Bitcoin (BTC)

Bitcoin (BTC)

+1.27% 24H

- 63ソーシャル・センチメント・インデックス(SSI)-6.59% (24h)

- #71マーケット・パルス・ランキング(MPR)+13

- 1,28524時間ソーシャルメンション-28.21% (24h)

- 65%24時間のKOL強気比率491人のアクティブなKOL

- 概要

- 強気のシグナル

- 弱気のシグナル

ソーシャル・センチメント・インデックス(SSI)

- データ全体63SSI

- SSIトレンド(7日間)価格(7日間)センチメントの分布非常に強気 (24%)強気 (41%)中立 (14%)弱気 (17%)非常に弱気 (4%)SSIインサイト

マーケット・パルス・ランキング(MPR)

- アラートインサイト

Xへの投稿

MR SHIFT 🦁 Media Influencer B59.68K @KevinWSHPod

MR SHIFT 🦁 Media Influencer B59.68K @KevinWSHPod MR SHIFT 🦁 Media Influencer B59.68K @KevinWSHPod329 32 230.62K オリジナル >リリース後のBTCのトレンド中立

MR SHIFT 🦁 Media Influencer B59.68K @KevinWSHPod329 32 230.62K オリジナル >リリース後のBTCのトレンド中立 𝐃𝐚𝐯𝐢𝐝𝐎𝐧𝐂𝐫𝐲𝐩𝐭𝐨 📘 TA_Analyst Trader B7.68K @DavidOnCrypto_

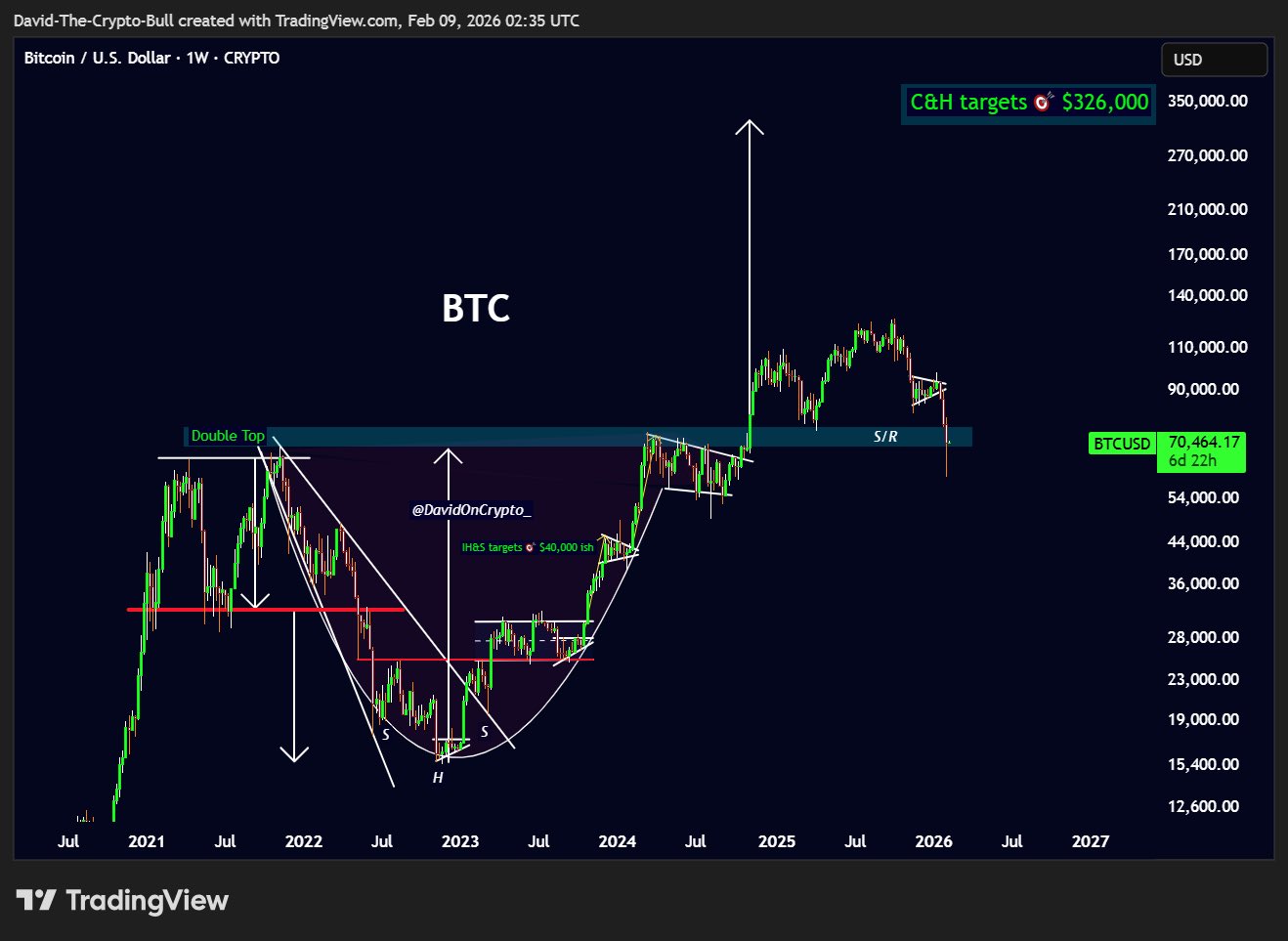

𝐃𝐚𝐯𝐢𝐝𝐎𝐧𝐂𝐫𝐲𝐩𝐭𝐨 📘 TA_Analyst Trader B7.68K @DavidOnCrypto_ 𝐃𝐚𝐯𝐢𝐝𝐎𝐧𝐂𝐫𝐲𝐩𝐭𝐨 📘 TA_Analyst Trader B7.68K @DavidOnCrypto_9 0 1.54K オリジナル >リリース後のBTCのトレンド強気

𝐃𝐚𝐯𝐢𝐝𝐎𝐧𝐂𝐫𝐲𝐩𝐭𝐨 📘 TA_Analyst Trader B7.68K @DavidOnCrypto_9 0 1.54K オリジナル >リリース後のBTCのトレンド強気 𝐃𝐚𝐯𝐢𝐝𝐎𝐧𝐂𝐫𝐲𝐩𝐭𝐨 📘 TA_Analyst Trader B7.68K @DavidOnCrypto_

𝐃𝐚𝐯𝐢𝐝𝐎𝐧𝐂𝐫𝐲𝐩𝐭𝐨 📘 TA_Analyst Trader B7.68K @DavidOnCrypto_ 𝐃𝐚𝐯𝐢𝐝𝐎𝐧𝐂𝐫𝐲𝐩𝐭𝐨 📘 TA_Analyst Trader B7.68K @DavidOnCrypto_

𝐃𝐚𝐯𝐢𝐝𝐎𝐧𝐂𝐫𝐲𝐩𝐭𝐨 📘 TA_Analyst Trader B7.68K @DavidOnCrypto_ 31 0 3.00K オリジナル >リリース後のBTCのトレンド非常に強気

31 0 3.00K オリジナル >リリース後のBTCのトレンド非常に強気- リリース後のBTCのトレンド中立

- リリース後のBTCのトレンド強気

- リリース後のBTCのトレンド弱気

- リリース後のBTCのトレンド非常に強気

- リリース後のBTCのトレンド強気

- リリース後のBTCのトレンド非常に強気

- リリース後のBTCのトレンド中立