Euler (EUL)

Euler (EUL)

- 69Social Sentiment Index (SSI)+0.74% (24h)

- #53Market Pulse Ranking (MPR)-10

- 224h Social Mention+100.00% (24h)

- 100%24h KOL Bullish Ratio1 Active KOL

- SummaryEUL price rose 6.03% over 24h, social hype slightly increased, the tweet is only a basic introduction, with no new developments yet.

- Bullish Signals

- Price up 6.03%

- Social hype ↑0.74%

- Modular design receives praise

- Supports long-tail assets

- EUL governance active

- Bearish Signals

- Lack of substantive new news

- Interactions only 6

- DeFi regulatory risk

- Overall market volatility

- Liquidity unknown

Social Sentiment Index (SSI)

- Data Overall69SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionBullish (100%)SSI InsightsEUL social hype slightly rises to 68.5/100 (+0.74%), driven primarily by a 100% increase in KOL attention from 0→1, with sentiment and activity maintaining a perfect score.

Market Pulse Ranking (MPR)

- Alert InsightEUL warning rank falls to #53 (↓10), social anomaly remains high at 100/100, sentiment polarization at 50/100, and the lack of new news causes the anomaly to persist.

X Posts

CryptoJournaal Media Educator C18.60K @CryptoJournaal

CryptoJournaal Media Educator C18.60K @CryptoJournaal#EulerFinance ( $EUL ) - #Explanation 💡 What is Euler Finance ( $EUL )? Euler Finance is a decentralized finance protocol (DeFi) on the Ethereum blockchain, focusing on lending and borrowing a wide range of crypto assets. The protocol distinguishes itself with its modular and permissionless design, allowing users to lend or borrow virtually any ERC-20 token, including illiquid or volatile "long-tail" assets often excluded on traditional platforms. The platform functions as a "Lending Super App," integrating lending, borrowing, swapping, and liquidity management into one ecosystem. Euler serves both retail users and institutional players, with a focus on capital efficiency, risk management, and customizable markets. The native token $EUL plays a central role in governance and value creation through the Euler DAO (Decentralized Autonomous Organization). #CryptoEcosystem ⚙️ How does Euler Finance work? The Euler ecosystem consists of multiple components that work together to provide a secure and flexible lending platform: 🔸 Euler Vault Kit (EVK) Users can create custom lending markets and vaults, with customizable parameters for collateral, interest rates, and risks. This supports permissionless deployment of new markets and makes the protocol modular. 🔸 Ethereum Vault Connector (EVC) Connects vaults to each other, allowing them to serve as collateral in other vaults. This simplifies looping strategies, where borrowed funds are reinvested in other markets. 🔸 Permissionless Lending & Borrowing Supports virtually any ERC-20 token, including volatile or illiquid assets, with risk-based tiers (such as Isolation Mode for high-risk assets). 🔸 Risk Management Advanced mechanisms such as dynamic liquidations and subsidies for liquidators increase efficiency and protect against undercollateralization. 🔸 Fee Flow Protocol fees (interest and swap costs) are automatically auctioned and used for $EUL buybacks and burns, creating value for token holders. 🔸 Cross-Chain Support Active on multiple blockchains, including Ethereum, Arbitrum, Avalanche, Base, and Monad, with bridges for seamless transfers. 🔸 Integrations Collaboration with Pendle (for locked yields), Merkl (incentives), Allo Protocol (points farming), and Chainlink (oracles) strengthens the ecosystem and increases functionality. #BlockchainInnovation 🪙 The role of $EUL The $EUL token is designed as the core of Euler Finance and fulfills multiple functions: 🔸 Governance Token holders vote via the DAO on protocol upgrades, risk parameters, and treasury management. 🔸 Fee Flow Auctions 50% of protocol revenues are used to buy back and burn $EUL, which acts deflationary and creates value for holders. 🔸 Rewards Holders can stake $EUL or participate in incentive programs, with rewards in rEUL (reward EUL) for market participation. #Tokenomics 🛠️ Key features: 🔸 Maximum supply: 27,182,818 $EUL tokens, inspired by Euler's mathematical constant e. 🔸 Distribution: Community & Liquidity Mining: ~25% Team & Advisors: ~20.65% Strategic Partners: ~39.5% Euler Labs Shareholders: ~25.85% Euler Foundation/DAO Treasury: ~3.7% + other for ecosystem growth 🔸 Utility: Governance, fee flow buybacks, staking, and incentive programs. 🔸 Mechanism: Fixed supply prevents rampant inflation; after four years, an annual inflation of max. 2.718% can be discussed by the DAO for treasury financing. #BlockchainProgress 📜 History and development: Euler Finance shows a clear evolution of DeFi lending towards modular, permissionless, and institutionally-oriented DeFi: 2021: Launch of Euler Finance. 2023: Major hack where ~$200 million was misused; the team responded with a security overhaul, white-hat bounty, and extensive audits. 2024: Launch of Euler V2 with modular architecture and vault isolation for safer markets. 2025: Strong growth in TVL and deposits, rollout on new chains such as Arbitrum, Avalanche, Base, and Monad, integration with institutional partners, and introduction of EulerSwap and Euler USD. The team continues to drive innovation through cross-chain expansion and improvements to the Euler Vault Kit ecosystem. #CryptoHistory 💸 Market and user information: Euler Finance targets both retail and institutional users. Thanks to permissionless lending, new assets can be added directly, ensuring a wide and diverse offering of lending and borrowing markets. The ecosystem encourages participation through incentives, staking, and fee flow mechanisms, allowing holders and users to generate value by participating in governance and markets. #MarketAnalysis ✅ Advantages of Euler Finance: 🔸 Permissionless access to lending and borrowing. 🔸 Modular architecture for safer and more flexible risk management. 🔸 Cross-chain operations and integrations with oracles and incentive platforms. 🔸 Deflationary buyback mechanism strengthens token value. 🔸 Suitable for both retail and institutional adoption. #DeFiApplications ⚠️ Challenges and risks: 🔸 Volatility of DeFi markets can affect returns. 🔸 Monthly unlocks of $EUL can cause selling pressure. 🔸 Regulatory risks and operational risks such as liquidation cascades. 🔸 Technically complex ecosystem that requires user attention. #CryptoChallenges 🛠️ Applications and adoption: The use of Euler Finance is broad: 🔸 Lending & Borrowing: Lending and borrowing of almost any ERC-20 token, including volatile and illiquid assets. 🔸 Institutional Integrations: Collaboration with funds such as tokenized Treasury Funds and cross-chain partners. 🔸 DeFi Yield & Incentives: Users can earn rEUL through staking and market participation. 🔸 Modular Innovation: New vaults and markets can be added permissionlessly via EVK. #DeFiAdoption 📊 Price and market performance: Euler Finance is a leading modular DeFi protocol, known for its innovation and security mechanisms. Its success is measured by TVL, cross-chain adoption, and institutional partnerships, not solely by price movements. #MarketVolatility 🔮 Future outlook: The future of Euler Finance lies in further expansion and adoption: 🔸 Further rollout of permissionless vaults and cross-chain markets. 🔸 Further collaboration with institutional partners. 🔸 Introduction of Euler USD and EulerSwap for flexible lending/borrowing strategies. 🔸 Ongoing improvements to risk management and protocol efficiency. #DeFiFuture 🎯 Conclusion: Euler Finance ( $EUL ) is a robust and modular DeFi protocol that democratizes lending through permissionless access, advanced risk management, and innovative governance. The project combines advanced technology, institutional integrations, and a deflationary token mechanism, making $EUL attractive to long-term holders. Euler continues to grow as a leading modular DeFi platform, focusing on security, flexibility, and broad adoption. #CryptoConclusion 🛒 Want to buy $EUL yourself? $EUL is easy to buy on #Bitvavo: ✅ More than 400 #Altcoins available ✅ Up to €100,000 #Accountguarantee ✅ Registered with De Nederlandsche Bank (#DNB) ✅ Sign up via the link below and trade up to €10,000 completely #Free! 🔗 https://t.co/DThEHyXfzf #CryptoJournaal #AltcoinPedia #Bitcoin #Crypto #Exchange 📚 Useful resources and additional information Want to know more about #EulerFinance ( $EUL )? Check out the official channels and documentation below: 🔹Discord: https://t.co/Ap607TAb6C 🔹GitHub: https://t.co/wsU7Uyg6n1 🔹Website: https://t.co/VNtAIewjr9 🔹Telegram: https://t.co/3WlutR1r0l 🔹X (Twitter): https://t.co/vkqU0cjNQD ⚠️ Important note: 🔹 This post is purely for educational purposes and not financial advice! 🔹 Only invest what you are willing to lose! ----------------- 👇Follow us👇 ----------------- 🚨 Follow @CryptoJournaal – the place for independent crypto information: 📰 News | 📊 Facts | 🧠 Backgrounds | 🎓 Education 💬 No sponsored tokens 📜 Fully MiCAR-compliant 🔍 Always knowledge over hype 📲 Join us via: 🌐 Website: https://t.co/i0eHsaqt3O 📘 Facebook: https://t.co/he5bTXLFXR 💬 Telegram: https://t.co/i976fBvtv0 👥 CryptoJournaal-AltcoinPedia Community: https://t.co/3yFdzLLS2O 🐦 X-profiel: https://t.co/fd2bI2MInh #Altcoins #Bitcoin #CryptoNews #CryptoEducation

2 0 111 Original >Trend of EUL after releaseBullishEuler Finance is a powerful DeFi protocol, and the EUL token has innovative features and deflationary mechanisms, attracting long-term holders.

2 0 111 Original >Trend of EUL after releaseBullishEuler Finance is a powerful DeFi protocol, and the EUL token has innovative features and deflationary mechanisms, attracting long-term holders. CryptoJournaal Media Educator C18.60K @CryptoJournaal

CryptoJournaal Media Educator C18.60K @CryptoJournaal#EulerFinance ( $EUL ) - #Explainer 💡 What is Euler Finance ( $EUL )? Euler Finance is a decentralized finance protocol (DeFi) on the Ethereum blockchain, focusing on lending and borrowing a wide range of crypto assets. The protocol stands out for its modular and permissionless design, allowing users to lend or borrow almost any ERC-20 token, including illiquid or volatile "long-tail" assets often excluded on traditional platforms. The platform functions as a "Lending Super App," integrating lending, borrowing, swapping, and liquidity management into a single ecosystem. Euler serves both retail users and institutional players, with a focus on capital efficiency, risk management, and customizable markets. The native token $EUL plays a central role in governance and value creation via the Euler DAO (Decentralized Autonomous Organization). #CryptoEcosystem ⚙️ How does Euler Finance work? The Euler ecosystem consists of multiple components working together to provide a secure and flexible lending platform: 🔸 Euler Vault Kit (EVK) Users can create custom lending markets and vaults, with adjustable parameters for collateral, interest rates, and risks. This supports permissionless deployment of new markets and makes the protocol modular. 🔸 Ethereum Vault Connector (EVC) Connects vaults with each other, allowing them to serve as collateral in other vaults. This simplifies looping strategies, where borrowed funds are reinvested in other markets. 🔸 Permissionless Lending & Borrowing Supports almost any ERC-20 token, including volatile or illiquid assets, with risk-based tiers (such as Isolation Mode for high-risk assets). 🔸 Risk Management Advanced mechanisms like dynamic liquidations and subsidies for liquidators increase efficiency and protect against undercollateralization. 🔸 Fee Flow Protocol fees (interest and swap costs) are automatically auctioned and used for $EUL buybacks and burns, creating value for token holders. 🔸 Cross-Chain Support Active on multiple blockchains, including Ethereum, Arbitrum, Avalanche, Base, and Monad, with bridges for seamless transfers. 🔸 Integrations Collaborations with Pendle (for locked yields), Merkl (incentives), Allo Protocol (points farming), and Chainlink (oracles) strengthen the ecosystem and increase functionality. #BlockchainInnovation 🪙 The role of $EUL The $EUL token is designed as the core of Euler Finance and serves multiple functions: 🔸 Governance Token holders vote via the DAO on protocol upgrades, risk parameters, and treasury management. 🔸 Fee Flow Auctions 50% of protocol revenues are used to buy back and burn $EUL, creating a deflationary effect and value for holders. 🔸 Rewards Holders can stake $EUL or participate in incentive programs, receiving rewards in rEUL (reward EUL) for market participation. #Tokenomics 🛠️ Key features: 🔸 Maximum supply: 27,182,818 $EUL tokens, inspired by Euler’s mathematical constant e. 🔸 Distribution: Community & Liquidity Mining: ~25% Team & Advisors: ~20.65% Strategic Partners: ~39.5% Euler Labs Shareholders: ~25.85% Euler Foundation/DAO Treasury: ~3.7% + others for ecosystem growth 🔸 Utility: Governance, fee flow buybacks, staking, and incentive programs. 🔸 Mechanism: Fixed supply prevents uncontrolled inflation; after four years, an annual inflation of max. 2.718% can be discussed by the DAO for treasury funding. #BlockchainProgress 📜 History and development: Euler Finance shows a clear evolution from DeFi lending to modular, permissionless, and institutionally-oriented DeFi: 2021: Launch of Euler Finance. 2023: Major hack where ~$200 million was exploited; the team responded with a security overhaul, white-hat bounty, and extensive audits. 2024: Launch of Euler V2 with modular architecture and vault isolation for safer markets. 2025: Strong growth in TVL and deposits, rollout on new chains such as Arbitrum, Avalanche, Base, and Monad, integration with institutional partners, and introduction of EulerSwap and Euler USD. The team continues to drive innovation through cross-chain expansion and improvements to the Euler Vault Kit ecosystem. #CryptoHistory 💸 Market and user information: Euler Finance targets both retail and institutional users. Permissionless lending allows new assets to be added directly, creating a broad and diverse range of lending and borrowing markets. The ecosystem encourages participation via incentives, staking, and fee flow mechanisms, allowing holders and users to generate value through governance and market participation. #MarketAnalysis ✅ Advantages of Euler Finance: 🔸 Permissionless access to lending and borrowing. 🔸 Modular architecture for safer and more flexible risk management. 🔸 Cross-chain operations and integrations with oracles and incentive platforms. 🔸 Deflationary buyback mechanism strengthens token value. 🔸 Suitable for both retail and institutional adoption. #DeFiApplications ⚠️ Challenges and risks: 🔸 Volatility of DeFi markets can affect returns. 🔸 Monthly $EUL unlocks may create selling pressure. 🔸 Regulatory and operational risks such as liquidation cascades. 🔸 Technically complex ecosystem that requires user attention. #CryptoChallenges 🛠️ Use cases and adoption: The use of Euler Finance is broad: 🔸 Lending & Borrowing: Lend and borrow almost any ERC-20 token, including volatile and illiquid assets. 🔸 Institutional Integrations: Collaboration with funds such as tokenized Treasury Funds and cross-chain partners. 🔸 DeFi Yield & Incentives: Users can earn rEUL via staking and market participation. 🔸 Modular Innovation: New vaults and markets can be added permissionlessly via EVK. #DeFiAdoption 📊 Price and market performance: Euler Finance is a leading modular DeFi protocol, known for its innovation and security mechanisms. Success is measured by TVL, cross-chain adoption, and institutional partnerships, not just price movements. #MarketVolatility 🔮 Future outlook: The future of Euler Finance lies in further expansion and adoption: 🔸 Further rollout of permissionless vaults and cross-chain markets. 🔸 Continued collaboration with institutional partners. 🔸 Introduction of Euler USD and EulerSwap for flexible lending/borrowing strategies. 🔸 Ongoing improvements to risk management and protocol efficiency. #DeFiFuture 🎯 Conclusion: Euler Finance ( $EUL ) is a robust and modular DeFi protocol that democratizes lending through permissionless access, advanced risk management, and innovative governance. The project combines advanced technology, institutional integrations, and a deflationary token mechanism, making $EUL attractive for long-term holders. Euler continues to grow as a leading modular DeFi platform, focusing on safety, flexibility, and broad adoption. #CryptoConclusion 🛒 Want to trade $EUL on #WEEX? WEEX is a global #Exchange where you can easily start trading crypto and futures: ✅ Access to 1,700+ #Altcoins ✅ Up to $30,000 USDT in #Bonuses for new users ✅ User-friendly app & web platform ✅ Trusted exchange with millions of traders worldwide 👉 Sign up now via the link below and claim your welcome bonus! 🔗 https://t.co/q8pSdzpIh8 #CryptoJournaal #AltcoinPedia #Bitcoin #Crypto #Exchange #Futures ⚠️ Important Note: 🔹 This post is for educational purposes only and not financial advice! 🔹 Only invest what you are willing to lose! 📚 Useful resources and additional information: Want to dive deeper into the world of #EulerFinance ( $EUL ) or looking for the latest updates and developments? These links will help you stay up to date: 🔹Discord: https://t.co/Ap607TAb6C 🔹GitHub: https://t.co/wsU7Uyg6n1 🔹Website: https://t.co/VNtAIewjr9 🔹Telegram: https://t.co/3WlutR1r0l 🔹X (Twitter): https://t.co/vkqU0cjNQD ----------------- 👇Follow us👇 ----------------- 🚨 Follow @CryptoJournaal – the go-to source for independent crypto information: 📰 News | 📊 Facts | 🧠 Insights | 🎓 Education 💬 No sponsored tokens 📜 Fully MiCAR-compliant 🔍 Knowledge over hype, always 📲 Join via: 🌐 Website: https://t.co/i0eHsaqt3O 📘 Facebook: https://t.co/he5bTXLFXR 💬 Telegram: https://t.co/i976fBvtv0 👥 CryptoJournaal-AltcoinPedia Community: https://t.co/3yFdzLLS2O 🐦 X-profiel: https://t.co/fd2bI2MInh #Altcoins #Bitcoin #CryptoNews #CryptoEducation #CryptoPrices

2 0 113 Original >Trend of EUL after releaseBullishEUL is an innovative modular DeFi protocol with long-term holding value.

2 0 113 Original >Trend of EUL after releaseBullishEUL is an innovative modular DeFi protocol with long-term holding value. Leo.Master.edge🦭. MemeMax ⚡️ Influencer DeFi_Expert C11.46K @ezeroho8245

Leo.Master.edge🦭. MemeMax ⚡️ Influencer DeFi_Expert C11.46K @ezeroho8245. @brevis_zk Euler was the first protocol launched on Incentra. A few months later, let's revisit how important this moment was. Traditional reward campaigns require custom contracts, backend scripts, and manual distribution. Someone has to calculate who gets what, and users simply have to trust that the calculation is correct. Incentra presented an easier path toward a completely new model. Every four hours it captures a snapshot of Euler's Arbitrum market, generates a ZK proof for the reward calculation, and posts it on-chain. No intermediaries, no spreadsheets. Only verifiable mathematical calculations that anyone can audit. As a result, from that moment LPs no longer need to trust that rewards were calculated fairly. With us, LPs can verify themselves. And as users trust the system, they engage more deeply. Euler launched the service over a weekend with no new contracts and zero operating costs. This plug-and-play ZK verification is exactly that.

13 12 280 Original >Trend of EUL after releaseBullishIncentra provides an efficient, verifiable ZK proof solution for Euler's reward campaign on Arbitrum, enhancing user trust and reducing costs.

13 12 280 Original >Trend of EUL after releaseBullishIncentra provides an efficient, verifiable ZK proof solution for Euler's reward campaign on Arbitrum, enhancing user trust and reducing costs. Brevis Dev Researcher B474.56K @brevis_zk

Brevis Dev Researcher B474.56K @brevis_zkEuler was the first protocol to launch on Incentra. A few months in, let’s revisit how significant this moment was. Traditional reward campaigns require custom contracts, backend scripts, and manual distributions. Someone has to calculate who gets what, and users just have to trust the math is right. Incentra offered an easier path to a brand new model. Every 4 hours it captured a snapshot of Euler's Arbitrum markets, generated a ZK proof of the reward calculations, and posted it on-chain. No intermediaries, no spreadsheets. Just verifiable math anyone can audit. The result: From that moment on LPs didn't have to trust that rewards were calculated fairly. With us, they can verify it themselves. And when users trust the system, they engage more deeply. Euler went live in a weekend with zero new contracts and zero ops overhead. That's what plug-and-play ZK verification looks like. Check out the many currently active Incentra campaigns we have now: https://t.co/c6ZCQRKcze

Brevis Dev Researcher B474.56K @brevis_zk

Brevis Dev Researcher B474.56K @brevis_zk🤝Brevis and @eulerfinance partnered up to go live with Incentra-powered campaigns a little over two weeks ago—and they’ve been doing great! ✅Trustless rewards are here and powered entirely by zero-knowledge proofs from Incentra! 🔗https://t.co/P0FvcxsBUz https://t.co/qnHYLshzNr

603 129 74.27K Original >Trend of EUL after releaseBullishEuler protocol successfully launched a ZK-driven trustless reward system on Incentra, improving efficiency and user trust.

603 129 74.27K Original >Trend of EUL after releaseBullishEuler protocol successfully launched a ZK-driven trustless reward system on Incentra, improving efficiency and user trust. Vav Crypto 🌊 Educator Regulatory_Expert B17.15K @VaveylaCrypto

Vav Crypto 🌊 Educator Regulatory_Expert B17.15K @VaveylaCrypto Vav Crypto 🌊 Educator Regulatory_Expert B17.15K @VaveylaCrypto

Vav Crypto 🌊 Educator Regulatory_Expert B17.15K @VaveylaCryptosome days you look at the space and realize how fast the core logic of web3 is shifting @brevis_zk isn’t just building a better zk toolkit it’s pushing the ecosystem toward a verifiable compute model brevis makes this modular, so developers skip the heavy lifting and reuse proofs across chains the idea is simple move critical off-chain work into a transparent layer where proofs handle data retrieval, state checks, and ai inference projects like euler, pancakeswap, and uniswap v4 are already running production workloads on brevis with automated rewards, dynamic fee logic, and on-chain subsidy rules that shows brevis has moved from works in theory to works at scale as apps demand smarter behavior based on history and intent, brevis zk co-processor becomes the natural path it turns dapps from static rule engines into systems that can reason if web3 expands its trust radius, brevis will likely be one of the core drivers of that shift gBrevis @brevis_zk @KaitoAI #KAITO #brevis_zk

168 148 1.68K Original >Trend of EUL after releaseBullishBrevis zk makes Web3 compute verifiable, enhancing DeFi applications Conny DeFi_Expert Influencer B10.59K @ConnyConny253

Conny DeFi_Expert Influencer B10.59K @ConnyConny253 Cheeezzyyyy D9.09K @0xCheeezzyyyy

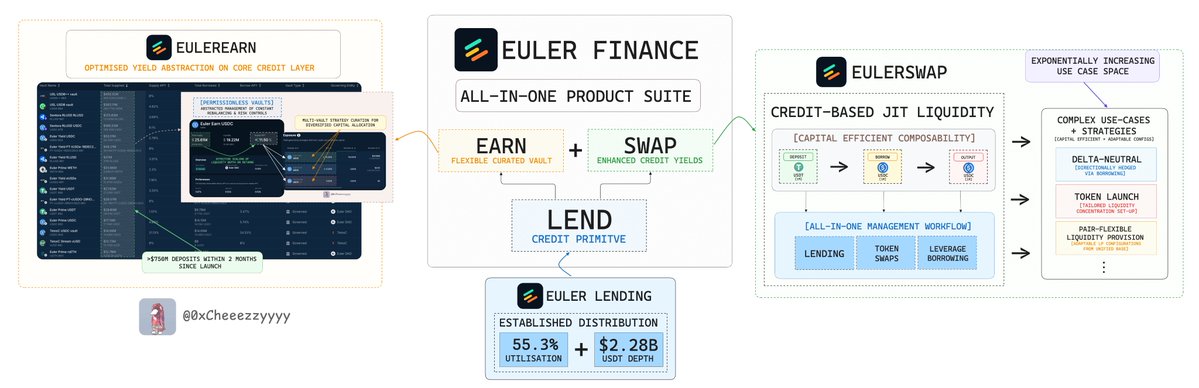

Cheeezzyyyy D9.09K @0xCheeezzyyyyTrue teams like @eulerfinance understand that the real endgame isn’t just distribution → it’s differentiated + end-to-end value capture. The 'SuperApp Thesis' has always been about full-stack leverage: owning the entire user journey through distributional reach + multi-layered product depth. By embedding complementary features into a unified experience, Euler turns scale into stickiness via transforming user convenience into a strategic moat. This design intrinsically creates high switching costs, amplified by Euler’s stack-level differentiation where a multi-layered yield stack compounds across markets, risk tranches & credit primitives. The final unlock is accessibility, achieved through deep abstraction of complexity which is precisely what EulerEarn delivers: an interface that translates complex DeFi strategies into 'effortless' participation. Because in the end, not all credit primitives are created equal. Some are simply better engineered to capture and distribute value 🫡

69 34 2.62K Original >Trend of EUL after releaseExtremely BullishEuler Finance, leveraging its SuperApp strategy and multi-layered products, captures value and simplifies DeFi participation.

69 34 2.62K Original >Trend of EUL after releaseExtremely BullishEuler Finance, leveraging its SuperApp strategy and multi-layered products, captures value and simplifies DeFi participation. Zak 🐳 DeFi_Expert Educator A1.14K @ZakLaMedaille

Zak 🐳 DeFi_Expert Educator A1.14K @ZakLaMedailleAre you really living the life at it's full potential if you're not choosing the max the leverage on @eulerfinance when looping ? https://t.co/Cu4PHtkapO

2 0 159 Original >Trend of EUL after releaseExtremely BullishThe tweet strongly encourages using max leverage for looping borrowing on Euler Finance.

2 0 159 Original >Trend of EUL after releaseExtremely BullishThe tweet strongly encourages using max leverage for looping borrowing on Euler Finance. Tryrex Trader TA_Analyst S21.29K @Tryrexcrypto

Tryrex Trader TA_Analyst S21.29K @Tryrexcrypto$EUL stop-loss to break even

Tryrex Trader TA_Analyst S21.29K @Tryrexcrypto

Tryrex Trader TA_Analyst S21.29K @Tryrexcrypto🟥 🟥 EUL SHORT TRADE 🟥🟥 $EUL is in a very strong downtrend. Doing some trend-following and shorting this here.

31 13 4.37K Original >Trend of EUL after releaseExtremely BearishEUL is in a strong downtrend; the author recommends shorting and setting a stop loss.

31 13 4.37K Original >Trend of EUL after releaseExtremely BearishEUL is in a strong downtrend; the author recommends shorting and setting a stop loss. Tryrex Trader TA_Analyst S21.29K @Tryrexcrypto

Tryrex Trader TA_Analyst S21.29K @Tryrexcrypto🟥 🟥 EUL SHORT TRADE 🟥🟥 $EUL is in a very strong downtrend. Doing some trend-following and shorting this here.

41 15 8.49K Original >Trend of EUL after releaseExtremely BearishEUL is in a strong downtrend; the author recommends shorting and setting a stop loss.

41 15 8.49K Original >Trend of EUL after releaseExtremely BearishEUL is in a strong downtrend; the author recommends shorting and setting a stop loss. katexbt.hl DeFi_Expert Researcher B25.26K @katexbt

katexbt.hl DeFi_Expert Researcher B25.26K @katexbtfinally upgraded to a 64gb ram macbook pro now my @eulerfinance website loading is 30% faster few https://t.co/0AzzxNxae5

117 55 4.38K Original >Trend of EUL after releaseBullishAfter the user upgraded the MacBook Pro, the Euler Finance website loading speed increased by 30%, providing a better experience.

117 55 4.38K Original >Trend of EUL after releaseBullishAfter the user upgraded the MacBook Pro, the Euler Finance website loading speed increased by 30%, providing a better experience.