Another week, another flood of takes.

This time, the ones that stood out to me cut across trading psychology, AI revolutions, crypto jobs, tokenization cracks, top-tier airdrops you can’t afford to miss, and mindset shifts nobody wants to admit.

Here’s another weekly alpha recap, pointing you towards most of what actually mattered this week.

—

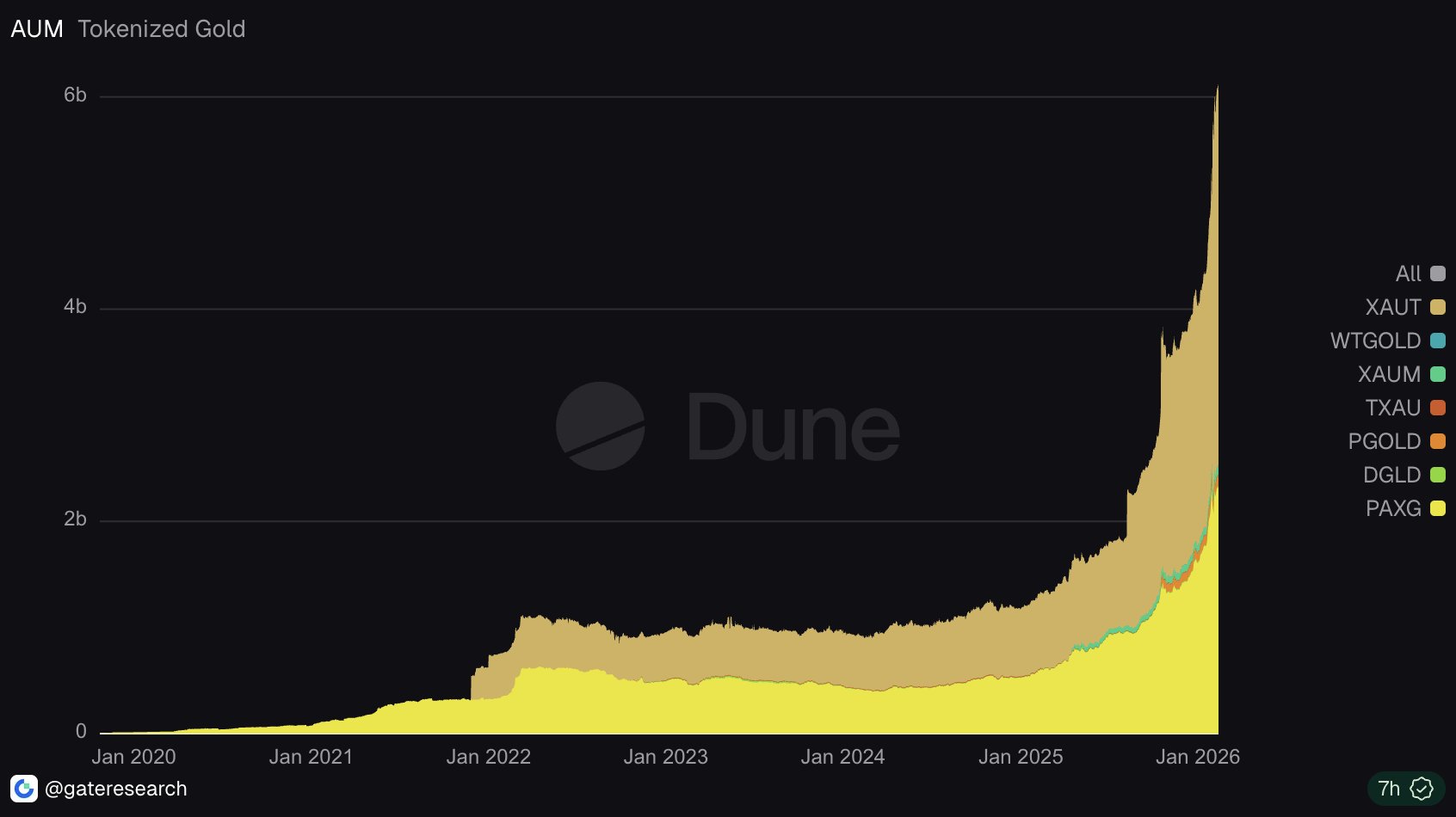

Onchain tokenization of RWAs shows growing AUM and institutional interest, but the market remains fragile.

Tokenized assets face extreme slippage, shallow liquidity, and systemic risks due to poor infra and inefficient market making. Off-chain price streaming, perp futures, and aggregated onchain vaults improve trade execution but introduce centralization and collateral limitations.

@Eli5defi suggests that tokenization models need to be redesigned for capital efficiency and deep liquidity.

https://t.co/uqepCqwdkQ

—

Most people spend their careers chasing opportunities, operating from scarcity, which repels what they want.

The alternative is to attract opportunities by focusing on a craft, building in public, and detaching from outcomes.

@BawsaXBT advises to master one skill, show your work consistently, and act from abundance, not desperation. Over time, the right people notice, opportunities compound, and doors open naturally.

https://t.co/qJQGUmttII

—

In need of crypto jobs? Here’s the perfect place to start.

@jussy_world highlights aggregators like @CryptoJobs, @CryptoJobsList,and @bondexapp, ecosystem-specific platforms like Solana Jobs and @SuperteamEarn, and @WellfoundHQ for startup-style roles.

The key takeaway is applying aggressively, specializing in one niche, and compounding opportunities.

https://t.co/cKSfWIKtna

—

Stablecoin farming isn’t dead, it just got riskier and more complex. After recent blowups and protocols quitting pre-TGE, the “20% stable yield” era is clearly over.

@phtevenstrong talks about new protocols on his radar, including @Neutrl, @re, @USDai_Official, @3janexyz, and @OuroborosCap8. He also highlights risk-adjusted plays like @aave and @ethena.

The new meta is fewer assumptions, more due diligence, and yields that actually reflect risk.

https://t.co/MPdMtK7cYE

—

@defikadic says the 2026 meta is fewer wallets, deeper usage, Tier S focus, and farming like a user, not a bot.

Projects have moved from spraying airdrops to filtering for real onchain users, and focus is shifting to AI, high performance L1/L2s, prediction markets, and perp DEXs.

Recent drops from projects like @Lighter_xyz and @brevis_zk prove that early and active users still win. If you’re looking to position for upcoming airdrops, you might want to check out projects like @HyperliquidX, @paradex, @Polymarket, and @base.

https://t.co/QUWhHAITlb

—

@belizardd points out that XAUt is safe, but far from trustless. While it offers convenient gold exposure without storage or KYC friction, it requires full trust in Tether.

Supply is backed by reported gold holdings, but the structure is centralized, contracts are controlled by Tether, and wallets can be frozen.

The bottom line is, it’s practical for small allocations, but it’s not censorship-resistant or risk-free.

https://t.co/L1ZNAZAcEK

—

@icobeast breaks down why CT feels “bad” despite growing adoption and institutional momentum.

Tokens with near-zero real value launch at absurd valuations, with insiders engineering exits while retail bleeds. PvP behavior has replaced collaboration, shifting the space from opportunity to scarcity and survival mode.

So basically, CT isn’t dying because crypto is failing. It’s dying because incentives are broken.

https://t.co/SC6oCx9JFY

—

@YashasEdu explains that traders don’t blow up because their strategy fails, but because they override it.

Losses trigger stress responses that shut down rational thinking, and winning streaks create overconfidence. The result is a predictable loop: trigger → emotion → rule-breaking → drawdown.

The edge isn’t better entries, it’s better self-management. Track behavioral mistakes, review process over outcomes, and reduce “behavioral slippage”.

https://t.co/BNDQRuYtVa

—

@hmalviya9 points out that we’re moving out of the “checkbox era”. Credentials and gatekeepers now matter less as AI lowers execution barriers.

But with everyone able to create instantly, “vibe culture” explodes and attention becomes scarce.

This article is a subtle reminder that as productivity gets automated, the edge isn’t competing with AI. It’s maintaining your originality, grit, and focus.

https://t.co/edma4x4VLi

—

@Defi_Warhol did a thing with this mega Q1 farming list, breaking down 45 protocols across lending, trading, prediction markets, L1/L2, yield, fintech, AI and more.

Top picks are @HyperliquidX, @Polymarket, @base and a few others with real users, funding, and PMF.

The airdrop meta has shifted. Spray-and-pray wallets no longer move the needle. The smarter play is maxing out on high-conviction projects farming.

https://t.co/g2FfJu3k5I

—

Systems are changing, but underneath the noise, the real edge is adapting and positioning. This w

eek’s recap contains a good number of opportunities you can leverage to stay ahead of the curve.

Tether Gold (XAUT)

Tether Gold (XAUT) Mars_DeFi Researcher Educator B29.66K @Mars_DeFi

Mars_DeFi Researcher Educator B29.66K @Mars_DeFi Mars_DeFi Researcher Educator B29.66K @Mars_DeFi

Mars_DeFi Researcher Educator B29.66K @Mars_DeFi 21 6 730 Original >Tendencia de XAUT tras el lanzamientoNeutral

21 6 730 Original >Tendencia de XAUT tras el lanzamientoNeutral YashasEdu Educator Tokenomics_Expert B8.93K @YashasEdu

YashasEdu Educator Tokenomics_Expert B8.93K @YashasEdu Mars_DeFi Researcher Educator B29.66K @Mars_DeFi

Mars_DeFi Researcher Educator B29.66K @Mars_DeFi 21 6 730 Original >Tendencia de XAUT tras el lanzamientoNeutral

21 6 730 Original >Tendencia de XAUT tras el lanzamientoNeutral Olivia Vande Woude Tokenomics_Expert OnChain_Analyst A2.03K @cryptoreine

Olivia Vande Woude Tokenomics_Expert OnChain_Analyst A2.03K @cryptoreine DWF Labs VC DeFi_Expert D125.52K @DWFLabs

DWF Labs VC DeFi_Expert D125.52K @DWFLabs

7 1 447 Original >Tendencia de XAUT tras el lanzamientoAlcista

7 1 447 Original >Tendencia de XAUT tras el lanzamientoAlcista FREKI ANCIENT CRYPTO OG | 2011 | HBAR XRP BTC ETH Influencer Educator B9.95K @Freki_OG

FREKI ANCIENT CRYPTO OG | 2011 | HBAR XRP BTC ETH Influencer Educator B9.95K @Freki_OG Cointelegraph Media Influencer C2.90M @Cointelegraph

Cointelegraph Media Influencer C2.90M @Cointelegraph 363 138 21.46K Original >Tendencia de XAUT tras el lanzamientoExtremadamente alcista

363 138 21.46K Original >Tendencia de XAUT tras el lanzamientoExtremadamente alcista