Berachain (BERA)

Berachain (BERA)

$0.886 +0.91% 24H

- 49Social Sentiment Index (SSI)+46.27% (24h)

- #3Market Pulse Ranking (MPR)+102

- 424h Social Mention+300.00% (24h)

- 0%24h KOL Bullish Ratio1 Active KOL

- Summary

- Bullish Signals

- Bearish Signals

Social Sentiment Index (SSI)

- Data Overall49SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionExtremely Bearish (100%)SSI Insights

Market Pulse Ranking (MPR)

- Alert Insight

X Posts

chainyoda FA_Analyst Researcher B41.86K @chainyoda

chainyoda FA_Analyst Researcher B41.86K @chainyoda cami D38.99K @camiinthisthang59 13 3.36K Original >Trend of BERA after releaseBullish

cami D38.99K @camiinthisthang59 13 3.36K Original >Trend of BERA after releaseBullish Naeven OnChain_Analyst Researcher B2.35K @Naeven_

Naeven OnChain_Analyst Researcher B2.35K @Naeven_ Naeven OnChain_Analyst Researcher B2.35K @Naeven_

Naeven OnChain_Analyst Researcher B2.35K @Naeven_ 30 17 647 Original >Trend of BERA after releaseExtremely Bearish

30 17 647 Original >Trend of BERA after releaseExtremely Bearish Naeven OnChain_Analyst Researcher B2.35K @Naeven_

Naeven OnChain_Analyst Researcher B2.35K @Naeven_ Naeven OnChain_Analyst Researcher B2.35K @Naeven_

Naeven OnChain_Analyst Researcher B2.35K @Naeven_ 30 17 647 Original >Trend of BERA after releaseExtremely Bearish

30 17 647 Original >Trend of BERA after releaseExtremely Bearish Naeven OnChain_Analyst Researcher B2.35K @Naeven_

Naeven OnChain_Analyst Researcher B2.35K @Naeven_ Naeven OnChain_Analyst Researcher B2.35K @Naeven_

Naeven OnChain_Analyst Researcher B2.35K @Naeven_ 30 17 647 Original >Trend of BERA after releaseExtremely Bearish

30 17 647 Original >Trend of BERA after releaseExtremely Bearish- Trend of BERA after releaseExtremely Bearish

Coinfessions Media Influencer B221.51K @coinfessions

Coinfessions Media Influencer B221.51K @coinfessions Coinfessions Media Influencer B221.51K @coinfessions208 40 18.21K Original >Trend of BERA after releaseBearish

Coinfessions Media Influencer B221.51K @coinfessions208 40 18.21K Original >Trend of BERA after releaseBearish- Trend of BERA after releaseBullish

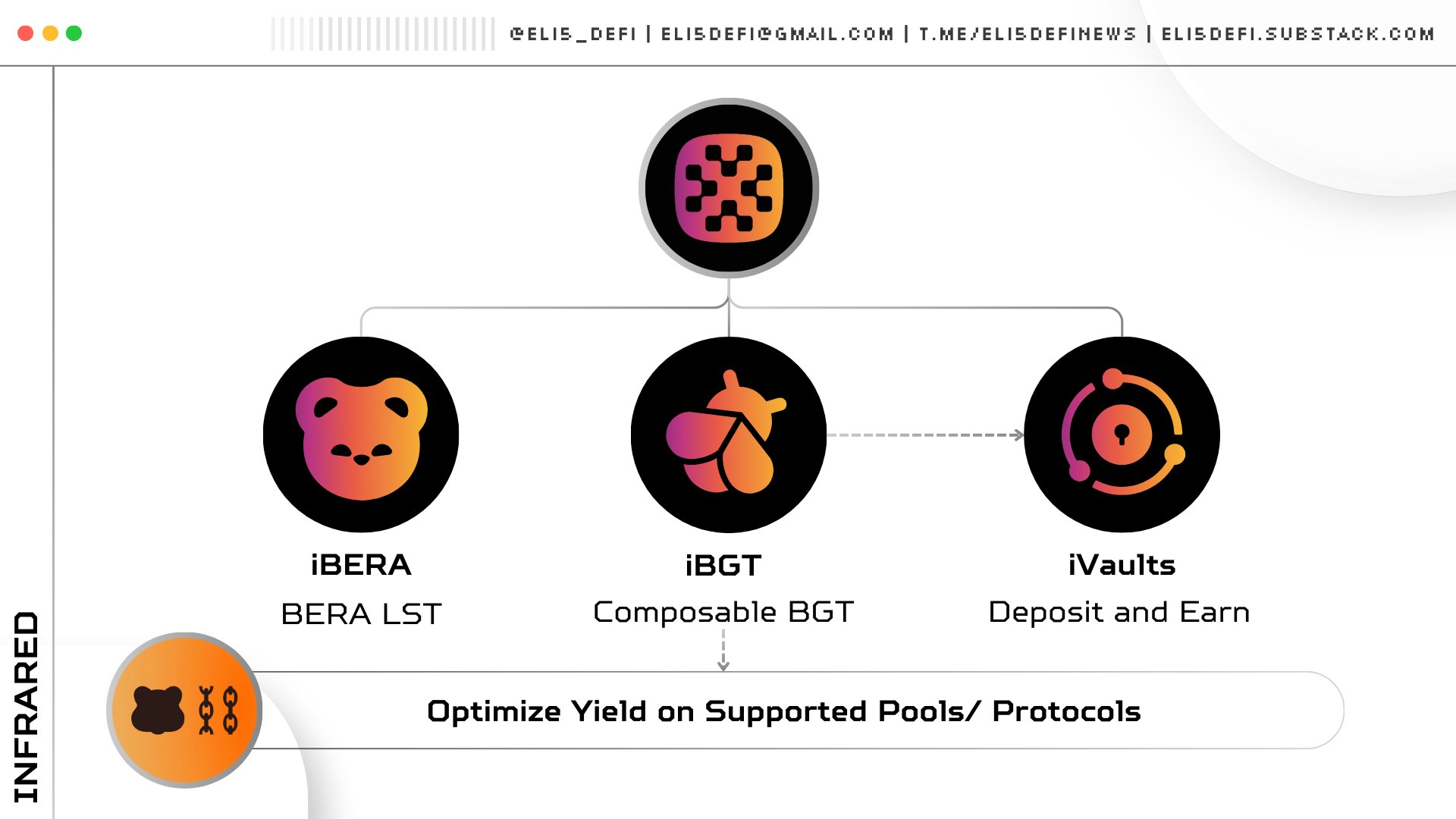

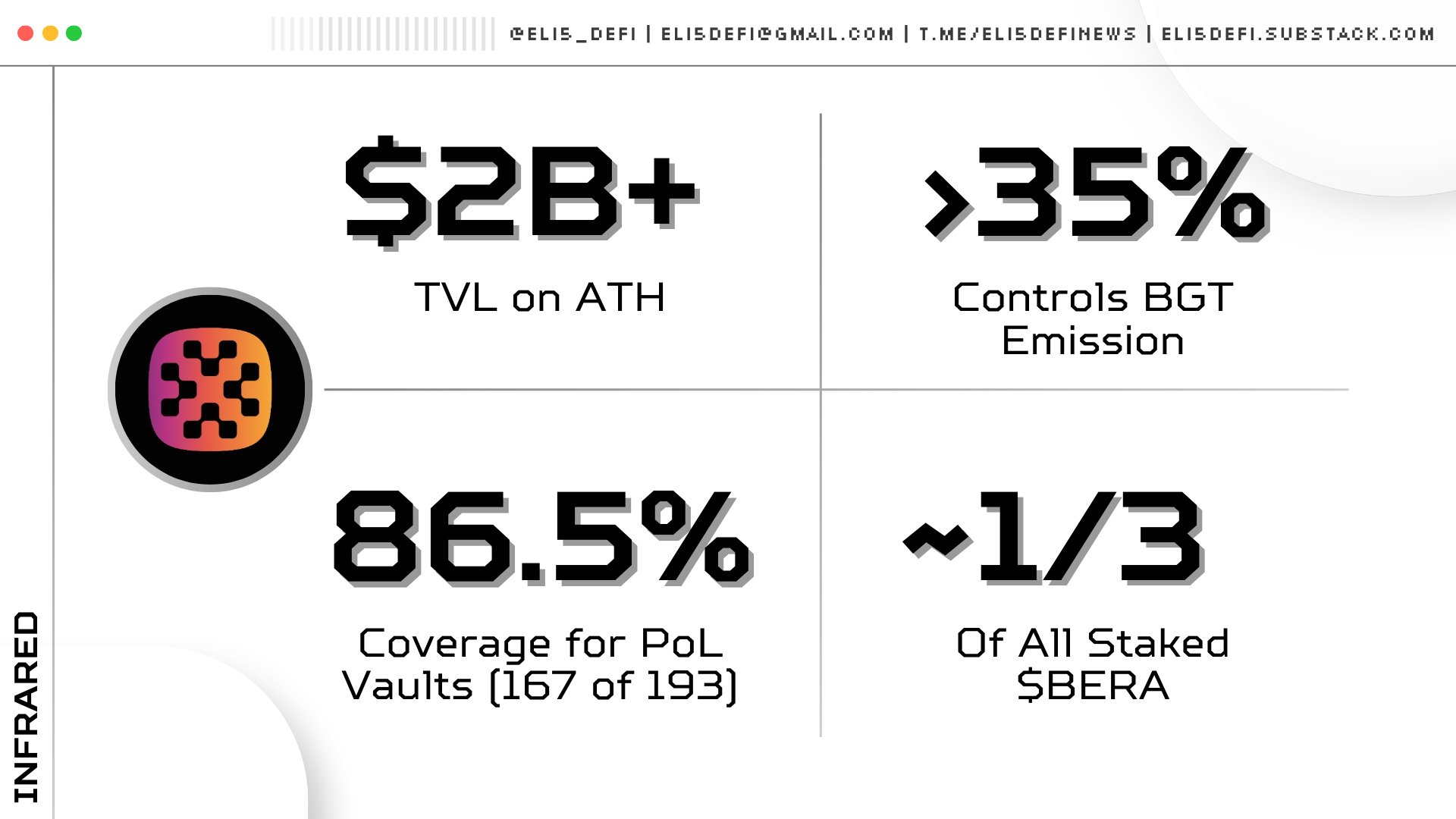

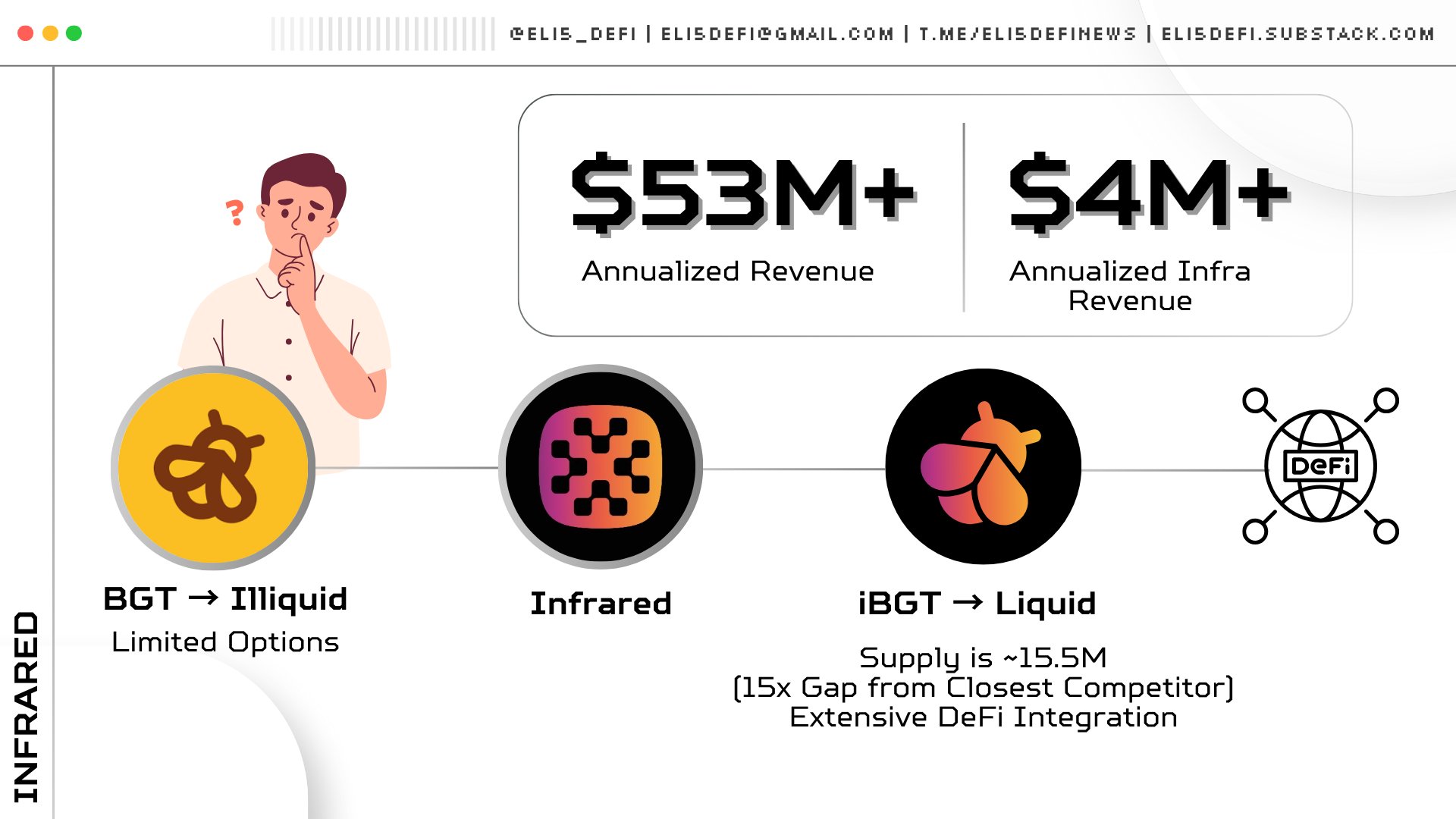

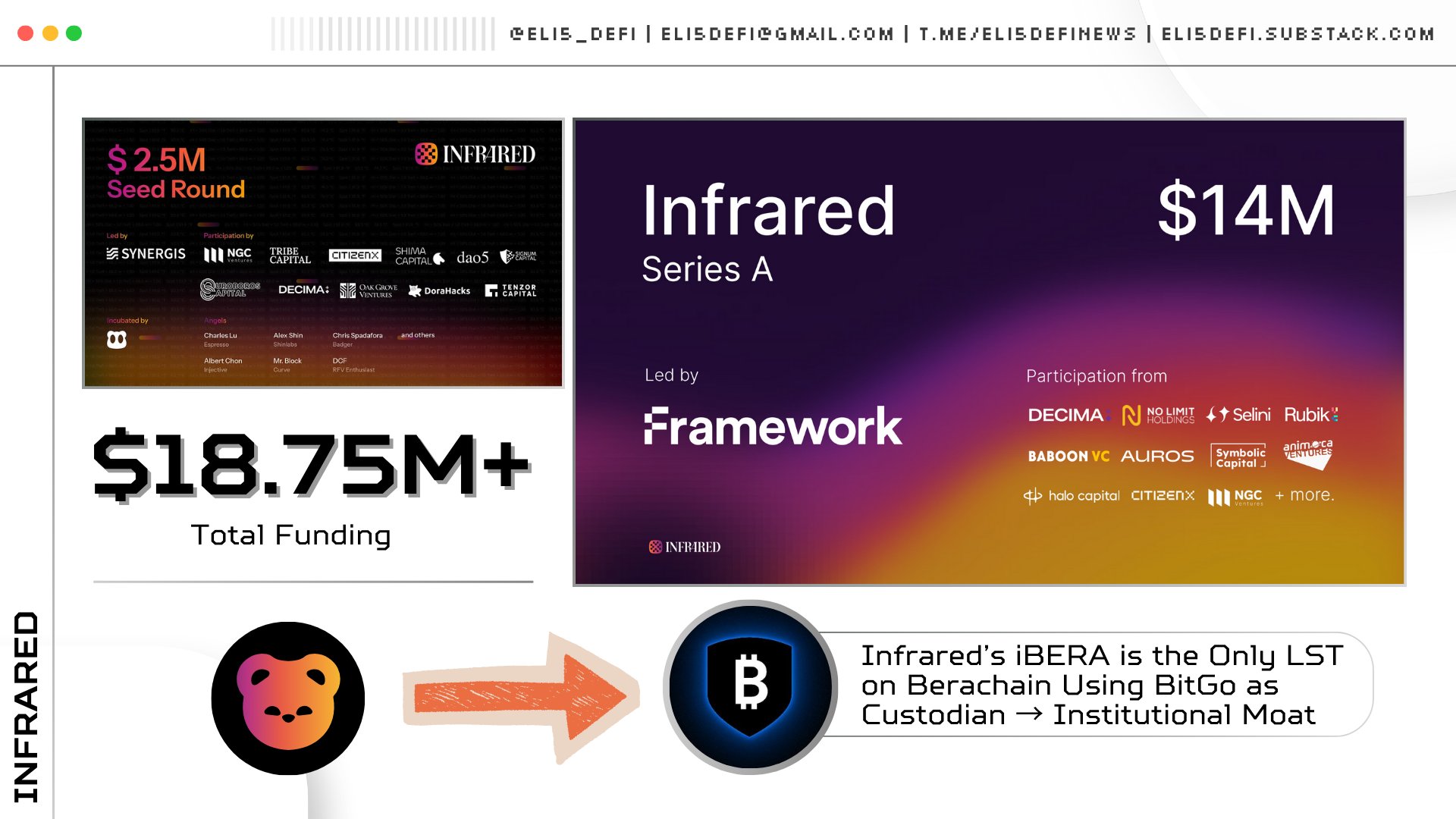

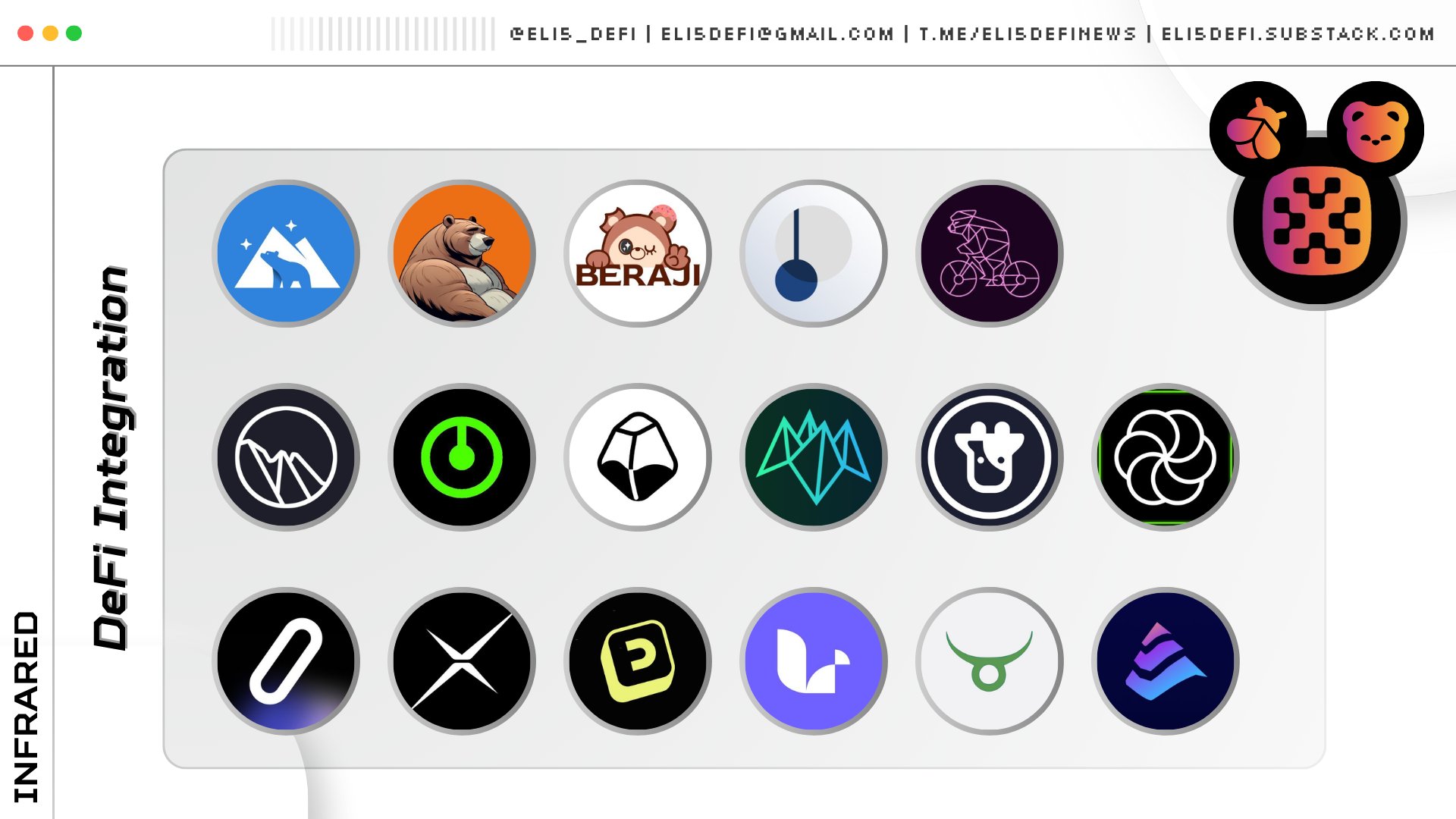

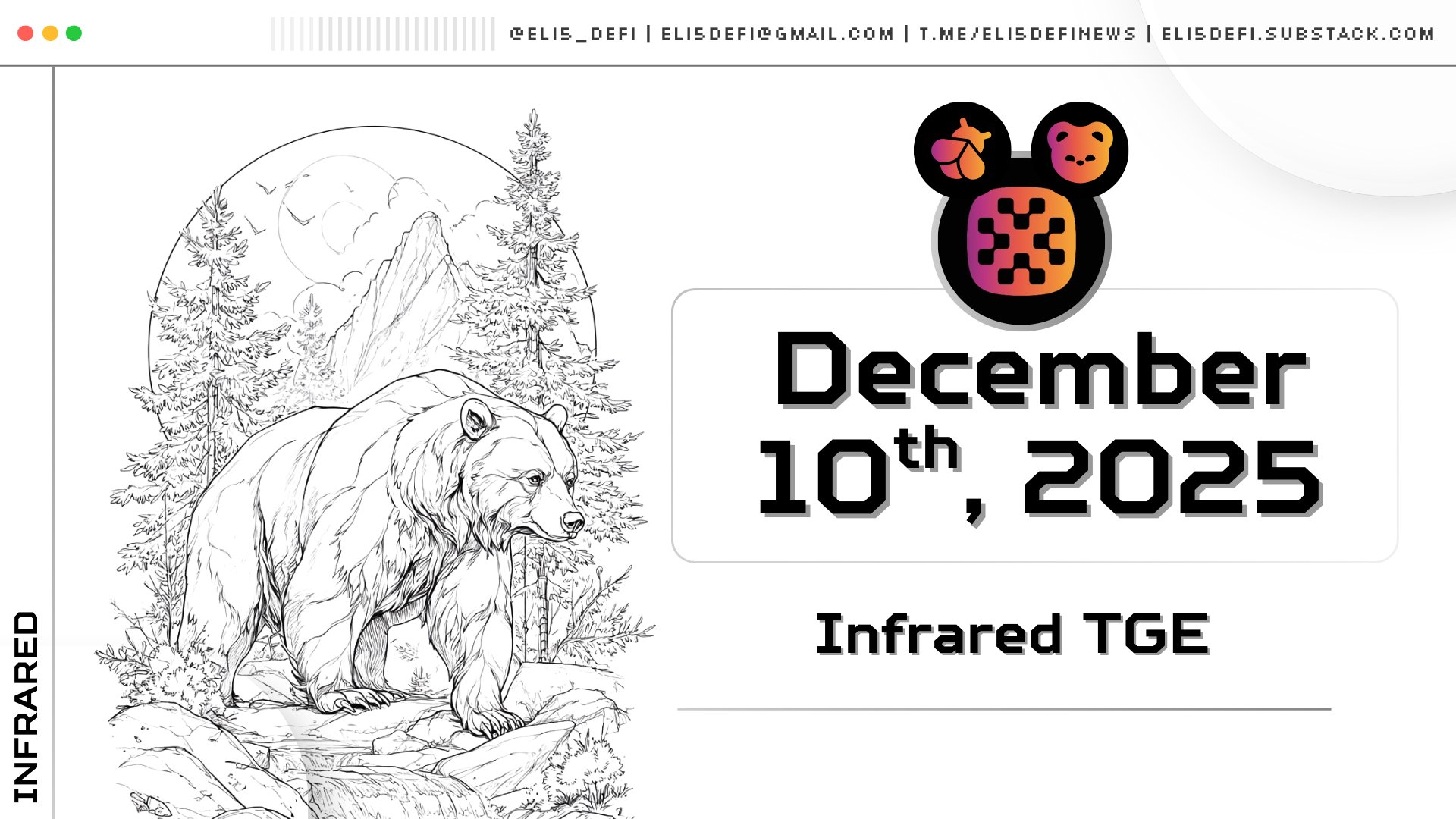

Eli5DeFi Educator DeFi_Expert C43.43K @Eli5defi

Eli5DeFi Educator DeFi_Expert C43.43K @Eli5defi

Eli5DeFi Educator DeFi_Expert C43.43K @Eli5defi

Eli5DeFi Educator DeFi_Expert C43.43K @Eli5defi

Eli5DeFi Educator DeFi_Expert C43.43K @Eli5defi

Eli5DeFi Educator DeFi_Expert C43.43K @Eli5defi

Eli5DeFi Educator DeFi_Expert C43.43K @Eli5defi

Eli5DeFi Educator DeFi_Expert C43.43K @Eli5defi

Eli5DeFi Educator DeFi_Expert C43.43K @Eli5defi

Eli5DeFi Educator DeFi_Expert C43.43K @Eli5defi

Eli5DeFi Educator DeFi_Expert C43.43K @Eli5defi

Eli5DeFi Educator DeFi_Expert C43.43K @Eli5defi

Eli5DeFi Educator DeFi_Expert C43.43K @Eli5defi

Eli5DeFi Educator DeFi_Expert C43.43K @Eli5defi

Eli5DeFi Educator DeFi_Expert C43.43K @Eli5defi71 29 4.68K Original >Trend of BERA after releaseExtremely Bullish

Eli5DeFi Educator DeFi_Expert C43.43K @Eli5defi71 29 4.68K Original >Trend of BERA after releaseExtremely Bullish- Trend of BERA after releaseBullish

- Trend of BERA after releaseBullish