yearn.finance (YFI)

yearn.finance (YFI)

$3,650.4 -4.38% 24H

- 31Índice de sentimiento social (ISS)-47.90% (24h)

- #109Clasificación del pulso del mercado (CPM)-16

- 1Mención en redes sociales de 24 h-66.67% (24h)

- 0%Ratio alcista de KOL en 24 h1 KOL activo

- Resumen

- Señales alcistas

- Señales bajistas

Índice de sentimiento social (ISS)

- Datos generales31SSI

- Tendencia ISS (7 días)Precio (7 días)Distribución de sentimientosBajista (100%)Perspectivas de ISS

Clasificación del pulso del mercado (CPM)

- Alerta Insight

Publicaciones de X

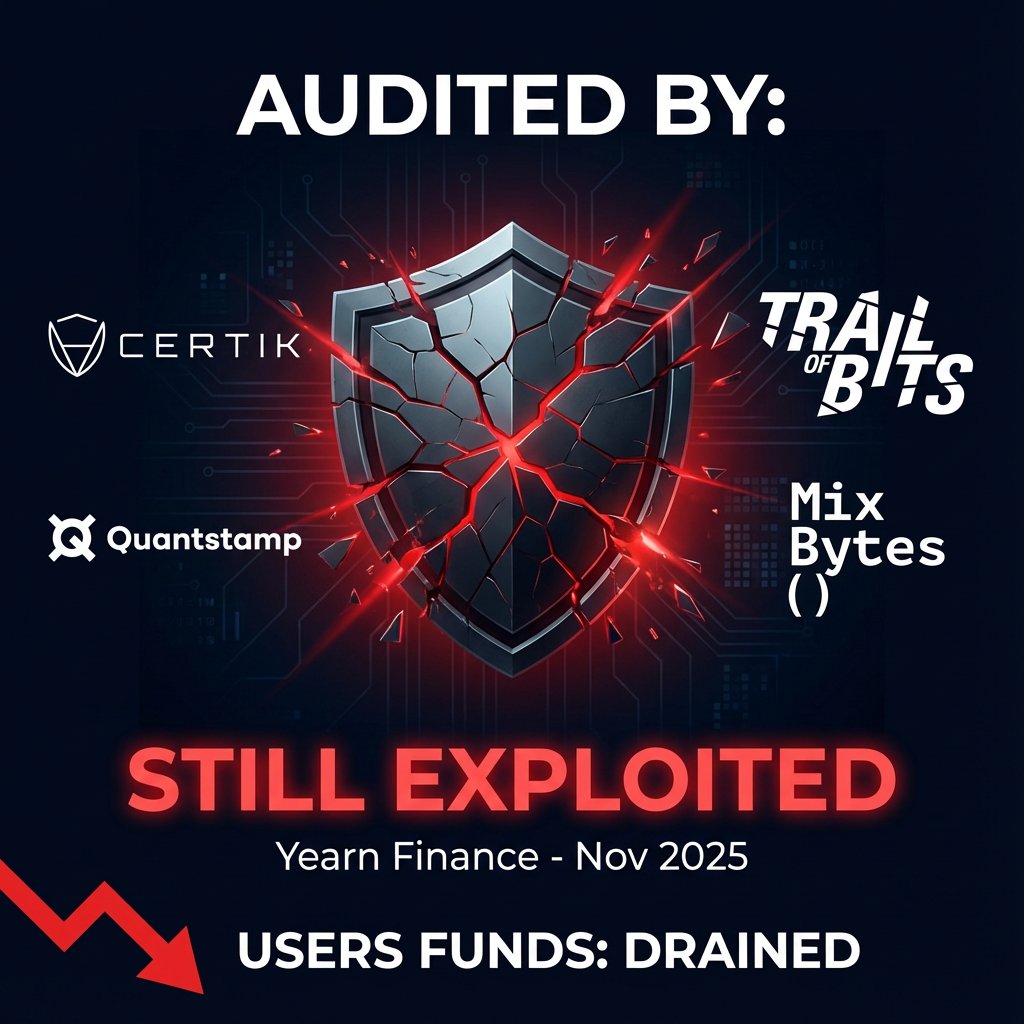

- Tendencia de YFI tras el lanzamientoBajista

Eldar DeFi_Expert FA_Analyst A2.00K @eldarcap

Eldar DeFi_Expert FA_Analyst A2.00K @eldarcap Superform D119.80K @superformxyz

Superform D119.80K @superformxyz 5 2 1.85K Original >Tendencia de YFI tras el lanzamientoAlcista

5 2 1.85K Original >Tendencia de YFI tras el lanzamientoAlcista andrew.moh DeFi_Expert OnChain_Analyst B53.70K @andrewmoh

andrew.moh DeFi_Expert OnChain_Analyst B53.70K @andrewmoh andrew.moh DeFi_Expert OnChain_Analyst B53.70K @andrewmoh

andrew.moh DeFi_Expert OnChain_Analyst B53.70K @andrewmoh 124 84 8.94K Original >Tendencia de YFI tras el lanzamientoAlcista

124 84 8.94K Original >Tendencia de YFI tras el lanzamientoAlcista- Tendencia de YFI tras el lanzamientoExtremadamente bajista

- Tendencia de YFI tras el lanzamientoExtremadamente bajista

DBCrypto Influencer Educator B15.96K @DBCrypt0

DBCrypto Influencer Educator B15.96K @DBCrypt0 DBCrypto Influencer Educator B15.96K @DBCrypt0

DBCrypto Influencer Educator B15.96K @DBCrypt0 462 96 50.61K Original >Tendencia de YFI tras el lanzamientoExtremadamente bajista

462 96 50.61K Original >Tendencia de YFI tras el lanzamientoExtremadamente bajista Zamza Salim Influencer Educator B54.29K @Autosultan_team

Zamza Salim Influencer Educator B54.29K @Autosultan_team Ara D1.86K @Arakawamei79 80 1.00K Original >Tendencia de YFI tras el lanzamientoAlcista

Ara D1.86K @Arakawamei79 80 1.00K Original >Tendencia de YFI tras el lanzamientoAlcista- Tendencia de YFI tras el lanzamientoExtremadamente bajista

- Tendencia de YFI tras el lanzamientoNeutral

- Tendencia de YFI tras el lanzamientoAlcista