Pi Network (PI)

Pi Network (PI)

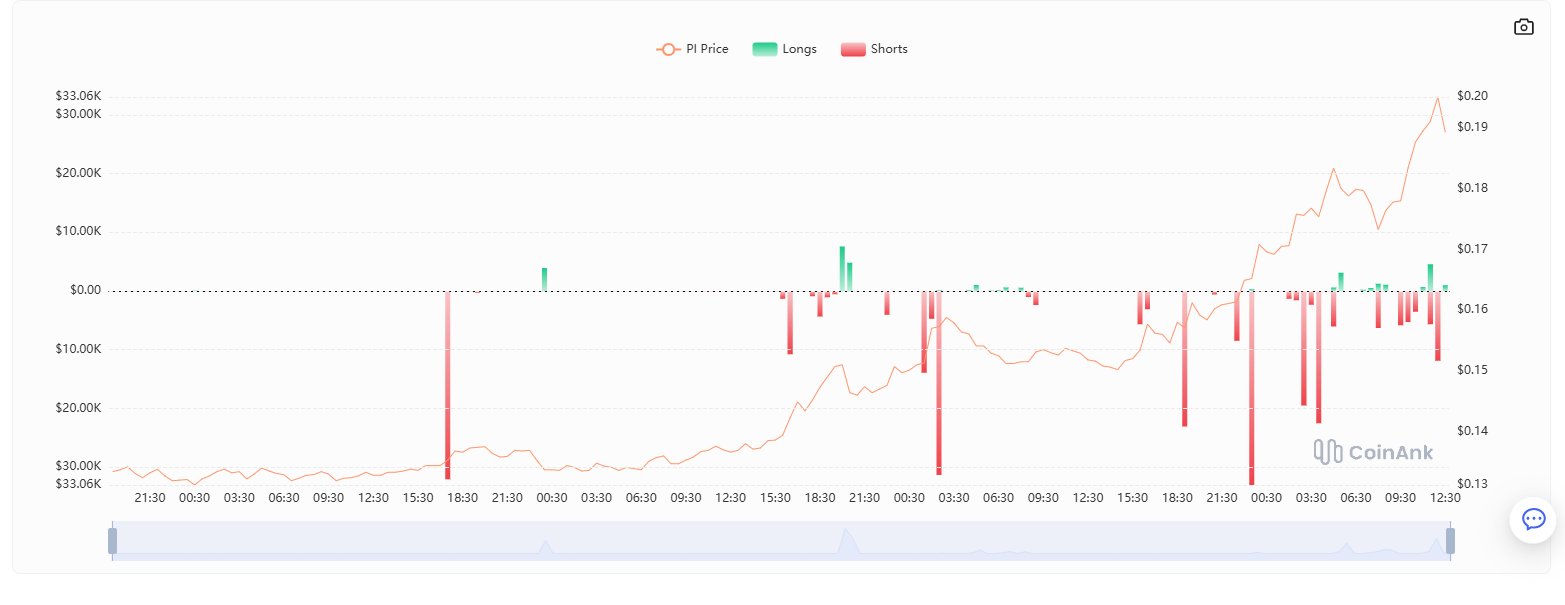

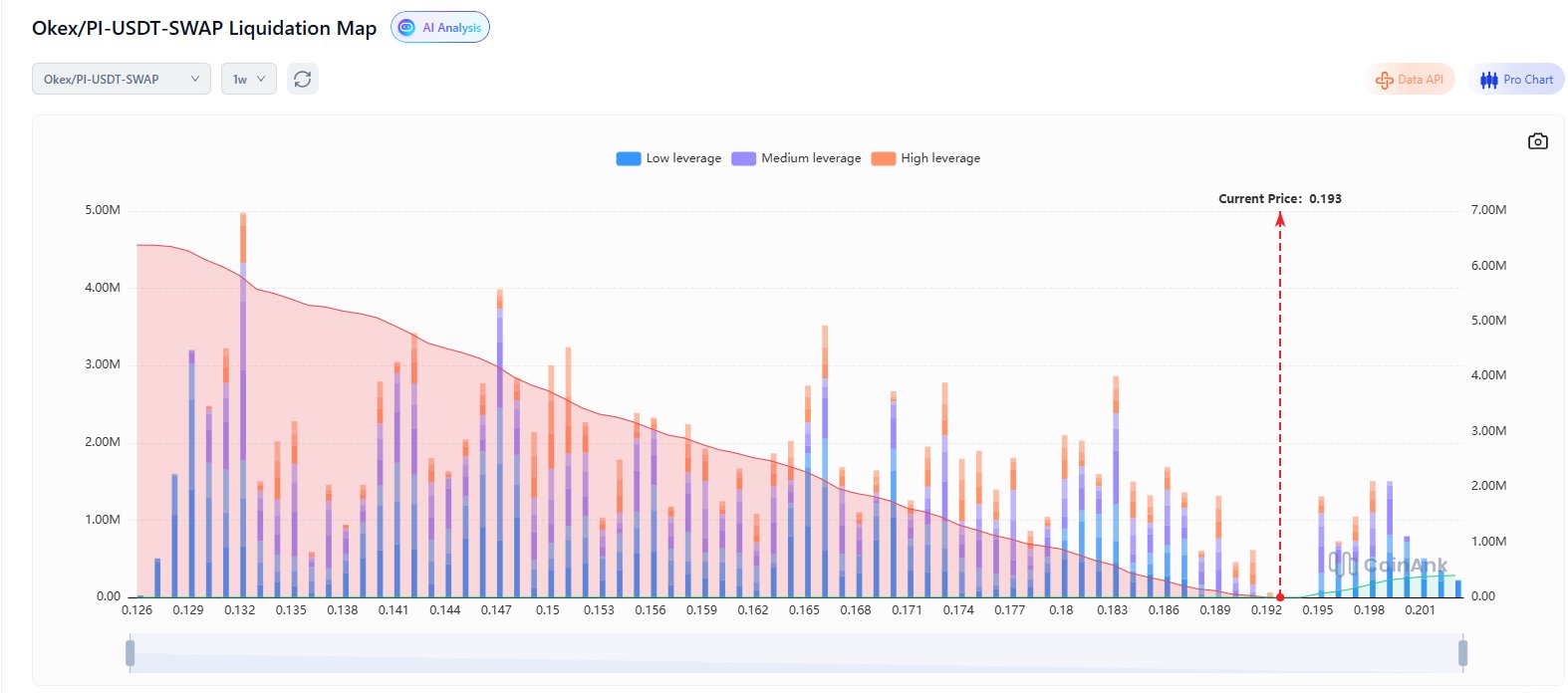

$0.1816 +15.37% 24H

- 88Índice de sentimiento social (ISS)+58.77% (24h)

- #38Clasificación del pulso del mercado (CPM)+29

- 13Mención en redes sociales de 24 h+160.00% (24h)

- 70%Ratio alcista de KOL en 24 h7 KOL activo

- Resumen

- Señales alcistas

- Señales bajistas

Índice de sentimiento social (ISS)

- Datos generales88SSI

- Tendencia ISS (7 días)Precio (7 días)Distribución de sentimientosExtremadamente alcista (8%)Alcista (62%)Neutral (15%)Bajista (15%)Perspectivas de ISS

Clasificación del pulso del mercado (CPM)

- Alerta Insight

Publicaciones de X

- Tendencia de PI tras el lanzamientoNeutral

- Tendencia de PI tras el lanzamientoAlcista

- Tendencia de PI tras el lanzamientoAlcista

- Tendencia de PI tras el lanzamientoAlcista

crypto.news Media Influencer D111.77K @cryptodotnews

crypto.news Media Influencer D111.77K @cryptodotnews crypto.news Media Influencer D111.77K @cryptodotnews45 2 1.64K Original >Tendencia de PI tras el lanzamientoAlcista

crypto.news Media Influencer D111.77K @cryptodotnews45 2 1.64K Original >Tendencia de PI tras el lanzamientoAlcista- Tendencia de PI tras el lanzamientoExtremadamente alcista

Dao world Educator Influencer A19.15K @Koreanteacher1

Dao world Educator Influencer A19.15K @Koreanteacher1

Dao world Educator Influencer A19.15K @Koreanteacher1

Dao world Educator Influencer A19.15K @Koreanteacher1 79 7 2.40K Original >Tendencia de PI tras el lanzamientoBajista

79 7 2.40K Original >Tendencia de PI tras el lanzamientoBajista- Tendencia de PI tras el lanzamientoBajista

- Tendencia de PI tras el lanzamientoAlcista

- Tendencia de PI tras el lanzamientoAlcista