Sei Network (SEI)

Sei Network (SEI)

$0.0774 +1.98% 24H

- 52Índice de sentimiento social (ISS)-6.74% (24h)

- #112Clasificación del pulso del mercado (CPM)-52

- 8Mención en redes sociales de 24 h-33.33% (24h)

- 88%Ratio alcista de KOL en 24 h8 KOL activo

- Resumen

- Señales alcistas

- Señales bajistas

Índice de sentimiento social (ISS)

- Datos generales52SSI

- Tendencia ISS (7 días)Precio (7 días)Distribución de sentimientosExtremadamente alcista (38%)Alcista (50%)Bajista (12%)Perspectivas de ISS

Clasificación del pulso del mercado (CPM)

- Alerta Insight

Publicaciones de X

- Tendencia de SEI tras el lanzamientoAlcista

- Tendencia de SEI tras el lanzamientoExtremadamente alcista

Gilmo FA_Analyst OnChain_Analyst B15.30K @0xgilllee

Gilmo FA_Analyst OnChain_Analyst B15.30K @0xgilllee Sei Media Community_Lead C780.46K @SeiNetwork84 29 3.82K Original >Tendencia de SEI tras el lanzamientoAlcista

Sei Media Community_Lead C780.46K @SeiNetwork84 29 3.82K Original >Tendencia de SEI tras el lanzamientoAlcista- Tendencia de SEI tras el lanzamientoAlcista

- Tendencia de SEI tras el lanzamientoAlcista

- Tendencia de SEI tras el lanzamientoAlcista

Umair Crypto TA_Analyst Trader C27.35K @Umairorkz

Umair Crypto TA_Analyst Trader C27.35K @Umairorkz

Umair Crypto TA_Analyst Trader C27.35K @Umairorkz

Umair Crypto TA_Analyst Trader C27.35K @Umairorkz 39 13 3.53K Original >Tendencia de SEI tras el lanzamientoBajista

39 13 3.53K Original >Tendencia de SEI tras el lanzamientoBajista Sei Media Community_Lead C780.46K @SeiNetwork

Sei Media Community_Lead C780.46K @SeiNetwork Sei Media Community_Lead C780.46K @SeiNetwork

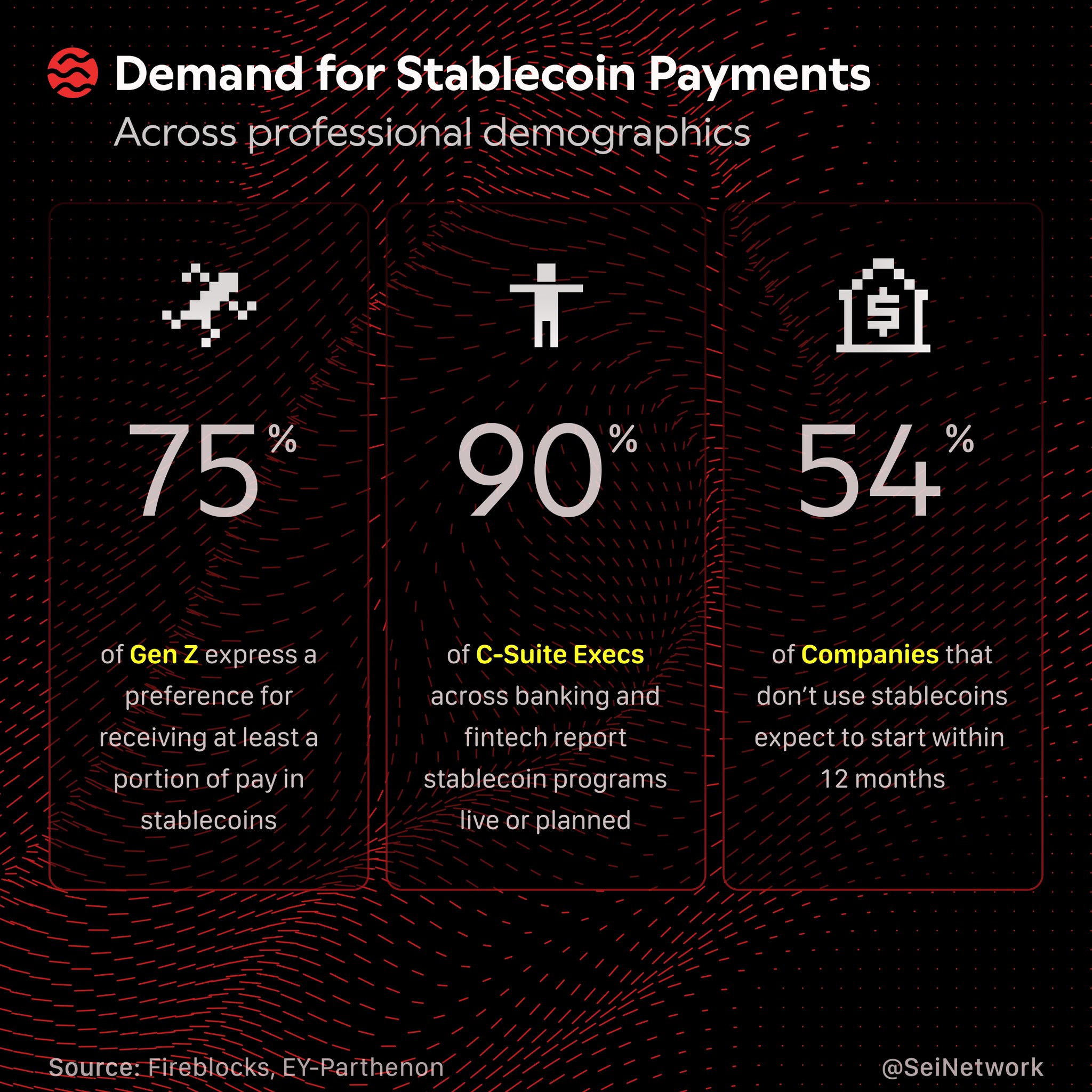

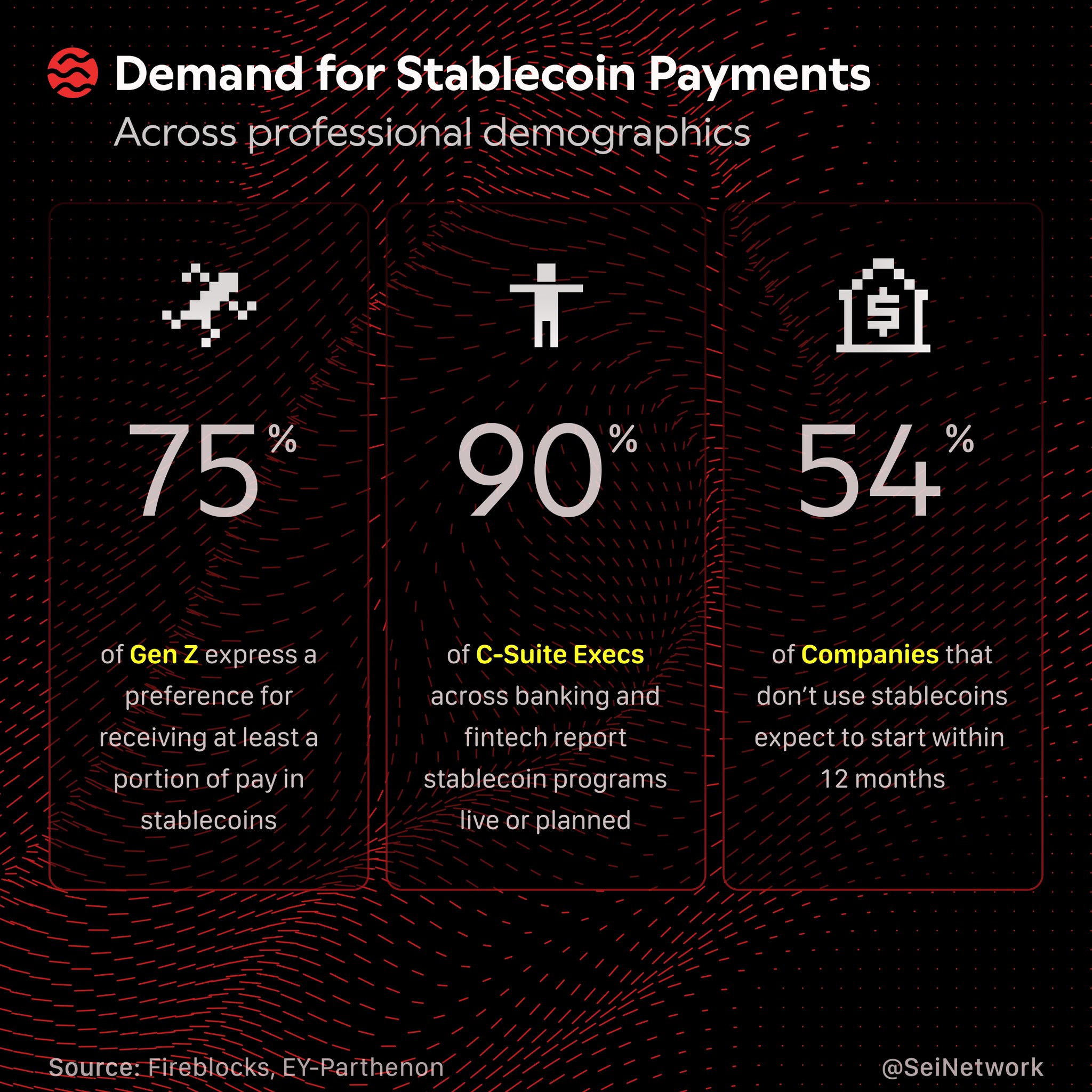

Sei Media Community_Lead C780.46K @SeiNetwork 395 36 10.93K Original >Tendencia de SEI tras el lanzamientoExtremadamente alcista

395 36 10.93K Original >Tendencia de SEI tras el lanzamientoExtremadamente alcista Nick Research Derivatives_Expert OnChain_Analyst S10.27K @Nick_Researcher

Nick Research Derivatives_Expert OnChain_Analyst S10.27K @Nick_Researcher Sei Media Community_Lead C780.46K @SeiNetwork

Sei Media Community_Lead C780.46K @SeiNetwork 395 36 10.93K Original >Tendencia de SEI tras el lanzamientoExtremadamente alcista

395 36 10.93K Original >Tendencia de SEI tras el lanzamientoExtremadamente alcista Sei Media Community_Lead C780.46K @SeiNetwork

Sei Media Community_Lead C780.46K @SeiNetwork Sei Media Community_Lead C780.46K @SeiNetwork443 30 32.53K Original >Tendencia de SEI tras el lanzamientoAlcista

Sei Media Community_Lead C780.46K @SeiNetwork443 30 32.53K Original >Tendencia de SEI tras el lanzamientoAlcista