Jupiter (JUP)

Jupiter (JUP)

- 91ソーシャル・センチメント・インデックス(SSI)+86.14% (24h)

- #35マーケット・パルス・ランキング(MPR)+86

- 3324時間ソーシャルメンション+560.00% (24h)

- 64%24時間のKOL強気比率17人のアクティブなKOL

- 概要JUP community focuses on DAO voting, deciding to execute the Jupuary airdrop or pause issuance, price up 9%, hype up 86%.

- 強気のシグナル

- Airdrop if it meets incentive demand

- Net-zero issuance reduces selling pressure

- High DAO participation enhances trust

- Social hype rises sharply

- ASR rewards continue

- 弱気のシグナル

- Airdrop delay may be disappointing

- Weak market suppresses buying

- Supply uncertainty increases risk

- Community disagreement causes volatility

- Uncertainty of voting outcomes

ソーシャル・センチメント・インデックス(SSI)

- データ全体91SSI

- SSIトレンド(7日間)価格(7日間)センチメントの分布非常に強気 (12%)強気 (52%)中立 (36%)SSIインサイトJUP social hype is extremely high (90.68/100, +86.14%), activity is at full ↑162.86% and KOL attention up ↑566.67%, sentiment slightly down -28.68%, driven by DAO voting airdrop decision and price +9%.

マーケット・パルス・ランキング(MPR)

- アラートインサイトJUP warning rank rises to #35 (↑86), social abnormality score max 100 ↑332.93% and KOL attention shift ↑3300%, sentiment polarization drops to 25.52, linked to high volatility from DAO airdrop voting.

Xへの投稿

spacebyte ⛓ OnChain_Analyst DeFi_Expert A24.40K @_thespacebyte

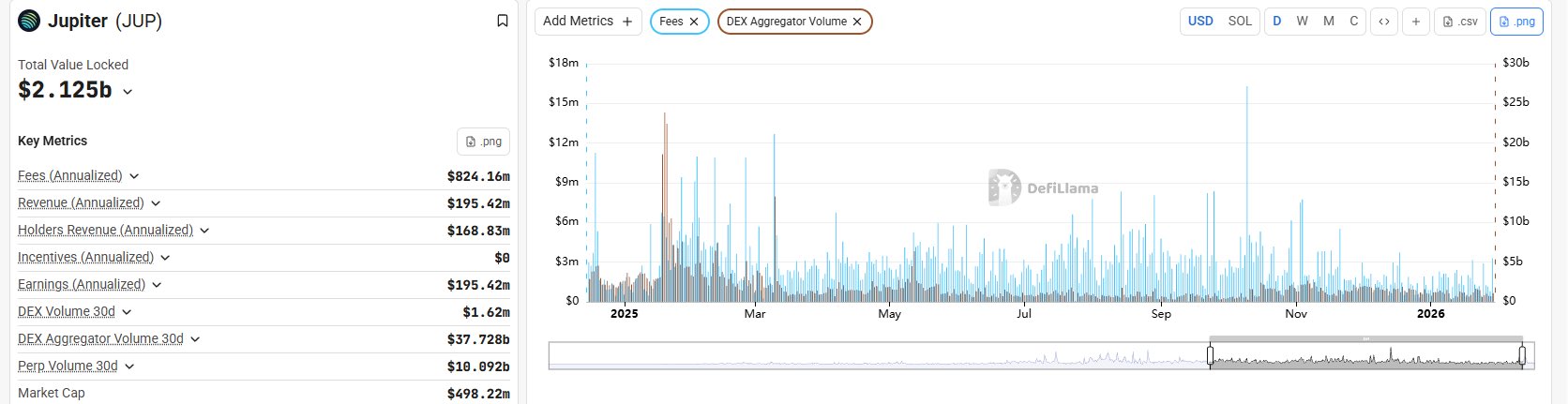

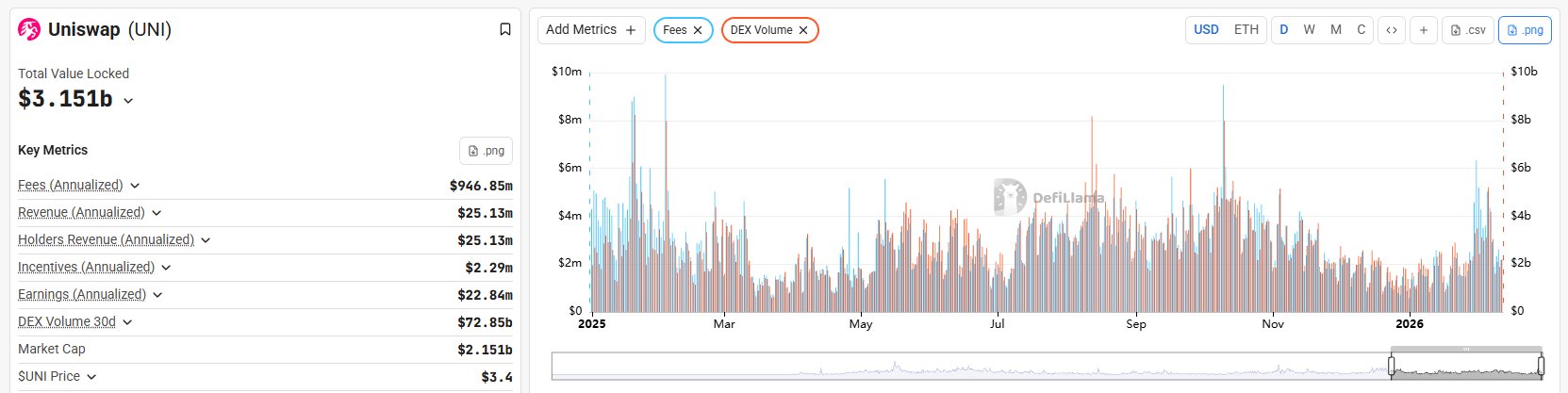

spacebyte ⛓ OnChain_Analyst DeFi_Expert A24.40K @_thespacebyteThe DEX vs Aggregator argument is fading. The real shift is pool ownership → order-flow ownership. - @JupiterExchange is routing ~$37B/month in volume. - @Uniswap earnings are exploding. Different positions in the stack. Same conclusion: Control the flow, capture the value. Liquidity is becoming a commodity. Distribution and routing are becoming the moat.

64 41 1.22K オリジナル >リリース後のJUPのトレンド非常に強気Jupiter and Uniswap excel in order‑flow control, with strong growth in both volume and revenue.

64 41 1.22K オリジナル >リリース後のJUPのトレンド非常に強気Jupiter and Uniswap excel in order‑flow control, with strong growth in both volume and revenue. Kash (🐱, 🐐) DeFi_Expert Community_Lead A48.81K @kashdhanda

Kash (🐱, 🐐) DeFi_Expert Community_Lead A48.81K @kashdhanda wassieloyer D43.14K @wassielawyer

wassieloyer D43.14K @wassielawyerSome thoughts on the latest Jupiter proposal, Jupiter's tokenomics and emissions in general. Starting in reverse order, let's break down as a matter of first principles what emissions are. I think of emissions as a tax on the existing tokenholder base via inflation. When a token is emitted to a user as rewards, a project is essentially asking all existing tokenholders to subsidize the reward to the user. Similarly, when a token is emitted to a team member or an investor, you are socializing the cost of that team member or investor on the general tokenholder base. Now it is not always unreasonable for tokenholders to bear these inflationary costs. Tokenholders economic interests are served when the demand for the token outstrips the supply and there are scenarios where introducing more tokens into the market via inflation may create net demand (e.g. team is building a better product, more people use the product, more people want the token etc). The question is who should have the right to decide whether

76 37 7.28K オリジナル >リリース後のJUPのトレンド中立JUP's inflationary issuance is seen as a cost to holders and requires careful governance. Jupiter DeFi_Expert Media C610.10K @JupiterExchange

Jupiter DeFi_Expert Media C610.10K @JupiterExchange JupiterDAO D70.74K @jup_dao

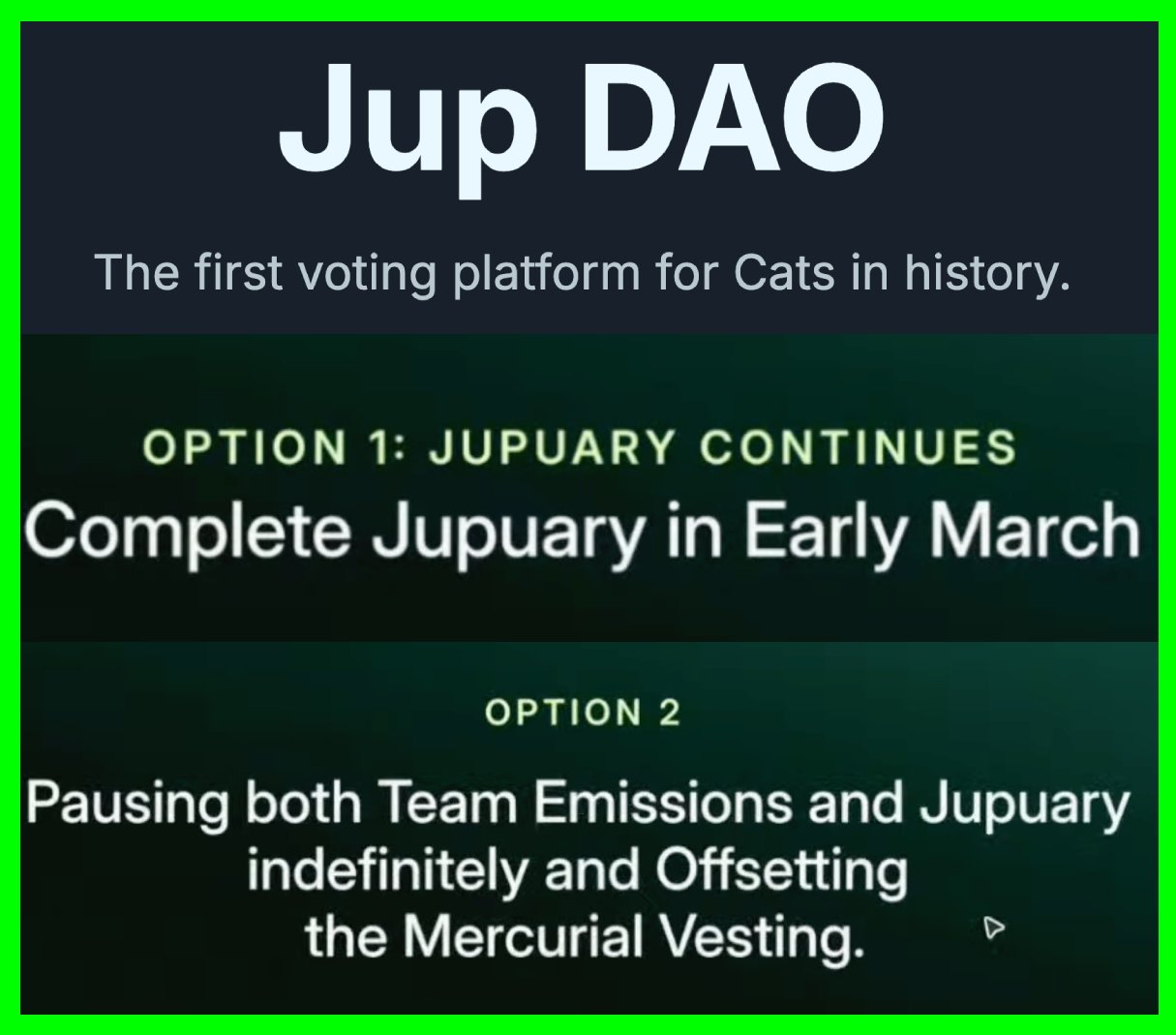

JupiterDAO D70.74K @jup_daoA new DAO proposal is now LIVE! This is a crucial vote that impacts all token holders. High leverage decisions about $JUP are exactly what the DAO is built for, and so this must be decided collectively. The vote comes down to 2 options regarding the emissions schedule for 2026: Option 1: Proceed with Jupuary Jupuary will continue as planned, with the airdrop checker released ~1 week after the conclusion of the vote. In the event that option 1 passes, Jupuary emissions, Team emissions, and Mercurial emissions will proceed as per their regular vesting schedules. Option 2: Pause Emissions - Jupuary will be postponed, with tokens returned to the Community Cold Multisig - Tokens will not be emitted from the team reserve for the foreseeable future, and Jupiter will absorb any team token sales - Mercurial stakeholders will be airdropped their remaining tokens and an equivalent number will be purchased by Jupiter The vote begins on Tuesday the 17th @ 11am UTC and will run to Saturday to give people enough t

269 82 23.10K オリジナル >リリース後のJUPのトレンド中立JUP DAO vote will decide the direction of the 2026 emission schedule. Crypto Warehouse Media Educator S5.60K @GibCryptoNews

Crypto Warehouse Media Educator S5.60K @GibCryptoNews🟢 Voting is Important Get involved in the vote on @jup_dao, this starts next Tuesday. Stop emissions Continue emissions You vote, you decide, links below. @JupiterExchange

JupiterDAO D70.74K @jup_dao

JupiterDAO D70.74K @jup_daoA new DAO proposal is now LIVE! This is a crucial vote that impacts all token holders. High leverage decisions about $JUP are exactly what the DAO is built for, and so this must be decided collectively. The vote comes down to 2 options regarding the emissions schedule for 2026: Option 1: Proceed with Jupuary Jupuary will continue as planned, with the airdrop checker released ~1 week after the conclusion of the vote. In the event that option 1 passes, Jupuary emissions, Team emissions, and Mercurial emissions will proceed as per their regular vesting schedules. Option 2: Pause Emissions - Jupuary will be postponed, with tokens returned to the Community Cold Multisig - Tokens will not be emitted from the team reserve for the foreseeable future, and Jupiter will absorb any team token sales - Mercurial stakeholders will be airdropped their remaining tokens and an equivalent number will be purchased by Jupiter The vote begins on Tuesday the 17th @ 11am UTC and will run to Saturday to give people enough t

14 0 3.61K オリジナル >リリース後のJUPのトレンド中立JUP 2026 emission plan voting opened, deciding whether to pause or continue the airdrop Kash (🐱, 🐐) DeFi_Expert Community_Lead A48.81K @kashdhanda

Kash (🐱, 🐐) DeFi_Expert Community_Lead A48.81K @kashdhanda@Uzzynaire https://t.co/myvbrOwrbR https://t.co/lOzkiOygbk

Kash (🐱, 🐐) DeFi_Expert Community_Lead A48.81K @kashdhanda

Kash (🐱, 🐐) DeFi_Expert Community_Lead A48.81K @kashdhandaappreciate the thoughtful feedback! but will have to disagree here - doing all at once is the only way to go. It’s all or nothing. Team has already shown conviction many times (3b burn, locking tokens, 50% of revenue to token, etc) This time, it’s about setting a powerful narrative. It’s not net zero emissions if there’s 700M tokens being emitted lol. If this vote passes, it creates an unignorable story in a market filled with tokens that have massive supply unlocks. It changes fundamentally the way the market will view JUP. But the only way to get to net zero is across the board put everything down. reasonable minds can differ though, excited to see the convo continue and the vote happen next week

0 0 1 オリジナル >リリース後のJUPのトレンド強気The vote passing will allow JUP to achieve network-wide emission reductions, and the market is optimistic about its value. pamanberuang 🇮🇩 DeFi_Expert Educator S10.79K @bukanpamanmu

pamanberuang 🇮🇩 DeFi_Expert Educator S10.79K @bukanpamanmuJUP Rally just finished, and here are the key points to note. A new vote will soon take place in the DAO, which will determine the next steps regarding Jupuary 2026. No final decision yet. The community will set the direction. Two options are being discussed: Option 1⃣: ▫️Proceed as planned ▫️Checker airdrop opens around Feb 28 ▫️Jupuary distribution starts March 7 ▫️Airdrop 200 million $JUP + 200 million bonus pool ▫️300 million allocated for JupNet incentives Option 2⃣: ▫️Delay and restructure ▫️Postpone Jupuary until an unspecified time ▫️Return tokens to Community Multisig ▫️Stop Team Reserve emission ▫️Balance Mercurial stakeholder emission (given current market conditions) ⚠️ Important context: Jupuary was originally approved through governance DAO, so any delay or change must also be decided through the same mechanism. This is not a unilateral decision by the team. The final outcome is determined by $JUP stakers. ⁉️Will you choose to continue distribution in March, or delay and restructure?

13 2 798 オリジナル >リリース後のJUPのトレンド中立The JUP community will vote to decide the Jupuary airdrop and token allocation plan.

13 2 798 オリジナル >リリース後のJUPのトレンド中立The JUP community will vote to decide the Jupuary airdrop and token allocation plan. Marino FA_Analyst DeFi_Expert A20.13K @marinonchain

Marino FA_Analyst DeFi_Expert A20.13K @marinonchainWhat will you be voting for regarding Jupuary? Postpone Jupuary & pause team emissions? Or proceed with the airdrop as planned? Both paths have real trade‑offs 👇 1⃣ Option 1: Rip The Band‑Aid Off ✅ Complete the airdrop 👉 Fairer to those who focused on (high) activity ✅ Enter new bull market with major unlocks behind us 👉 Jupuary fully distributed 👉 Including 200M bonus pool 👉 Mercurial emissions fully ended (Dec '26) 2⃣ Option 2: Net‑Zero Emissions ✅ Snapshot preserved for potential future DAO release ✅ Pause team emissions ✅ Mercurial emissions absorbed through buybacks ✅ No new net supply pressure ✅ Give $JUP room to stabilise in a weak market ✅ Important to note 👉 ASR continues as usual (50M $JUP each Quarter) 3⃣ It comes down to this: ✅ Clear the unlock overhang now OR ✅ Freeze emissions & reset supply for the foreseeable future - and stabilise the token. What is your view? Or preferred option?

56 53 3.93K オリジナル >リリース後のJUPのトレンド中立The JUP community vote decides whether to postpone the airdrop and pause team emissions to stabilize the token or relieve unlock pressure.

56 53 3.93K オリジナル >リリース後のJUPのトレンド中立The JUP community vote decides whether to postpone the airdrop and pause team emissions to stabilize the token or relieve unlock pressure. MUSE Influencer Community_Lead A24.80K @NFTMuse_

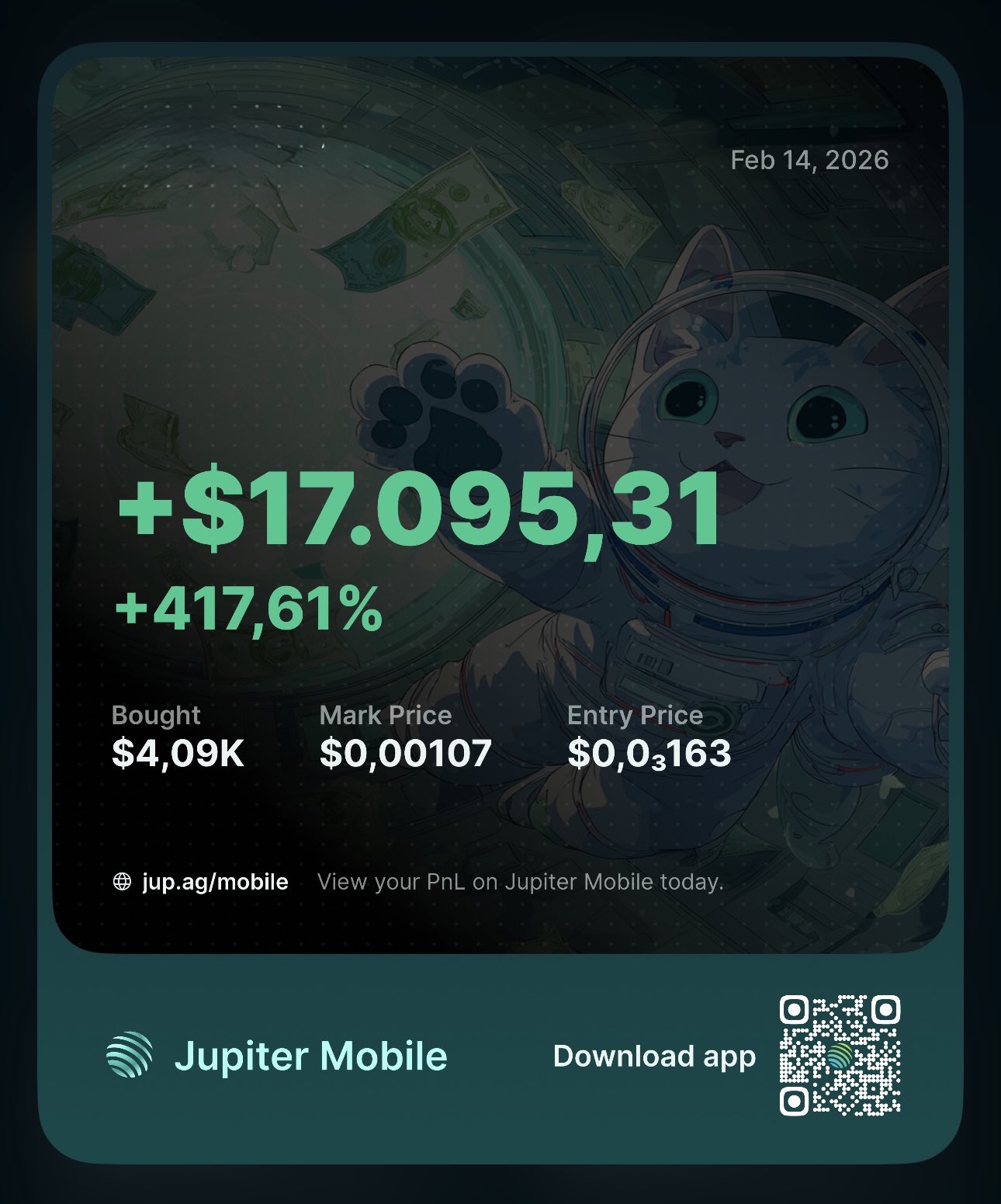

MUSE Influencer Community_Lead A24.80K @NFTMuse_The worst market conditions I’ve experienced and some of my best trades so far Girls can trade too, vlog coming soon! One @jup_mobile and a dream. https://t.co/BzVDgYGmox

90 25 2.87K オリジナル >リリース後のJUPのトレンド非常に強気The author achieved over 400% profit, reaching $17,000, using Jupiter Mobile in harsh market conditions.

90 25 2.87K オリジナル >リリース後のJUPのトレンド非常に強気The author achieved over 400% profit, reaching $17,000, using Jupiter Mobile in harsh market conditions. Marino FA_Analyst DeFi_Expert A20.13K @marinonchain

Marino FA_Analyst DeFi_Expert A20.13K @marinonchainThe $JUP Rally sent shockwaves through the Jupiter community 🪐 Do we proceed with Jupuary - or pause emissions indefinitely? And what happens to ASR rewards? I went through the full livestream & summarised the key insights. So you know exactly what you’re voting on 🧵👇 1️⃣ What The Rally Actually Confirmed ✅ This is a real @jup_dao decision 👉 Not a unilateral team move 👉 Jupuary was DAO-approved before 👉 Any change must go through the DAO again ✅ The vote is clearly framed 👉 Option 1 = Proceed with Jupuary 👉 Option 2 = Pause team emissions + postpone Jupuary indefinitely ✅ The timeline is locked in 👉 Discussion live now 👉 Town Hall Feb 16 👉 Vote Feb 17–21 ✅ ASR continues either way 👉 50M $JUP per quarter 👉 Same structure as today 👉 Staking rewards are NOT being removed 👉 “Net zero emissions” does NOT include ASR 2️⃣ Option 1 - Execute Jupuary Now ✅ The execution‑first path 👉 Checker ~ Feb 28 👉 Airdrop ~ Mar 7 👉 Deliver exactly what was planned ✅ The strongest argument 👉 Credibility & consistency 👉 Users positioned around Jupuary 👉 “We committed - we deliver” ✅ The real market risk? 👉 Near‑term supply enters a weak market 👉 Adds potential sell pressure 👉 Can quickly turn into “exit liquidity” optics 3️⃣ Option 2 - Go Net Zero ✅ The core idea 👉 No net new supply hitting the market 👉 Immediate shift in $JUP supply dynamics ✅ What it actually includes 👉 Pause team emissions (~50M/month cited) 👉 Postpone Jupuary & return ~700M $JUP to cold multisig ◆ Offset Mercurial stakeholder emissions via buybacks if they sell ✅ Why this is a strong signal 👉 Jupiter becomes a structural $JUP accumulator 👉 Clear supply reset narrative: “No net new emissions” 👉 Clear, simple supply story 4️⃣ Why There’s No Hybrid Option ✅ The objective of Option 2 is very specific 👉 Net zero emissions indefinitely 👉 Not “reduced emissions” 👉 Not “offset most of it” 👉 Zero net new supply hitting the market ✅ Jupuary itself is a major emission event 👉 ~700M $JUP enters circulation 👉 Even if team emissions pause 👉 Circulating supply still expands materially 👉 That directly breaks the “net zero” framing ✅ A hybrid sounds simple - but it changes the thesis 👉 “Do Jupuary but pause team” still expands supply now 👉 It becomes partial dilution reduction ◆ It’s no longer a supply reset ◆ It becomes “less dilution” - not “zero emissions" 5️⃣ My Personal View ✅ Option 1 - Rip The Band‑Aid Off 👉 Get the distribution over with 👉 Jupuary done 👉 Mercurial emissions end December 2026 👉 200M bonus pool unlock completes 👉 We enter 2027 with major unlocks behind us ✅ Option 2 - Stabilise First 👉 Snapshot preserved for potential future release 👉 Pause team emissions 👉 Mercurial emissions absorbed through buybacks 👉 No new net supply pressure 👉 Let the token stabilise in a weak market ✅ Both are defensible - it comes down to this: 👉 Clear the unlock overhang now 👉 Or protect the floor & reset supply 👉 Vote based on which future you believe is stronger 🔚

0 0 8 オリジナル >リリース後のJUPのトレンド中立JUP community will vote on Jupuary and token emissions, and the tweet provides a detailed analysis of the two proposals.

0 0 8 オリジナル >リリース後のJUPのトレンド中立JUP community will vote on Jupuary and token emissions, and the tweet provides a detailed analysis of the two proposals. Kash (🐱, 🐐) DeFi_Expert Community_Lead A48.81K @kashdhanda

Kash (🐱, 🐐) DeFi_Expert Community_Lead A48.81K @kashdhandajupiter goes green https://t.co/XPxgbuPK2h

fannz D4.14K @0xfannz

fannz D4.14K @0xfannzjupiter has already proven they actually care about the token. burned 3b tokens including 30% of team allocation. founders locked to 2030, meow locked to 2030 50% of revenue to buybacks. in these market conditions, emitting millions tokens just doesn’t make sense. i’d rather have fewer tokens that are worth more than more tokens that dump in price. option 2 is the most bullish move i’ve seen. team doesn’t get tokens, they get credits. if they want to sell? jupiter buys them for the balance sheet. this is skin in the game on steroids. mercurial fully offset. every sale equals an equivalent buy by jupiter. zero sell pressure. jupuary postponed but snapshot stays. we’re not losing anything, just waiting for the right moment. result? emissions go to roughly zero in 2026. jupiter’s balance sheet fills up with jup. team and community economics tied to one token. this isn’t short term thinking. this is playing the long game. building value instead of diluting it. some people will be angry becau

116 55 7.13K オリジナル >リリース後のJUPのトレンド強気JUP achieves zero sell pressure through burns and buybacks, bullish in the long term.