ATH (ATH)

ATH (ATH)

- 63Social Sentiment Index (SSI)- (24h)

- #64Market Pulse Ranking (MPR)0

- 124h Social Mention- (24h)

- 100%24h KOL Bullish Ratio1 Active KOL

- SummaryATH ranks first in cumulative smart money, inflow about 47.13K, but 24h price down 2.67% and social heat unchanged.

- Bullish Signals

- Smart money cumulative highest

- Funding inflow 47.13K

- Top of hot list

- Bearish Signals

- Price down 2.67%

- Social heat unchanged

Social Sentiment Index (SSI)

- Data Overall63SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionBullish (100%)SSI InsightsATH social heat is moderate (63.5/100,↔), activity high (35/40), sentiment positive (27.5/30) but KOL attention extremely low (1/30), due to smart money leading inflow of 47.13K the heat remains unchanged.

Market Pulse Ranking (MPR)

- Alert InsightATH warning rank #64, social abnormality 70.41/100 median, sentiment polarization 50/100, KOL attention extremely low 1/100, correlated with smart money inflow yet price down 2.67%.

X Posts

BeingInvested🕯️ OnChain_Analyst Derivatives_Expert S5.51K @0xbeinginvested

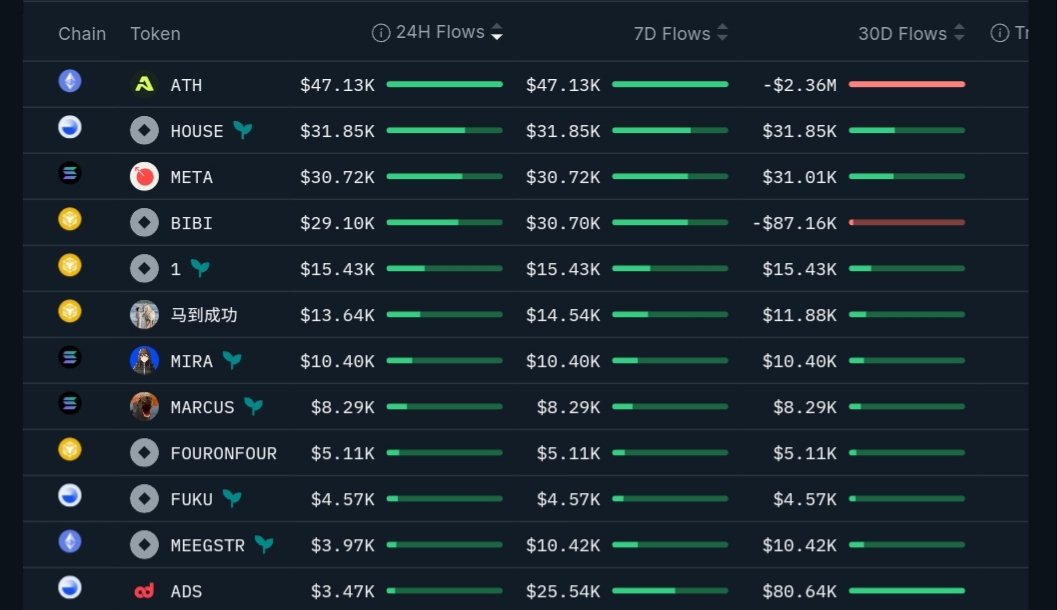

BeingInvested🕯️ OnChain_Analyst Derivatives_Expert S5.51K @0xbeinginvestedHotlist Tokens Accumulating Gm legends, Here are the top token accumulating by smart money in the past 24hrs $ATH $47.13K $HOUSE $31.85K $META $30.72K $BIBI $29.10K $MIRA $10.40K $MARCUS $8.29K $FOURONFOUR $5.11K $FUKU $4.57K $MEEGSSTR $3.97K $ADS $3.47K Which token are you buying? Source: @nansen_ai

16 4 700 Original >Trend of ATH after releaseBullishSmart money accumulated ATH, HOUSE and other hot tokens over the past 24 hours.

16 4 700 Original >Trend of ATH after releaseBullishSmart money accumulated ATH, HOUSE and other hot tokens over the past 24 hours. onchainschool.pro OnChain_Analyst Educator S4.46K @how2onchain

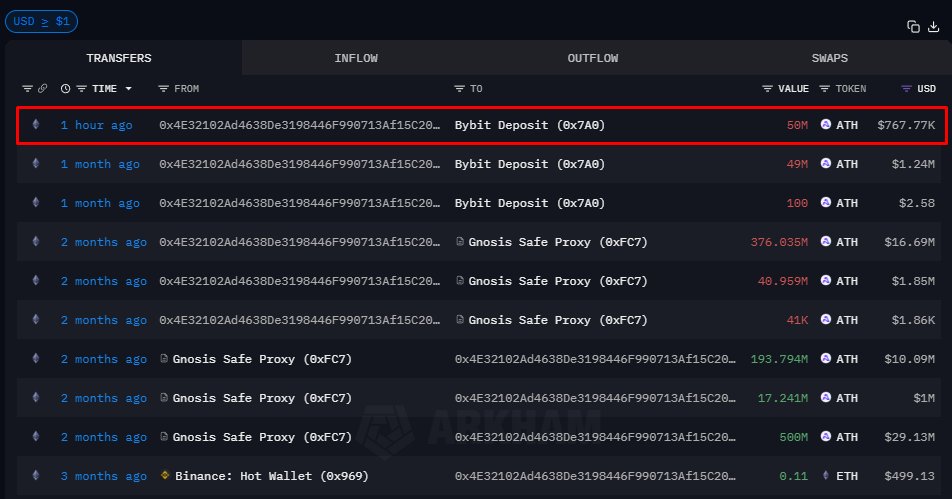

onchainschool.pro OnChain_Analyst Educator S4.46K @how2onchain$ATH TEAM WALLET ON THE MOVE 1 hour ago, the team wallet transferred $768K worth of $ATH to Bybit. This is the second month in a row with similar outflows from the same wallet The wallet still holds approximately $3M in tokens Wallet: 0x4E32102Ad4638De3198446F990713Af15C200f6A https://t.co/gGjWhW94RU

9 2 1.63K Original >Trend of ATH after releaseBearishThe ATH team wallet has transferred tokens to Bybit for two consecutive months, most recently moving $768K, indicating potential selling pressure.

9 2 1.63K Original >Trend of ATH after releaseBearishThe ATH team wallet has transferred tokens to Bybit for two consecutive months, most recently moving $768K, indicating potential selling pressure. Rui VC Researcher A59.38K @YeruiZhang

Rui VC Researcher A59.38K @YeruiZhangIn a market where both liquidity and attention are scarce, no matter how clever the mechanism design, it cannot be discovered. Since the tweet, ATH price moved from 0.5 to 0.16, and DAT POAI dropped from a high of 15 to 6. At a glance, the past two months have been unsuccessful; the flywheel needs price volatility to trigger it. From a fundamentals perspective, ATH is still operating, still a protocol with 30‑day revenue of $1.5 M, and enterprise clients remain. From the external environment, GPU compute power remains in short supply in the AI world; power and compute shortages persist, and even the major narrative in US equities this year is that Bitcoin mining farms are massively transitioning to AI data centers. The GPUs and compute power owned by ATH remain quality assets. Projecting forward, during a down‑cycle, revenue from enterprise clients' leasing business will be paid in ATH tokens and injected into the DAT listed company. The tokens will be locked at low market cap, awaiting a rebound in the token‑side secondary market; the price anchoring will provide DAT with higher revenue expectations and support its stock price. The team will soon disclose the DAT company's address to increase model transparency. This will also allow a direct view of how they are performing, what the expected token lock‑up situation is, and thus infer whether we are in a bottoming phase.

Rui VC Researcher A59.38K @YeruiZhang

Rui VC Researcher A59.38K @YeruiZhangPutting aside the token price fluctuations, ATH's DAT is a very interesting mechanism: This system has three types of assets: the token, DAT stock, and points. Players fall into four categories: token holders, stock holders, points (compute‑power providers who earn tokens by offering services), and enterprise clients (who pay tokens to receive services). The previous business model was simple: compute‑power providers delivered services to enterprise clients, settled in tokens. In a typical DAT model, the foundation buys tokens; when token value is high, DAT stock is valuable, and purchases are financed by selling more stock to buy tokens. Aethir’s model adds a compute‑power concept: the token is not directly linked to DAT stock, but to compute power, which in turn is tied to the stock price. This gameplay assumes that the compute‑power business can stay hot continuously, and that ATH, as a compute‑power market, can reliably take a cut. If these conditions are met, during an up‑cycle the foundation provides a 20 % grant to DAT to attract cash investors—essentially, if you use cash to buy compute power, the foundation gives an extra 20 % of stock, amplifying NAV and lowering the buyer’s cost. Higher stock prices correspond to more compute power because users receiving 20 % free stock will prefer to buy compute power with cash. More compute power generates more business, allowing the foundation to take a 20 % platform fee; this fee is effectively additional stock given to users who purchase compute power with cash. Higher stock means higher NAV, which drives token‑holding users to place spot buy orders. In a down‑cycle, enterprise clients pay for compute‑power leasing with ATH tokens; this selling pressure is redeemed by DAT, hedging the pressure. Tokens held by the stock company are converted into company revenue, and DAT sells the leased compute power to generate cash flow. As long as enterprise clients exist, DAT earns income that gradually prevents token collapse and slowly pulls the discount back. Lock‑up token holders receive stock, effectively shifting the unlocking selling pressure onto the stock. Behind the stock is revenue‑generating compute power; compute‑power providers are essentially aligned with token holders because they earn through the network. Lock‑up token users provide tokens, compute‑power providers supply compute, investors provide cash, and all receive stock. Without unlocking pressure, the token can rally more easily; compute‑power providers also contribute cash and tokens, deepening the network tie. The foundation contributes part of its revenue as the system’s base. Logically, it’s a win‑win‑win. What are the risk points? First, if the business falls short of expectations, the cake may be too small or the 20 % grant cannot be sustained; without new buying pressure the system becomes vulnerable. Second, a token price collapse: when token investors’ extracted token price no longer matches the machine’s value, token providers outnumber machine providers, putting short‑term pressure on the stock. Therefore, maintaining enterprise client revenue and token price is the team’s biggest concern. This appears to be the most rational and gamified DAT we’ve seen recently; compared to a pure token‑stock DAT, it’s far superior and worth watching its future performance.

40 22 13.53K Original >Trend of ATH after releaseBullishThe ATH and DAT mechanisms are reasonable, and enterprise leasing will support the token, worth attention. Lao Bai VC Researcher B72.51K @Wuhuoqiu

Lao Bai VC Researcher B72.51K @WuhuoqiuPreviously I wrote that I'm not very optimistic about the decentralized compute power track, mainly because even though there is a price advantage, commercial-grade SLA is hard to guarantee in a decentralized setting. However, the relatively okay player in this track is @AethirCloud; before they sold the node at that time, I had a detailed chat with the team. The reason it's relatively okay is mainly two reasons: 1. Many of Aethir's GPUs are idle GPUs in small-to-medium data centers, which are far more stable than individual users' gaming GPUs. 2. The node they sold back then was a node similar to a Check Ping and status monitoring node, intended to confirm that the “working GPU node” stays online and meets performance standards at all times. These two features aim for commercial-grade SLA, so it’s acceptable. Interestingly, Aethir's DAT works like this: if it runs well, it’s a flywheel; if not, it’s a stuck gear. But regardless, it's different from the MSTR model. It uses POAI, a Web2 company that receives compute orders, and Aethir is POAI's sole compute provider. When orders come, there's demand for ATH, they earn money and then BuyBack ATH, effectively binding the ATH token to GPU resources. However, it’s not a simple 1:1 mapping/conversion of GPU resources you might see on X; the ratio depends on how the flywheel turns—i.e., how much compute order demand POAI can bring. In an era where GPUs are becoming strategic assets for the next 10 years, this kind of DAT, if it gains traction, is still more reliable than many DATs that merely buy and hoard tokens.

Van1sa D8.32K @vanisaxxm

Van1sa D8.32K @vanisaxxm“Does AI really need Crypto?” Even if you don’t understand AI models or blockchain technology, you know that “AI+Crypto” is the next hot trend. At the same time, you might wonder: does AI really need Crypto? 00:20 AI trillion-dollar infrastructure: decentralized cloud computing— is a business of selling “gold shovels” through Crypto viable? 02:04 Crypto + Open Source = Better large language models? Bitcoin’s lessons for decentralized AI 04:34 A simple x402 example to understand AI’s demand for Crypto at the application layer 06:04 The idle problem of Web3 AI projects: good on-chain data and revenue, but unable to translate to tokens; @AethirCloud’s innovative DAT solution

39 34 10.69K Original >Trend of ATH after releaseBullishAethir's ATH token is bound to GPU compute power, has commercial-grade SLA, and has a promising outlook. onchainschool.pro OnChain_Analyst Educator S4.46K @how2onchain

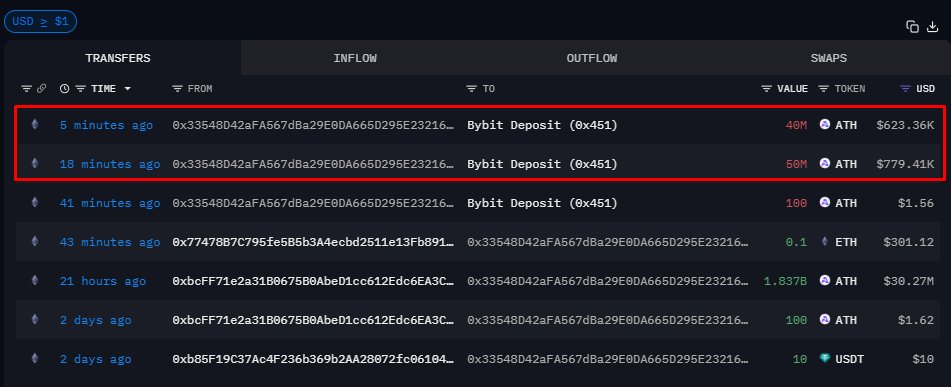

onchainschool.pro OnChain_Analyst Educator S4.46K @how2onchainNEW $ATH WITHDRAWALS FROM TEAM WALLETS Less than 30 minutes ago, $1.4M worth of $ATH was withdrawn to Bybit Just yesterday, this wallet received $30.3M worth of $ATH, and today the outflows have already started The wallet is currently holding $27.3M worth of tokens Wallet: 0x33548D42aFA567dBa29E0DA665D295E232166a43

8 1 1.49K Original >Trend of ATH after releaseBearishATH team wallet massive withdrawals to Bybit, may face selling pressure

8 1 1.49K Original >Trend of ATH after releaseBearishATH team wallet massive withdrawals to Bybit, may face selling pressure onchainschool.pro OnChain_Analyst Educator S4.46K @how2onchain

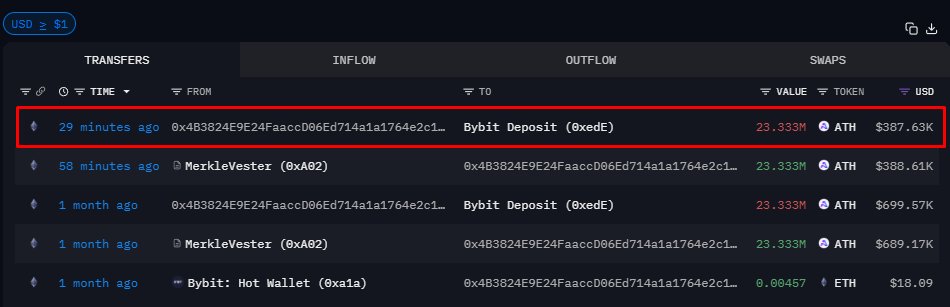

onchainschool.pro OnChain_Analyst Educator S4.46K @how2onchain$ATH VESTING WALLET WITHDRAWALS 1 hour ago, almost $400K worth of $ATH was withdrawn from the vesting wallet to another wallet that has been sending tokens to Bybit for the second month in a row 30 minutes ago, the tokens were already transferred to the exchange The vesting wallet frequently sends large amounts to various wallets, as $ATH unlocks occur daily Vesting wallet: 0xA02ba54a0F9840BD286dDF1b4A9c5dE08d8D8bBE Wallet used for exchange withdrawals: 0x4B3824E9E24FaaccD06Ed714a1a1764e2c1D8Ec3

6 0 964 Original >Trend of ATH after releaseBearishA large amount of ATH tokens moved from the vesting wallet to exchanges, potentially adding sell pressure.

6 0 964 Original >Trend of ATH after releaseBearishA large amount of ATH tokens moved from the vesting wallet to exchanges, potentially adding sell pressure. Cointelegraph Media Influencer C2.89M @Cointelegraph

Cointelegraph Media Influencer C2.89M @Cointelegraph🔥 UPDATE: Decentralized GPU provider Aethir hit $39.8M in Q3 revenue and $147M+ ARR. Aethir also reports 435K+ GPU containers and 1.4B AI compute hours, making it a leader in DePIN computing. https://t.co/MvNIT0UZLM

256 69 24.57K Original >Trend of ATH after releaseBullishAethir Q3 revenue is strong, with ARR surpassing $147 million, a leader in DePIN computing.

256 69 24.57K Original >Trend of ATH after releaseBullishAethir Q3 revenue is strong, with ARR surpassing $147 million, a leader in DePIN computing. 吴说区块链 Media Researcher D168.37K @wublockchain12

吴说区块链 Media Researcher D168.37K @wublockchain12Wu said that the decentralized GPU cloud platform Aethir disclosed its latest performance, with Q3 2025 revenue of $39.8 million and ARR surpassing $147 million. Its network has deployed over 435,000 enterprise-grade GPU containers (including H100, B200, etc.), delivering more than 1.4 billion compute hours, with customers covering AI firms such as Kluster and Attentions. In October, Aethir completed a $344 million ATH private placement and launched a Digital Asset Treasury (DAT), now holding 5.7 billion ATH, and plans to repurchase tokens using compute income to build a positive ecosystem loop. https://t.co/n1ItGAvFuY

5 1 4.48K Original >Trend of ATH after releaseBullishAethir's performance is impressive, planning to buy back ATH tokens, outlook is positive onchainschool.pro OnChain_Analyst Educator S4.46K @how2onchain

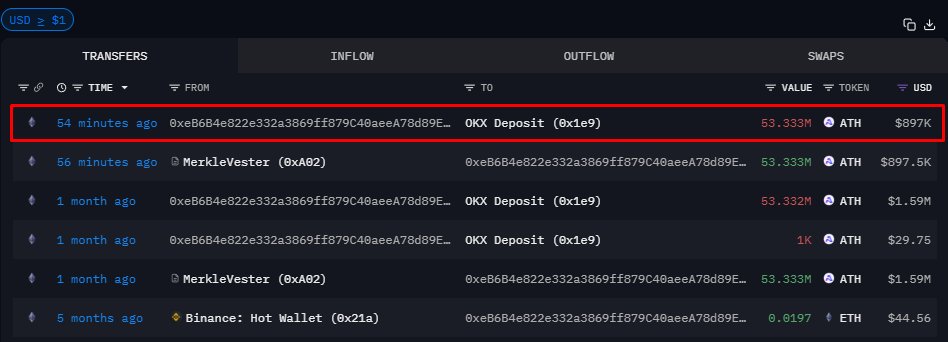

onchainschool.pro OnChain_Analyst Educator S4.46K @how2onchain$ATH VESTING TOKENS MOVING AGAIN 1 hour ago, $ATH tokens worth $897K were withdrawn from the vesting wallet and sent to the OKX exchange This has been happening consistently for the past 2 months, around the 20th of each month, with similar amounts being moved It’s worth monitoring this wallet for large token outflows The wallet still holds $115M worth of tokens Vesting wallet: 0xA02ba54a0F9840BD286dDF1b4A9c5dE08d8D8bBE

12 1 1.18K Original >Trend of ATH after releaseBearishATH locked tokens continuously flowing to exchanges, beware of potential sell‑off risk.

12 1 1.18K Original >Trend of ATH after releaseBearishATH locked tokens continuously flowing to exchanges, beware of potential sell‑off risk. Clockwise Crypto Influencer Media B99.01K @clockwisecrypto

Clockwise Crypto Influencer Media B99.01K @clockwisecrypto DARC by Solus Group D1.27K @solus_partners

DARC by Solus Group D1.27K @solus_partnersResearch: Computation DePIN (Nov 2025) Key Findings: ▫️ DePIN growth is real (YoY fees did ~5x) but concentrated in a few networks (Aethir, ionet, Helium) ▫️ Top 3 protocols by Comparative Scoring: @AethirCloud (Leader), @ionet (Watch), @Argentum_AI (Early Watch) ▫️ @Argentum_AI: early entrant, that targets two gaps - reuse of second‑gen GPUs and security/region diversification for institutions ▫️ Attestation and SLA dashboards are the primary adoption bottlenecks for regulated buyers Full report: https://t.co/NEZKQhVEEE Authors & Contributors: @0xfrigg, @0xSalazar, @rektonomist_, @obchakevich_, @crypto_goos, @rukizcukiz, @Dillion_Empire, @KongBTC, @zenbirb, @LisaFlorentina8, @cryptobrass, @leshka_eth, @CryptoGideon_, @Eliteonchain

486 42 24.16K Original >Trend of ATH after releaseBullishDePIN computation sector is experiencing strong growth, with projects such as Aethir and ionet emerging as market leaders.

486 42 24.16K Original >Trend of ATH after releaseBullishDePIN computation sector is experiencing strong growth, with projects such as Aethir and ionet emerging as market leaders.