XRP (XRP)

XRP (XRP)

$1.5257 +7.79% 24H

- 69Social Sentiment Index (SSI)-4.61% (24h)

- #88Market Pulse Ranking (MPR)+13

- 19324h Social Mention-20.88% (24h)

- 86%24h KOL Bullish Ratio54 Active KOL

- Summary

- Bullish Signals

- Bearish Signals

Social Sentiment Index (SSI)

- Data Overall69SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionExtremely Bullish (41%)Bullish (45%)Neutral (4%)Bearish (7%)Extremely Bearish (3%)SSI Insights

Market Pulse Ranking (MPR)

- Alert Insight

X Posts

- Trend of XRP after releaseBullish

JackTheRippler ©️ Influencer Media B439.03K @RippleXrpie

JackTheRippler ©️ Influencer Media B439.03K @RippleXrpie JackTheRippler ©️ Influencer Media B439.03K @RippleXrpie

JackTheRippler ©️ Influencer Media B439.03K @RippleXrpie 859 95 16.53K Original >Trend of XRP after releaseBullish

859 95 16.53K Original >Trend of XRP after releaseBullish Ripple Bull Winkle | Crypto Researcher 🚀🚨 FA_Analyst Influencer D130.72K @RipBullWinkle

Ripple Bull Winkle | Crypto Researcher 🚀🚨 FA_Analyst Influencer D130.72K @RipBullWinkle 10 1 136 Original >Trend of XRP after releaseExtremely Bullish

10 1 136 Original >Trend of XRP after releaseExtremely Bullish Ryan (King) Solomon Founder Media B173.85K @IOV_OWL

Ryan (King) Solomon Founder Media B173.85K @IOV_OWL xrpl_Adam D7.53K @xrpl_adam91 14 13.88K Original >Trend of XRP after releaseBullish

xrpl_Adam D7.53K @xrpl_adam91 14 13.88K Original >Trend of XRP after releaseBullish 𝗕𝗮𝗻𝗸XRP FA_Analyst Influencer B266.31K @BankXRP

𝗕𝗮𝗻𝗸XRP FA_Analyst Influencer B266.31K @BankXRP

Ledger Man 🎩 D13.08K @strivex_

Ledger Man 🎩 D13.08K @strivex_

140 7 5.29K Original >Trend of XRP after releaseExtremely Bullish

140 7 5.29K Original >Trend of XRP after releaseExtremely Bullish bill morgan FA_Analyst OnChain_Analyst A27.00K @Belisarius2020

bill morgan FA_Analyst OnChain_Analyst A27.00K @Belisarius2020 Tony Xu D138 @Tonyxu9216 3 939 Original >Trend of XRP after releaseBearish

Tony Xu D138 @Tonyxu9216 3 939 Original >Trend of XRP after releaseBearish bill morgan FA_Analyst OnChain_Analyst A27.00K @Belisarius2020

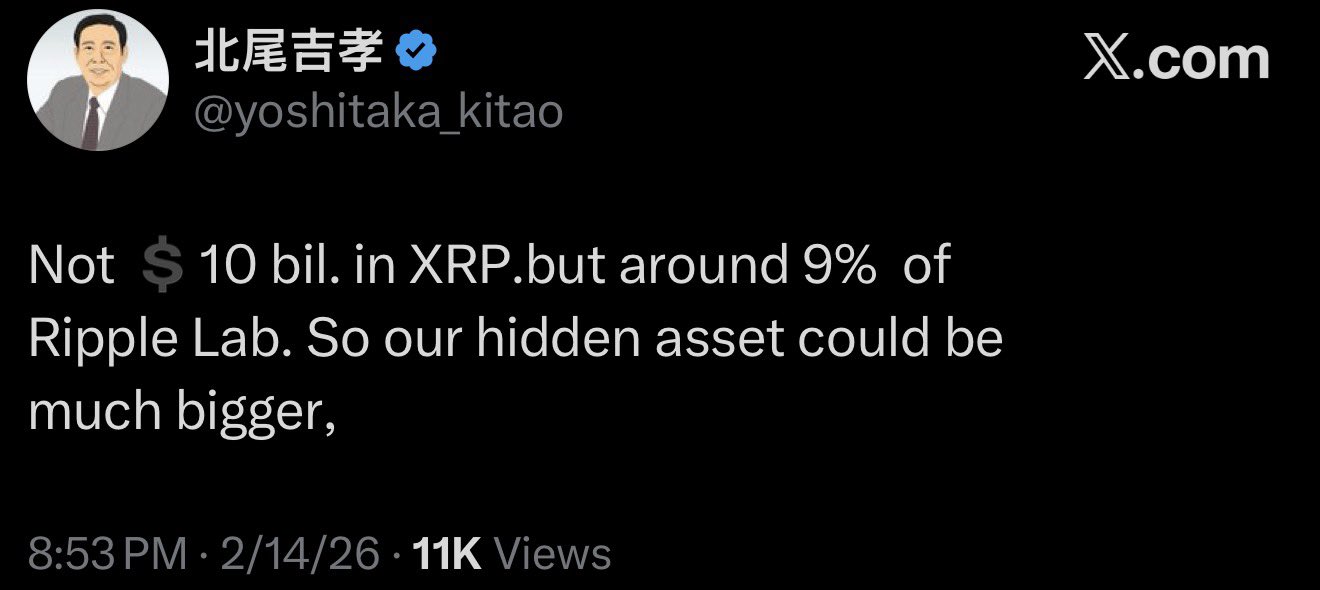

bill morgan FA_Analyst OnChain_Analyst A27.00K @Belisarius2020 北尾吉孝 D145.04K @yoshitaka_kitao19 1 772 Original >Trend of XRP after releaseBullish

北尾吉孝 D145.04K @yoshitaka_kitao19 1 772 Original >Trend of XRP after releaseBullish- Trend of XRP after releaseBullish

- Trend of XRP after releaseExtremely Bullish

T-Crypto & Stocks (TCS) Trader TA_Analyst D14.21K @Crypto_TomP

T-Crypto & Stocks (TCS) Trader TA_Analyst D14.21K @Crypto_TomP BSCN D1.32M @BSCNews2 0 94 Original >Trend of XRP after releaseBullish

BSCN D1.32M @BSCNews2 0 94 Original >Trend of XRP after releaseBullish