Uniswap (UNI)

Uniswap (UNI)

$3.598 +2.74% 24H

- 78Índice de sentimiento social (ISS)-17.38% (24h)

- #94Clasificación del pulso del mercado (CPM)-93

- 48Mención en redes sociales de 24 h-63.16% (24h)

- 48%Ratio alcista de KOL en 24 h41 KOL activo

- Resumen

- Señales alcistas

- Señales bajistas

Índice de sentimiento social (ISS)

- Datos generales78SSI

- Tendencia ISS (7 días)Precio (7 días)Distribución de sentimientosExtremadamente alcista (21%)Alcista (27%)Neutral (10%)Bajista (25%)Extremadamente bajista (17%)Perspectivas de ISS

Clasificación del pulso del mercado (CPM)

- Alerta Insight

Publicaciones de X

Tony Edward (Thinking Crypto Podcast) Media Influencer B140.60K @thinkingcrypto

Tony Edward (Thinking Crypto Podcast) Media Influencer B140.60K @thinkingcrypto Brecca Stoll D18.01K @breccastoll

Brecca Stoll D18.01K @breccastoll 280 23 65.60K Original >Tendencia de UNI tras el lanzamientoAlcista

280 23 65.60K Original >Tendencia de UNI tras el lanzamientoAlcista Laura Shin Media Influencer C281.42K @laurashin

Laura Shin Media Influencer C281.42K @laurashin Brecca Stoll D18.01K @breccastoll

Brecca Stoll D18.01K @breccastoll 280 23 65.60K Original >Tendencia de UNI tras el lanzamientoAlcista

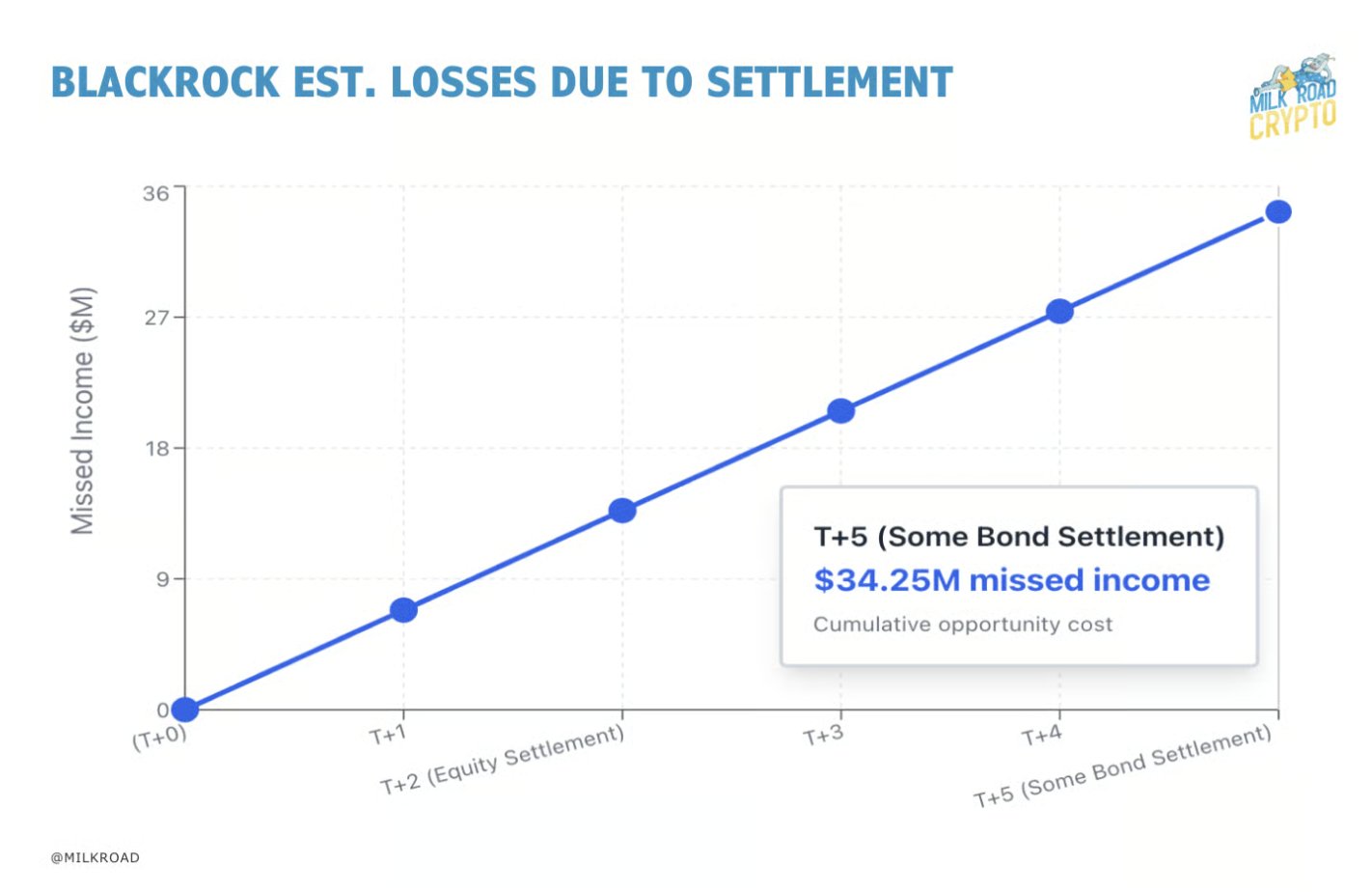

280 23 65.60K Original >Tendencia de UNI tras el lanzamientoAlcista Milk Road Educator Influencer D94.09K @MilkRoad

Milk Road Educator Influencer D94.09K @MilkRoad Milk Road Educator Influencer D94.09K @MilkRoad

Milk Road Educator Influencer D94.09K @MilkRoad 14 3 2.27K Original >Tendencia de UNI tras el lanzamientoAlcista

14 3 2.27K Original >Tendencia de UNI tras el lanzamientoAlcista フ ォ リ ス Trader TA_Analyst B124.73K @follis_

フ ォ リ ス Trader TA_Analyst B124.73K @follis_

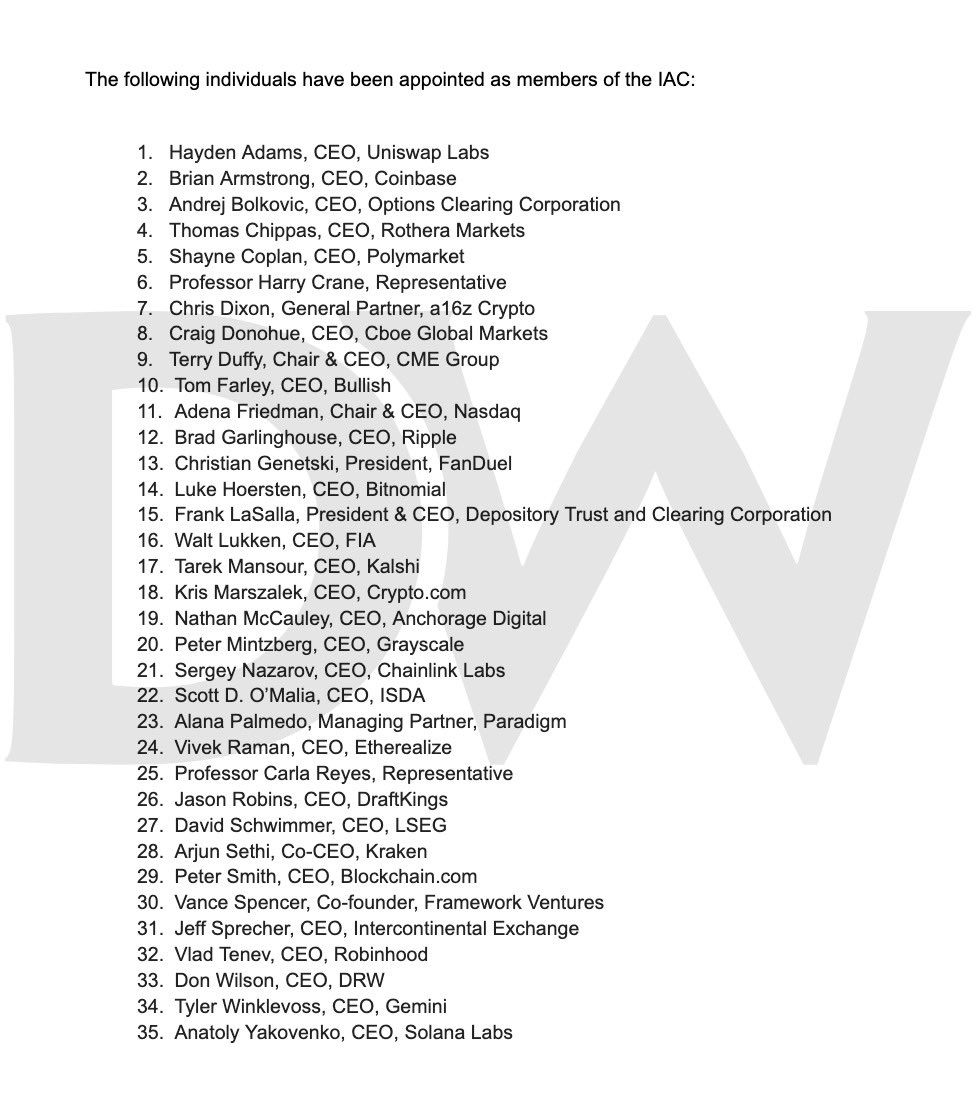

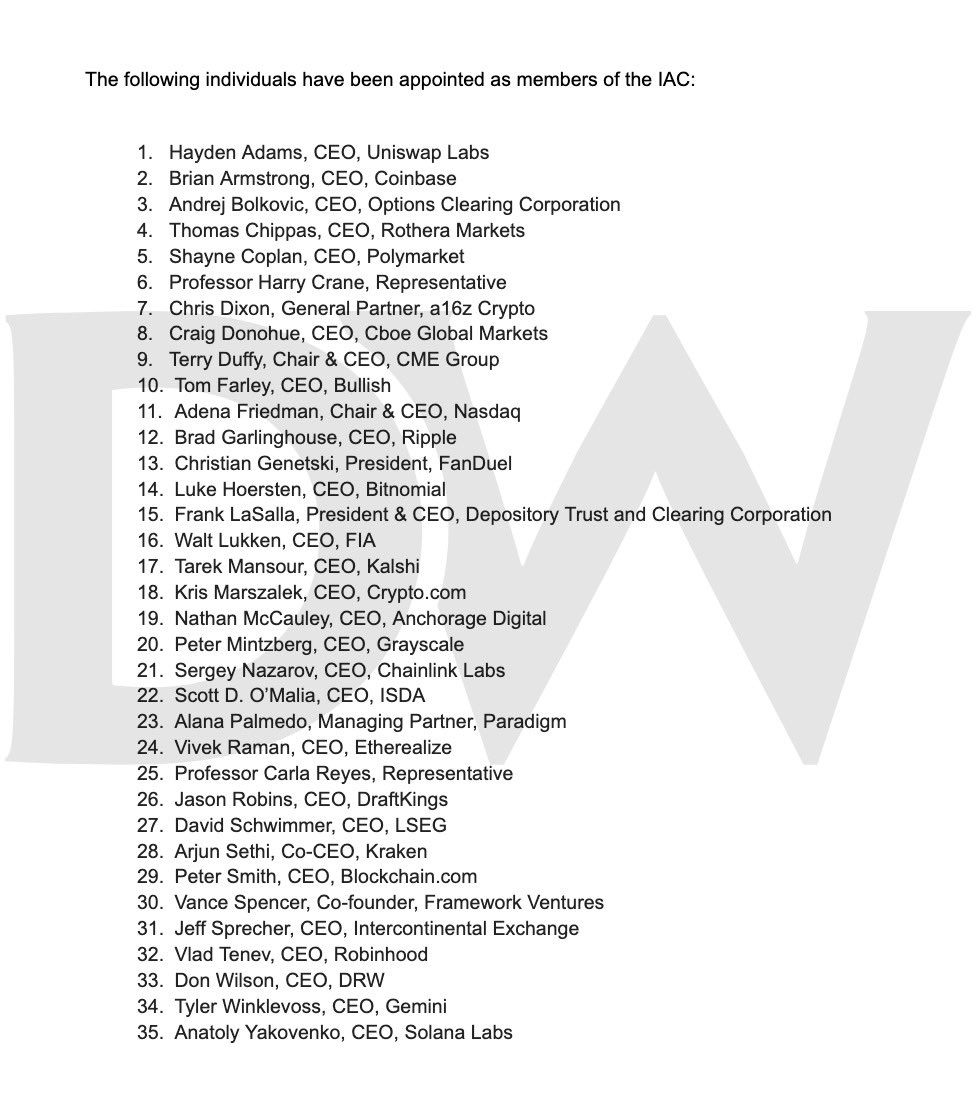

Uniswap Labs 🦄 Dev DeFi_Expert C1.47M @Uniswap

Uniswap Labs 🦄 Dev DeFi_Expert C1.47M @Uniswap 51 10 6.03K Original >Tendencia de UNI tras el lanzamientoBajista

51 10 6.03K Original >Tendencia de UNI tras el lanzamientoBajista- Tendencia de UNI tras el lanzamientoExtremadamente alcista

Harrison.dime DeFi_Expert Tokenomics_Expert B2.71K @DfiHrn

Harrison.dime DeFi_Expert Tokenomics_Expert B2.71K @DfiHrn Harrison.dime DeFi_Expert Tokenomics_Expert B2.71K @DfiHrn1 1 65 Original >Tendencia de UNI tras el lanzamientoNeutral

Harrison.dime DeFi_Expert Tokenomics_Expert B2.71K @DfiHrn1 1 65 Original >Tendencia de UNI tras el lanzamientoNeutral Milk Road Educator Influencer D94.09K @MilkRoad

Milk Road Educator Influencer D94.09K @MilkRoad Milk Road Educator Influencer D94.09K @MilkRoad106 13 13.94K Original >Tendencia de UNI tras el lanzamientoAlcista

Milk Road Educator Influencer D94.09K @MilkRoad106 13 13.94K Original >Tendencia de UNI tras el lanzamientoAlcista- Tendencia de UNI tras el lanzamientoExtremadamente bajista

Milk Road Educator Influencer D94.09K @MilkRoad

Milk Road Educator Influencer D94.09K @MilkRoad Milk Road Educator Influencer D94.09K @MilkRoad

Milk Road Educator Influencer D94.09K @MilkRoad 72 7 22.36K Original >Tendencia de UNI tras el lanzamientoExtremadamente alcista

72 7 22.36K Original >Tendencia de UNI tras el lanzamientoExtremadamente alcista- Tendencia de UNI tras el lanzamientoBajista