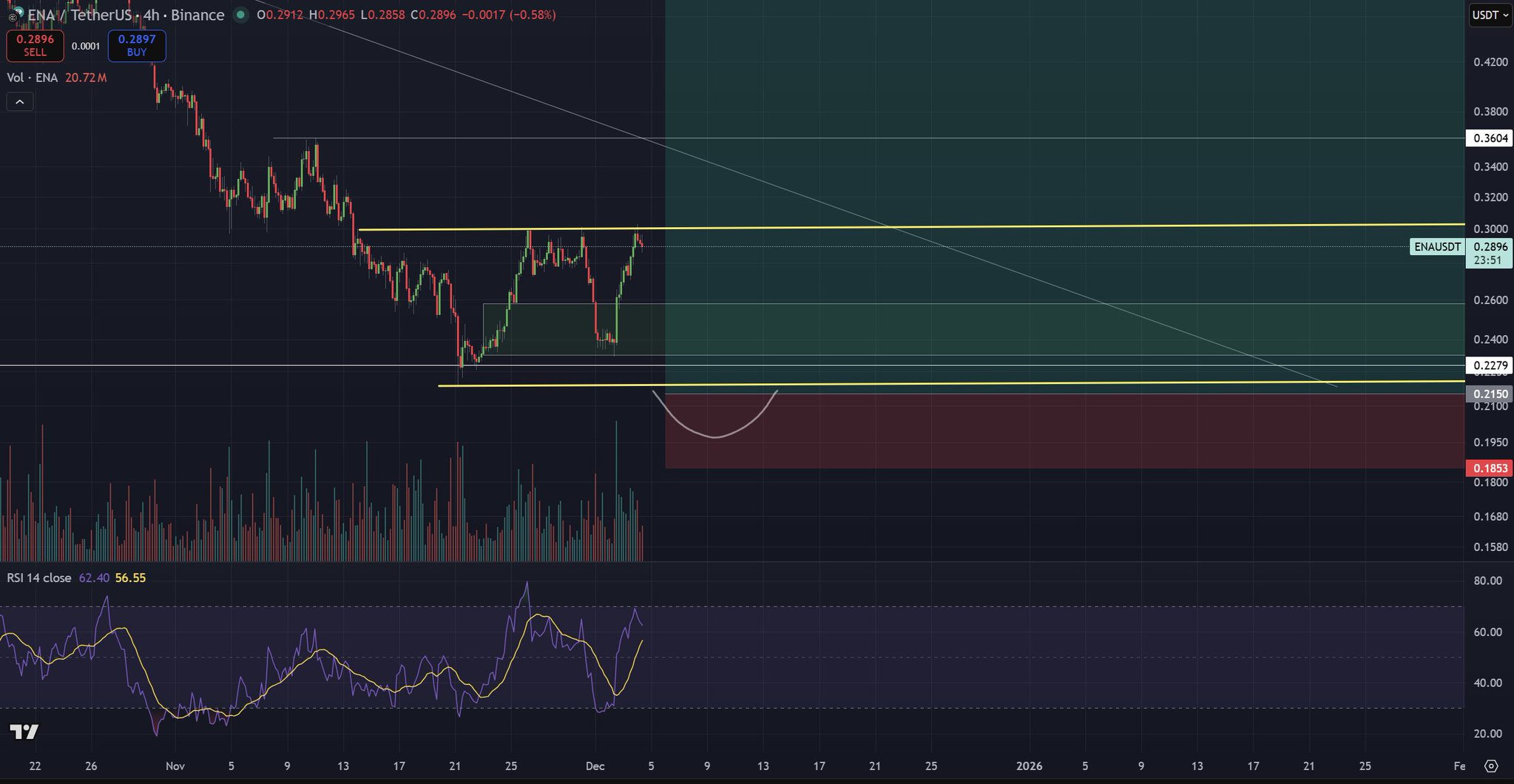

ENA (ENA)

ENA (ENA)

$0.2612 -5.33% 24H

- 33Social Sentiment Index (SSI)-59.19% (24h)

- #152Market Pulse Ranking (MPR)-130

- 424h Social Mention-66.67% (24h)

- 50%24h KOL Bullish Ratio4 Active KOL

- Summary

- Bullish Signals

- Bearish Signals

Social Sentiment Index (SSI)

- Data Overall33SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionExtremely Bullish (25%)Bullish (25%)Neutral (25%)Bearish (25%)SSI Insights

Market Pulse Ranking (MPR)

- Alert Insight

X Posts

- Trend of ENA after releaseBullish

- Trend of ENA after releaseBearish

- Trend of ENA after releaseNeutral

- Trend of ENA after releaseExtremely Bullish

- Trend of ENA after releaseBullish

Alucard Educator Influencer B52.81K @xCryptoAlucard

Alucard Educator Influencer B52.81K @xCryptoAlucard Ethena Labs D248.39K @ethena_labs

Ethena Labs D248.39K @ethena_labs 236 164 2.10K Original >Trend of ENA after releaseBullish

236 164 2.10K Original >Trend of ENA after releaseBullish Cryptoinsightuk TA_Analyst Influencer B50.96K @Cryptoinsightuk

Cryptoinsightuk TA_Analyst Influencer B50.96K @Cryptoinsightuk

Cryptoinsightuk TA_Analyst Influencer B50.96K @Cryptoinsightuk

Cryptoinsightuk TA_Analyst Influencer B50.96K @Cryptoinsightuk

22 4 4.43K Original >Trend of ENA after releaseExtremely Bullish

22 4 4.43K Original >Trend of ENA after releaseExtremely Bullish- Trend of ENA after releaseNeutral

- Trend of ENA after releaseBullish

- Trend of ENA after releaseBullish