Arbitrum (ARB)

Arbitrum (ARB)

- 72شاخص احساسات اجتماعی (SSI)-2.11% (24h)

- #90رتبهبندی نبض بازار (MPR)+31

- 33اشاره 24 ساعته در شبکههای اجتماعی+10.34% (24h)

- 88%نسبت صعودی 24 ساعته KOL20 KOL فعال

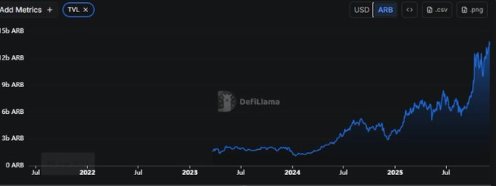

- خلاصهArbitrum's TVL reached a 24‑hour all‑time high of $17.5B, active addresses held steady at 237k, trading volume $750 million, institutional funds flowed in, yet the ARB token still fell 1.6%.

- سیگنالهای صعودی

- TVL breaks through $17.5B

- Trading volume $750 million

- Active addresses stable at 237k

- Institutional RWA funds $100M

- P/F ratio 2.48, valuation low

- سیگنالهای نزولی

- ARB price down 70% over two years

- 24h down 1.63%

- Token decoupled from fundamentals

- Social heat down 2.11%

- L2 curse suppresses token

شاخص احساسات اجتماعی (SSI)

- دادههای کلی72SSI

- روند SSI (7ر)قیمت (7ر)توزیع احساساتبسیار صعودی (21%)صعودی (67%)خنثی (9%)نزولی (3%)اطلاعات آماری SSIARB social heat moderate (71.6/100, -2.11%), activity up 6.22% and sentiment down 10.29%, KOL attention at capacity, stimulated by TVL all‑time high and institutional inflows but affected by token down 1.6%.

رتبهبندی نبض بازار (MPR)

- تحلیل هشدارARB warning rank rises to #90 (+31), social anomaly index up 36.31% to 31.6, KOL attention shift up 160% to 13, corresponding to abnormal volatility from TVL all‑time high and price pull‑back.

پستهای X

Alucard Educator Influencer B52.81K @xCryptoAlucard

Alucard Educator Influencer B52.81K @xCryptoAlucardUnderstanding transaction costs on @arbitrum is not that hard. The chain’s own computation costs are tracked separately from the cost of posting data to Ethereum and both adjust dynamically based on network load. Arbitrum One and Nova have a 7 million gas per second limit. When activity starts pushing that boundary, fees rise automatically, basically acting like a safety valve. It cuts down on spam and keeps room for the transactions that actually matter. So, the fees you pay are the sum of the costs incurred at that time. This setup helps keep the network stable over the long term.

120 46 229 اصلی >روند ARB پس از انتشارصعودیArbitrum's transaction fee mechanism ensures network stability and efficiency through dynamic adjustments and gas limits.

120 46 229 اصلی >روند ARB پس از انتشارصعودیArbitrum's transaction fee mechanism ensures network stability and efficiency through dynamic adjustments and gas limits. 𝗵𝘂𝗻𝘁𝗲𝗿 Community_Lead Influencer B15.21K @BFreshHB

𝗵𝘂𝗻𝘁𝗲𝗿 Community_Lead Influencer B15.21K @BFreshHBwould fit very well on @arbitrum

vitalik.eth Dev Researcher C5.86M @VitalikButerin

vitalik.eth Dev Researcher C5.86M @VitalikButerinWe need a good trustless onchain gas futures market. (Like, a prediction market on the BASEFEE) I've heard people ask: "today fees are low, but what about in 2 years? You say they'll stay low because of increasing gaslimit from BAL + ePBS + later ZK-EVM, but do I believe you?" An onchain gas futures market would help solve this: people would get a clear signal of people's expectations of future gas fees, and would even be able to hedge against future gas prices, effectively prepaying for any specific quantity of gas in a specific time interval.

24 8 1.13K اصلی >روند ARB پس از انتشارصعودیSuggest building a gas futures market on Arbitrum to forecast fees and hedge MobΞth Community_Lead Influencer B3.50K @MobWeth

MobΞth Community_Lead Influencer B3.50K @MobWeth elltzy D1.98K @elltzy775

elltzy D1.98K @elltzy775GN CT stylus performance on @arbitrum is opening up a whole new level for developers who want to push the boundaries of smart contract execution and when paired with the arbitrum hackathon, the two become an explosive combination that sparks wild ideas, rapid prototyping, and serious experimentation this momentum is not just a competition, but a collective learning space where new coding styles, extreme optimization, and cross-anguage approaches can be tested directly on a real scale to shape the next wave of innovation, while expanding our understanding of the potential of on chain computing ------------------------------------------------- yield driven action at @MemeMax_Fi is beginning to form a movement pattern that focuses on how each small step can generate greater value the flow is simple but intense users observe the return stream, wait for a strengthening point, then execute actions that accelerate the growth of their positions this pattern makes mememax dynamics feel like a series of rapid,

91 86 602 اصلی >روند ARB پس از انتشاربسیار صعودیArbitrum's Stylus performance and hackathon are considered to greatly drive smart contract innovation and on-chain computing development.

91 86 602 اصلی >روند ARB پس از انتشاربسیار صعودیArbitrum's Stylus performance and hackathon are considered to greatly drive smart contract innovation and on-chain computing development. Marcus 🧪 Educator Influencer B8.13K @marcuslayerx

Marcus 🧪 Educator Influencer B8.13K @marcuslayerxproject 2: @arbitrum no it's not solely because they are one of the strongest l2's atm it’s primarily because of their focus around bringing tokenized stocks onchain with robinhood and to understand why that matters, let's zoom out a bit stocks went from paper, then to phone brokerage, then toweb trading, then to mobile apps every jump significantly altered who could participate, how fast markets moved, and what people could build around them (the shift to online trading alone basically kicked off the entire retail era) now we’re watching the next jump happen in front of our eyes real time stocks are moving onchain and the implications are pretty massive... > these assets suddenly become composable > you can trade them 24/7 without waiting for tradfi opening hours > they can plug into onchain products, collateral systems, structured products, indexing, etc - things that simply weren’t possible on legacy infra and retail doesn’t even have to come onchain to use it, robinhood is the funnel what i like about arbitrum is that they’re not just tweeting about real world assets, they’re actually becoming a home for them as an aside - they’re also currently running one of the strongest grants programs in the space if you’ve got a strong idea for a project or initiative it's worth putting in an application

Marcus 🧪 Educator Influencer B8.13K @marcuslayerx

Marcus 🧪 Educator Influencer B8.13K @marcuslayerxproject 1 - @peaq we’re clearly heading into a machine first world elon musk is speculating that ai will get us to a point where no job is needed and we’ll live in an economy of abundance governments are openly pivoting into robotics and automation as a core strategic industry although it's a cool idea in theory it would be a nightmare if all the upside goes to a handful of corporations that’s why peaq stands out to me personally and why i like the direction they're building in they’re positioning from the perspective of - if machines are going to do more and more work, who will end up owning them and who gets paid? they’re shipping infra you can already use, and is applicable to real world/everyday people you can run apps like silencio or mapmetrics and get paid for data your phone is already producing you can co own real machines through projects like xmaquina you can connect your smart devices and share your energy data, effectively becoming nodes in the network, via combinder if we’re really moving into a world where robots do more of the work i would rather be early to infra that lets normal people plug into that economy wouldn't you?

22 21 354 اصلی >روند ARB پس از انتشارصعودیThe author is bullish on Arbitrum's tokenized stocks and Peaq's machine economy potential.

22 21 354 اصلی >روند ARB پس از انتشارصعودیThe author is bullish on Arbitrum's tokenized stocks and Peaq's machine economy potential. Kirari Influencer Educator B3.17K @Kiraribami22

Kirari Influencer Educator B3.17K @Kiraribami22 elltzy D1.98K @elltzy775

elltzy D1.98K @elltzy775GN CT stylus performance on @arbitrum is opening up a whole new level for developers who want to push the boundaries of smart contract execution and when paired with the arbitrum hackathon, the two become an explosive combination that sparks wild ideas, rapid prototyping, and serious experimentation this momentum is not just a competition, but a collective learning space where new coding styles, extreme optimization, and cross-anguage approaches can be tested directly on a real scale to shape the next wave of innovation, while expanding our understanding of the potential of on chain computing ------------------------------------------------- yield driven action at @MemeMax_Fi is beginning to form a movement pattern that focuses on how each small step can generate greater value the flow is simple but intense users observe the return stream, wait for a strengthening point, then execute actions that accelerate the growth of their positions this pattern makes mememax dynamics feel like a series of rapid,

91 86 602 اصلی >روند ARB پس از انتشارصعودیArbitrum Stylus performance and the hackathon drive smart contract innovation, and MemeMax_Fi shows yield growth potential.

91 86 602 اصلی >روند ARB پس از انتشارصعودیArbitrum Stylus performance and the hackathon drive smart contract innovation, and MemeMax_Fi shows yield growth potential. Dr.OVG Influencer Educator A46.31K @OVGNFT

Dr.OVG Influencer Educator A46.31K @OVGNFTArbitrum is the hub of diamond builders, with over 1,000 protocols live, it's undoubtedly one of the biggest builder chain Q4 has been massive for @arbitrum, from hitting various all time highs to securing big partnerships like Warden and Anoma. Arbitrum is the leading L2 with over $17.5B in TVL This all sums up to show that Arbitrum and $ARB have a huge demand, and will continue dominate the market in 2026

Arbitrum D1.17M @arbitrum

Arbitrum D1.17M @arbitrumMassive wins from our builders this week! 🏆 - @RobinhoodApp hits 1,000+ tokenized stocks, ETFs and commodities with $10M in total tokenized value on Arbitrum One (All onchain and accessible to EU users today) - Arbitrum was featured in @Etherealize_io's Ethereum’s Layer 2 Landscape: The Future of Financial Infrastructure report with Arbitrum leading in L2 dominance with $17.5B in TVL - @OstiumLabs raises $20 million as they continue building the platform for the perpification of everything (massive win for perps) - @Calderaxyz launched the Onchain Expansion Program, giving ERA holders access to deep liquidity on Arbitrum One - @poidhxyz's big Arbitrum Everywhere bounty was claimed by @EddieBuff49. Eddie took a picture with Arbitrum Everywhere above the Arctic circle IRL! - @hinkal_protocol goes lives enabling confidential payments for users on Arbitrum - @Footium brings on @ManUtd legendary footballer Dimitar Berbatov as both a manager and a strategic backer. (love seeing legends of the greatest game

129 114 1.29K اصلی >روند ARB پس از انتشاربسیار صعودیArbitrum ecosystem is developing strongly, Q4 achievements are remarkable, and it is expected to dominate the market in the future.

129 114 1.29K اصلی >روند ARB پس از انتشاربسیار صعودیArbitrum ecosystem is developing strongly, Q4 achievements are remarkable, and it is expected to dominate the market in the future. Marc Shawn Brown OnChain_Analyst Media S29.57K @MarcShawnBrown

Marc Shawn Brown OnChain_Analyst Media S29.57K @MarcShawnBrownCapital doesn’t chase narratives. It chases efficiency. $ARB is undervalued on fundamentals, printing revenues at scale with the deepest TVL base. $SUI is where activity lives, dominating DEX and derivatives flow with stable price action. $SEI is the asymmetric bet. Low TVL. Low market cap. Real infra upgrades and institutional rails coming online. When fees, volume, and users move first, price follows later. By the time the timeline agrees, the edge is already gone. Watch what chains monetize, not what they promise.

100 8 6.94K اصلی >روند ARB پس از انتشارصعودیFocusing on the on-chain monetization capabilities of ARB, SUI, and SEI, their value is undervalued. Ni Researcher DeFi_Expert B40.64K @ni_celeb

Ni Researcher DeFi_Expert B40.64K @ni_celebclassic crypto moments: the chain is booming, metrics look god-tier, builders won’t stop shipping… yet the token is getting folded like laundry. @EdgenTech when fundamentals and price diverge this hard, it usually means the market is mispricing something or hasn’t caught up to the structural shift underneath. arbitrum tvl hits all-time highs, so why is the token down 70%? $arb might genuinely be one of the most mispriced assets in crypto right now. the @arbitrum ecosystem is on fire tvl exploding, activity up, dev pipelines stacked but the token itself has been sliding nearly 70% over the last three months. that disconnect is exactly what analyst michaël van de poppe has been calling out: arbitrum is outpacing almost every l2 in growth, yet its token keeps bleeding. the data hits hard: • tvl (in arb terms) went parabolic mid-2024 • multiple aths through 2025 • now pushing $15b+ arb locked • dex volumes climbing week after week • liquidity deepening across the stack • new apps launching nonstop, even in a cooling macro the ecosystem’s expanding while the broader market naps that alone already breaks the usual cycle logic. so why is arb dumping? because price isn’t reacting to fundamentals right now it’s reacting to: • rotation flows into “shinier” narratives • short-term leverage wipeouts • heavy unlock expectations • macro de-risking • traders chasing faster momentum elsewhere meanwhile, the core metrics that actually matter for long-term value accrual usage, liquidity, builder activity are all trending the opposite way. the gap between fundamentals and price won’t stay this wide forever. when it closes, it tends to close violently. arb looks less like a failing token and more like a compressed spring mispriced today because the market’s attention is elsewhere, but structurally positioned for a much cleaner repricing once rotation cycles back into real activity.

26 16 182 اصلی >روند ARB پس از انتشاربسیار صعودیArbitrum's fundamentals are strong but the token is undervalued, and it may see a violent rebound in the future.

26 16 182 اصلی >روند ARB پس از انتشاربسیار صعودیArbitrum's fundamentals are strong but the token is undervalued, and it may see a violent rebound in the future. Marc Shawn Brown OnChain_Analyst Media S29.57K @MarcShawnBrown

Marc Shawn Brown OnChain_Analyst Media S29.57K @MarcShawnBrown🔥 LATEST: Arbitrum TVL is up 22.85% over 180 days https://t.co/GEMYgpfF6q

33 16 2.02K اصلی >روند ARB پس از انتشارصعودیArbitrum's TVL has increased significantly by 22.85% over 180 days

33 16 2.02K اصلی >روند ARB پس از انتشارصعودیArbitrum's TVL has increased significantly by 22.85% over 180 days Feyi Influencer Educator A13.87K @gvofeyii

Feyi Influencer Educator A13.87K @gvofeyiiDoes market conditions really affect an Airdrop? I think it’s a cheap excuse projects use after delivering a bad airdrop If a team has a good intention to cook, they will Or am I wrong for thinking this way?

194 82 5.62K اصلی >روند ARB پس از انتشارخنثیThe project uses market conditions as an excuse to delay the airdrop, which is a fraudulent behavior, and it is recommended to stay vigilant.