understand: → why revenue became the bottleneck → acp as the commerce layer → what revenue incentives for ai actually is → how the pool is funded → how distribution works in practice → what this changes for builders ▫️ why revenue became the bottleneck over the last year, launching ai agents became much easier because tools reduced both the cost and the technical effort required (already launched 5, but dumped all of them) a recent post from @virtuals_io explains that the main constraint is no longer building or distributing agents, but actually making money from them. in earlier cycles, most projects depended on trading activity to generate income, which worked only when markets were active and attention was high. the issue looks like this: • trading volume goes up and down w/ market mood • attention shifts from one narrative to another • competition pushes fees lower when revenue depends mostly on speculation, income moves w/ price swings instead of real usage. their point is simple: long-term earnings must come from people actually paying for useful services, and w/o real demand no reward system can fix weak usage. ▫️ acp as the commerce layer before adding incentives, virtuals built the agent commerce protocol - acp. acp sets the basic onchain rails that let agents transact w/ other agents and w/ users. core components: • agent wallets that act like persistent digital identities • systems to register tasks, jobs and requests • different pricing options for services • cross-chain settlement so payments are not limited to one chain • escrow smart contracts that lock funds per job • automated settlement after evaluation phases the goal was to make agents capable of doing real economic activity, not just exist as tokens. one year later, they add the capital layer on top of that base. learn more about acp here: https://t.co/maPsxXLKtt ▫️ what revenue incentives for ai actually is revenue incentives for ai means redistributing protocol revenue based on actual service output. instead of keeping earnings, virtuals plans to allocate up to around $1m per month to agents that sell services through acp. distribution is automatic, meaning there are no applications, no grants and no committee decisions. allocation depends only on measurable output. mechanism: • more services sold • bigger share of the weekly pool this ties protocol-level earnings directly to builders who generate real activity. ▫️ how the pool is funded 2 streams fund the pool each epoch: i) 30 bps - 0.3% - from virtual ecosystem token swaps ii) 10% of gross revenue from acp-based service transactions so trading activity adds to the pool. but service sales decide who receives what. ▫️ how distribution works in practice each qualifying agent’s allocation is divided equally: • 50% goes to the builder in usdc • 50% is used to buy the agent’s token on the open market those bought tokens are given to customers and unlock gradually over 12 months. this creates a simple loop: • agent provides a useful service • more people use it • service volume improves ranking • ranking increases allocation • builder gets stable cash plus token buy pressure • customers become longer-term participants example from one of their posts: w/ a $1m epoch pool, capturing 10% equals $100k, split into $50k usdc and $50k market buy pressure, plus whatever the agent earned directly from services. even $500 in service sales can unlock $100k allocation if it ranks first that week. long-tail case: • $20 in service revenue • 1% of long-tail volume • $7k allocation split evenly ▫️ what this changes for builders the system pushes builders to focus on making services people actually use, instead of trying to boost trading volume. to qualify, agents must be tokenized through virtuals protocol, since only those integrated into the ecosystem share in the pool. the loop becomes straightforward: i) trading activity fills the pool ii) service demand decides distribution iii) token buybacks reinforce productive agents the shift described is from building infra to building sustainable income around real agent work. liked what you've read? like & repost it so others can read it too don't forget to follow @raares for more alphas & explainers.

115 63 7.81K オリジナル >リリース後のVIRTUALのトレンド非常に強気Virtuals Protocol's new AI agent monetization model is expected to reshape the industry, focusing on real utility.

115 63 7.81K オリジナル >リリース後のVIRTUALのトレンド非常に強気Virtuals Protocol's new AI agent monetization model is expected to reshape the industry, focusing on real utility. Crypto Katze Influencer Educator B2.59K @CryptoKatze

Crypto Katze Influencer Educator B2.59K @CryptoKatze Chyan | chyan.base.eth OnChain_Analyst Influencer C12.24K @Chyan

Chyan | chyan.base.eth OnChain_Analyst Influencer C12.24K @ChyanYo @virtuals_io — what’s going on here? 👀 $VIRTUAL

84 11 16.59K オリジナル >リリース後のVIRTUALのトレンド中立No clear opinion on VIRTUAL yet, suggest to wait and see Sovereign Trader DeFi_Expert A3.80K @Sovereign_Web3

Sovereign Trader DeFi_Expert A3.80K @Sovereign_Web3they know it's the final exit scam pump before coin prices go to hades. good luck to the $virtual community on surviving

Lookonchain OnChain_Analyst Media C680.83K @lookonchain

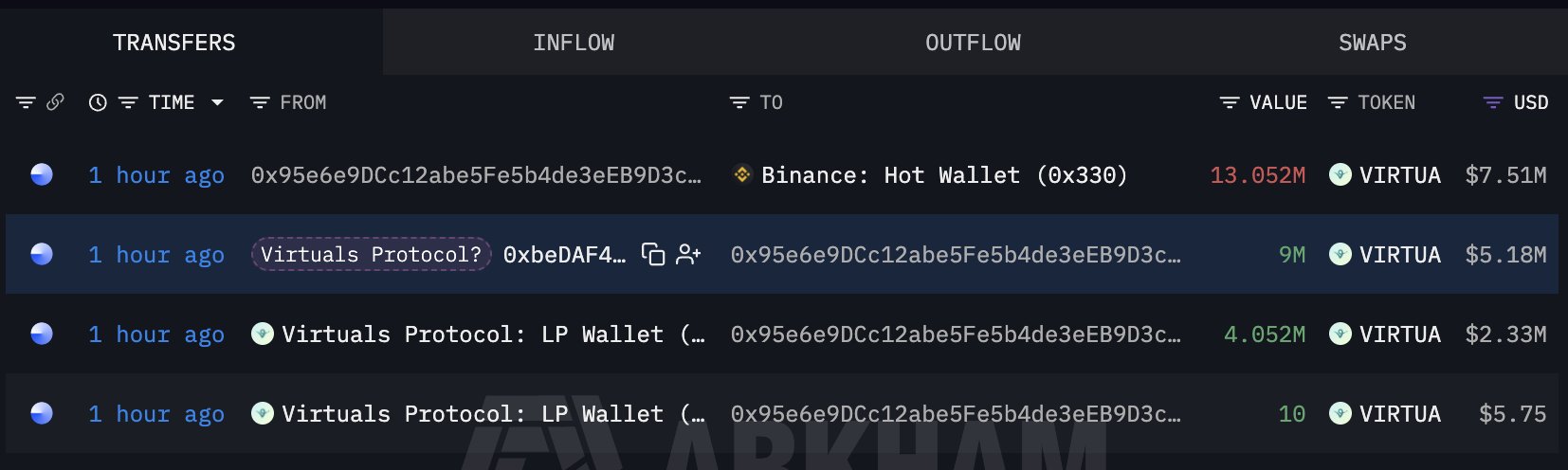

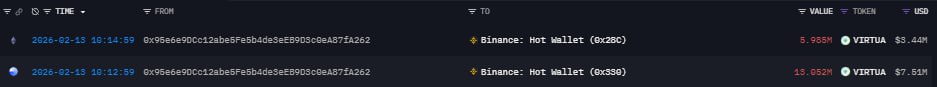

Lookonchain OnChain_Analyst Media C680.83K @lookonchainVirtuals Protocol deposited 13.05M $VIRTUAL($7.51M) to #Binance an hour ago. https://t.co/vqdB1yJDTI https://t.co/yVDyIvXjVF

2 2 491 オリジナル >リリース後のVIRTUALのトレンド非常に弱気Virtuals Protocol transferred a large amount of VIRTUAL tokens to Binance, seen as a pump before the exit scam.

2 2 491 オリジナル >リリース後のVIRTUALのトレンド非常に弱気Virtuals Protocol transferred a large amount of VIRTUAL tokens to Binance, seen as a pump before the exit scam. More Crypto Online TA_Analyst Educator B47.45K @Morecryptoonl

More Crypto Online TA_Analyst Educator B47.45K @Morecryptoonl$VIRTUAL: A break above $0.68 is needed for a first signal that a low has formed in wave ii/b. https://t.co/7BZqr3D7pu

58 26 5.54K オリジナル >リリース後のVIRTUALのトレンド中立VIRTUAL needs to break above $0.68 to confirm the formation of a bottom, currently the price is near the support level.

58 26 5.54K オリジナル >リリース後のVIRTUALのトレンド中立VIRTUAL needs to break above $0.68 to confirm the formation of a bottom, currently the price is near the support level. onchainschool.pro OnChain_Analyst Educator A6.03K @how2onchain

onchainschool.pro OnChain_Analyst Educator A6.03K @how2onchain$VIRTUAL: LARGE BINANCE TRANSFER 2 hours ago, approximately $11M worth of $VIRTUAL was transferred to #Binance , and the impact is already visible in price action The funds originated from: 0xbeDAF4736c7BC4eC837b270956794804b51a8f15 Notably, the previous movement from this wallet occurred about a year ago, and it still holds roughly another $11M in tokens Receiving wallet: 0x95e6e9DCc12abe5Fe5b4de3eEB9D3c0eA87fA262

4 0 1.05K オリジナル >リリース後のVIRTUALのトレンド中立A $11M worth of VIRTUAL tokens was transferred to Binance, affecting the price.

4 0 1.05K オリジナル >リリース後のVIRTUALのトレンド中立A $11M worth of VIRTUAL tokens was transferred to Binance, affecting the price.