Curve DAO Token (CRV)

Curve DAO Token (CRV)

$0.252 -0.79% 24H

- 30ソーシャル・センチメント・インデックス(SSI)+1.96% (24h)

- #124マーケット・パルス・ランキング(MPR)+17

- 124時間ソーシャルメンション0% (24h)

- 0%24時間のKOL強気比率1人のアクティブなKOL

- 概要

- 強気のシグナル

- 弱気のシグナル

ソーシャル・センチメント・インデックス(SSI)

- データ全体30SSI

- SSIトレンド(7日間)価格(7日間)センチメントの分布中立 (100%)SSIインサイト

マーケット・パルス・ランキング(MPR)

- アラートインサイト

Xへの投稿

captnhayz ¤ FA_Analyst Tokenomics_Expert B3.24K @captnhayz

captnhayz ¤ FA_Analyst Tokenomics_Expert B3.24K @captnhayz Michael Egorov Founder DeFi_Expert B42.28K @newmichwill14 0 1.25K オリジナル >リリース後のCRVのトレンド中立

Michael Egorov Founder DeFi_Expert B42.28K @newmichwill14 0 1.25K オリジナル >リリース後のCRVのトレンド中立 FREKI ANCIENT CRYPTO OG | 2011 | HBAR XRP BTC ETH Influencer Educator B9.95K @Freki_OG

FREKI ANCIENT CRYPTO OG | 2011 | HBAR XRP BTC ETH Influencer Educator B9.95K @Freki_OG CrediBULL Crypto TA_Analyst Educator B485.18K @CredibleCrypto441 29 60.75K オリジナル >リリース後のCRVのトレンド中立

CrediBULL Crypto TA_Analyst Educator B485.18K @CredibleCrypto441 29 60.75K オリジナル >リリース後のCRVのトレンド中立- リリース後のCRVのトレンド強気

protechtor TA_Analyst Trader A2.25K @protechtor

protechtor TA_Analyst Trader A2.25K @protechtor TraderJB TA_Analyst Trader A2.35K @TraderJBx

TraderJB TA_Analyst Trader A2.35K @TraderJBx 64 7 8.36K オリジナル >リリース後のCRVのトレンド強気

64 7 8.36K オリジナル >リリース後のCRVのトレンド強気 FREKI ANCIENT CRYPTO OG | 2011 | HBAR XRP BTC ETH Influencer Educator B9.95K @Freki_OG

FREKI ANCIENT CRYPTO OG | 2011 | HBAR XRP BTC ETH Influencer Educator B9.95K @Freki_OG TraderJB TA_Analyst Trader A2.35K @TraderJBx

TraderJB TA_Analyst Trader A2.35K @TraderJBx 1 0 274 オリジナル >リリース後のCRVのトレンド非常に強気

1 0 274 オリジナル >リリース後のCRVのトレンド非常に強気 FREKI ANCIENT CRYPTO OG | 2011 | HBAR XRP BTC ETH Influencer Educator B9.95K @Freki_OG

FREKI ANCIENT CRYPTO OG | 2011 | HBAR XRP BTC ETH Influencer Educator B9.95K @Freki_OG TraderJB TA_Analyst Trader A2.35K @TraderJBx

TraderJB TA_Analyst Trader A2.35K @TraderJBx 392 39 34.66K オリジナル >リリース後のCRVのトレンド強気

392 39 34.66K オリジナル >リリース後のCRVのトレンド強気- リリース後のCRVのトレンド強気

- リリース後のCRVのトレンド強気

Michael Egorov Founder DeFi_Expert B42.28K @newmichwill

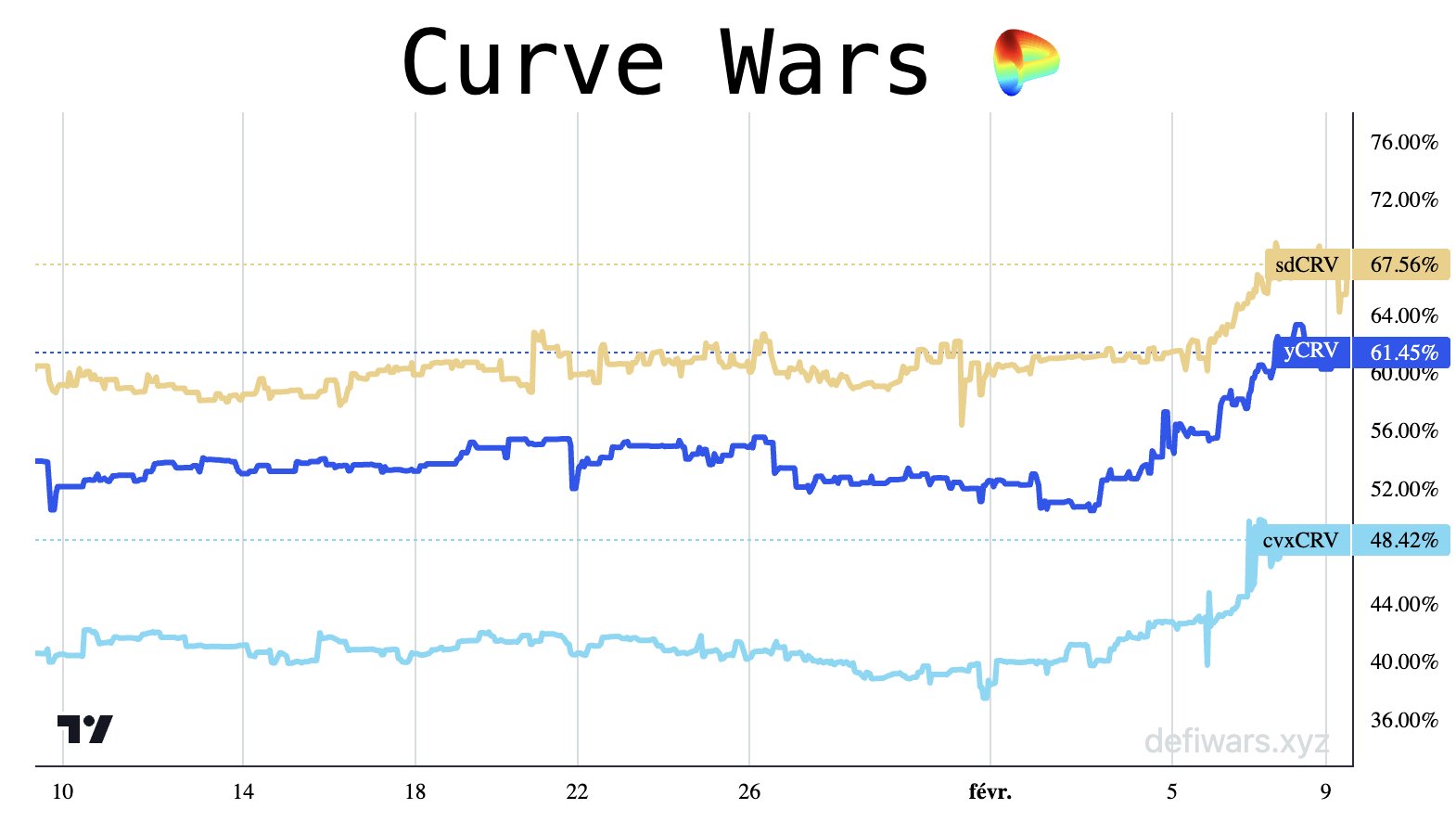

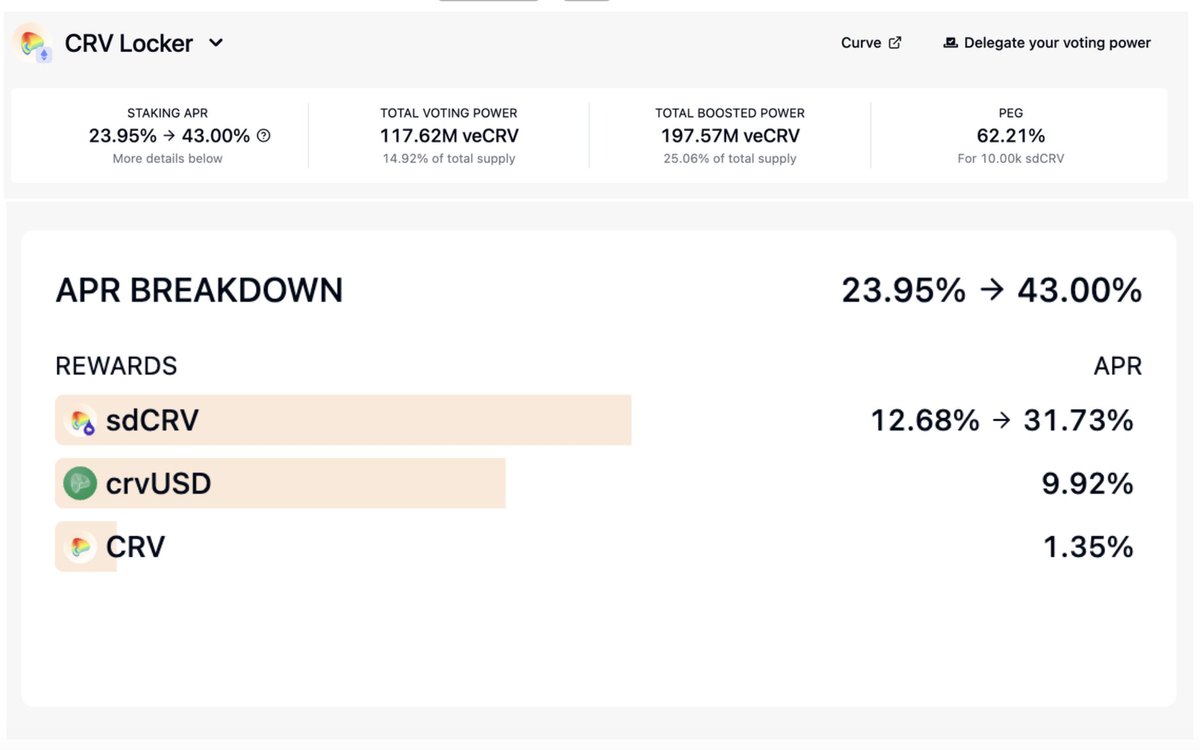

Michael Egorov Founder DeFi_Expert B42.28K @newmichwill Stake DAO D26.97K @StakeDAOHQ

Stake DAO D26.97K @StakeDAOHQ 77 7 5.45K オリジナル >リリース後のCRVのトレンド非常に強気

77 7 5.45K オリジナル >リリース後のCRVのトレンド非常に強気 Michael Egorov Founder DeFi_Expert B42.28K @newmichwill

Michael Egorov Founder DeFi_Expert B42.28K @newmichwill Cigarette.eth D159 @0x_Cigarettes

Cigarette.eth D159 @0x_Cigarettes 23 2 2.47K オリジナル >リリース後のCRVのトレンド非常に強気

23 2 2.47K オリジナル >リリース後のCRVのトレンド非常に強気