Cosmos was right.

For years the Cosmos pitch was basically: why rent when you can own? Run your own chain, control your own rules and costs, and still connect to everyone via IBC.

Most of crypto shrugged - because as long as Ethereum L2s looked like the default path, sovereignty = ideology.

Then @VitalikButerin post hit: L2 decentralization and interoperability have been slower than hoped, @ethereum L1 itself is scaling, and generic "Ethereum-but-cheaper" L2s need a new reason to exist....

That shift is exactly where Cosmos lives. (By ‘Cosmos’ here I mostly mean Cosmos Labs + the accounts shipping/pushing the stack.)

--

Why Cosmos is swinging right now

After Vitalik's post, you cannot ignore the fact that being an Ethereum L2 means building a business as a tenant on someone else's platform - and that risk gets real when the landlord opens a competing store on the ground floor.

Cosmos' whole thesis is the opposite of tenanthood: own the chain, own the rules, connect outward. The moment the market starts thinking in "platform risk" terms, that pitch is no longer ideology and a lot more like risk management.

So the team moved fast. Dropped a blog; @0xMagmar posted a "this reads like a troll but isn't" migration checklist: move an Ethereum L2 into a sovereign EVM L1 in days, not months. Users barely notice.

"DM me, we'll do it for you."

Clear and open invitation to every L2 team that's starting to question their setup.

--

Cosmos is crossing off the old objection list

To make that pitch real, Cosmos has been shipping what used to be the "yeah but..." list:

▫️ Cosmos EVM - keep Solidity + familiar tooling. Your contracts move over. Devs learn nothing new.

▫️ PoA mode - start with a smaller, permissioned validator set if you don't want to bootstrap a whole validator economy on day 1. Evolve later if you need to.

▫️ IBC upgrades - the promise is "sovereign but connected," with connectivity beyond just Cosmos chains becoming a first-class goal.

Net: every "but Cosmos can't..." from two years ago is getting crossed off.

--

Who's already voting with their feet

I've been posting about this for a while - there's a broader pattern forming: more big players want their own rails instead of being tenants.

Examples of that "go sovereign" direction:

▫️ @circle announced its own L1 ("Arc") built for stablecoin finance.

▫️ @HyperliquidX built its own chain.

▫️ @OndoFinance and @Figure are leaning into Cosmos-style sovereign setups.

▫️ @tempo - incubated by @stripe & @paradigm - is being built as a payments-focused L1.

The specifics differ, and a lot of names and teams we don't know about yet, but the direction is consistent: sovereignty is back in fashion.

--

So what did Vitalik actually say?

ELI5: Ethereum's old plan was basically "L2s are like Ethereum franchises - same brand, same trust, just faster and cheaper."

Vitalik said that framing doesn't fit anymore:

1. Decentralization + interoperability on L2s has been slower/harder than hoped

2. Ethereum L1 is scaling and could get meaningfully more capacity in 2026

And he told L2s to find a value-add other than "we scale Ethereum."

This isn't "L2s are dead."

It's "generic L2s can't coast on the scaling story forever."

That's a big difference - but if 'Ethereum-but-cheaper' is all you've got, you should be nervous.

--

What users should care about

Users don’t care about "L1 vs L2" labels. They care if it’s fast, cheap, connected, and won’t rug them if the base platform changes its mind.

This whole fight is about that last one.

L2s borrow Ethereum’s security (great), but you’re still a tenant - subject to the landlord’s rules, fees, or competition.

Sovereign chains own the stack and plug into others.

Different risk, different upside.

--

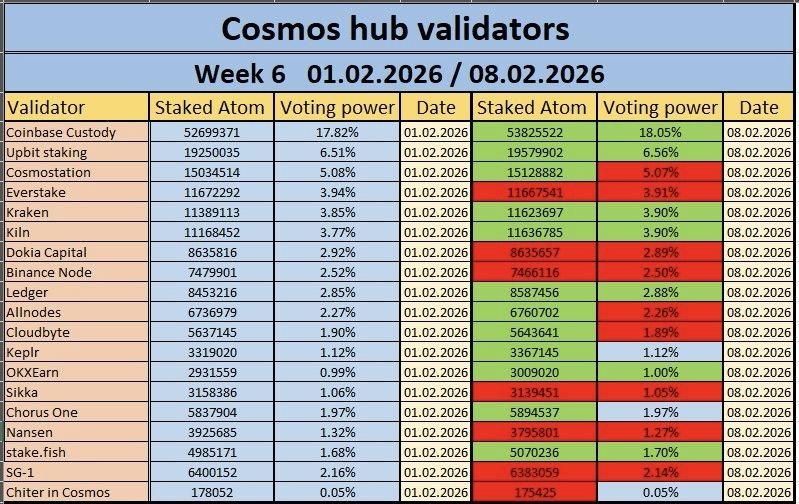

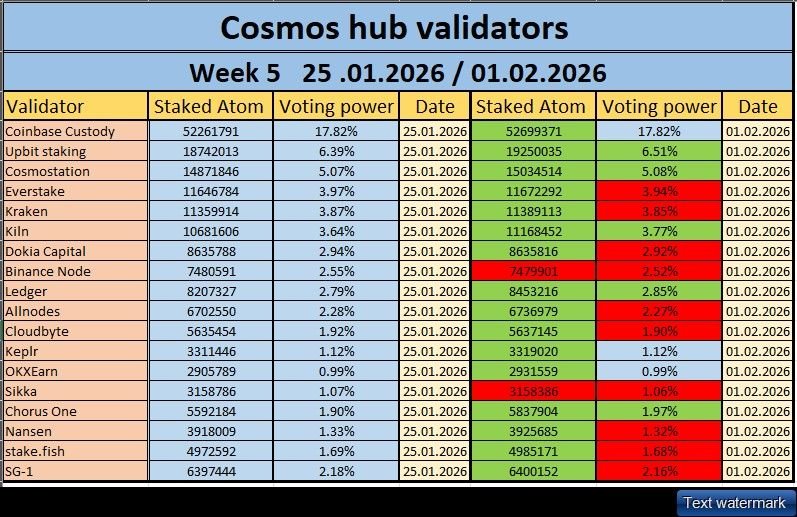

The $ATOM question - separate and unavoidable

Cosmos "winning the moment" is not the same thing as $ATOM holders winning.

If the thesis is "development funded in whole or part by $ATOM should benefit $ATOM," then the value-accrual path can't be vibes. It has to be explicit: fees, services, buybacks, revenue share, whatever the mechanism ends up being.

Sovereign chains and @cosmoslabs_io can be a win for the stack - but $ATOM needs a clear contract for how it captures value from that stack.

--

What I'm watching

Cosmos wins this moment only if two things are true in production:

1. "Sovereign but connected" needs to feel boring and reliable.

2. Migrations have to be buttery smooth in production

If they nail execution, this could pull real volume (and maybe finally some $ATOM demand via Hub services/fees).

🫡

Sources:

https://t.co/WXY0bgaiOi

https://t.co/T0nOjcjPfX

https://t.co/UZwxhccRYn

https://t.co/QIfhnA6r7k

Cosmos (ATOM)

Cosmos (ATOM) CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.93K @IvanM10529875Wimar.X D251.46K @DefiWimar

CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.93K @IvanM10529875Wimar.X D251.46K @DefiWimar 5 1 747 Original >Tendencia de ATOM tras el lanzamientoExtremadamente bajista

5 1 747 Original >Tendencia de ATOM tras el lanzamientoExtremadamente bajista O.N.Y.E.M.A🕵🏽♂️ Community_Lead DeFi_Expert B5.41K @ioDeFi

O.N.Y.E.M.A🕵🏽♂️ Community_Lead DeFi_Expert B5.41K @ioDeFi Prof K of MANTRA (🕉️,🏠) D6.80K @Profoneur

Prof K of MANTRA (🕉️,🏠) D6.80K @Profoneur 75 20 3.95K Original >Tendencia de ATOM tras el lanzamientoAlcista

75 20 3.95K Original >Tendencia de ATOM tras el lanzamientoAlcista CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.93K @IvanM10529875

CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.93K @IvanM10529875

24 0 904 Original >Tendencia de ATOM tras el lanzamientoNeutral

24 0 904 Original >Tendencia de ATOM tras el lanzamientoNeutral CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.93K @IvanM10529875

CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.93K @IvanM10529875

CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.93K @IvanM10529875

CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.93K @IvanM10529875 23 2 1.83K Original >Tendencia de ATOM tras el lanzamientoNeutral

23 2 1.83K Original >Tendencia de ATOM tras el lanzamientoNeutral