ZKsync (ZK)

ZKsync (ZK)

$0.02252 -1.14% 24H

- 82Social Sentiment Index (SSI)+14.23% (24h)

- #30Market Pulse Ranking (MPR)-15

- 924h Social Mention+28.57% (24h)

- 89%24h KOL Bullish Ratio8 Active KOL

- Summary

- Bullish Signals

- Bearish Signals

Social Sentiment Index (SSI)

- Data Overall82SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionExtremely Bullish (56%)Bullish (33%)Bearish (11%)SSI Insights

Market Pulse Ranking (MPR)

- Alert Insight

X Posts

- Trend of ZK after releaseBullish

Zh0u 🧬 OnChain_Analyst DeFi_Expert B8.72K @Crypto_Zh0u

Zh0u 🧬 OnChain_Analyst DeFi_Expert B8.72K @Crypto_Zh0u Zh0u 🧬 OnChain_Analyst DeFi_Expert B8.72K @Crypto_Zh0u

Zh0u 🧬 OnChain_Analyst DeFi_Expert B8.72K @Crypto_Zh0u 15 4 507 Original >Trend of ZK after releaseExtremely Bullish

15 4 507 Original >Trend of ZK after releaseExtremely Bullish- Trend of ZK after releaseBearish

ManLy FA_Analyst OnChain_Analyst B95.44K @ManLyNFT

ManLy FA_Analyst OnChain_Analyst B95.44K @ManLyNFT

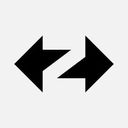

Keyring Research D1.17K @KeyringResearch228 45 10.31K Original >Trend of ZK after releaseExtremely Bullish

Keyring Research D1.17K @KeyringResearch228 45 10.31K Original >Trend of ZK after releaseExtremely Bullish Haris Ebrat OnChain_Analyst Influencer S12.29K @HarisEbrat

Haris Ebrat OnChain_Analyst Influencer S12.29K @HarisEbrat

Keyring Research D1.17K @KeyringResearch49 30 3.89K Original >Trend of ZK after releaseExtremely Bullish

Keyring Research D1.17K @KeyringResearch49 30 3.89K Original >Trend of ZK after releaseExtremely Bullish t0xic 🧪 DeFi_Expert Influencer B15.90K @amit0xic

t0xic 🧪 DeFi_Expert Influencer B15.90K @amit0xic

Keyring Research D1.17K @KeyringResearch76 35 1.98K Original >Trend of ZK after releaseBullish

Keyring Research D1.17K @KeyringResearch76 35 1.98K Original >Trend of ZK after releaseBullish Praetor OnChain_Analyst Educator S5.99K @FourVork

Praetor OnChain_Analyst Educator S5.99K @FourVork Neutize (ZK arc) D1.40K @neutize

Neutize (ZK arc) D1.40K @neutize 32 7 2.67K Original >Trend of ZK after releaseExtremely Bullish

32 7 2.67K Original >Trend of ZK after releaseExtremely Bullish- Trend of ZK after releaseExtremely Bullish

Unique singh Influencer Educator B15.92K @uniquesingh__

Unique singh Influencer Educator B15.92K @uniquesingh__ Keyring Research D1.17K @KeyringResearch107 94 2.41K Original >Trend of ZK after releaseBullish

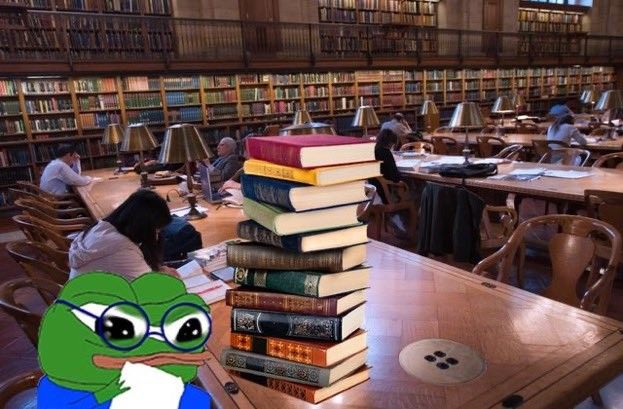

Keyring Research D1.17K @KeyringResearch107 94 2.41K Original >Trend of ZK after releaseBullish ©️Jamisky DeFi_Expert OnChain_Analyst A6.74K @_Jamisky

©️Jamisky DeFi_Expert OnChain_Analyst A6.74K @_Jamisky

©️Jamisky DeFi_Expert OnChain_Analyst A6.74K @_Jamisky

©️Jamisky DeFi_Expert OnChain_Analyst A6.74K @_Jamisky 65 32 1.50K Original >Trend of ZK after releaseExtremely Bullish

65 32 1.50K Original >Trend of ZK after releaseExtremely Bullish