Momentum (MMT)

Momentum (MMT)

- 65ソーシャル・センチメント・インデックス(SSI)- (24h)

- #12マーケット・パルス・ランキング(MPR)0

- 124時間ソーシャルメンション- (24h)

- 100%24時間のKOL強気比率1人のアクティブなKOL

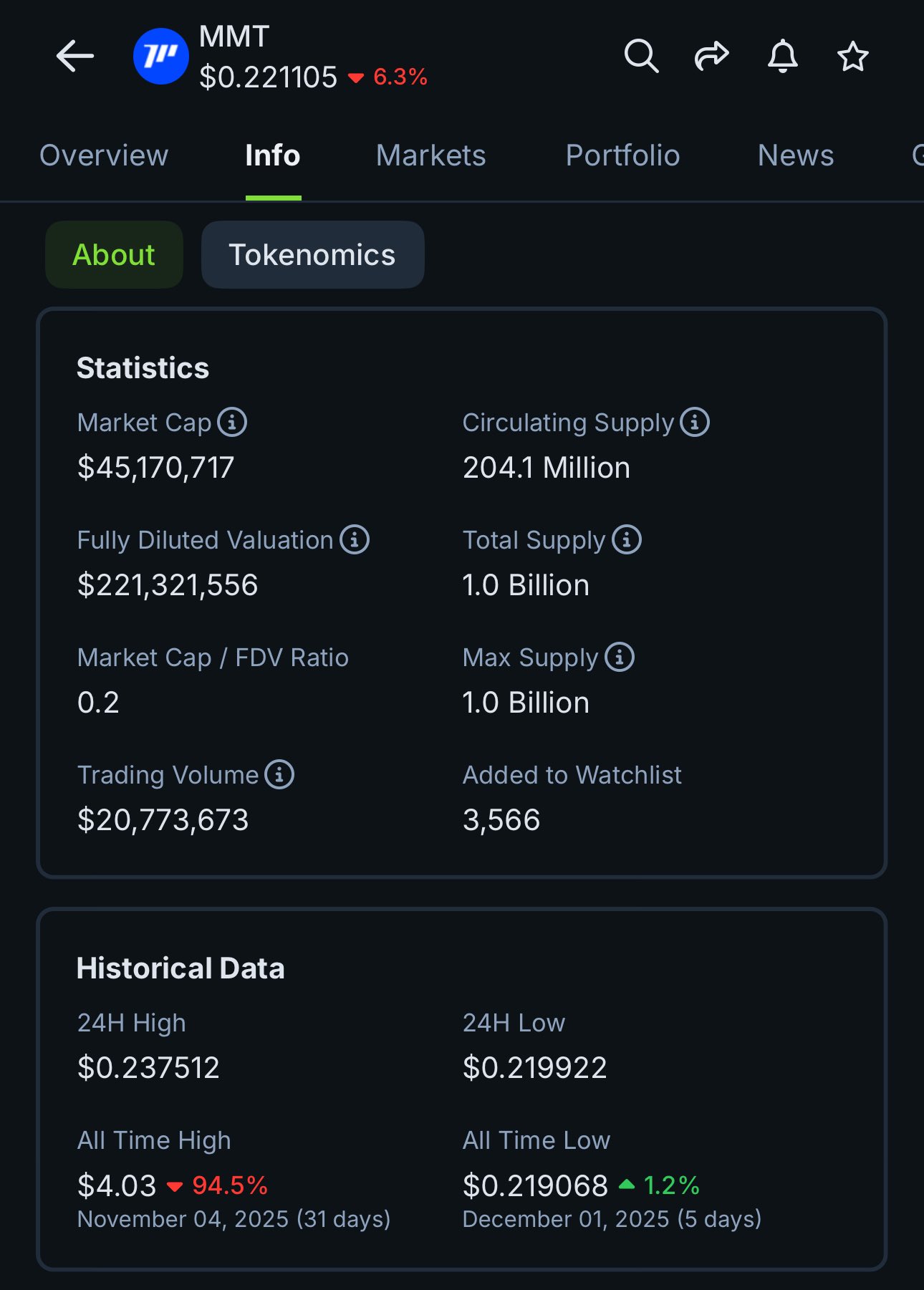

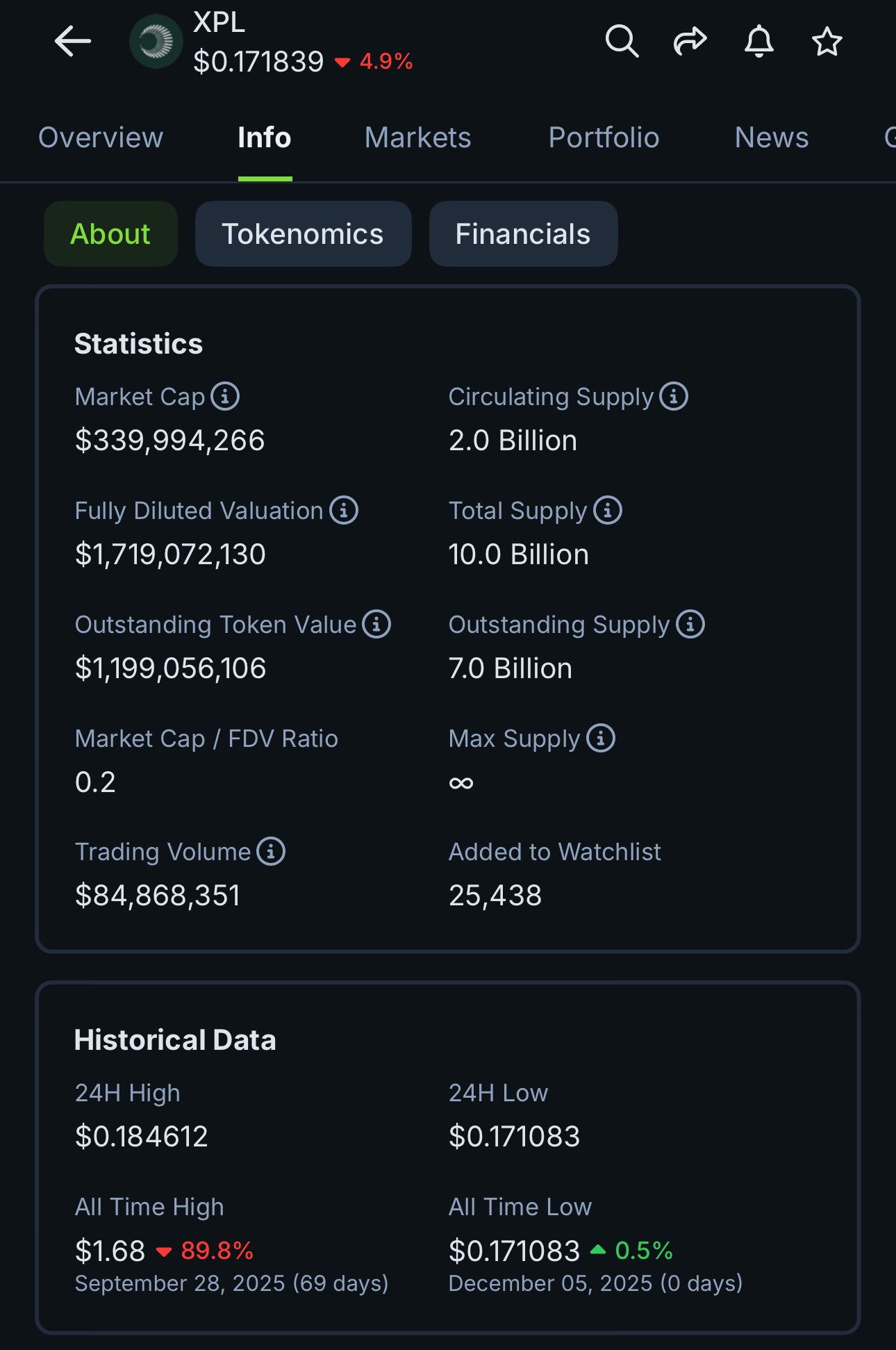

- 概要MMT released full roadmap, reviewed development and Beta DEX launch, price slipped 2% over 24h

- 強気のシグナル

- Full roadmap released

- Beta DEX launched

- Focus on unified liquidity layer

- Community-driven development

- Possesses composable DeFi potential

- 弱気のシグナル

- Price down 2% over 24h

- Social heat stable

- Short-term lack of new hype

- Intense market competition

- No major collaborations recently

ソーシャル・センチメント・インデックス(SSI)

- データ全体65SSI

- SSIトレンド(7日間)価格(7日間)センチメントの分布非常に強気 (100%)SSIインサイトMMT social heat moderate to high (65.5/100), activity 35/40, sentiment positive 30/30 are all high, KOL attention only 0.5/30, remains stable driven by roadmap and Beta DEX release.

マーケット・パルス・ランキング(MPR)

- アラートインサイトMMT warning rank #12, social anomaly 79.42/100, sentiment polarization 100/100 significantly increased, mainly related to sentiment polarization after roadmap release and slight price decline.

Xへの投稿

InfoSpace OG DeFi_Expert FA_Analyst C93.62K @InfoSpace_OG

InfoSpace OG DeFi_Expert FA_Analyst C93.62K @InfoSpace_OG InfoSpace OG DeFi_Expert FA_Analyst C93.62K @InfoSpace_OG

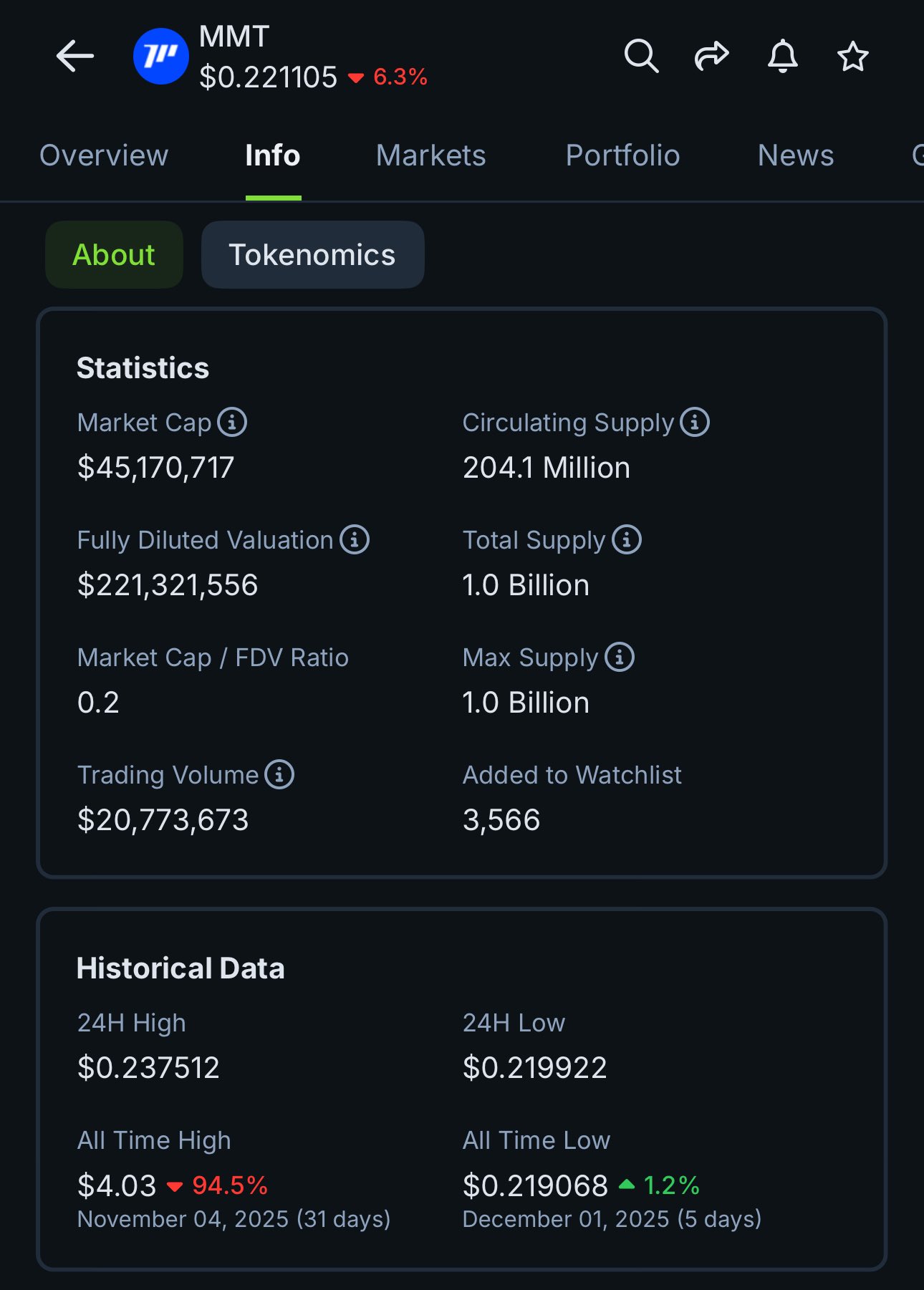

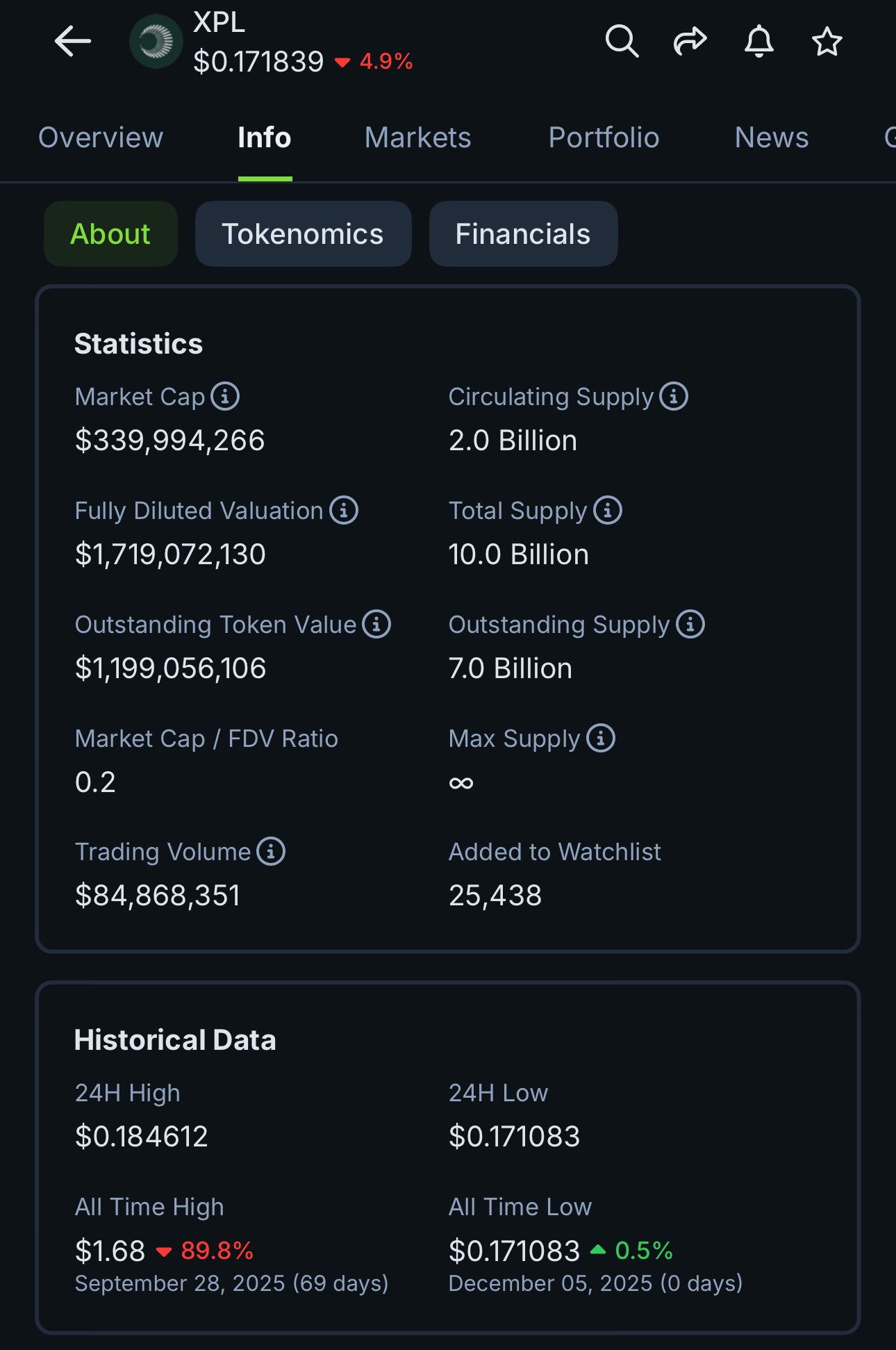

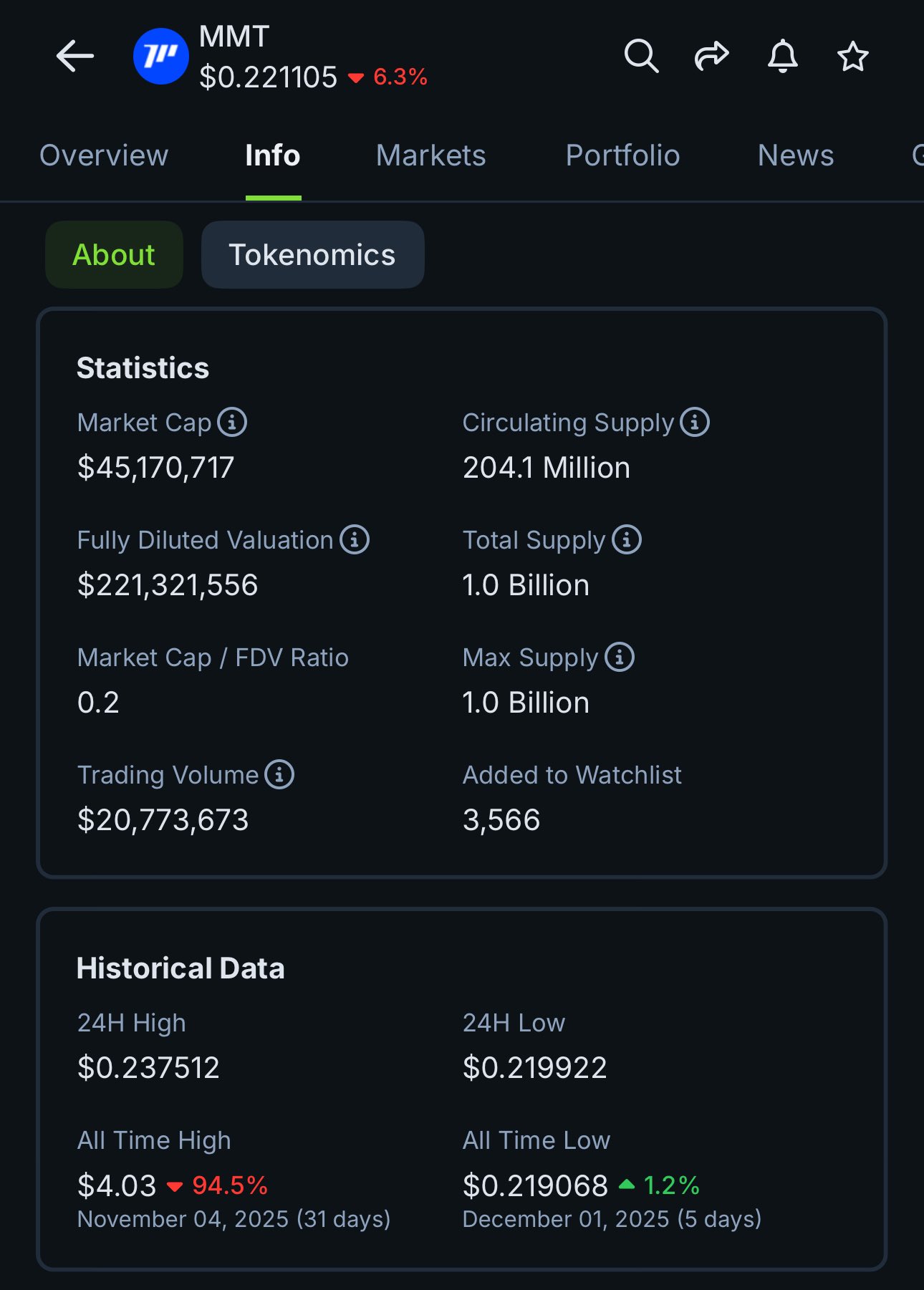

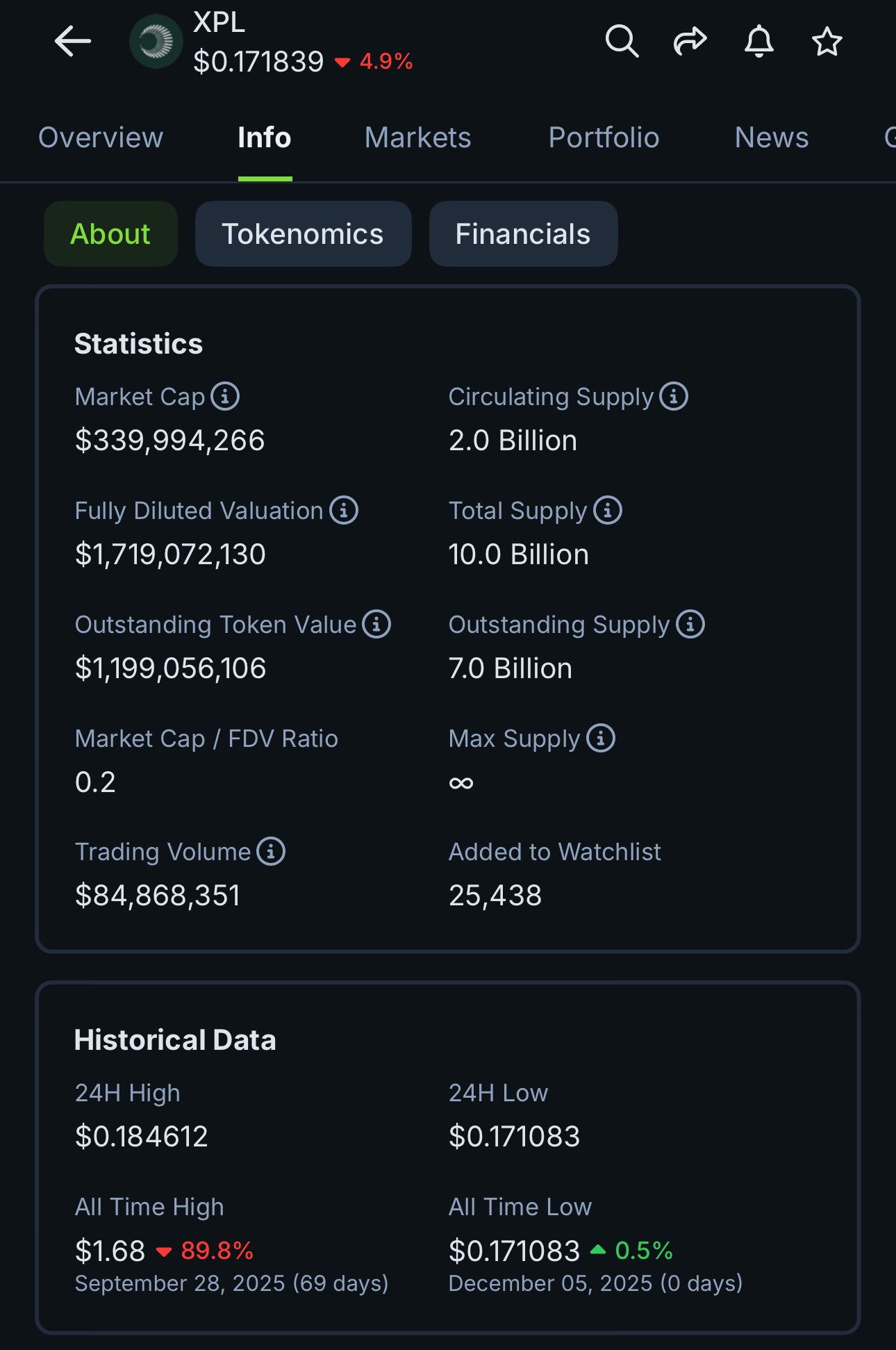

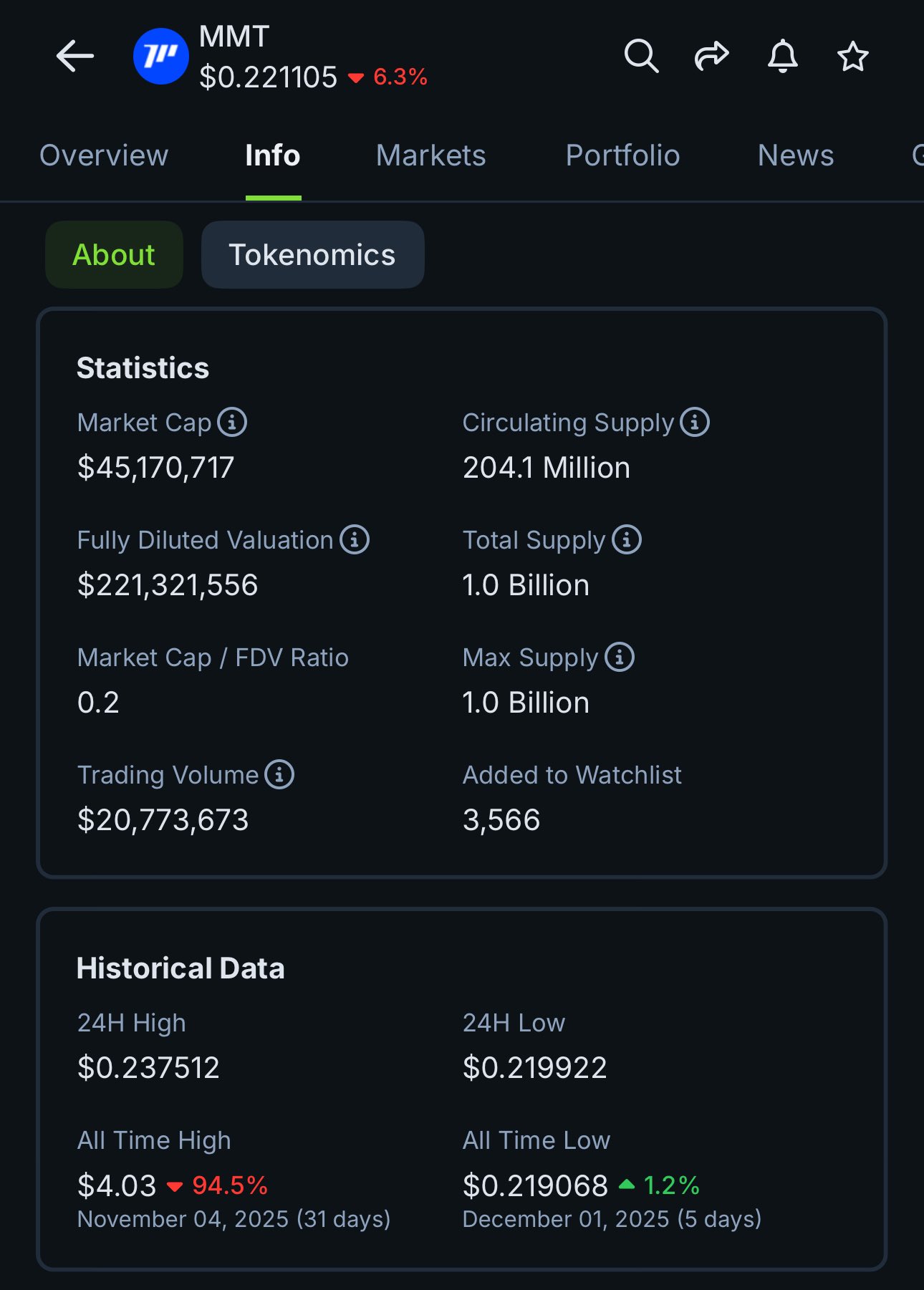

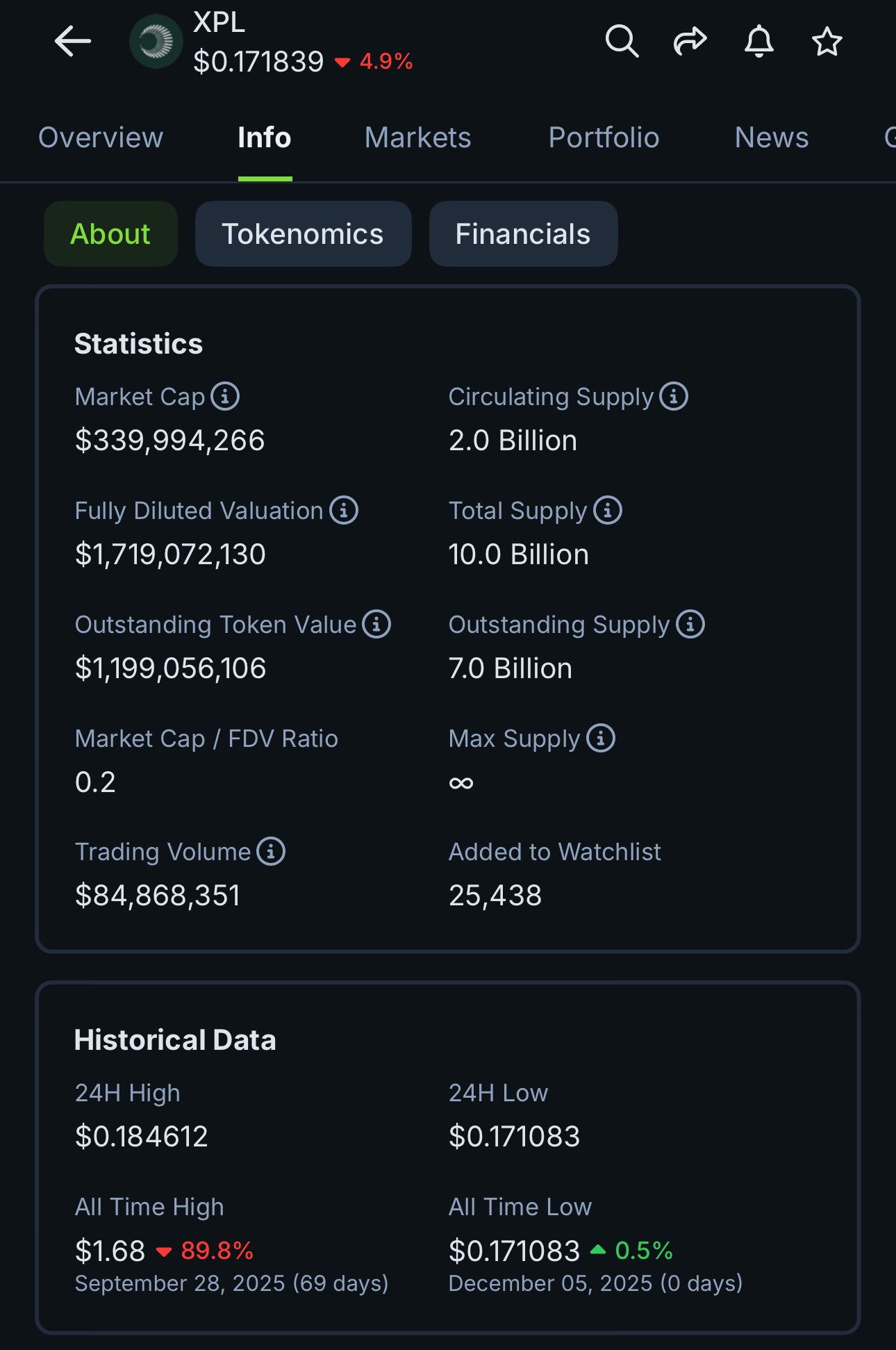

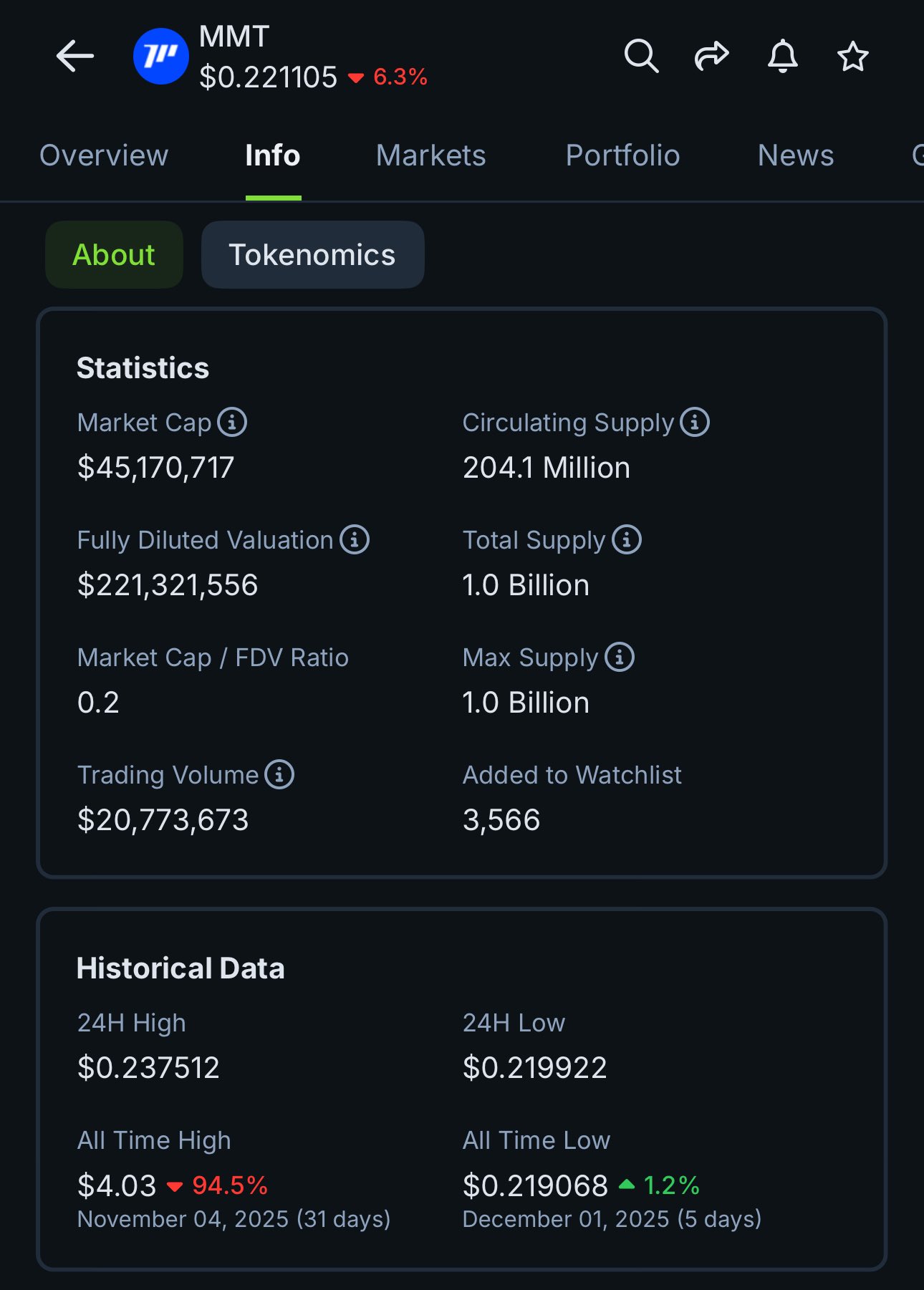

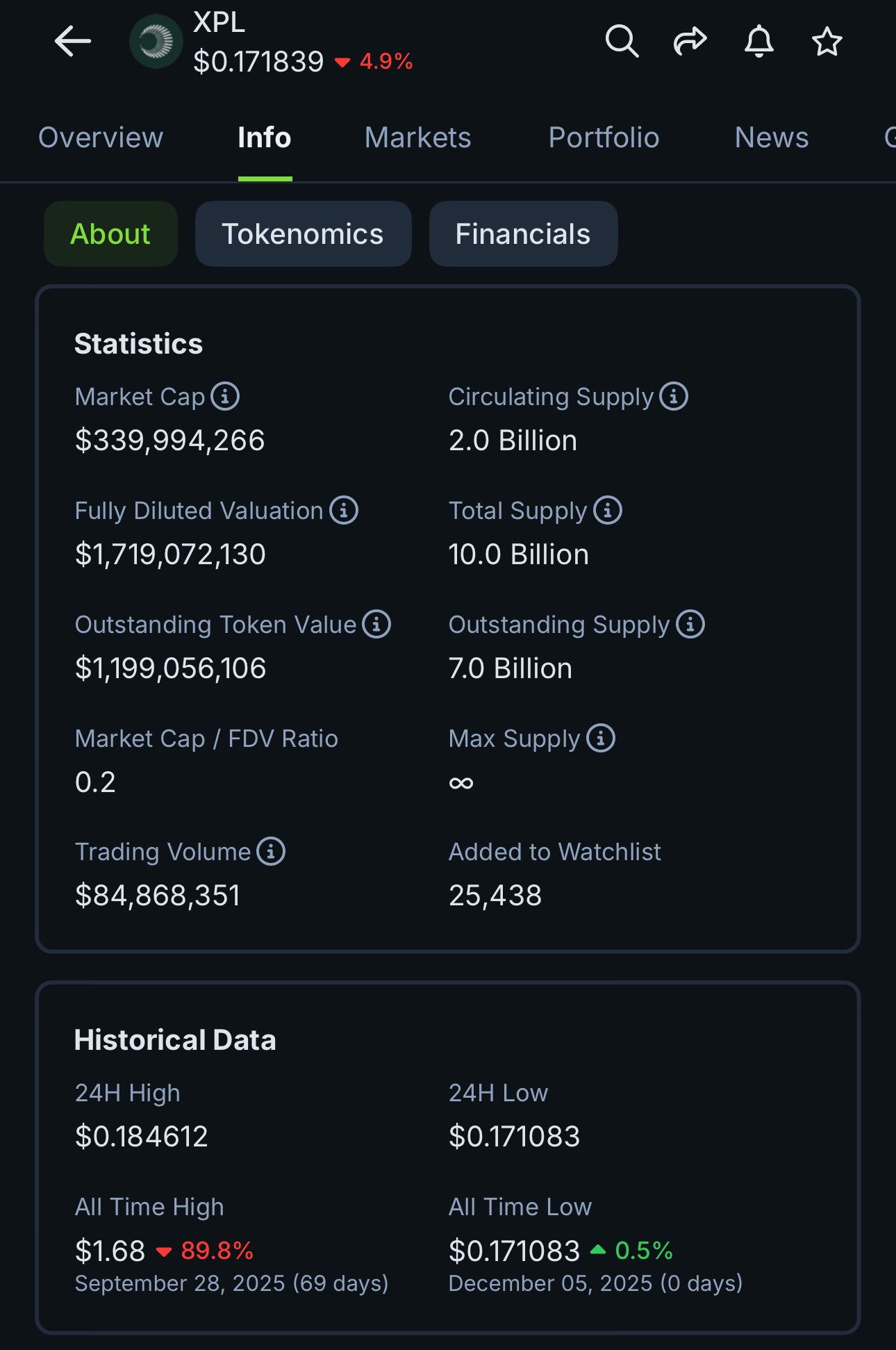

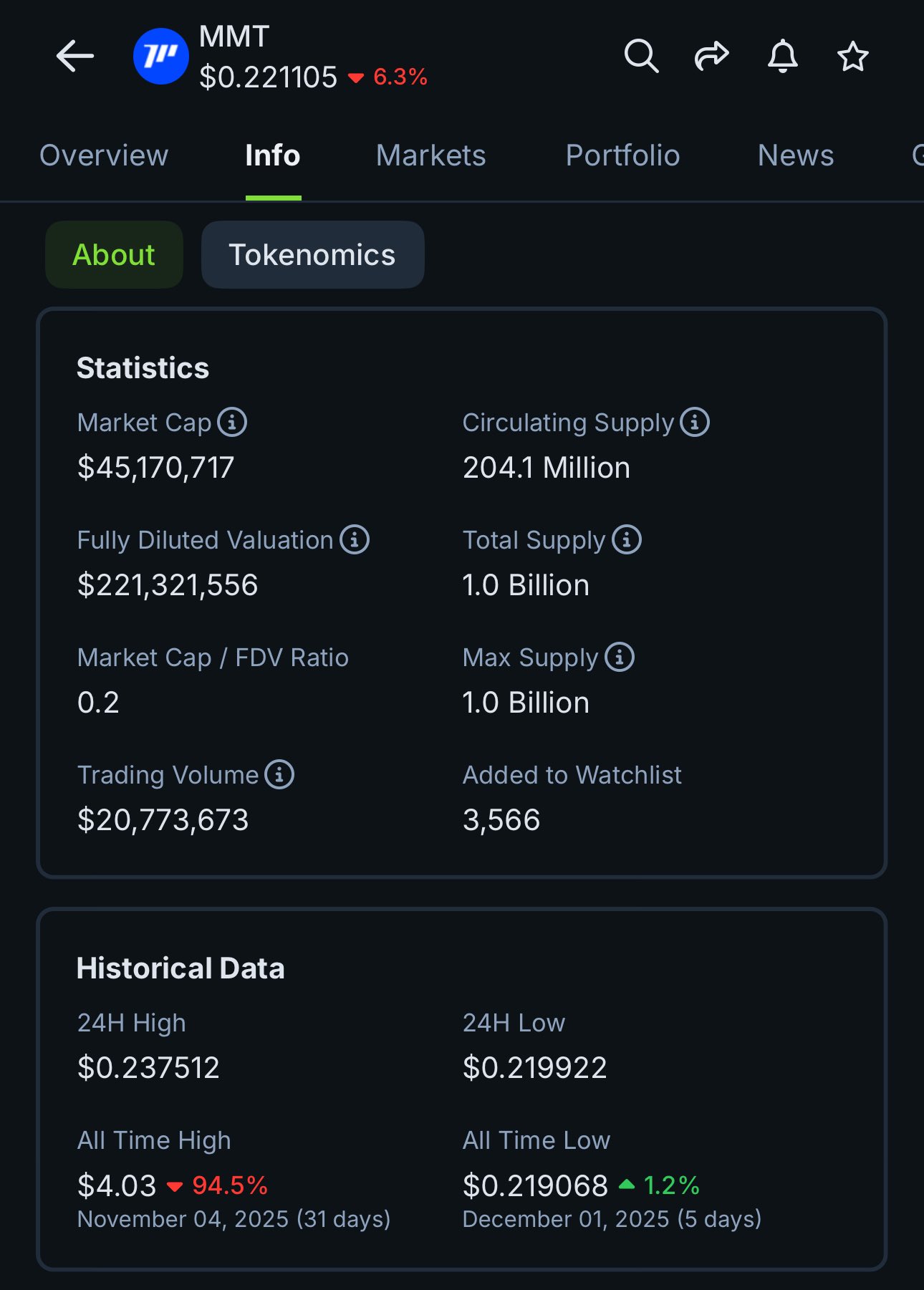

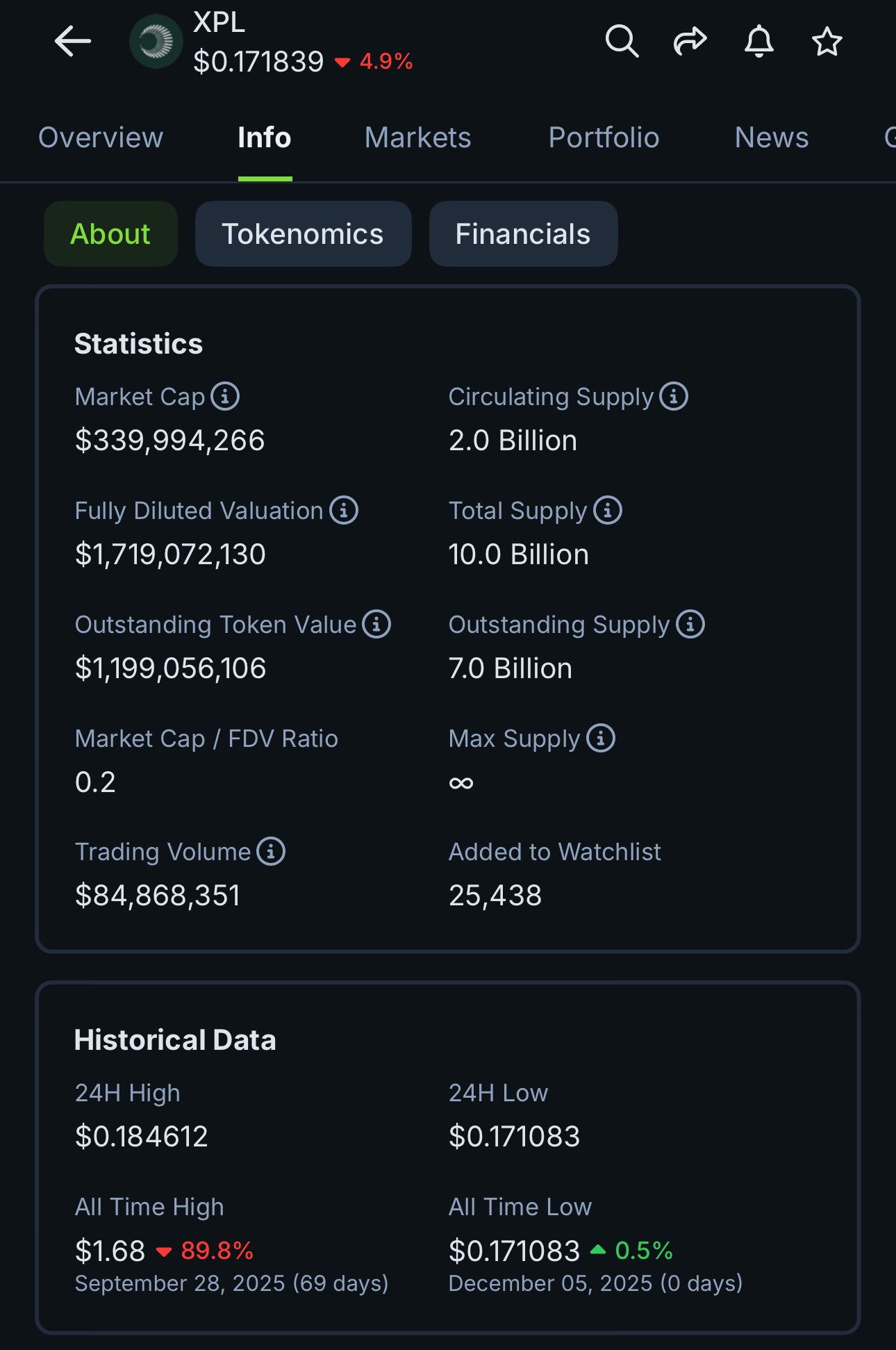

InfoSpace OG DeFi_Expert FA_Analyst C93.62K @InfoSpace_OGIt's barely a month Momentum launched and the token is already below ICo price and 94% down from ATH. Plasma launched about 2 months ago and it's 89% down from ATH. IMO, this is high time Projects start to rethink their launch Val cos you can't get Core believer like this. I'd never be interested in holding a token I know I can be 94% down on in just a month. The points of ICOs and launching at low Val is to give core believers the chance to be a part of your project and have a stake (incentivized to talk about the Tech). No matter how good the tech is, if the token is down 94% and still tanking, hardly would anybody want to talk about it.

50 27 1.16K オリジナル >リリース後のMMTのトレンド非常に弱気After the MMT and XPL tokens were listed, they fell sharply; the author criticizes the project's high-valuation issuance model.

50 27 1.16K オリジナル >リリース後のMMTのトレンド非常に弱気After the MMT and XPL tokens were listed, they fell sharply; the author criticizes the project's high-valuation issuance model. InfoSpace OG DeFi_Expert FA_Analyst C93.62K @InfoSpace_OG

InfoSpace OG DeFi_Expert FA_Analyst C93.62K @InfoSpace_OG InfoSpace OG DeFi_Expert FA_Analyst C93.62K @InfoSpace_OG

InfoSpace OG DeFi_Expert FA_Analyst C93.62K @InfoSpace_OGIt's barely a month Momentum launched and the token is already below ICo price and 94% down from ATH. Plasma launched about 2 months ago and it's 89% down from ATH. IMO, this is high time Projects start to rethink their launch Val cos you can't get Core believer like this. I'd never be interested in holding a token I know I can be 94% down on in just a month. The points of ICOs and launching at low Val is to give core believers the chance to be a part of your project and have a stake (incentivized to talk about the Tech). No matter how good the tech is, if the token is down 94% and still tanking, hardly would anybody want to talk about it.

50 27 1.16K オリジナル >リリース後のMMTのトレンド非常に弱気MMT and XPL new tokens have suffered huge drops, the author criticizes the project teams' issuance strategies.

50 27 1.16K オリジナル >リリース後のMMTのトレンド非常に弱気MMT and XPL new tokens have suffered huge drops, the author criticizes the project teams' issuance strategies. InfoSpace OG DeFi_Expert FA_Analyst C93.62K @InfoSpace_OG

InfoSpace OG DeFi_Expert FA_Analyst C93.62K @InfoSpace_OG InfoSpace OG DeFi_Expert FA_Analyst C93.62K @InfoSpace_OG

InfoSpace OG DeFi_Expert FA_Analyst C93.62K @InfoSpace_OGIt's barely a month Momentum launched and the token is already below ICo price and 94% down from ATH. Plasma launched about 2 months ago and it's 89% down from ATH. IMO, this is high time Projects start to rethink their launch Val cos you can't get Core believer like this. I'd never be interested in holding a token I know I can be 94% down on in just a month. The points of ICOs and launching at low Val is to give core believers the chance to be a part of your project and have a stake (incentivized to talk about the Tech). No matter how good the tech is, if the token is down 94% and still tanking, hardly would anybody want to talk about it.

50 27 1.16K オリジナル >リリース後のMMTのトレンド非常に弱気MMT and XPL tokens crashed after listing, and the author questions new project issuance strategies.

50 27 1.16K オリジナル >リリース後のMMTのトレンド非常に弱気MMT and XPL tokens crashed after listing, and the author questions new project issuance strategies. InfoSpace OG DeFi_Expert FA_Analyst C93.62K @InfoSpace_OG

InfoSpace OG DeFi_Expert FA_Analyst C93.62K @InfoSpace_OG InfoSpace OG DeFi_Expert FA_Analyst C93.62K @InfoSpace_OG

InfoSpace OG DeFi_Expert FA_Analyst C93.62K @InfoSpace_OGIt's barely a month Momentum launched and the token is already below ICo price and 94% down from ATH. Plasma launched about 2 months ago and it's 89% down from ATH. IMO, this is high time Projects start to rethink their launch Val cos you can't get Core believer like this. I'd never be interested in holding a token I know I can be 94% down on in just a month. The points of ICOs and launching at low Val is to give core believers the chance to be a part of your project and have a stake (incentivized to talk about the Tech). No matter how good the tech is, if the token is down 94% and still tanking, hardly would anybody want to talk about it.

50 27 1.16K オリジナル >リリース後のMMTのトレンド非常に弱気New project tokens MMT and XPL have plunged 94% and 89% respectively in the short term, and the author criticizes the project's issuance strategy as a failure.

50 27 1.16K オリジナル >リリース後のMMTのトレンド非常に弱気New project tokens MMT and XPL have plunged 94% and 89% respectively in the short term, and the author criticizes the project's issuance strategy as a failure. InfoSpace OG DeFi_Expert FA_Analyst C93.62K @InfoSpace_OG

InfoSpace OG DeFi_Expert FA_Analyst C93.62K @InfoSpace_OG InfoSpace OG DeFi_Expert FA_Analyst C93.62K @InfoSpace_OG

InfoSpace OG DeFi_Expert FA_Analyst C93.62K @InfoSpace_OGIt's barely a month Momentum launched and the token is already below ICo price and 94% down from ATH. Plasma launched about 2 months ago and it's 89% down from ATH. IMO, this is high time Projects start to rethink their launch Val cos you can't get Core believer like this. I'd never be interested in holding a token I know I can be 94% down on in just a month. The points of ICOs and launching at low Val is to give core believers the chance to be a part of your project and have a stake (incentivized to talk about the Tech). No matter how good the tech is, if the token is down 94% and still tanking, hardly would anybody want to talk about it.

50 27 1.16K オリジナル >リリース後のMMTのトレンド非常に弱気The author is not optimistic about the holding value of new project tokens such as MMT and XPL, which have sharply declined after listing.

50 27 1.16K オリジナル >リリース後のMMTのトレンド非常に弱気The author is not optimistic about the holding value of new project tokens such as MMT and XPL, which have sharply declined after listing. InfoSpace OG DeFi_Expert FA_Analyst C93.62K @InfoSpace_OG

InfoSpace OG DeFi_Expert FA_Analyst C93.62K @InfoSpace_OGIt's barely a month Momentum launched and the token is already below ICo price and 94% down from ATH. Plasma launched about 2 months ago and it's 89% down from ATH. IMO, this is high time Projects start to rethink their launch Val cos you can't get Core believer like this. I'd never be interested in holding a token I know I can be 94% down on in just a month. The points of ICOs and launching at low Val is to give core believers the chance to be a part of your project and have a stake (incentivized to talk about the Tech). No matter how good the tech is, if the token is down 94% and still tanking, hardly would anybody want to talk about it.

50 27 1.16K オリジナル >リリース後のMMTのトレンド非常に弱気After the MMT and XPL tokens were listed, they fell sharply; the author criticizes the project's high-valuation issuance model.

50 27 1.16K オリジナル >リリース後のMMTのトレンド非常に弱気After the MMT and XPL tokens were listed, they fell sharply; the author criticizes the project's high-valuation issuance model. CryptoJournaal Media Educator C18.60K @CryptoJournaal

CryptoJournaal Media Educator C18.60K @CryptoJournaal#Roadmap 🇳🇱 #Momentum ( $MMT ) — Complete Roadmap 🧵 From a mission to create a unified liquidity layer for the tokenized future to a composable DeFi ecosystem, #Momentum has evolved at a rapid pace. Here is the complete journey: Past → Present → Future #CryptoRoadmap 📜 Past: Development & Launch Momentum emerged from the need for more efficient liquidity provision in the Move ecosystem, with Sui as a fast and cost-effective base layer. Key milestones: 🔹 Early Development Phase The team established the core principles of concentrated liquidity market-making (CLMM) and built smart contracts in Move for secure swaps, pools, and incentives, with a strong focus on community-driven development. 🔹 Beta Launch of Momentum DEX The decentralized exchange enabled seamless trading on Sui, including automated yield strategies via vaults, providing users with efficient liquidity and fee optimization. 🔹 Growth of Core Infrastructure Integration of liquid staking and lending, along with the rebranding of MSafe to Momentum, reflected the vision of a unified liquidity layer that makes all assets accessible. 🔹 Preparation of the $MMT token The governance and incentive token was set up with a vote-escrow mechanism (veMMT) to transform users into active stakeholders. Impact: A transition from a CLMM DEX concept to a fundamental DeFi hub with advanced governance, community engagement, and composable asset management. #MomentumHistory ⚡ Present: Current Status & Developments Momentum now functions as the central liquidity hub of the Move ecosystem, with Momentum DEX as its flagship product providing concentrated liquidity for efficient trading and yield generation. Ecosystem Expansion: Partnerships with protocols such as NODO and Nemo introduce automated vaults with hands-off strategies, while integrations with Wormhole, SafePal, Bitlayer, and Coin98 enable cross-chain interoperability and seamless asset management. Technical Progress: Auto-compounding vaults, continuous rebalancing, and AI-driven yield strategies enhance liquidity efficiency and risk management. Governance & Incentives: The ve(3,3) model allows $MMT holders to lock tokens for veMMT, granting voting rights over emissions, fee distribution, and protocol upgrades, thereby aligning incentives between traders, liquidity providers, and builders. Community initiatives include Token Generation Labs (TGL), RWA tokenization, meetups, and NFT giveaways (Momentum Deeds). Ecosystem Challenges: Scaling liquidity, maintaining high efficiency, and fostering active participation remain central, while community-driven governance ensures long-term alignment. #MomentumNow #DeFiInfrastructure 🚀 Future: Planned Roadmap (2025–2030+) Momentum's future vision focuses on a phased expansion into a universal financial OS where crypto and real-world assets harmoniously converge, supported by on-chain compliance and AI optimizations. Key Roadmap Directions: 🔹 Sui Native Deepening (2025–2026) Deepening of the CLMM core, perpetual DEX for derivatives trading, advanced auto-compounding vaults, and TGL onboarding of more Sui projects. DAO-driven governance and AI-powered yield strategies strengthen protocol operations. 🔹 Cross-Chain Scalability (2026–2027) Seamless asset transfers via Wormhole NTTP, multi-chain vaults, and a unified marketplace for crypto trading with optimized routing and low-latency bridges. 🔹 RWA & Compliance Integration (2027–2030+) Launch of Momentum X with universal KYC/AML via zero-knowledge proofs, integrating tokenized RWAs alongside crypto-assets in shared pools. Expansion into B2B2C models, stablecoin issuance, and Web3 trading platforms. Impact: A composable, globally accessible DeFi ecosystem that connects crypto and traditional assets, governed by community DAOs, with intuitive and inclusive financial applications. Risks & Opportunities: Technical complexity, liquidity scalability, and governance coordination pose challenges. Strong community participation, developer engagement, and AI integration provide a solid foundation for sustainable growth. #MomentumFuture #DeFiInnovation ✅ Conclusion Momentum has evolved from a focused liquidity protocol into a comprehensive, community-driven DeFi hub that enables efficient trading, staking, and yield management. With innovations in concentrated liquidity, AI-driven automation, governance, and composable asset integration, $MMT lays the foundation for the tokenized financial future. #RoadmapConclusion 🛒 Want to buy $MMT yourself? $MMT is easy to buy on #Bitvavo: ✅ More than 400 #Altcoins available ✅ Up to €100,000 #AccountGuarantee ✅ Registered with De Nederlandsche Bank (#DNB) ✅ Sign up via the link below and trade up to €10,000 completely #Free! 🔗 https://t.co/DThEHyXfzf #CryptoJournaal #AltcoinPedia #Bitcoin #Crypto #Exchange 📚 Useful resources and additional information Want to know more about #Momentum ( $MMT )? Check out the official channels and documentation below: 🔹Discord: https://t.co/OR9jnFg97Z 🔹Telegram: https://t.co/naKfyaPXSt 🔹Website: https://t.co/9h0bSafTdU 🔹X (Twitter): https://t.co/6cxNDm6QIt ⚠️ Important note: 🔹 This post is purely for educational purposes and not financial advice! 🔹 Only invest what you are willing to lose! ----------------- 👇Follow us👇 ----------------- 🚨 Follow @CryptoJournaal – the place for independent crypto information: 📰 News | 📊 Facts | 🧠 Backgrounds | 🎓 Education 💬 No sponsored tokens 📜 Fully MiCAR-compliant 🔍 Always knowledge over hype 📲 Join us via: 🌐 Website: https://t.co/i0eHsaqt3O 📘 Facebook: https://t.co/he5bTXLFXR 💬 Telegram: https://t.co/i976fBvtv0 👥 CryptoJournaal-AltcoinPedia Community: https://t.co/3yFdzLLS2O 🐦 X-profile: https://t.co/fd2bI2MInh #Altcoins #Bitcoin #CryptoNews #CryptoEducation #CryptoCourses

4 0 384 オリジナル >リリース後のMMTのトレンド非常に強気Momentum (MMT) details its robust roadmap from a liquidity protocol to a DeFi hub, looking ahead to RWA integration and cross-chain expansion.

4 0 384 オリジナル >リリース後のMMTのトレンド非常に強気Momentum (MMT) details its robust roadmap from a liquidity protocol to a DeFi hub, looking ahead to RWA integration and cross-chain expansion. 梭教授说 Trader Influencer C173.09K @hellosuoha

梭教授说 Trader Influencer C173.09K @hellosuohaThe story is only half told, why? Because I know the market maker of $MMT, and this isn’t the first time they’ve done this. (I’ve been slashed several times.) Moreover, because the current regulatory body tightly controls “contract pumping,” this market maker no longer dares to use “contract operations.” This also means that this market maker now just wants to “take a good rest,” because they made a big profit on $MMT, and all other positions they hold are in a continuous downtrend, with no intention to pump. I even know exactly how much the market maker was allocated. 😮💨 Since I’ve been repeatedly slashed, the question arises: if they can’t pump via contracts and don’t want to pump via spot markets, are they forced to go into a continuous decline? It's lamentable and tragic; they may have “clocked out,” or may have been forced to “clock out,” and I recall a period when adjusting the “position margin” directly the positions disappeared.”

30 7 14.82K オリジナル >リリース後のMMTのトレンド弱気TRADOOR, because the market maker is regulated and has no intention to pump, the price experienced violent fluctuations and then continued to decline, and the author was slashed multiple times. Tryrex Trader TA_Analyst S21.29K @Tryrexcrypto

Tryrex Trader TA_Analyst S21.29K @Tryrexcrypto$MMT has an interesting 8-hour chart First sign of a recovery after this downward consolidation Not the best entry, but a strong impulsive move back to 0.35$ remains possible. We'll see if price spikes up now or consolidates more around 0.24 https://t.co/4lUGUJFK36

85 31 6.45K オリジナル >リリース後のMMTのトレンド強気MMT shows signs of recovery after a decline, potentially rallying strongly to $0.35.

85 31 6.45K オリジナル >リリース後のMMTのトレンド強気MMT shows signs of recovery after a decline, potentially rallying strongly to $0.35. AB Kuai.Dong Researcher Media S92.52K @_FORAB

AB Kuai.Dong Researcher Media S92.52K @_FORABJust have to say I'm amazed. A few veteran OGs in the crypto space have regrouped after 25 years to start a new venture, and one of them is a well‑respected industry senior with a great reputation among peers. There's no choice; there have been far too many people collapsing from MMT, and now this Sahara incident has come up. In the MMT episode, even an exchange poured its own money, covering a lot to compensate the big holders. It is said that on the day MMT went down, it was taken over by that. A story of a group with ideals, but they messed up. https://t.co/pA7OhNgw8P

加密无畏 D208.51K @cryptobraveHQ

加密无畏 D208.51K @cryptobraveHQSAHARA's active market maker was liquidated, the same market maker as $MMT. Wuwei learned that last night $SAHARA's price dropped abnormally, due to the recent liquidation of the active market maker. According to insiders, that active market maker operated several well‑known projects including $MMT and $SAHARA. Later, the MM was flagged by the exchange for abnormal market making on a certain project, and all associated addresses/accounts of that MM were identified and its holdings were restricted. In the end, the position was risk‑controlled, leading to last night's crash. The market maker and the boss's specific names are not disclosed for now.

148 70 99.48K オリジナル >リリース後のMMTのトレンド弱気SAHARA's market maker was liquidated, causing a price crash.