Arbitrum (ARB)

Arbitrum (ARB)

$0.1182 +0.68% 24H

- 65Índice de sentimiento social (ISS)-20.63% (24h)

- #81Clasificación del pulso del mercado (CPM)-47

- 18Mención en redes sociales de 24 h-35.71% (24h)

- 95%Ratio alcista de KOL en 24 h6 KOL activo

- Resumen

- Señales alcistas

- Señales bajistas

Índice de sentimiento social (ISS)

- Datos generales65SSI

- Tendencia ISS (7 días)Precio (7 días)Distribución de sentimientosExtremadamente alcista (28%)Alcista (67%)Neutral (5%)Perspectivas de ISS

Clasificación del pulso del mercado (CPM)

- Alerta Insight

Publicaciones de X

MobΞth Researcher Tokenomics_Expert B3.60K @MobWeth

MobΞth Researcher Tokenomics_Expert B3.60K @MobWeth Arbitrum D1.16M @arbitrum113 30 7.48K Original >Tendencia de ARB tras el lanzamientoAlcista

Arbitrum D1.16M @arbitrum113 30 7.48K Original >Tendencia de ARB tras el lanzamientoAlcista MobΞth Researcher Tokenomics_Expert B3.60K @MobWeth

MobΞth Researcher Tokenomics_Expert B3.60K @MobWeth Arbitrum D1.16M @arbitrum91 17 37.07K Original >Tendencia de ARB tras el lanzamientoAlcista

Arbitrum D1.16M @arbitrum91 17 37.07K Original >Tendencia de ARB tras el lanzamientoAlcista- Tendencia de ARB tras el lanzamientoAlcista

- Tendencia de ARB tras el lanzamientoAlcista

- Tendencia de ARB tras el lanzamientoAlcista

- Tendencia de ARB tras el lanzamientoAlcista

SimpleFarmer DeFi_Expert Founder B7.08K @OxSimpleFarmer

SimpleFarmer DeFi_Expert Founder B7.08K @OxSimpleFarmer

ApeCoin D465.83K @apecoin19 7 818 Original >Tendencia de ARB tras el lanzamientoExtremadamente alcista

ApeCoin D465.83K @apecoin19 7 818 Original >Tendencia de ARB tras el lanzamientoExtremadamente alcista- Tendencia de ARB tras el lanzamientoExtremadamente alcista

MobΞth Researcher Tokenomics_Expert B3.60K @MobWeth

MobΞth Researcher Tokenomics_Expert B3.60K @MobWeth Arbitrum D1.16M @arbitrum124 17 7.72K Original >Tendencia de ARB tras el lanzamientoAlcista

Arbitrum D1.16M @arbitrum124 17 7.72K Original >Tendencia de ARB tras el lanzamientoAlcista 𝗵𝘂𝗻𝘁𝗲𝗿 Media Community_Lead A15.75K @BFreshHB

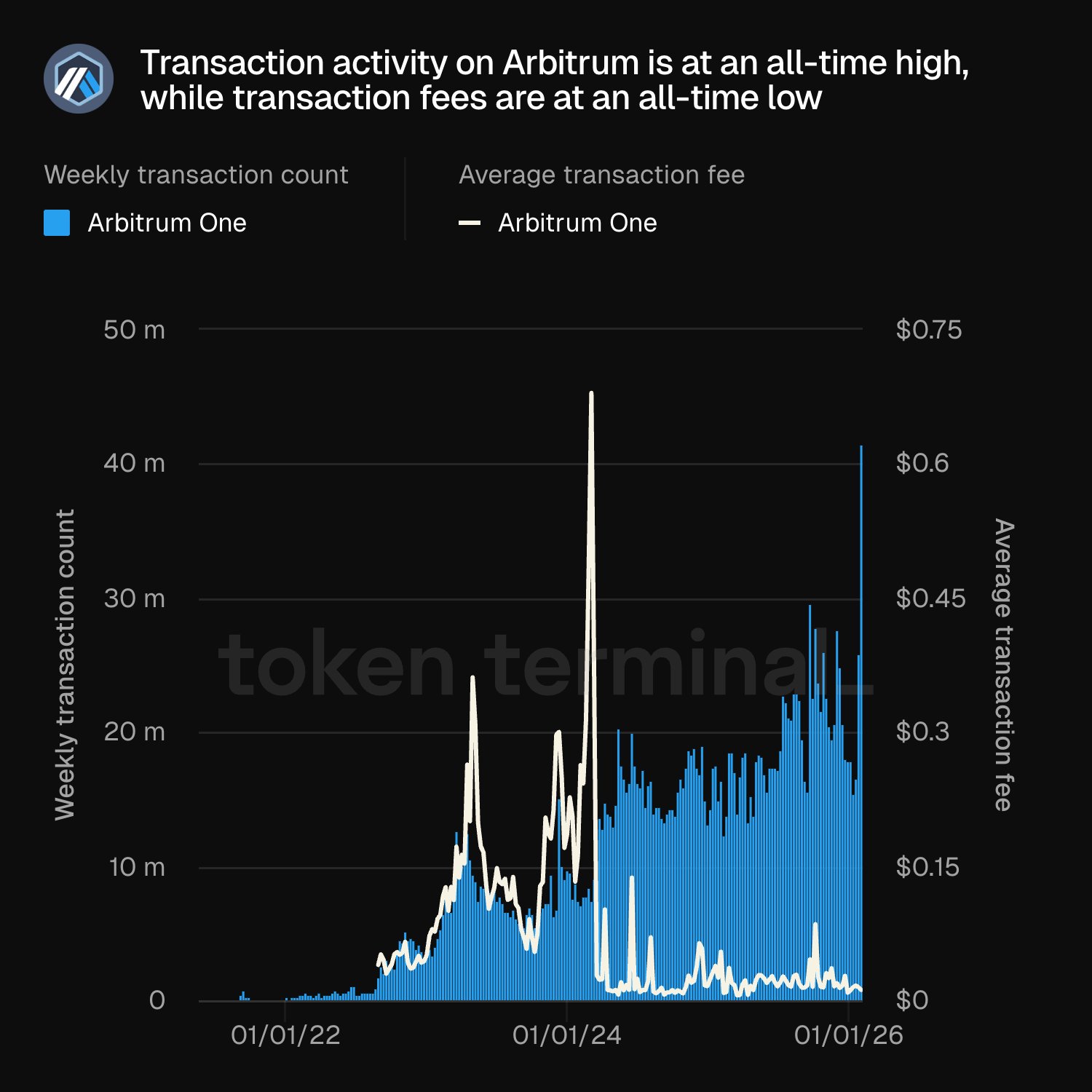

𝗵𝘂𝗻𝘁𝗲𝗿 Media Community_Lead A15.75K @BFreshHB Token Terminal 📊 D155.17K @tokenterminal

Token Terminal 📊 D155.17K @tokenterminal 37 8 11.12K Original >Tendencia de ARB tras el lanzamientoExtremadamente alcista

37 8 11.12K Original >Tendencia de ARB tras el lanzamientoExtremadamente alcista